Explore a collection of free Excel templates specifically designed for loan risk assessment. These templates streamline your analysis by providing structured formats that help you evaluate borrower creditworthiness, financial health, and repayment capabilities. Each template includes sections for calculating key metrics such as debt-to-income ratios, credit scores, and historical financial performance, allowing you to make informed lending decisions with ease.

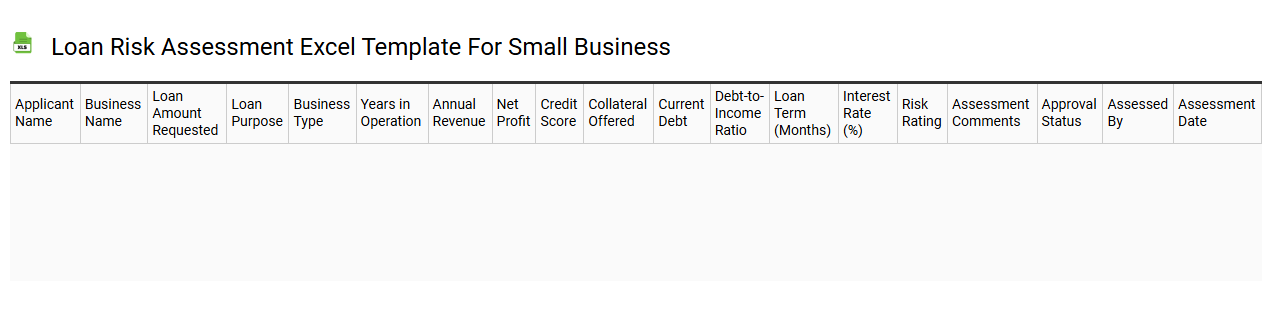

Loan risk assessment Excel template for small business

💾 Loan risk assessment Excel template for small business template .xls

A Loan Risk Assessment Excel template for small businesses is a structured tool designed to evaluate the creditworthiness of potential borrowers. This template typically includes sections for inputting financial data, such as revenue, expenses, credit history, and existing debts. By utilizing various financial ratios and indicators, it facilitates a comprehensive analysis of the borrower's ability to repay the loan. As you navigate through the template, consider how it can evolve to incorporate advanced risk modeling techniques, such as predictive analytics or machine learning algorithms, to enhance your assessment capabilities.

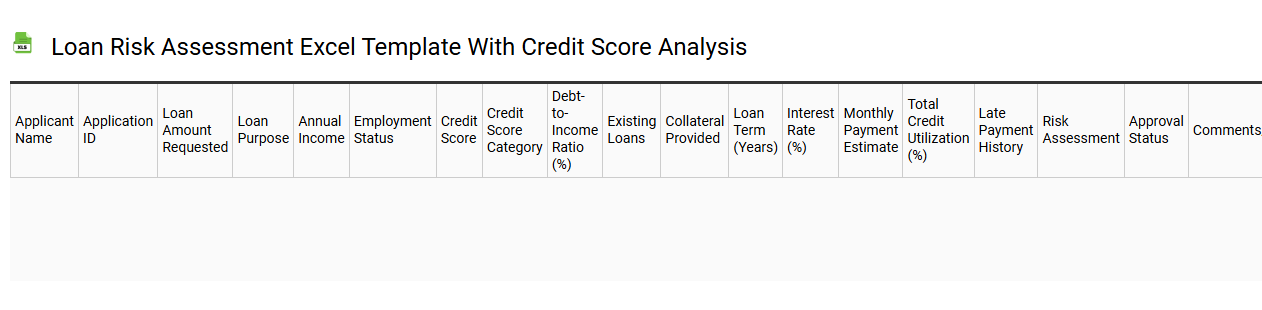

Loan risk assessment Excel template with credit score analysis

💾 Loan risk assessment Excel template with credit score analysis template .xls

A Loan Risk Assessment Excel template with credit score analysis is a structured spreadsheet tool designed to evaluate the creditworthiness of loan applicants. This template often includes various financial metrics, such as income, debt-to-income ratio, and historical payment behavior. You will find a section dedicated to credit score analysis, which provides insights into how an applicant's credit score impacts their risk level. Basic usage includes calculating risk profiles, while potential advanced features may involve predictive modeling and machine learning algorithms for more in-depth analysis.

