Explore an array of free XLS templates specifically designed for credit risk analysis. Each template provides essential features such as risk assessment matrices, borrower profiling tools, and comprehensive data visualization options. These user-friendly spreadsheets enable you to evaluate creditworthiness effectively, ensuring informed decision-making in financial assessments.

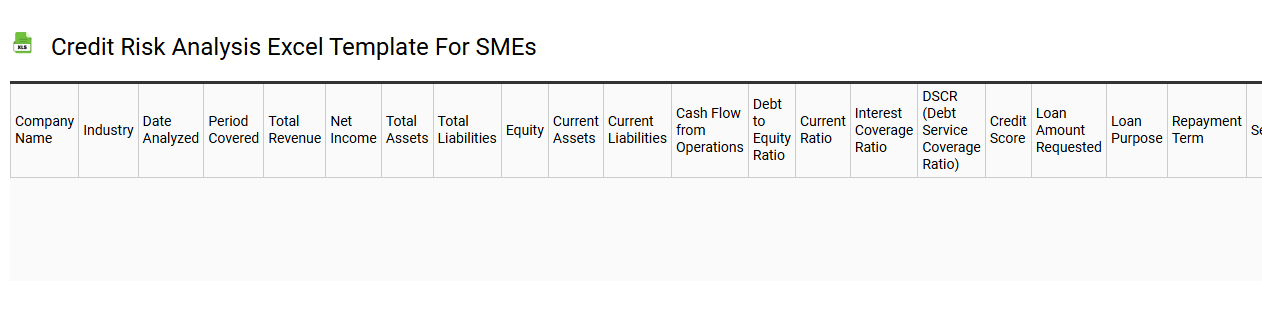

Credit risk analysis Excel template for SMEs

💾 Credit risk analysis Excel template for SMEs template .xls

The Credit Risk Analysis Excel template for SMEs is a structured tool designed to evaluate the creditworthiness of small and medium enterprises. It offers various financial metrics, such as debt-to-equity ratio, cash flow analysis, and historical repayment patterns. Visual aids, including graphs and charts, help you quickly interpret the data and make informed lending decisions. This template's fundamental use enhances risk assessment processes, while more advanced functionalities might include predictive analytics and scenario modeling for future risk management.

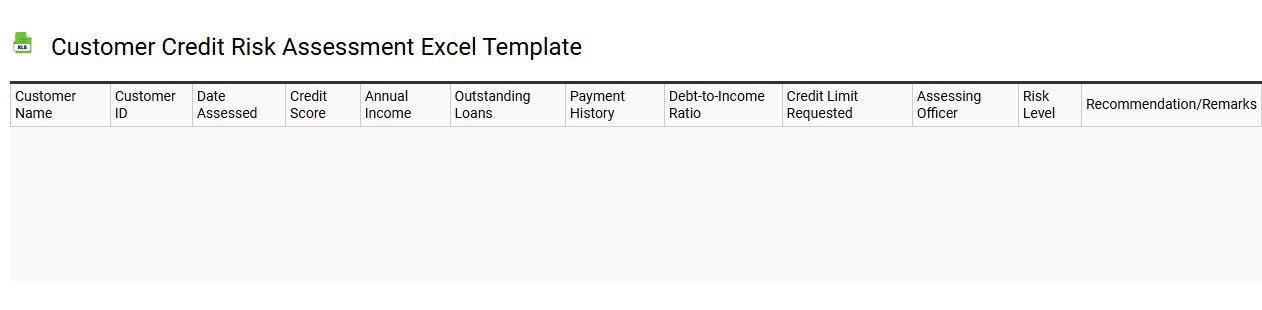

Customer credit risk assessment Excel template

💾 Customer credit risk assessment Excel template template .xls

A Customer Credit Risk Assessment Excel template is a pre-designed spreadsheet that helps businesses evaluate the creditworthiness of potential customers. This tool typically includes sections for inputting customer financial data, such as income, debt levels, and payment histories, alongside formulas that calculate risk scores based on this information. Users can customize the template to suit their specific industry needs, making it easier to analyze trends and make informed lending decisions. You can leverage this template for basic credit evaluations or expand its functionality with advanced analytics like predictive modeling and risk segmentation.

