Discover an array of free Excel templates specifically designed for payroll deductions. These templates simplify the tracking of employee contributions, taxes, and other deductions, ensuring accuracy in payroll processing. With customizable fields and user-friendly layouts, you can easily adapt each template to meet your company's unique payroll requirements.

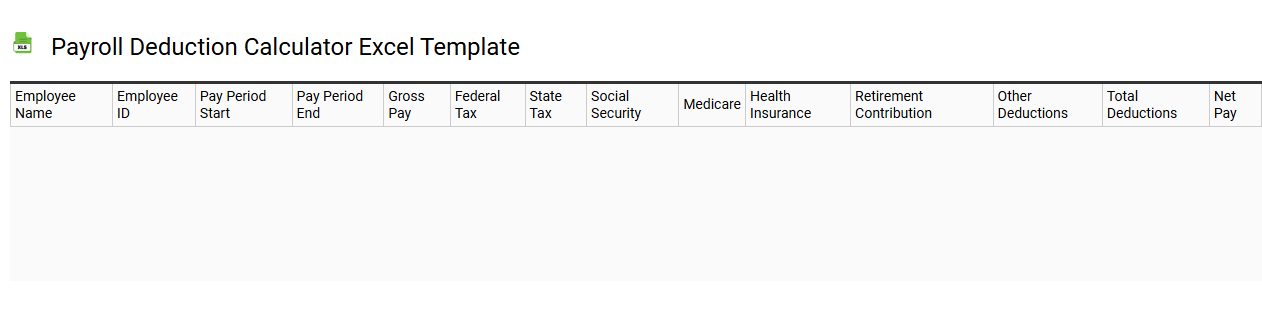

Payroll deduction calculator Excel template

💾 Payroll deduction calculator Excel template template .xls

A Payroll Deduction Calculator Excel template is a customizable spreadsheet designed to help businesses and individuals automate the process of calculating deductions from employee paychecks. This tool typically features formulas that account for various deductions, such as taxes, retirement contributions, health insurance premiums, and other benefits, ensuring accuracy in payroll processing. You can easily input employee salary details and deduction rates, which allows for real-time calculations and adjustments as needed. This template serves basic payroll needs while offering the potential for more advanced functions, such as scenario analysis and integration with payroll software.

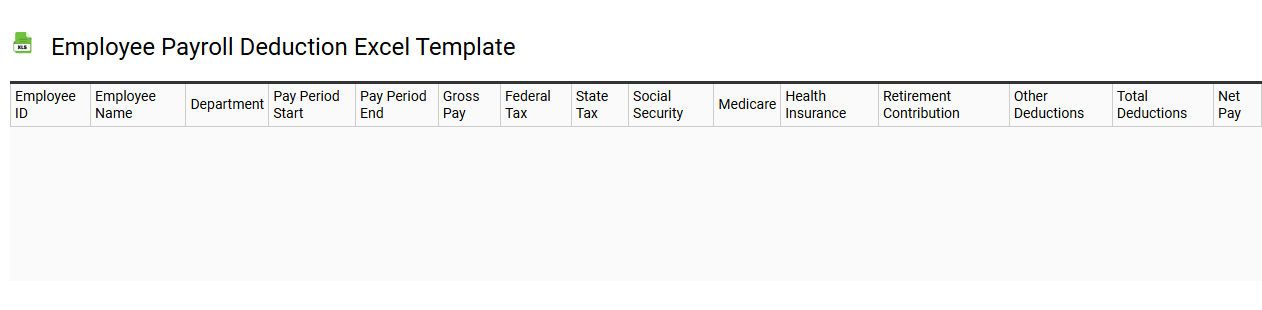

Employee payroll deduction Excel template

💾 Employee payroll deduction Excel template template .xls

An Employee Payroll Deduction Excel template is a structured spreadsheet designed to facilitate accurate calculations of various deductions from employee paychecks. This tool typically includes sections for recording employee information, gross pay, and specific deductions such as taxes, retirement contributions, and healthcare premiums. By effectively organizing these details, the template allows for straightforward tracking and management of payroll expenses, ensuring compliance with tax regulations. You can customize the template to fit your organization's needs, with further potential for advanced features like automated calculations and integration with accounting software.

Payroll deduction tracking Excel template

![]()

💾 Payroll deduction tracking Excel template template .xls

A Payroll Deduction Tracking Excel template is a customizable spreadsheet designed to monitor and manage payroll deductions for employees. This tool allows you to track various deductions such as taxes, retirement contributions, health premiums, and other benefits accurately. You will find columns for employee names, deduction types, amounts deducted, and total earnings, simplifying payroll processes significantly. As your business grows, this template can be expanded to incorporate advanced features like automation with macros or integration with payroll software for enhanced reporting and analytics.

