Explore a collection of free Excel templates designed specifically for self-employed individuals to manage their budgets effectively. These templates offer structured layouts that allow you to track income, expenses, and savings, providing a clear overview of your financial health. Customizable features enable you to tailor the spreadsheet to your unique business needs, making it easier for you to plan and project your future earnings and costs.

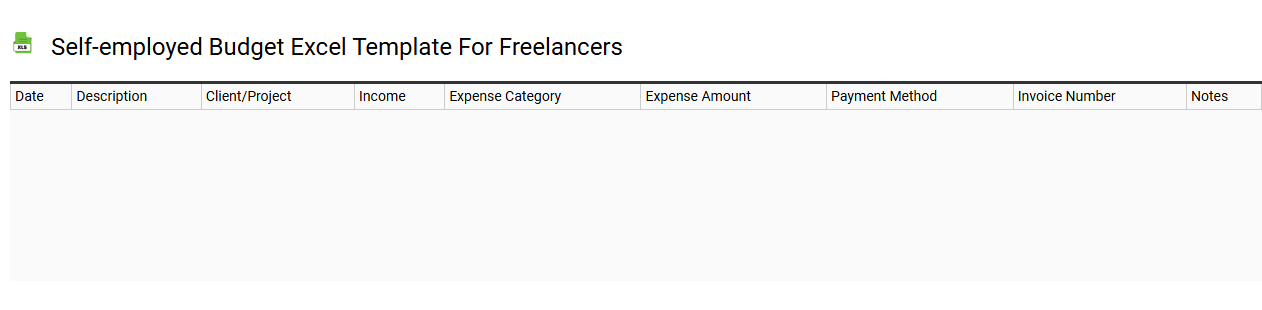

Self-employed budget Excel template for freelancers

💾 Self-employed budget Excel template for freelancers template .xls

A self-employed budget Excel template for freelancers offers a structured format to manage finances effectively. This template helps track income from various clients, monitor expenses tied to project work, and categorize costs such as marketing, supplies, and software subscriptions. You can visualize your financial health with easy-to-read charts and graphs summarizing key metrics like profit margins and monthly earnings. Such a template not only assists in daily budgeting but also lays the groundwork for more advanced needs, including cash flow forecasts and tax liability calculations.

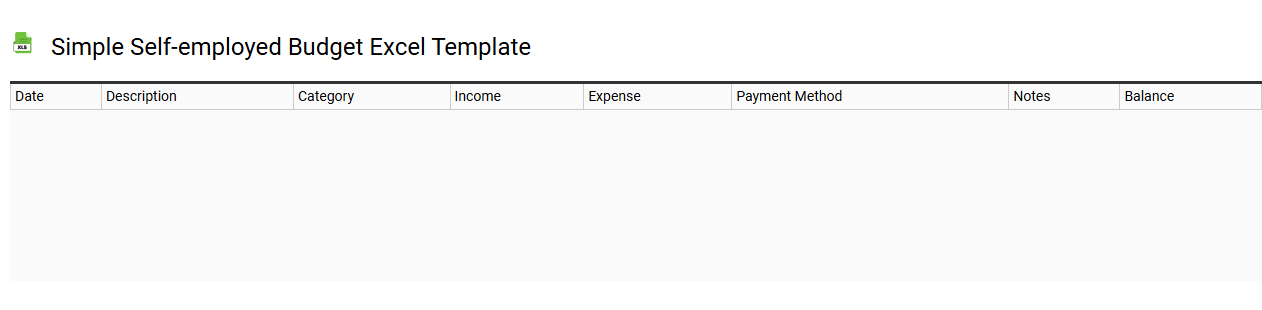

Simple self-employed budget Excel template

💾 Simple self-employed budget Excel template template .xls

A simple self-employed budget Excel template is a streamlined tool designed to help freelancers and independent contractors manage their finances effectively. This template typically includes sections for income tracking, expense monitoring, and profit calculations, allowing you to see where your money is coming from and where it's going. You can easily input your earnings from various clients alongside your business-related expenses like supplies, marketing, and utilities. By using this template, you can establish a solid financial foundation while also identifying potential areas for cost-saving and investment opportunities, paving the way for advanced financial management strategies later on.

