A range of free XLS templates for loan agreement records can simplify tracking terms and payments. Each template typically includes sections for the borrower's information, loan amount, interest rate, repayment schedule, and signatures for both parties. By using one of these templates, you can ensure organized record-keeping and enhance clarity throughout the loan process.

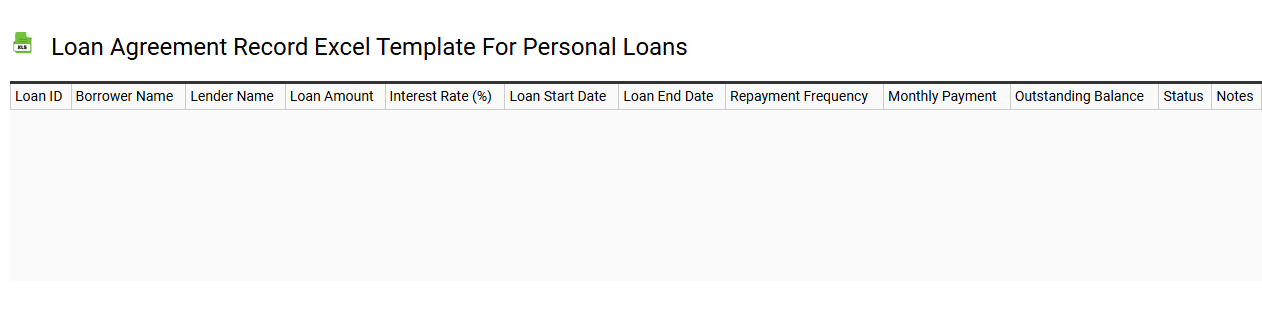

Loan agreement record Excel template for personal loans

💾 Loan agreement record Excel template for personal loans template .xls

A Loan Agreement Record Excel template for personal loans serves as a structured document to track essential details related to a personal loan. This template typically includes sections for borrower and lender information, loan amount, interest rate, repayment terms, payment schedule, and outstanding balance. You can easily customize it to accommodate specifics such as late payment fees, prepayment options, and collateral details. Tracking these elements helps you maintain accurate records, simplifying both personal budgeting and any potential future analysis, like cash flow projections or loan refinancing evaluations.

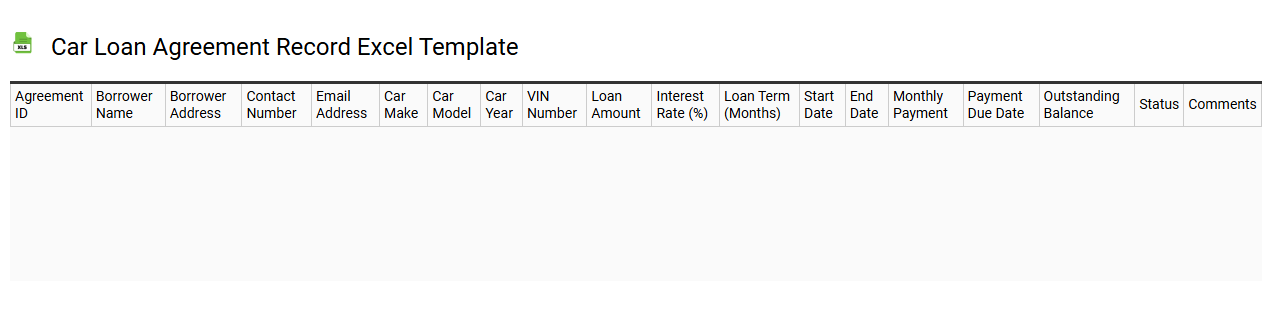

Car loan agreement record Excel template

💾 Car loan agreement record Excel template template .xls

A car loan agreement record Excel template serves as a structured tool for tracking the details of your car financing. This template typically includes fields for the loan amount, interest rate, loan term, monthly payment, and payment due dates, allowing you to monitor your loan's progress efficiently. You can also incorporate features such as an amortization schedule, which breaks down the principal and interest components of each payment over the loan's duration. Such a template meets basic record-keeping needs, with potential for enhancing your financial management through advanced calculations like early repayment scenarios or lease vs. buy analysis.

