Discover a variety of free Excel templates designed specifically for payroll invoices. These templates streamline the process, allowing you to easily input employee information, working hours, and deductions. With a user-friendly layout, you can ensure accurate calculations and prompt payments, enabling you to manage your payroll efficiently.

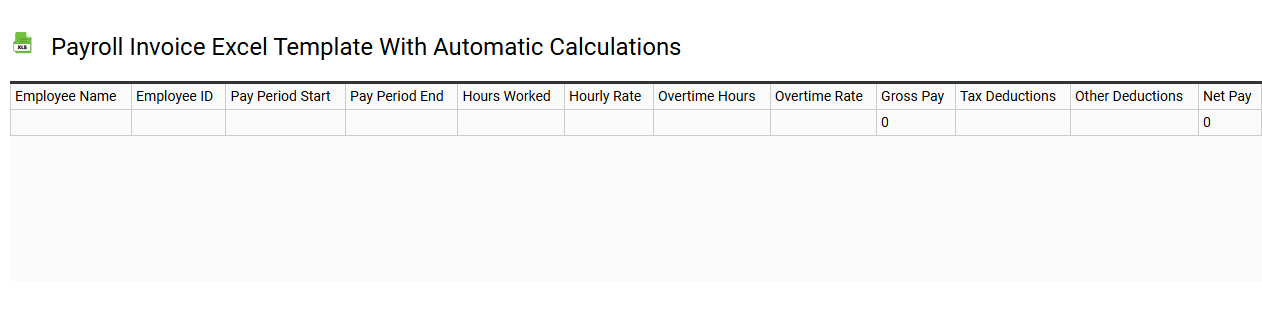

Payroll invoice Excel template with automatic calculations

💾 Payroll invoice Excel template with automatic calculations template .xls

A Payroll invoice Excel template with automatic calculations streamlines the payroll process by providing pre-set formulas that calculate employee wages, taxes, and deductions effortlessly. This tool allows you to input hours worked, hourly rates, and additional earnings such as bonuses or overtime, which the template automatically processes to display total compensation. Color-coded sections and clear labels enhance usability, making it simple for you to track payroll information across different periods and employees. This basic tool can be expanded for more advanced functionalities, such as integrating with accounting software or customizing for various tax regulations and benefit calculations.

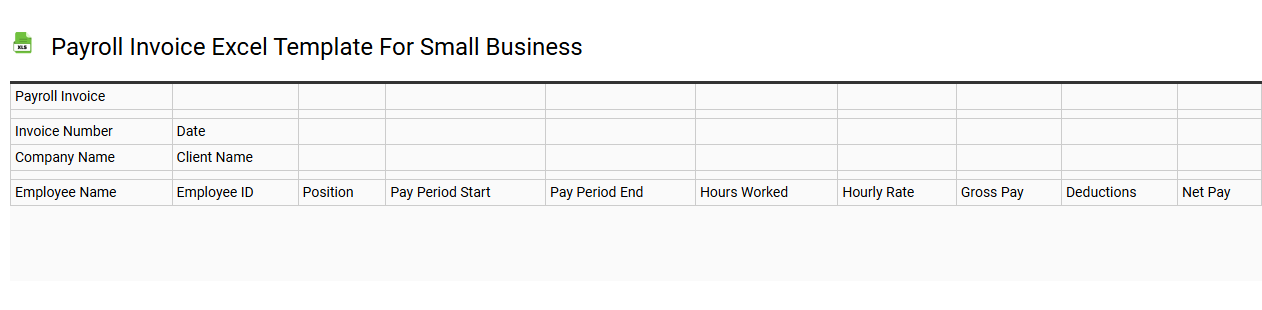

Payroll invoice Excel template for small business

💾 Payroll invoice Excel template for small business template .xls

A Payroll invoice Excel template for small businesses simplifies the process of tracking employee wages, deductions, and payment schedules. This customizable spreadsheet helps business owners maintain organized records of each employee's hours worked, hourly rates, and applicable taxes. With built-in formulas, the template automatically calculates total payments, making payroll processing more efficient and less prone to errors. Such a tool not only streamlines regular payroll tasks but can also support further financial management needs, including advanced analytics, forecasting, and budgeting.

