Free XLS templates for payroll sheets are available to help streamline your payroll process. These templates typically include fields for employee names, hours worked, pay rates, overtime calculations, and deductions, ensuring accurate computations. By using these customizable formats, you can easily track payroll details while maintaining compliance with regulations.

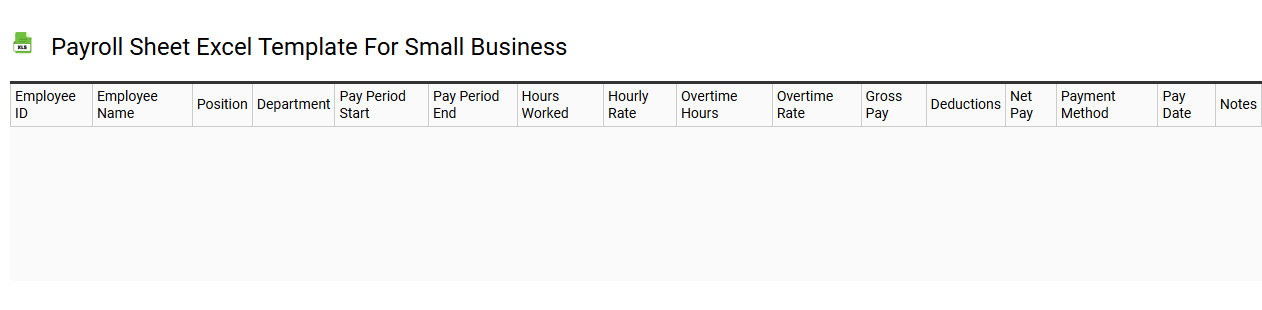

Payroll sheet Excel template for small business

💾 Payroll sheet Excel template for small business template .xls

A Payroll sheet Excel template for small business is a pre-designed tool that simplifies the process of managing employee payroll. It typically includes sections for employee names, hours worked, wage rates, overtime calculations, deductions, and final payment amounts, allowing for streamlined data entry and accurate financial tracking. This template helps ensure compliance with tax regulations while providing a clear overview of your payroll expenses in one organized document. As your business grows, you may find the need to incorporate advanced features such as automated calculations with formulas and integration with accounting software for more comprehensive financial management.

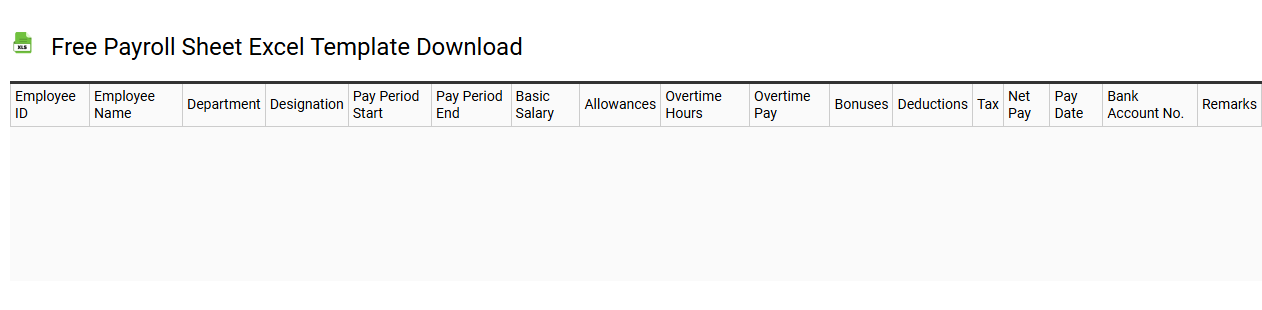

Free payroll sheet Excel template download

💾 Free payroll sheet Excel template download template .xls

A free payroll sheet Excel template is a downloadable tool designed to simplify the process of tracking employee salaries, hours worked, and deductions. This customizable spreadsheet allows employers to enter employee information, including names, pay rates, and work hours, ensuring accurate calculations of wages and taxes. The clear layout helps you visualize payroll data, making it easier to manage payments consistently. Basic usage allows for straightforward salary computations, while advanced functions can include automated tax calculations, overtime tracking, and customizable reports for further analytical needs.

