Explore a variety of free Excel templates designed specifically for part-time employee payroll management. These templates feature user-friendly formats that simplify the tracking of work hours, wages, and deductions, ensuring accuracy in payroll calculations. Customizable fields allow you to tailor the templates to fit your business needs, making payroll processing efficient and straightforward.

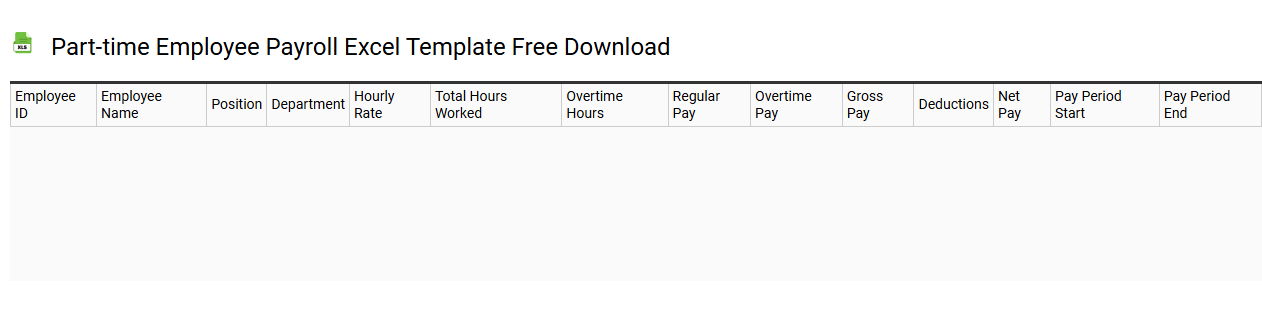

Part-time employee payroll Excel template free download

💾 Part-time employee payroll Excel template free download template .xls

A part-time employee payroll Excel template is a user-friendly spreadsheet designed to streamline the payroll process for part-time workers. This template typically includes sections for employee details, hours worked, wage rates, tax deductions, and total earnings. Customizable features allow businesses to tailor the sheet to their specific needs, ensuring accurate calculations for every payroll cycle. This straightforward tool can aid in managing employee compensation efficiently while providing the flexibility for more advanced features, such as automated calculations and integration with accounting software.

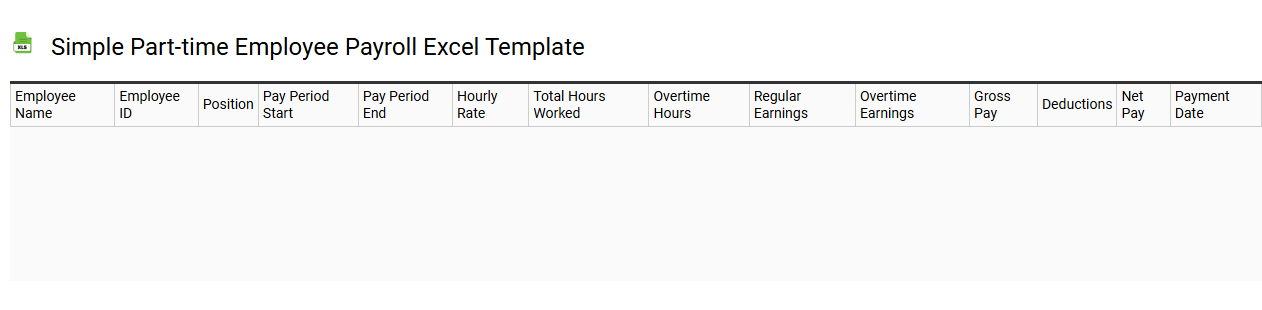

Simple part-time employee payroll Excel template

💾 Simple part-time employee payroll Excel template template .xls

A simple part-time employee payroll Excel template offers a structured framework for efficiently managing employee compensation and tracking hours worked. It typically includes sections for employee information, such as name, identification number, and pay rate, alongside columns for recording hours worked, overtime, and deductions. Calculations for gross pay and net pay are automated to minimize errors and save time. This template is ideal for small businesses or individuals looking to streamline payroll processes, and it can be expanded to include features such as tax calculations and benefits tracking to accommodate more complex payroll needs.

