Explore a collection of free XLS templates designed specifically for calculating tax expenses. These templates provide user-friendly interfaces where you can easily input your income and deductible expenses, automatically generating accurate tax calculations. With customizable sections tailored to different tax scenarios, you'll efficiently manage your finances and gain clarity on your tax liabilities.

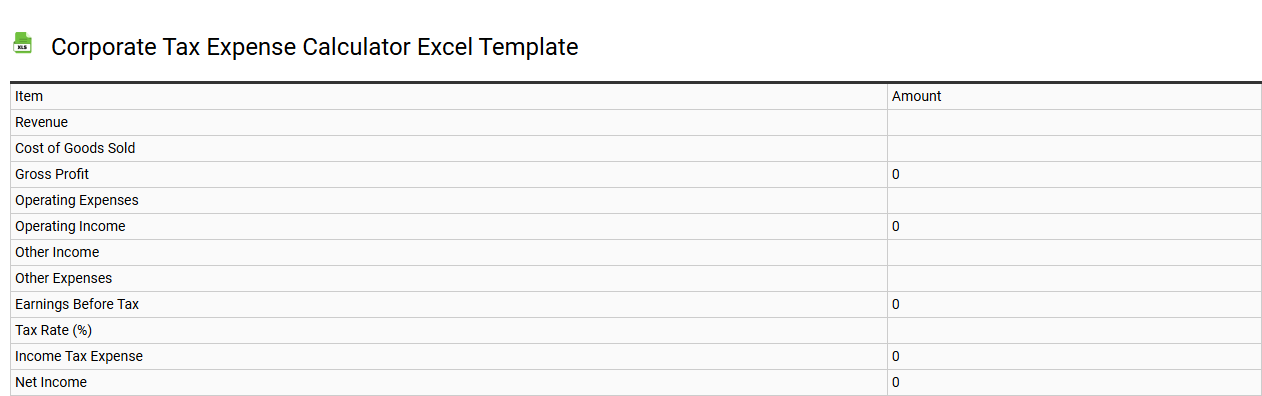

Corporate tax expense calculator Excel template

💾 Corporate tax expense calculator Excel template template .xls

A Corporate Tax Expense Calculator Excel template is a tool designed to help businesses calculate their tax liabilities efficiently. It typically includes fields for entering financial data such as revenue, allowable deductions, and tax rates. The template automates calculations, providing a clear breakdown of taxable income and the resulting tax expense. This straightforward tool can later be enhanced for more nuanced financial analysis, including integration with advanced financial modeling and forecasting techniques.

Small business tax expense tracker Excel template

![]()

💾 Small business tax expense tracker Excel template template .xls

The Small Business Tax Expense Tracker Excel template is a specialized tool designed to help entrepreneurs manage and organize their tax-related expenses efficiently. It features dedicated sections for categorizing expenses, tracking receipts, and calculating totals needed for filing taxes. You can customize entering data according to your specific business activities, making it easier to keep everything in order. This template not only aids in basic expense tracking but can also be expanded to accommodate advanced analytical needs, such as forecasting tax liabilities or integrating with financial management software for more comprehensive financial oversight.

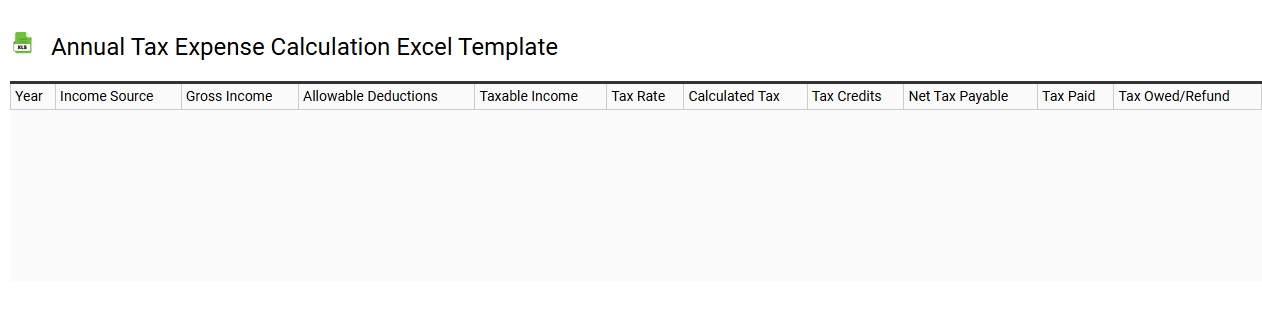

Annual tax expense calculation Excel template

💾 Annual tax expense calculation Excel template template .xls

An Annual Tax Expense Calculation Excel template simplifies the process of estimating your tax liabilities over the year. It typically includes organized sections for income, deductions, credits, and tax rates, allowing you to input your financial data easily. Formulas are embedded to automatically calculate totals and tax owed, streamlining your financial planning. This template serves not only for basic annual tax calculations but can also be expanded to analyze quarterly estimates or explore tax-saving strategies.