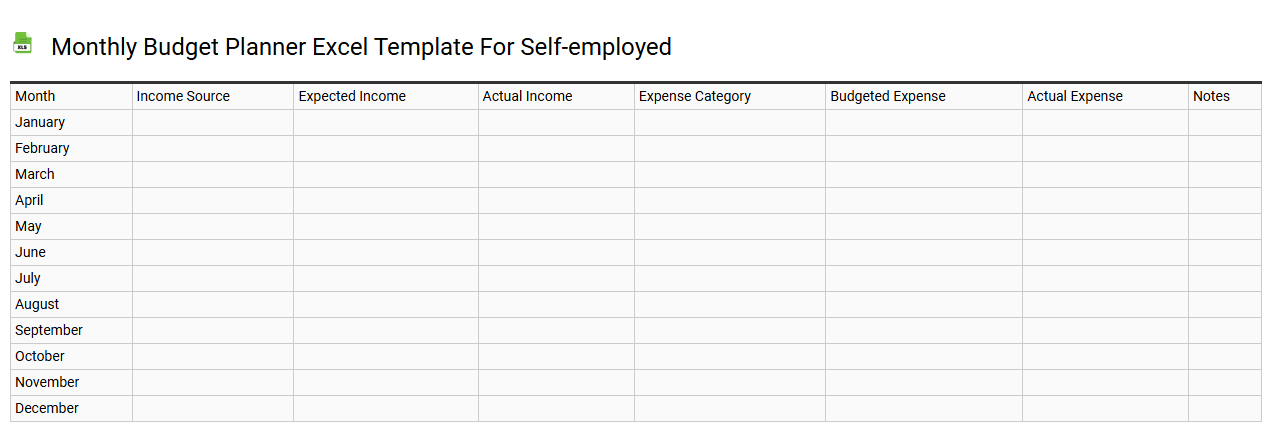

Monthly budget planner Excel template for self-employed

💾 Monthly budget planner Excel template for self-employed template .xls

A Monthly Budget Planner Excel template for self-employed individuals serves as a powerful tool for tracking income and expenses systematically. It typically includes sections for categorizing various income streams, such as freelance work or consulting fees, alongside essential expenses like office supplies, software subscriptions, and utilities. You can customize this template to reflect your specific financial situation and easily visualize your cash flow over the month. With basic functionalities like formulas for automatic calculations, this template can further adapt to more advanced needs, such as forecasting future revenue and applying dynamic financial modeling.

