Discover a selection of free XLS templates designed specifically for VAT invoices that simplify your financial record-keeping. Each template features clearly defined sections for company details, item descriptions, VAT calculations, and totals, ensuring compliance and ease of use. Customizable elements allow you to personalize the templates to suit your unique business requirements, helping you streamline your invoicing process efficiently.

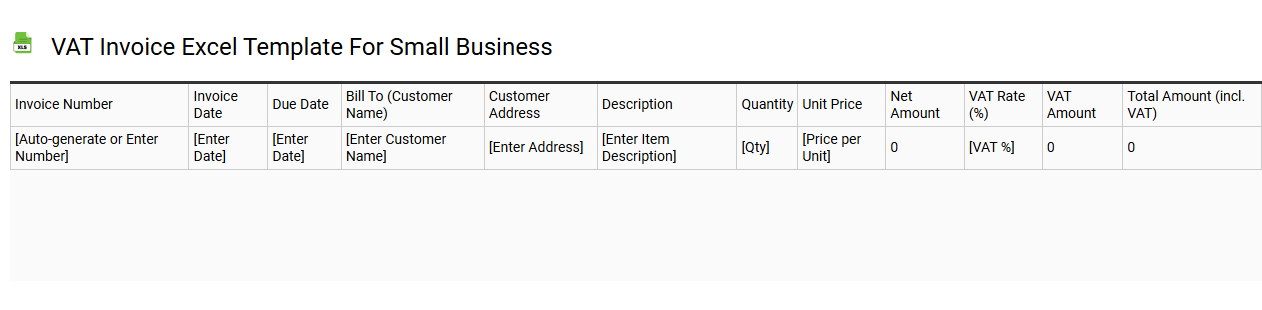

VAT invoice Excel template for small business

💾 VAT invoice Excel template for small business template .xls

A VAT invoice Excel template for small businesses is a customizable spreadsheet designed to generate invoices that include Value Added Tax details. This template typically features fields for essential elements such as your business name, address, contact information, client details, invoice number, date, item descriptions, quantities, unit prices, and the applicable VAT rates. It simplifies the invoicing process, ensuring compliance with tax regulations while allowing for easy tracking of sales and taxation amounts. You can use this basic tool for daily transactions, and further enhance your invoicing capabilities by incorporating advanced features like automated calculations, inventory management, or integration with accounting software.

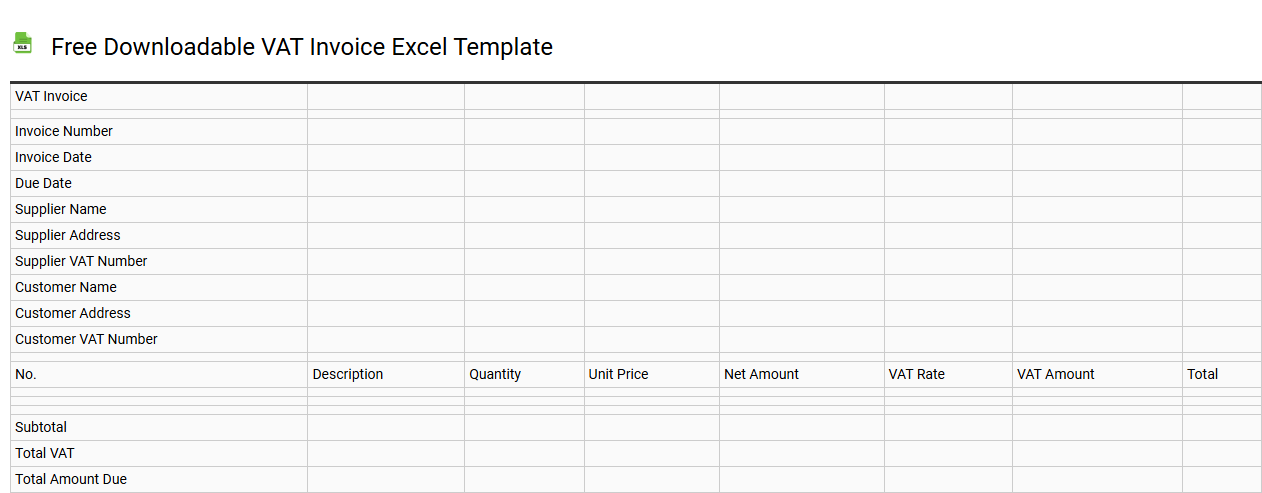

Free downloadable VAT invoice Excel template

💾 Free downloadable VAT invoice Excel template template .xls

A free downloadable VAT invoice Excel template is a pre-formatted spreadsheet that allows you to easily create invoices compliant with VAT regulations. It typically includes fields for essential information such as invoice number, date, buyer and seller details, description of goods or services, VAT rate, and total amount due. This tool helps businesses streamline their invoicing process, ensuring calculations for VAT are accurate and compliant. You can customize the template to suit your branding and operational needs, making it suitable for both basic invoicing and advanced financial tracking or reporting requirements.