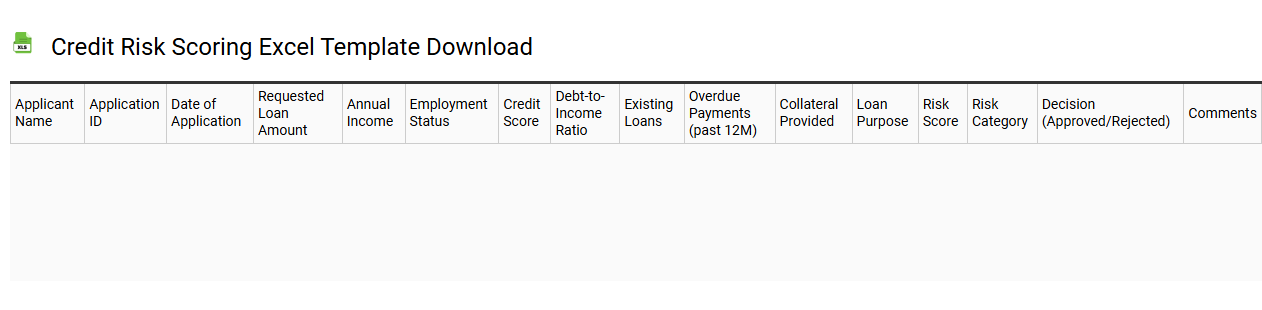

Credit risk scoring Excel template download

💾 Credit risk scoring Excel template download template .xls

A Credit Risk Scoring Excel template is a pre-designed spreadsheet tool that helps assess the creditworthiness of borrowers. It typically includes fields for entering borrower information, financial metrics, and scoring criteria, enabling quantitative analysis of credit risk. By evaluating factors such as payment history, debt-to-income ratio, and credit history length, the template generates a score that indicates the likelihood of default. You can use this tool for credit assessments, and for more advanced needs, consider exploring machine learning algorithms to enhance predictive accuracy.

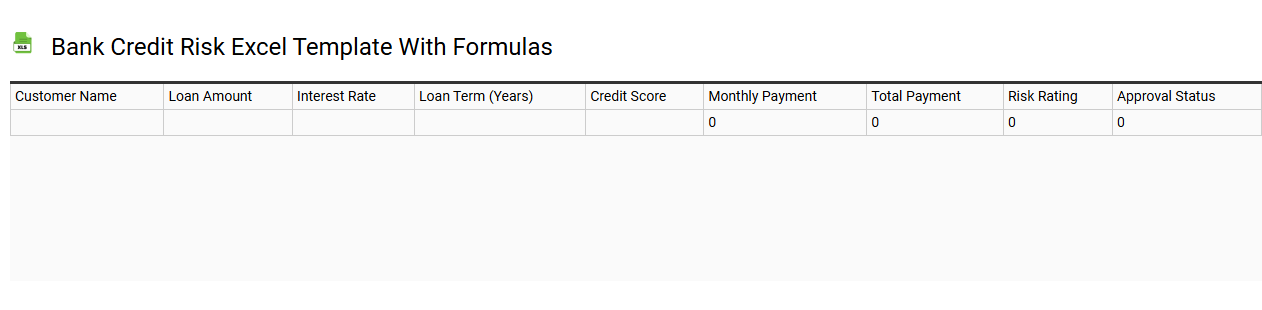

Bank credit risk Excel template with formulas

💾 Bank credit risk Excel template with formulas template .xls

A Bank credit risk Excel template is a structured spreadsheet designed to help financial institutions assess the creditworthiness of borrowers. This template often includes various input fields such as borrower details, loan amounts, interest rates, and repayment schedules. You'll also find built-in formulas that calculate key metrics like debt-to-income ratio, probability of default, and expected loss, providing a comprehensive analysis of potential risks associated with lending. Such a template can serve not only for basic credit assessment but also for more advanced analytical needs, such as stress testing and portfolio risk management.

