Investment risk analysis Excel templates come in various formats, each designed to help you assess potential risks in your investment portfolio effectively. You can find templates featuring detailed risk assessment matrices that categorize risks by probability and impact, allowing for a clear visualization of potential challenges. Others may include built-in calculators for metrics like Value at Risk (VaR) and Standard Deviation, providing you with essential insights needed for informed investment decisions.

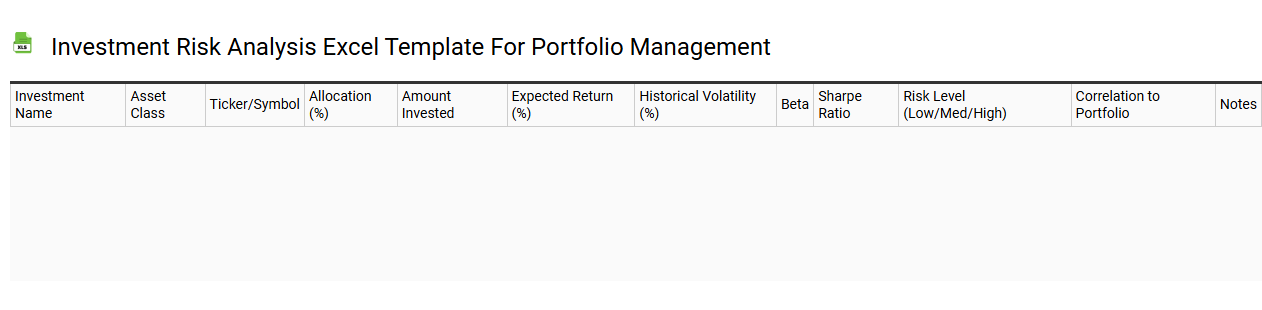

Investment risk analysis Excel template for portfolio management

💾 Investment risk analysis Excel template for portfolio management template .xls

An Investment Risk Analysis Excel template for portfolio management is a robust tool designed to assess and quantify the risks associated with your investment portfolio. This template often includes various metrics, such as Value at Risk (VaR), standard deviation, and beta, which provide insights into the volatility and potential loss of your investments. You might find built-in formulas and graphs that visualize risk exposures, helping you to make data-driven decisions. As you master the basic functions, you can leverage advanced statistical methods like Monte Carlo simulations or regression analysis to further refine your risk management strategies.

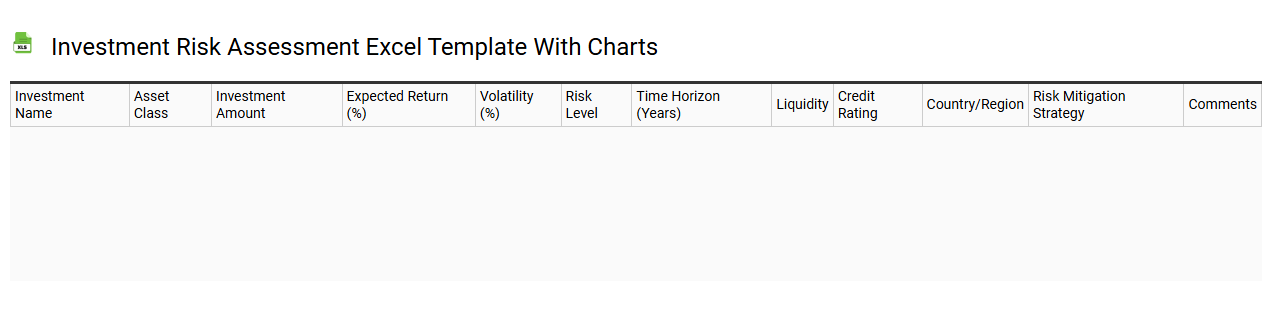

Investment risk assessment Excel template with charts

💾 Investment risk assessment Excel template with charts template .xls

An Investment Risk Assessment Excel template with charts serves as a vital tool for evaluating potential risks in investment portfolios. This user-friendly document typically integrates various financial metrics, including volatility, liquidity, and correlation coefficients, providing visual representations of risk factors through dynamic charts. You can easily customize these charts to reflect different scenarios, helping you identify trends and make informed decisions. This template not only streamlines the initial assessment but also lays the groundwork for advanced analyses, such as Monte Carlo simulations and value-at-risk calculations.

