Discover a variety of free XLS templates tailored for banking risk management, designed to streamline your data analysis and reporting tasks. These templates typically include risk assessment matrices, credit risk calculators, and compliance checklists, ensuring you cover essential aspects of risk management effectively. Each template is customizable, allowing you to input specific figures and scenarios relevant to your institution, enhancing your overall decision-making process.

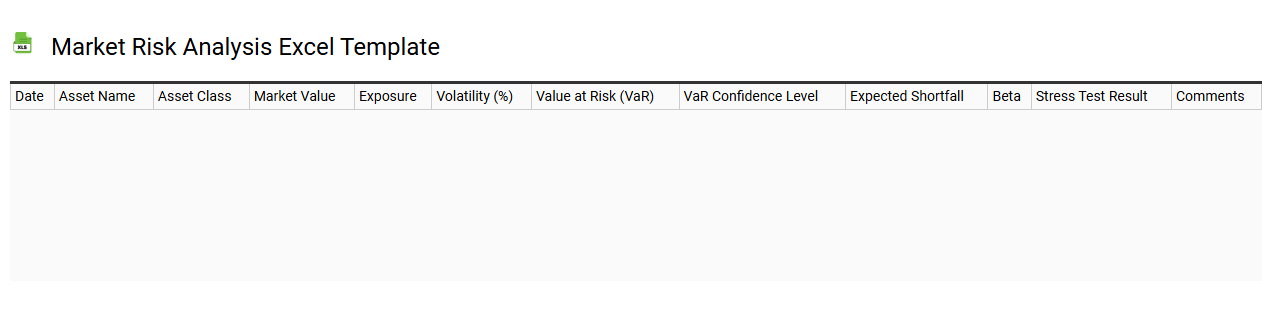

Market risk analysis Excel template

💾 Market risk analysis Excel template template .xls

A Market Risk Analysis Excel template serves as a structured tool for assessing financial risks associated with market fluctuations. It typically includes sections for inputting historical price data, calculating volatility, and projecting potential losses or gains based on various scenarios. You can customize it to incorporate key metrics like Value-at-Risk (VaR), sensitivity analysis, and stress testing. This template not only aids in evaluating current market exposure but also lays the groundwork for advanced techniques such as Monte Carlo simulations and risk factor modeling.

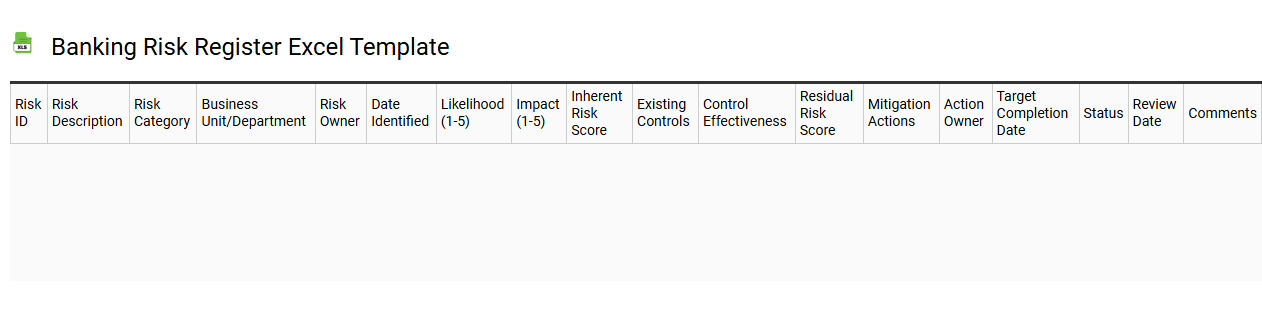

Banking risk register Excel template

💾 Banking risk register Excel template template .xls

A banking risk register Excel template is a structured tool designed to help financial institutions identify, assess, and manage various risks associated with their operations. This template typically includes categories such as credit risk, market risk, operational risk, and compliance risk, allowing you to document each risk's nature, likelihood, potential impact, and mitigation strategies. Users benefit from an organized layout that facilitates tracking and updating risk information efficiently, ensuring timely responses to emerging threats. Basic usage includes risk identification and response planning, with further potential for integrating advanced analytics, risk modeling, and regulatory compliance alignment.