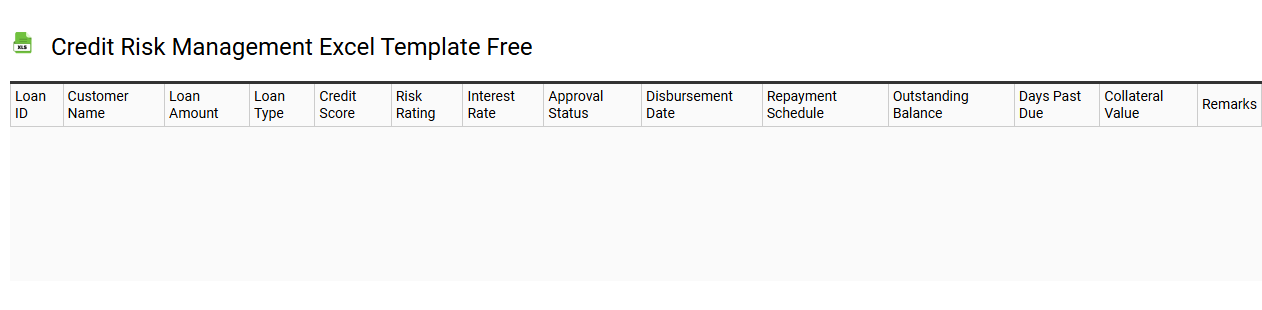

Credit risk management Excel template free

💾 Credit risk management Excel template free template .xls

A Credit Risk Management Excel template is a customizable spreadsheet designed to help businesses assess and manage credit risk associated with lending activities. This tool typically includes features such as borrower credit scoring models, risk rating scales, and graphical representations of risk exposure. Users can analyze data on credit history, payment behavior, and outstanding debts to make informed decisions. For basic usage, this template can track individual customer credit profiles, but for more advanced needs, incorporating machine learning algorithms and predictive analytics techniques can enhance risk assessment processes.

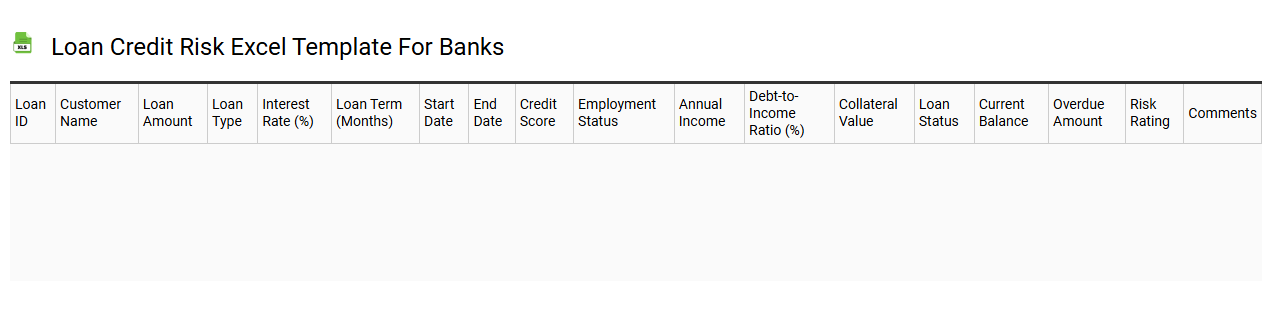

Loan credit risk Excel template for banks

💾 Loan credit risk Excel template for banks template .xls

A Loan Credit Risk Excel template serves as a vital tool for banks to assess and manage the risk associated with lending. This template typically includes various parameters such as borrower credit scores, debt-to-income ratios, and historical repayment behavior, allowing users to evaluate the likelihood of default. It may also incorporate stress testing scenarios to simulate potential economic downturns and their impacts on loan portfolios. You can adapt this template for basic loan assessments or explore further potential needs such as advanced risk modeling techniques like Value at Risk (VaR) or Credit Value Adjustment (CVA).

