Explore a variety of free GST invoice Excel templates tailored to streamline your billing process. These templates are designed to automatically calculate totals, tax amounts, and allow for easy customization of item details to suit your business needs. With user-friendly layouts, you can effortlessly track payments, maintain accurate records, and ensure compliance with GST regulations.

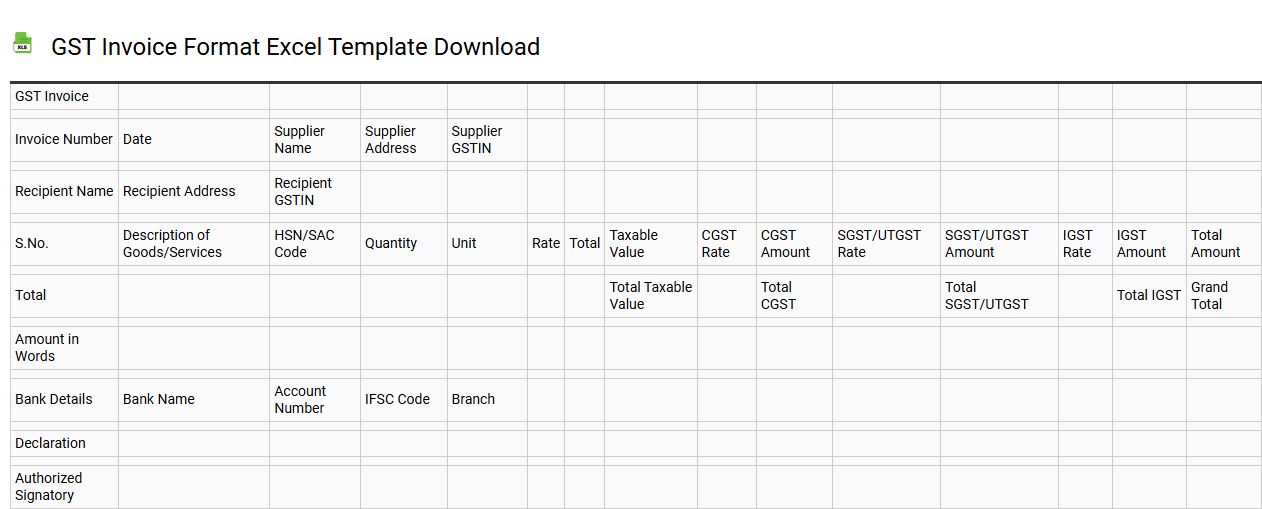

GST invoice format Excel template download

💾 GST invoice format Excel template download template .xls

A GST invoice format Excel template is a pre-designed spreadsheet that allows businesses to create invoices compliant with the Goods and Services Tax (GST) regulations. This template typically includes essential fields such as invoice number, date, buyer and seller details, description of goods or services, GST rates, and total amounts. Customizable sections enable you to modify headers, adjust item quantities, and update tax percentages according to specific transactions. Using this template can simplify your billing process now while allowing for further needs like integration with accounting software or automation of recurring invoices.