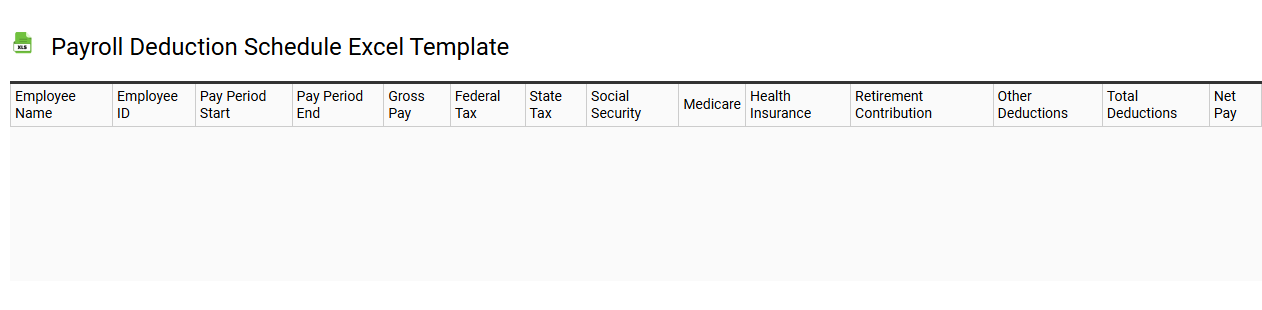

Payroll deduction schedule Excel template

💾 Payroll deduction schedule Excel template template .xls

A Payroll Deduction Schedule Excel template is a spreadsheet tool designed to help businesses manage and track employee payroll deductions efficiently. It typically includes columns for employee names, deduction types, amounts, and pay periods, allowing HR professionals to maintain accurate records of contributions for benefits like health insurance, retirement funds, or tax withholdings. This organized format simplifies calculations and ensures compliance with labor regulations. You can use this template not just for basic payroll management but also to project future deductions and analyze spending patterns, integrating advanced financial forecasting methods and data visualization tools.

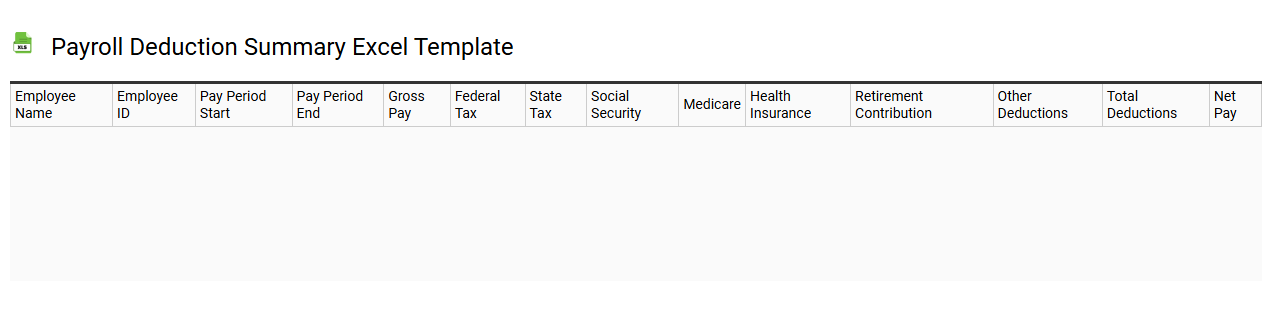

Payroll deduction summary Excel template

💾 Payroll deduction summary Excel template template .xls

A Payroll Deduction Summary Excel template is designed to streamline the tracking and management of employee payroll deductions. It helps you organize various deductions such as taxes, health insurance, retirement contributions, and other benefits, providing a clear overview of what is withheld from each employee's paycheck. You can customize it to include fields like employee names, deduction types, amounts, and totals, ensuring accurate financial records for both employees and the organization. This template serves basic payroll processing needs while also paving the way for advanced analytics, such as forecasting future deductions or integrating with payroll software.

