Explore a diverse range of free Excel templates designed specifically for mortgage calculation. These templates enable you to input loan amount, interest rate, and loan term, automatically generating monthly payment estimates and total interest paid over the loan's lifetime. Tailor these tools to your needs for budgeting or comparing different mortgage options, making it easier to plan your financial future.

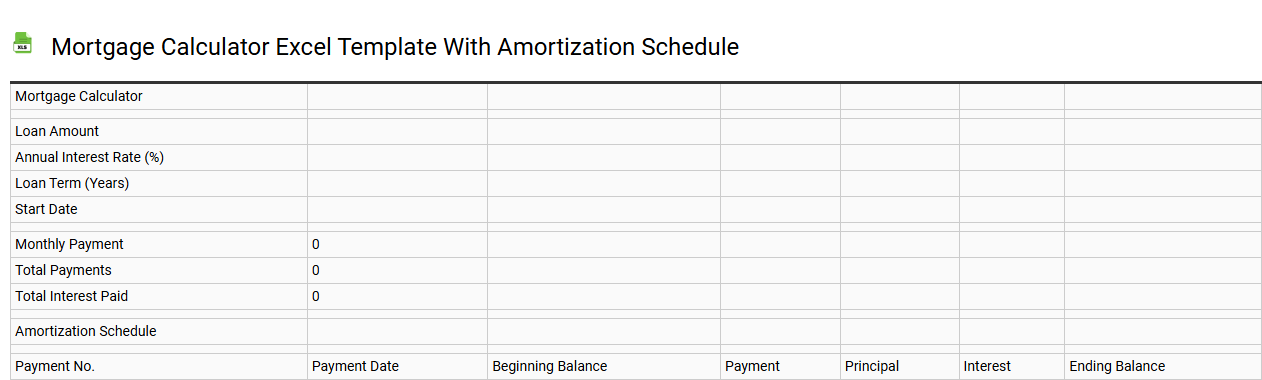

Mortgage calculator Excel template with amortization schedule

💾 Mortgage calculator Excel template with amortization schedule template .xls

A Mortgage calculator Excel template provides a user-friendly tool for managing and visualizing mortgage payments. It typically includes an amortization schedule that breaks down each payment into principal and interest components, showing how your balance decreases over time. The template allows you to input key variables such as loan amount, interest rate, and loan term, resulting in instant calculations of monthly payments and total interest paid. This basic tool can be further enhanced with advanced features like extra payment options, graphical payment trends, and scenario analysis for varying interest rates or loan types.

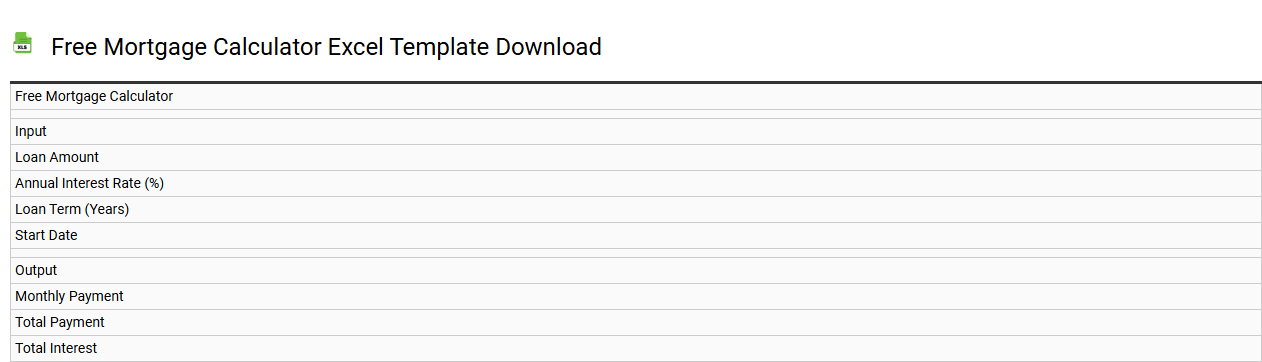

Free mortgage calculator Excel template download

💾 Free mortgage calculator Excel template download template .xls

A Free mortgage calculator Excel template is a customizable spreadsheet tool that helps you estimate mortgage payments based on loan amount, interest rate, and term length. This template typically includes features that allow you to input various parameters, such as down payment, property taxes, and insurance, giving you a comprehensive view of monthly costs. As you adjust these metrics, the calculator can dynamically update the principal and interest breakdown, as well as total payment amounts over the loan's lifespan. You can save your calculations for future reference or modify them as your financial situation evolves, ensuring that you stay informed about potential costs and advanced terms like amortization, escrow, and refinancing options.

