Explore a selection of free XLS templates designed specifically for payroll reporting. Each template features comprehensive sections for employee data, hours worked, and tax deductions, ensuring accurate calculations every payroll cycle. You can easily customize these templates to fit your business needs, making payroll management more efficient and organized.

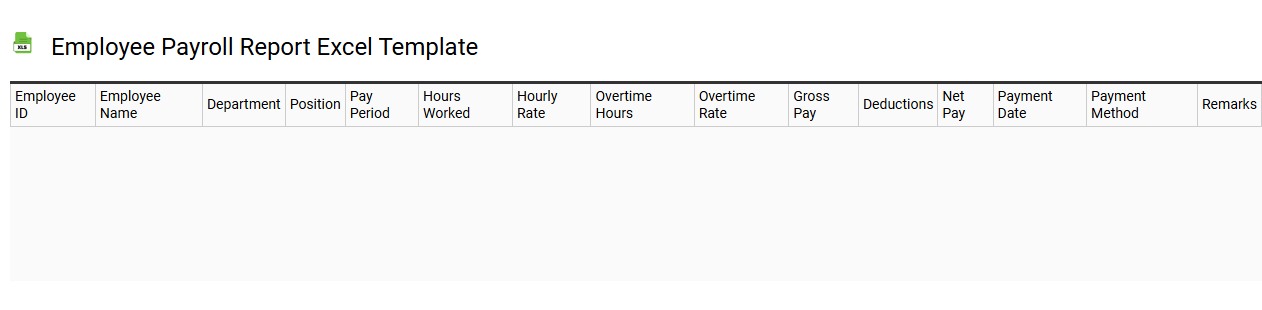

Employee payroll report Excel template

💾 Employee payroll report Excel template template .xls

An Employee Payroll Report Excel template is a pre-formatted spreadsheet designed to help organizations manage and document employee compensation processes efficiently. This template typically includes essential columns such as employee names, ID numbers, hours worked, overtime pay, deductions, and net pay, providing a comprehensive overview of payroll information. By utilizing such a template, you ensure accurate calculations and streamline the payroll process, significantly reducing the potential for errors. This basic tool can also be expanded to incorporate advanced features like automated calculations, tax compliance tracking, and customized reporting, ensuring it meets your organization's evolving payroll management needs.

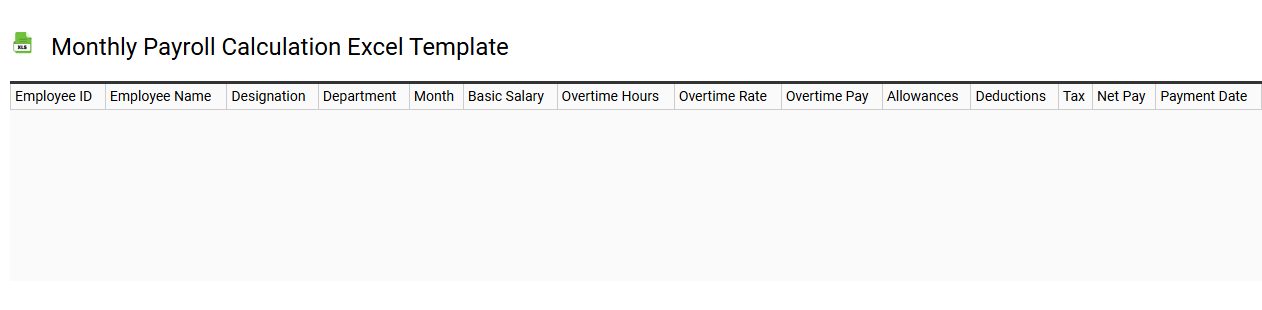

Monthly payroll calculation Excel template

💾 Monthly payroll calculation Excel template template .xls

A Monthly payroll calculation Excel template is a pre-designed spreadsheet that simplifies the process of calculating employee wages for a given month. It typically includes various essential components such as employee names, hours worked, hourly rates, deductions, and bonuses to ensure accurate paychecks. Columns for tax withholdings and benefits deductions allow for comprehensive financial tracking while maintaining compliance with local regulations. You can customize this template further to incorporate advanced calculations like overtime pay, commission structures, and gross-to-net pay analysis.

