Discover a range of free Excel templates designed specifically for pay stubs and payroll management. These templates simplify the process of calculating employee earnings, deductions, and net pay, ensuring accuracy in your payroll documents. Each template is customizable, allowing you to tailor fields to fit your business needs while maintaining professional presentation.

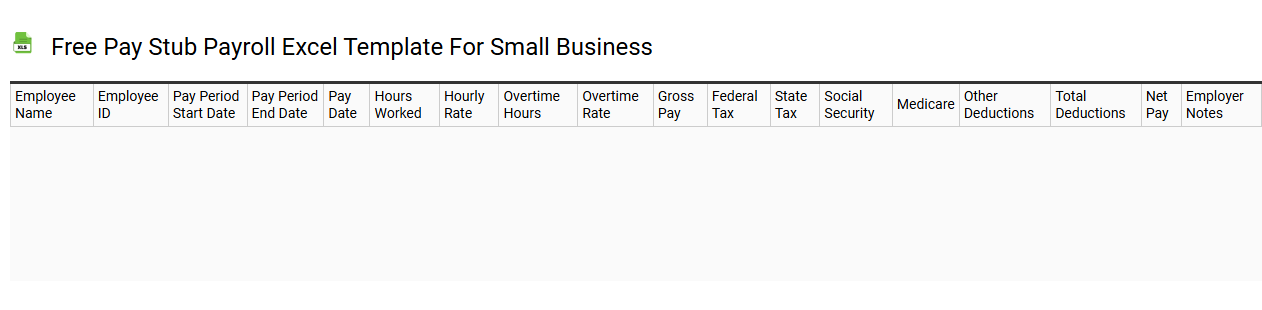

Free Pay stub payroll Excel template for small business

💾 Free Pay stub payroll Excel template for small business template .xls

A Free Pay Stub Payroll Excel template designed for small businesses offers a user-friendly solution to track employee wages and deductions efficiently. This customizable spreadsheet includes sections for employee information, hours worked, gross pay, taxes withheld, and net pay, enabling accurate calculations with ease. You can easily adjust the template to suit your business needs, ensuring compliance with local labor laws. This tool not only helps in managing payroll but also lays the groundwork for future advancements like integrating advanced payroll software or automating tax calculations.

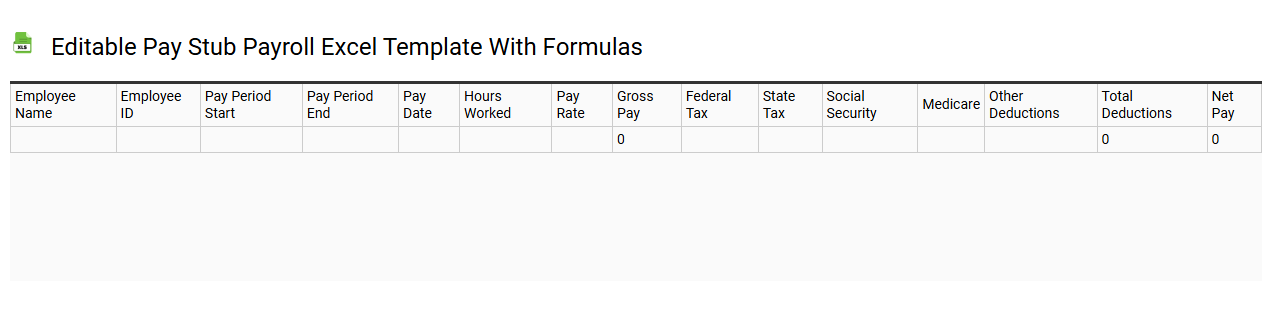

Editable Pay stub payroll Excel template with formulas

💾 Editable Pay stub payroll Excel template with formulas template .xls

An Editable Pay Stub Payroll Excel template with formulas provides a convenient and customizable solution for managing employee payroll calculation. This template typically includes sections for employee information, hours worked, rates of pay, deductions, and net pay, all formula-driven for accuracy. You can input employee data and automatically generate pay stubs, showing details such as gross income, tax withholdings, and benefit deductions. Such templates can also be adapted for complex payroll needs, including overtime calculations, bonus structures, and tax adjustments, supporting both basic and advanced payroll requirements.

