Explore a variety of free XLS templates designed specifically for payroll reporting in Excel. These templates offer structured layouts for tracking employee hours, calculating wages, and managing deductions, ensuring your payroll process is both efficient and accurate. Customizable fields allow you to tailor the templates to fit your organization's specific needs, making payroll management a seamless task.

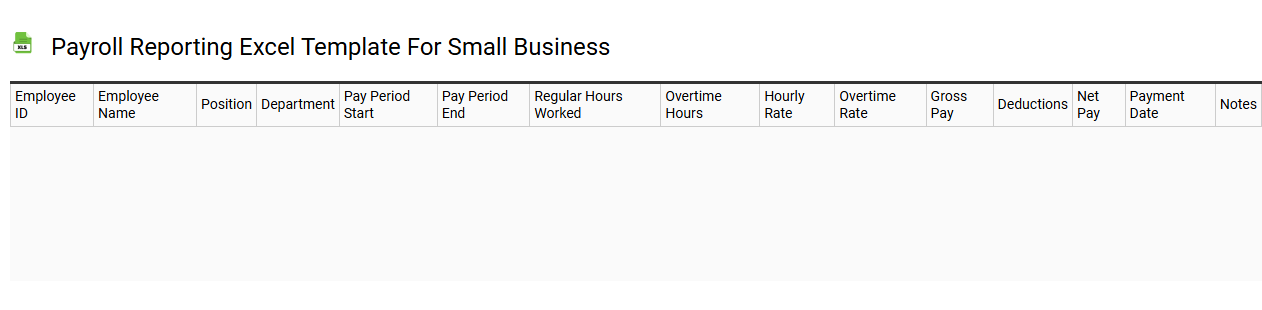

payroll reporting Excel template for small business

💾 payroll reporting Excel template for small business template .xls

A payroll reporting Excel template for small businesses serves as a streamlined tool to calculate and manage employee wages, tax withholdings, and other deductions efficiently. It typically includes rows for employee names, hours worked, pay rates, gross pay, and net pay, allowing for easy tracking and updates. Utilizing formulas within the template automates calculations, reducing the risk of human error while consolidating data for quick reference during payroll preparation. This basic tool can evolve into more sophisticated payroll management systems as your business grows, incorporating features like automated tax calculations and compliance reporting.

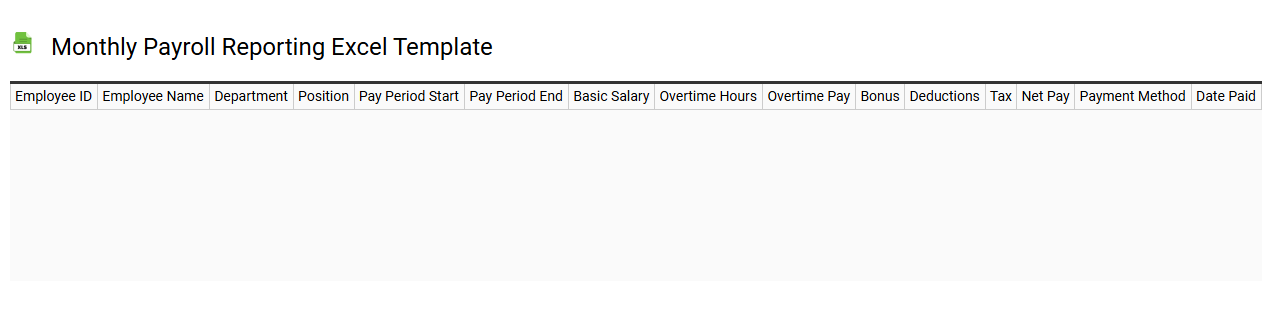

monthly payroll reporting Excel template

💾 monthly payroll reporting Excel template template .xls

A monthly payroll reporting Excel template is a structured spreadsheet designed to streamline the payroll process for businesses. It typically includes sections for employee names, hours worked, hourly rates, deductions, and net pay calculations, making it easier to track compensation and compliance. The template often features built-in formulas to automatically compute totals and ensure accuracy, saving you time on manual calculations. This foundational tool can be adapted for more advanced needs, such as integrating tax withholding calculations and department-specific payroll tracking.