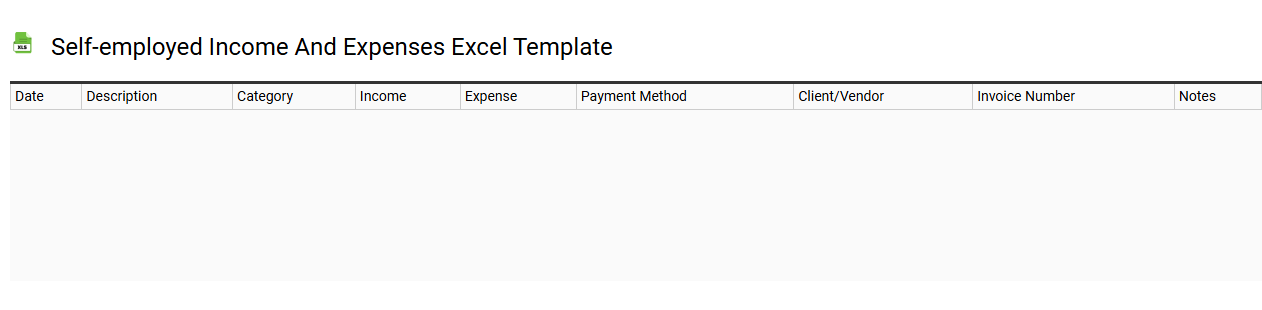

Self-employed income and expenses Excel template

💾 Self-employed income and expenses Excel template template .xls

A Self-employed income and expenses Excel template is a structured spreadsheet designed to help freelancers and independent contractors track their earnings and expenditures efficiently. This template typically includes designated sections for income sources, such as client payments or sales revenue, ensuring accurate financial monitoring. You can also record various expenses, ranging from office supplies to travel costs, facilitating easy calculation of net profit or loss. Furthermore, this template can be customized to meet specific financial reporting needs, offering advanced functionalities like forecasting and categorization for better insights into your business finances.

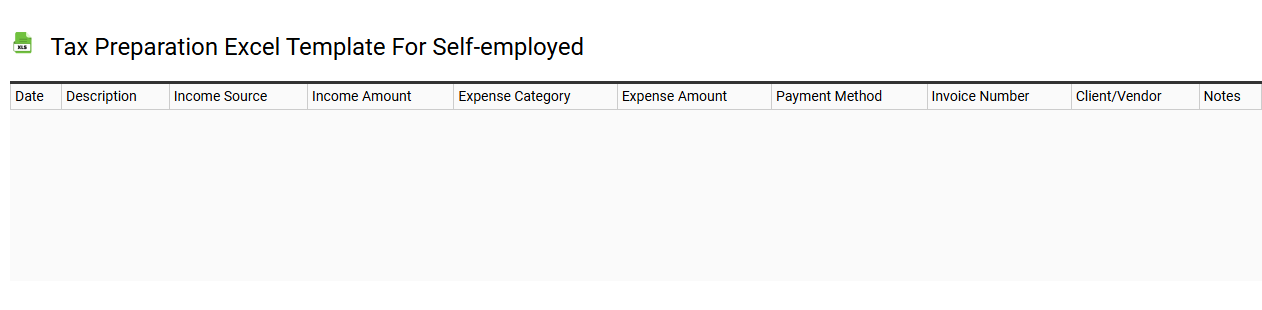

Tax preparation Excel template for self-employed

💾 Tax preparation Excel template for self-employed template .xls

A Tax preparation Excel template for self-employed individuals serves as a structured tool to simplify the process of organizing income, expenses, and deductions. This template typically includes separate sections for business revenues, operating costs, and any potential tax credits. Users can easily input data, utilize formulas for automatic calculations, and visualize their financial status through graphs and charts. This basic framework can evolve to accommodate more complex projections, such as estimated quarterly tax payments, self-employment tax calculations, and reporting requirements to maximize tax efficiency.

