Explore a collection of free Excel templates designed specifically for managing your credit card balances. These templates provide clear layouts for tracking due dates, outstanding amounts, and payment histories, ensuring you maintain control over your finances. Enjoy customizable features allowing you to input your specific credit card details for a more personalized budgeting experience.

Credit card balance tracker Excel template

![]()

💾 Credit card balance tracker Excel template template .xls

A Credit Card Balance Tracker Excel template is a pre-formatted spreadsheet designed to help you monitor your credit card balances, payments, and due dates. This tool typically includes columns for the credit card issuer, balance owed, interest rates, payment history, and upcoming payment dates, providing a user-friendly interface for financial management. By using this tracker, you can visualize your spending habits, stay on top of your payments, and avoid late fees, making it easier to manage your finances efficiently. You can customize it further to suit your needs, perhaps by incorporating advanced features such as cash flow forecasting or integrating with budgeting models to enhance your financial strategy.

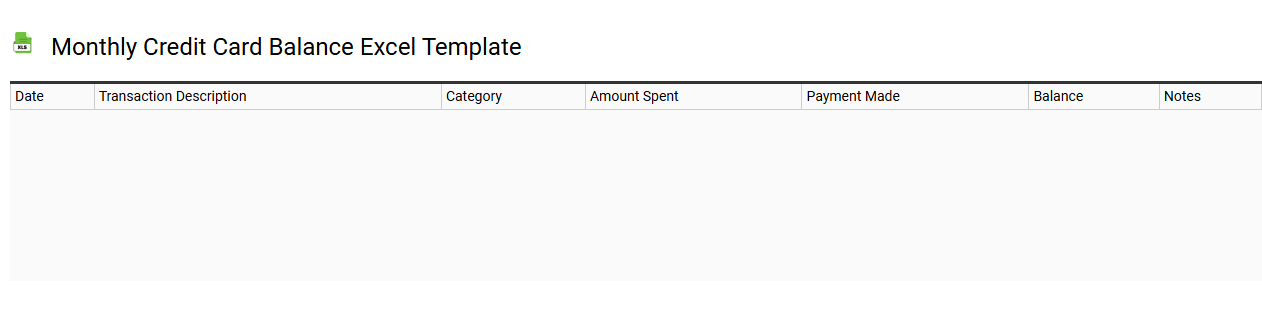

Monthly credit card balance Excel template

💾 Monthly credit card balance Excel template template .xls

A monthly credit card balance Excel template is a pre-designed spreadsheet that helps you track your credit card expenditures, payments, and balances over a monthly period. This template typically includes columns for transaction dates, descriptions, amounts charged, payments made, and the remaining balance. Users can easily visualize their spending habits and observe how their balances change over time, assisting in better financial management. By analyzing the data, you can identify patterns and potential areas for savings, facilitating more informed decisions about reinvesting or managing credit card usage. Basic usage involves inputting transactions each month, while further potential needs might include integrating advanced financial modeling techniques or utilizing pivot tables for in-depth analyses of spending trends.

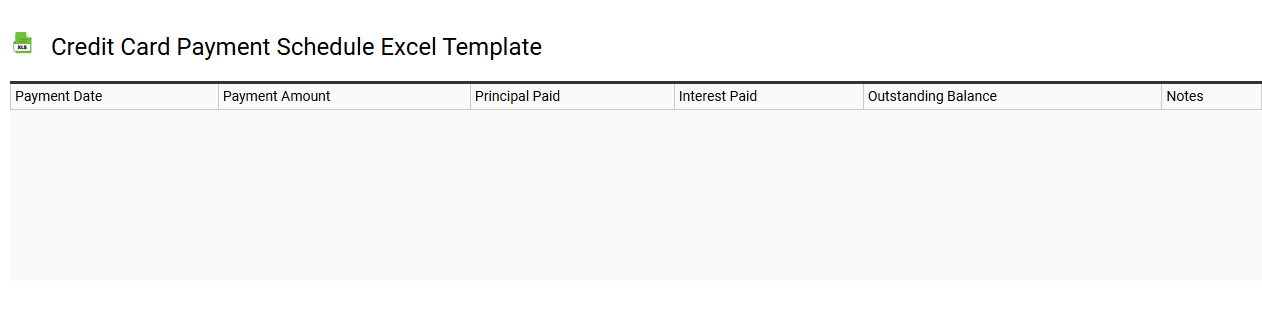

Credit card payment schedule Excel template

💾 Credit card payment schedule Excel template template .xls

A Credit Card Payment Schedule Excel template is a structured tool designed to help you manage and track credit card payments effectively. This template typically includes columns for your credit card issuer, due dates, minimum payments, current balances, and payment amounts. You can easily input and calculate important data, such as interest rates and total payment over time. Your financial planning will benefit from such a template, which also allows for further potential needs like creating amortization schedules or a detailed debt payoff strategy using advanced financial modeling techniques.

