Explore a variety of free payroll tax Excel templates designed for efficient calculations and accurate record-keeping. Each template simplifies the process of tracking employee wages, taxes withheld, and other deductions, ensuring compliance with local tax regulations. With user-friendly layouts and pre-formatted fields, you can easily input employee data, customize tax rates, and generate reports to streamline your payroll management.

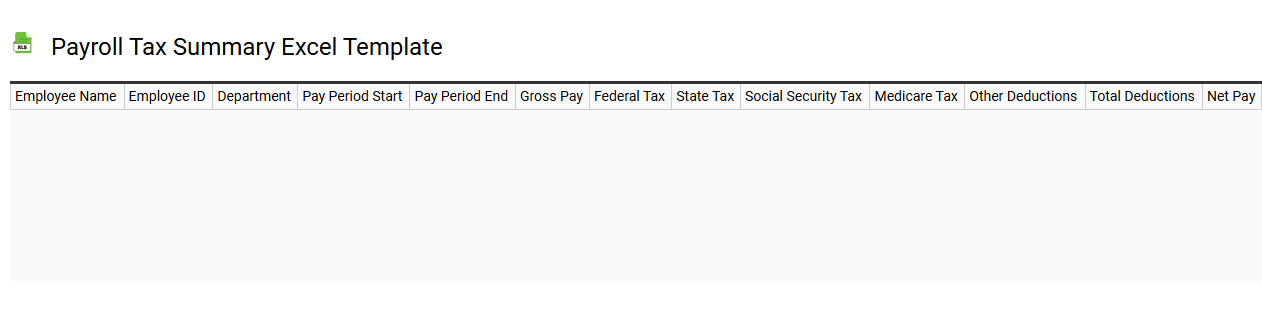

Payroll tax summary Excel template

💾 Payroll tax summary Excel template template .xls

A Payroll Tax Summary Excel template is a pre-formatted spreadsheet designed to help businesses track and summarize payroll taxes for employees. This template typically includes fields for employee information, wages, tax withholdings, and employer contributions, allowing for a comprehensive overview of payroll liabilities. You can easily input data for different pay periods, ensuring accuracy in reporting and compliance with tax regulations. Utilizing this template can not only simplify basic calculations but also serve as a foundation for advanced analyses, such as payroll tax forecasting and employee compensation modeling.

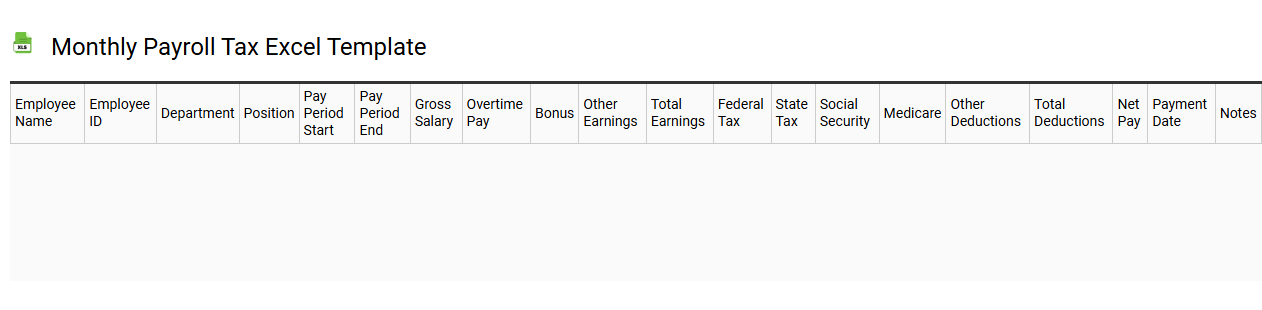

Monthly payroll tax Excel template

💾 Monthly payroll tax Excel template template .xls

A monthly payroll tax Excel template offers a structured format for businesses to calculate and organize their payroll tax obligations efficiently. This template typically includes fields for employee information, gross pay, deductions, and total taxes owed, making it easier for you to manage payroll data effectively. Users can customize the template to suit specific tax regulations and employer needs, incorporating various payroll codes and tax rates. Basic usage of this template can streamline monthly calculations, while further potential needs may involve integrating more advanced features like automated updates of tax rates and compliance tracking functionalities.