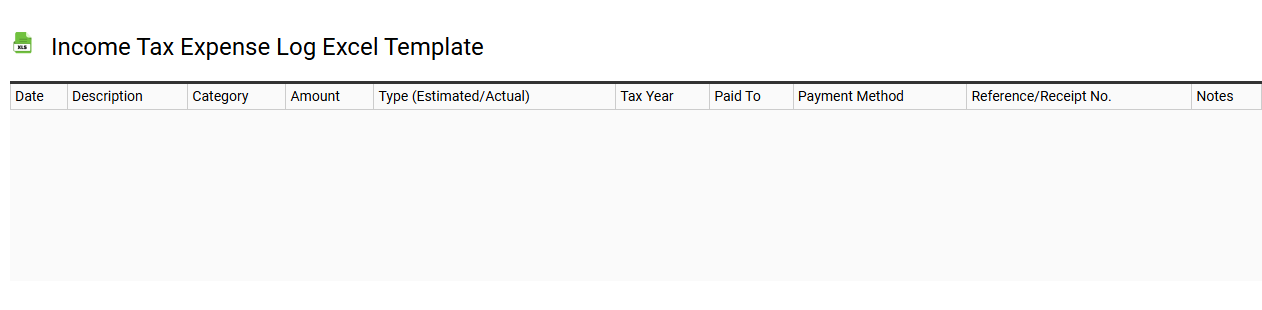

Income tax expense log Excel template

💾 Income tax expense log Excel template template .xls

An Income Tax Expense Log Excel template is a structured spreadsheet designed to help individuals and businesses track their income tax obligations efficiently. This template typically includes sections for recording taxable income, allowable deductions, tax rates, and calculated tax liabilities for various periods. Users can easily input financial data, enabling quick calculations that assist in anticipating tax expenses and planning ahead. By utilizing this template, you can streamline your tax preparation process while keeping detailed records for review, audits, or strategic financial planning, paving the way for more complex usages such as forecasting tax implications with advanced data analytics.

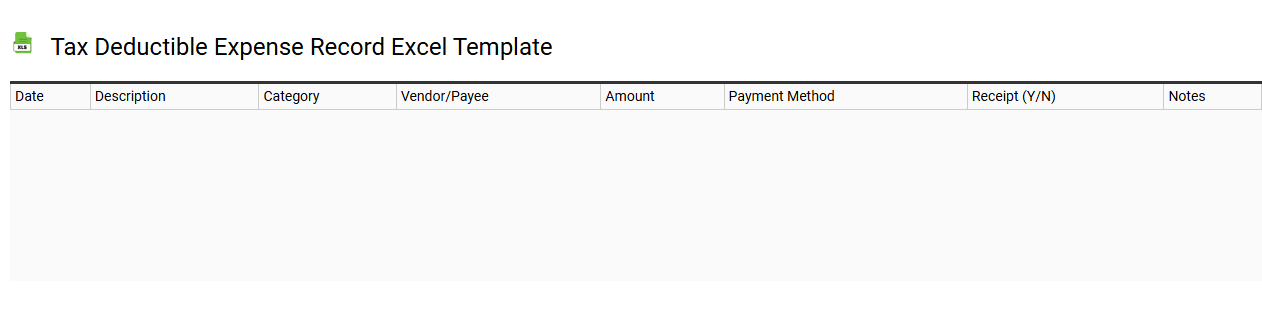

Tax deductible expense record Excel template

💾 Tax deductible expense record Excel template template .xls

A Tax Deductible Expense Record Excel template is a structured spreadsheet designed to help individuals and businesses track expenses that can be deducted from taxable income. It typically comprises multiple columns, including the date of the expense, the category (such as travel, meals, or supplies), the amount spent, and a description of the expense for clarity. Users can easily categorize and summarize their expenditures, aiding in efficient organization for tax preparation. This tool is essential for maximizing deductions, while more advanced users may integrate formulas and pivot tables for deeper financial analysis.

