Explore a diverse range of free XLS templates designed specifically for payroll records. Each template offers customizable fields for employee information, hours worked, and tax calculations, ensuring accurate tracking of payments. Simplify your payroll process with user-friendly formats that help you maintain organized financial records effortlessly.

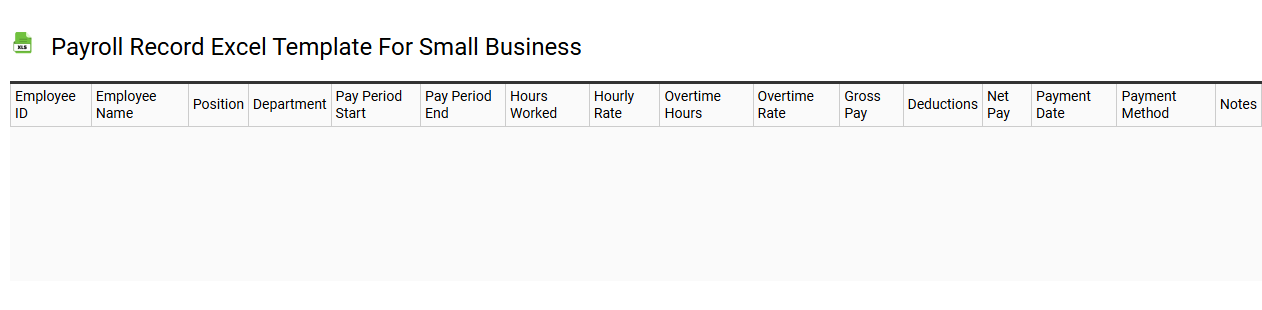

Payroll record Excel template for small business

💾 Payroll record Excel template for small business template .xls

A Payroll Record Excel template for small businesses serves as an organized spreadsheet to manage employee salary information, tax contributions, and hours worked. This template typically includes columns for employee names, identification numbers, work hours per pay period, gross earnings, deductions, and net pay. You can easily customize it to suit specific business needs, ensuring compliance with tax regulations and simplifying reporting processes. This basic setup can evolve into a more sophisticated system with added functionalities, such as automated calculations, integration with accounting software, or detailed analytics for payroll expenses.

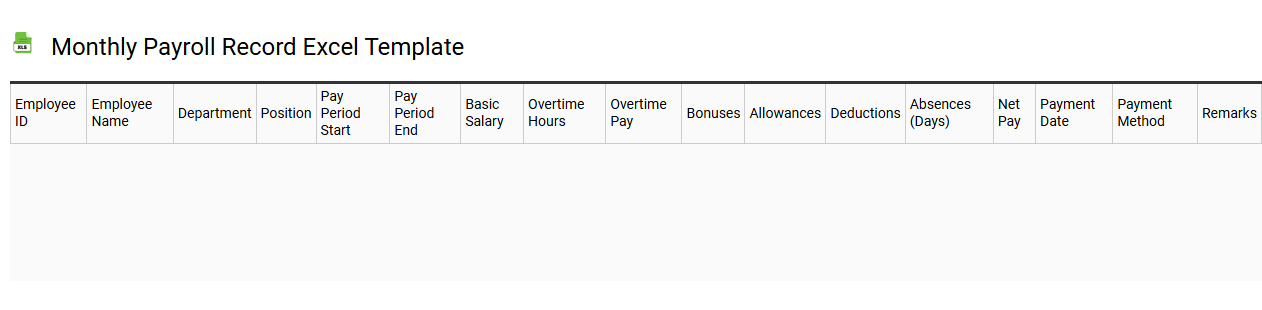

Monthly payroll record Excel template

💾 Monthly payroll record Excel template template .xls

A monthly payroll record Excel template is a pre-designed spreadsheet that facilitates efficient tracking and calculation of employee wages, deductions, and net pay for a specific month. It typically includes columns for employee names, identification numbers, hours worked, hourly rates, gross pay, tax deductions, and final amounts payable. Such a template streamlines payroll processing by automating calculations and providing a clear layout for easy reference. Beyond basic usage for payroll management, it can also be customized to incorporate complex formulas, tax codes, or integration with accounting software for advanced financial oversight.

