Explore a range of free Excel templates designed specifically for tax audit documentation. Each template offers organized sections to capture essential financial data, ensuring clarity and compliance with tax regulations. With user-friendly layouts, these templates empower you to streamline your documentation process, facilitating easier audits and comprehensive record-keeping for both individuals and businesses.

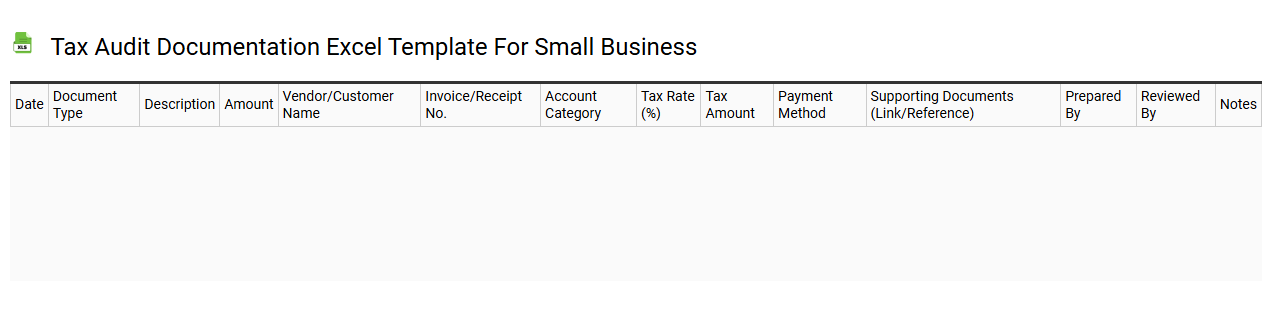

Tax audit documentation Excel template for small business

💾 Tax audit documentation Excel template for small business template .xls

A Tax audit documentation Excel template for small businesses is a structured spreadsheet designed to streamline the organization of financial records for auditing purposes. This template typically includes sections for income statements, expense reports, and detailed transaction logs, facilitating easy access to essential data. Each category allows for the input of relevant figures, ensuring that all financial activities are thoroughly documented. Maintaining this template supports not only current audit compliance but also prepares your business for potential future audits and advanced tax planning strategies.

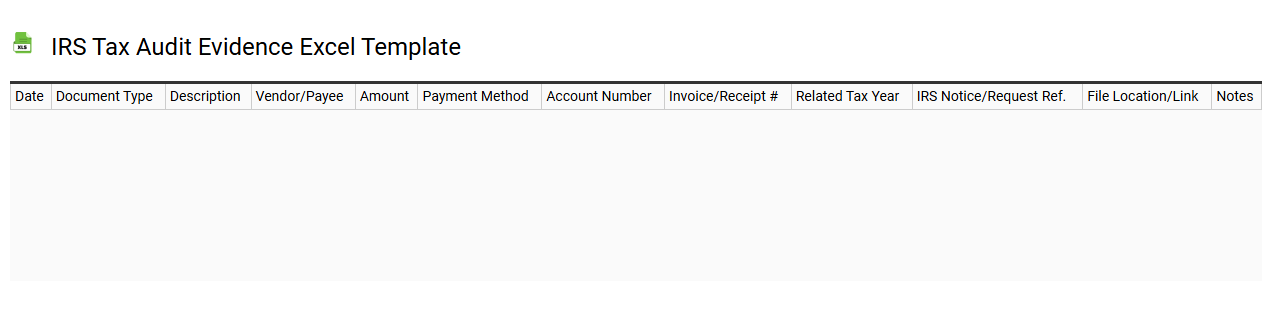

IRS tax audit evidence Excel template

💾 IRS tax audit evidence Excel template template .xls

An IRS tax audit evidence Excel template is a structured spreadsheet designed to help taxpayers organize documentation and support for financial transactions during an audit. This template typically includes sections for income, expenses, deductions, and credits, allowing users to input relevant data systematically. Each section may contain spaces for dates, amounts, and descriptions, ensuring clarity and comprehensiveness in tracking financial activities. Utilizing this template simplifies the process of gathering necessary documents and can enhance your preparedness for IRS inquiries, as well as meet basic compliance needs while enabling a more detailed examination of advanced tax strategies like asset allocation or depreciation methods.