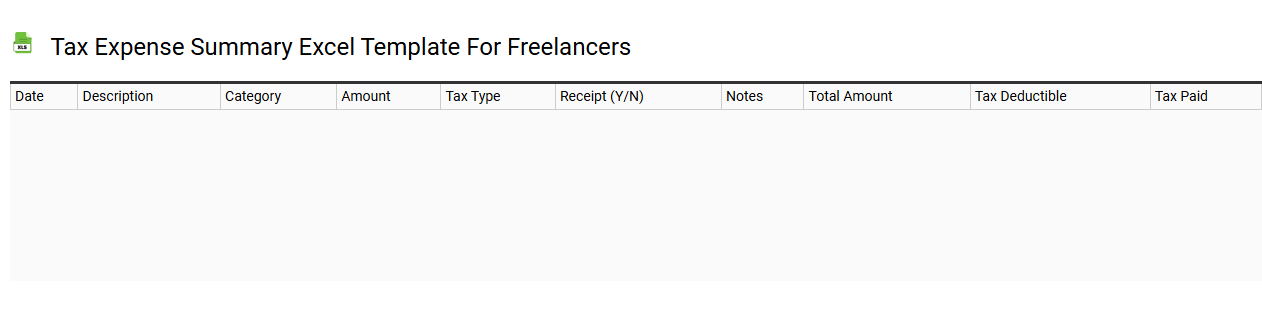

Tax expense summary Excel template for freelancers

💾 Tax expense summary Excel template for freelancers template .xls

A Tax Expense Summary Excel template for freelancers consolidates essential financial data, making it easier to track earnings and expenses for accurate tax filing. This template typically includes sections for listing income sources, deductible expenses, and potential tax liabilities, allowing freelancers to analyze their cash flow effectively. Users can customize the spreadsheet to suit individual business operations, incorporating formulas that automatically calculate totals and percentages. By utilizing this tool, you simplify tax preparation and gain insights into your financial health, with the potential for advanced features like data visualization and tax forecasting.

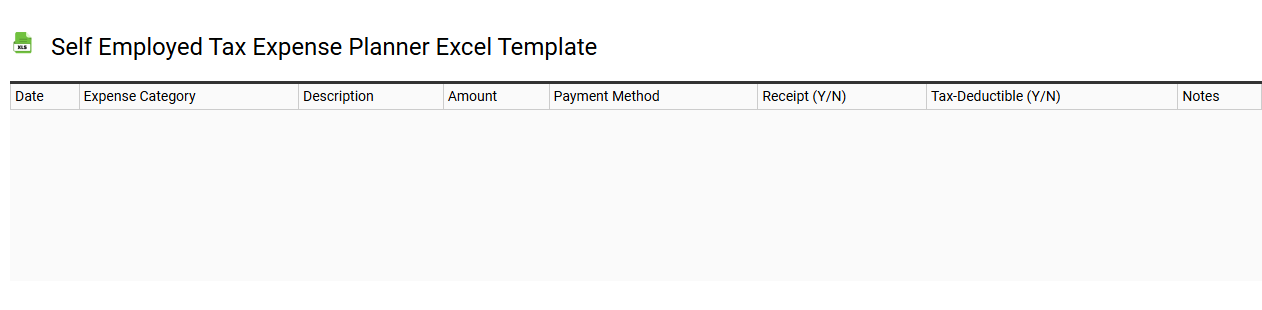

Self employed tax expense planner Excel template

💾 Self employed tax expense planner Excel template template .xls

The Self-Employed Tax Expense Planner Excel template is a user-friendly financial tool designed specifically for individuals operating as freelancers, independent contractors, or business owners. This template allows you to track income, expenses, and tax deductions, helping to simplify your tax preparation process. It includes various sections for inputting data, calculating estimated taxes owed, and identifying deductible expenses tailored to your specific business activities. You can use this template for basic tracking needs, while more advanced versions may incorporate features like integrated forecasting, multi-year projections, and customizable tax scenarios.