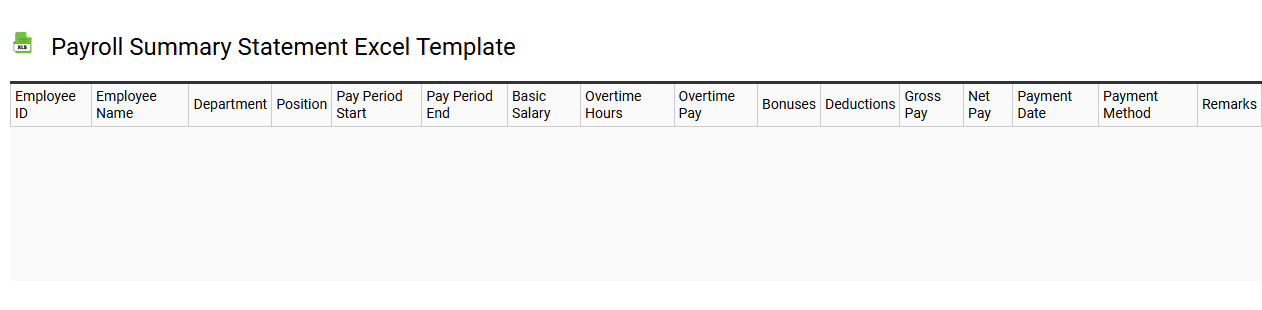

Payroll summary statement Excel template

💾 Payroll summary statement Excel template template .xls

A Payroll Summary Statement Excel template serves as a comprehensive tool for tracking and managing employee compensation details, deductions, and tax obligations within your organization. This template typically features organized columns for employee names, identification numbers, gross wages, various deductions like health insurance or retirement contributions, and net pay amounts. Users find it especially beneficial for visualizing total payroll costs and simplifying the payroll processing workflow. Beyond basic tracking, this template may further support advanced payroll analysis or forecasting needs, as well as integration with payroll software and compliance management.

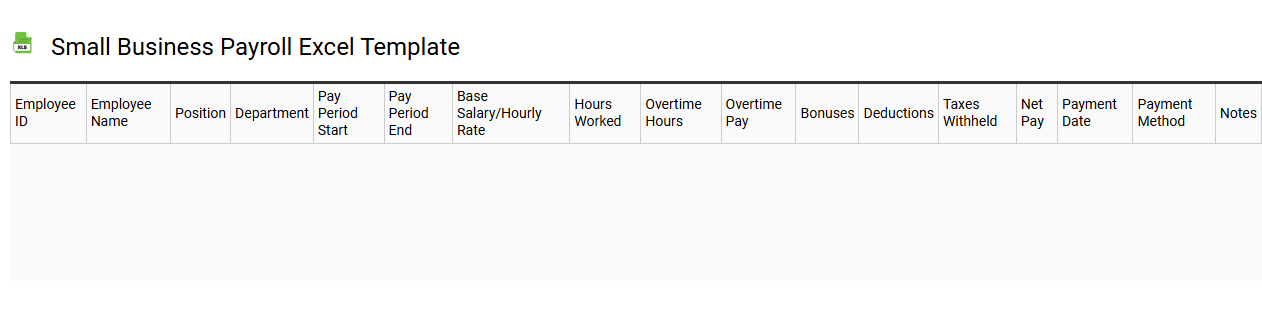

Small business payroll Excel template

💾 Small business payroll Excel template template .xls

A Small Business Payroll Excel template is a customizable spreadsheet designed to streamline payroll management for small businesses. This tool helps you track employee hours, calculate wages, and manage taxes effectively. Each section includes essential fields such as employee names, hourly rates, overtime pay, deductions, and total earnings, ensuring accuracy and compliance with regulations. As your business grows, you may need to integrate more sophisticated payroll software or explore advanced features like automated tax calculations and direct deposit options.