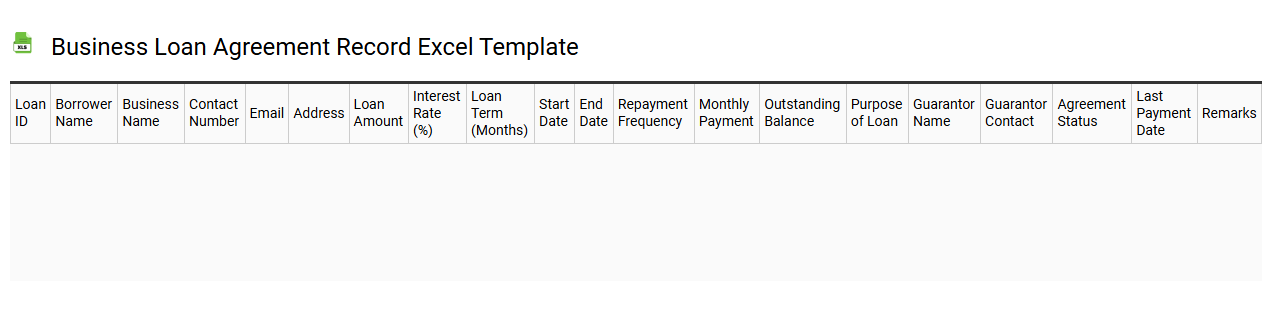

Business loan agreement record Excel template

💾 Business loan agreement record Excel template template .xls

A Business Loan Agreement Record Excel template serves as a structured tool for documenting the terms and conditions of a loan between a lender and a borrower. This template typically includes essential elements such as loan amount, interest rate, repayment schedule, and collateral details. Items like borrower and lender information are crucial for ensuring all parties involved are accurately represented. Such a template can also be customized to track payment history and calculate future payment projections, supporting your basic financial organization and enabling advanced analytical insights into your borrowing needs.

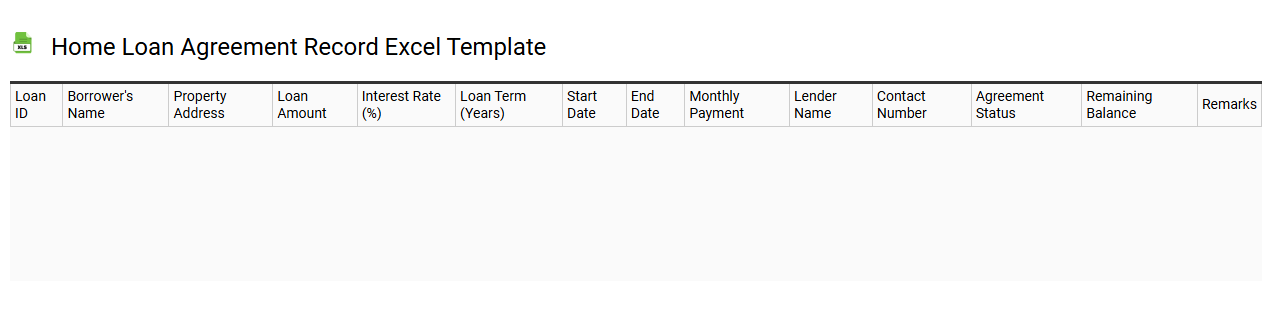

Home loan agreement record Excel template

💾 Home loan agreement record Excel template template .xls

A Home Loan Agreement Record Excel template is a structured spreadsheet designed to help individuals track and manage the details of their home loans efficiently. This template typically includes fields for borrower information, loan amount, interest rate, repayment schedule, and payment history. With this organized format, you can easily visualize your loan obligations, upcoming payments, and remaining balance. Such a tool is essential for budgeting and can be adapted for advanced financial analysis by incorporating functions for calculating amortization schedules or interest over time.