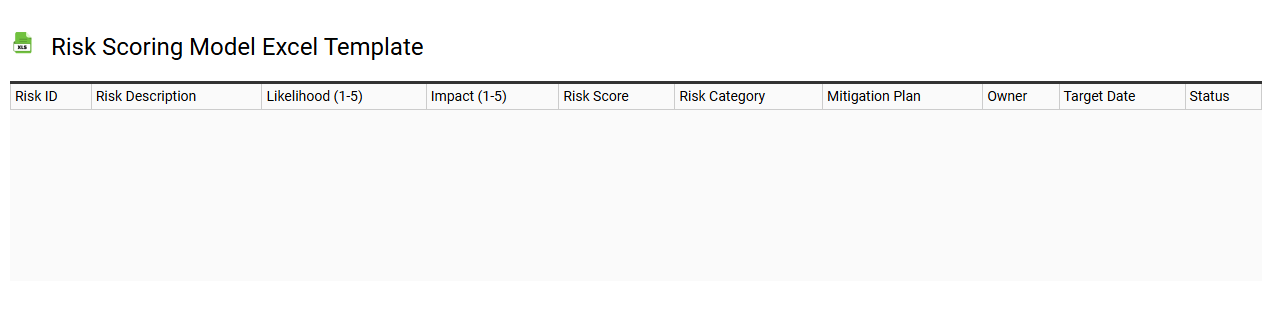

Risk scoring model Excel template

💾 Risk scoring model Excel template template .xls

A Risk Scoring Model Excel template is a structured tool designed to assess and quantify potential risks within a project, organization, or process. The template typically includes categories such as likelihood, impact, and risk prioritization, allowing users to assign scores to various risk factors. Users can easily customize formulas and thresholds, enabling tailored risk assessments that reflect specific needs. This basic usage can evolve into more sophisticated applications, using advanced statistical methods, machine learning algorithms, or predictive analytics for comprehensive risk management.

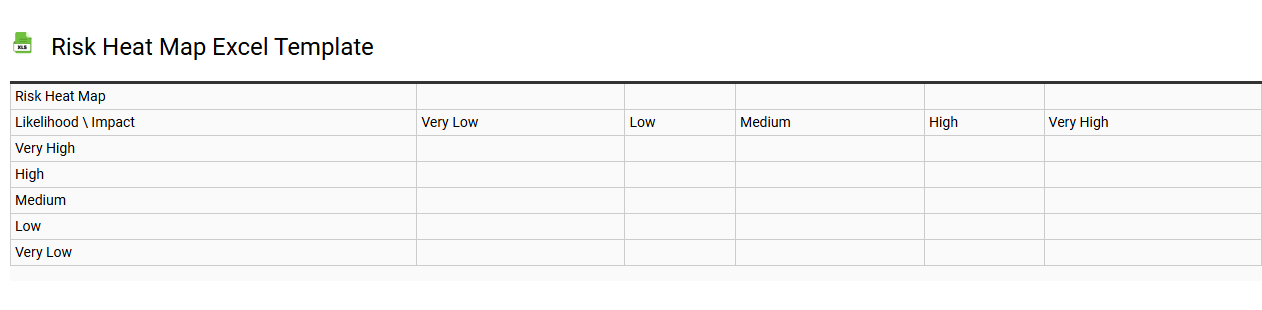

Risk heat map Excel template

💾 Risk heat map Excel template template .xls

A Risk Heat Map Excel template visually represents potential risks within a project or organization by categorizing them based on their likelihood and impact. Each risk is plotted on a grid, with axes typically indicating the probability of occurrence and the severity of the impact, allowing you to quickly identify high-priority hazards. The color-coded design enhances clarity, with red signifying critical risks, yellow for moderate concerns, and green indicating lower-risk areas. Basic usage involves plotting risks as they arise, while advanced applications can integrate real-time data analytics and scenario modeling to better predict and manage risk exposure.