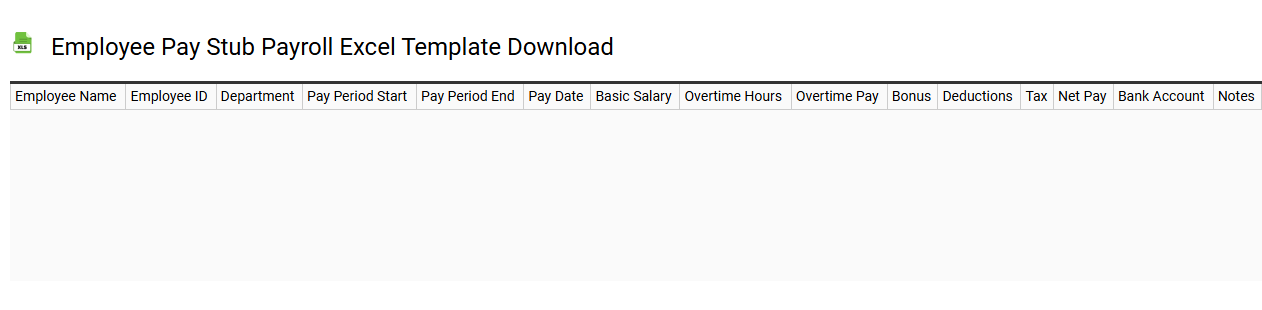

Employee Pay stub payroll Excel template download

💾 Employee Pay stub payroll Excel template download template .xls

An Employee Pay Stub Payroll Excel template provides a simple and efficient way for businesses to create pay stubs for their employees. This template typically includes essential information such as employee name, pay period, hours worked, gross pay, deductions, and net pay. Users can easily customize the template to match their specific payroll requirements, ensuring accuracy and compliance with tax regulations. This tool not only streamlines the payroll process but also facilitates further potential needs like payroll reporting, tax calculations, and financial forecasting, which can be enhanced by advanced features like macros or formulas.