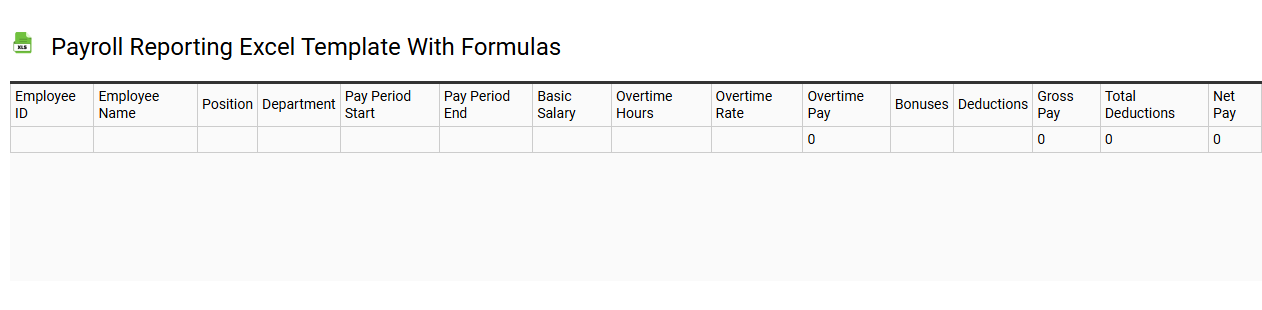

payroll reporting Excel template with formulas

💾 payroll reporting Excel template with formulas template .xls

A payroll reporting Excel template with formulas provides a structured format for managing employee compensation and tax deductions. It typically includes columns for employee names, hours worked, hourly rates, gross pay, tax withholdings, and net pay, all of which are calculated using specific formulas to ensure accuracy. You can customize this template to reflect benefits, overtime, and other deductions, making it a versatile tool for payroll management. This basic setup can evolve into more complex applications, such as integrating with HRIS systems and utilizing advanced Excel functions like VLOOKUP and pivot tables for deeper data analysis and reporting needs.

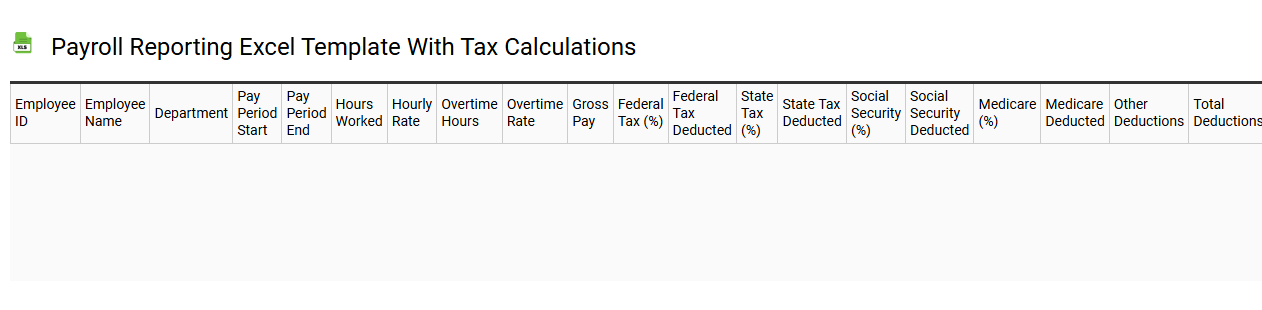

payroll reporting Excel template with tax calculations

💾 payroll reporting Excel template with tax calculations template .xls

A payroll reporting Excel template with tax calculations serves as a structured tool for businesses to efficiently manage employee salary data. This template typically includes fields for employee names, hours worked, gross pay, deductions, and net pay, ensuring comprehensive tracking of payments. Tax calculations are seamlessly integrated, allowing payroll administrators to automatically compute federal, state, and local taxes based on up-to-date regulations. Such templates not only streamline regular payroll processing but also offer the potential for advanced financial analysis and forecasting by incorporating complex functions and macros.

