Explore an array of free XLS templates specifically designed for construction payroll management. These templates streamline the calculation of employee wages, overtime, and deductions, ensuring accurate payroll processing. Each template is customizable, allowing you to easily input your project's details, such as worker classifications and hours worked, to maintain organized and compliant payroll records.

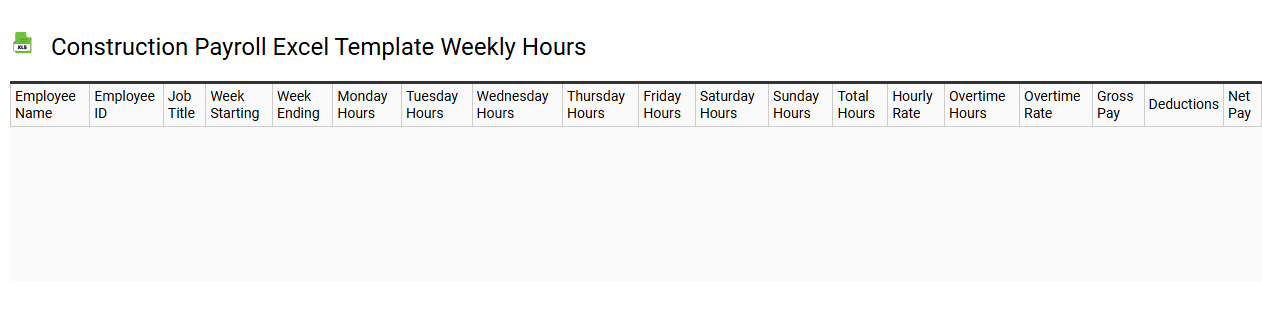

Construction payroll Excel template weekly hours

💾 Construction payroll Excel template weekly hours template .xls

A Construction payroll Excel template for weekly hours simplifies the process of tracking employee work time in construction projects. It typically includes sections for entering employee names, hours worked, overtime calculations, and total pay. Features like built-in formulas streamline calculations, reducing errors and saving time. Your construction team can use this template for basic payroll management or expand it to handle more complex tasks like taxes, benefits, and project-specific costs.

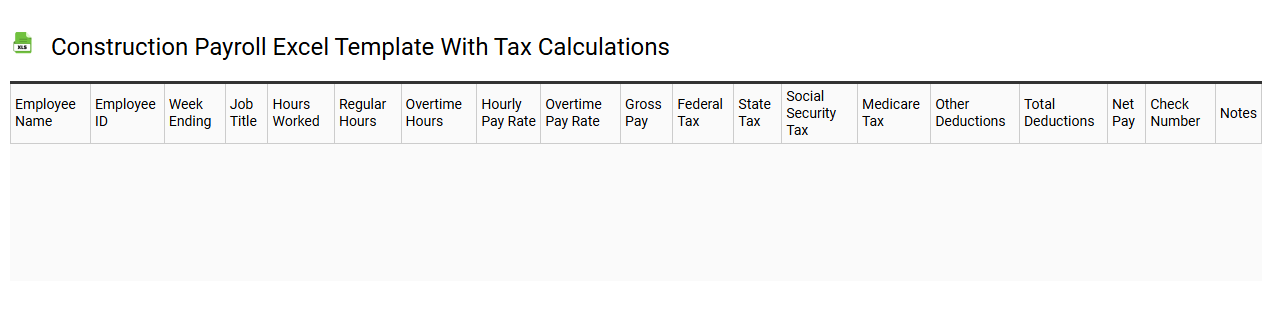

Construction payroll Excel template with tax calculations

💾 Construction payroll Excel template with tax calculations template .xls

A Construction payroll Excel template is a specialized tool designed to streamline the payroll process for construction companies. It typically includes fields for employee information, hours worked, wage rates, and various tax calculations such as federal and state withholdings, Social Security, and Medicare contributions. This user-friendly interface allows you to easily input and manage payroll data, ensuring accuracy and compliance with labor laws. Beyond basic functionalities, you may explore advanced capabilities like automated reporting, integration with accounting software, or customizable tax modules to enhance payroll efficiency.