Loan agreement tracking Excel template

![]()

💾 Loan agreement tracking Excel template template .xls

A Loan Agreement Tracking Excel template helps you manage the details of loans efficiently. This spreadsheet typically includes columns for borrower information, loan amounts, interest rates, repayment schedules, and due dates. You can track payments made, outstanding balances, and payment statuses, ensuring that you are always informed about your financial obligations and deadlines. This template is valuable not only for personal loans but can also be customized for business loans or investments, allowing you to explore advanced features like amortization schedules and financial forecasts.

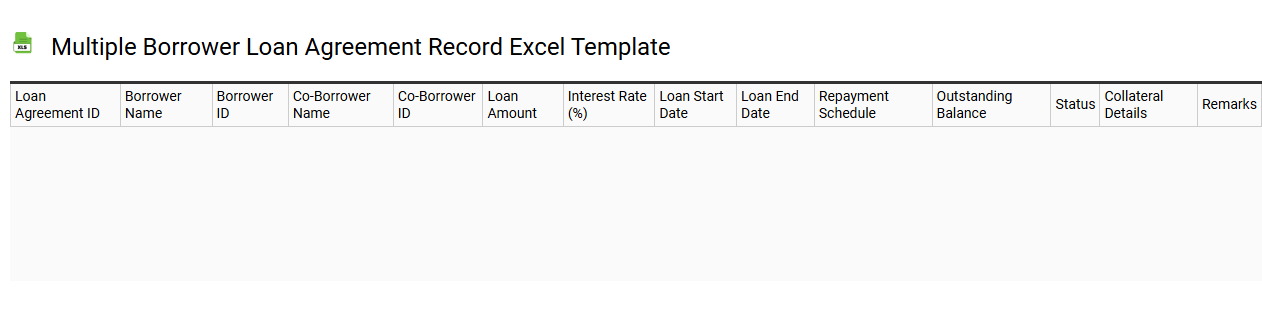

Multiple borrower loan agreement record Excel template

💾 Multiple borrower loan agreement record Excel template template .xls

A Multiple Borrower Loan Agreement Record Excel template serves as a structured tool for documenting loan agreements involving multiple borrowers. This template includes essential fields such as borrower names, loan amounts, interest rates, repayment schedules, and terms and conditions. It facilitates easy tracking of individual borrower contributions and responsibilities, ensuring clarity in the loan agreement process. You can use this template for basic record-keeping, and for more complex needs, consider integrating financial forecasting models or risk assessment analytics.

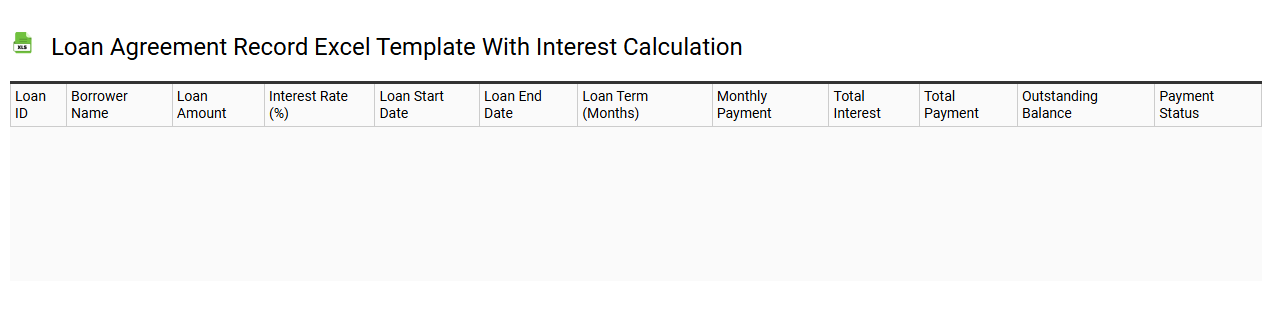

Loan agreement record Excel template with interest calculation

💾 Loan agreement record Excel template with interest calculation template .xls

A Loan Agreement Record Excel template efficiently organizes the details of your loan transactions, providing a clear view of the terms and conditions agreed upon by both parties. It often includes fields for borrower and lender information, loan amount, interest rate, start date, end date, and repayment schedule. Interest calculations are automated, allowing you to see accruing interest over time based on the principal and specified interest rate, streamlining financial tracking. This template serves as a foundational tool for managing repayment schedules, but can also accommodate advanced features like amortization schedules and variable interest rates if your financial needs evolve.