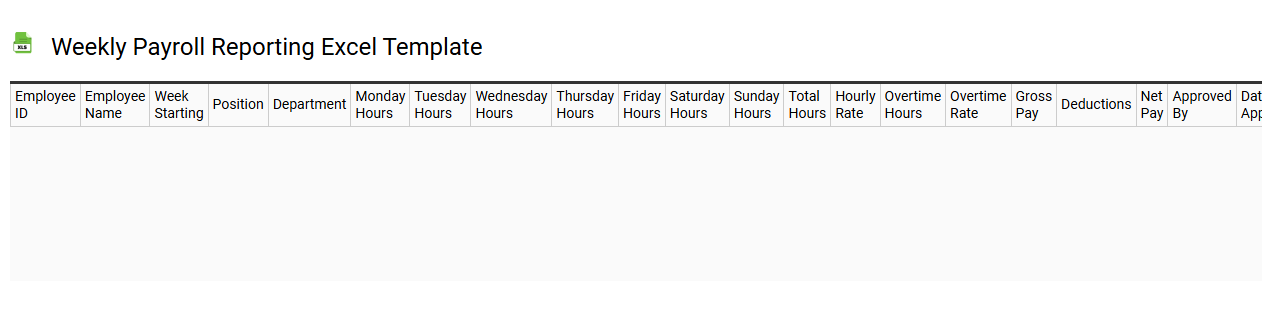

weekly payroll reporting Excel template

💾 weekly payroll reporting Excel template template .xls

A weekly payroll reporting Excel template is designed to streamline the process of tracking employee wages, hours worked, and deductions. This template typically includes columns for employee names, hourly rates, hours worked, overtime calculations, and tax deductions, making it easy to compile comprehensive payroll data. Using this template simplifies payroll management, ensuring that you can quickly generate accurate reports for financial tracking and compliance purposes. Further applications may include integration with advanced payroll software, customization for complex tax regulations, or automation of data entry through macros.

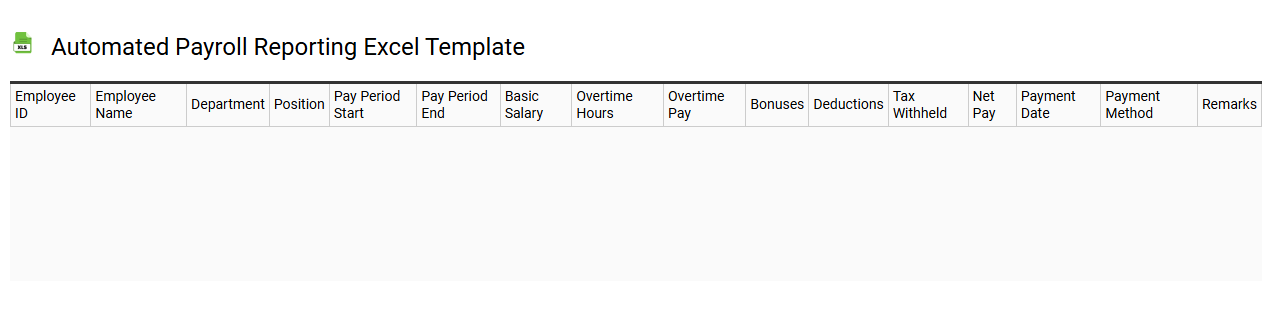

automated payroll reporting Excel template

💾 automated payroll reporting Excel template template .xls

An automated payroll reporting Excel template streamlines the process of calculating, tracking, and reporting employee payroll information. It usually includes features like automated calculations for wages, deductions, taxes, and net pay, reducing the likelihood of human error. Using formulas and macros, the template can generate detailed reports that summarize payroll data for specified periods, aiding in financial analysis and compliance. For your needs, this template can provide basic payroll processing, with further potential enhancements using advanced data visualization and integration with HR management systems.