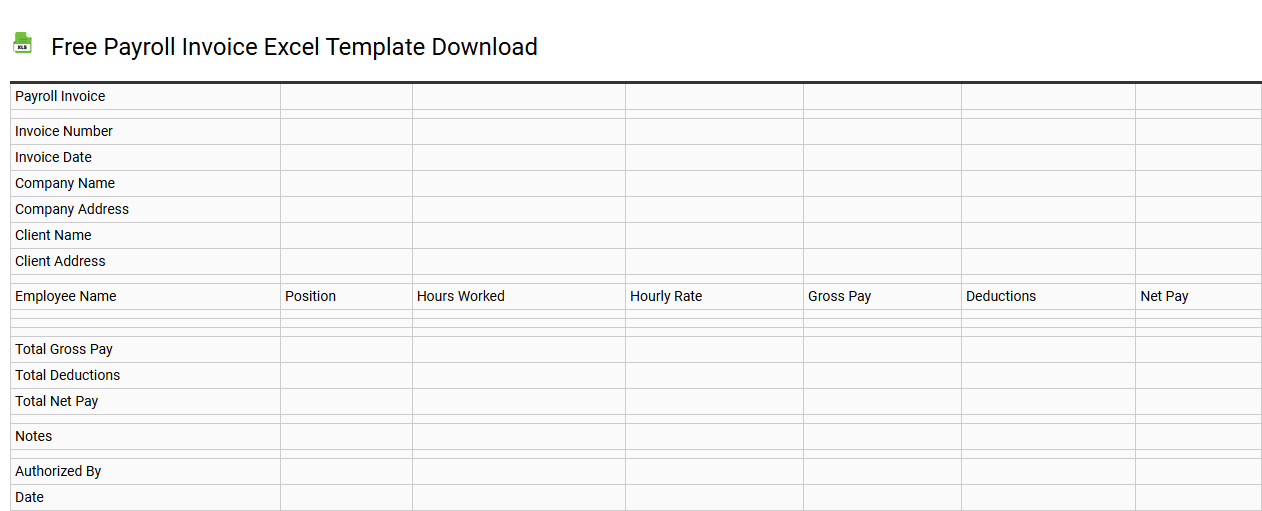

Free payroll invoice Excel template download

💾 Free payroll invoice Excel template download template .xls

A Free Payroll Invoice Excel template is a ready-to-use spreadsheet designed to simplify the process of generating payroll invoices for employees or contractors. It typically includes essential fields such as employee names, hours worked, hourly rates, deductions, and net pay calculations. Using such a template allows for efficient tracking and management of employee payments, ensuring accuracy and compliance with labor laws. This basic tool can easily be adapted for more complex payroll requirements, such as integrating tax calculations, overtime rates, and benefits management.