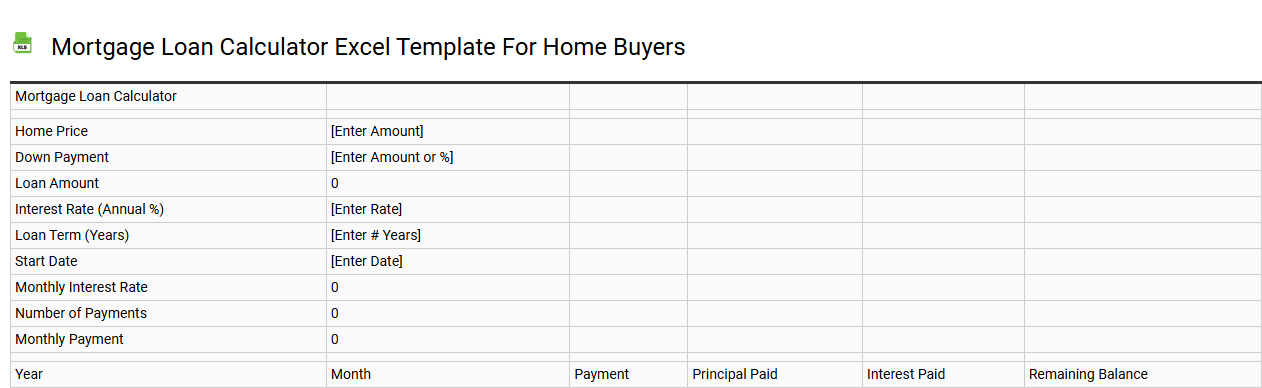

Mortgage loan calculator Excel template for home buyers

💾 Mortgage loan calculator Excel template for home buyers template .xls

A mortgage loan calculator Excel template simplifies the process of calculating monthly mortgage payments, interest, and total loan costs for home buyers. It allows you to input key variables such as loan amount, interest rate, and loan term, providing instant results based on your specifications. The template can also include additional features like amortization schedules and payment breakdowns to help you visualize long-term payments over the life of the loan. Understanding these calculations can help you make informed decisions about your home purchase and evaluate potential refinancing options or prepayment strategies in the future.

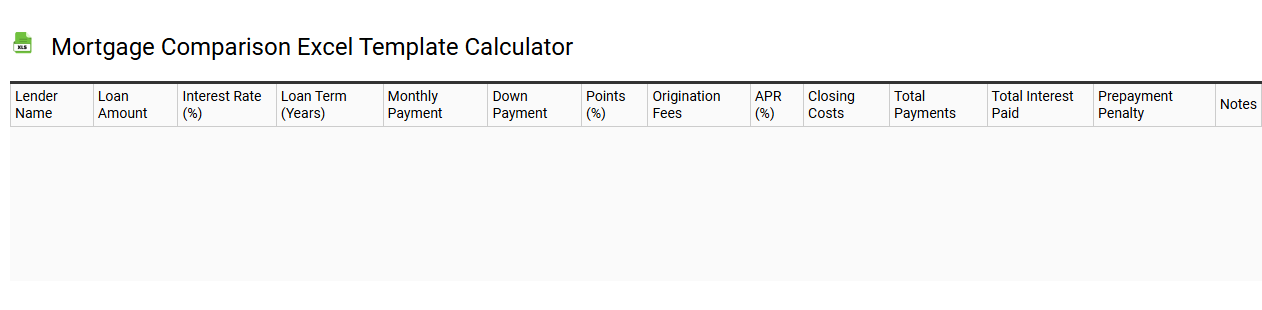

Mortgage comparison Excel template calculator

💾 Mortgage comparison Excel template calculator template .xls

A Mortgage comparison Excel template calculator simplifies the process of evaluating different mortgage offers by allowing you to input key variables such as loan amounts, interest rates, and loan terms. You can easily compare monthly payments, total costs over the loan's lifetime, and potential savings from different lenders or mortgage products. The template often includes built-in formulas to automatically calculate amortization schedules, helping you visualize how interest and principal payments evolve over time. This tool not only aids in choosing the best mortgage option but also serves as a foundation for potential needs like refinancing strategies or investment property analysis.