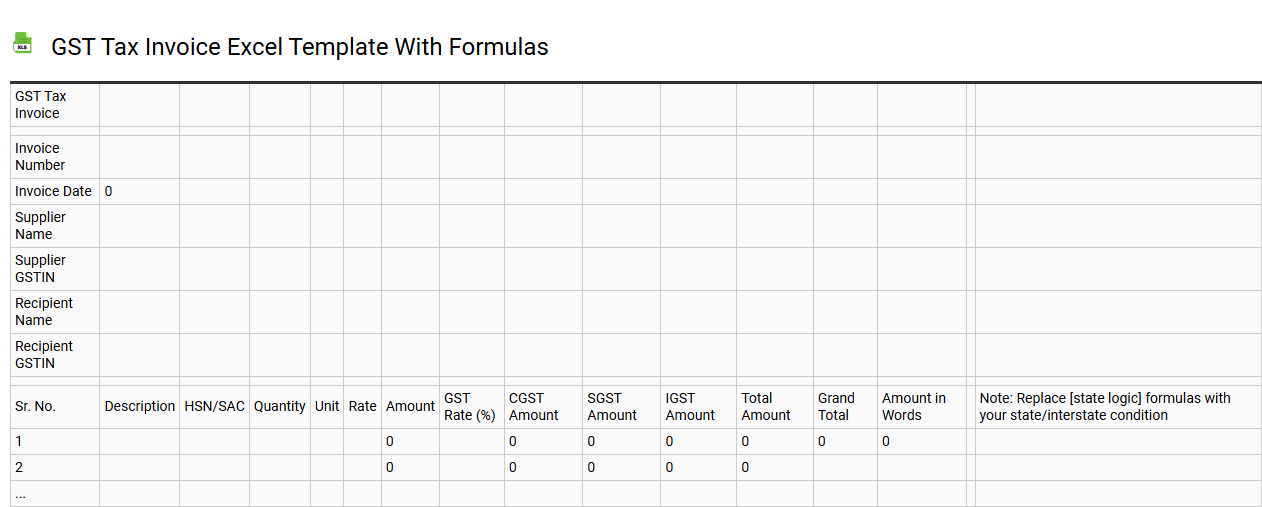

GST tax invoice Excel template with formulas

💾 GST tax invoice Excel template with formulas template .xls

A GST tax invoice Excel template serves as a structured tool for businesses to generate valid tax invoices that comply with Goods and Services Tax regulations. This template typically includes essential fields such as invoice number, date, buyer's details, seller's details, item descriptions, quantities, rates, and the applicable GST rates. Formulas within the template help automate calculations for total amounts, applying GST to subtotal values, and ensuring accurate totals inclusive of tax. You can further enhance this template by integrating advanced functionalities like pivot tables for detailed sales analysis or data validation for improving data entry accuracy.