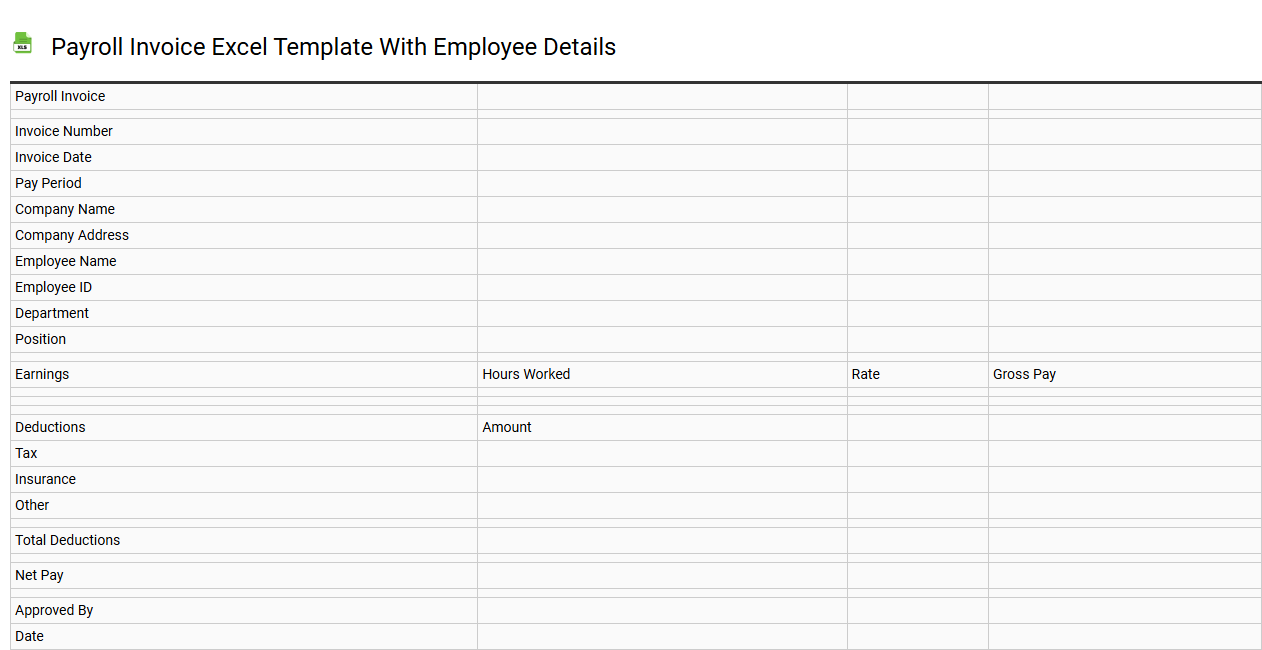

Payroll invoice Excel template with employee details

💾 Payroll invoice Excel template with employee details template .xls

A Payroll invoice Excel template is a structured spreadsheet designed for managing employee payment processes, capturing essential details such as employee names, identification numbers, hours worked, and wage rates. This template typically includes sections for calculating gross pay, deductions, and net pay, allowing for streamlined payroll management. In addition to financial calculations, it often features areas for documenting payment dates and methods, creating a comprehensive record for auditing purposes. You can leverage this template not only for basic payroll tasks but also for more complex functions like automated tax calculations and employee benefit tracking.

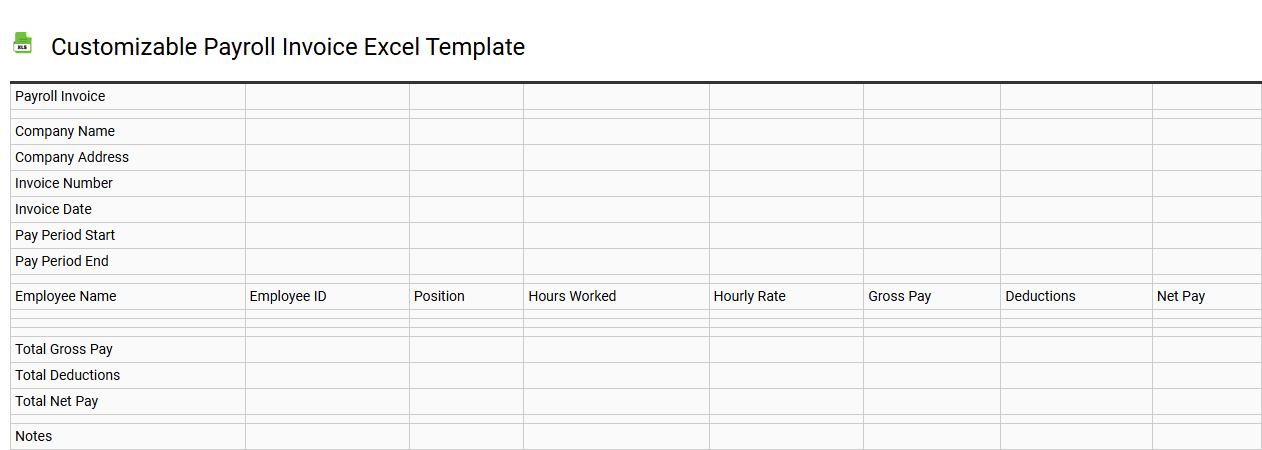

Customizable payroll invoice Excel template

💾 Customizable payroll invoice Excel template template .xls

A customizable payroll invoice Excel template is a versatile tool designed to streamline the payroll process for businesses. This template allows you to input employee details, hours worked, and pay rates, ensuring accurate calculations for gross and net salaries. Easy to modify, you can adjust fields and formulas to suit your specific business needs and incorporate tax deductions or bonuses. Beyond basic payroll functions, this template can also serve future potential needs, such as generating reports or linking with advanced financial analysis software for deeper insights.