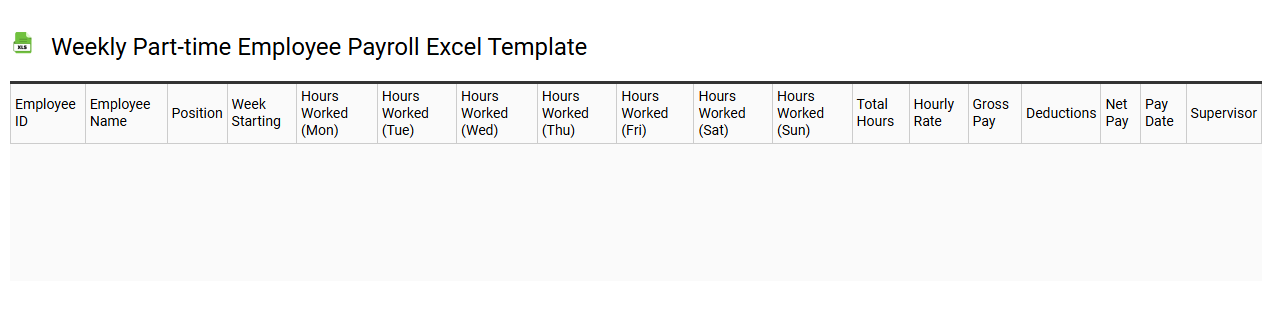

Weekly part-time employee payroll Excel template

💾 Weekly part-time employee payroll Excel template template .xls

A Weekly part-time employee payroll Excel template is a structured spreadsheet designed to help businesses efficiently track and manage the salaries of part-time employees. This template typically includes key data points such as employee names, hours worked, hourly rates, overtime, deductions, and total pay. By inputting relevant information, you can easily calculate gross wages and net pay, ensuring accurate financial records. This template can be further customized to address advanced requirements such as tax calculations, benefits administration, and reporting compliance.

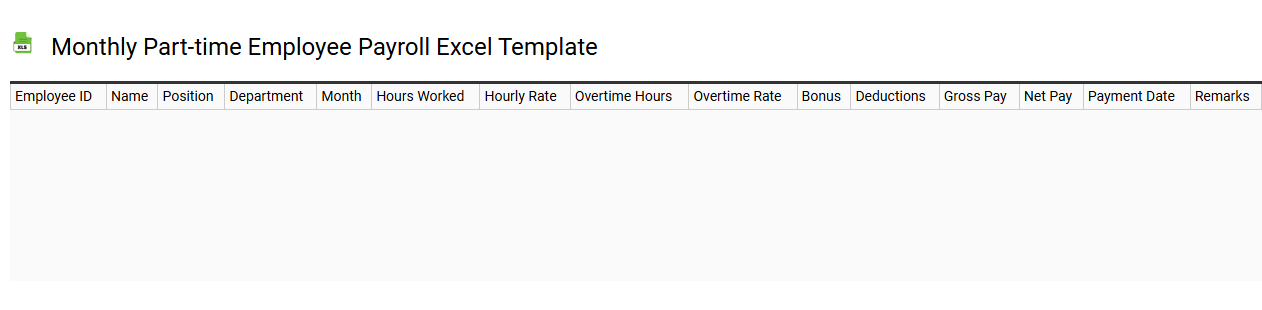

Monthly part-time employee payroll Excel template

💾 Monthly part-time employee payroll Excel template template .xls

A Monthly part-time employee payroll Excel template serves as a structured tool to manage and calculate employee wages for part-time staff on a monthly basis. This template usually includes essential elements such as employee details, hourly rates, hours worked, and deductions, making it easy to track payroll calculations. Customizable fields allow you to adapt the template to fit specific business needs or payment structures. You can use this basic template for efficient payroll processing, and later explore advanced features like automated calculations, integrated tax compliance, or multi-currency support for broader financial management.