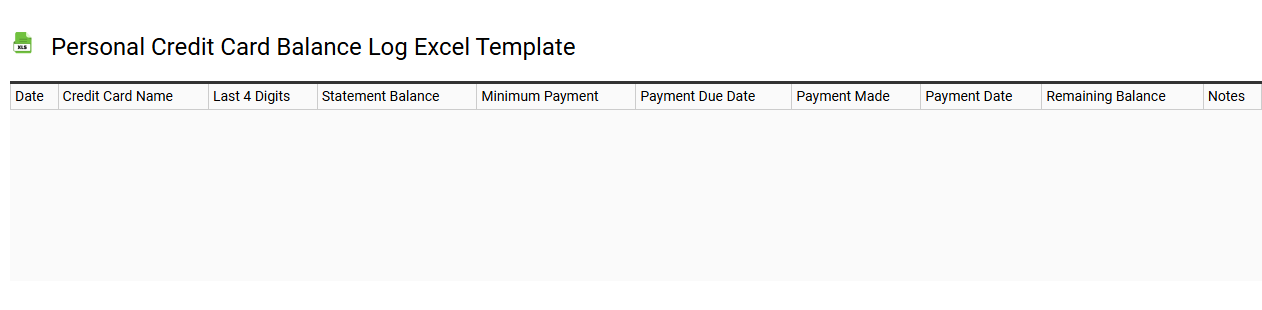

Personal credit card balance log Excel template

💾 Personal credit card balance log Excel template template .xls

A Personal Credit Card Balance Log Excel template is a structured spreadsheet designed to help you track your credit card balances over time. It typically includes columns for the transaction date, description, charges, payments, and the running balance, allowing you to monitor spending habits effectively. You can customize this template to reflect multiple credit cards, enabling a comprehensive view of your financial obligations. This tool aids in budgeting efforts and can highlight areas where you may need to make adjustments, while also providing insights into advanced financial management techniques like debt snowball or avalanche methods.

Credit card expense tracker Excel template

![]()

💾 Credit card expense tracker Excel template template .xls

A Credit Card Expense Tracker Excel template is a versatile tool designed to help you monitor and manage your credit card expenditures efficiently. This template typically includes sections to record transaction dates, descriptions, amounts, and categories, allowing for easy analysis of spending habits. You can customize it by adding budgets for specific categories, which helps in seeing where your money goes each month. This basic tracker can evolve into a more advanced financial management system, incorporating features like graphs, pivot tables, or integration with financial APIs for real-time expense tracking.

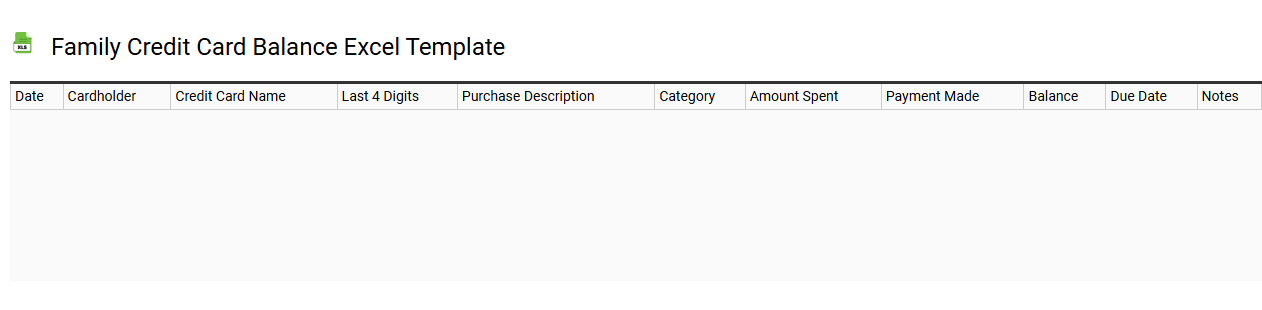

Family credit card balance Excel template

💾 Family credit card balance Excel template template .xls

The Family credit card balance Excel template is a structured spreadsheet designed to help you manage and track credit card balances within a household. It typically includes designated columns for the card issuer, balance amount, payment due dates, and interest rates, making it easy to visualize your family's financial obligations. You can categorize expenses, set reminders for upcoming payments, and monitor spending patterns over time. This tool not only simplifies budgeting but also enhances your financial decision-making, allowing you to explore advanced strategies like optimizing rewards and managing credit utilization effectively.