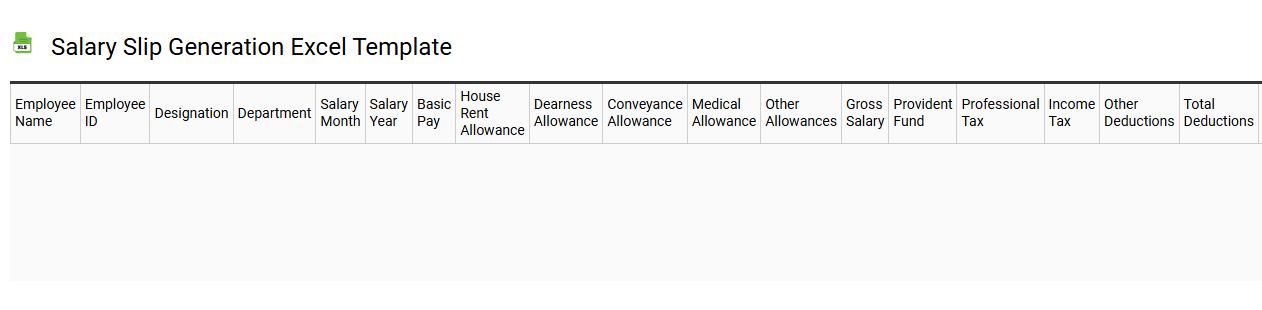

Salary slip generation Excel template

💾 Salary slip generation Excel template template .xls

A salary slip generation Excel template is a pre-designed spreadsheet that simplifies the process of calculating and formatting employee salary details. This template typically includes essential fields such as employee name, designation, salary components, deductions, and net pay. You can easily customize the template to fit your organization's specific requirements, making it user-friendly for HR professionals. For your ongoing financial management, consider exploring advanced functionalities like automated payroll calculations and integration with accounting software.

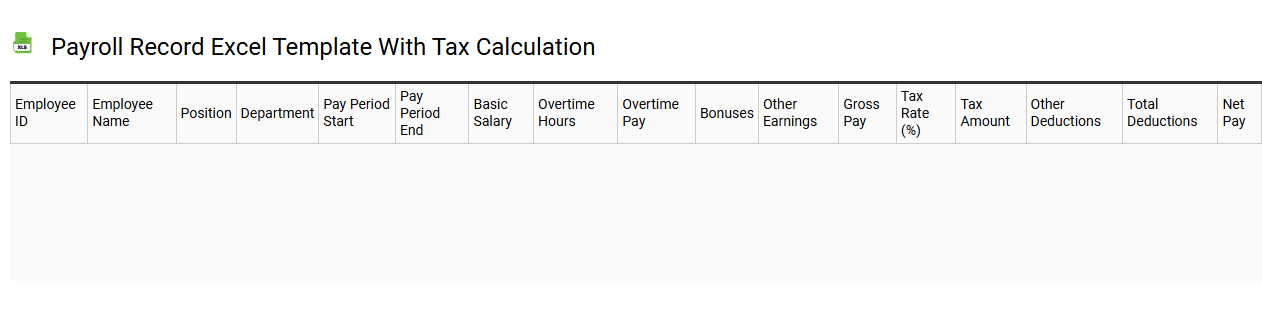

Payroll record Excel template with tax calculation

💾 Payroll record Excel template with tax calculation template .xls

A Payroll record Excel template with tax calculation is a structured spreadsheet designed to streamline the management of employee payroll data. This template typically includes sections for employee information, such as name, identification number, and pay rate, along with a detailed breakdown of hours worked and gross earnings. Built-in tax calculation formulas automatically determine deductions based on applicable local, state, and federal tax rates, enhancing accuracy and efficiency in payroll administration. You can easily adapt this tool to suit your specific workforce demands, and it can scale to manage complex elements like bonuses, overtime pay, and benefits administration, addressing advanced payroll needs.