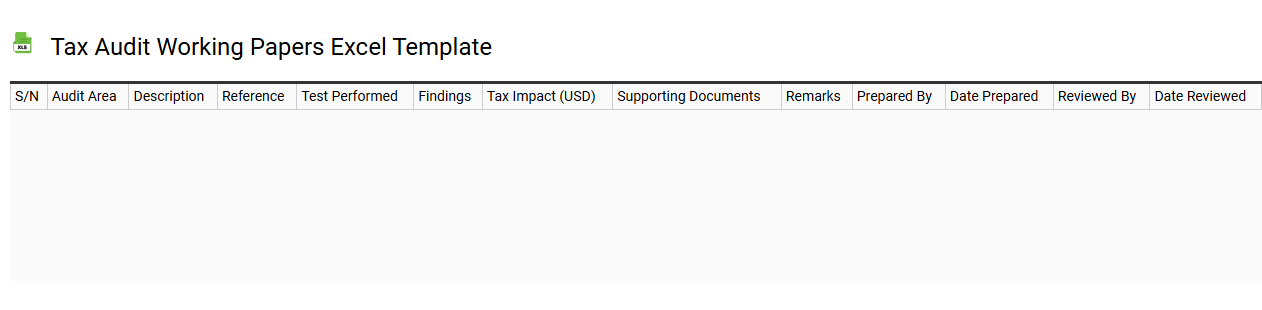

Tax audit working papers Excel template

💾 Tax audit working papers Excel template template .xls

A Tax audit working papers Excel template is a structured digital document designed to assist accountants and tax professionals in organizing financial records and supporting documents during a tax audit process. This template typically includes sections for income statements, balance sheets, and expense details, making it easier to present findings clearly and concisely. You can also find fields for notes and comments to explain specific entries and any adjustments made during the audit. This format is essential not only for compliance but also for identifying areas of potential tax savings or liabilities, paving the way for advanced financial analysis and strategic tax planning.

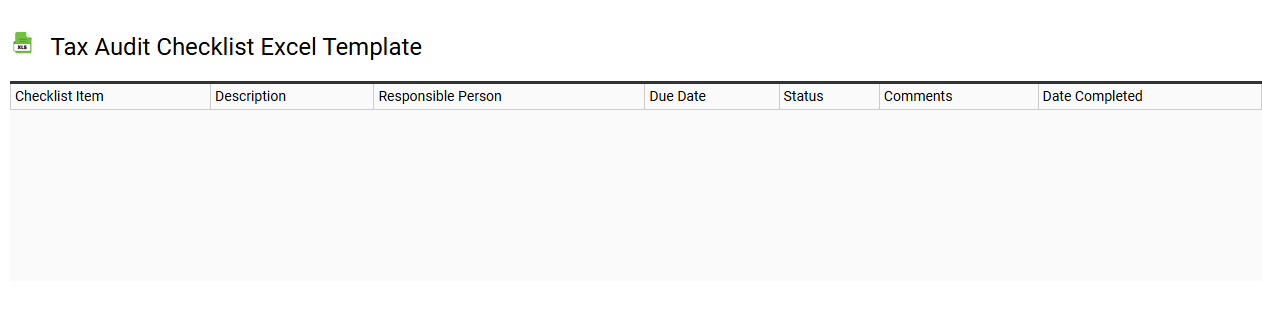

Tax audit checklist Excel template

💾 Tax audit checklist Excel template template .xls

A tax audit checklist Excel template serves as a comprehensive tool for tracking necessary documentation and actions during a tax audit process. You can find sections focusing on financial statements, tax returns, and supporting documents like receipts and invoices, ensuring that you have everything organized neatly. This template often includes a column for notes, allowing you to document any discrepancies or issues as they arise. Utilizing this structured approach helps you prepare effectively for audits, ultimately streamlining the compliance process and minimizing potential future complications. Basic usage may involve tracking simple categories, while further potential needs could include integration with sophisticated accounting software or advanced data analytics features.