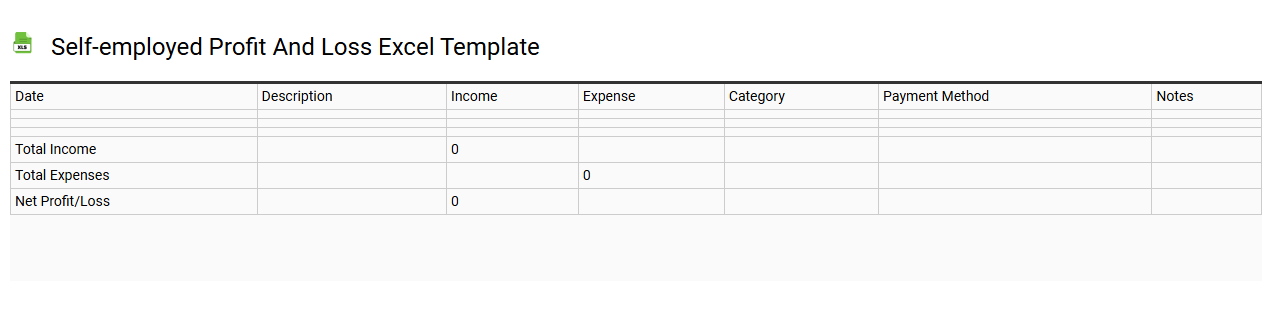

Self-employed profit and loss Excel template

💾 Self-employed profit and loss Excel template template .xls

A self-employed profit and loss Excel template is a financial tool designed to help independent workers, freelancers, or small business owners track their income and expenses over a specific period. This template typically includes sections for recording revenue sources, variable costs, fixed expenses, and net profit or loss calculations. With clear organization and customizable features, it allows you to gain insights into your financial health, making it easier to prepare for tax filings or assess business performance. Basic usage can lead to advanced financial management techniques, including cash flow forecasting, break-even analysis, and budgeting strategies.

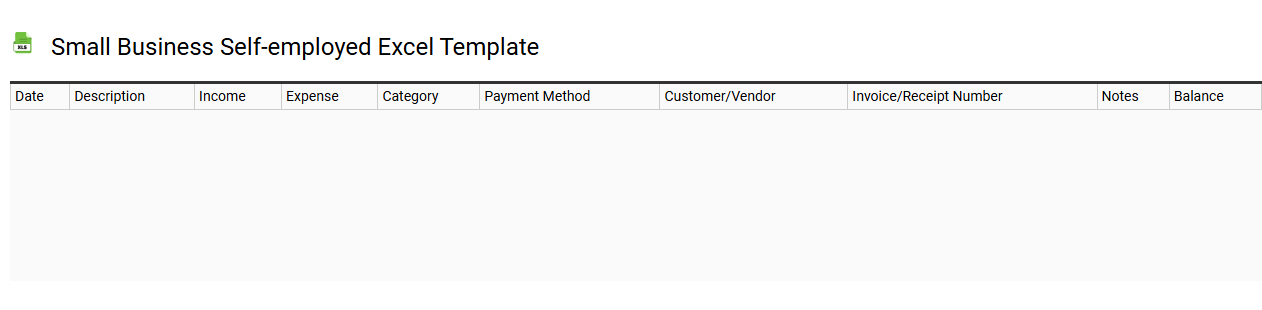

Small business self-employed Excel template

💾 Small business self-employed Excel template template .xls

A Small Business Self-Employed Excel template is a customizable spreadsheet designed to help self-employed individuals and small business owners manage their finances. This template typically includes sections for tracking income, expenses, invoices, and profits, allowing you to easily monitor your financial health. Features like built-in formulas automatically calculate totals, giving you immediate insights into your cash flow. Further potential needs may involve integration with advanced data analytics tools or budgeting software for comprehensive financial management.

Self-employed invoice tracker Excel template

![]()

💾 Self-employed invoice tracker Excel template template .xls

A self-employed invoice tracker Excel template serves as a crucial tool for freelancers and independent contractors, enabling you to organize and manage your invoicing process efficiently. This template typically includes fields for client information, services rendered, invoice dates, payment statuses, and amounts due, promoting clarity in your financial records. By utilizing such a tracker, you can easily monitor outstanding payments and maintain an accurate accounting system, thereby streamlining cash flow management. For more complex needs, consider integrating advanced functions like pivot tables, automated calculations, or even macros to enhance your invoicing process further.