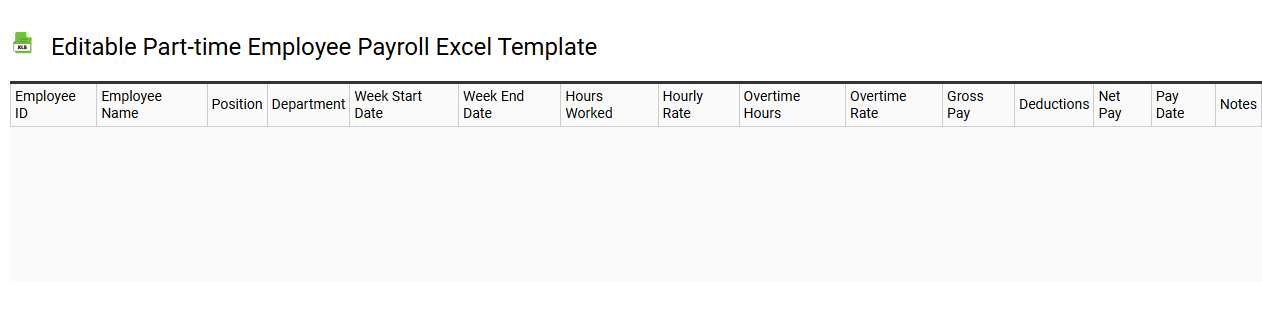

Editable part-time employee payroll Excel template

💾 Editable part-time employee payroll Excel template template .xls

An editable part-time employee payroll Excel template is a convenient spreadsheet designed to help businesses manage and calculate the payroll for part-time staff efficiently. This template usually includes sections for employee details, hourly rates, worked hours, and deductions, providing a comprehensive view of each employee's compensation. You can easily customize it to fit your specific needs, adjusting fields as necessary to align with your company's payroll practices. For advanced tracking, consider incorporating features like automatic tax calculations or integration with accounting software to streamline your payroll process even further.

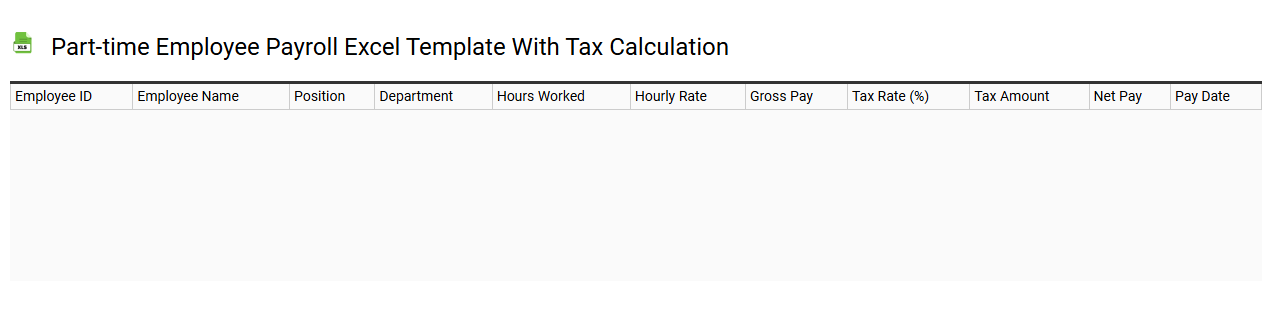

Part-time employee payroll Excel template with tax calculation

💾 Part-time employee payroll Excel template with tax calculation template .xls

A part-time employee payroll Excel template with tax calculation streamlines the process of managing payroll for individuals working fewer hours than full-time staff. This template typically features dedicated sections for employee information, hours worked, hourly rates, deductions, and tax calculations that align with the latest tax regulations. Formulas within the spreadsheet automatically compute gross pay, net pay, and any applicable withholdings, saving you time and reducing the chance of errors. Essential for businesses that employ part-time workers, this template can also be tailored to meet advanced needs such as multi-state tax compliance or integration with accounting software.