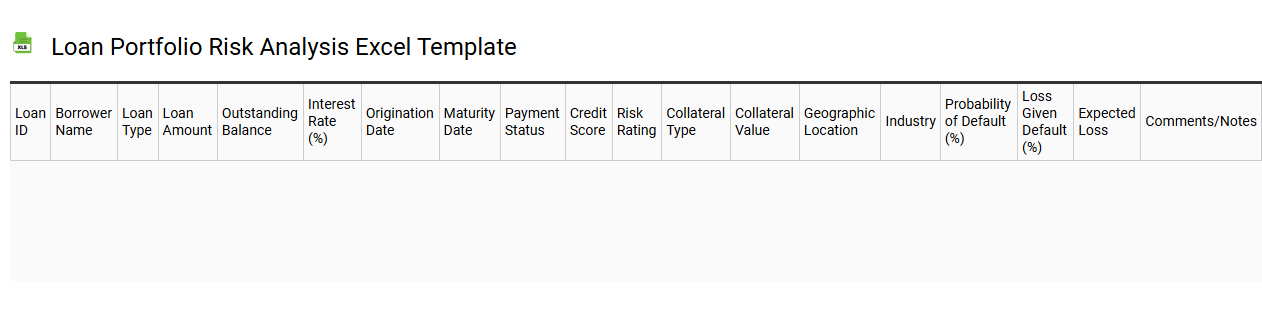

Loan portfolio risk analysis Excel template

💾 Loan portfolio risk analysis Excel template template .xls

A Loan Portfolio Risk Analysis Excel template provides a structured format for assessing the risk associated with various loans within a portfolio. This tool enables you to input key data such as loan amounts, interest rates, borrower credit scores, and repayment histories, allowing for detailed analysis. The template typically includes built-in formulas to calculate metrics such as default risk, loss given default, and exposure at default, helping you make informed decisions. By using this template, you can identify potential problem loans and develop strategies to mitigate risks, thus optimizing your lending operations and enhancing financial performance while preparing for advanced methodologies like Monte Carlo simulations or scenario analyses.

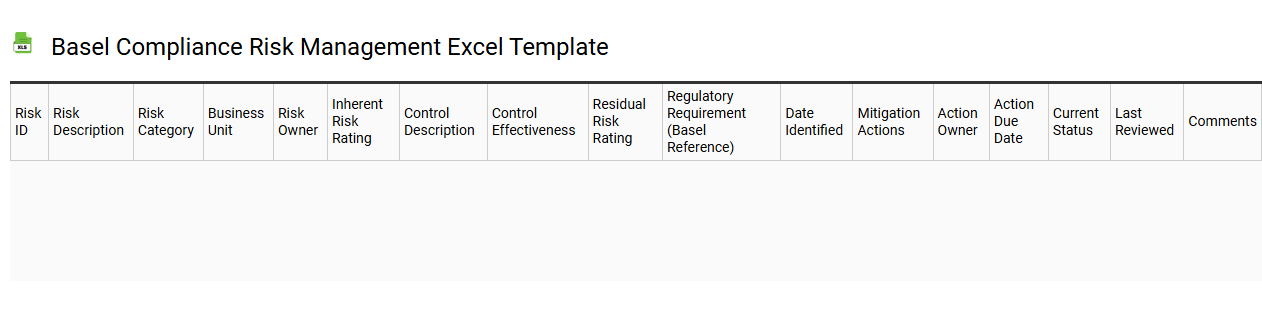

Basel compliance risk management Excel template

💾 Basel compliance risk management Excel template template .xls

A Basel compliance risk management Excel template is a specialized tool designed to help financial institutions adhere to the Basel Accords, which set international standards for banking regulations. This template typically includes various sections such as risk assessment worksheets, capital adequacy calculations, liquidity ratios, and credit risk evaluations. You can customize it to input your institution's specific data, allowing for streamlined analysis and reporting. Understanding the basic functions of this template can assist in meeting compliance needs, while advanced users may explore integrating it with predictive analytics or machine learning algorithms for enhanced risk assessment capabilities.