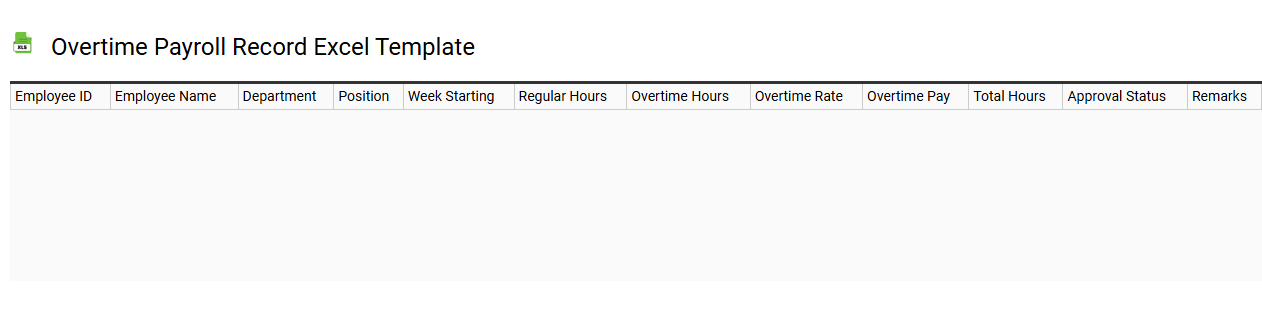

Overtime payroll record Excel template

💾 Overtime payroll record Excel template template .xls

An Overtime Payroll Record Excel template serves as a structured tool for tracking employee overtime hours and corresponding pay. This template typically includes columns for employee names, regular hours worked, overtime hours, hourly wage, and total pay calculations. Using such a template enhances accuracy in payroll processing and ensures compliance with labor regulations. For basic usage, it meets standard payroll tracking needs, while advanced features could incorporate calculations for varying overtime rates and integration with payroll systems.

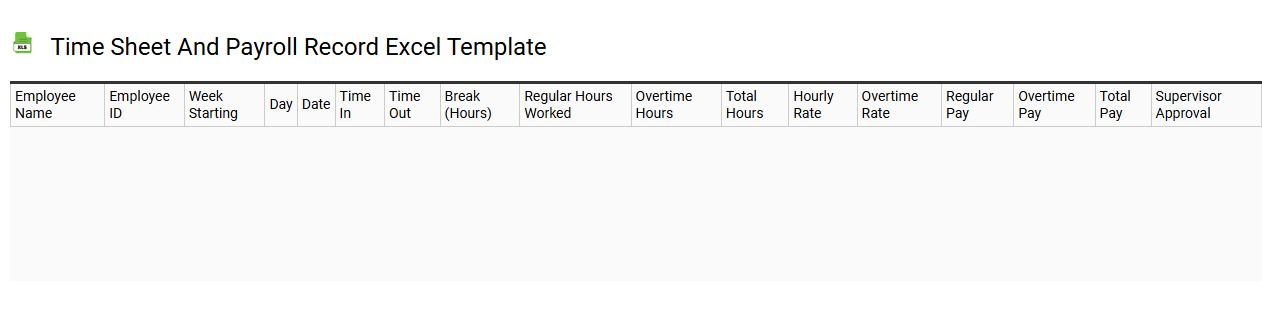

Time sheet and payroll record Excel template

💾 Time sheet and payroll record Excel template template .xls

A timesheet and payroll record Excel template simplifies the management of employee work hours and payment information. This template typically includes columns for employee names, hours worked, overtime, and deductions, making it easy for you to track labor expenses accurately. The user-friendly format allows for quick data entry and automated calculations, reducing the risk of manual errors. By utilizing this tool, companies can effectively monitor attendance and streamline payroll processes, while also allowing for advanced functionalities like importing data for analytics and reporting.