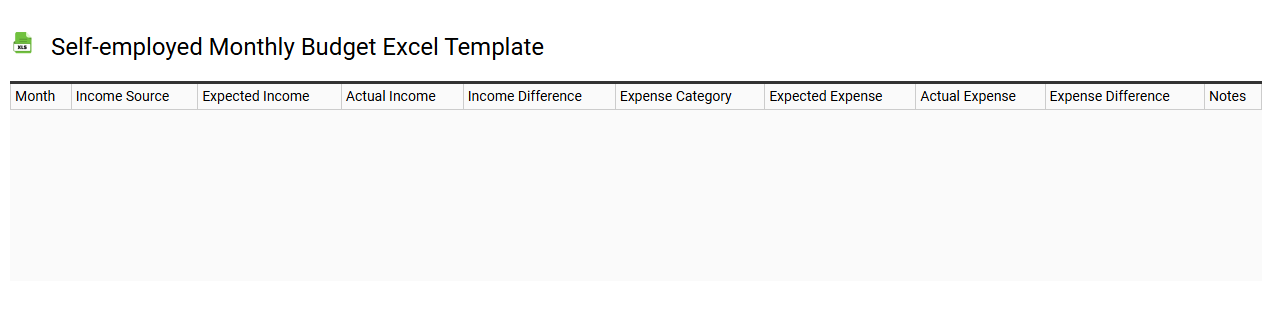

Self-employed monthly budget Excel template

💾 Self-employed monthly budget Excel template template .xls

A self-employed monthly budget Excel template is a structured spreadsheet designed specifically for freelancers, entrepreneurs, or solo business owners to manage their finances. It typically includes sections for income, expenses, savings, and investments, allowing you to categorize and track your financial activities clearly. Each category can provide detailed entries such as project income, operational costs, and tax obligations, enabling you to visualize your cash flow. This tool not only assists you in monitoring your monthly budget but also helps in forecasting future financial scenarios, ensuring you are prepared for both basic budgeting and more advanced financial planning needs, like cash reserves or investment analysis.

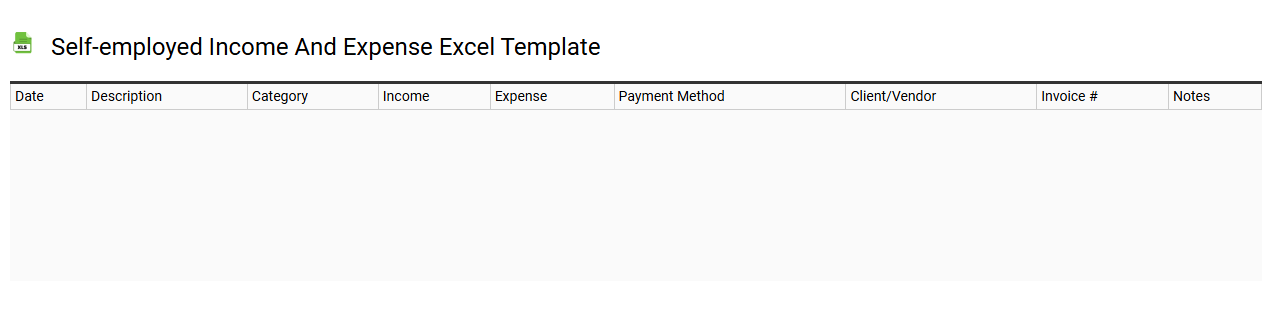

Self-employed income and expense Excel template

💾 Self-employed income and expense Excel template template .xls

A Self-employed income and expense Excel template is a customizable tool designed to help freelancers, contractors, and small business owners track their earnings and expenditures. This structured spreadsheet typically features separate columns for income sources, expenses categories, and net profit calculations. Users can easily input their financial data, making it simple to monitor cash flow and assess financial health over specific periods. Such templates could also be expanded to include advanced features like forecasting, tax estimations, and detailed reports for comprehensive financial analysis.