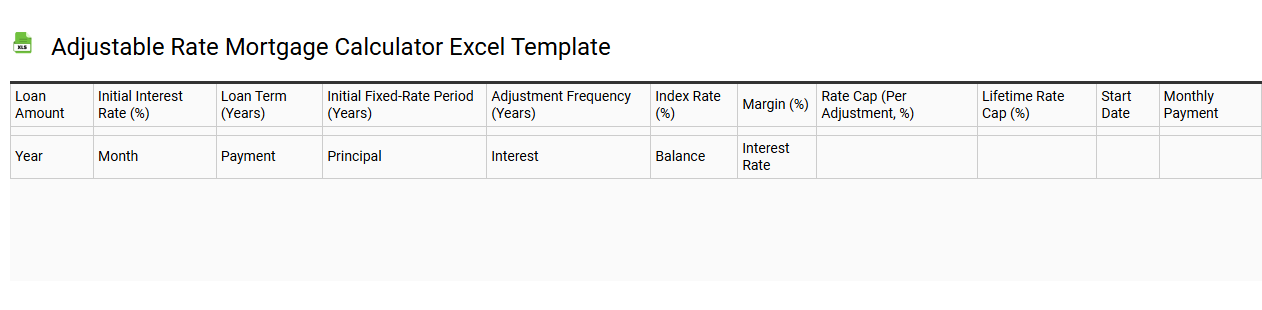

Adjustable rate mortgage calculator Excel template

💾 Adjustable rate mortgage calculator Excel template template .xls

An Adjustable Rate Mortgage (ARM) calculator Excel template is a customized spreadsheet designed to help users estimate monthly mortgage payments for loans with fluctuating interest rates. This tool allows you to input essential details such as the loan amount, initial interest rate, adjustment frequency, and loan term. You can visualize how monthly payments may change over time based on interest rate adjustments, which can aid in assessing your financial situation. It serves as a starting point for basic mortgage calculations while offering potential for advanced financial analysis, including amortization schedules and interest rate scenario modeling.

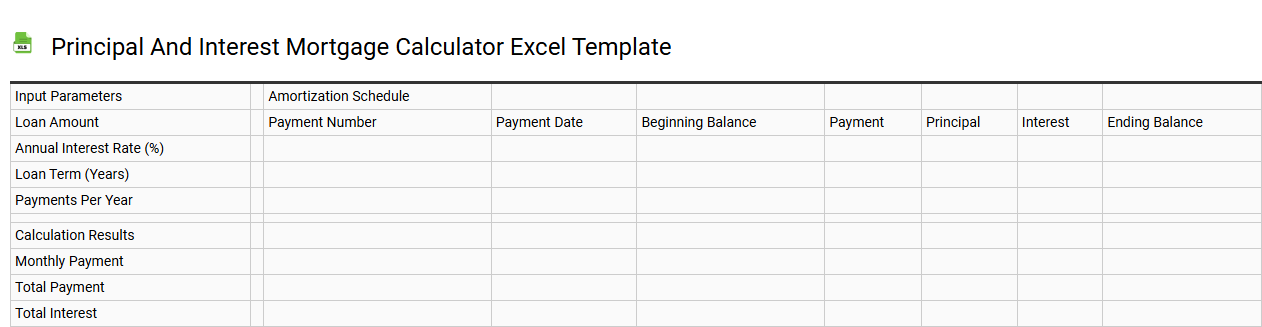

Principal and interest mortgage calculator Excel template

💾 Principal and interest mortgage calculator Excel template template .xls

A Principal and Interest Mortgage Calculator Excel template is a powerful tool for anyone considering taking out a mortgage or refinancing an existing loan. This template allows you to input essential variables such as loan amount, interest rate, and loan term in years. Once these parameters are entered, the calculator automatically computes your monthly payment breakdown, showing how much goes toward principal and how much to interest over the life of the loan. You can further customize this template to accommodate additional scenarios, such as varying interest rates or extra payments, allowing you to explore advanced financial strategies for mortgage management.

