Explore a range of free XLS templates designed specifically for payroll account summaries. These templates streamline the tracking of employee wages, deductions, and net pay, ensuring accurate financial management. Customize fields to suit your needs, making it easier for your organization to maintain comprehensive payroll records while adhering to local regulations.

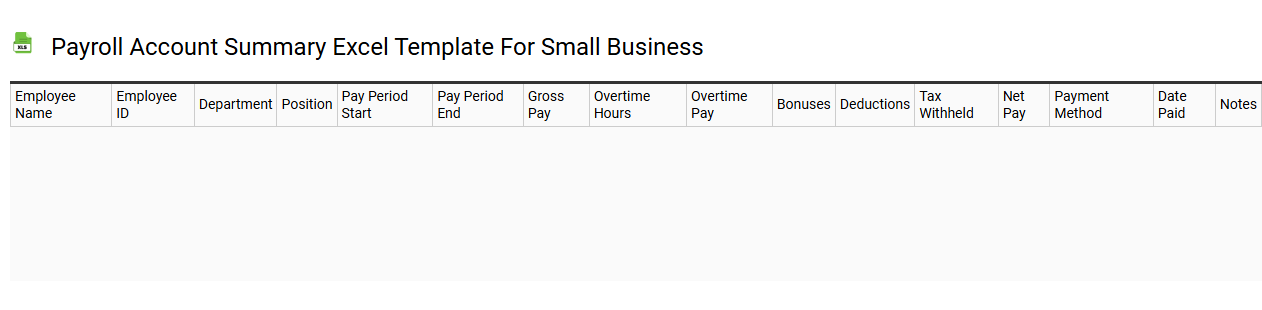

Payroll account summary Excel template for small business

💾 Payroll account summary Excel template for small business template .xls

A Payroll account summary Excel template for small businesses organizes employee compensation data efficiently. It typically includes essential fields such as employee names, identification numbers, salary rates, hours worked, and deductions. This structured format allows for accurate tracking of payroll expenses and timely distribution of employee payments. You can use this template not only for current payroll management but also to analyze trends, forecast future expenses, and ensure compliance with tax regulations and labor laws.

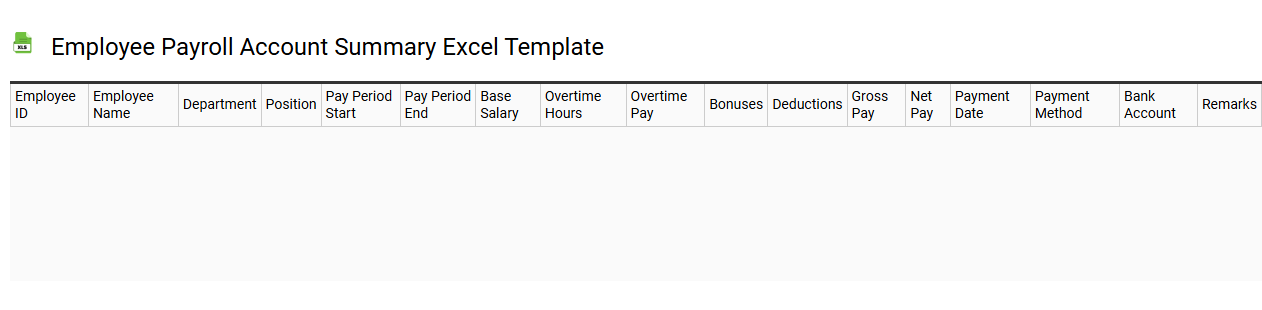

Employee payroll account summary Excel template

💾 Employee payroll account summary Excel template template .xls

An Employee Payroll Account Summary Excel template is a pre-designed spreadsheet that simplifies the management of employee payroll data. This template typically includes sections for employee identification, gross salary, deductions, net pay, and tax information. It allows for easy input and calculation, reducing the risk of errors in payroll processing. As you use this template for basic payroll management, you might explore its potential for integration with advanced reporting tools or payroll software platforms to enhance financial analysis and compliance tracking.