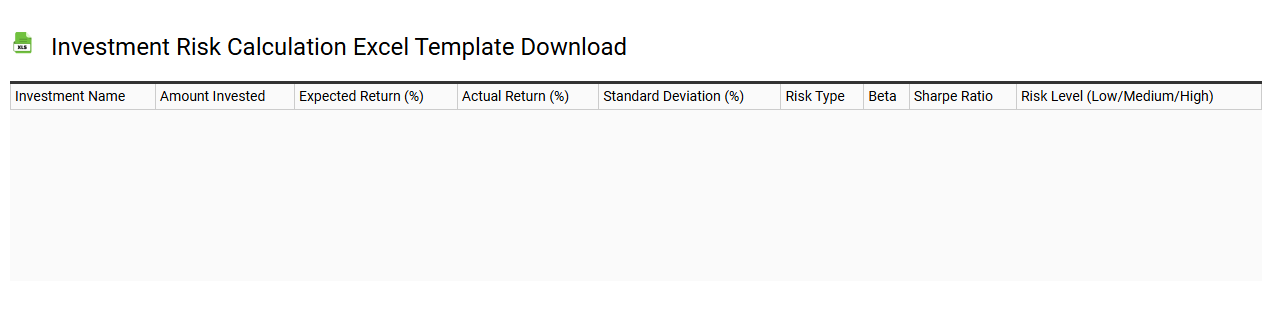

Investment risk calculation Excel template download

💾 Investment risk calculation Excel template download template .xls

An Investment Risk Calculation Excel template allows you to assess potential risks associated with your investment portfolio. The template includes pre-built formulas to analyze various risk factors, such as volatility, standard deviation, and value at risk (VaR). You can input your investment data and receive insights on how different market conditions might affect your returns. This tool caters to both basic portfolio assessments and advanced analyses, such as scenario analysis or stress testing, to address your future investment strategies comprehensively.

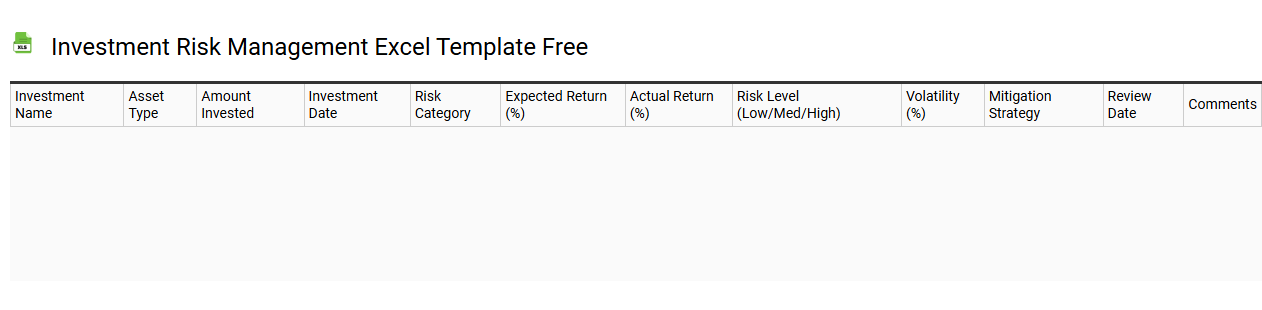

Investment risk management Excel template free

💾 Investment risk management Excel template free template .xls

An Investment Risk Management Excel template is a tool designed to help investors and financial professionals assess and manage potential risks associated with their investment portfolios. This template typically includes various features such as risk assessment matrices, portfolio diversification analysis, and performance metrics to evaluate risk levels over time. You can customize it by inputting your specific investments, historical data, and market variables to analyze potential risks effectively. Basic usage of this template includes tracking volatility and potential drawdowns, while advanced needs may involve Monte Carlo simulations, Value-at-Risk (VaR) calculations, and scenario analysis for comprehensive risk assessments.

