Explore a variety of free XLS templates designed specifically for business loan calculations. Each template provides easy input fields where you can enter loan amounts, interest rates, and payment terms, allowing you to see detailed amortization schedules and total interest paid over the loan's life. These resources empower you to make informed financial decisions, ensuring you have a clear understanding of your potential obligations.

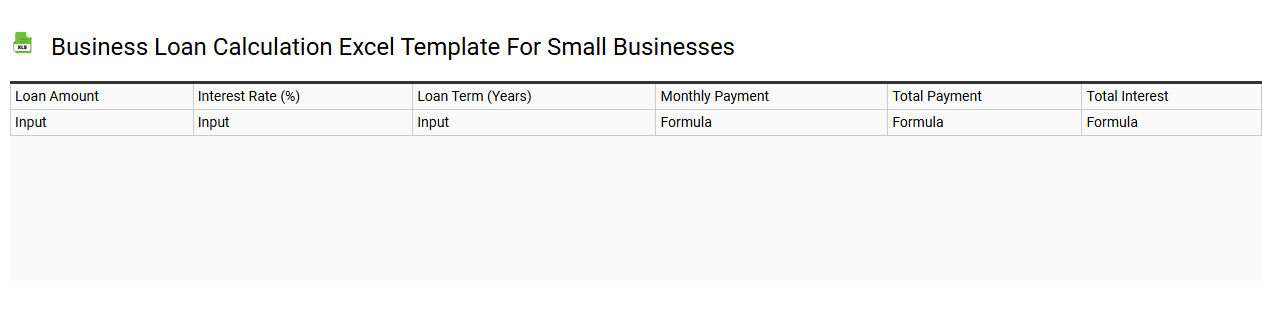

Business loan calculation Excel template for small businesses

💾 Business loan calculation Excel template for small businesses template .xls

A business loan calculation Excel template is a powerful tool designed specifically for small businesses to streamline their financial planning and loan management processes. It typically includes essential fields such as loan amount, interest rate, loan term, monthly payments, and total interest paid, allowing you to input figures and instantly see how different scenarios impact your finances. User-friendly graphs may visualize payment schedules or outstanding balances, making it easier to analyze and forecast cash flow. This template can assist with basic loan assessments while also offering potential enhancements like scenario analysis and amortization schedules for more advanced needs.

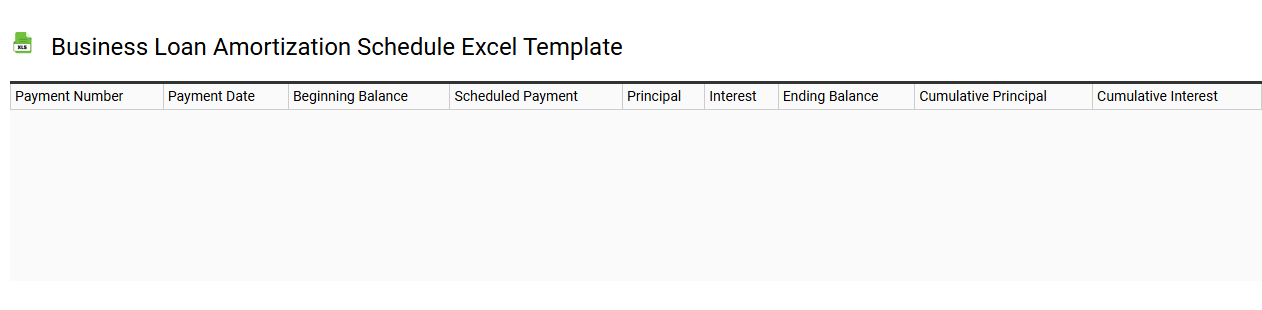

Business loan amortization schedule Excel template

💾 Business loan amortization schedule Excel template template .xls

A Business loan amortization schedule Excel template is an organized spreadsheet designed to track the repayment of a business loan over time. It typically includes columns for the payment number, payment date, principal amount, interest applied, total payment, and remaining balance. This template allows you to visualize how each payment affects the overall loan balance, helping you manage cash flow effectively. You can customize it to include advanced financial metrics like prepayment impact, early repayment options, or varying interest rates if your financing needs evolve.