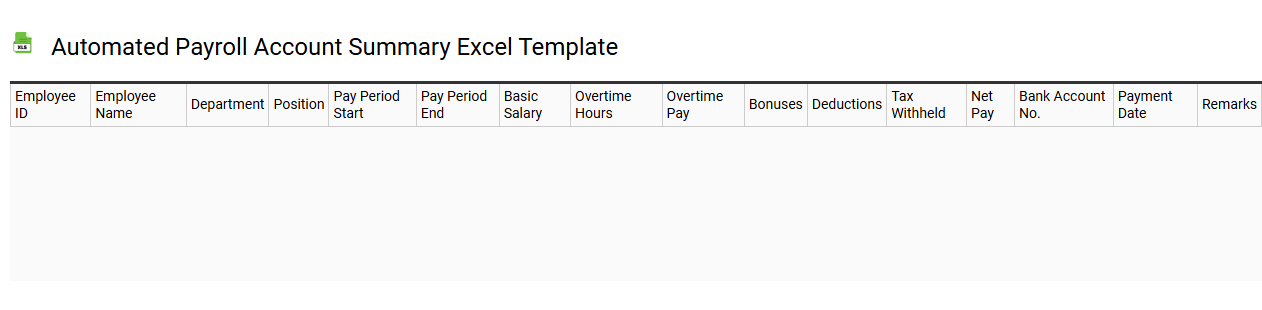

Automated payroll account summary Excel template

💾 Automated payroll account summary Excel template template .xls

An Automated Payroll Account Summary Excel template streamlines the payroll process, allowing businesses to efficiently manage employee compensation records. This template typically includes automated calculations for gross wages, deductions, taxes, and net pay, reducing the risk of human error and saving time during payroll cycles. User-friendly features such as drop-down menus for employee names and positions enhance ease of use, while formatted sections provide clarity for tracking financial summaries over various periods. You can expand its functionality to integrate complex formulas for overtime calculation, benefits management, and compliance reporting as your payroll needs become more sophisticated.

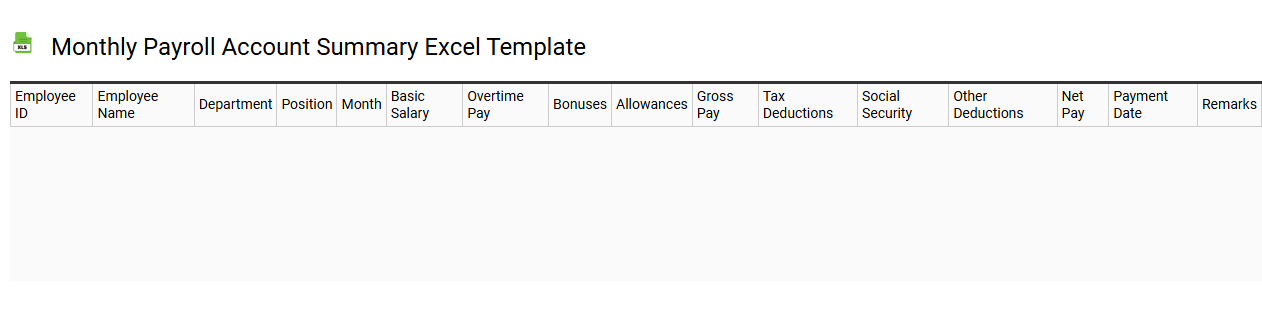

Monthly payroll account summary Excel template

💾 Monthly payroll account summary Excel template template .xls

The Monthly Payroll Account Summary Excel template is a structured tool designed to streamline payroll calculations and reporting for organizations. It allows you to input employee data, including names, positions, salaries, and deductions, which automatically computes total hours worked and net pay. This template often includes built-in formulas for tax calculations and benefits deductions, ensuring accuracy and efficiency in payroll processing. Beyond basic payroll management, it can support advanced analytics, enabling you to track trends, forecast payroll expenditures, and ensure compliance with financial regulations.