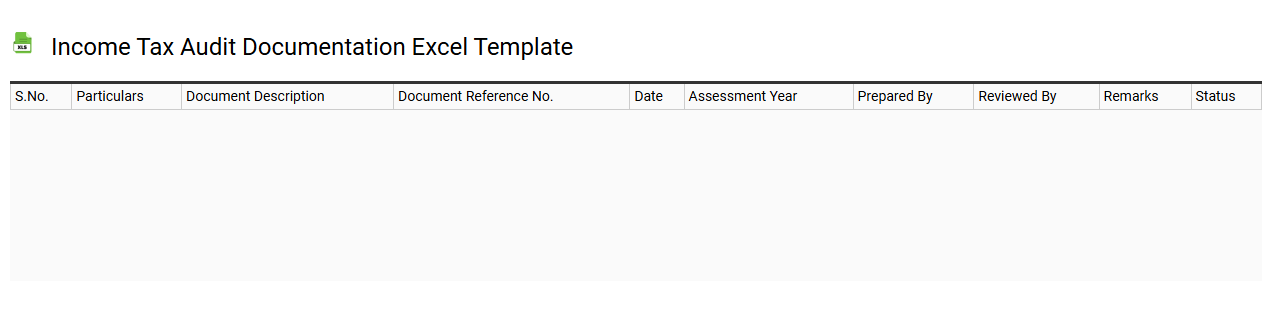

Income tax audit documentation Excel template

💾 Income tax audit documentation Excel template template .xls

An Income Tax Audit Documentation Excel template is a structured spreadsheet designed to help individuals or businesses organize and present their financial records for tax audit purposes. This template typically includes sections for income statements, expense tracking, asset inventories, and any relevant supporting documentation that the tax authorities may require. You can customize the fields to include specific income sources, deductions, and credits applicable to your situation. Proper documentation in this format not only simplifies compliance but also enhances your ability to analyze your financial health and prepare for more complex scenarios, such as cost-benefit analyses or forensic accounting investigations.

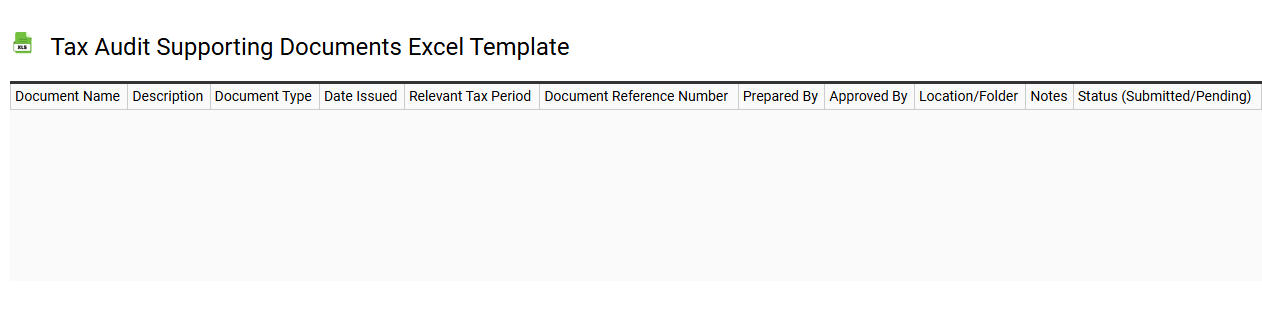

Tax audit supporting documents Excel template

💾 Tax audit supporting documents Excel template template .xls

A tax audit supporting documents Excel template serves as a structured tool to organize and present essential financial records during an audit process. This template typically includes sections for income statements, expense reports, bank statements, invoices, and receipts, ensuring all relevant documents are easy to access and review. You can customize the format to fit specific requirements, enhancing clarity and streamlining the audit procedure. Such templates not only simplify basic organization but can also be adapted for more advanced financial analyses and compliance needs, helping you maintain thorough documentation throughout the tax audit.