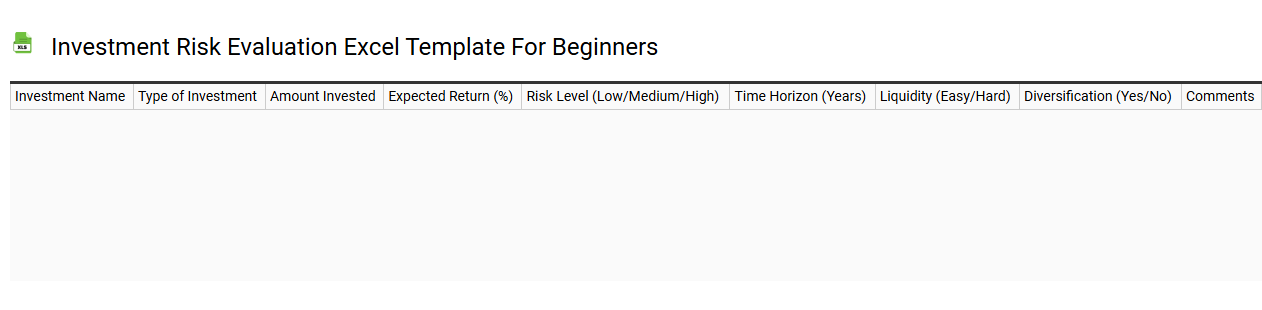

Investment risk evaluation Excel template for beginners

💾 Investment risk evaluation Excel template for beginners template .xls

An Investment Risk Evaluation Excel template provides a structured way to assess potential risks associated with various investment opportunities. It typically includes fields for inputting data like asset type, expected return, risk level, and correlation with other investments. The template often features built-in formulas for calculating metrics such as volatility and value at risk, making it easier for you to analyze diverse portfolios. While this template serves as a foundational tool for basic risk assessment, you may explore advanced concepts like Monte Carlo simulations and scenario analysis to deepen your understanding.

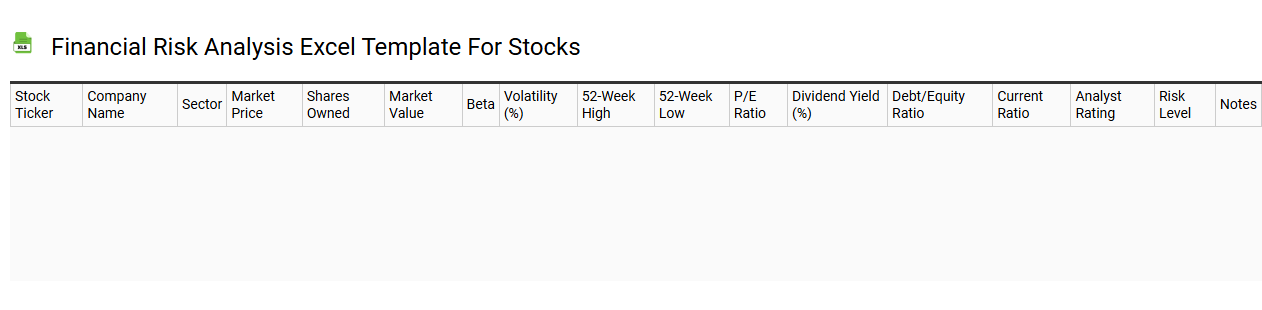

Financial risk analysis Excel template for stocks

💾 Financial risk analysis Excel template for stocks template .xls

A Financial Risk Analysis Excel template specifically designed for stocks provides a structured framework to assess the potential risks associated with stock investments. You can input historical price data, financial metrics, and other relevant information to evaluate various risk factors, including volatility, market risk, and liquidity risk. This template often features built-in formulas and charts that help visualize the data, making it easier to interpret potential scenarios. Basic usage can lead to advanced analytical techniques such as Value at Risk (VaR) and Monte Carlo simulations for more comprehensive risk assessments.