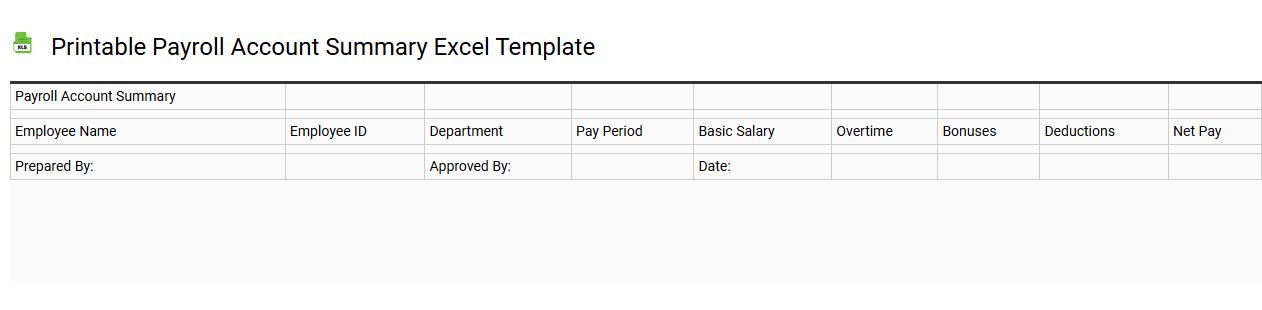

Printable payroll account summary Excel template

💾 Printable payroll account summary Excel template template .xls

Printable payroll account summary Excel template is a structured spreadsheet designed to organize and present payroll data efficiently. This template typically includes employee details such as names, IDs, and pay rates, as well as critical information like hours worked, overtime pay, deductions, and net pay. The layout facilitates easy updates and comparisons, allowing businesses to track payroll expenses accurately. You can utilize this template for basic payroll calculations and expand its functionality to integrate advanced features like automated tax calculations or reporting tools to enhance overall payroll management.

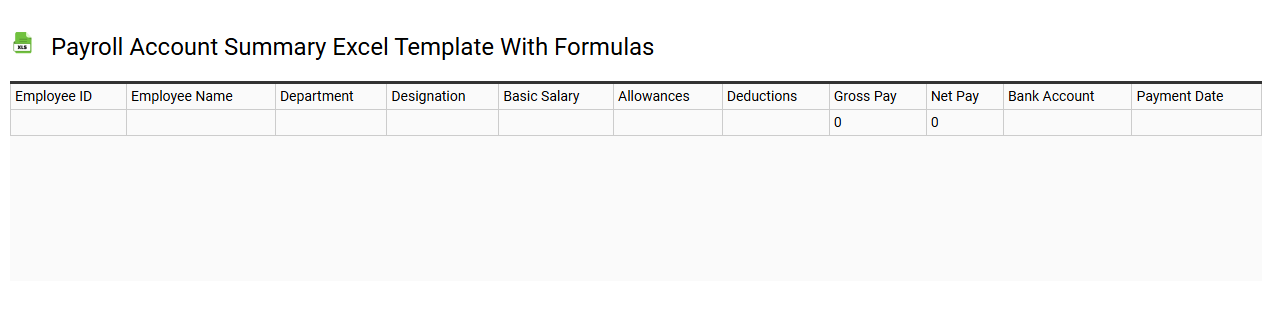

Payroll account summary Excel template with formulas

💾 Payroll account summary Excel template with formulas template .xls

A Payroll account summary Excel template is designed to streamline payroll management by consolidating employee salary, deductions, and tax information into a single spreadsheet. This template typically includes essential data fields such as employee names, identification numbers, hours worked, pay rates, gross salary, and net pay calculations. Formulas are embedded in the template to automatically compute the total deductions, taxes owed, and final payout, ensuring accuracy and efficiency in financial reporting. You can customize this template to fit your specific payroll needs, making it useful for both basic salary calculations and more advanced functionalities like multi-tiered deduction systems and compliance reporting.