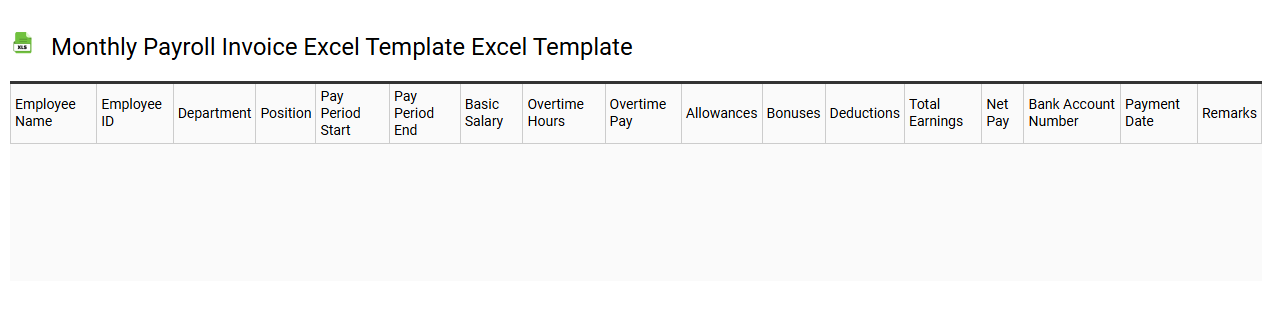

Monthly payroll invoice Excel template Excel template

💾 Monthly payroll invoice Excel template Excel template template .xls

The Monthly Payroll Invoice Excel template is a pre-designed spreadsheet tool that simplifies the process of calculating and documenting employee wages, deductions, and net pay. This template typically includes sections for inputting employee details, hours worked, hourly rates, and applicable taxes or deductions. It allows you to generate accurate invoices for payroll purposes, ensuring your records are well-organized and easy to understand. As your business grows, you may find it beneficial to explore advanced features like automated formulas, pivot tables, and integration with accounting software for enhanced financial management.

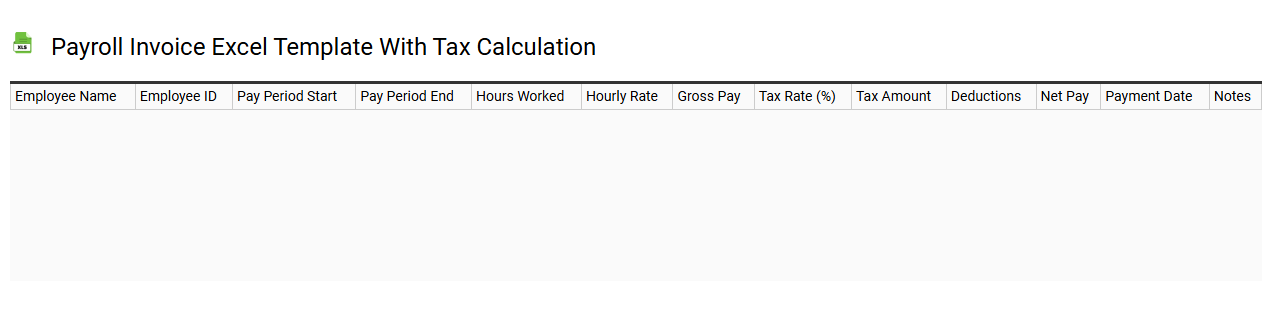

Payroll invoice Excel template with tax calculation

💾 Payroll invoice Excel template with tax calculation template .xls

A Payroll Invoice Excel template with tax calculation streamlines the payroll process for businesses by automatically calculating employee wages, taxes, and deductions. This template typically includes fields for employee details, hours worked, hourly rates, and applicable tax rates, making it easy to input information and generate invoices. Visual formulas and pivot tables within the Excel sheet enhance accuracy and simplify calculations, allowing you to focus on managing payroll efficiently. For basic usage, this template can meet immediate payroll needs, while advanced features may include integrations with accounting software and real-time payroll reporting functionalities.

