Explore a variety of free XLS templates designed specifically for employee payment management. These templates typically include fields for employee names, hourly rates, hours worked, and total earnings, allowing you to easily track and calculate payments. Customizable features enable you to adapt the templates to suit your unique payroll processes and business requirements.

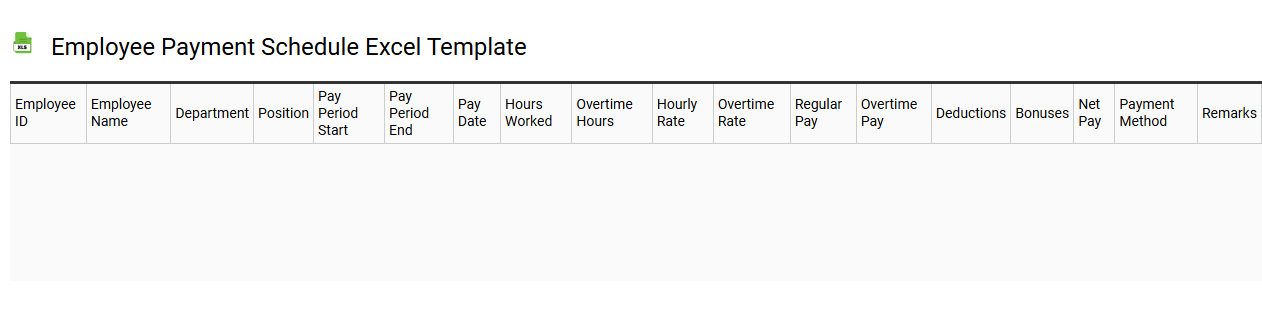

Employee payment schedule Excel template

💾 Employee payment schedule Excel template template .xls

An Employee Payment Schedule Excel template serves as a structured tool for tracking and managing employee payments over a specified period. It typically includes columns for employee names, pay rates, payment dates, and total hours worked, enabling you to calculate gross pay and deductions easily. This template enhances financial efficiency by providing clear visibility into payment timelines and amounts, helping maintain accurate records for accounting and payroll purposes. You can further customize the template to suit your organization's specific needs, integrating advanced functions like VLOOKUP for real-time data updates or pivot tables for comprehensive reporting.

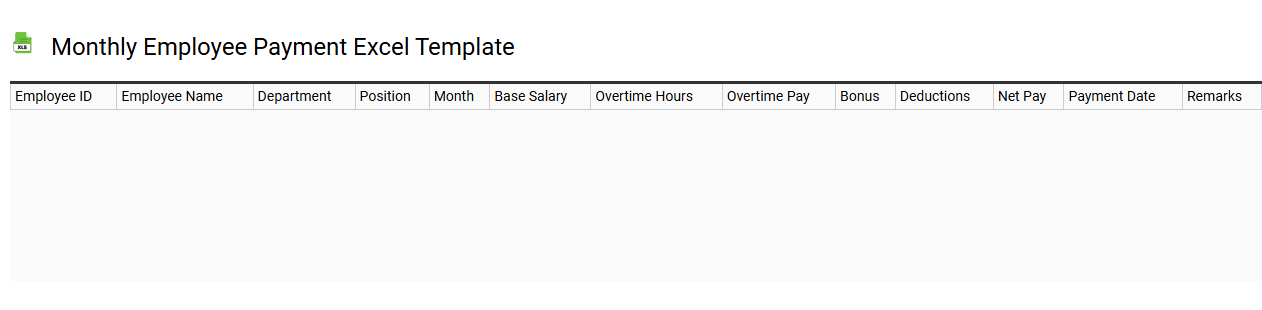

Monthly employee payment Excel template

💾 Monthly employee payment Excel template template .xls

A Monthly Employee Payment Excel template is a structured spreadsheet designed to facilitate the calculation and management of employee salaries on a monthly basis. It typically includes columns for employee names, job titles, hours worked, rates of pay, bonuses, deductions, and net pay, ensuring all relevant data is captured efficiently. Users can easily input values, and built-in formulas automatically calculate totals, making payroll processing quicker and less prone to errors. This template serves as a foundational tool for managing payroll needs, with the potential for advanced features such as automated tax calculations, compliance tracking, or integration with HR systems.

