Automated payroll Excel templates streamline the payroll process, minimizing errors and saving time. Features often include automatic calculation of wages, deductions, and taxes based on employee hours and pay rates. Utilizing these templates allows you to easily manage payroll for multiple employees while ensuring accurate, efficient, and hassle-free calculations.

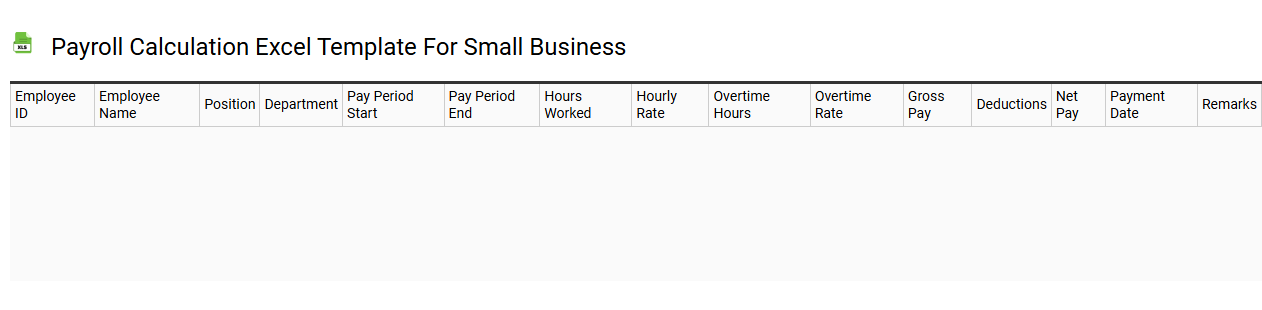

Payroll calculation Excel template for small business

💾 Payroll calculation Excel template for small business template .xls

A Payroll calculation Excel template for small businesses streamlines the payroll process by automating various calculations. It typically includes essential components like employee names, hours worked, hourly rates, and tax deductions, making it easy for you to manage employee compensation accurately. Visualization tools, such as graphs or pie charts, can enhance understanding of labor costs and trends in payroll expenses. This template not only simplifies basic payroll tasks but also has the potential for advanced usage, like integrating with financial forecasting models and payroll tax compliance analysis.

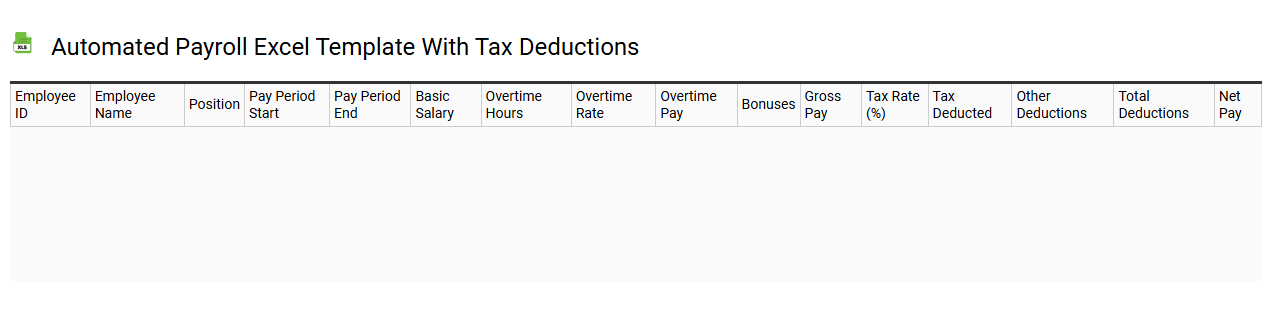

Automated payroll Excel template with tax deductions

💾 Automated payroll Excel template with tax deductions template .xls

An Automated Payroll Excel template with tax deductions streamlines the process of calculating employee wages while ensuring compliance with tax regulations. This template typically includes built-in formulas to automatically compute gross pay, deduct taxes, and calculate net pay based on inputs such as hours worked, hourly rates, and applicable tax brackets. You can easily customize fields to accommodate various employee types and different tax laws relevant to your location. Such a tool not only simplifies payroll management but also lays the groundwork for future enhancements, such as integration with HR systems or advanced data analytics for workforce optimization.