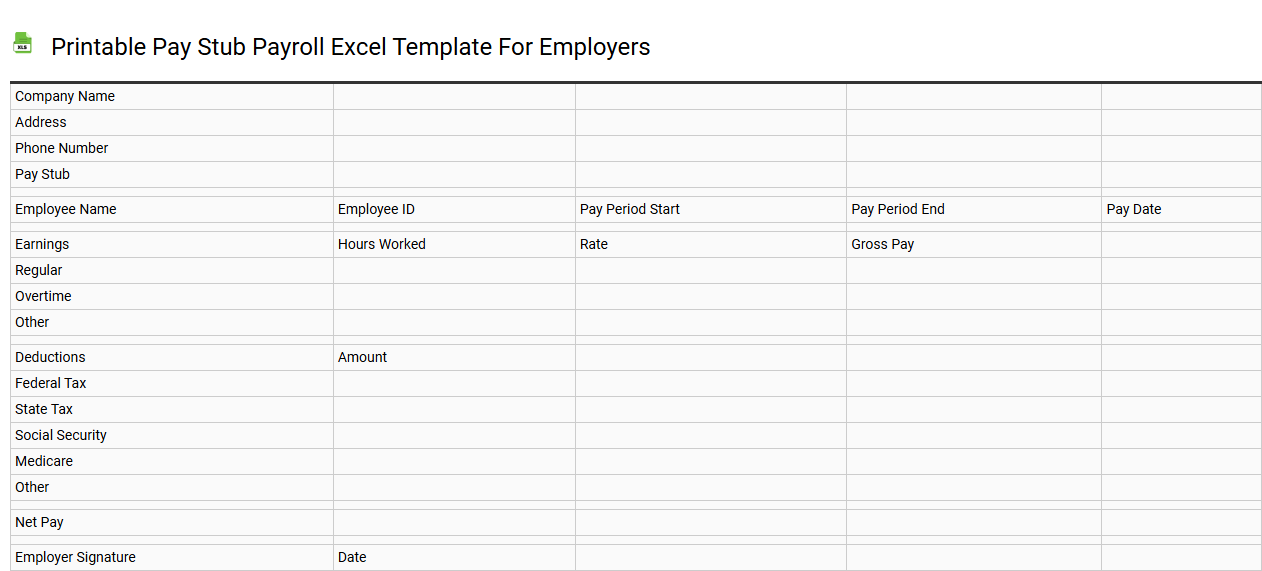

Printable Pay stub payroll Excel template for employers

💾 Printable Pay stub payroll Excel template for employers template .xls

A Printable Pay Stub Payroll Excel Template is a pre-designed spreadsheet that allows employers to generate pay stubs for their employees easily. This template typically includes essential information such as the employee's name, gross pay, deductions, and net pay, all formatted for clarity and professionalism. Customizable fields enable you to input specific financial data, ensuring accuracy and compliance with payroll regulations. Such tools streamline payroll processes, fulfilling immediate needs while laying the groundwork for more advanced payroll management solutions like automated payroll systems or integration with accounting software.

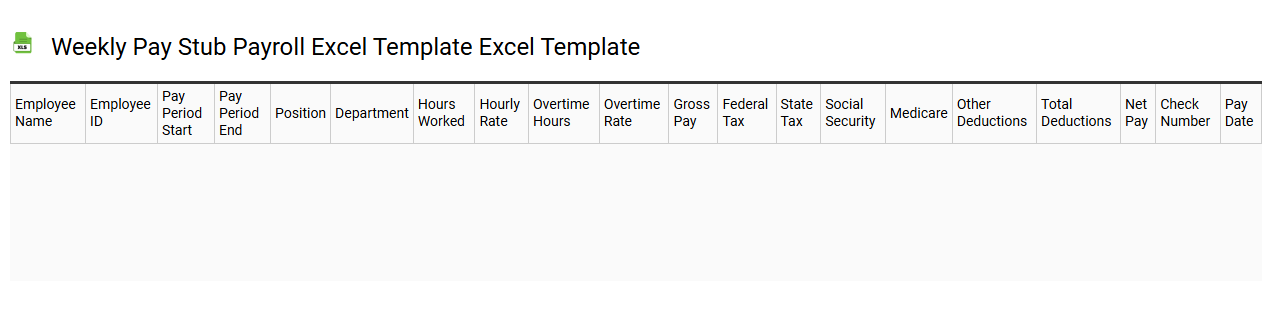

Weekly Pay stub payroll Excel template Excel template

💾 Weekly Pay stub payroll Excel template Excel template template .xls

A Weekly Pay Stub Payroll Excel Template is a customizable spreadsheet designed to simplify the payroll process for businesses. It enables you to track employee earnings, deductions, and taxes effectively, ensuring accurate payment for each pay period. This template typically includes sections for employee information, hours worked, pay rates, gross pay, and various deductions such as taxes and benefits. You can further adapt it to specific needs, incorporating advanced features like automated calculations and tracking for overtime or bonuses.

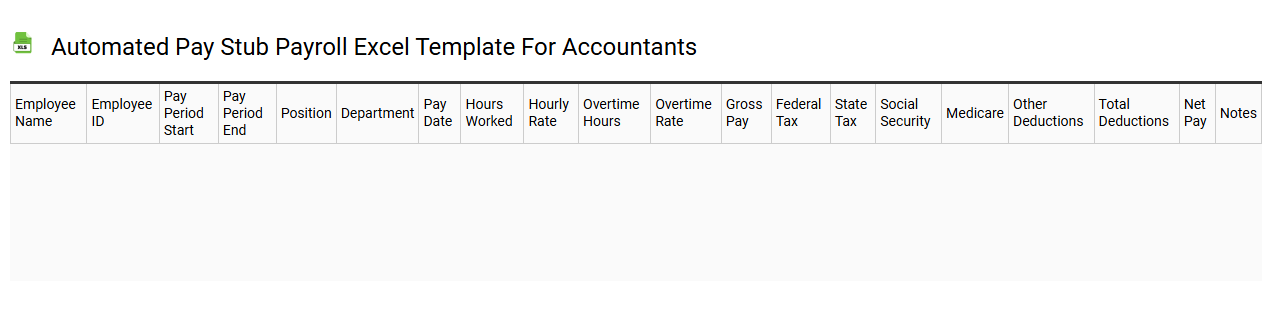

Automated Pay stub payroll Excel template for accountants

💾 Automated Pay stub payroll Excel template for accountants template .xls

An Automated Pay Stub Payroll Excel Template serves as a streamlined tool for accountants, allowing them to efficiently manage payroll processing. This template typically includes essential fields such as employee information, hours worked, deductions, and net pay calculations, ensuring accurate financial reporting. With built-in formulas, it automatically computes taxes, overtime, and other deductions, reducing the potential for human error. You can adapt this template for more complex financial tasks, such as forecasting and financial modeling, maximizing its utility in various accounting scenarios.