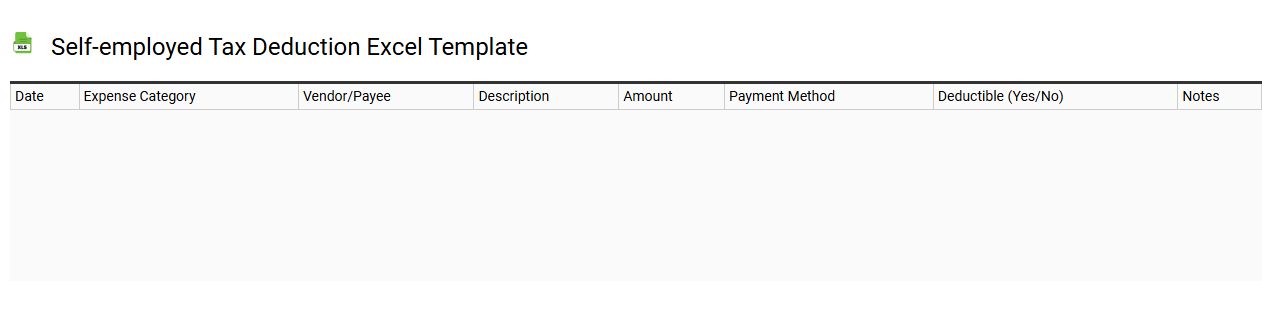

Self-employed tax deduction Excel template

💾 Self-employed tax deduction Excel template template .xls

A Self-employed tax deduction Excel template is a practical tool designed to simplify the tracking of income and expenses for individuals operating their own businesses. This template typically includes designated sections to categorize various expenses, such as office supplies, travel costs, and utilities, helping you organize financial data efficiently. By entering your income and deductible expenses, you can easily calculate your taxable income, which is crucial for accurate tax filing. Basic usage facilitates efficient record-keeping, while further potential needs could involve advanced features like automated calculations or integration with accounting software for comprehensive financial management.

Self-employed business expense tracker Excel template

![]()

💾 Self-employed business expense tracker Excel template template .xls

A self-employed business expense tracker Excel template is a specialized tool designed to help you manage and organize your business-related expenses. The template allows for easy input of various expenses, categorizing them by type, such as utilities, supplies, travel, and more. Visual charts and summary reports can provide insights into spending patterns, helping you make informed financial decisions. This tool not only simplifies basic record-keeping but also has the potential to include advanced features like automated calculations and integration with accounting software for enhanced financial management.

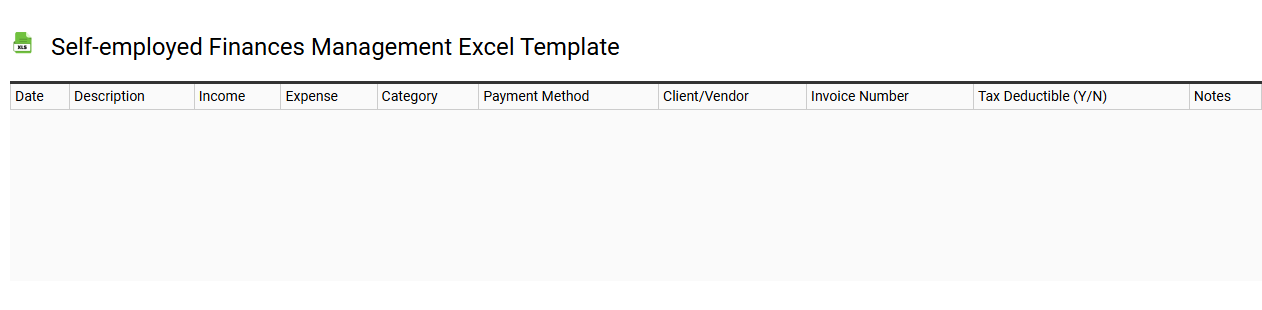

Self-employed finances management Excel template

💾 Self-employed finances management Excel template template .xls

A self-employed finances management Excel template serves as a comprehensive tool to help freelancers and independent contractors organize their financial activities efficiently. It typically includes sections for tracking income, expenses, invoices, and tax deductions. Users can easily input and categorize financial transactions, enabling clearer insights into cash flow and budgeting. This template not only aids in daily financial management but also lays the groundwork for more advanced financial analysis, such as profit forecasting, tax planning, or investment tracking.