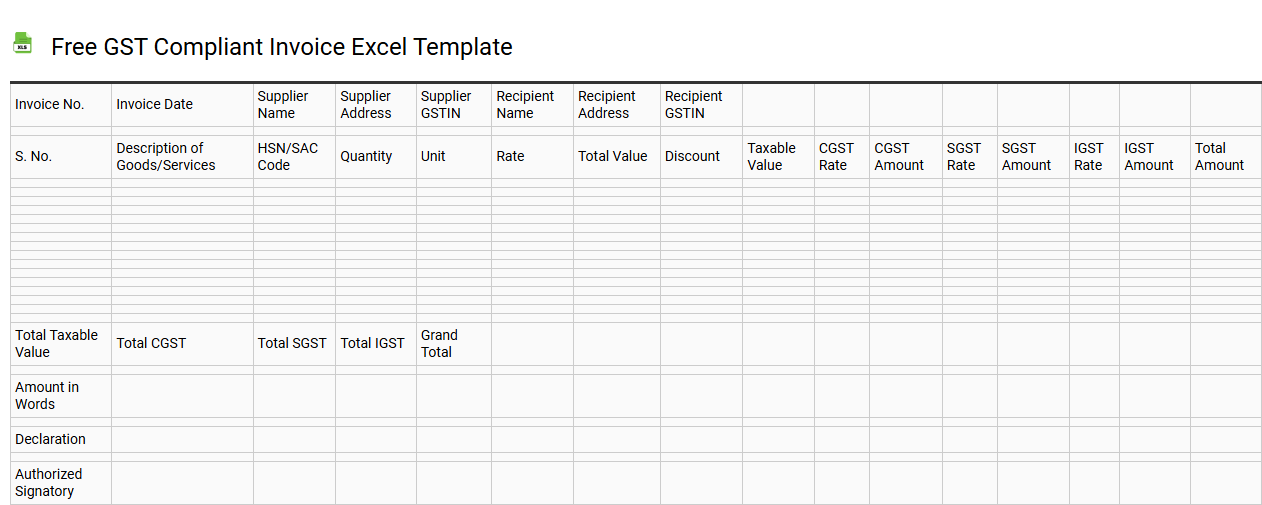

Free GST compliant invoice Excel template

💾 Free GST compliant invoice Excel template template .xls

A Free GST compliant invoice Excel template serves as a pre-designed spreadsheet to facilitate the creation of invoices adhering to Goods and Services Tax regulations. This template typically includes essential fields such as invoice number, date, seller details, buyer information, item descriptions, and GST rates, ensuring accuracy in tax calculations. You can customize the format and branding elements to align with your business identity while maintaining compliance with state and national tax laws. This template is particularly useful for small business owners and freelancers looking to streamline invoicing processes, while more advanced integration could involve incorporating automated billing and reporting features.

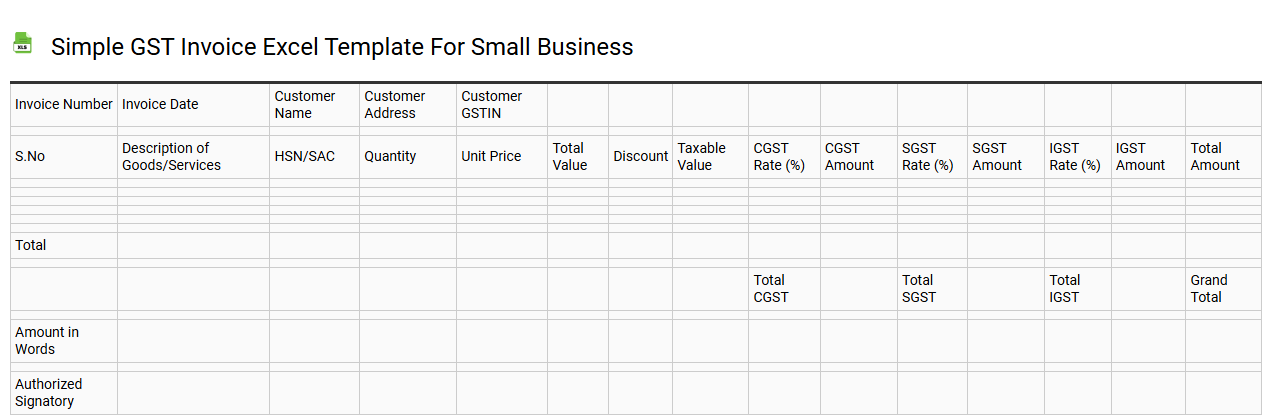

Simple GST invoice Excel template for small business

💾 Simple GST invoice Excel template for small business template .xls

A Simple GST invoice Excel template streamlines the billing process for small businesses by providing a structured format to record sales and tax details. The template typically includes fields for your business name, GST number, customer information, item descriptions, quantities, rates, and applicable GST rates. Such invoices ensure compliance with tax regulations and help maintain clear financial records. This basic template can be adapted further to incorporate advanced features like automatic tax calculations, filtering options for transaction categories, and integration with accounting software for enhanced financial tracking.