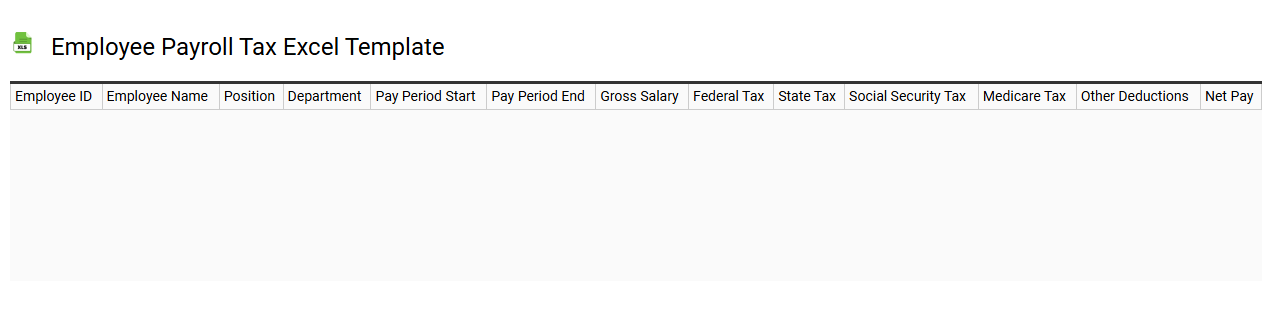

Employee payroll tax Excel template

💾 Employee payroll tax Excel template template .xls

An Employee Payroll Tax Excel template is a pre-designed spreadsheet that simplifies the management of payroll-related taxes for businesses. This template includes essential fields such as employee details, hours worked, tax deductions, and net pay calculations. Customizable formulas ensure accurate calculations of federal, state, and local taxes, making it easier for you to meet tax obligations. By utilizing this template, your payroll process can become streamlined, enabling you to easily adapt it for more advanced functionalities like payroll forecasting or integration with accounting software.

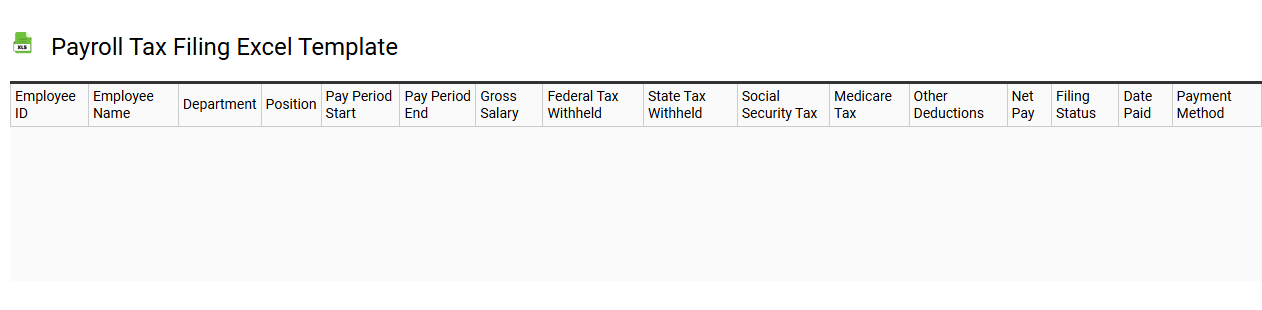

Payroll tax filing Excel template

💾 Payroll tax filing Excel template template .xls

A payroll tax filing Excel template serves as a structured spreadsheet tool designed to streamline the recording and reporting of employee wages, tax deductions, and contributions to social security and Medicare. This template typically includes organized sections for inputting employee names, social security numbers, gross pay, withheld taxes, and other relevant payroll information. Utilizing this Excel template can enhance accuracy in calculations, making it easier for you to comply with tax regulations and submissions. For more complex needs, consider exploring automated payroll solutions or advanced accounting software to manage multifaceted tax scenarios.