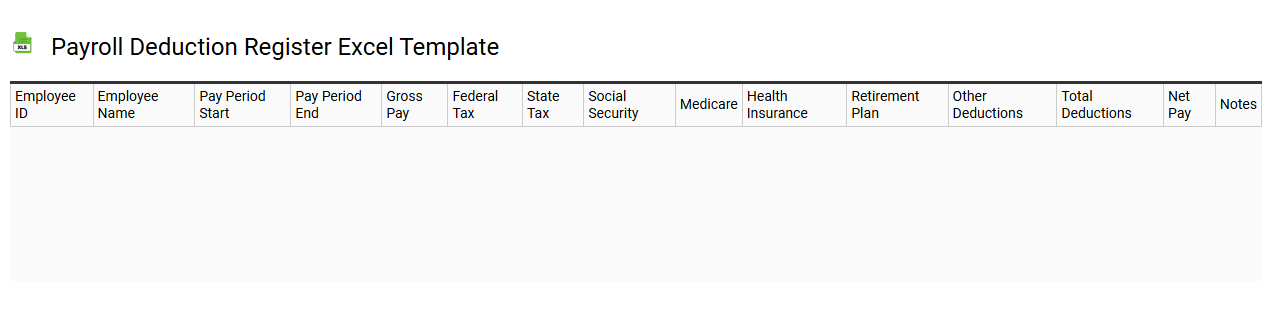

Payroll deduction register Excel template

💾 Payroll deduction register Excel template template .xls

A Payroll Deduction Register Excel template serves as a vital tool for businesses to track employee deductions from their paychecks. This template typically includes columns for employee names, ID numbers, various deduction types such as taxation, retirement contributions, and health insurance premiums, along with the respective amounts. By organizing this information, you gain clarity on overall payroll expenses and ensure compliance with regulatory requirements. This basic tool can be enhanced with features like automated calculations and data validation to streamline payroll processing and accommodate more advanced functions like integrating with accounting software or generating detailed financial reports.

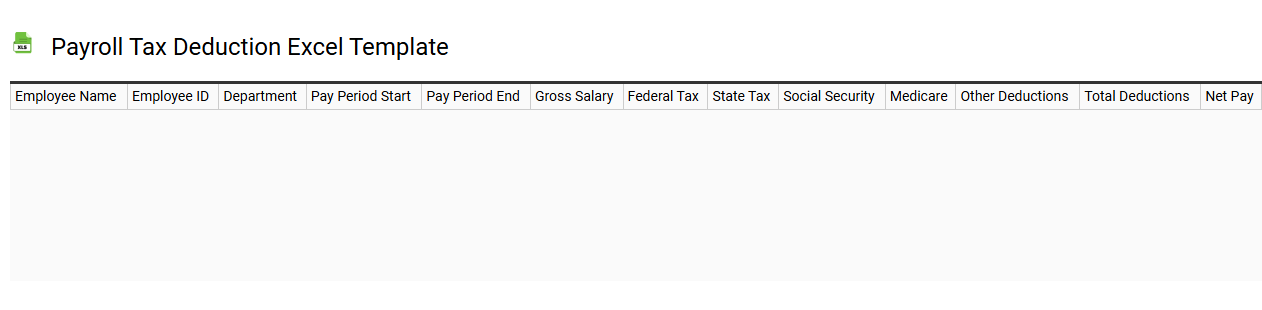

Payroll tax deduction Excel template

💾 Payroll tax deduction Excel template template .xls

A Payroll Tax Deduction Excel template is a structured spreadsheet designed to calculate and track payroll taxes withheld from employee wages. This tool simplifies the payroll process by outlining federal, state, and local tax rates, ensuring compliance with tax regulations. It typically includes fields for employee information, gross pay, and applicable deductions, allowing for accurate calculations of net pay. You can further customize this template for advanced applications, such as integrating with payroll software or incorporating intricate tax scenarios and benefits management.