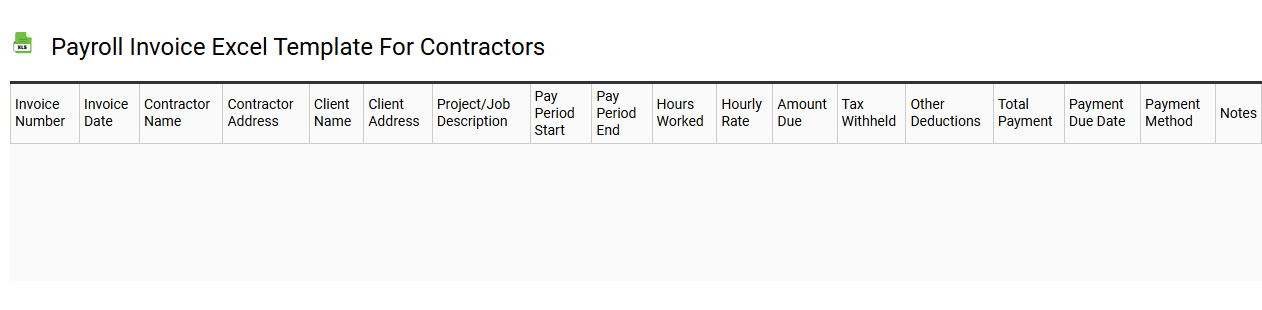

Payroll invoice Excel template for contractors

💾 Payroll invoice Excel template for contractors template .xls

A Payroll invoice Excel template for contractors is a structured spreadsheet designed to facilitate the process of billing for services rendered. It typically includes fields for contractor information, such as name and contact details, along with sections for specifying the type of services provided, hours worked, and corresponding rates. This template often features automatic calculations for subtotals, taxes, and total amounts due, making it easy to generate accurate invoices. Using this tool not only simplifies your invoicing process but also paves the way for advanced financial tracking and reporting needs, such as integration with accounting software or payroll management systems.

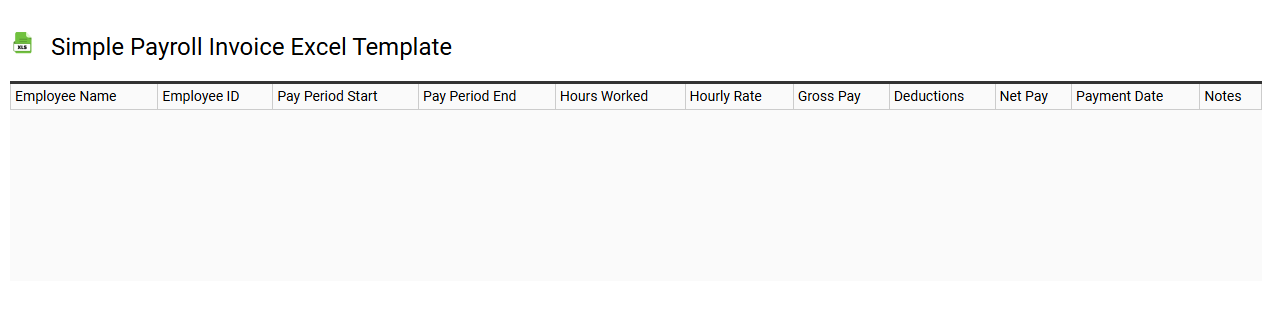

Simple payroll invoice Excel template

💾 Simple payroll invoice Excel template template .xls

A Simple payroll invoice Excel template streamlines the process of tracking employee wages and hours worked. This template typically includes fields for employee names, gross pay, deductions, and net pay, simplifying calculations for payroll administrators. Users can easily input hours worked and apply any relevant tax rates or deductions, ensuring accurate and timely payments. This basic tool is ideal for small businesses, but as your needs grow, you might explore advanced features like automated calculations or integration with accounting software.

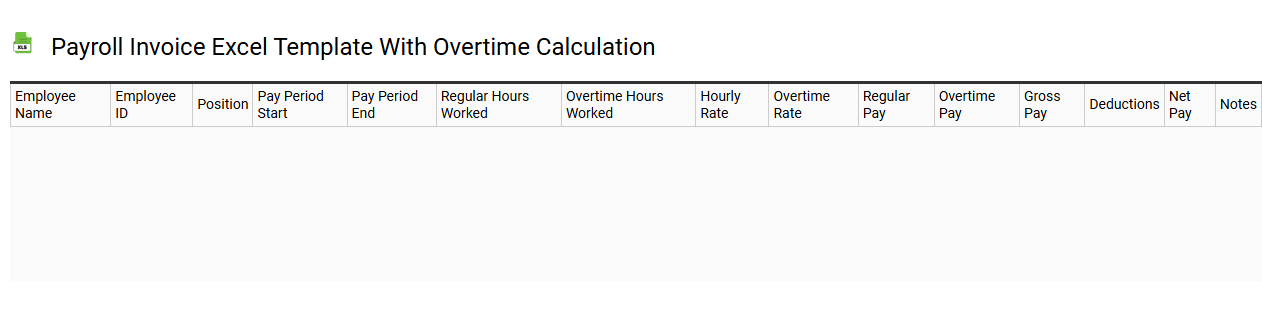

Payroll invoice Excel template with overtime calculation

💾 Payroll invoice Excel template with overtime calculation template .xls

A Payroll invoice Excel template with overtime calculation serves as a tool to efficiently manage employee wages, factoring in regular hours and additional overtime. This template typically includes fields for employee names, hourly rates, total hours worked, and overtime hours, allowing for clear calculations using formulas. You can easily customize it to fit various pay structures, including different rates for overtime. This template can streamline your payroll process, while further potential adaptations may involve integrating advanced features like automated tax calculations and compliance tracking.