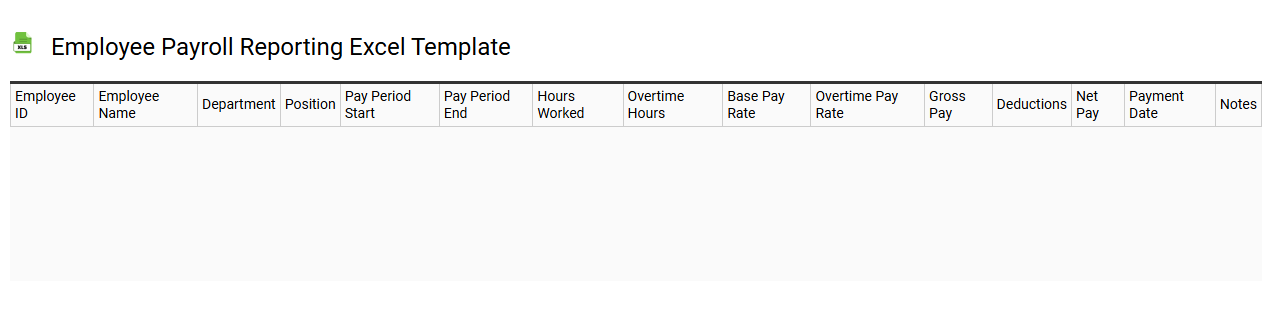

Employee payroll reporting Excel template

💾 Employee payroll reporting Excel template template .xls

An Employee payroll reporting Excel template is a structured spreadsheet tool designed to organize and calculate employee compensation details. It typically includes essential columns for employee names, identification numbers, hours worked, pay rates, deductions, and net pay calculations. This template streamlines the payroll process, ensuring accuracy and compliance with taxation requirements, while also providing a clear overview of employee payroll data. You can adapt this template for basic payroll management, or expand its functionality to include advanced features like automated tax calculations and forecasting modules.

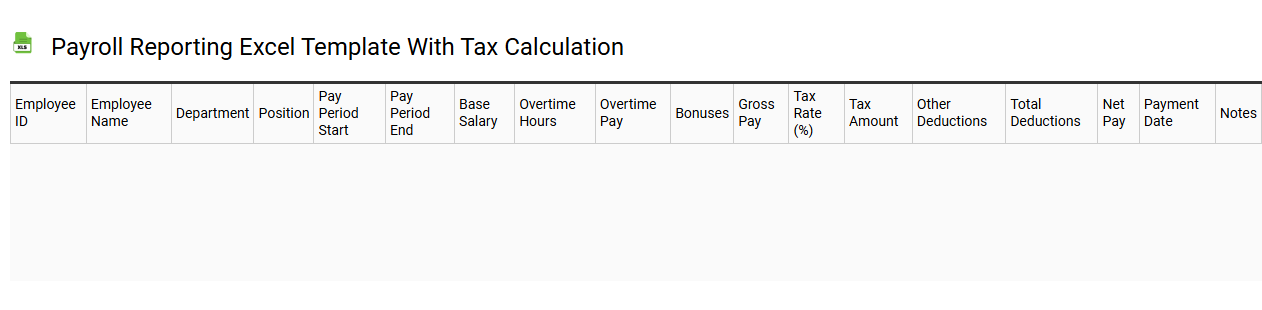

Payroll reporting Excel template with tax calculation

💾 Payroll reporting Excel template with tax calculation template .xls

A Payroll reporting Excel template with tax calculation is a structured spreadsheet designed to simplify the management of employee payroll data. It typically includes fields for employee names, job titles, hours worked, wages, and various deductions such as federal, state, and local taxes. Formulas embedded within the template automatically compute total earnings, net pay, and applicable taxes based on the inputted information. These templates cater to basic payroll needs but can be expanded to incorporate advanced features such as customized tax brackets, overtime calculations, and benefits tracking.