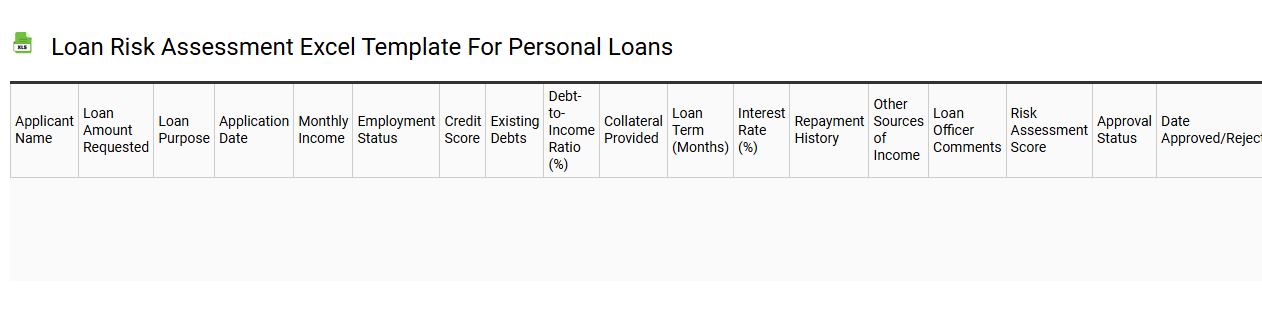

Loan risk assessment Excel template for personal loans

💾 Loan risk assessment Excel template for personal loans template .xls

A Loan Risk Assessment Excel template for personal loans helps lenders evaluate the creditworthiness of potential borrowers effectively. This tool typically includes key financial metrics such as income verification, debt-to-income ratio, credit score tracking, and employment history. Users can customize the template to input various data points, enabling a structured analysis of the risk associated with approving a loan. Such a template not only streamlines the approval process but can also adapt to your needs in assessing advanced scenarios like multiple loan applications and predictive modeling of borrower default risks.

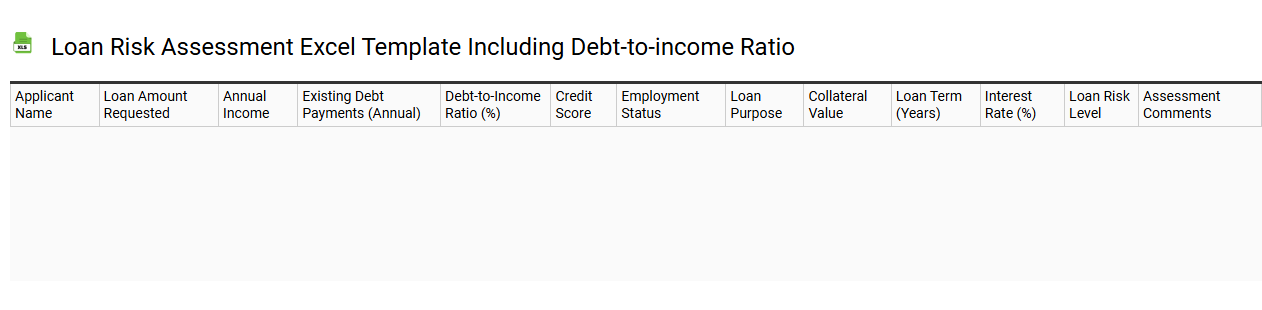

Loan risk assessment Excel template including debt-to-income ratio

💾 Loan risk assessment Excel template including debt-to-income ratio template .xls

A Loan Risk Assessment Excel template is a structured tool designed to evaluate the creditworthiness of borrowers. It typically includes various financial metrics, prominently featuring the debt-to-income (DTI) ratio, which measures an individual's monthly debt obligations against their gross monthly income. This ratio helps in assessing whether a borrower can comfortably manage monthly repayments alongside their existing debts. Such a template not only streamlines the evaluation process but can also be customized for advanced analyses, incorporating factors like credit scores, loan-to-value ratios, and stress testing scenarios.