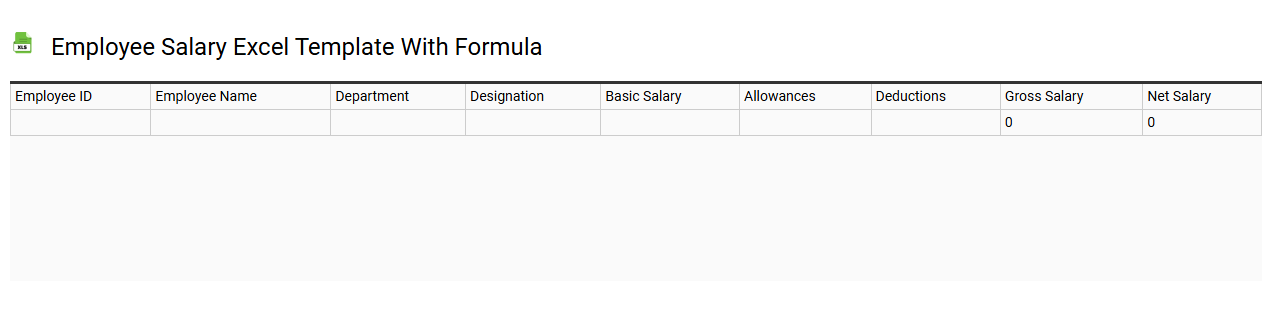

Employee salary Excel template with formula

💾 Employee salary Excel template with formula template .xls

An Employee Salary Excel template is a pre-designed spreadsheet that helps organizations calculate and manage employee compensation efficiently. This tool typically includes fields for entering details such as employee names, positions, working hours, base salary, bonuses, deductions, and net pay. Formulas are embedded within the template to automatically compute total earnings, tax withholdings, and final payout. You can customize the template further to accommodate advanced functions like overtime calculations, performance-based incentives, and detailed payroll reporting.

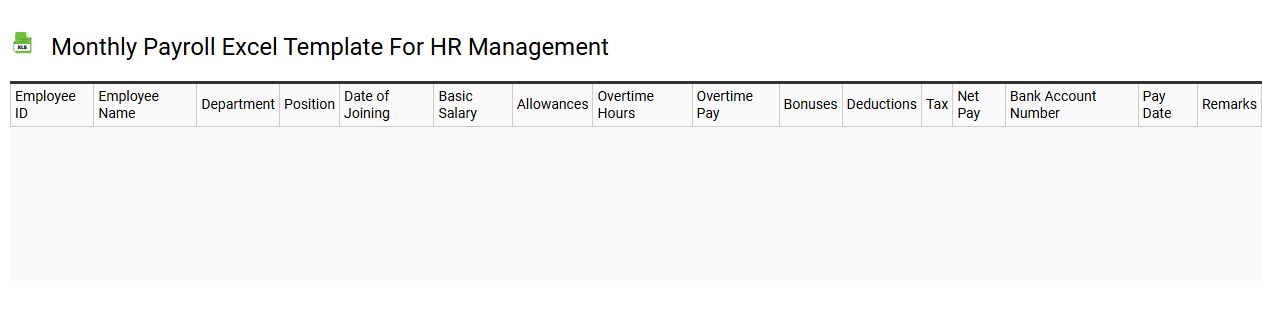

Monthly payroll Excel template for HR management

💾 Monthly payroll Excel template for HR management template .xls

A Monthly Payroll Excel template for HR management is a meticulously designed spreadsheet that simplifies the process of calculating employee salaries, deductions, and bonuses. This template typically includes sections for employee details, hours worked, pay rates, and tax calculations, allowing for streamlined data entry and accurate financial tracking. You can customize fields to accommodate various earning types, such as overtime or commissions, ensuring all aspects of payroll are covered. Basic usage might include recording monthly payments, while further potential needs could involve integrating advanced features like macros for automated calculations or data visualization tools to analyze payroll trends effectively.

Weekly payroll Excel template with attendance tracking

![]()

💾 Weekly payroll Excel template with attendance tracking template .xls

A Weekly payroll Excel template with attendance tracking serves as a comprehensive tool for managing employee payroll and monitoring attendance. It allows you to input employee names, hours worked, and any deductions or bonuses, streamlining the payroll process. The attendance tracking feature helps you record daily attendance, late arrivals, and absenteeism, ensuring accurate payroll calculations. You can further enhance this template with advanced formulas and macros to automate complex payroll calculations and generate insightful reports.