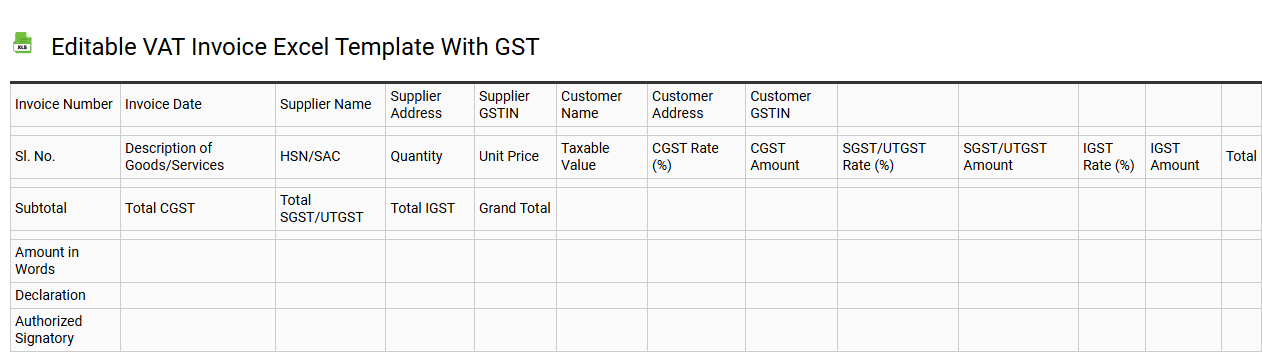

Editable VAT invoice Excel template with GST

💾 Editable VAT invoice Excel template with GST template .xls

An Editable VAT invoice Excel template with GST enables businesses to generate invoices that comply with tax regulations. This template includes fields for essential information, such as the seller's and buyer's details, invoice number, date, item descriptions, quantities, and respective rates. The built-in formulas automatically calculate GST and total amounts, simplifying financial management. You can customize this template to suit your specific business needs or expand its functionality to include advanced features like automatic tax reporting and integration with accounting software.

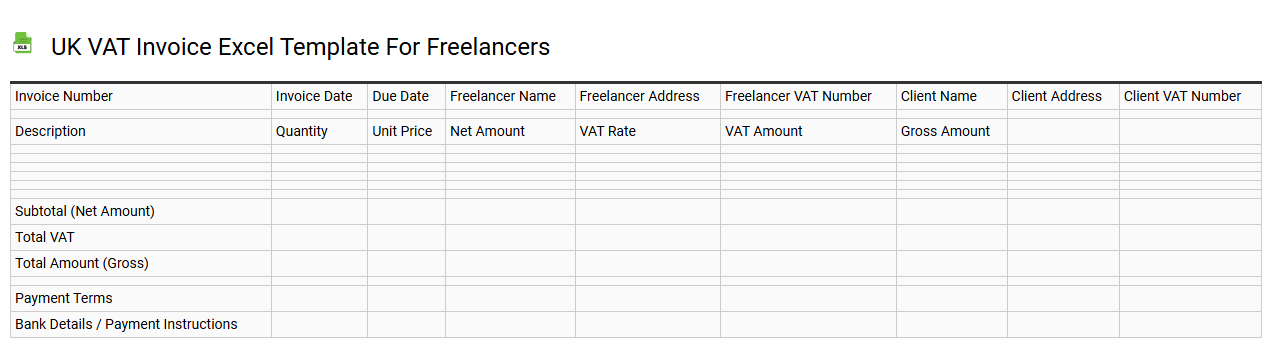

UK VAT invoice Excel template for freelancers

💾 UK VAT invoice Excel template for freelancers template .xls

A UK VAT invoice Excel template for freelancers is a pre-designed spreadsheet that simplifies the process of generating invoices compliant with UK VAT regulations. This template typically includes essential fields such as your business name, address, VAT registration number, client details, invoice number, date, description of goods or services, and applicable VAT rates. You can easily input your services or products along with their costs, allowing for automatic calculations of totals and VAT amounts. Such a template enables streamlined invoicing and helpful record-keeping, serving not only basic invoicing needs but also potential advanced features like integration with accounting software or automated tax calculations.