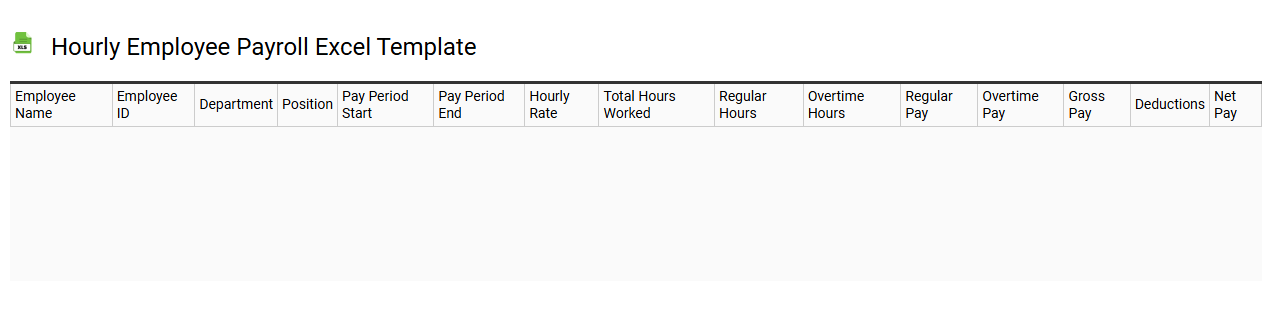

Hourly employee payroll Excel template

💾 Hourly employee payroll Excel template template .xls

An Hourly employee payroll Excel template is a structured spreadsheet designed to assist businesses in managing and calculating payroll for employees who are paid based on hours worked. This template typically includes sections for tracking employee details, hours worked, overtime, pay rates, and deductions, making it easier to compute total earnings accurately. You can customize this template to fit specific business requirements, ensuring that employee information is organized and accessible. Beyond basic payroll calculations, you may explore advanced features like automated tax calculations and integration with financial software for comprehensive payroll management.

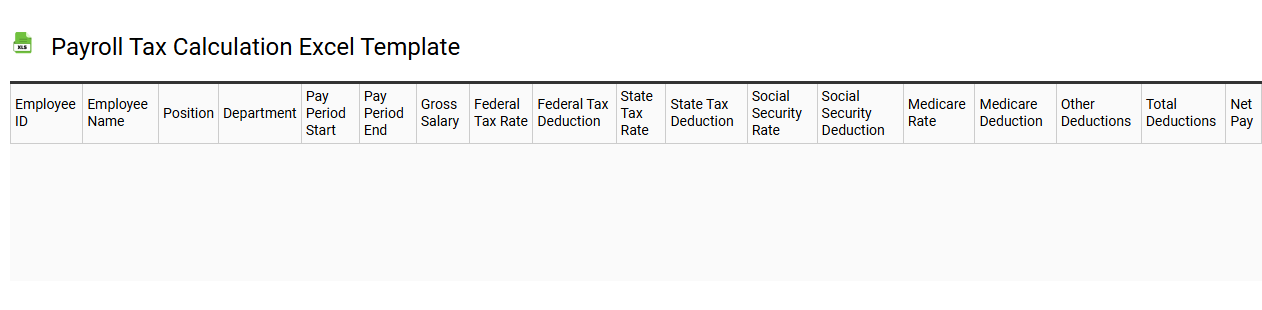

Payroll tax calculation Excel template

💾 Payroll tax calculation Excel template template .xls

A Payroll tax calculation Excel template simplifies the process of determining employee tax obligations using predefined formulas and structured layouts. It typically includes sections for employee details, earnings, deductions, and tax rates, ensuring accurate calculations for various scenarios. By inputting gross pay and applicable tax rates, you can swiftly receive net pay figures along with other necessary tax information. This basic tool serves immediate payroll needs, while advanced functionalities can be integrated, such as automated updates for tax law changes or comprehensive reporting for compliance and forecasting purposes.