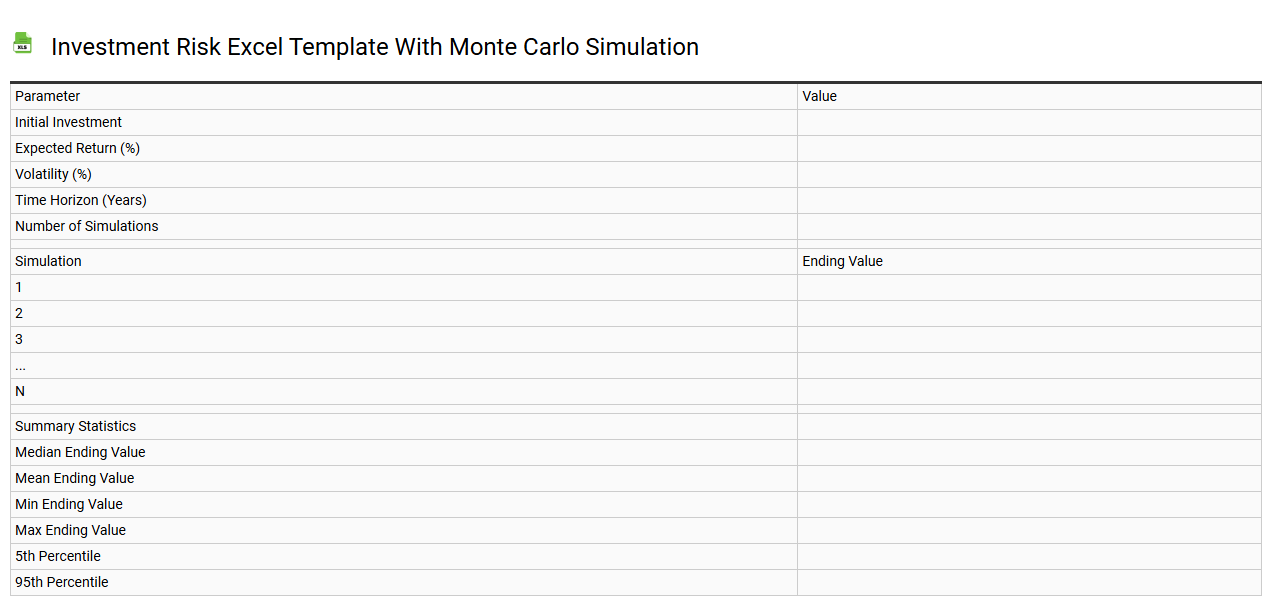

Investment risk Excel template with Monte Carlo simulation

💾 Investment risk Excel template with Monte Carlo simulation template .xls

An Investment Risk Excel template with Monte Carlo simulation provides a structured way to analyze and quantify investment risks through a statistical approach. This template allows users to generate a range of possible investment outcomes based on historical data and varying market scenarios, helping to visualize the impact of different risk factors. You can input parameters such as expected return, volatility, and correlation coefficients to simulate thousands of potential future performance paths. This tool not only serves basic portfolio risk assessment but can also be expanded for advanced financial modeling, such as Value at Risk (VaR) and scenario analysis.