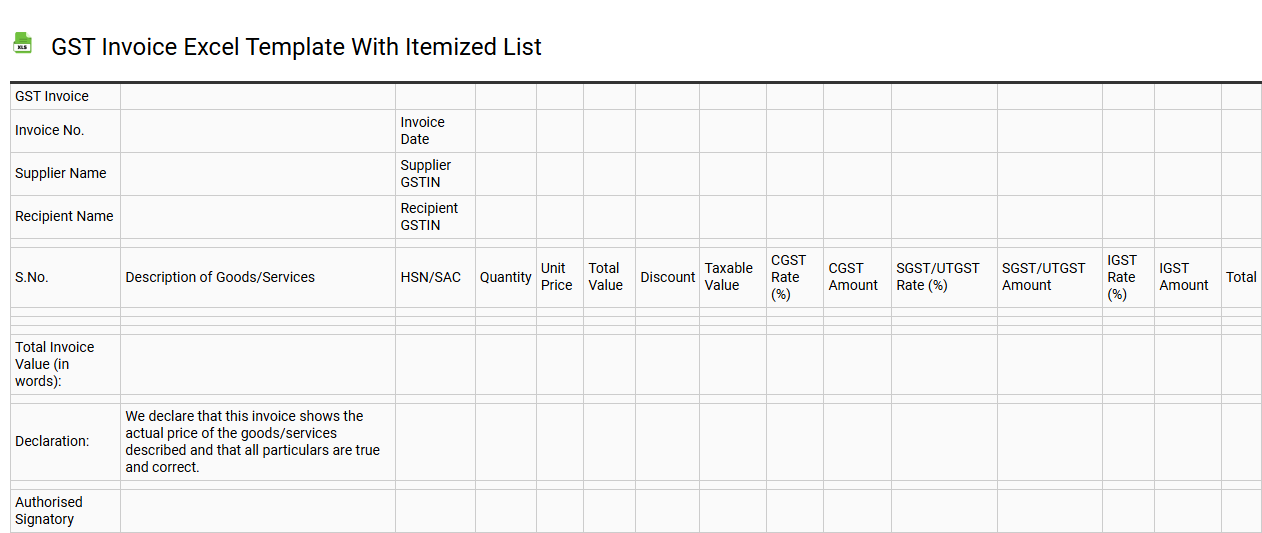

GST invoice Excel template with itemized list

💾 GST invoice Excel template with itemized list template .xls

A GST invoice Excel template with an itemized list provides a structured format for businesses to generate invoices while adhering to Goods and Services Tax regulations. Each row in the itemized list enables detailed entry of products or services, including descriptions, quantities, and individual prices, ensuring accuracy in billing. The template typically includes necessary columns for GST rates, total amounts, and fields for buyer and seller information. This tool simplifies compliance with tax laws and can easily accommodate further enhancements, such as integrating automated calculations or advanced reporting features.

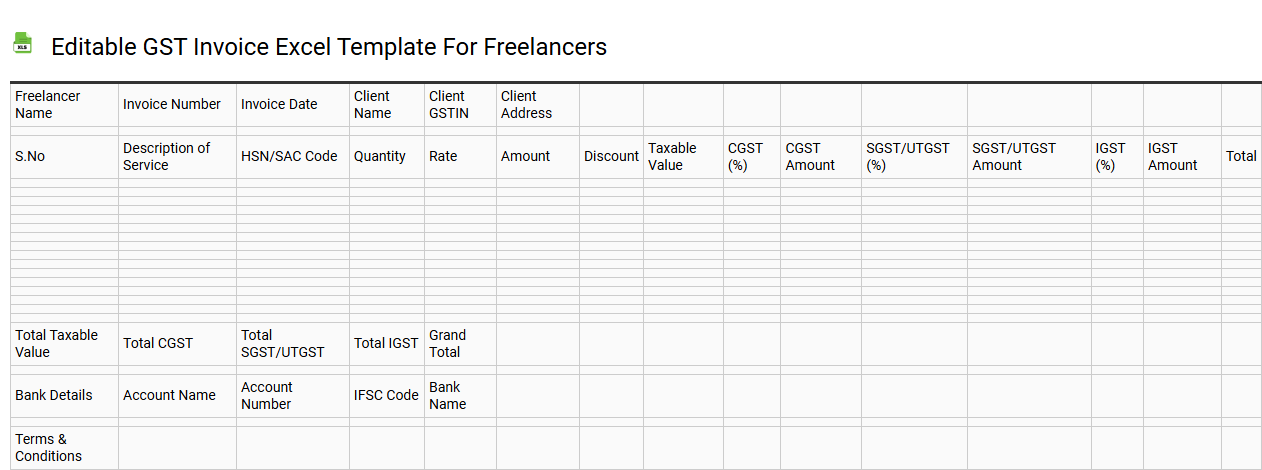

Editable GST invoice Excel template for freelancers

💾 Editable GST invoice Excel template for freelancers template .xls

An editable GST invoice Excel template for freelancers is a customizable spreadsheet that enables you to create invoices compliant with Goods and Services Tax (GST) regulations. This template typically includes essential fields such as invoice number, date, client details, item descriptions, quantities, rates, and applicable taxes, ensuring accurate billing. You can easily modify the template to reflect your branding, services offered, and payment terms, making it versatile for various projects. Such templates simplify the invoicing process, but for more advanced financial management, you might explore integration with accounting software or deeper analytics tools.