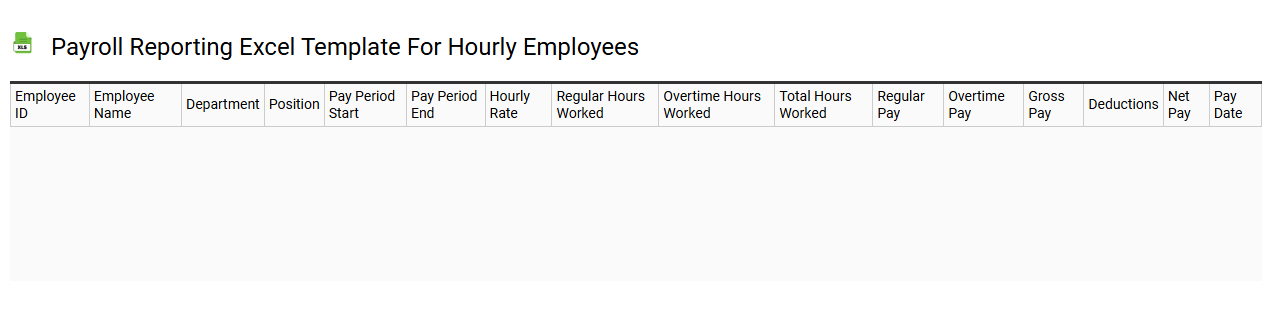

Payroll reporting Excel template for hourly employees

💾 Payroll reporting Excel template for hourly employees template .xls

A Payroll reporting Excel template for hourly employees simplifies the tracking and management of hours worked, wages, and deductions. This template typically includes fields for employee names, IDs, scheduled hours, actual hours worked, overtime, and applicable rates. You can easily calculate gross pay, deductions, and net pay using built-in formulas, ensuring accuracy and efficiency in your payroll process. For basic usage, you might just need the standard data entry, but further potential needs could involve advanced functions like VLOOKUP, pivot tables for analytics, and integration with HR software.

Payroll reporting Excel template with overtime tracking

![]()

💾 Payroll reporting Excel template with overtime tracking template .xls

A Payroll reporting Excel template with overtime tracking is a structured spreadsheet designed to efficiently manage and track employee hours worked, including regular and overtime hours. This template typically features sections for entering employee names, hourly rates, and total hours worked, segmented into regular and overtime categories. Formulas within the spreadsheet automatically calculate total pay based on the entered data, ensuring accuracy in payroll processing. You can easily adapt this tool for your organization's specific needs, potentially incorporating advanced functions like pivot tables or macros for enhanced data analysis and reporting.

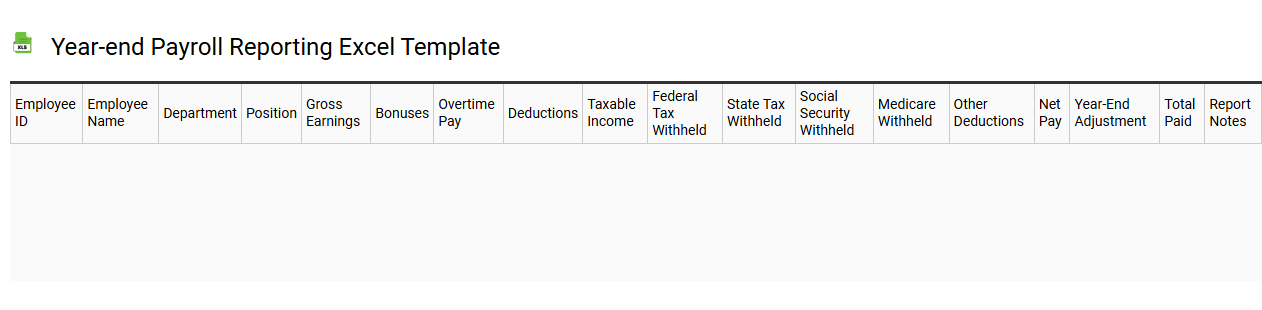

Year-end payroll reporting Excel template

💾 Year-end payroll reporting Excel template template .xls

A Year-end payroll reporting Excel template is a structured file designed to simplify the process of compiling and analyzing payroll data at the end of the fiscal year. This template typically includes sections for employee details, total wages, tax withholdings, and any additional deductions. You can efficiently track essential information like bonuses, overtime payments, and retirement contributions, ensuring compliance with tax regulations. As you utilize this template, consider advanced features like pivot tables and macros to further enhance your payroll reporting efficiency, adapting the tool to your complex reporting requirements.