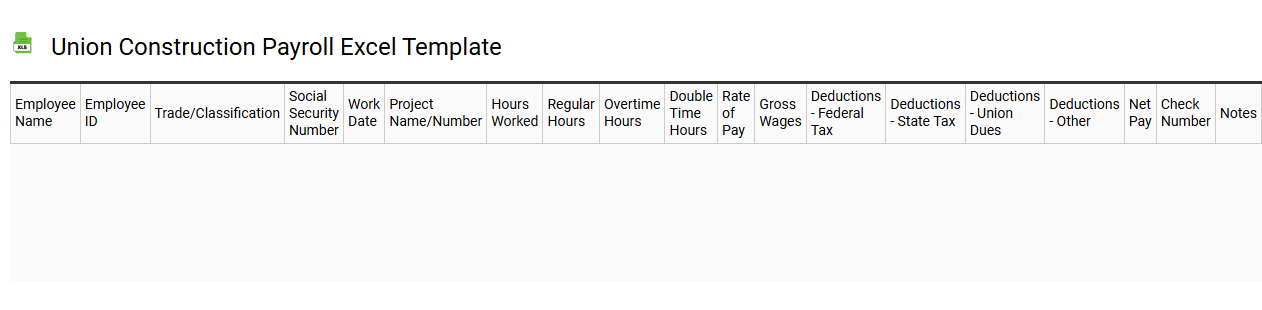

Union construction payroll Excel template

💾 Union construction payroll Excel template template .xls

A Union construction payroll Excel template is a specialized tool designed to streamline the management of payroll for construction workers who are union members. It typically includes pre-defined fields such as employee names, hours worked, pay rates, and deductions specific to union agreements. This template enables accurate tracking of wages while ensuring compliance with various labor regulations. Your payroll process can evolve with this template, accommodating advanced features like automated calculations, reporting capabilities, and integration with financial software for comprehensive payroll management.

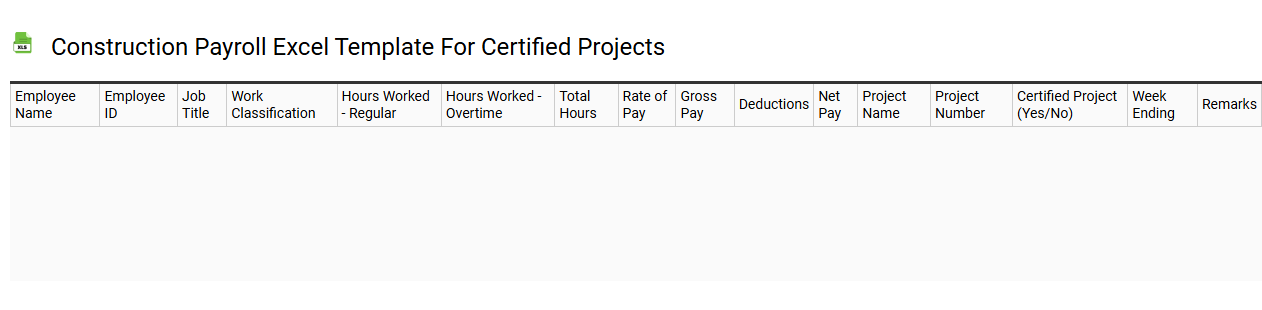

Construction payroll Excel template for certified projects

💾 Construction payroll Excel template for certified projects template .xls

A Construction payroll Excel template for certified projects is a specialized spreadsheet designed to manage and track labor costs for construction work that requires compliance with certain regulations, such as prevailing wage laws. This template typically includes essential fields such as employee names, job classifications, hours worked, pay rates, and necessary deductions. It may also incorporate features to calculate total payroll automatically, ensuring accuracy in wage distribution and adherence to legal requirements. Utilizing this template can streamline payroll processes for your projects while allowing for advanced functions like budget forecasting and labor cost analysis.