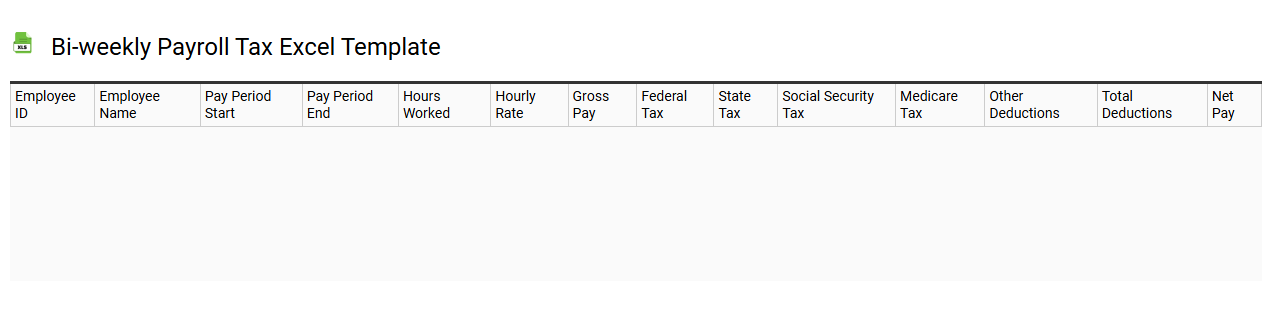

Bi-weekly payroll tax Excel template

💾 Bi-weekly payroll tax Excel template template .xls

A bi-weekly payroll tax Excel template serves as an essential tool for businesses to efficiently manage employee payroll and tax calculations every two weeks. This template typically includes fields for employee names, hours worked, gross pay, tax deductions, and net pay, simplifying the payroll process. You can easily customize the template to reflect your specific tax rates, benefits, and deductions relevant to your state or region. Utilizing such a template not only streamlines payroll processing but also aids in accurate record-keeping, accommodating both basic payroll needs and more advanced functionalities like automated tax calculations and variance reporting.

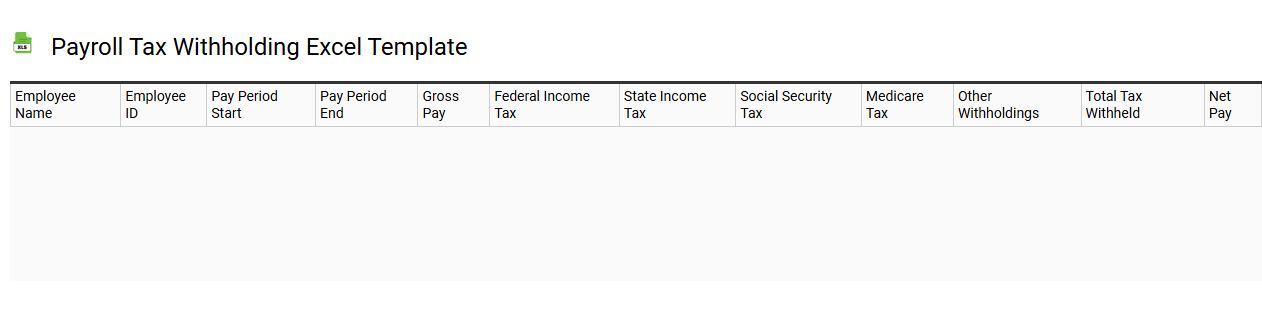

Payroll tax withholding Excel template

💾 Payroll tax withholding Excel template template .xls

A Payroll tax withholding Excel template is a pre-designed spreadsheet that helps businesses calculate and manage employee payroll tax deductions efficiently. This template typically includes fields for entering employee information, gross wages, and applicable tax rates, ensuring accurate withholding amounts. You can customize the template to align with local tax regulations and your unique payroll processes, making it easier to maintain compliance. Such a tool not only streamlines payroll preparation but also has further potential for intricate financial modeling and analytical reporting.

