Explore a range of free XLS templates designed specifically for nonprofit payroll management. These templates simplify tracking employee hours, calculating wages, and managing deductions, ensuring compliance with tax regulations. Each template offers an intuitive layout that makes it easy for you to input data and generate reports, enhancing your organization's financial transparency and efficiency.

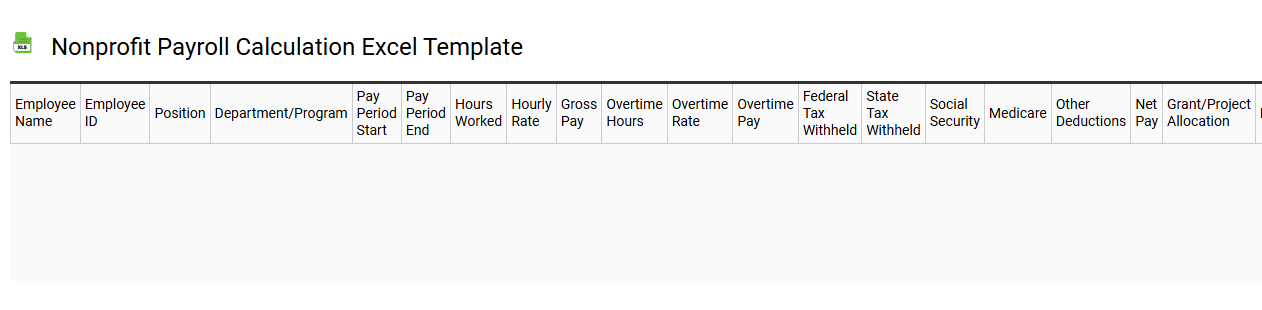

Nonprofit payroll calculation Excel template

💾 Nonprofit payroll calculation Excel template template .xls

A nonprofit payroll calculation Excel template streamlines the process of managing employee compensation in nonprofit organizations. This customizable tool allows you to input data such as employee hours, pay rates, and benefits, ensuring accurate calculations of gross pay, taxes, and deductions. With built-in formulas, the template automates complex calculations, saving time and reducing the likelihood of errors. You can harness this template for basic payroll needs while also considering enhancements like automated tax updates and compliance tracking to suit more intricate organizational requirements.

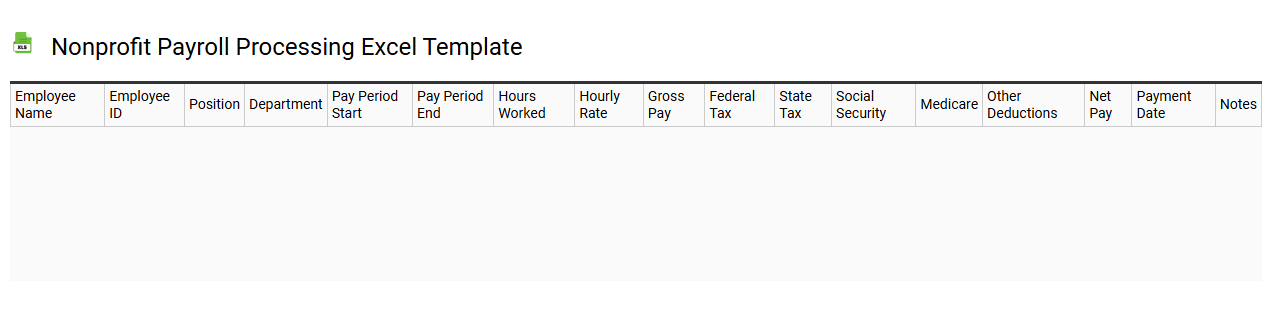

Nonprofit payroll processing Excel template

💾 Nonprofit payroll processing Excel template template .xls

A nonprofit payroll processing Excel template is a customizable spreadsheet designed specifically for organizations that operate on a nonprofit basis. This template allows you to effectively manage employee payroll by tracking hours worked, calculating wages, and ensuring compliance with relevant tax regulations. It typically includes pre-set formulas for deductions and benefits, automating much of the calculation process to reduce the risk of errors. Using this template can help streamline your payroll activities, but as your organization grows, you may want to explore more advanced payroll software solutions that offer integrated tax management and reporting capabilities.