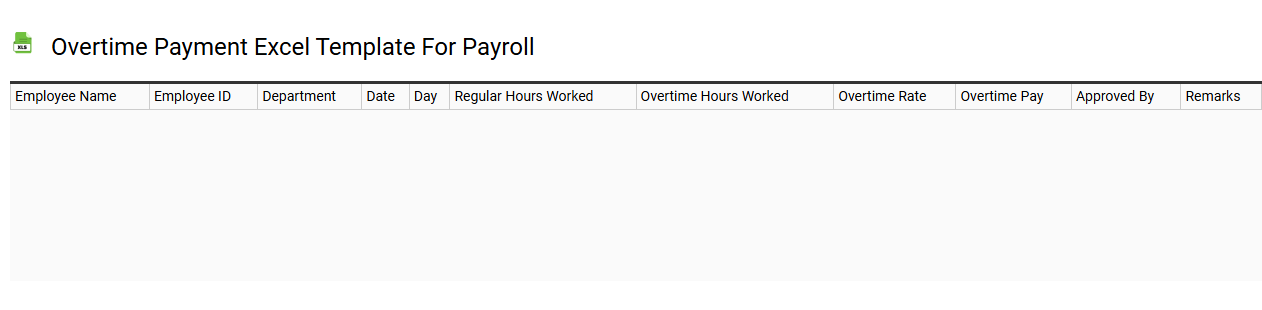

Overtime payment Excel template for payroll

💾 Overtime payment Excel template for payroll template .xls

An Overtime Payment Excel template for payroll is a specialized spreadsheet designed to accurately track and calculate employee overtime hours and corresponding pay. It typically includes sections for employee names, regular hours worked, overtime hours, pay rates, and total overtime pay, providing a clear overview of compensation. The template often incorporates formulas to automate calculations, ensuring accuracy and efficiency in payroll processing. This tool proves useful for managing workforce expenses and can be further customized to accommodate advanced needs such as taxation, benefits integration, or compliance with labor laws.

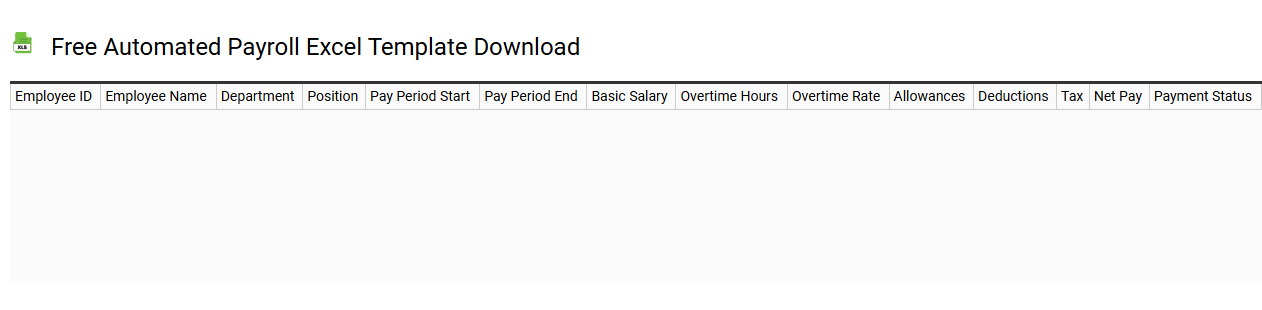

Free automated payroll Excel template download

💾 Free automated payroll Excel template download template .xls

A Free automated payroll Excel template is a downloadable spreadsheet designed to simplify the payroll process for businesses and individuals. This template typically includes pre-set formulas and functions to calculate wages, taxes, and deductions, allowing for efficient data entry and accuracy. Users can customize the template to fit their specific payroll needs, including varying pay rates and overtime calculations. While basic usage includes managing employee hours and calculating payments, further potential needs might involve integration with accounting software and advanced analytics for comprehensive payroll management.