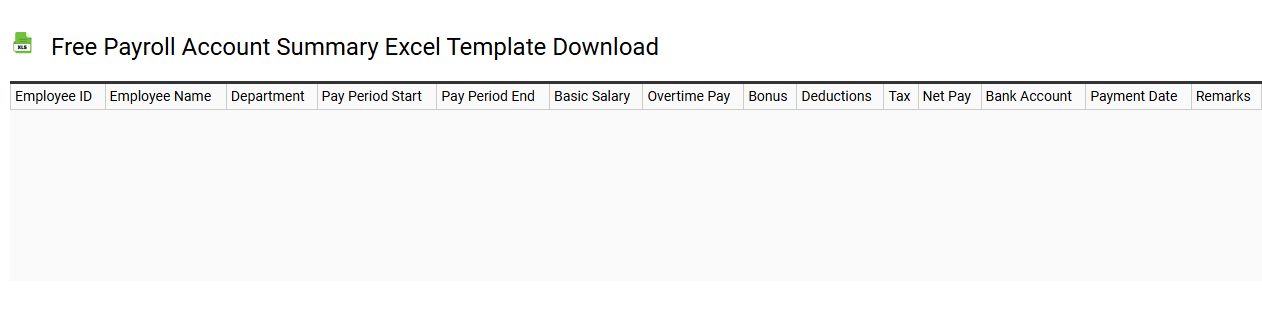

Free payroll account summary Excel template download

💾 Free payroll account summary Excel template download template .xls

A Free Payroll Account Summary Excel template is a useful tool that allows you to efficiently track employee payment details, deductions, and net earnings in a structured format. This template typically includes essential columns such as employee names, hours worked, pay rates, tax deductions, and total compensation for easy calculation and record-keeping. You can customize it to fit your specific payroll needs, including adding additional fields for bonuses, benefits, or overtime. This template serves as a foundational resource, offering the potential for more advanced payroll analytics or integrations with accounting software for comprehensive financial management.

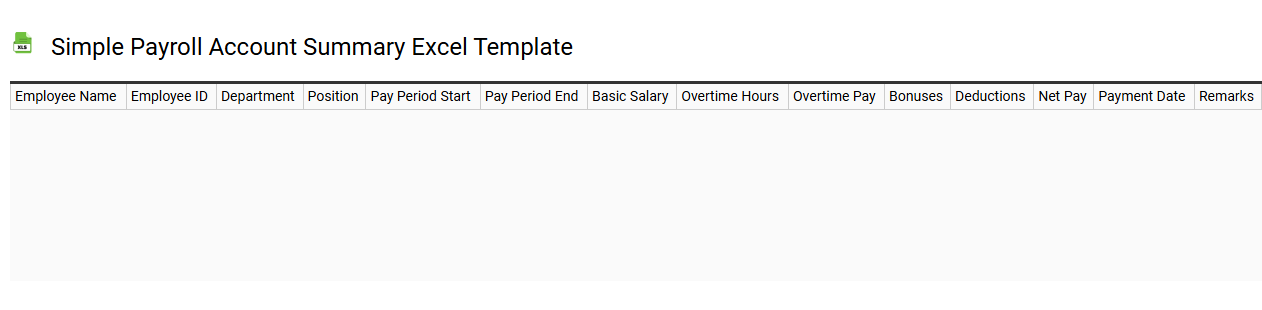

Simple payroll account summary Excel template

💾 Simple payroll account summary Excel template template .xls

A Simple Payroll Account Summary Excel template is a user-friendly spreadsheet designed to help individuals or small businesses manage employee payroll data efficiently. It typically includes essential columns such as employee names, identification numbers, hours worked, pay rates, gross earnings, deductions, and net pay. This organized layout allows you to easily track payroll expenses and ensures compliance with tax regulations. Using this template not only simplifies your payroll management but also lays the groundwork for more advanced functionalities like automated calculations, reporting features, and integration with accounting software.