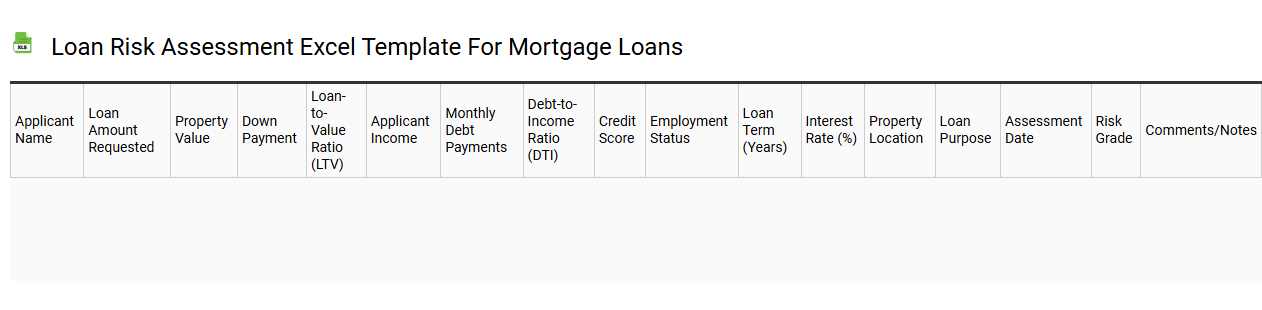

Loan risk assessment Excel template for mortgage loans

💾 Loan risk assessment Excel template for mortgage loans template .xls

A Loan Risk Assessment Excel template for mortgage loans streamlines the process of evaluating potential borrowers by capturing crucial financial metrics. It typically includes features for calculating debt-to-income ratios, credit scores, and loan-to-value ratios, providing a comprehensive overview of an applicant's financial health. This template enables you to input various data points, such as income details, existing debts, and property appraisals, resulting in a clear risk profile for each loan candidate. Enhanced functionalities can include scenario analysis and sensitivity testing, catering to more advanced assessments, like stress-testing for interest rate fluctuations or economic downturns.

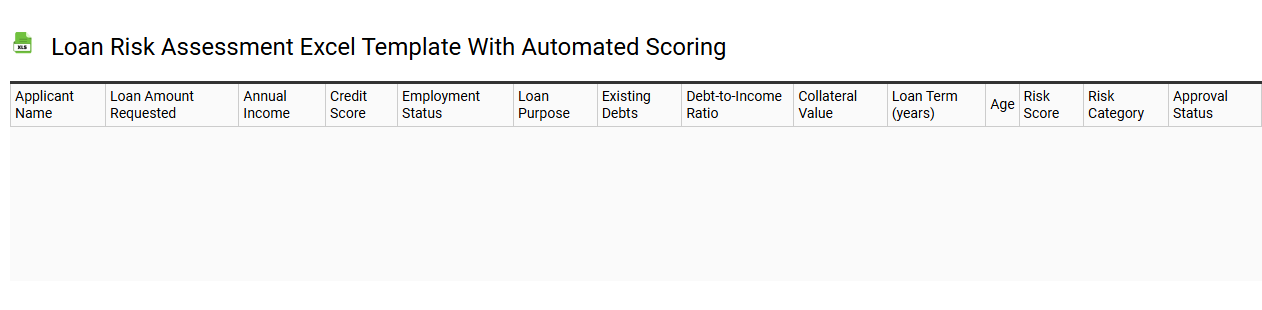

Loan risk assessment Excel template with automated scoring

💾 Loan risk assessment Excel template with automated scoring template .xls

A Loan Risk Assessment Excel template with automated scoring is a powerful tool designed to evaluate potential borrowers' creditworthiness. It organizes essential data such as income, credit history, and debt-to-income ratios, allowing you to input borrower information efficiently. The template utilizes built-in formulas and functions to automatically calculate risk scores based on pre-defined criteria, significantly speeding up the assessment process. This resource not only simplifies basic evaluations but also has the potential for advanced analytics, such as machine learning applications and predictive modeling for more nuanced financial risk analysis.