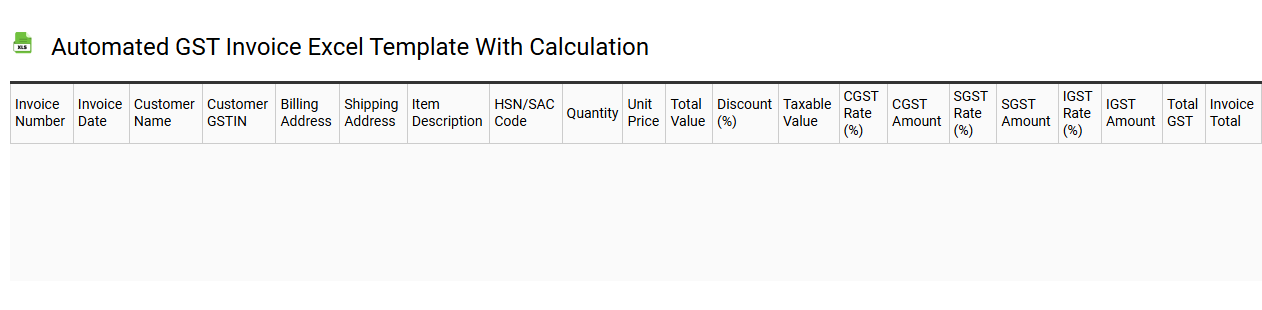

Automated GST invoice Excel template with calculation

💾 Automated GST invoice Excel template with calculation template .xls

The Automated GST invoice Excel template streamlines the invoicing process, allowing businesses to generate GST-compliant invoices with ease. This template includes built-in formulas that automatically calculate Goods and Services Tax, totals, and applicable discounts, saving you time and minimizing errors. User-friendly features enable quick data entry for product details, quantities, and pricing, ensuring that all necessary information is neatly organized. Consider this template for your basic invoicing needs, with the potential for further customization using advanced features like pivot tables and macro programming for enhanced reporting and analytics.