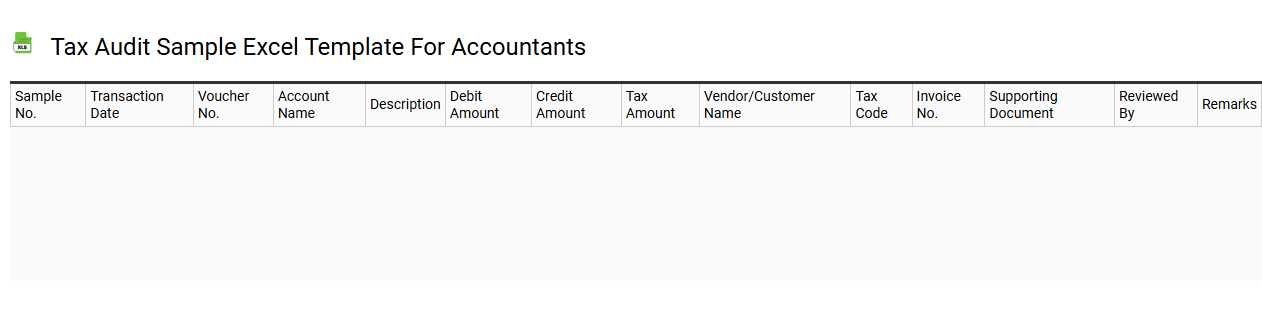

Tax audit sample Excel template for accountants

💾 Tax audit sample Excel template for accountants template .xls

A Tax audit sample Excel template for accountants serves as a structured tool to efficiently organize and analyze financial data during tax assessments. It typically includes multiple sheets for various categories such as income, deductions, credits, and compliance checks, allowing for thorough documentation of financial transactions. Data can be easily inputted and updated, making it simpler to calculate totals, identify discrepancies, and track potential issues that may arise during an audit. This template not only facilitates basic tax filing processes but may also be tailored for more complex needs, such as forensic accounting and advanced tax strategy analysis.

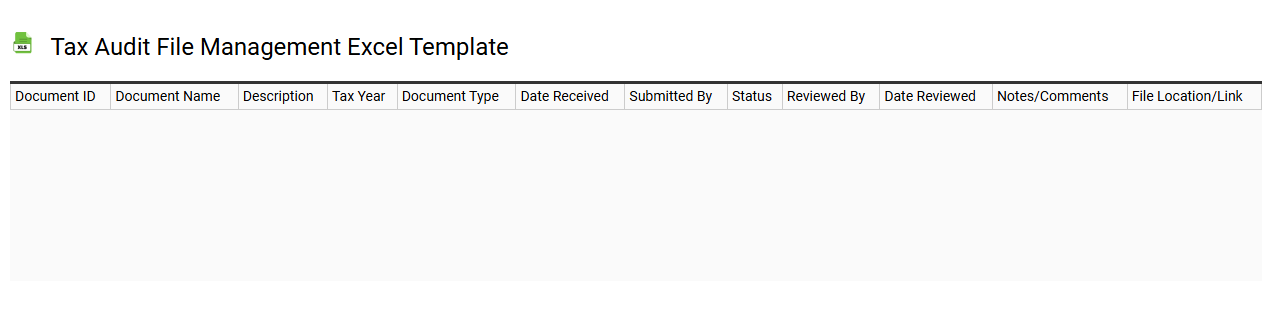

Tax audit file management Excel template

💾 Tax audit file management Excel template template .xls

A Tax Audit File Management Excel template is a structured tool designed to help individuals and businesses systematically organize and manage their tax-related documents and information during an audit. This template typically includes sections for essential data such as income statements, expense reports, and deduction schedules. Users can easily track deadlines, manage communications with tax authorities, and maintain records of submitted documents to ensure compliance and transparency. Beyond basic usage for current audits, this template can evolve to support advanced data analytics, allowing for trend analysis and forecasting of future tax liabilities.

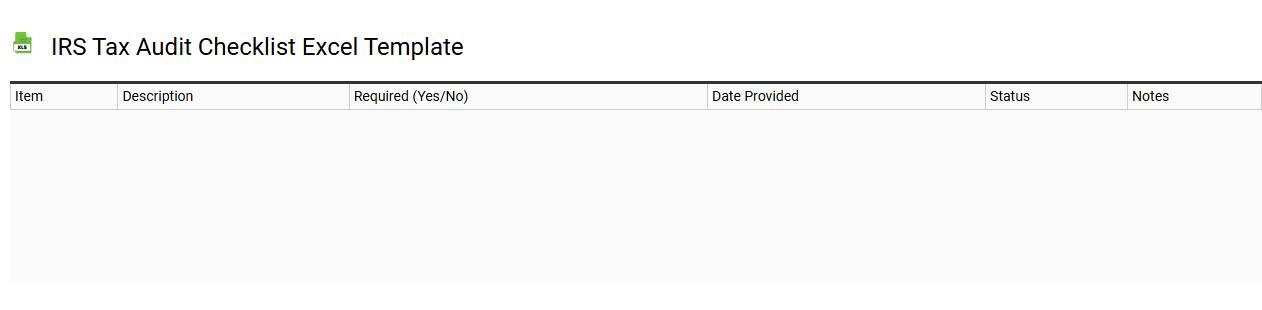

IRS tax audit checklist Excel template

💾 IRS tax audit checklist Excel template template .xls

An IRS tax audit checklist Excel template serves as a comprehensive guide for individuals and businesses preparing for an audit by the Internal Revenue Service. This template includes crucial elements such as documentation of income, expense receipts, bank statements, and previous tax returns, ensuring all relevant information is organized and readily accessible. Customizable sections allow you to add industry-specific items or particular deductions applicable to your situation, enhancing the overall preparation process. Proper use of this template can not only simplify the audit experience but also serve as a foundation for understanding advanced tax strategies and compliance improvements.