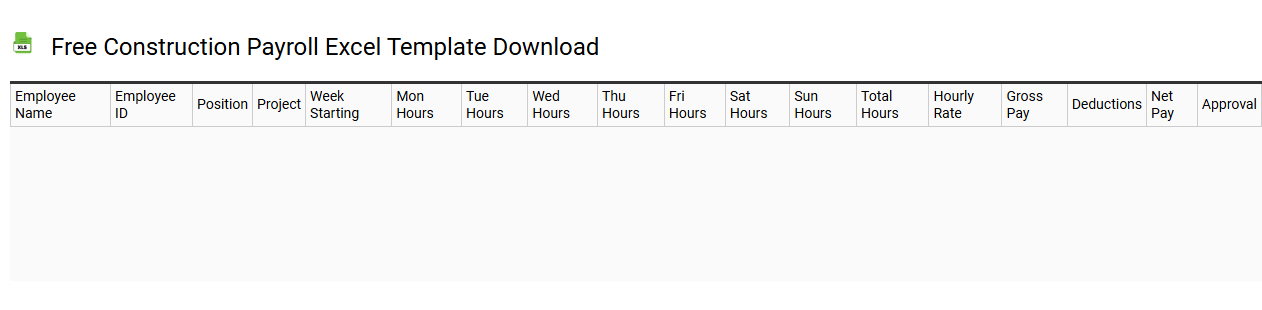

Free construction payroll Excel template download

💾 Free construction payroll Excel template download template .xls

A Free construction payroll Excel template allows contractors and construction companies to efficiently manage employee payroll within the construction industry. This template typically includes essential fields such as employee names, hours worked, pay rates, and deductions, streamlining the payroll process. You can customize it to fit your specific project needs, including different pay structures for varying job roles. For more advanced usage, consider integrating it with project management software or automating calculations through Excel functions like VLOOKUP or pivot tables.

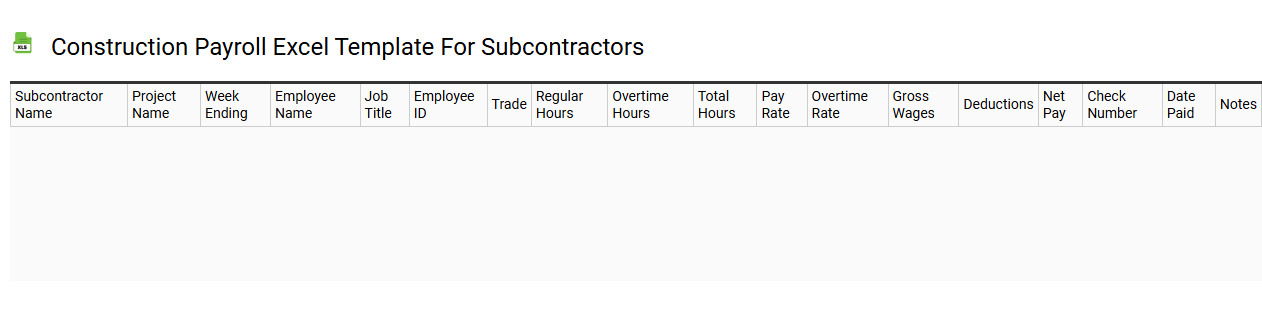

Construction payroll Excel template for subcontractors

💾 Construction payroll Excel template for subcontractors template .xls

A Construction payroll Excel template for subcontractors is a pre-designed spreadsheet that streamlines the payroll process for subcontracted workers in the construction industry. It typically includes essential fields such as employee names, hours worked, rates of pay, and calculations for overtime and deductions. This template helps ensure accuracy in payroll calculations, allowing subcontractors to manage their expenses efficiently. You can easily modify this template for your specific project needs, laying the groundwork for more complex financial tracking and reporting systems, such as Construction Management Software or ERP solutions.