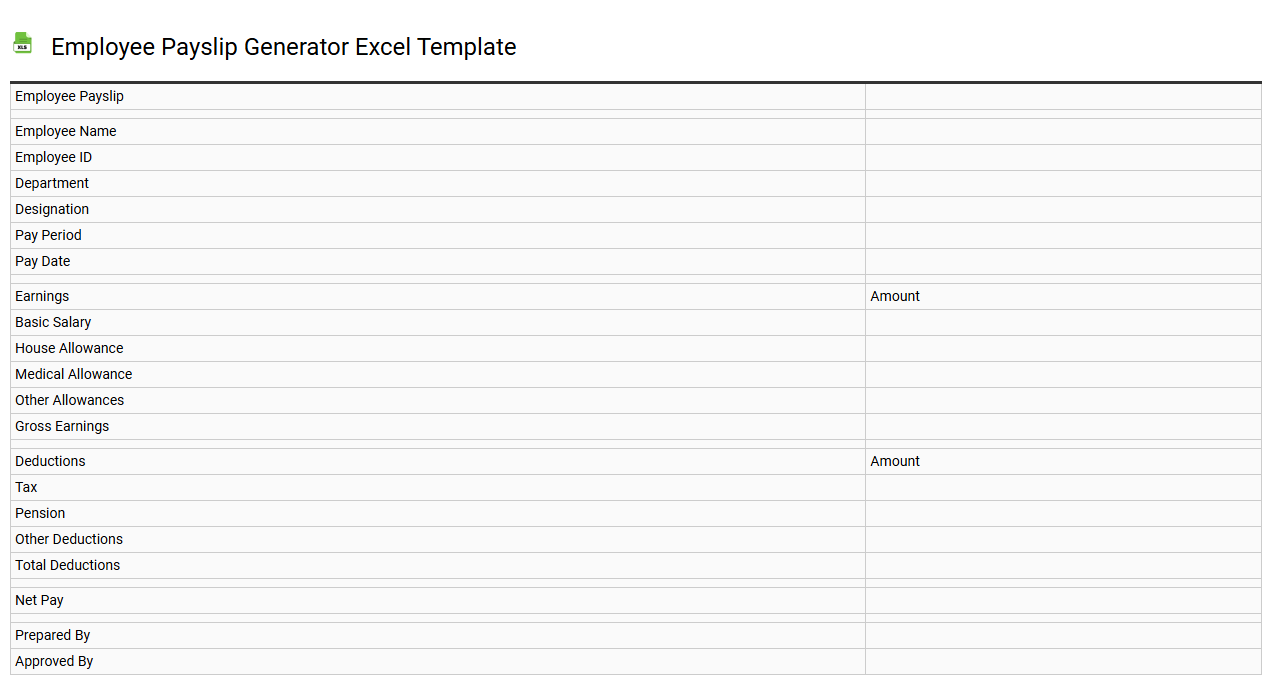

Employee payslip generator Excel template

💾 Employee payslip generator Excel template template .xls

An Employee Payslip Generator Excel template is a customizable tool designed to simplify the creation of payslips for employees. It typically includes essential fields such as employee name, gross salary, deductions, net pay, and payment date, ensuring that all vital information is clearly presented. Users can input data effortlessly into predefined cells, allowing for quick calculations and adjustments to meet specific payroll requirements. This versatile template not only serves basic payroll needs but can also be expanded to incorporate more complex features like tax calculations, overtime pay, and benefit deductions for advanced payroll management.