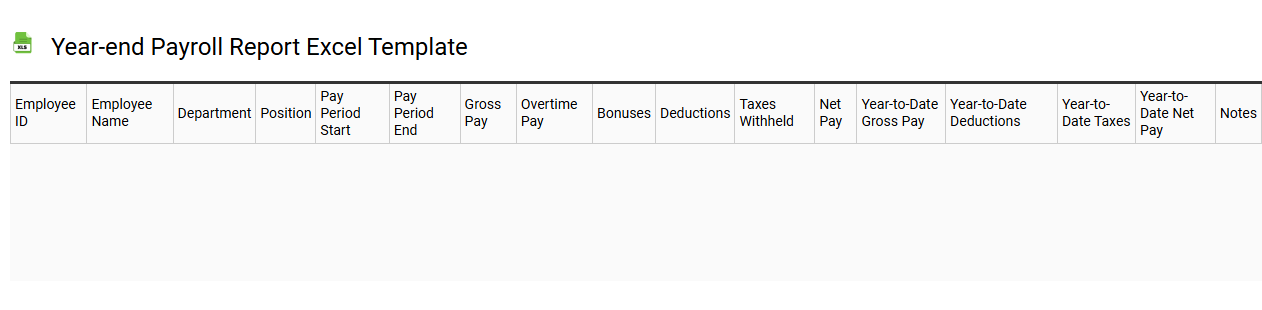

Year-end payroll report Excel template

💾 Year-end payroll report Excel template template .xls

A Year-end payroll report Excel template is a structured spreadsheet designed to streamline the process of summarizing employee earnings, deductions, and tax information for the fiscal year. This template typically includes sections for gross wages, taxable benefits, and various withholding amounts, making it easier for employers to prepare annual tax filings and ensure compliance with regulations. Customizable fields allow you to input specific company data, ensuring accuracy and relevance for your organization. You can use this basic template for straightforward payroll needs, while advanced features might include detailed employee analytics and integration with payroll software.

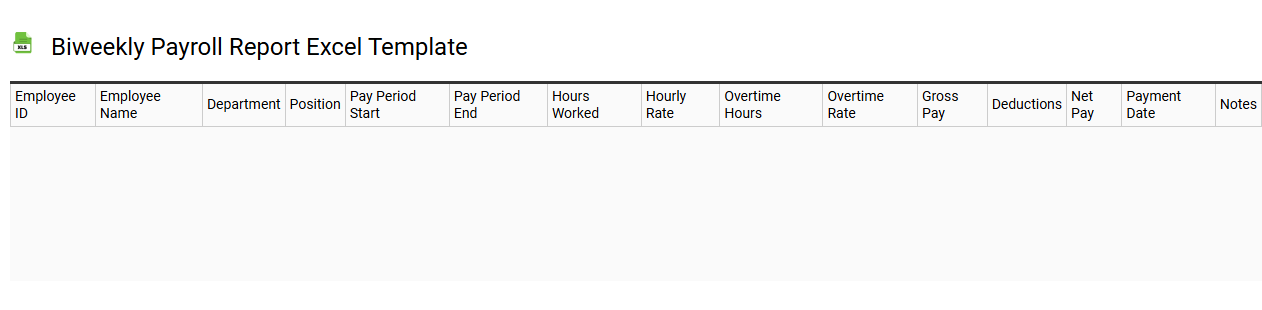

Biweekly payroll report Excel template

💾 Biweekly payroll report Excel template template .xls

A biweekly payroll report Excel template is a pre-designed spreadsheet that simplifies the process of tracking employee wages on a biweekly payment schedule. This template typically includes sections for employee names, hours worked, hourly rates, overtime calculations, and deductions, enabling you to calculate total pay accurately. You can customize fields for specific payroll needs, such as bonuses or commission structures, enhancing your financial management. Mastering this template can streamline your payroll processes and adapt it for more advanced functionalities like tax reporting or compliance with labor laws.