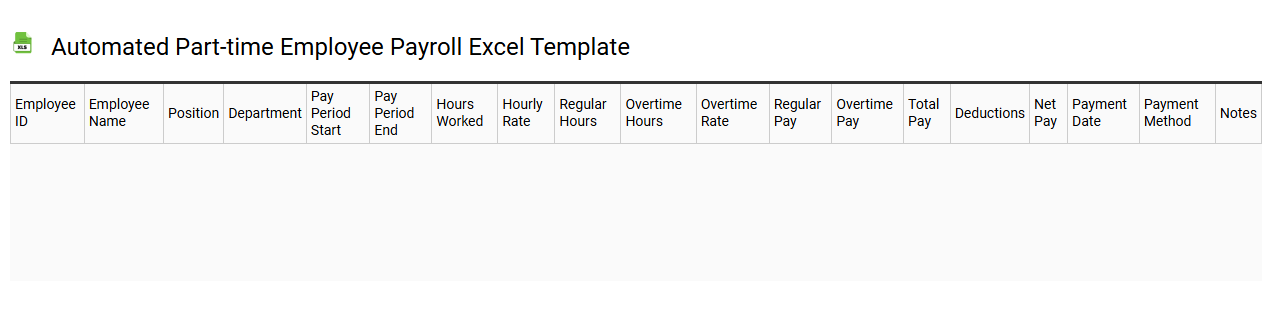

Automated part-time employee payroll Excel template

💾 Automated part-time employee payroll Excel template template .xls

An Automated Part-Time Employee Payroll Excel Template simplifies the payroll process for businesses that employ part-time workers. This tool allows you to input essential employee information, such as hours worked, hourly rates, and deductions, automatically generating accurate payroll calculations. The template often includes features like tax calculation and leave tracking, making it easy to manage diverse employee records within one organized spreadsheet. As your business grows, you may require advanced financial analytics or integration with accounting software for comprehensive payroll management.

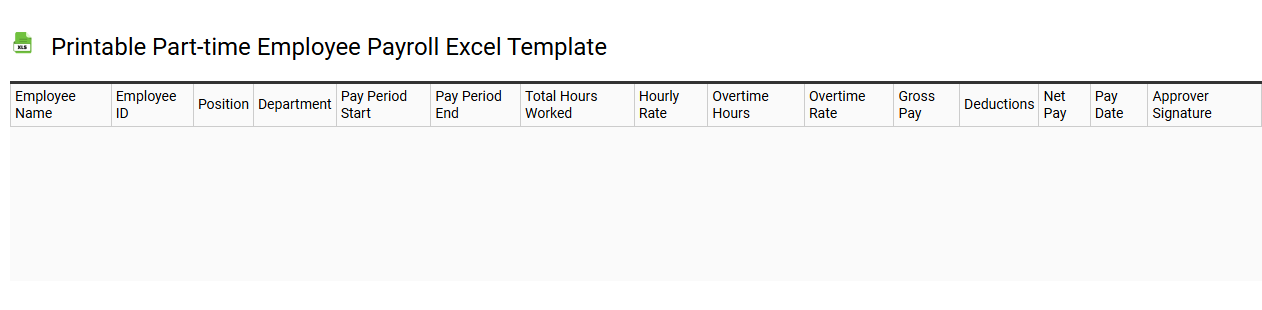

Printable part-time employee payroll Excel template

💾 Printable part-time employee payroll Excel template template .xls

A printable part-time employee payroll Excel template is a ready-to-use tool designed to simplify payroll management for part-time staff. It typically includes fields for employee information, hours worked, pay rate, overtime calculations, and total earnings. Customizable formulas allow you to automatically calculate total wages and deductions, streamlining the payroll process. This template can serve not only for basic payroll tasks but also for advanced needs such as tax calculations and regulatory compliance tracking.