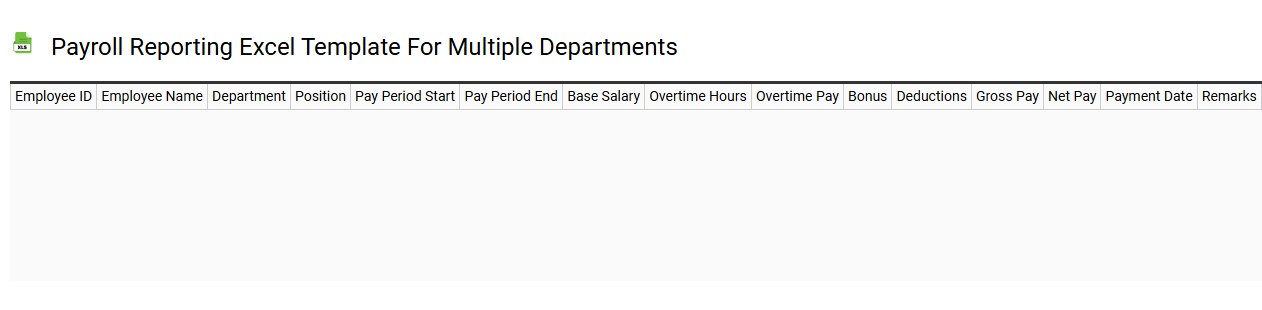

Payroll reporting Excel template for multiple departments

💾 Payroll reporting Excel template for multiple departments template .xls

A Payroll Reporting Excel template for multiple departments streamlines the process of tracking employee compensation across various sectors within your organization. This template typically includes columns for employee names, department identifiers, hours worked, pay rates, benefits, and deductions, ensuring clear organization and easy access to essential payroll data. Customizable features allow you to adjust the layout and formulas to match your specific payroll requirements, providing tailored insights into labor costs and departmental performance. Using this template can simplify your current payroll management while paving the way for more sophisticated analytics and integration with advanced payroll software solutions in the future.

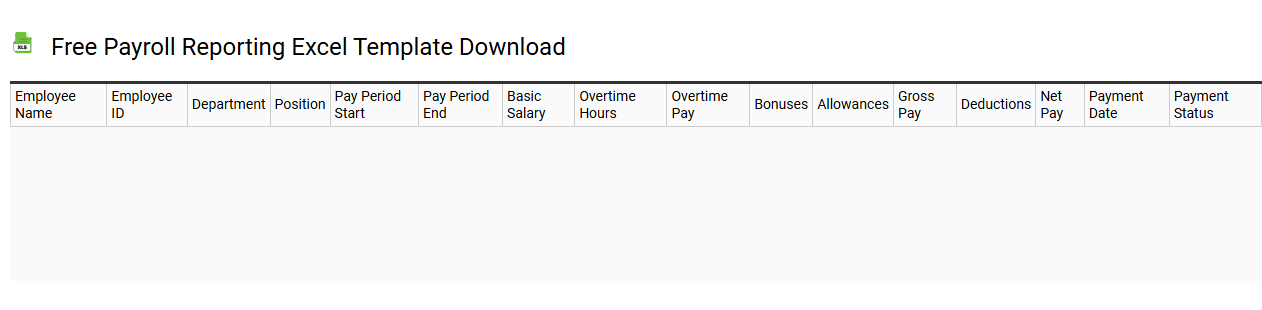

Free payroll reporting Excel template download

💾 Free payroll reporting Excel template download template .xls

Free payroll reporting Excel templates are pre-designed spreadsheets that facilitate the tracking and management of employee payroll data. These templates typically include essential fields such as employee names, hours worked, pay rates, deductions, and net pay calculations. Users can easily customize these templates to fit specific payroll structures or compliance requirements. These tools can serve basic payroll needs, as well as more complex conditions involving tax reporting, overtime calculations, and benefits management.