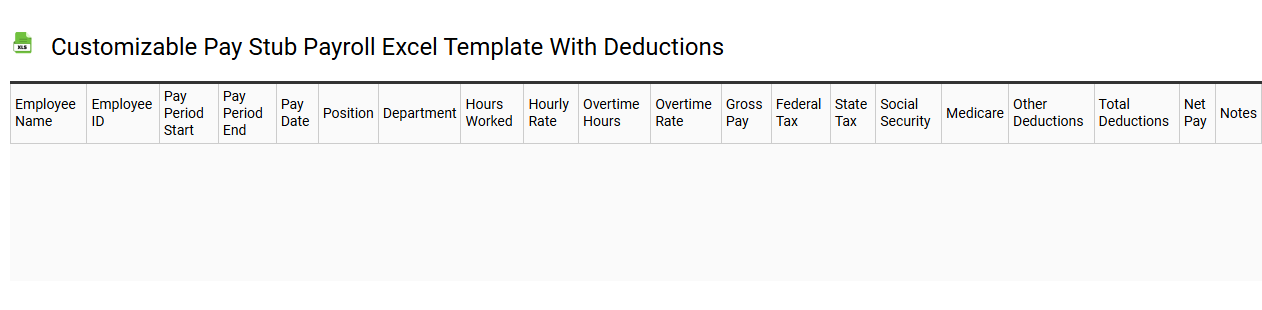

Customizable Pay stub payroll Excel template with deductions

💾 Customizable Pay stub payroll Excel template with deductions template .xls

A customizable pay stub payroll Excel template with deductions provides an easy-to-use framework for calculating employee earnings and withholdings. Each template typically includes fields for employee information, gross pay, overtime pay, and various deductions such as taxes, insurance, and retirement contributions. You can adjust the layout or formulas to meet your specific requirements, ensuring accurate and personalized payroll documentation. This tool streamlines payroll management, making it ideal for small businesses or freelancers who require reliable tracking of employee compensation while offering potential expansions into advanced payroll software integrations and analytical reporting.

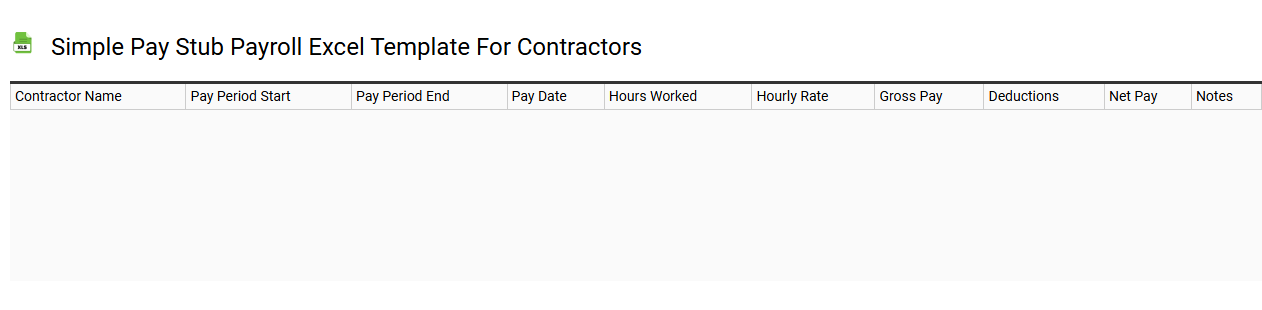

Simple Pay stub payroll Excel template for contractors

💾 Simple Pay stub payroll Excel template for contractors template .xls

A Simple Pay Stub Payroll Excel template for contractors provides a straightforward solution for managing payroll. This template allows you to input essential details such as contractor name, pay period, hours worked, hourly rate, and deductions. Clear sections break down gross pay, taxes, and net pay, making it easy for you to track payments and ensure compliance with tax regulations. Beyond basic payroll functions, you can also customize this template for more intricate calculations involving bonuses or multiple payment rates, enhancing financial management for varying contract requirements.