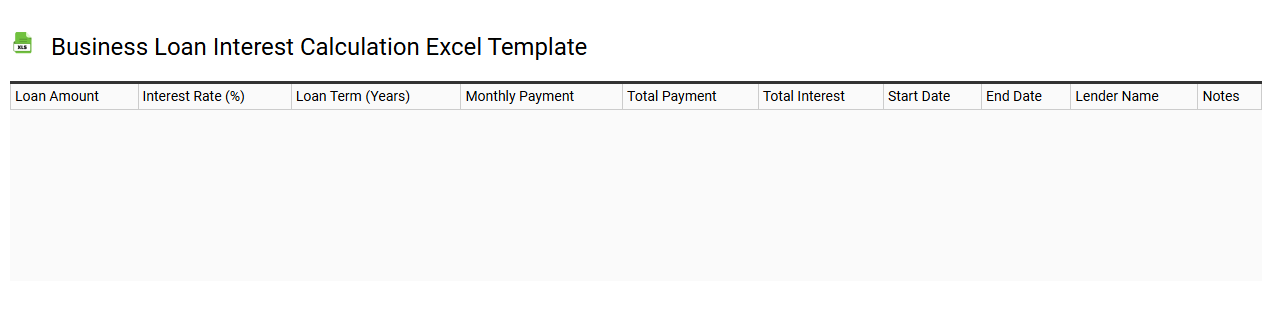

Business loan interest calculation Excel template

💾 Business loan interest calculation Excel template template .xls

A Business Loan Interest Calculation Excel template provides a structured way to calculate loan interest over time. This template typically includes fields for principal amount, interest rate, loan term, and payment frequency. Users can input these variables, allowing the spreadsheet to automatically calculate total interest paid, monthly payments, and remaining balances. Understanding this template can help you manage cash flow, budget for future expenses, and potentially explore more advanced financial modeling techniques like amortization schedules or break-even analysis.

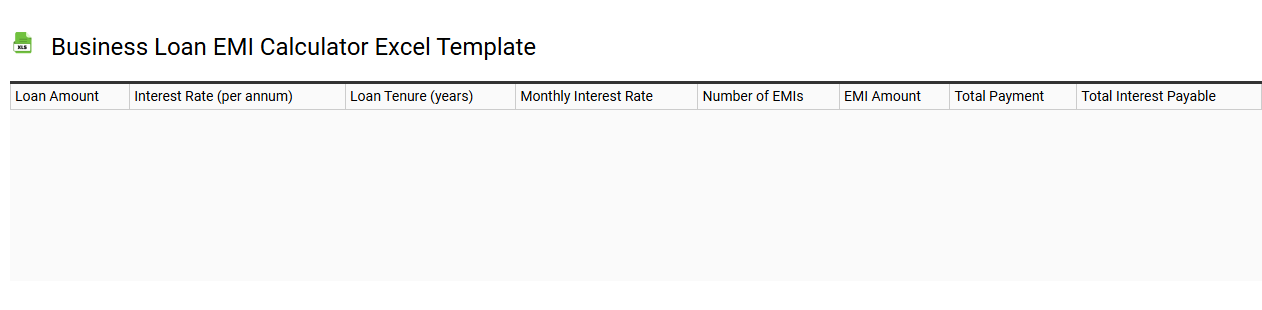

Business loan EMI calculator Excel template

💾 Business loan EMI calculator Excel template template .xls

A Business Loan EMI Calculator Excel template is a spreadsheet tool designed to help you compute the Equated Monthly Installment (EMI) for your business loan. It typically includes fields for principal amount, annual interest rate, and loan tenure, automatically calculating the monthly repayment amount based on your input data. The template often provides detailed amortization schedules, allowing you to visualize how your payments will break down over the loan period. Such a tool not only simplifies budgeting but also aids in financial planning, whether you are managing short-term financing or exploring more complex structures like leveraged buyouts and cash flow analysis.