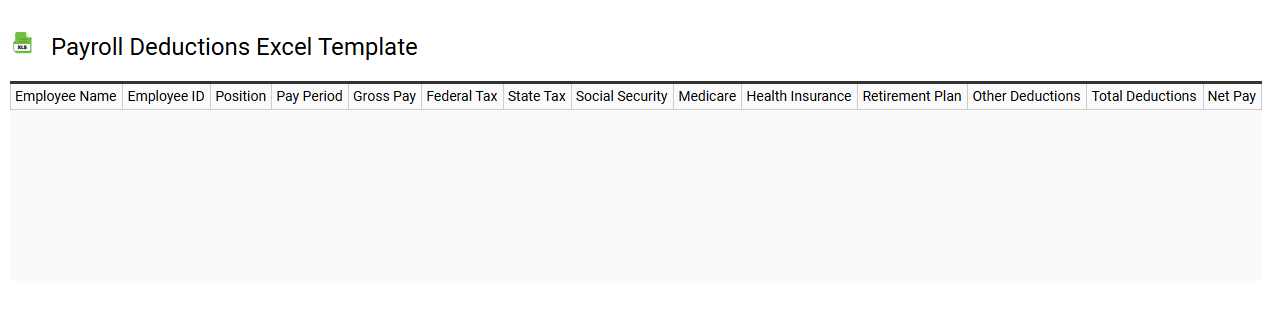

Payroll deductions Excel template

💾 Payroll deductions Excel template template .xls

A Payroll deductions Excel template is a pre-designed spreadsheet that helps businesses and organizations calculate and manage employee deductions from their salaries. This template typically includes fields for inputting employee information, gross pay, various deduction categories such as taxes, insurance premiums, and retirement contributions. Functions and formulas are often built into the spreadsheet for automatic calculations, ensuring accuracy and saving time during payroll processing. You can use this template for tracking deductions, generating reports, and simplifying compliance with tax regulations, while also expanding its functionality to integrate more advanced features like automated tax calculations and analytics dashboards.

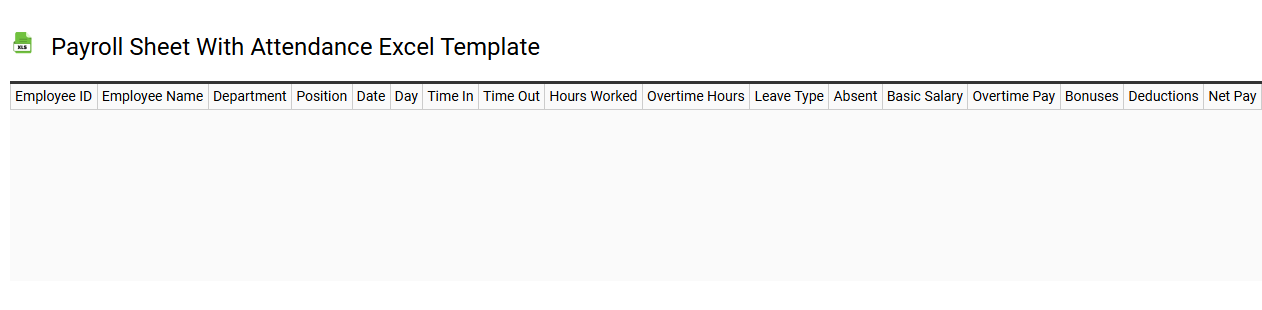

Payroll sheet with attendance Excel template

💾 Payroll sheet with attendance Excel template template .xls

A payroll sheet with an attendance Excel template serves as a comprehensive tool for managing employee wages and tracking attendance. This customizable spreadsheet incorporates clear sections to record employee names, hours worked, and overtime calculations, along with month-specific attendance data. You can easily input daily attendance, ensuring accurate compensation while enabling straightforward reporting and analysis. Such templates are basic yet powerful for managing payroll effectively, and with advanced functions like VLOOKUP or pivot tables, your potential for enhanced payroll analytics can be maximized.