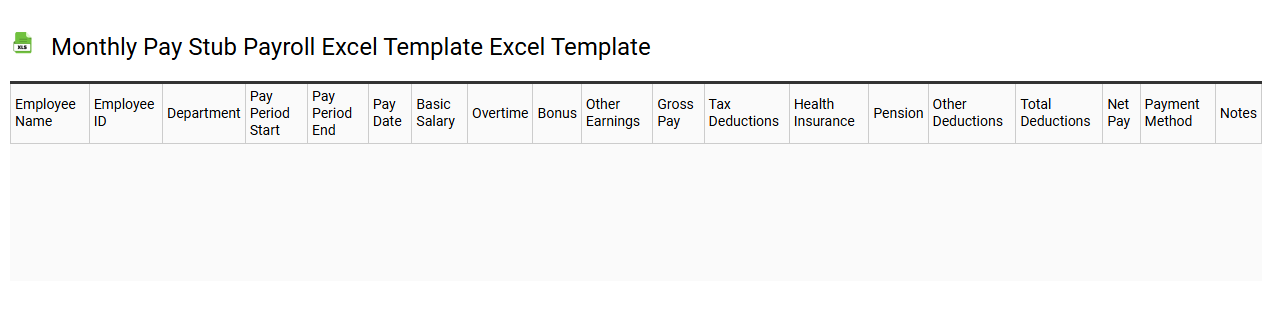

Monthly Pay stub payroll Excel template Excel template

💾 Monthly Pay stub payroll Excel template Excel template template .xls

A Monthly Pay Stub Payroll Excel template is a pre-designed spreadsheet that simplifies the process of calculating and organizing employee payroll data for each month. It typically includes sections for employee details, hours worked, deductions, and net pay, enabling you to track earnings accurately. This tool not only facilitates record-keeping but also helps ensure compliance with tax regulations by documenting essential information. You can customize it for advanced functionalities like integrating with accounting software or implementing complex payroll calculations for varying pay rates and benefits.

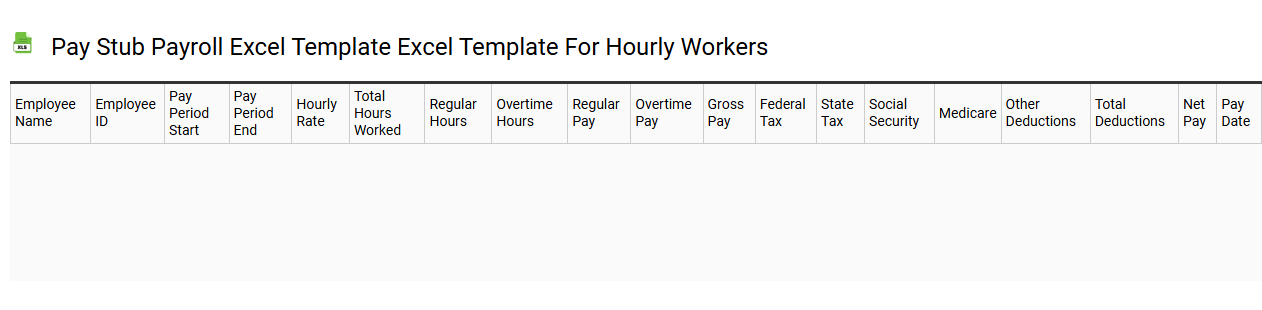

Pay stub payroll Excel template Excel template for hourly workers

💾 Pay stub payroll Excel template Excel template for hourly workers template .xls

A Pay Stub Payroll Excel template for hourly workers provides a streamlined way to calculate and document employee earnings. This template typically includes fields for hours worked, hourly rates, overtime pay, deductions for taxes, and benefits. You can input employee name, pay period dates, and any applicable bonuses to create an accurate summary of wages. Using this template not only simplifies payroll processing but also lays the groundwork for further advanced tracking, such as integrating with accounting software or applying complex tax calculations.