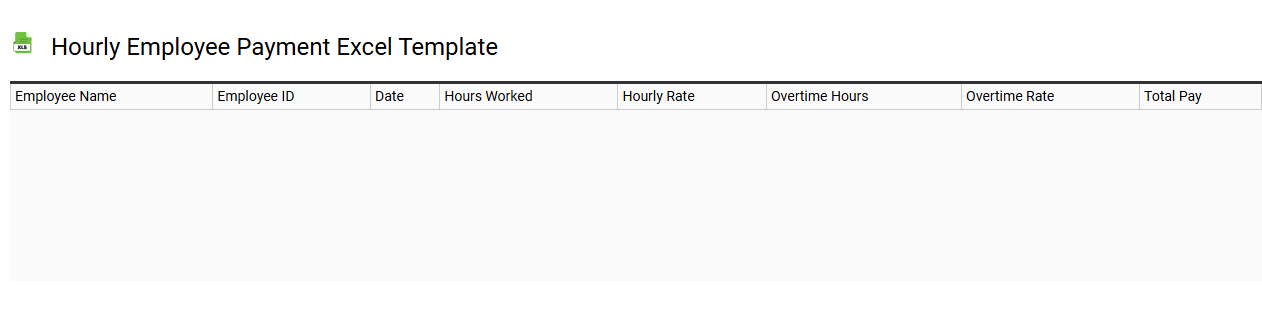

Hourly employee payment Excel template

💾 Hourly employee payment Excel template template .xls

An Hourly Employee Payment Excel template is a structured worksheet designed to facilitate the calculation and management of wages for hourly workers. This template typically includes essential fields such as employee name, hours worked, hourly rate, and total payment calculation. Users can easily input data, automate calculations using formulas, and track payment history for individual employees. Such a template can serve basic payroll needs while also being adaptable for more complex requirements like overtime calculations, tax deductions, and detailed reporting for financial analysis.

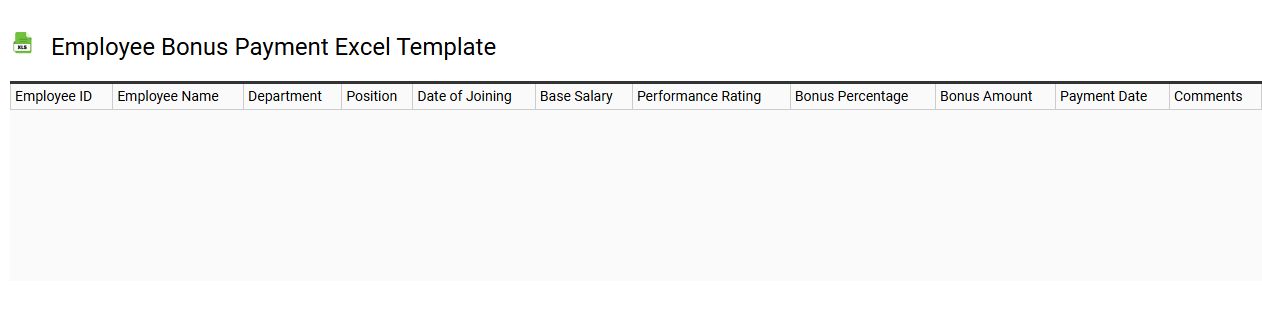

Employee bonus payment Excel template

💾 Employee bonus payment Excel template template .xls

An Employee Bonus Payment Excel template is a preformatted spreadsheet designed to streamline the process of calculating and distributing bonuses to employees. This tool typically includes fields for employee names, positions, performance metrics, base salary, and bonus amounts based on predetermined criteria. You can easily customize the template to fit your organization's specific bonus structure, allowing for direct calculations based on set criteria. Basic usage involves inputting employee data and predefined formulas, while advanced users may explore integrated analytics, performance tracking, and predictive modeling capabilities to enhance overall compensation strategy.