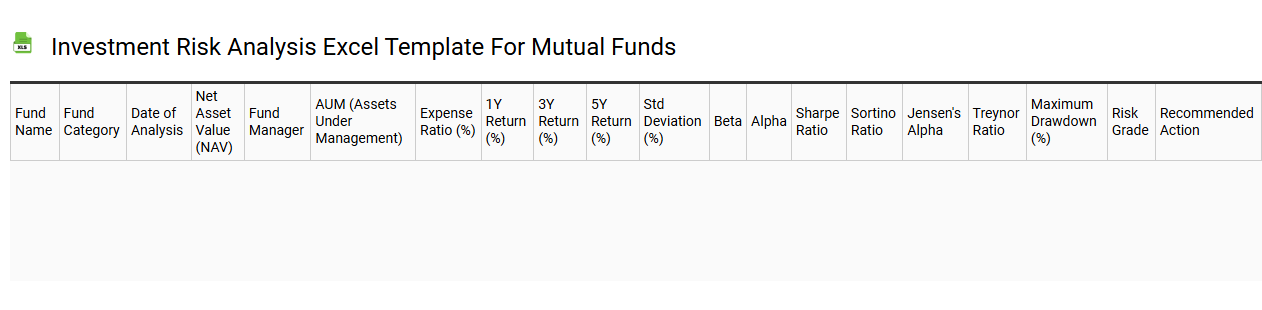

Investment risk analysis Excel template for mutual funds

💾 Investment risk analysis Excel template for mutual funds template .xls

An Investment Risk Analysis Excel template for mutual funds provides a structured framework for evaluating the risk associated with various mutual fund investments. This template typically includes sections for inputting historical performance data, risk metrics such as standard deviation, beta, and Value at Risk (VaR). In addition, you'll find charts that visually represent the risk-return profile, allowing for easier comparison between different funds. Using this template can help identify potential vulnerabilities in your portfolio while serving as a foundational tool for more complex analyses like Monte Carlo simulations or scenario analysis.

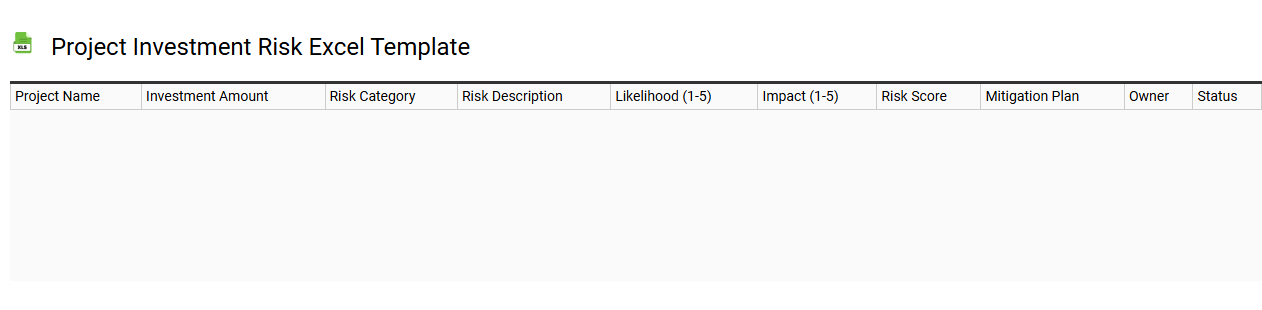

Project investment risk Excel template

💾 Project investment risk Excel template template .xls

A Project Investment Risk Excel template is a structured tool designed to assess and manage the potential risks associated with investment projects. It typically includes various sections for identifying risks, evaluating their potential impact, and determining mitigation strategies. You will often find fields for risk probability, severity, and overall risk ranking, helping you prioritize which risks require immediate attention. This template is essential for ensuring that project stakeholders can make informed decisions and be prepared for unforeseen challenges, while also serving as a foundation for more advanced quantitative analysis techniques like Monte Carlo simulations.