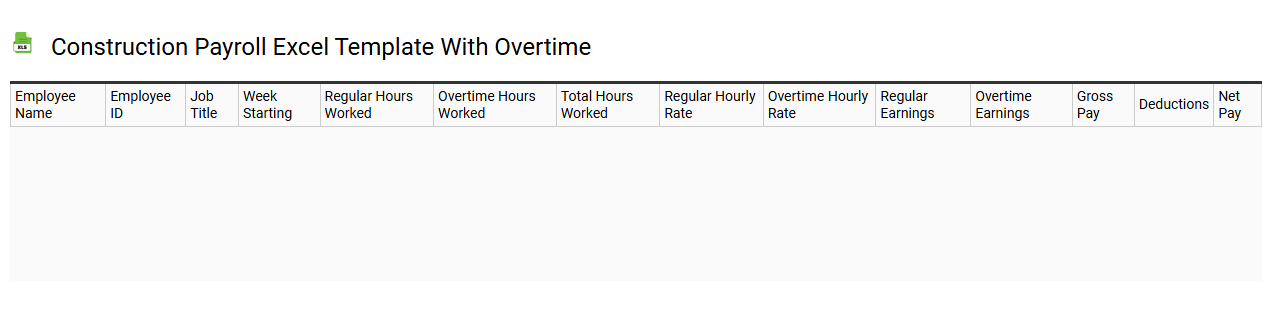

Construction payroll Excel template with overtime

💾 Construction payroll Excel template with overtime template .xls

A construction payroll Excel template with overtime is a tool designed to simplify the management of employee wages within the construction industry. This template typically includes fields for recording employee names, hours worked, regular pay rates, overtime hours, and overtime pay rates, allowing for an accurate calculation of total earnings. User-friendly features such as formulas for automatic calculations ensure efficiency and reduce the risk of errors. You can adapt this template to incorporate additional aspects like bonuses, deductions, or taxes, catering to complex payroll scenarios as your needs evolve.

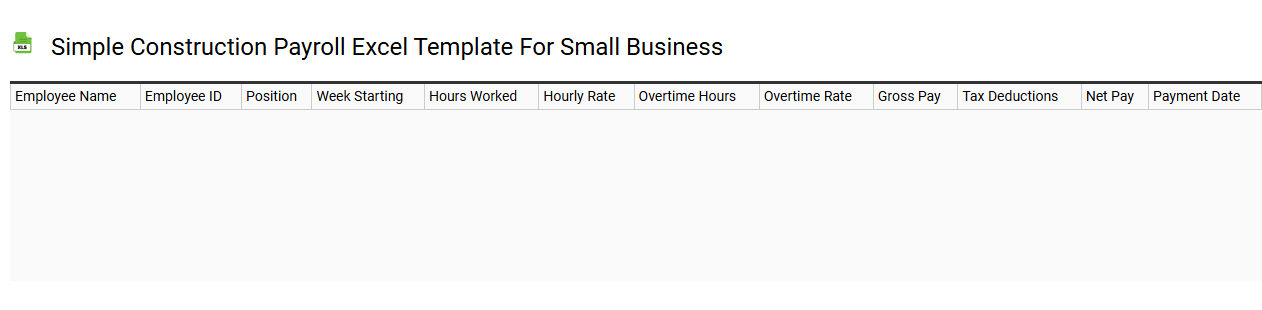

Simple construction payroll Excel template for small business

💾 Simple construction payroll Excel template for small business template .xls

A Simple Construction Payroll Excel template serves as a practical tool for small businesses engaged in construction projects. This template typically includes columns for employee names, hours worked, hourly rates, and deductions, enabling straightforward calculations for total wages. You can easily customize it to fit the specific needs of your workforce, including overtime calculations and benefits management. While it handles basic payroll tasks effectively, you may also explore advanced features like automated tax calculations and integration with accounting software for enhanced functionality.