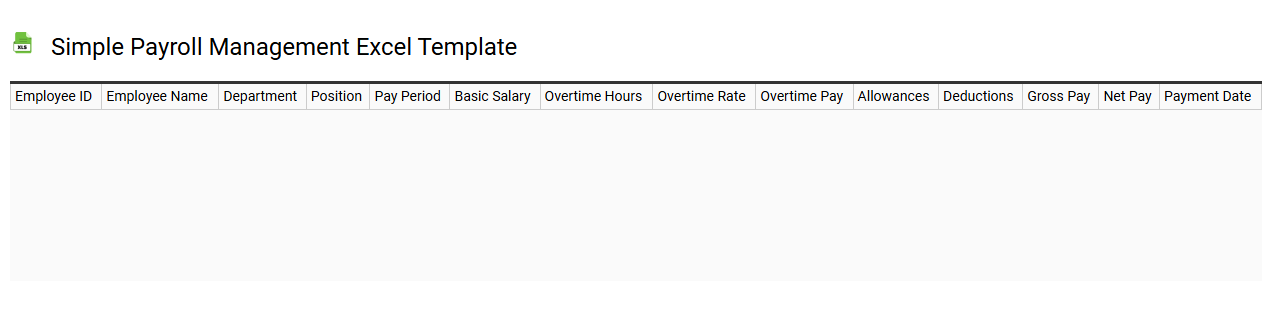

Simple payroll management Excel template

💾 Simple payroll management Excel template template .xls

A Simple Payroll Management Excel template streamlines the process of tracking employee salaries, deductions, and benefits. It typically features columns for employee names, hours worked, pay rates, total earnings, and tax withholdings, allowing for easy data entry and calculations. This format simplifies end-of-month payroll processing, ensuring accurate and timely payments to staff. Beyond basic usage, advanced features like automated tax calculations and integration with accounting software could enhance functionality to meet more complex payroll needs.

Payroll record Excel template with attendance tracker

![]()

💾 Payroll record Excel template with attendance tracker template .xls

A Payroll Record Excel template with an attendance tracker streamlines the payroll process by integrating employee attendance data directly with their compensation records. This template typically features columns for employee names, ID numbers, hours worked, overtime, and deductions, ensuring accurate calculations of wages and taxes. The attendance tracker monitors daily presence, absences, and tardiness, providing valuable insights into employee punctuality and reliability. Employing such a tool not only enhances organizational efficiency but also lays the groundwork for exploring more advanced functionalities like automated calculations, integration with HR systems, or predictive analytics for workforce management.

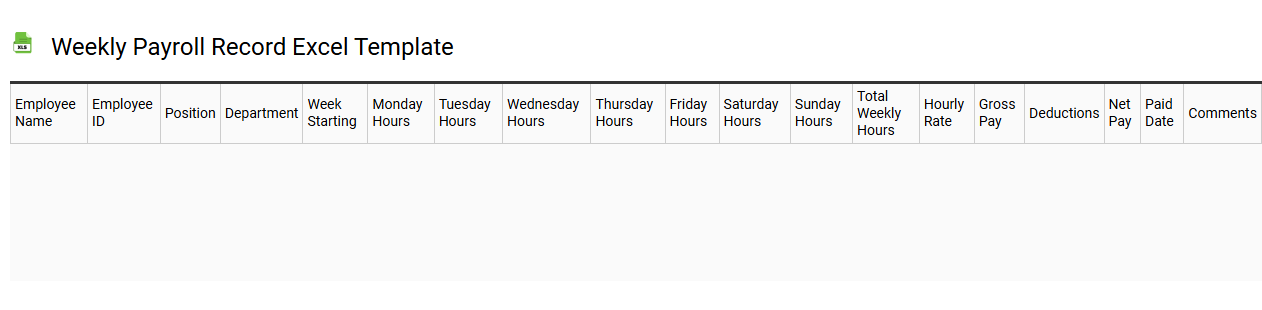

Weekly payroll record Excel template

💾 Weekly payroll record Excel template template .xls

A weekly payroll record Excel template serves as a structured tool for tracking employee hours, wages, and deductions on a weekly basis. You can easily input employee names, roles, hours worked, and rates of pay to streamline the payroll process. This template often features built-in formulas to automatically calculate total wages, taxes, and net pay, minimizing the risk of errors. Efficiently managing payroll not only ensures compliance with labor laws but also prepares your organization for more advanced payroll techniques, like automated payment systems and data analytics for financial forecasting.