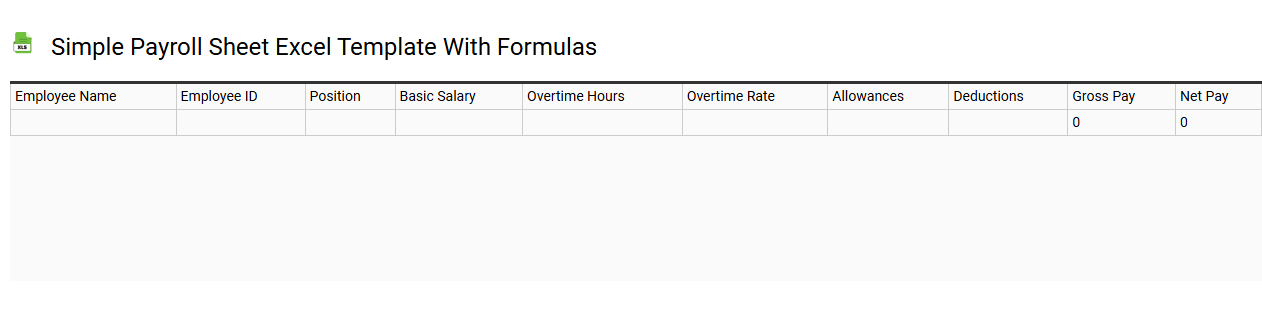

Simple payroll sheet Excel template with formulas

💾 Simple payroll sheet Excel template with formulas template .xls

A Simple Payroll Sheet Excel template is a user-friendly tool designed for tracking employee wages, hours worked, deductions, and calculations to ensure accurate payroll management. This template typically includes essential columns such as employee names, hourly rates, total hours worked, overtime pay, and tax deductions. Formulas are integrated to automate calculations for gross pay and net pay, reducing manual errors and saving time. You can effectively manage your payroll needs with this template, while also exploring advanced features like conditional formatting and pivot tables for deeper insights into your payroll data.

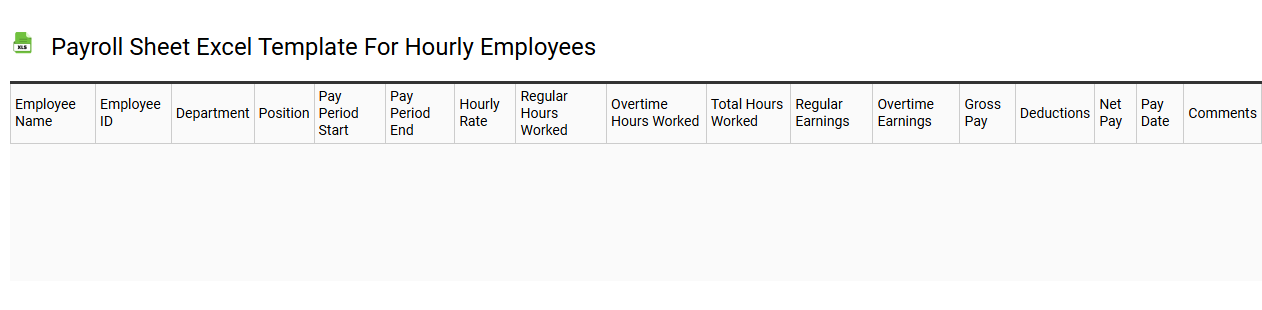

Payroll sheet Excel template for hourly employees

💾 Payroll sheet Excel template for hourly employees template .xls

A payroll sheet Excel template for hourly employees simplifies the process of tracking hours worked, calculating wages, and managing payroll information. It typically includes essential columns such as employee names, hours worked, hourly rates, gross pay, and deductions, providing a clear overview of each employee's earnings. The template allows you to easily input data and generate total payroll amounts, streamlining your financial reporting and payroll management tasks. For further potential needs, advanced features like automated tax calculations, overtime tracking, and integration with accounting software can enhance efficiency and accuracy.