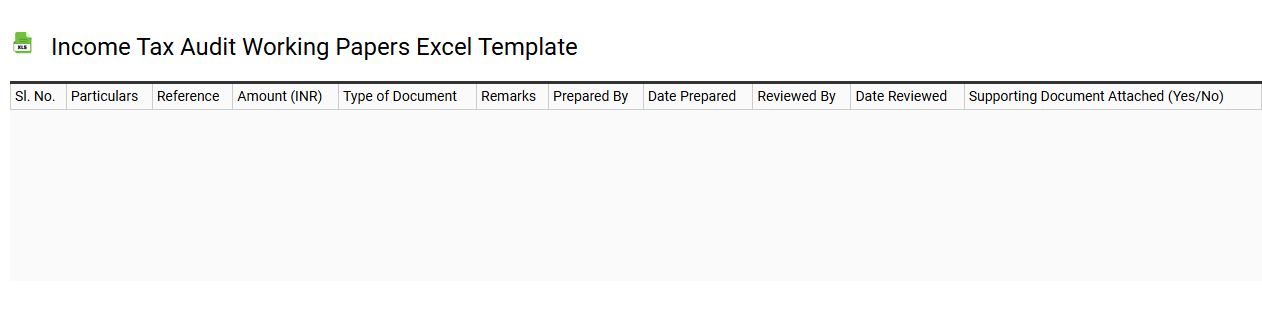

Income tax audit working papers Excel template

💾 Income tax audit working papers Excel template template .xls

An Income Tax Audit Working Papers Excel template is a structured tool designed to assist professionals in organizing and documenting essential information relevant to income tax audits. It typically includes detailed sections for income statements, expense breakdowns, deductions, and credits, fostering clarity and compliance during the audit process. The template streamlines data entry and analysis, allowing auditors to easily reference financial records and ensure accuracy in reported figures. For enhanced functionality, you may explore integration with advanced analytical tools or consider incorporating macros to automate repetitive tasks, ensuring efficiency in complex auditing scenarios.

Tax audit evidence tracker Excel template

![]()

💾 Tax audit evidence tracker Excel template template .xls

A Tax Audit Evidence Tracker Excel template is a specialized tool designed to help individuals and organizations maintain detailed records of documents and information needed during tax audits. This template typically includes fields for categorizing evidence, such as invoices, receipts, and bank statements, along with their respective dates and descriptions. Users can easily input and monitor the status of each document, ensuring that all required evidence is readily available to present to tax authorities. Such a comprehensive approach not only streamlines the audit process but also lays the groundwork for more advanced tax compliance strategies and data management practices, such as automated reporting and analytics integration.