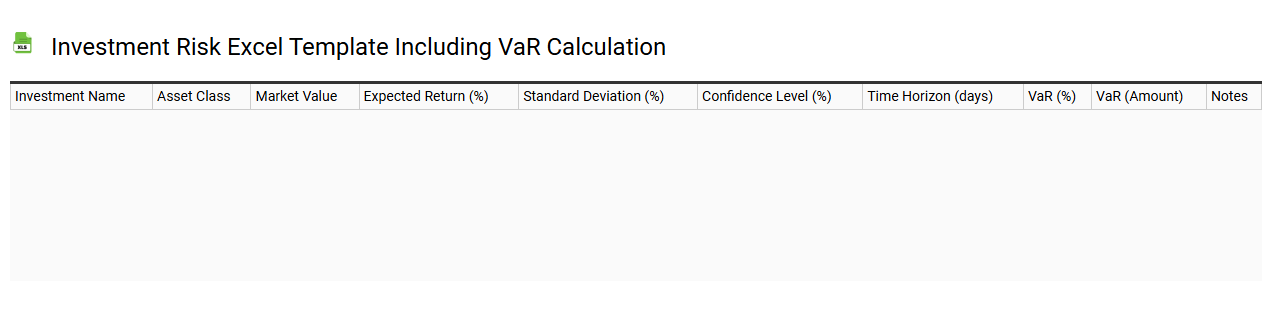

Investment risk Excel template including VaR calculation

💾 Investment risk Excel template including VaR calculation template .xls

An Investment Risk Excel template designed for Value at Risk (VaR) calculation serves as a crucial tool for assessing the potential financial loss in an investment portfolio over a specified time frame. This template typically includes sections for inputting historical financial data, such as asset prices or returns, and configurable parameters for risk assessment, including confidence intervals and holding periods. Users can visualize risk profiles through graphs and charts, enhancing insights into portfolio performance under different market conditions. Beyond basic VaR calculations, success in risk management may involve exploring advanced methodologies like Conditional Value at Risk (CVaR) and stress testing scenarios for comprehensive risk evaluation.

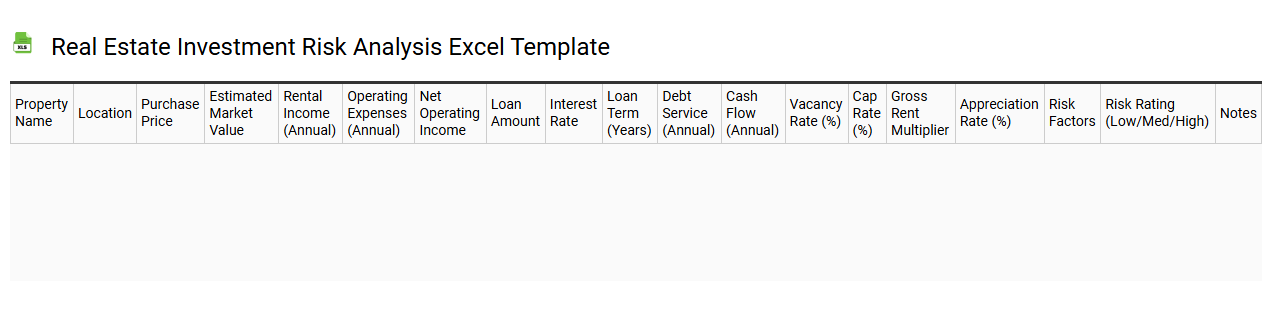

Real estate investment risk analysis Excel template

💾 Real estate investment risk analysis Excel template template .xls

A real estate investment risk analysis Excel template is a structured spreadsheet designed to evaluate the potential risks and returns associated with real estate investments. It typically includes sections for inputting data such as property costs, financing terms, market trends, and expected cash flows, allowing users to perform various calculations. Risk factors, such as market volatility, tenant vacancy rates, and maintenance costs, can be analyzed through built-in formulas and modeling techniques. You can enhance your investment strategy further by incorporating advanced financial metrics like IRR, NPV, and stress testing scenarios into the analysis.