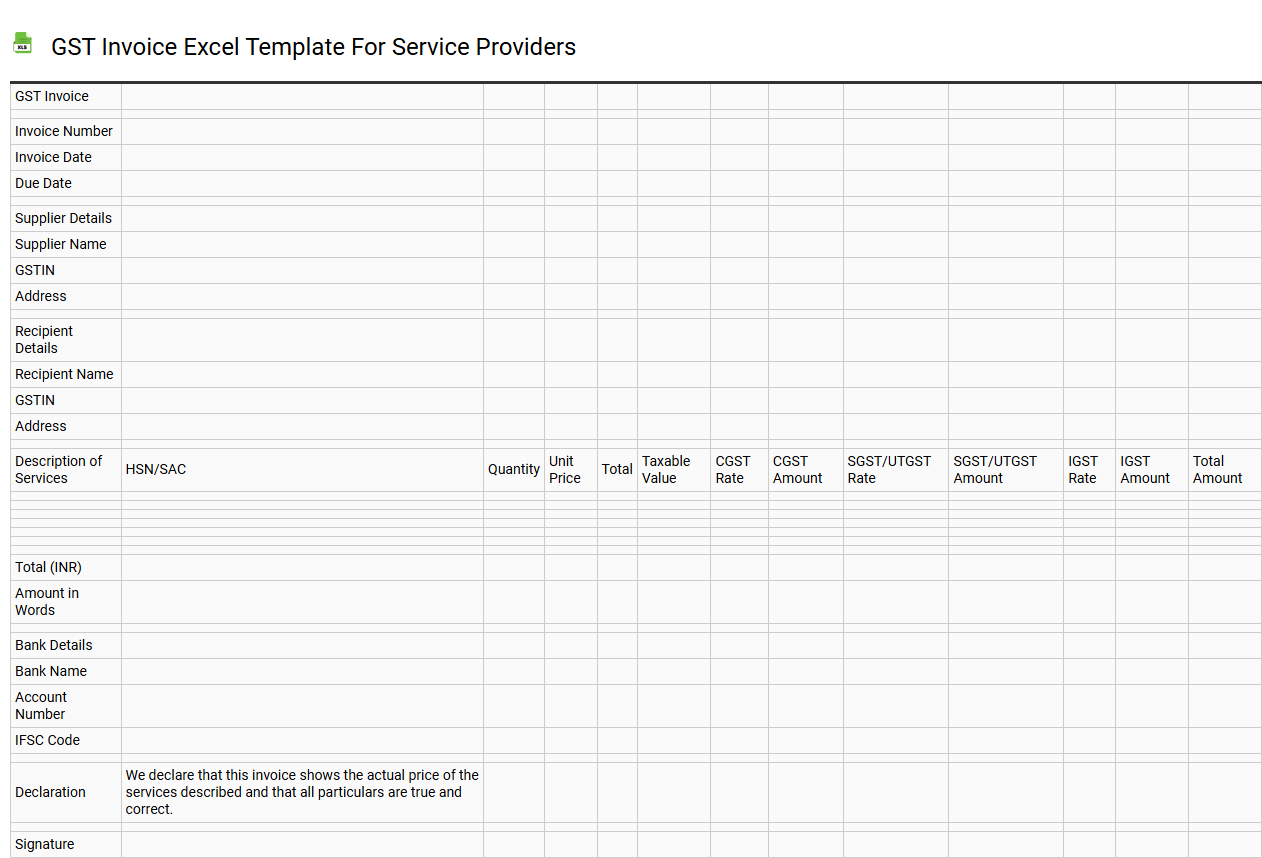

GST invoice Excel template for service providers

💾 GST invoice Excel template for service providers template .xls

A GST invoice Excel template for service providers streamlines the billing process by allowing you to create invoices compliant with Goods and Services Tax regulations. This template typically includes fields for your business details, client information, service descriptions, rates, taxable amounts, and the applicable GST percentage. Each item is clearly laid out, ensuring accurate calculations of the total payable amount, including tax. You can customize the format to suit your branding and create records for future reference, making it easier to manage client transactions and prepare for potential audit requirements. Beyond basic invoicing, consider incorporating features for tracking payments or generating financial reports for deeper analytics.