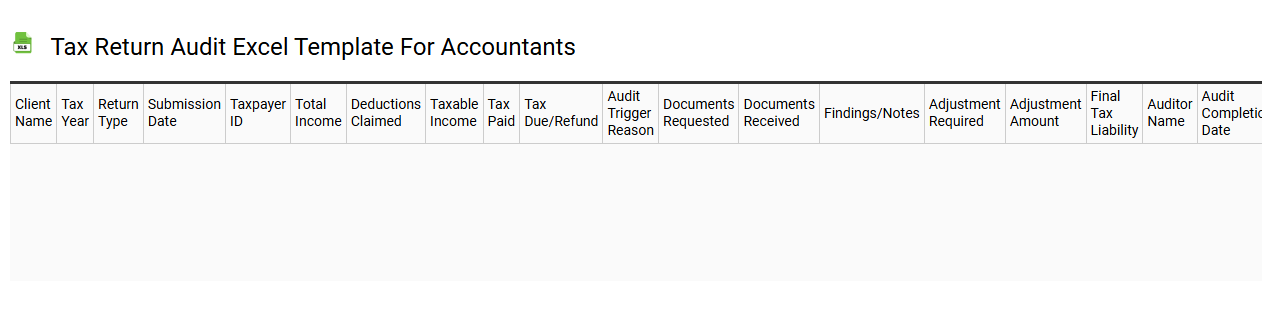

Tax return audit Excel template for accountants

💾 Tax return audit Excel template for accountants template .xls

A Tax return audit Excel template for accountants serves as a structured tool designed to streamline the auditing process of tax returns. This template typically includes various spreadsheets for tracking financial statements, identifying discrepancies, and documenting audit findings. Accountants can utilize built-in formulas to calculate tax liabilities or refunds, ensuring accuracy in financial reporting. As you explore this resource, consider its potential to enhance efficiency, risk analysis, and compliance, while also accommodating advanced features like pivot tables and data visualization for comprehensive insights.

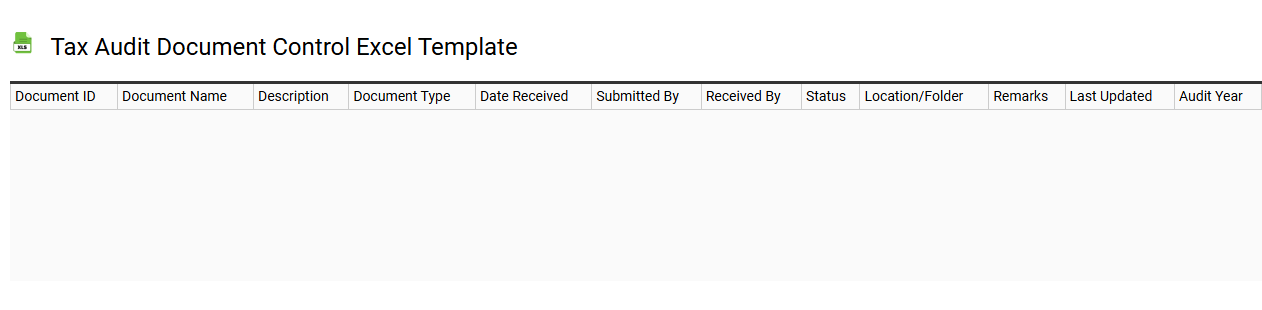

Tax audit document control Excel template

💾 Tax audit document control Excel template template .xls

A Tax Audit Document Control Excel template serves as a structured tool for organizing and managing the documentation required during a tax audit process. This template typically includes essential categories such as document type, date received, responsible party, and status, enabling efficient tracking of all necessary records. You can easily customize it to fit specific audit requirements, ensuring all documents are readily accessible for review. Utilizing this template not only streamlines your current audit process but also enhances your ability to manage complex tax compliance challenges, paving the way for advanced data analytics and automated reporting in the future.

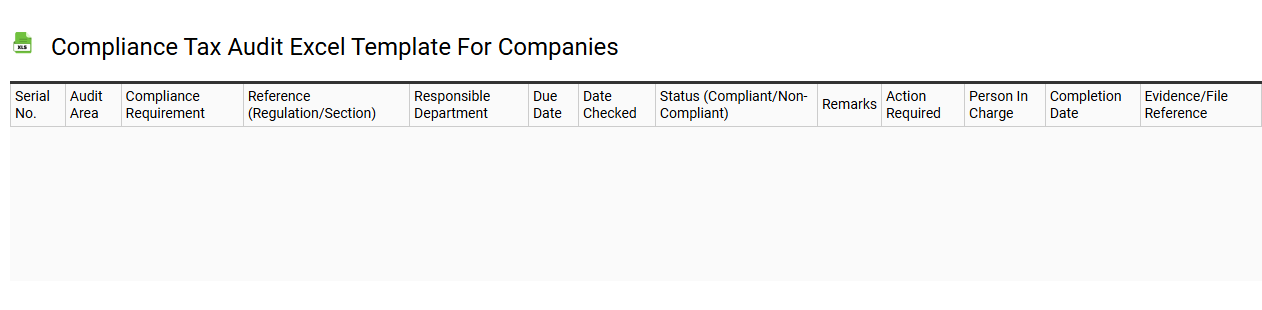

Compliance tax audit Excel template for companies

💾 Compliance tax audit Excel template for companies template .xls

A Compliance Tax Audit Excel template is a structured document designed to assist companies in organizing and analyzing tax information for auditing purposes. It typically features various sections that categorize financial data, such as income statements, expense reports, and deduction records, ensuring that all relevant tax compliance requirements are met. You can input figures into predefined fields, allowing for straightforward calculations and comparisons against regulatory standards. Leveraging this template enhances your ability to pinpoint discrepancies, thereby streamlining the audit process while preparing for more sophisticated tax planning and compliance automation tools in the future.