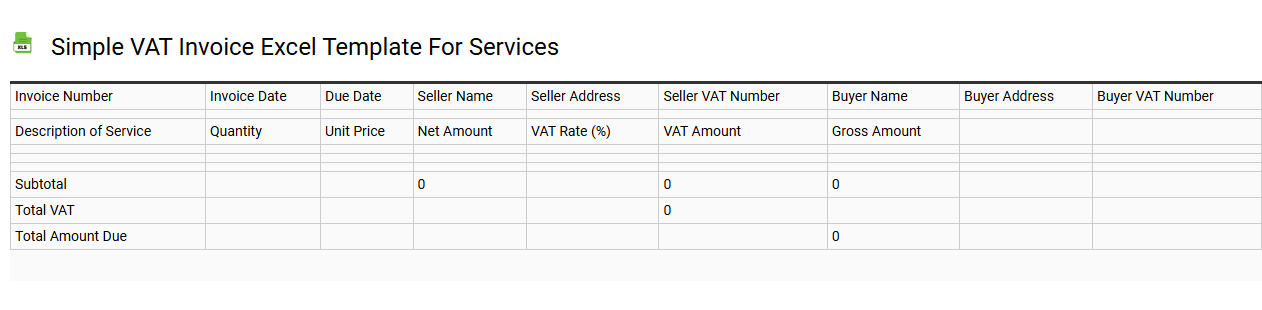

Simple VAT invoice Excel template for services

💾 Simple VAT invoice Excel template for services template .xls

A Simple VAT invoice Excel template for services efficiently streamlines your billing process. This customizable spreadsheet includes essential fields such as invoice number, date, client details, description of services rendered, VAT rates, and total amount due. By using this template, you can easily calculate taxes and maintain accurate records for compliance with tax regulations. Beyond basic invoicing, this template can be expanded to accommodate advanced invoicing needs like multi-currency support or integrating payment tracking features.

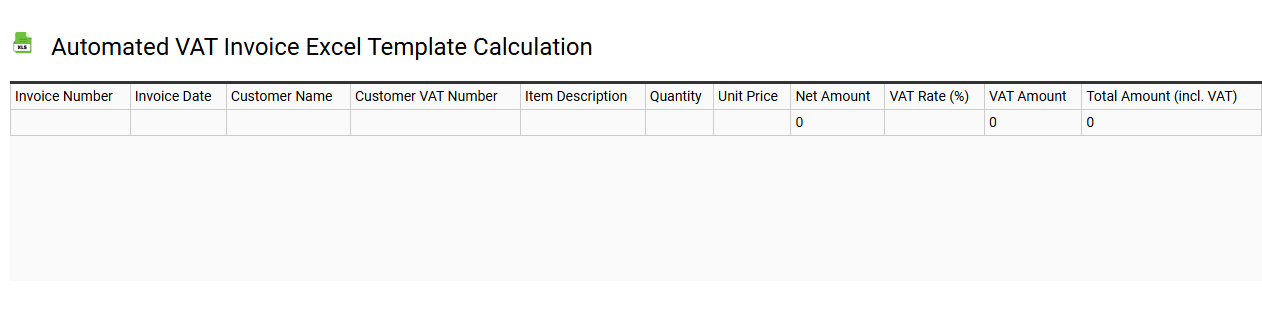

Automated VAT invoice Excel template calculation

💾 Automated VAT invoice Excel template calculation template .xls

An Automated VAT invoice Excel template streamlines the process of calculating Value Added Tax on sales by integrating input fields for product details, prices, and VAT percentage. This template automatically computes the VAT amount and total invoice value, ensuring accuracy and saving you time. User-friendly features may include dropdown lists for item categories and pre-set VAT rates, enhancing ease of use. For more advanced needs, the template can be customized to incorporate multi-tier VAT calculations and integration with accounting software, providing essential insights for your financial management.