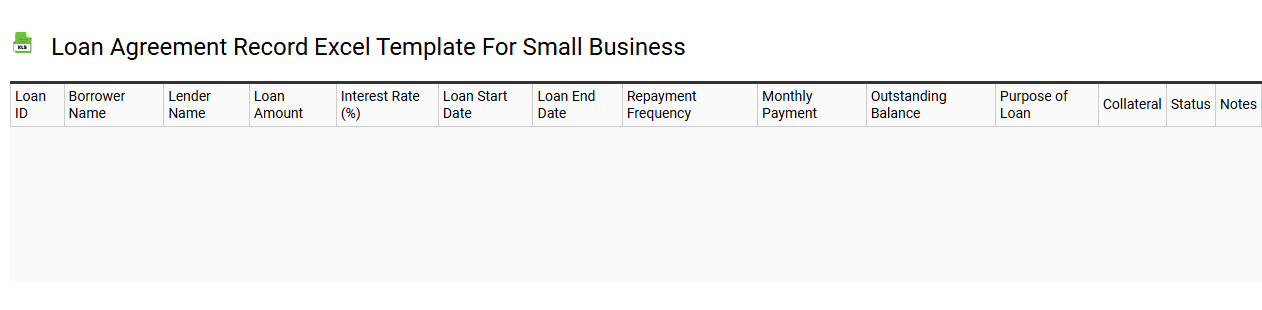

Loan agreement record Excel template for small business

💾 Loan agreement record Excel template for small business template .xls

A Loan Agreement Record Excel template for small businesses serves as a structured tool to manage and track loan agreements effectively. It typically includes essential columns for parties involved, loan amounts, interest rates, repayment schedules, and due dates. Each entry helps you monitor ongoing financial obligations and repayment history, enhancing clarity in your business finances. Utilizing this template can simplify the management of loans and potentially scale your financial tracking to incorporate more complex features like amortization schedules and predictive cash flow analysis.

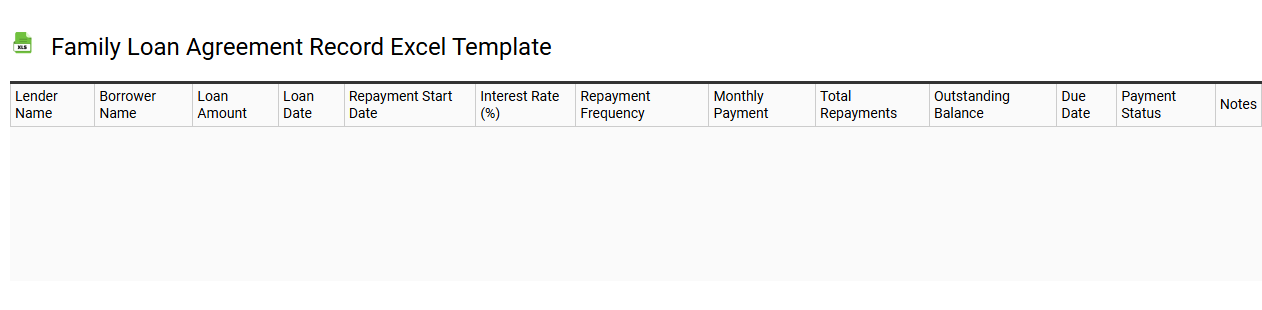

Family loan agreement record Excel template

💾 Family loan agreement record Excel template template .xls

A Family Loan Agreement Record Excel template serves as a structured document to track loans made among family members. This template typically includes essential details such as the lender's name, borrower's name, loan amount, interest rate, repayment schedule, and payment history. You can easily customize it to meet your family's unique needs while ensuring clarity and accountability in financial transactions. A well-organized record like this can help prevent misunderstandings and ensure that both parties are aware of the terms, while also providing a basis for more advanced financial planning and tracking tools in the future.