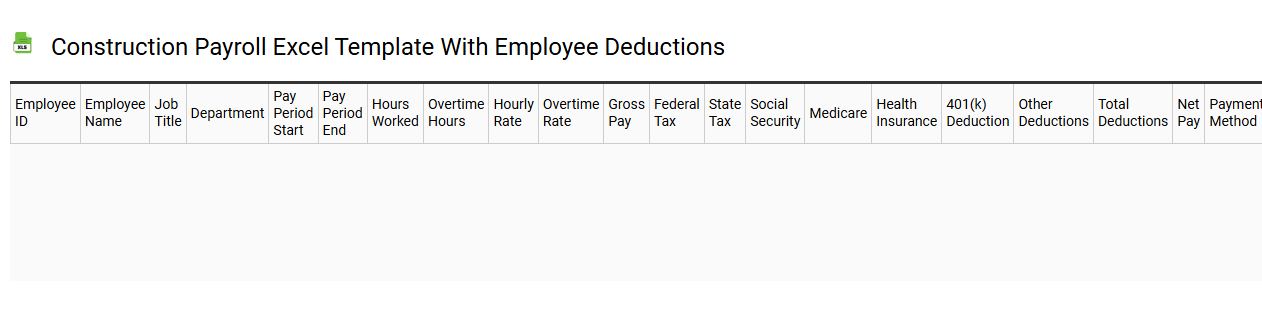

Construction payroll Excel template with employee deductions

💾 Construction payroll Excel template with employee deductions template .xls

A Construction payroll Excel template with employee deductions serves as a streamlined tool for managing payroll in the construction industry. This template typically includes essential fields such as employee names, hours worked, pay rates, and various deductions like taxes, insurance, and retirement contributions. It allows construction managers to efficiently calculate net pay while ensuring compliance with labor regulations. By utilizing this template, you can simplify payroll processes, but it may also adapt to complex financial requirements, including prevailing wage calculations and union dues management.

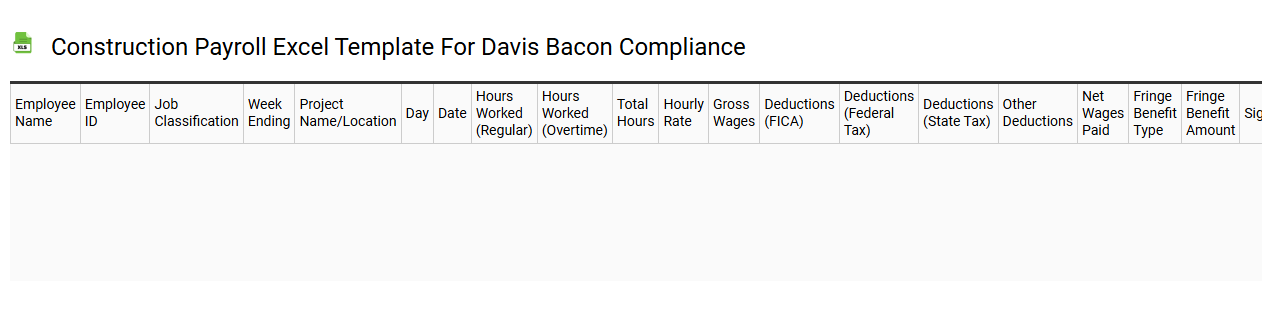

Construction payroll Excel template for Davis Bacon compliance

💾 Construction payroll Excel template for Davis Bacon compliance template .xls

A Construction payroll Excel template for Davis Bacon compliance is specifically designed to help contractors and subcontractors adhere to federal wage laws on public works projects. This template typically includes features for entering employee hours, job classifications, and corresponding prevailing wage rates as required by the Davis Bacon Act. It streamlines the process of calculating gross pay, deductions, and net pay, ensuring that all reported wages meet legal standards. Utilizing this template not only aids in compliance with basic reporting requirements but also prepares you for more advanced audits, calculations involving fringe benefits, and maintaining comprehensive records for federal or state agency review.