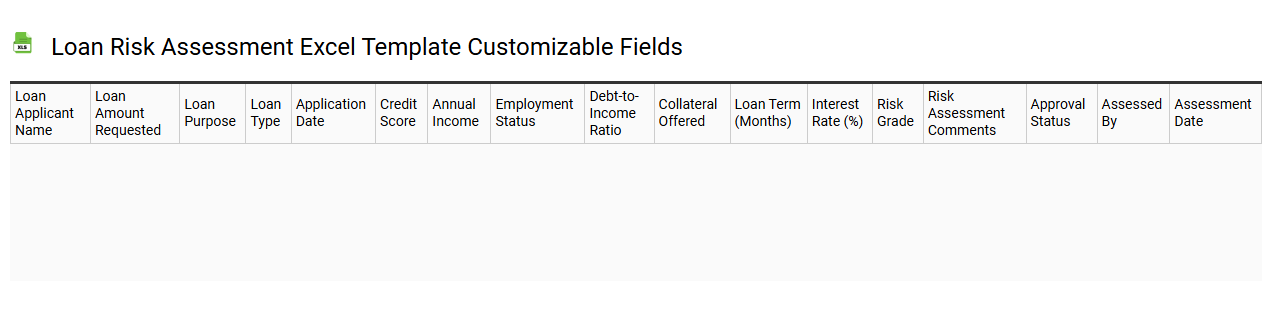

Loan risk assessment Excel template customizable fields

💾 Loan risk assessment Excel template customizable fields template .xls

A Loan Risk Assessment Excel template typically features customizable fields designed to capture essential borrower information and risk indicators. You can adjust sections for key data points, including loan amount, interest rate, loan term, borrower credit score, and employment history. Additional fields may include debt-to-income ratio, collateral valuation, and financial ratios, allowing a comprehensive overview of potential risks. This template serves basic needs like personal or business loan evaluations, while advanced users may explore machine learning models for predictive analytics or integrate with financial software systems for real-time risk monitoring.

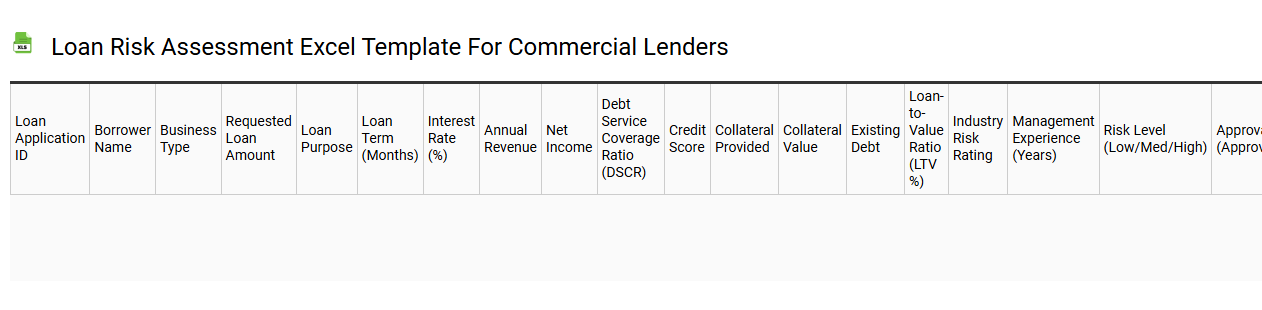

Loan risk assessment Excel template for commercial lenders

💾 Loan risk assessment Excel template for commercial lenders template .xls

A loan risk assessment Excel template for commercial lenders streamlines the evaluation process by providing a structured framework for analyzing borrower creditworthiness. This template typically includes sections for financial statement analysis, cash flow projections, debt service coverage ratios, and credit history reviews. Various weighted risk factors can be incorporated to help quantify the overall risk level associated with lending to a specific commercial entity. By utilizing such a template, you can efficiently assess potential risks and determine appropriate lending terms, while also adapting it for further advanced analytics like stress testing and scenario modeling.