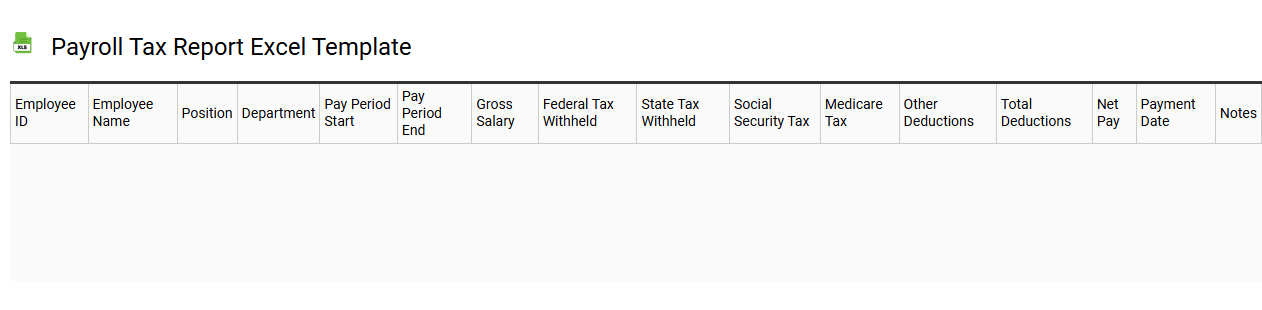

Payroll tax report Excel template

💾 Payroll tax report Excel template template .xls

A Payroll tax report Excel template serves as an organized tool for tracking and calculating payroll taxes for businesses. This customizable spreadsheet allows you to input employee wages, tax rates, and other relevant data, leading to accurate calculation of federal, state, and local taxes. You can monitor deductions for Social Security, Medicare, and unemployment contributions, as well as maintain compliance with tax regulations. This template is not only useful for basic calculations but can also be expanded to include complex scenarios like multi-state tax filings or various benefits deductions.

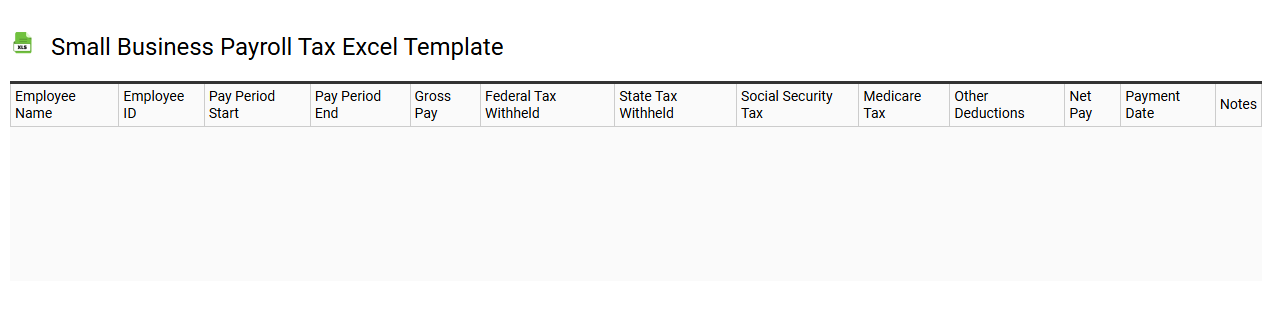

Small business payroll tax Excel template

💾 Small business payroll tax Excel template template .xls

A Small Business Payroll Tax Excel template is a pre-designed spreadsheet that helps small business owners manage and calculate their payroll tax obligations. This template typically includes sections for employee information, gross wages, deductions, and various tax calculations, making it easy to track payroll expenses efficiently. You can customize this tool to meet your specific business needs, allowing for accurate reporting and filing for federal, state, and local taxes. Understanding basic payroll functions, such as calculating FICA or FUTA taxes, can lead to more advanced needs like integrating payroll software or leveraging tax optimization strategies.