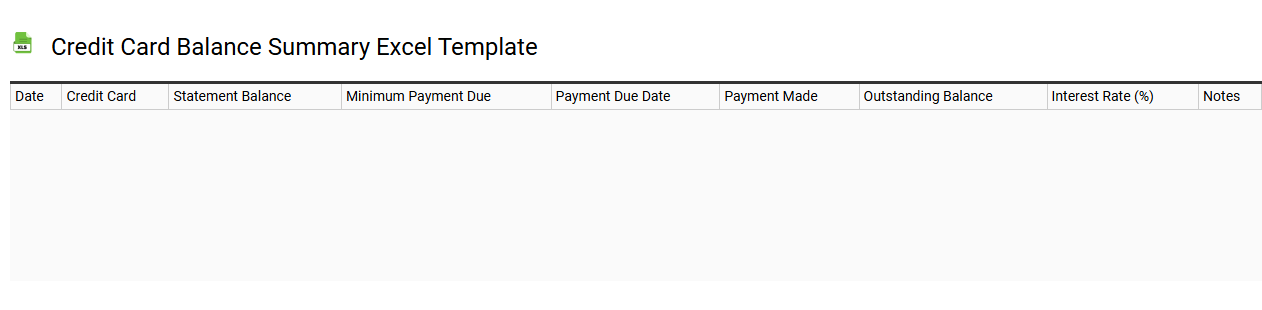

Credit card balance summary Excel template

💾 Credit card balance summary Excel template template .xls

A Credit Card Balance Summary Excel template is a structured tool designed to help users effectively track and manage their credit card expenses. This template typically includes various sections for recording your credit card balances, payment due dates, interest rates, and transaction details. You can easily input monthly spending, categorize charges, and monitor outstanding balances, allowing for better financial planning and responsible credit utilization. For enhanced management, explore advanced features like automated calculations for interest accrual and debt payoff projections.

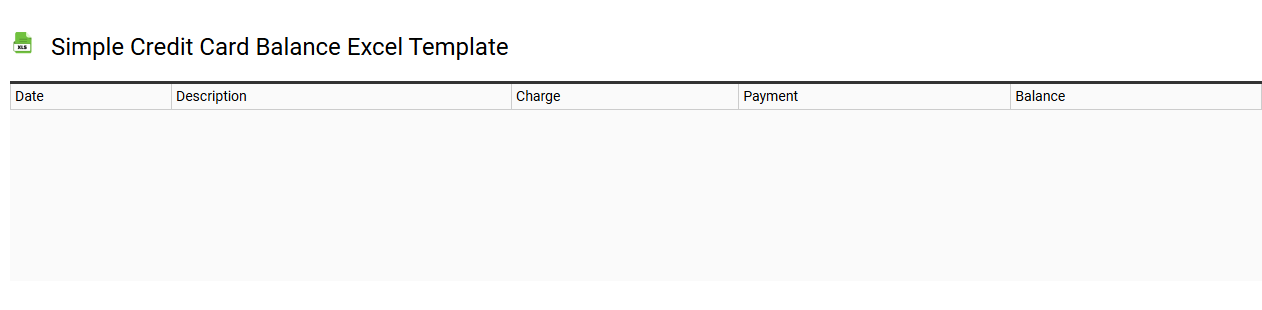

Simple credit card balance Excel template

💾 Simple credit card balance Excel template template .xls

A Simple credit card balance Excel template is a user-friendly tool designed to help you track your credit card transactions and manage your balances effectively. This template allows you to input details such as transaction dates, descriptions, and amounts, providing a clear overview of your spending patterns. You can also monitor payment dates, outstanding balances, and due dates to ensure timely payments and avoid interest charges. For budget-conscious users, this template can serve as a foundational resource, with potential for advanced financial analyses like budgeting forecasts or debt repayment strategies utilizing Excel's built-in functions.

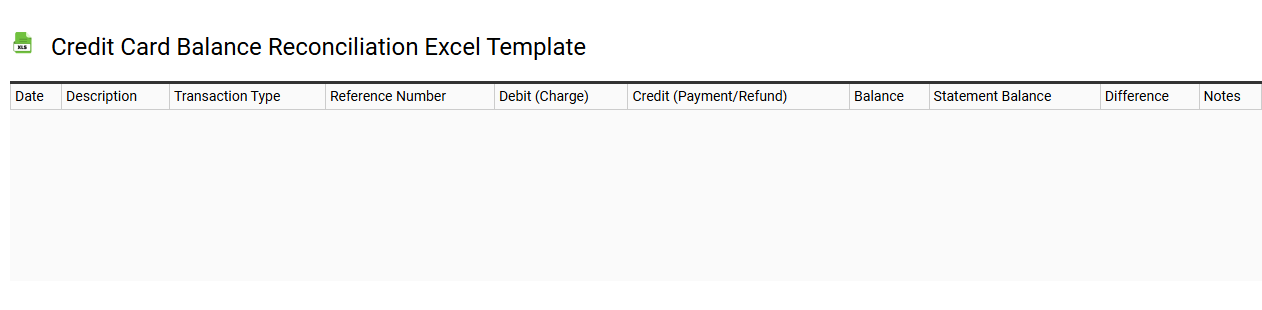

Credit card balance reconciliation Excel template

💾 Credit card balance reconciliation Excel template template .xls

A credit card balance reconciliation Excel template is a specialized tool designed to help you track and verify the amounts charged to your credit card against your bank statements. This template typically includes columns for transaction dates, descriptions, charges, payments, and your calculated balance. By inputting your credit card activity, you can easily pinpoint discrepancies between your records and the issuer's, ensuring accurate financial tracking. Such a template can serve basic needs like daily tracking and monthly reconciliation, while also offering further potential for advanced financial analysis or budgeting tools, depending on your preferences.