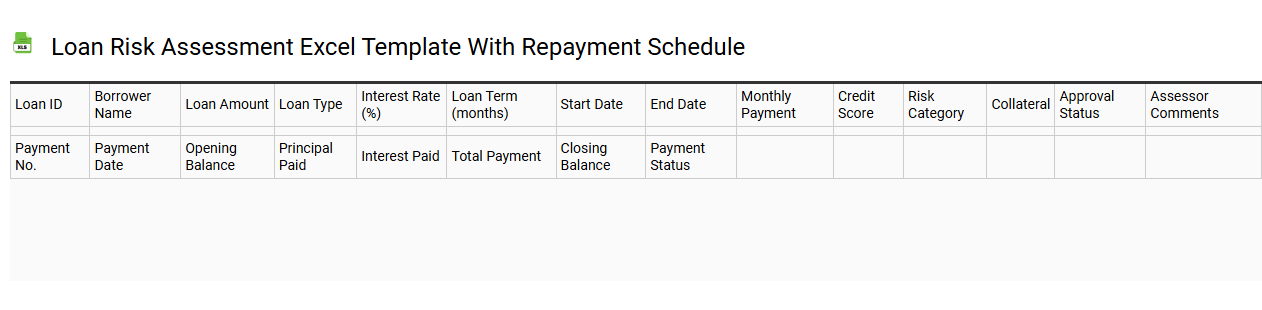

Loan risk assessment Excel template with repayment schedule

💾 Loan risk assessment Excel template with repayment schedule template .xls

A Loan Risk Assessment Excel template is a structured tool that helps you evaluate the potential risks associated with lending money. It typically includes sections for borrower information, loan amount, interest rates, and a detailed repayment schedule that outlines monthly payments and total interest paid over the loan period. This template allows you to input various scenarios, enabling a clearer understanding of the borrower's financial health and repayment capability. You can adapt the template for more complex needs, incorporating advanced analytics like sensitivity analysis or Monte Carlo simulations for thorough risk evaluation.

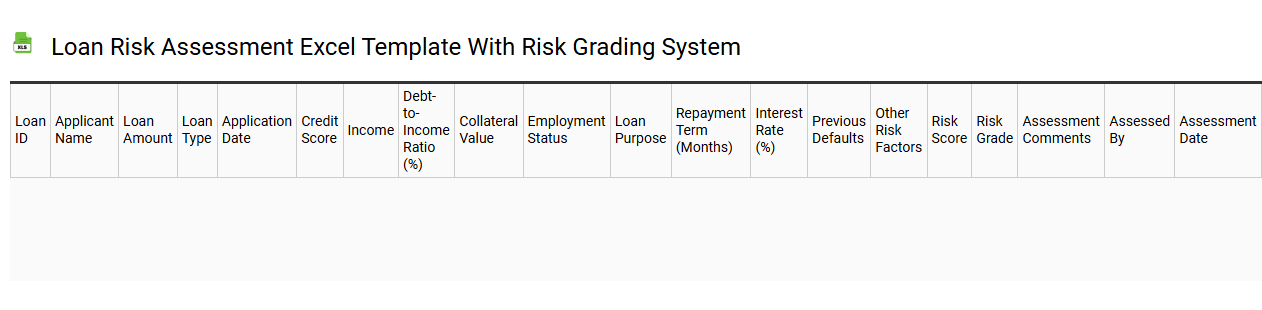

Loan risk assessment Excel template with risk grading system

💾 Loan risk assessment Excel template with risk grading system template .xls

A Loan Risk Assessment Excel template with a risk grading system is a powerful tool that helps lenders evaluate and quantify the creditworthiness of borrowers. This template typically includes various metrics such as credit score, loan-to-value ratio, and debt-to-income ratio, allowing you to assess the likelihood of default. The risk grading system categorizes borrowers into different risk levels, facilitating informed decision-making about loan approvals. Such a template can be fundamental for basic loan evaluations and has the potential for advanced risk modeling and predictive analytics, paving the way for enhanced financial decision-making processes.