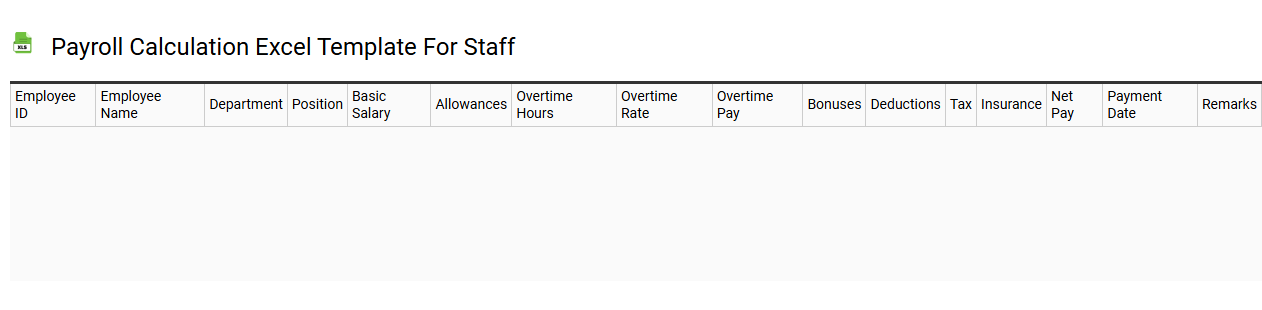

Payroll calculation Excel template for staff

💾 Payroll calculation Excel template for staff template .xls

A Payroll calculation Excel template is a pre-designed spreadsheet tool that facilitates the management of employee salary computations. It typically includes sections for employee details, hours worked, pay rates, taxes, deductions, and net pay calculation. You can customize formulas to suit your organization's specific needs, ensuring accuracy and efficiency in payroll processing. Beyond basic usage for salary calculations, the template can also be adapted for forecasting, employee leave management, or integrating with accounting systems.

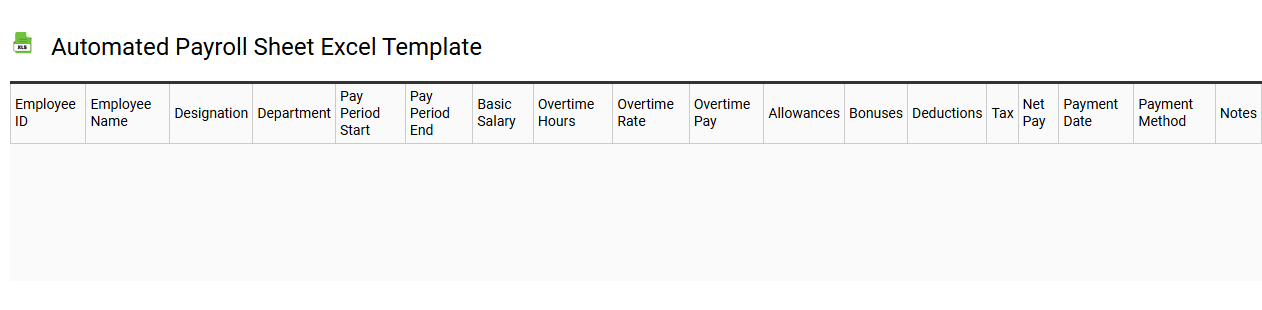

Automated payroll sheet Excel template

💾 Automated payroll sheet Excel template template .xls

An automated payroll sheet Excel template streamlines the calculation of employee wages, taxes, and deductions in a structured format. It typically includes essential fields such as employee names, hours worked, hourly rates, and corresponding pay periods, ensuring accuracy in calculations. The template often features built-in formulas that update totals automatically, minimizing errors and saving time for HR personnel. Beyond basic payroll management, this tool can be adapted for advanced analytics, such as forecasting labor costs or integrating with other HR systems for comprehensive data analysis.

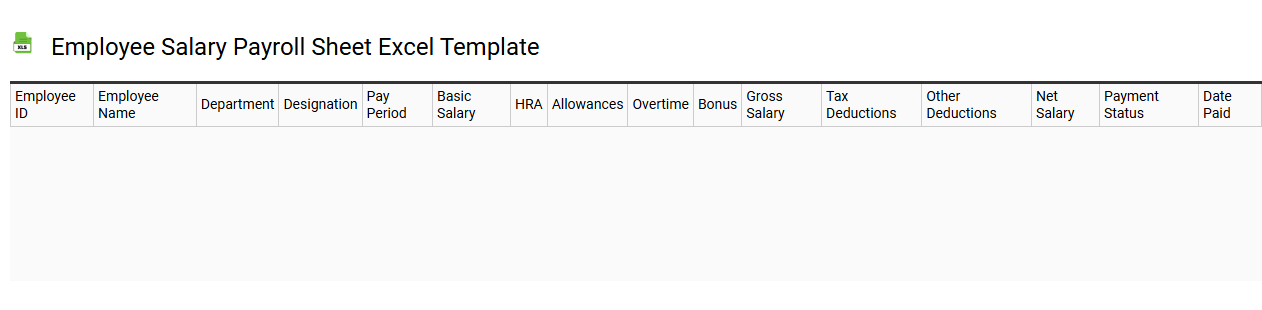

Employee salary payroll sheet Excel template

💾 Employee salary payroll sheet Excel template template .xls

An Employee salary payroll sheet Excel template is a structured spreadsheet designed to simplify the tracking and management of employee salaries, deductions, and payments. This template typically includes essential columns such as employee names, identification numbers, positions, base salaries, bonuses, tax withholdings, and net pay. Flexible formulas automate calculations, ensuring accuracy in payroll processing while saving time for HR departments. You can adapt the template to accommodate various payroll needs, from basic salary calculations to more complex features like overtime tracking and benefits administration.