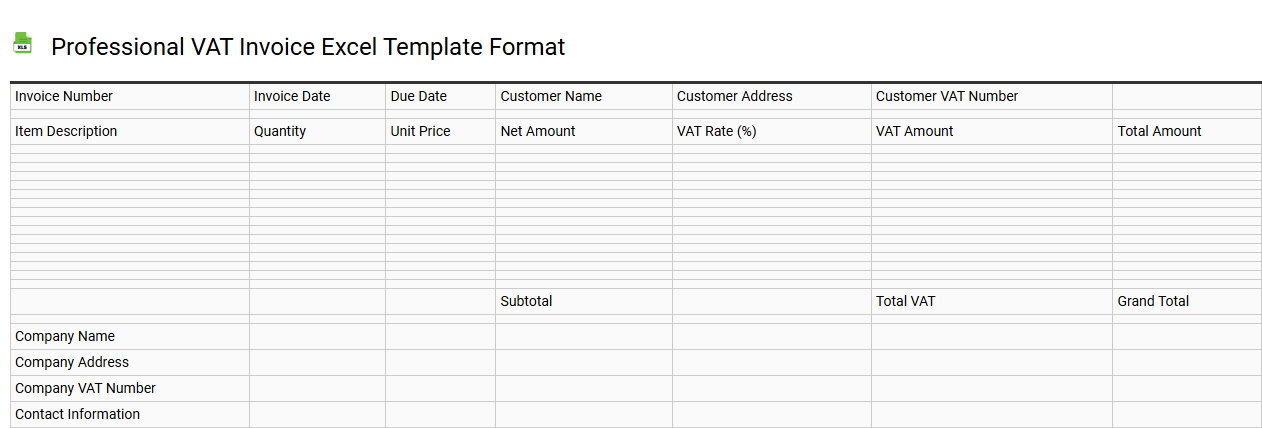

Professional VAT invoice Excel template format

💾 Professional VAT invoice Excel template format template .xls

A Professional VAT invoice Excel template typically includes several key components to ensure compliance with VAT regulations and to facilitate clear communication with clients. At the top, your business name, logo, and contact information provide a professional touch. The invoice details section includes fields for the invoice number, date of issuance, and due date, all essential for tracking payments. Line items for products or services rendered are accompanied by descriptions, quantity, unit price, and VAT rates, allowing for straightforward calculation of totals. This structured format can easily be adapted to cater to more advanced needs such as automated tax calculations or integration with accounting software.

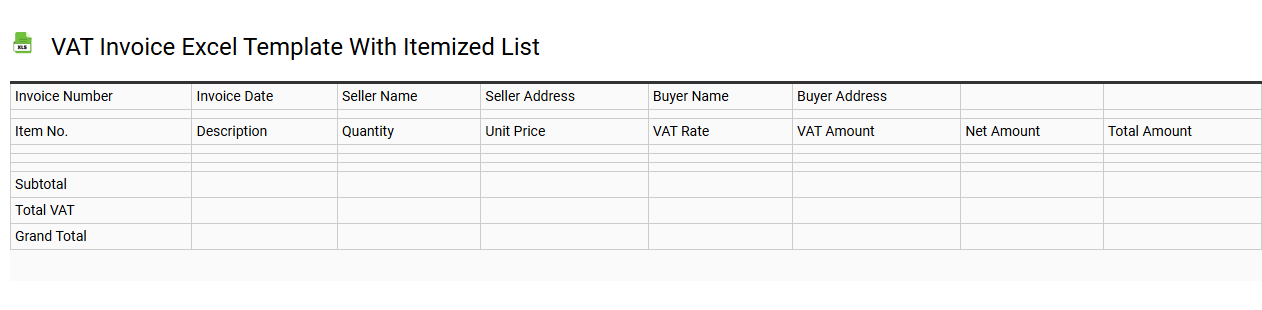

VAT invoice Excel template with itemized list

💾 VAT invoice Excel template with itemized list template .xls

A VAT invoice Excel template is a pre-designed spreadsheet that helps businesses generate invoices compliant with Value Added Tax regulations. This template typically includes fields for essential details such as the seller's and buyer's information, invoice number, date, and the total amount. An itemized list is crucial, detailing each product or service provided, including descriptions, quantities, unit prices, and the corresponding VAT rates applied. This organized format not only aids in record-keeping but also simplifies tax reporting and compliance, ensuring precise calculations for VAT and further advanced financial analyses like cash flow forecasting and tax optimization strategies.