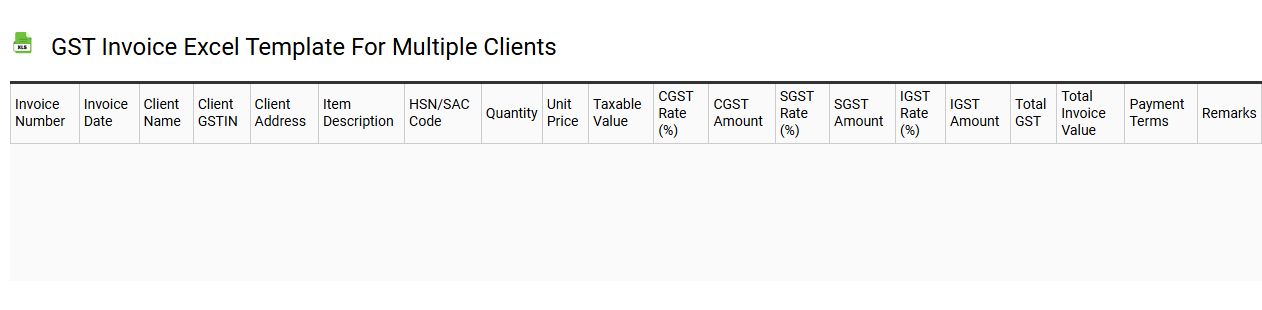

GST invoice Excel template for multiple clients

💾 GST invoice Excel template for multiple clients template .xls

A GST invoice Excel template for multiple clients simplifies the invoicing process for businesses by allowing you to create and manage invoices efficiently. This template typically features fields for client details, invoice numbers, dates, item descriptions, quantities, rates, and applicable GST rates, ensuring compliance with tax regulations. You can customize it for different clients by entering specific information while maintaining a uniform format, saving you valuable time and reducing errors. Beyond basic invoicing, consider exploring automation features, advanced formulas, or integrating with accounting software to enhance your invoicing capabilities.

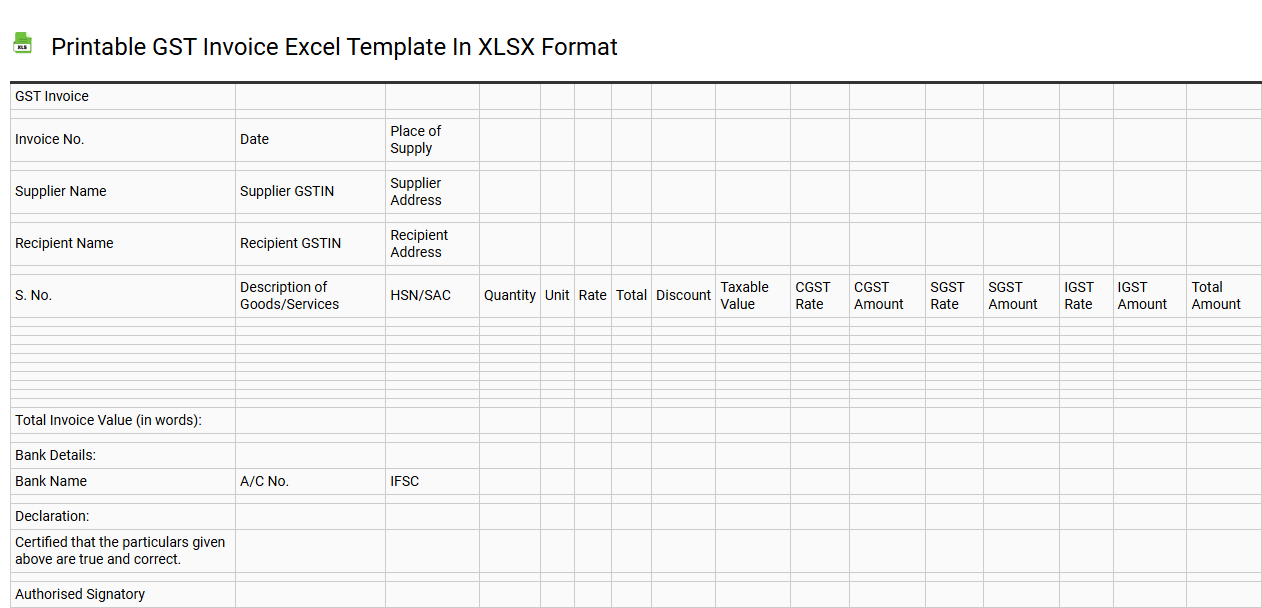

Printable GST invoice Excel template in XLSX format

💾 Printable GST invoice Excel template in XLSX format template .xls

A Printable GST invoice Excel template in XLSX format is a pre-designed spreadsheet designed to simplify the creation of Goods and Services Tax invoices. This Excel template typically includes essential fields such as invoice number, date, GSTIN, billing information, product details, tax rates, and total amounts. Users can easily input their transaction details while ensuring compliance with GST regulations, streamlining the invoicing process. This template can serve basic needs for small businesses, while further customization options and integration capabilities can enhance its functionality for more advanced financial management tasks.