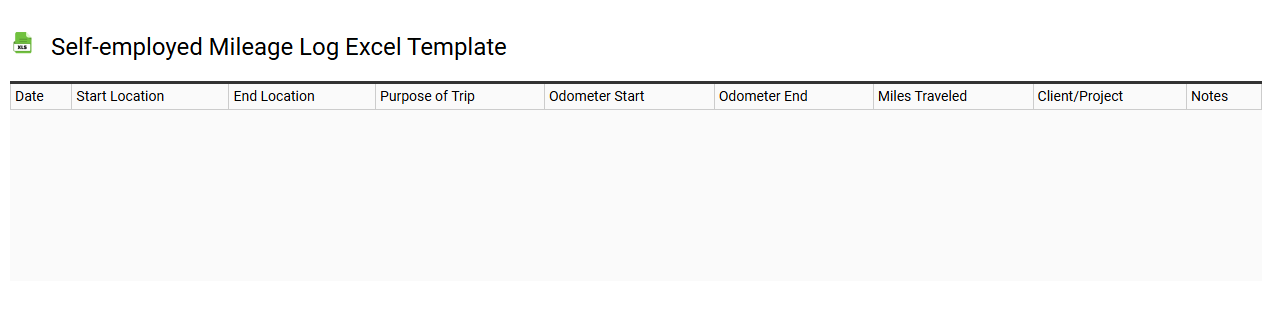

Self-employed mileage log Excel template

💾 Self-employed mileage log Excel template template .xls

A self-employed mileage log Excel template is a structured spreadsheet designed to help you track and organize your business-related driving expenses. This tool allows you to input key details such as the date of each trip, starting and ending addresses, total miles driven, and the purpose of your travel. You can also calculate the mileage deduction based on current IRS rates, providing a clear overview of your deductible expenses. Beyond basic logging, consider integrating advanced features like automated calculations or data visualization for comprehensive financial analysis.

Self-employed savings tracker Excel template

![]()

💾 Self-employed savings tracker Excel template template .xls

A self-employed savings tracker Excel template is a customizable spreadsheet designed to help freelancers and independent contractors monitor their income, expenses, and savings goals. This tool allows you to input various financial data, making it easier to visualize your cash flow and assess your financial health over time. It can include features like monthly income summaries, automatic calculations for total income and expenses, and savings progress tracking. By using this template, you can stay organized and plan for taxes, investments, or future projects, with potential expansions into budget forecasting or cash reserve analysis.

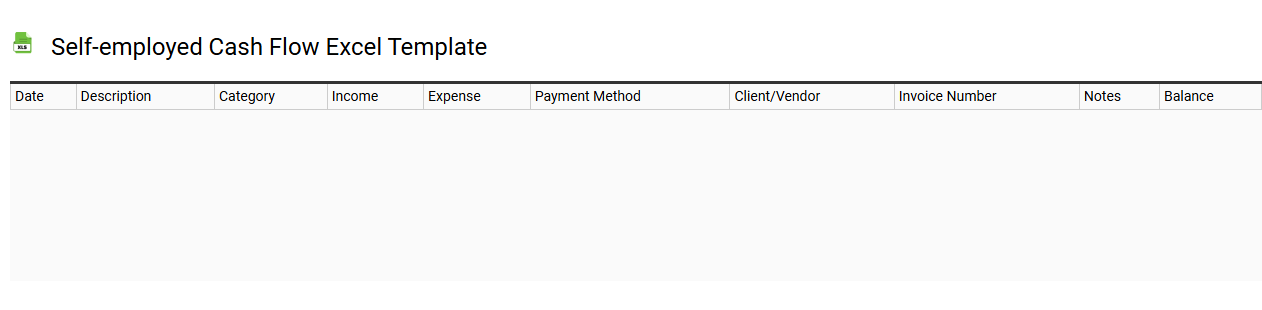

Self-employed cash flow Excel template

💾 Self-employed cash flow Excel template template .xls

A self-employed cash flow Excel template is a pre-designed spreadsheet tool that helps individuals track their income and expenses. It typically includes sections for categorizing various revenue streams, such as freelance work, consulting fees, or sales, alongside fixed and variable expenses like rent, utilities, and supplies. This template enables you to visualize your financial health over time, emphasizing cash inflows and outflows to manage your resources effectively. It's essential for basic budgeting and can be further enhanced for sophisticated financial modeling, investment projections, or tax planning.