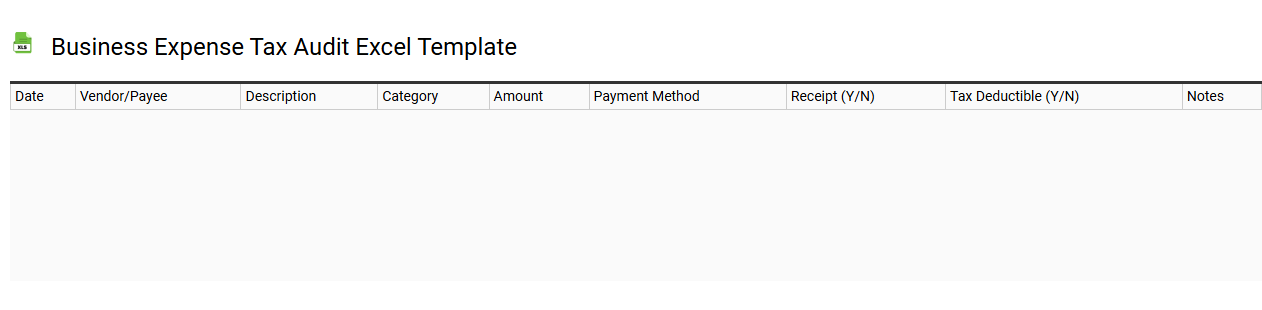

Business expense tax audit Excel template

💾 Business expense tax audit Excel template template .xls

A Business Expense Tax Audit Excel template serves as a structured tool to track and manage your business expenses, ensuring compliance during tax audits. This template typically features categories such as travel, meals, office supplies, and utilities, allowing you to input dates, descriptions, amounts, and payment methods. By maintaining accurate records within this template, you can streamline your financial reporting and facilitate easier access to necessary documentation during IRS audits. Such a tool can help you not only in basic expense tracking but also in optimizing deductions and ensuring adherence to complex tax regulations.

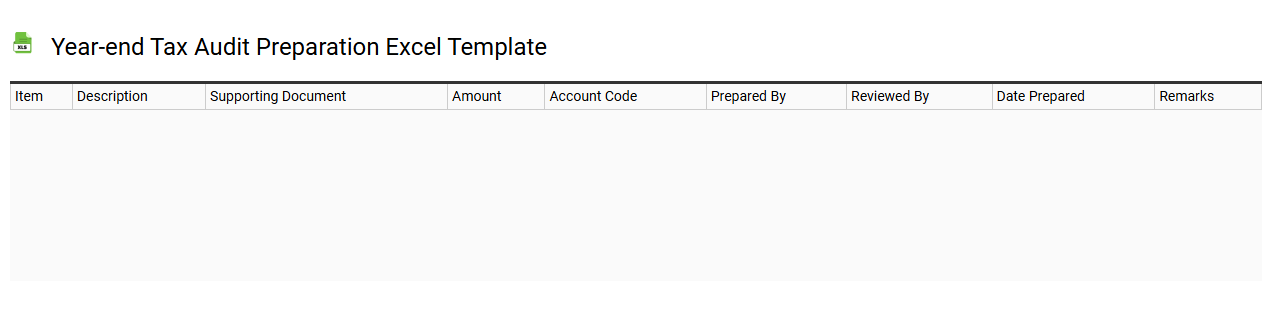

Year-end tax audit preparation Excel template

💾 Year-end tax audit preparation Excel template template .xls

A Year-end tax audit preparation Excel template is a structured spreadsheet designed to help individuals or businesses streamline the process of organizing financial data for tax audits. This template typically includes various sections for income, expenses, deductions, and supporting documentation, ensuring all relevant information is captured efficiently. Users can customize each category to match their specific financial situations, enabling easier tracking and reporting. Familiarizing yourself with this tool not only simplifies the basic audit preparation process but also opens up opportunities for deeper analysis, like forecasting tax liabilities and optimizing tax strategies.