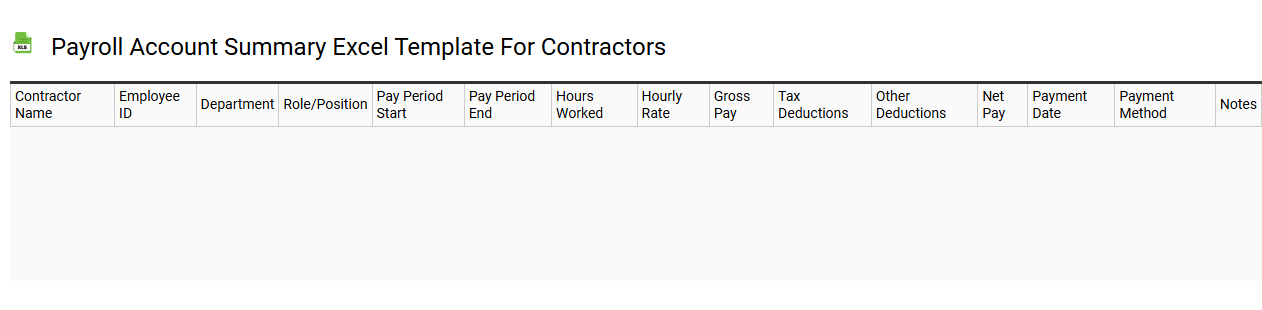

Payroll account summary Excel template for contractors

💾 Payroll account summary Excel template for contractors template .xls

A Payroll Account Summary Excel template for contractors is a structured tool designed to streamline payroll management for independent contractors. This template typically includes essential columns for contractor names, service dates, hours worked, rates, and total earnings. You can track deductions, tax implications, and any reimbursements, ensuring accurate financial documentation. Beyond basic payroll calculations, the template can be customized to accommodate advanced features, such as automated tax calculations or integration with accounting software, meeting your broader financial management needs.

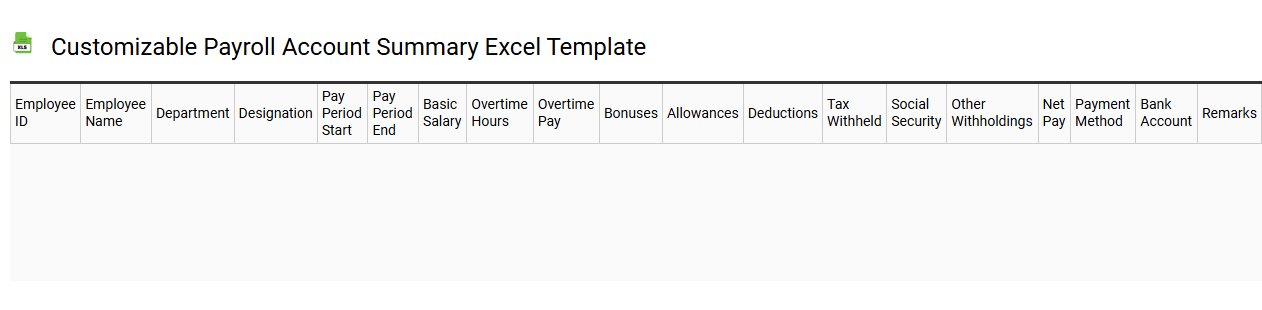

Customizable payroll account summary Excel template

💾 Customizable payroll account summary Excel template template .xls

A customizable payroll account summary Excel template is a pre-designed spreadsheet that allows you to input and manage employee payroll information tailored to your specific needs. This template typically includes sections for employee names, hours worked, pay rates, deductions, and net pay calculations, making it an efficient tool for tracking compensation and managing payroll processing. With user-friendly features, you can easily adjust formulas and layouts to fit your organization's requirements. Such a template simplifies basic payroll management while offering potential for more advanced functions like tax calculations, forecasting payroll expenses, and generating visual reports for better financial overview.