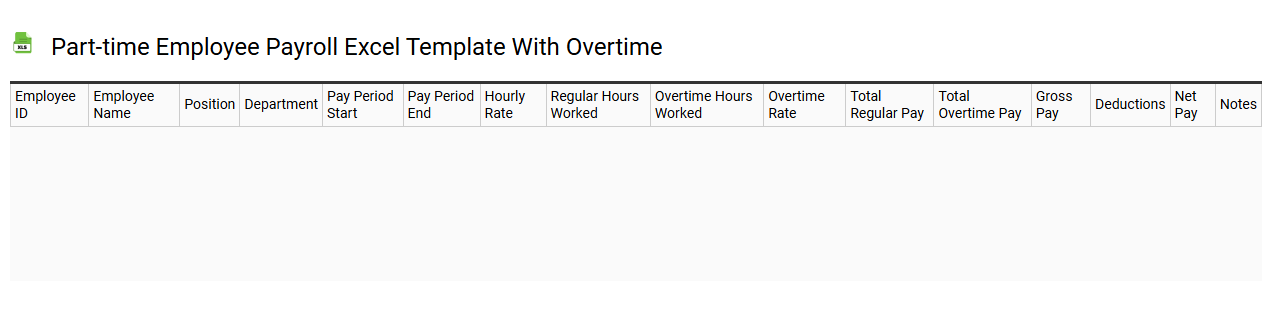

Part-time employee payroll Excel template with overtime

💾 Part-time employee payroll Excel template with overtime template .xls

A Part-time employee payroll Excel template with overtime allows businesses to efficiently track and manage payroll for part-time workers who may clock in extra hours beyond their regular schedules. This template typically includes columns for employee names, hourly rates, regular hours worked, overtime hours, and total earnings. You can customize it to calculate overtime pay according to labor laws, ensuring that your part-time staff is compensated accurately for their additional hours. For more complex needs, consider integrating features like automated tax calculations, leave management, or direct deposit setup.

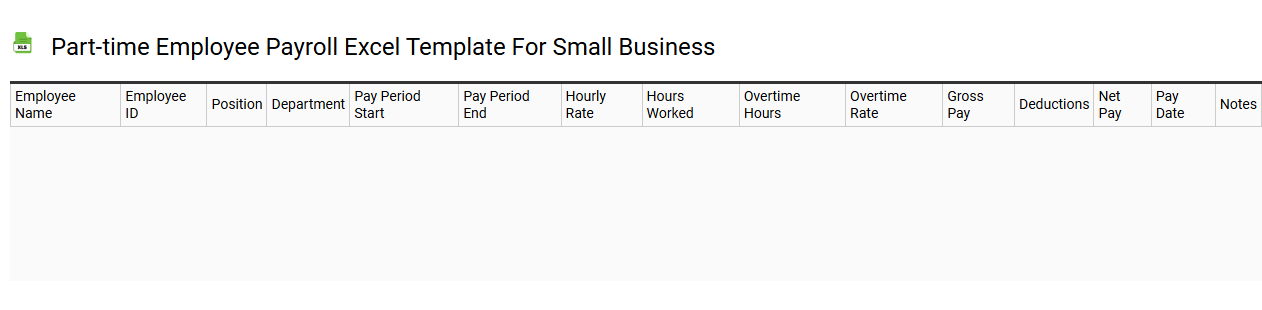

Part-time employee payroll Excel template for small business

💾 Part-time employee payroll Excel template for small business template .xls

Part-time employee payroll Excel templates are designed to help small business owners efficiently manage salary calculations, deductions, and tax contributions for part-time staff. These templates typically include formatted sections for employee details, hours worked, pay rates, and any applicable deductions for insurance or taxes. They allow for easy input and automated calculations, simplifying the payroll process while ensuring accuracy and compliance with local labor regulations. As your business grows, you might consider more advanced software for payroll to handle multiple complex pay structures, benefits administration, and real-time reporting.