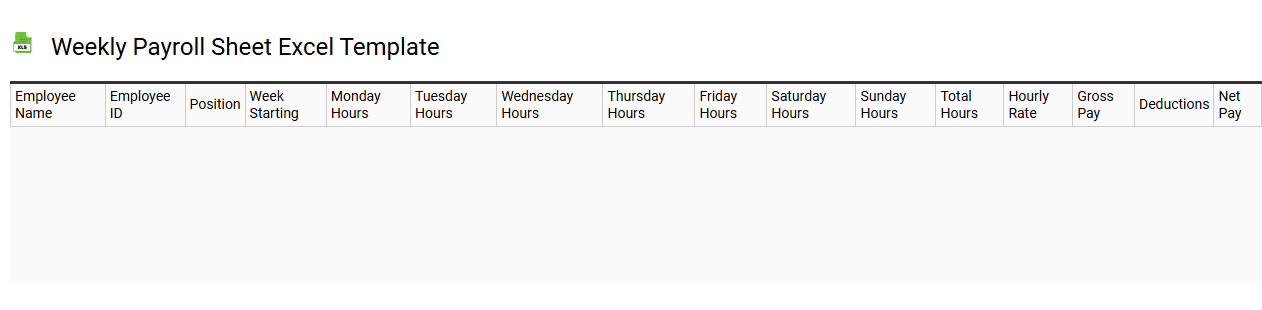

Weekly payroll sheet Excel template

💾 Weekly payroll sheet Excel template template .xls

The Weekly payroll sheet Excel template is a structured tool that simplifies the process of tracking employee wages on a weekly basis. This template typically includes sections for employee names, hours worked, hourly rates, and deductions, ensuring all essential data is organized efficiently. You can calculate total earnings and taxes automatically, streamlining payroll management and reducing errors. This versatile template not only serves basic payroll needs but can also be modified to incorporate advanced calculations such as overtime pay, commission structures, or benefit deductions tailored to your specific requirements.

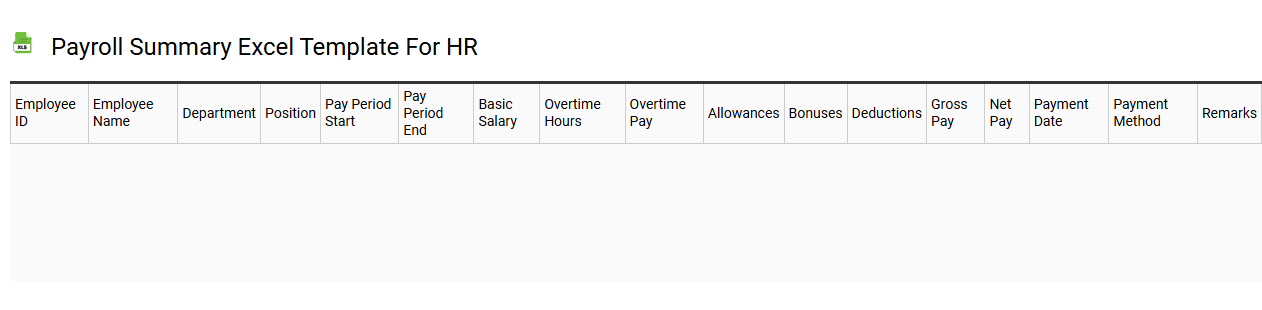

Payroll summary Excel template for HR

💾 Payroll summary Excel template for HR template .xls

A Payroll summary Excel template for HR consolidates employee payment information, including salaries, bonuses, deductions, and tax withholdings, into a concise format. Each row typically represents an employee, detailing their earnings, deductions, and net pay, allowing for easy tracking of total payroll expenses. This template enhances accuracy by minimizing manual calculations, ensuring compliance with tax regulations and internal policies. You can utilize the basic functions for payroll processing, while also considering advanced features such as pivot tables for analytics and macros for automation.