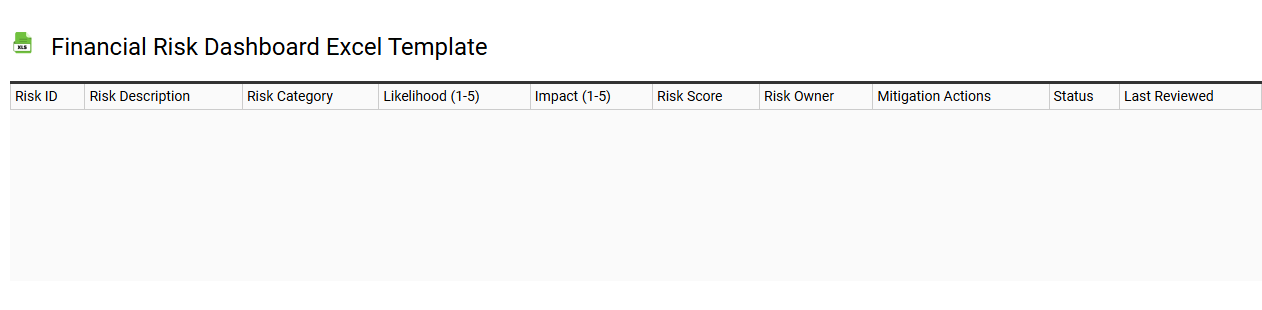

Financial risk dashboard Excel template

💾 Financial risk dashboard Excel template template .xls

A Financial Risk Dashboard Excel template provides a visual representation of an organization's financial health and potential risks. It typically includes key performance indicators (KPIs), financial ratios, and risk metrics that allow you to monitor trends and make informed decisions. Users can customize the dashboard to incorporate real-time data, visualizations such as graphs and charts, and scenario analysis tools. Further analysis may lead to evaluating advanced concepts like Value at Risk (VaR) or Monte Carlo simulations for deeper insights into financial uncertainties.

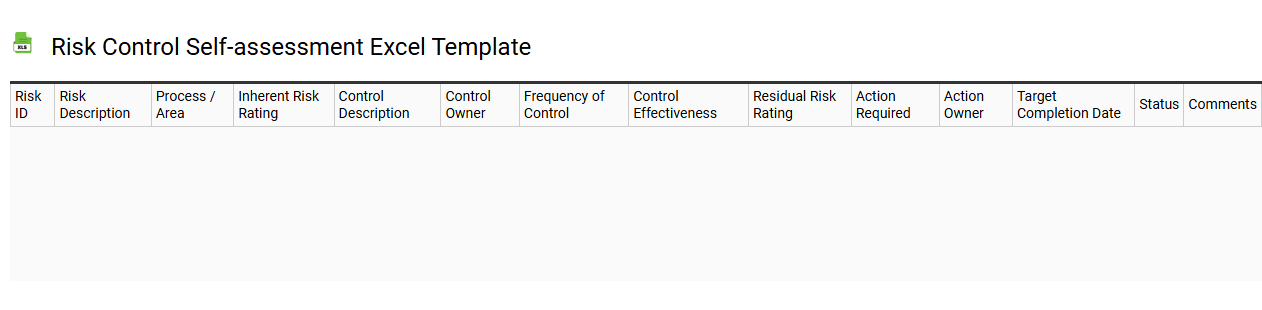

Risk control self-assessment Excel template

💾 Risk control self-assessment Excel template template .xls

A Risk Control Self-Assessment (RCSA) Excel template is a structured tool designed to help organizations identify, evaluate, and manage risks within their operations. This template typically includes sections for documenting risk descriptions, controls in place, assessment ratings, and action plans for mitigation. Users can systematically review their control environment, ensuring that existing measures are effective and identify areas needing improvement. For basic adoption, you can track risks and controls easily, while further potential usage may involve advanced analytics like trend analysis or integration with risk management software for comprehensive reporting.