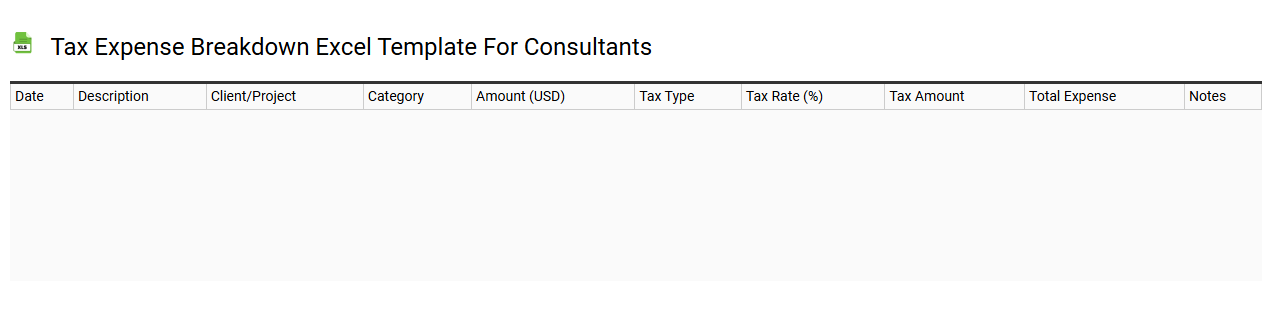

Tax expense breakdown Excel template for consultants

💾 Tax expense breakdown Excel template for consultants template .xls

A Tax Expense Breakdown Excel template for consultants organizes and streamlines tax-related expenses, providing clarity and precision. This template typically includes categories such as income taxes, payroll taxes, and sales taxes, making it easier for consultants to track their financial obligations. Each category features dedicated rows for specific entries, allowing for detailed notes and amounts alongside dates and payment statuses. Utilizing such a template not only aids in preparing for tax season but also facilitates deeper financial analysis and forecasting for your business growth, covering advanced concepts like deferred tax assets and liabilities.

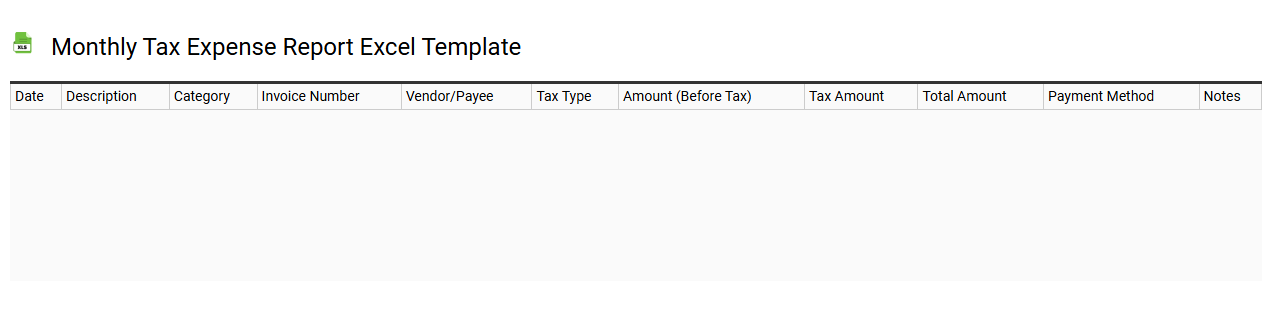

Monthly tax expense report Excel template

💾 Monthly tax expense report Excel template template .xls

A Monthly Tax Expense Report Excel template serves as a structured tool for tracking and organizing your tax-related expenses over the course of a month. It typically includes categories such as business expenses, deductions, and any other relevant financial data, allowing for streamlined data entry and analysis. This template not only simplifies the recording process but also aids in identifying patterns in spending, ensuring you're prepared for tax season. You can customize the layout to meet your specific requirements, with basic functionalities potentially extending to advanced features like pivot tables for deeper data insights.

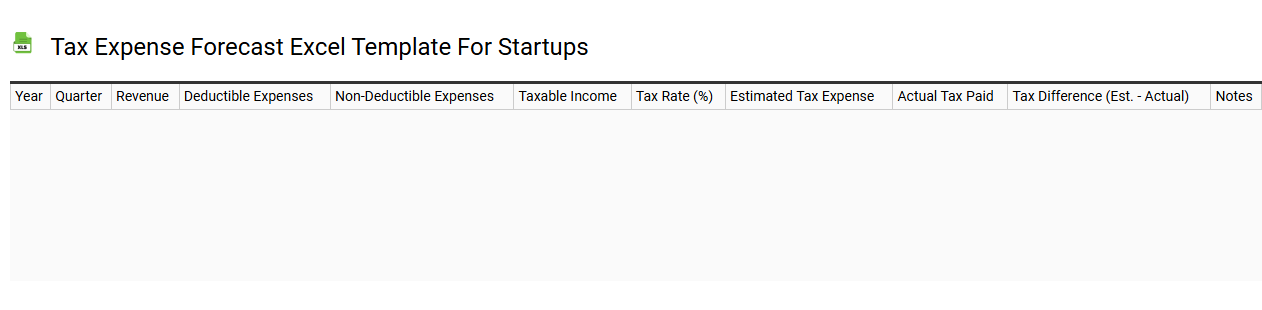

Tax expense forecast Excel template for startups

💾 Tax expense forecast Excel template for startups template .xls

A Tax Expense Forecast Excel template for startups helps you project your tax obligations over a specific period. This tool organizes anticipated income, deductible expenses, and applicable tax rates, ensuring you have a clear view of your future tax liabilities. By inputting your expected revenue and expenses, you can simulate various scenarios, adjusting for growth or unexpected costs. This template not only aids in basic tax calculations but also allows for deeper analysis, such as evaluating the impacts of tax incentives, credits, and strategic tax planning options.