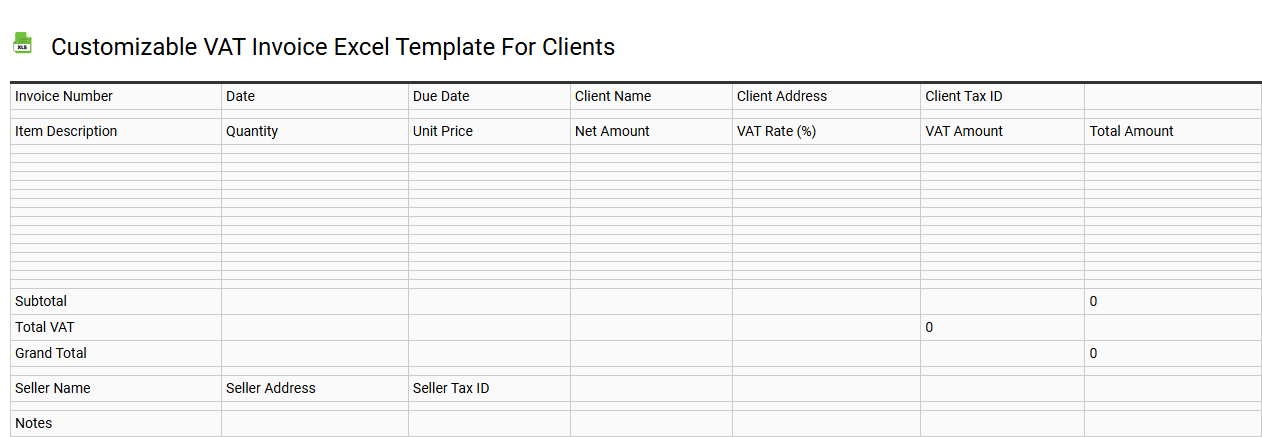

Customizable VAT invoice Excel template for clients

💾 Customizable VAT invoice Excel template for clients template .xls

A customizable VAT invoice Excel template allows you to create tailored invoices that comply with VAT regulations. This spreadsheet is designed to include essential elements like your business name, address, VAT number, client details, invoice date, and line items with their corresponding prices and tax calculations. The template's flexibility enables you to modify fields and design, ensuring it aligns with your branding and meets specific client requirements. Utilizing such a template not only simplifies the invoicing process but also accommodates potential needs for advanced features like automated tax calculations, multi-currency support, or integration with accounting software.

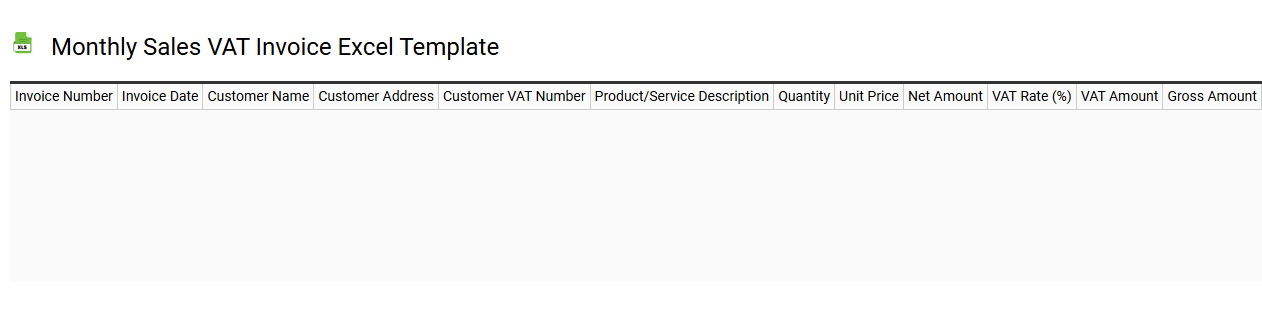

Monthly sales VAT invoice Excel template

💾 Monthly sales VAT invoice Excel template template .xls

A Monthly Sales VAT Invoice Excel template is a structured spreadsheet designed to facilitate the creation and management of value-added tax (VAT) invoices for sales transactions. This template includes essential fields such as invoice number, date, customer details, item descriptions, quantities, unit prices, and applicable VAT rates, ensuring compliance with tax regulations. You can easily customize the template to suit your business needs by adding branding elements such as your logo and colors. Basic usage involves entering sales data, generating invoices for customers, and tracking monthly sales, while more advanced functionalities can include automated calculations, integration with accounting software, and detailed reporting for improved financial analysis.