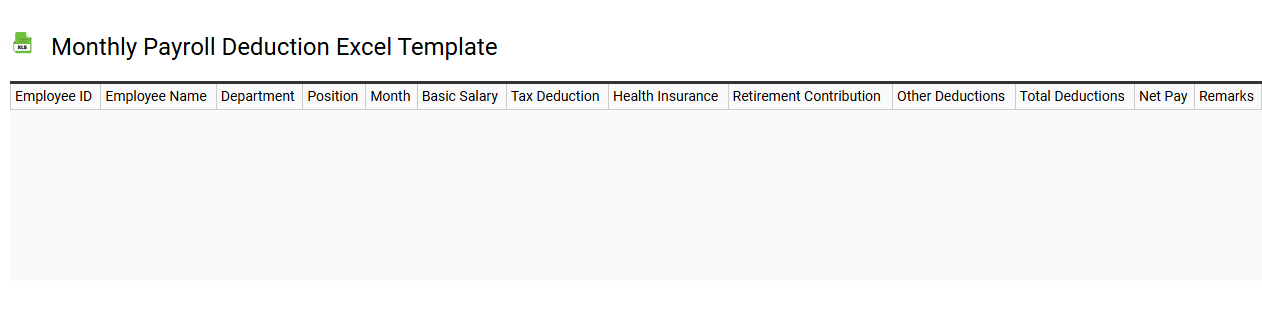

Monthly payroll deduction Excel template

💾 Monthly payroll deduction Excel template template .xls

A Monthly Payroll Deduction Excel template is a customizable spreadsheet designed to manage and calculate payroll deductions systematically. It includes essential components such as employee information, gross pay, and various categories for deductions such as taxes, retirement contributions, and health insurance premiums. This tool streamlines the payroll process, ensuring accuracy and compliance with regulations while also allowing for easy updates and modifications as needed. With the basic functionalities, you can further explore advanced features like automated calculations, tax compliance updates, and integration with accounting software.

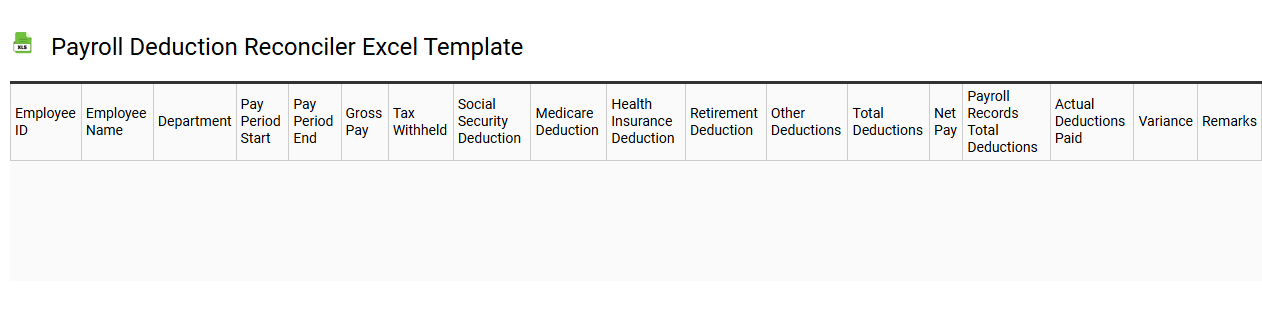

Payroll deduction reconciler Excel template

💾 Payroll deduction reconciler Excel template template .xls

A Payroll Deduction Reconciler Excel template serves as a systematic tool for tracking and reconciling payroll deductions within your business. This template typically includes essential categories such as employee names, deduction amounts, payroll periods, and total deductions to streamline the reconciliation process. It effectively organizes data, enabling you to compare actual deductions against your payroll records and swiftly identify discrepancies. As your needs grow, you might explore advanced capabilities like automated data integration, complex formulas, or macros to enhance efficiency and accuracy in payroll management.

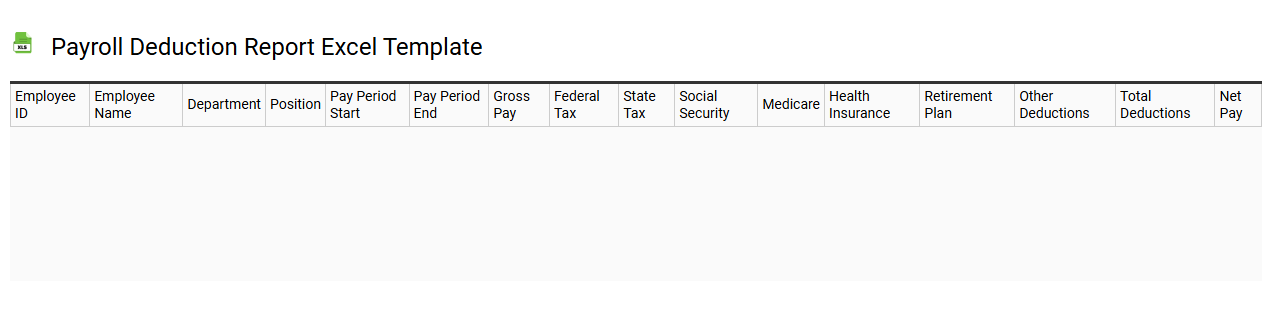

Payroll deduction report Excel template

💾 Payroll deduction report Excel template template .xls

A Payroll Deduction Report Excel template provides a structured way to track and manage payroll deductions for employees. This template typically includes key columns such as employee names, identification numbers, deduction types, amounts deducted, and reasons for each deduction. You can easily customize the template to align with specific organizational needs, ensuring accurate financial tracking and reporting. Using this template not only streamlines your payroll process but also allows you to analyze deduction trends, which can help identify areas for further optimization in employee benefits and compensation structures.