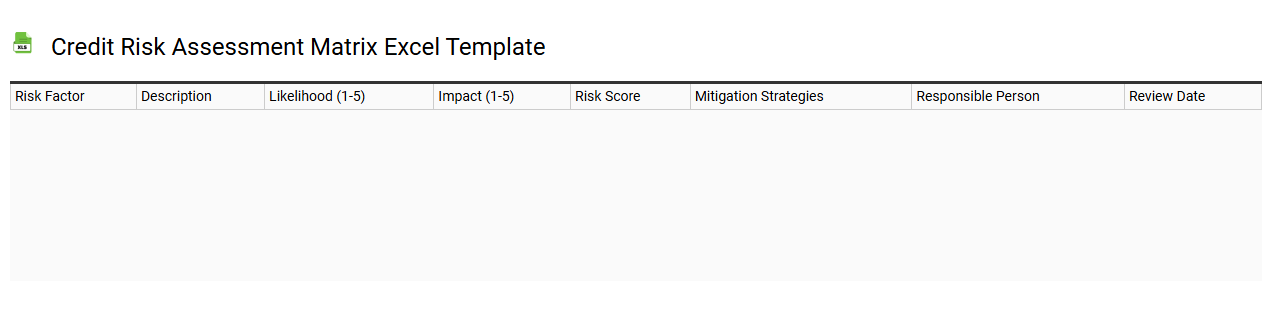

Credit risk assessment matrix Excel template

💾 Credit risk assessment matrix Excel template template .xls

A Credit Risk Assessment Matrix Excel template is a structured tool designed to evaluate and categorize potential credit risks associated with borrowers or loans. It typically includes various criteria such as financial ratios, credit scores, industry risks, and repayment history, allowing users to systematically assess the risk level. This matrix provides a visual representation of the risk assessment, making it easier to identify high-risk borrowers and necessary mitigation strategies. Using this template effectively can also serve as a foundation for more complex analyses, such as predictive modeling and stress testing in advanced credit risk management.

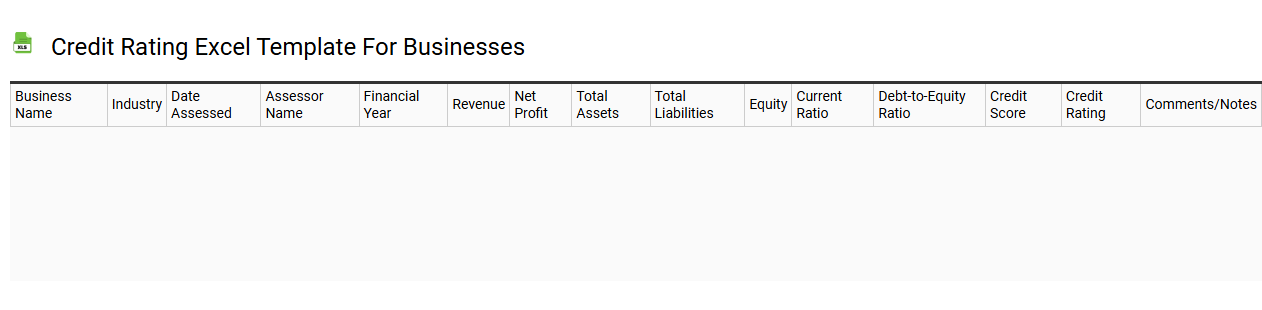

Credit rating Excel template for businesses

💾 Credit rating Excel template for businesses template .xls

A Credit Rating Excel template for businesses is a structured spreadsheet designed to evaluate the creditworthiness of an organization. This template typically includes sections for financial data input, such as income statements, balance sheets, and cash flow statements, enabling users to analyze key performance indicators. You can easily calculate important ratios like current ratio, debt-to-equity ratio, and interest coverage ratio, all of which are crucial for lenders and investors. The template can serve as a foundational tool for assessing risk and making informed financial decisions, while also supporting more complex analyses involving credit scoring models or predictive analytics.