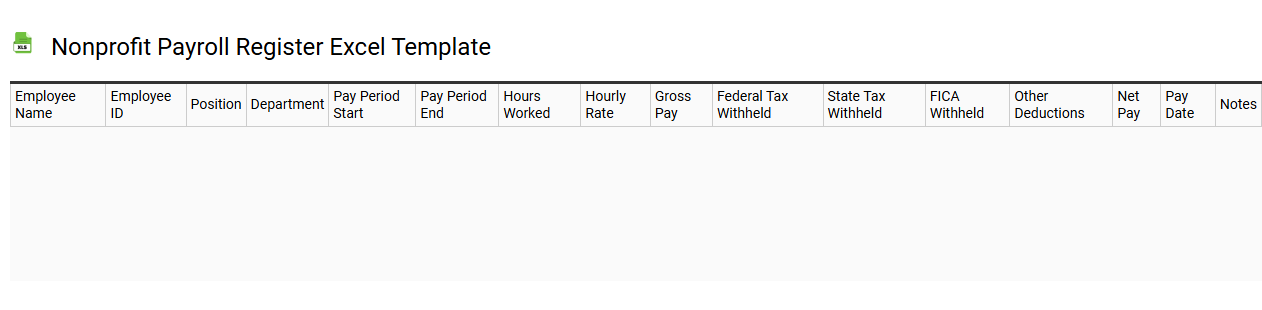

Nonprofit payroll register Excel template

💾 Nonprofit payroll register Excel template template .xls

A Nonprofit payroll register Excel template is a structured spreadsheet designed specifically for nonprofit organizations to efficiently track and manage employee payroll information. This template typically includes columns for employee names, identification numbers, hours worked, pay rates, deductions, and net pay. It allows organizations to maintain compliance with tax regulations while ensuring precise record-keeping of compensation details. By utilizing this template, you can simplify payroll processing and have a clear overview of expenses, which can aid in budgeting and financial planning for future projects. Further customization can enable advanced analytics or integration with accounting software.

Nonprofit payroll budget tracking Excel template

![]()

💾 Nonprofit payroll budget tracking Excel template template .xls

A nonprofit payroll budget tracking Excel template is a specialized spreadsheet designed to help nonprofit organizations manage their payroll expenses effectively. This template allows you to input employee salaries, benefits, taxes, and other related costs, providing a comprehensive overview of your payroll budget. With easily adjustable categories and formulas, you can project future payroll expenses and monitor actual spending against your budget. This tool is crucial for ensuring financial stability and compliance within your organization, while more advanced needs may incorporate features like variance analysis and allocation methods.

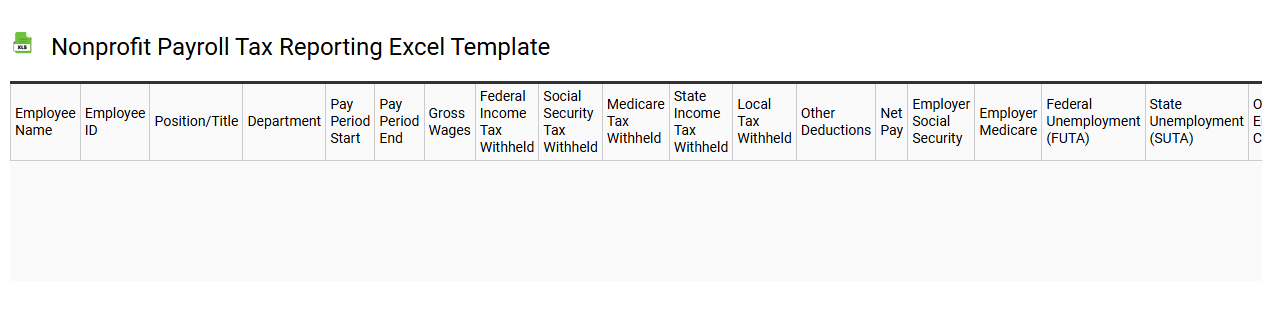

Nonprofit payroll tax reporting Excel template

💾 Nonprofit payroll tax reporting Excel template template .xls

A Nonprofit payroll tax reporting Excel template is a structured spreadsheet designed to simplify the reporting of payroll taxes for nonprofit organizations. This template typically includes essential data fields such as employee names, Social Security numbers, gross wages, tax withholdings, and employer tax contributions, ensuring accurate tracking and reporting. You can easily customize the template to meet your organization's specific requirements while ensuring compliance with federal and state tax regulations. Whether you manage a small staff or a larger team, using this template can help streamline your payroll processes and prepare for more advanced topics like IRS Form 941 reporting or employee benefit tax implications.