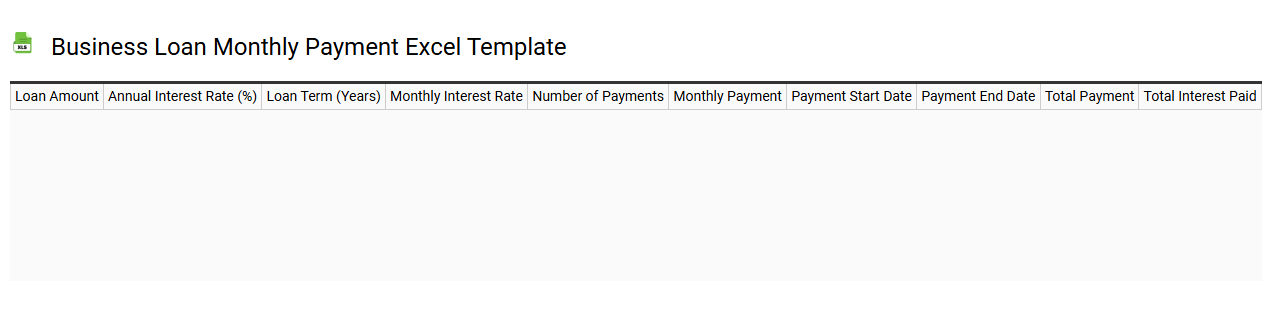

Business loan monthly payment Excel template

💾 Business loan monthly payment Excel template template .xls

A Business loan monthly payment Excel template is a customizable spreadsheet designed to help you calculate monthly payments for loans specific to your business needs. It typically includes fields for loan amount, interest rate, loan term, and the resulting monthly payment based on these variables. Utilizing formulas, the template can automate calculations, making it easier for you to analyze different scenarios and plan your finances. This tool can also accommodate extra features like amortization schedules and total interest paid, helping you assess both basic repayment options and more complex financing strategies.

Business loan balance sheet Excel template

💾 Business loan balance sheet Excel template template .xls

A business loan balance sheet Excel template is a structured spreadsheet designed to help businesses track and analyze their loan-related financial data. It typically includes essential components such as assets, liabilities, and equity, providing a snapshot of financial health. Users can input various data, including loan amounts, interest rates, payment schedules, and remaining balances for precise calculations. This template not only aids in managing current loans but also assists in forecasting future financial needs and potential expansions, taking into account terms like amortization and debt service coverage ratios.

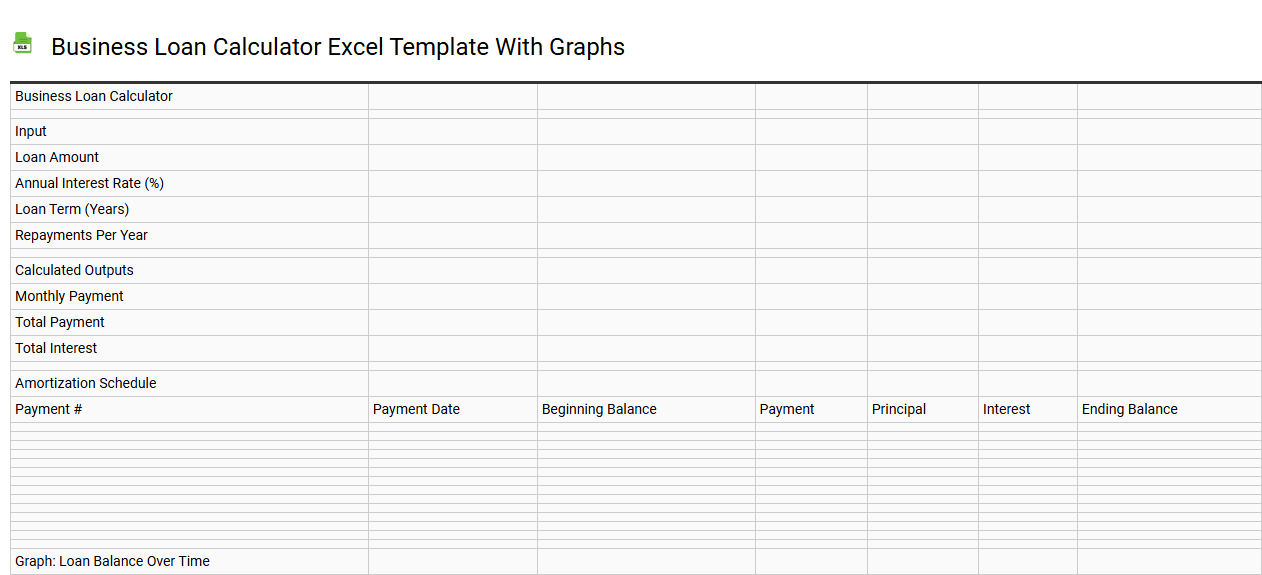

Business loan calculator Excel template with graphs

💾 Business loan calculator Excel template with graphs template .xls

A Business loan calculator Excel template with graphs is a powerful tool designed to help entrepreneurs and business owners assess their financing options. It allows you to input specific loan details such as principal amount, interest rate, and loan term, automatically generating calculations for monthly payments and total interest paid. Visual graphs illustrate the amortization schedule, showing how payments influence the outstanding balance over time. Utilizing this template provides fundamental insights into your borrowing capabilities and can aid in examining scenarios with advanced concepts like loan refinancing and cash flow projections as your business evolves.