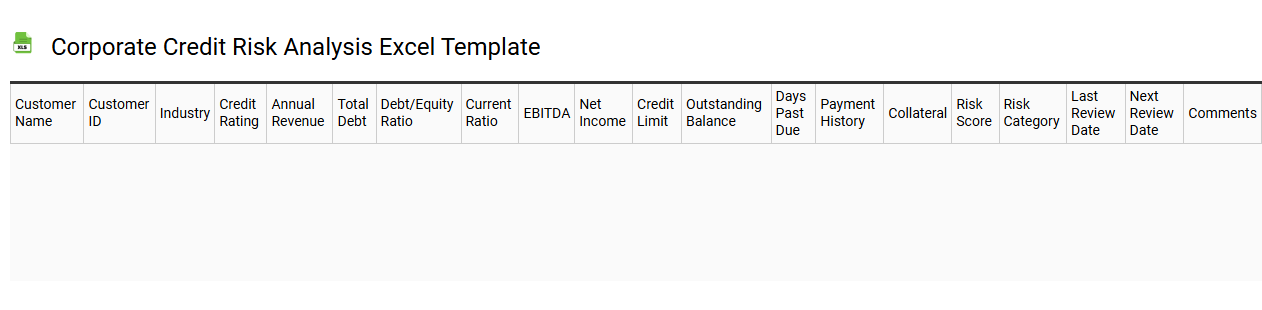

Corporate credit risk analysis Excel template

💾 Corporate credit risk analysis Excel template template .xls

A Corporate credit risk analysis Excel template is a structured tool designed to evaluate the creditworthiness of a company. It typically includes several key components such as financial ratios, historical performance metrics, and risk factors that assess the likelihood of default. The template allows you to input data like revenues, debts, and cash flows, enabling thorough analysis through calculations and visualizations like charts or graphs. This resource can greatly assist in making informed lending decisions and tailoring risk management strategies, while its advanced features can incorporate machine learning algorithms or scenario analyses for deeper insights.

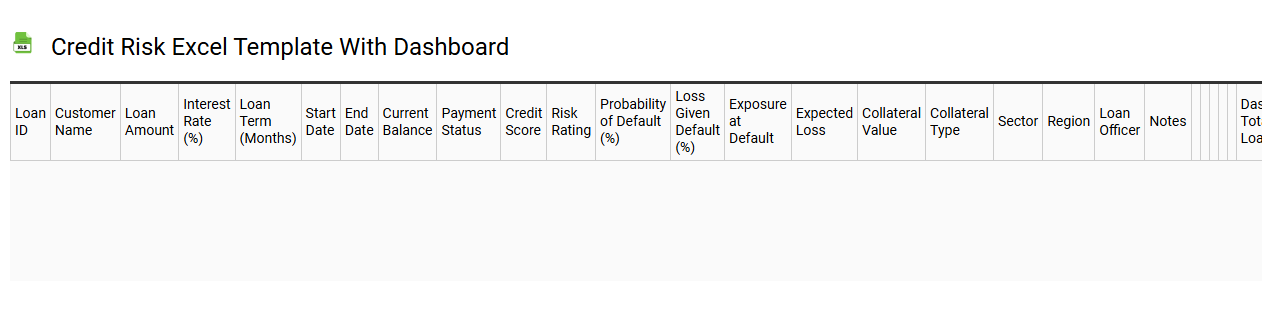

Credit risk Excel template with dashboard

💾 Credit risk Excel template with dashboard template .xls

A Credit Risk Excel template with a dashboard is a comprehensive tool designed to assess and visualize the creditworthiness of borrowers. It typically includes data inputs such as borrower financial statements, credit scores, and loan details, allowing you to compute key metrics like probability of default and exposure at default. The dashboard component visually represents these metrics using graphs and charts, making it easier for you to analyze trends and key risk indicators at a glance. This template not only simplifies basic risk assessment processes but can also be tailored for advanced analyses like stress testing and scenario modeling for varied financial conditions.