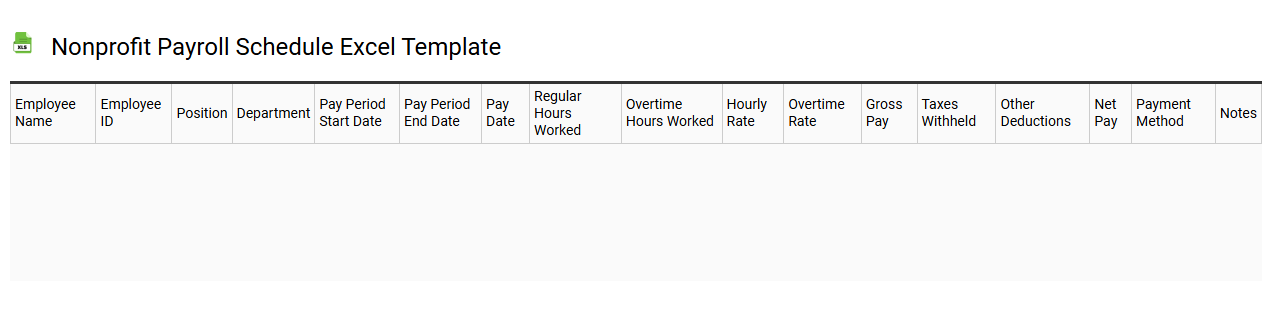

Nonprofit payroll schedule Excel template

💾 Nonprofit payroll schedule Excel template template .xls

A Nonprofit payroll schedule Excel template is a structured spreadsheet designed specifically for nonprofit organizations to manage and track employee payroll efficiently. It typically includes essential columns such as employee names, hours worked, hourly rates, deductions, and total pay. You can customize the template to align with your organization's payroll policies and reporting requirements, ensuring accuracy and compliance. Basic usage of this template facilitates streamlined payroll processing, while further potential needs could encompass advanced functions like automated tax calculations and integration with accounting software.

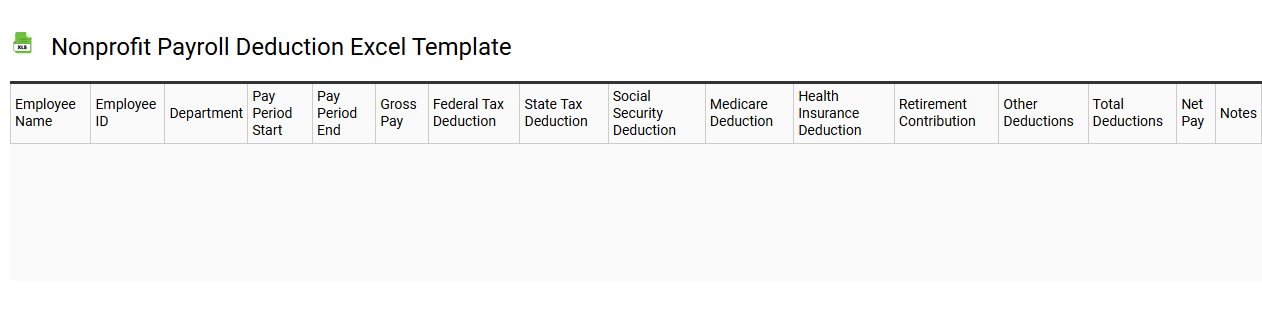

Nonprofit payroll deduction Excel template

💾 Nonprofit payroll deduction Excel template template .xls

A nonprofit payroll deduction Excel template streamlines the process of tracking and managing employee contributions to charitable causes. This tool allows organizations to record and calculate payroll deductions efficiently, ensuring accurate and transparent donations. Users can customize fields for various deductions, such as recurring donations, one-time gifts, or special campaign collections. Beyond basic usage, this template can be augmented with advanced features like automated calculations, data visualization charts, and integration with accounting software, allowing for refined financial analysis and reporting.