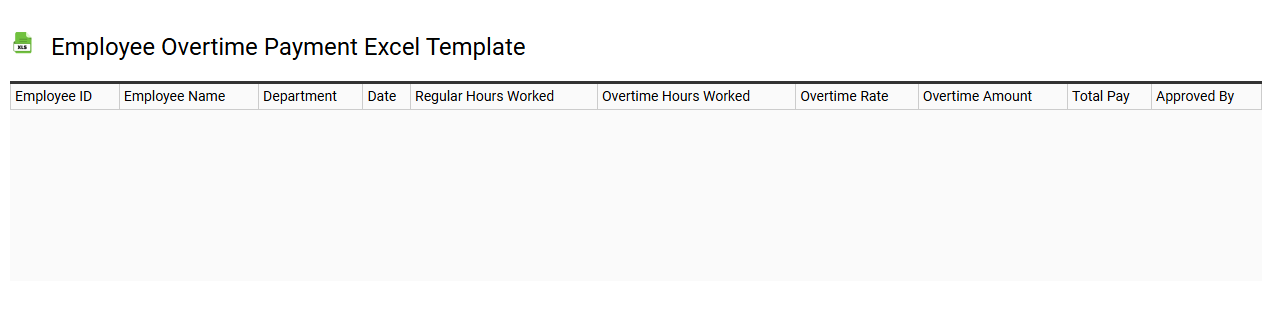

Employee overtime payment Excel template

💾 Employee overtime payment Excel template template .xls

An Employee Overtime Payment Excel template is a structured tool designed to simplify the calculation of overtime pay for employees based on their standard hourly wages. This template typically features sections for inputting employee details, regular hours worked, and overtime hours accrued, allowing for an accurate total of payment due. Users can customize the template to fit specific company policies, such as pay rates for different overtime levels or bonuses. This resource not only streamlines payroll processes but also has the potential to expand into more complex financial tracking systems, incorporating advanced features like automated tax calculations and predictive analytics.

Employee payment tracking Excel template

![]()

💾 Employee payment tracking Excel template template .xls

An Employee Payment Tracking Excel template provides a structured way to manage and monitor employee salaries, bonuses, and deductions in one easy-to-use spreadsheet. It typically includes fields for employee names, identification numbers, payment periods, gross pay, taxable income, taxes withheld, and net pay, ensuring all essential data is readily accessible. You can customize the template to account for overtime, commissions, or any other unique compensation structures relevant to your organization. This tool not only aids in accurate record keeping but also lays the groundwork for managing more complex payroll systems, like automated payroll processing or integration with accounting software for comprehensive financial reporting.

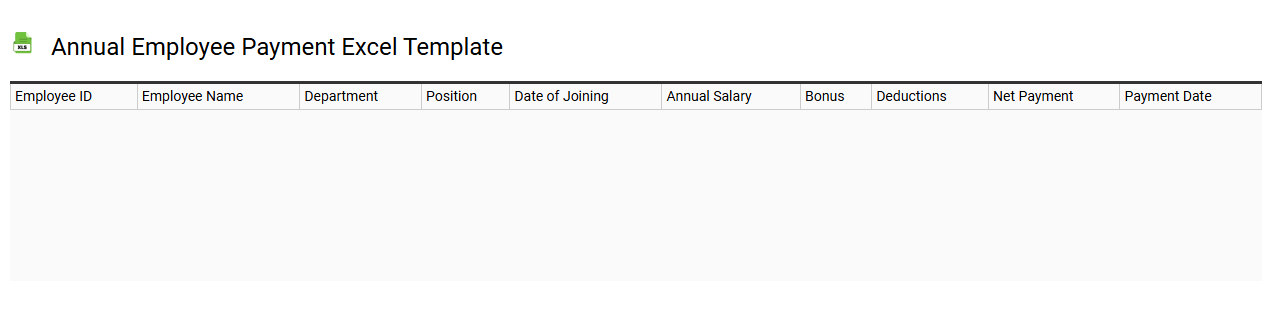

Annual employee payment Excel template

💾 Annual employee payment Excel template template .xls

An Annual Employee Payment Excel template is a structured spreadsheet designed to track and manage employee payroll over a year. This customizable tool features columns for employee information such as names, positions, base salaries, bonuses, and deductions. Users can easily calculate total annual costs for each employee, helping to streamline payroll processes and enhance budget forecasting. Beyond basic payroll tracking, this template can be expanded with advanced functions like tax calculations, benefits analysis, and predictive financial modeling, making it a versatile tool for your HR needs.