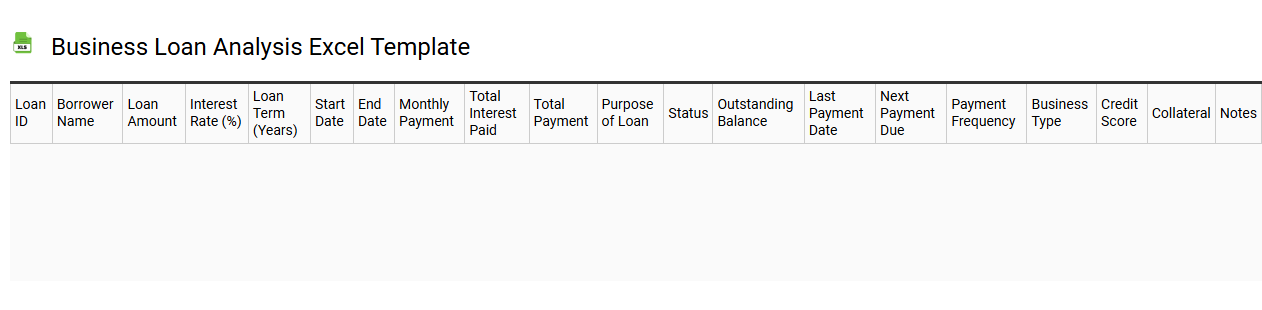

Business loan analysis Excel template

💾 Business loan analysis Excel template template .xls

A Business Loan Analysis Excel template is a structured spreadsheet designed to help entrepreneurs and financial professionals assess the viability of a business loan. It typically includes sections for entering essential data such as loan amount, interest rate, repayment terms, and business projections, allowing for clear financial modeling. You can visualize cash flow, repayment schedules, and profitability ratios, providing insights into whether the loan aligns with your business goals. This template serves as a fundamental tool for evaluating immediate financing needs while offering advanced analytical features for forecasts, scenario analysis, and risk assessments.

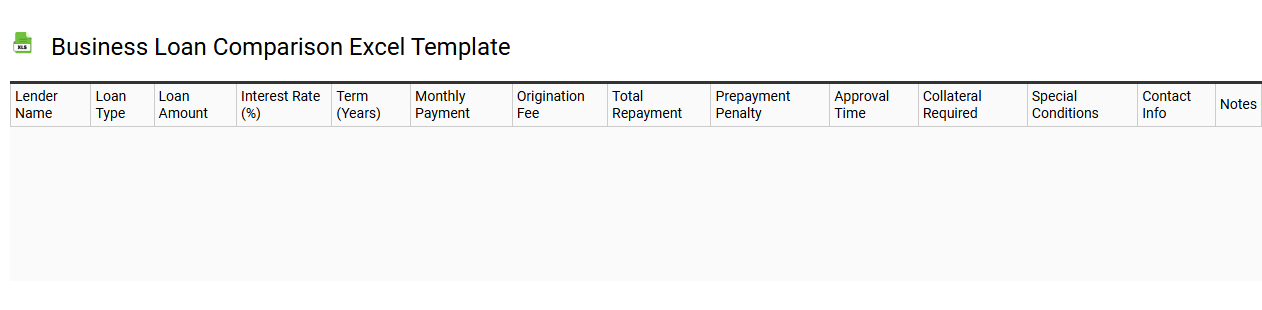

Business loan comparison Excel template

💾 Business loan comparison Excel template template .xls

A Business Loan Comparison Excel template is a spreadsheet designed to help you systematically evaluate various business loan offers. It typically includes columns for loan amounts, interest rates, terms, monthly payments, and total repayment amounts, allowing you to easily compare different lenders side by side. You can input specific terms for each loan, ensuring that you have a clear visual representation of your financing options. This tool can aid in making informed decisions about which loan best suits your business needs, potentially paving the way for financial projections and cash flow analysis in the future.