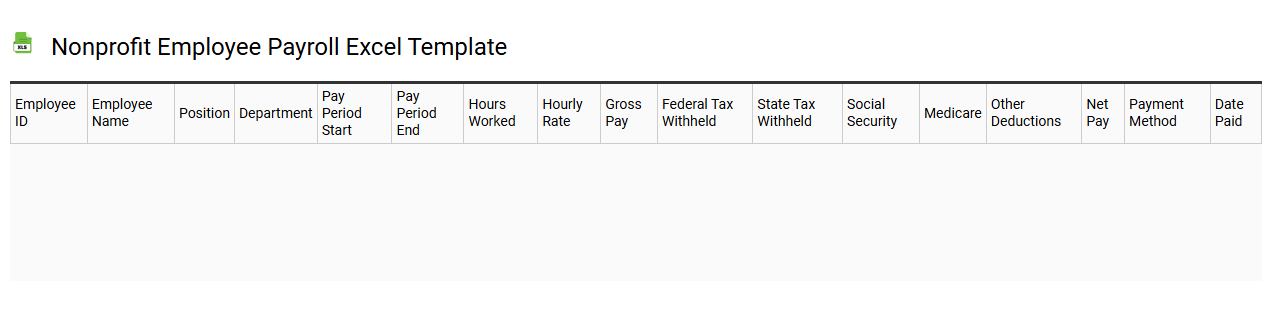

Nonprofit employee payroll Excel template

💾 Nonprofit employee payroll Excel template template .xls

A nonprofit employee payroll Excel template is a pre-designed spreadsheet designed to streamline the payroll process for nonprofit organizations. This template typically includes essential columns such as employee names, roles, hours worked, hourly rates, and total compensation. It simplifies calculations, allowing for the efficient tracking of employee salaries, bonuses, and deductions, ensuring compliance with IRS requirements. This tool can serve basic payroll needs and can be further adapted for advanced functionalities like tax calculations, benefit tracking, or integration with accounting software.

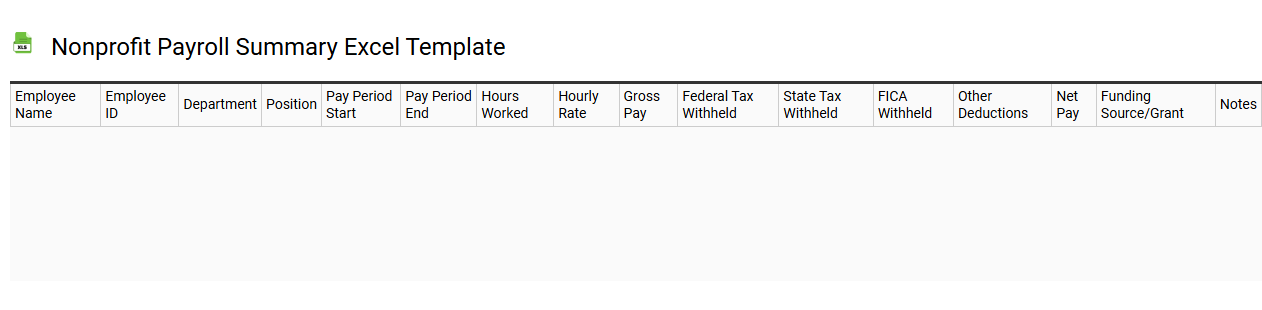

Nonprofit payroll summary Excel template

💾 Nonprofit payroll summary Excel template template .xls

A Nonprofit payroll summary Excel template is a customizable spreadsheet designed to help nonprofit organizations streamline their payroll processes. This template typically includes sections for employee information, wages, deductions, taxes, benefits, and total payroll expenses, ensuring an organized approach to tracking financial data. With built-in formulas, calculations for gross pay, net pay, and other essential figures can be automated, reducing the risk of errors. For basic usage, this template can simplify payroll management while offering further potential needs like advanced reporting, integration with accounting software, or compliance tracking.

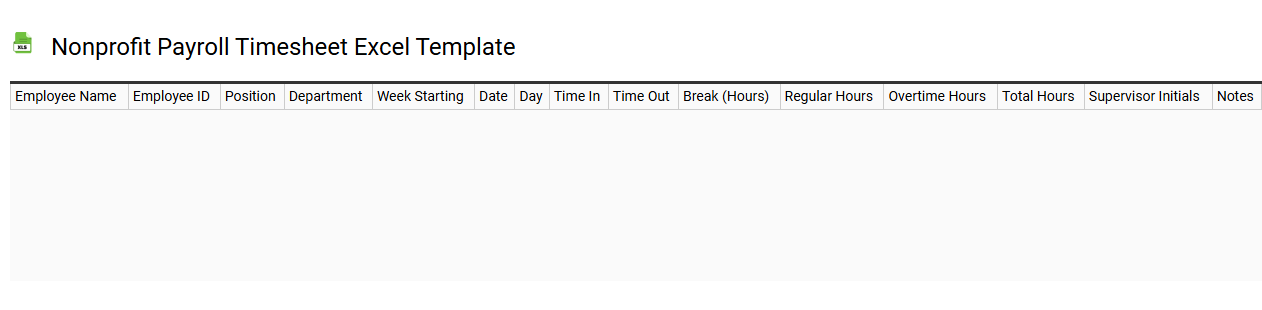

Nonprofit payroll timesheet Excel template

💾 Nonprofit payroll timesheet Excel template template .xls

A nonprofit payroll timesheet Excel template serves as a structured tool designed to help organizations accurately track employee hours, job roles, and associated payroll details efficiently. It typically includes fields for employee names, dates, worked hours, overtime, and any deductions or bonuses applicable. Each entry can be easily updated, allowing for straightforward calculations of total hours worked and gross pay. This simple yet effective format is essential for accurate financial reporting and can be adapted to more advanced payroll software or integrated with accounting systems for comprehensive financial management.