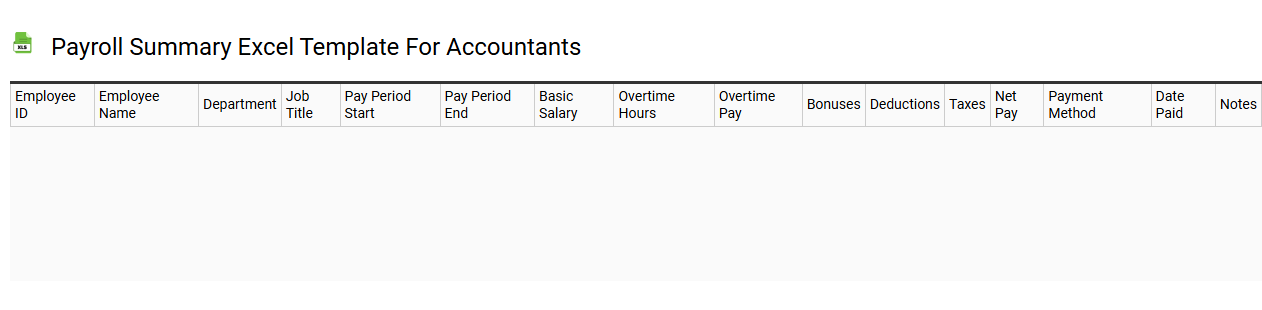

Payroll summary Excel template for accountants

💾 Payroll summary Excel template for accountants template .xls

A Payroll summary Excel template is a structured spreadsheet designed specifically for accountants and businesses to manage payroll information efficiently. It typically includes essential data such as employee names, identification numbers, gross pay, deductions, and net pay calculations, making it easier to track payroll liabilities and ensure accuracy. Customizable fields allow for the inclusion of various payroll elements like overtime, bonuses, and deductions for taxes or benefits. Utilizing such a template simplifies the process of generating reports, facilitating critical decisions based on labor costs, and addressing advanced requirements like compliance with labor laws or integrating with human resource management systems.

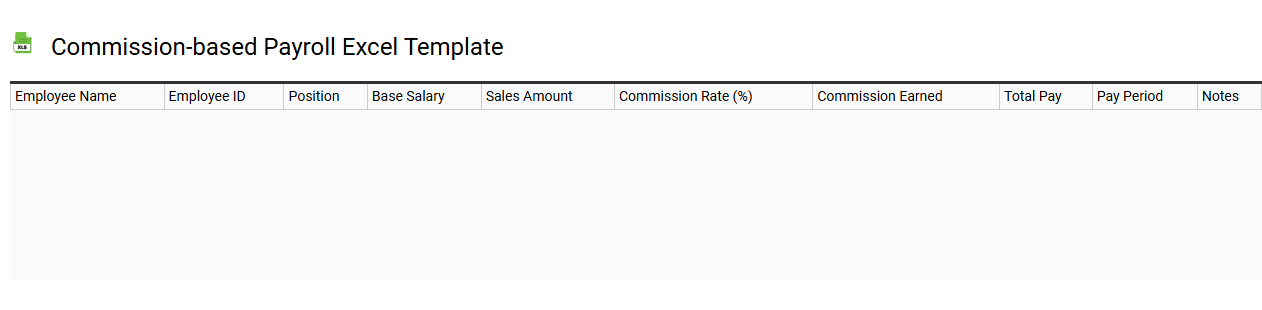

Commission-based payroll Excel template

💾 Commission-based payroll Excel template template .xls

A Commission-based payroll Excel template is a versatile tool designed to calculate employee earnings based on sales performance or specific achievements. This template typically includes essential components such as sales data, commission rates, and total earnings, allowing your organization to efficiently manage payroll expenses. You can customize the structure to fit various commission schemes, facilitating clear insights into both individual and team performance metrics. This template serves as a foundational resource, with the potential for advanced functionalities like integration with HR systems, automated reporting, and real-time data analysis.

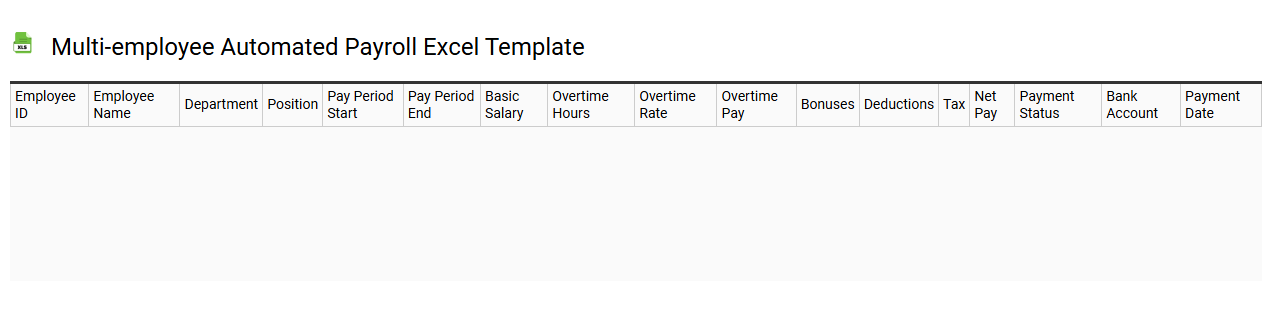

Multi-employee automated payroll Excel template

💾 Multi-employee automated payroll Excel template template .xls

A multi-employee automated payroll Excel template streamlines the payroll process by allowing businesses to manage and calculate employee salaries, deductions, and taxes efficiently. This template typically includes pre-built formulas to automate calculations, ensuring accuracy in payments and compliance with tax regulations. Designed for multiple employees, it enables easy tracking of hours worked, overtime, bonuses, and various deductions like health insurance or retirement contributions. You can use this basic template for immediate payroll needs while also considering advanced features like integration with accounting software or real-time data updates for enhanced payroll management.