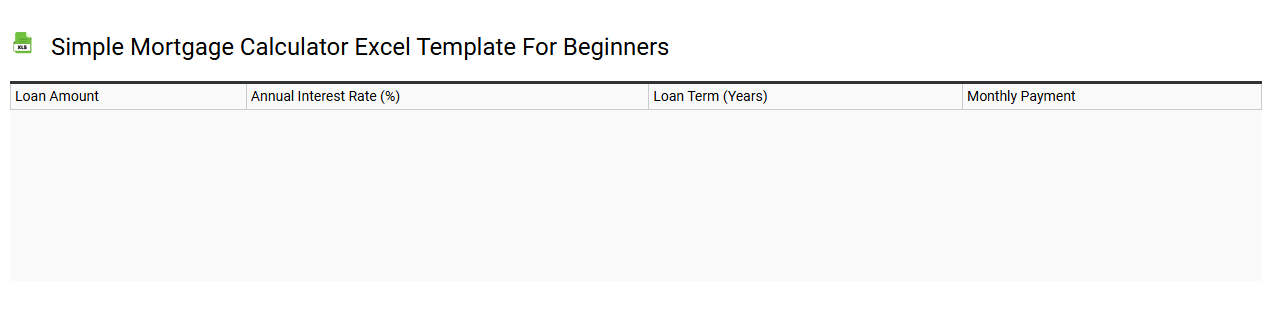

Simple mortgage calculator Excel template for beginners

💾 Simple mortgage calculator Excel template for beginners template .xls

A Simple Mortgage Calculator Excel template allows you to estimate your monthly mortgage payments based on the loan amount, interest rate, and loan term. You input figures into designated cells, and the template automatically calculates your monthly payment, total interest paid, and total payment over the life of the loan. User-friendly features enable quick alterations to factors like interest rates or loan duration, providing an immediate understanding of how these changes impact your payments. You can further explore functionalities such as amortization schedules, tax implications, or even extra payment strategies for a comprehensive financial plan.

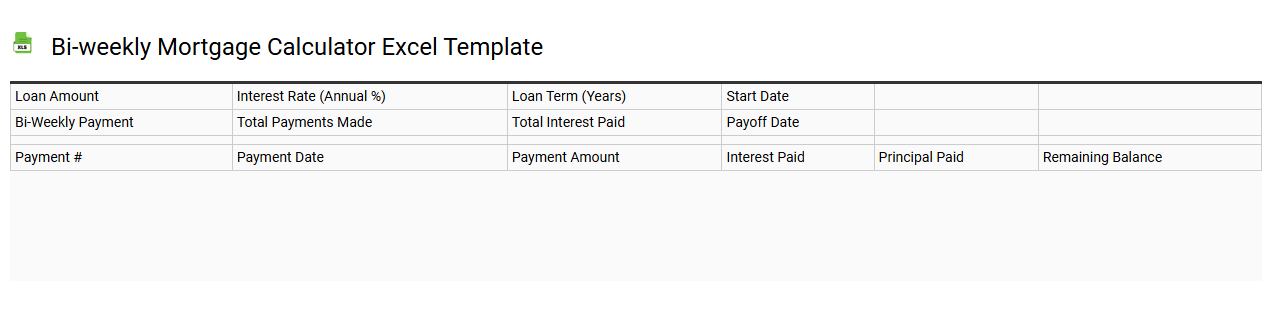

Bi-weekly mortgage calculator Excel template

💾 Bi-weekly mortgage calculator Excel template template .xls

A bi-weekly mortgage calculator Excel template is a customizable spreadsheet designed to help homeowners determine their mortgage payments and savings when opting for bi-weekly payments instead of monthly ones. It calculates the impact of making payments every two weeks, allowing users to visualize principal reduction and interest savings over the loan's lifetime. The template typically includes fields for inputting loan amount, interest rate, term length, and payment frequency, ensuring accurate calculations. This tool serves basic budgeting needs while offering potential for advanced analysis, such as amortization schedules and early payoff strategies.