Explore a diverse selection of free XLS templates designed specifically for debt payoff management. Each template typically includes features like payment tracking, interest calculations, and customizable fields, allowing you to tailor the spreadsheet to your individual financial situation. Utilize these resources to strategically plan and monitor your debt repayment journey, ensuring you stay organized and motivated toward financial freedom.

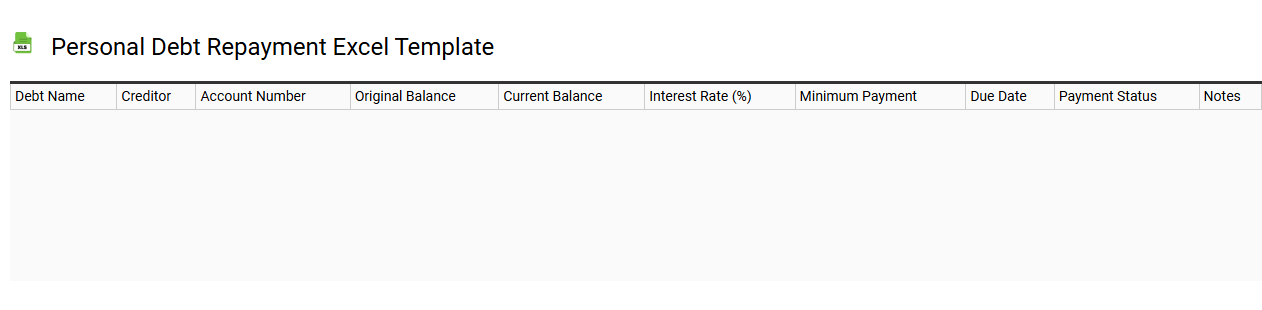

Personal debt repayment Excel template

💾 Personal debt repayment Excel template template .xls

A Personal Debt Repayment Excel template is a structured spreadsheet designed to help individuals manage and track their debt repayment journey. This template typically includes sections for listing different debts, such as credit cards, loans, and mortgages, along with details like interest rates, minimum payments, and outstanding balances. Users can input various repayment strategies, monitor progress over time, and visualize financial goals through charts or graphs. Beyond basic budgeting, this tool can be adapted for more complex scenarios like amortization schedules or prioritizing high-interest debts with advanced formulas.

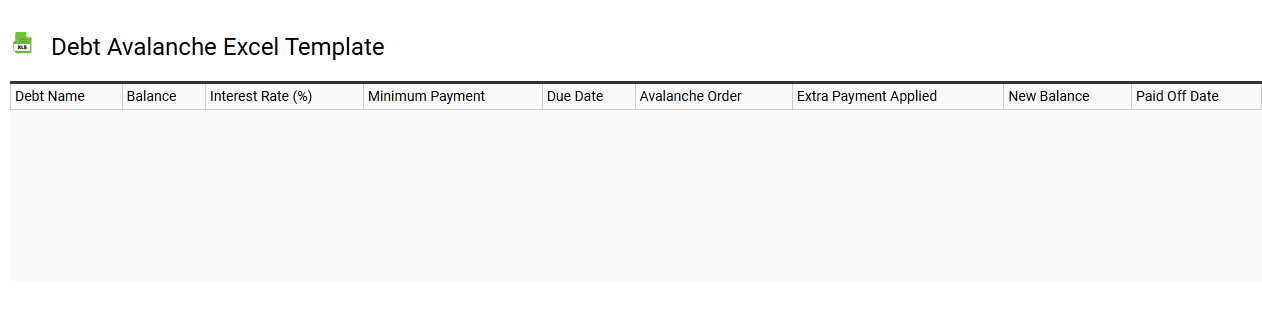

Debt avalanche Excel template

💾 Debt avalanche Excel template template .xls

The Debt Avalanche Excel template is a financial tool designed to help you efficiently manage and pay down your debts. Within this template, you enter your various debts--along with their interest rates and minimum payments--allowing you to visualize a structured repayment plan. The method prioritizes debts with the highest interest rates first, leading to reduced overall interest payments over time. This approach can optimize your debt repayment strategy, making it easier to plan for additional financial goals like investments or savings while leveraging concepts such as amortization schedules or negative amortization for advanced planning.

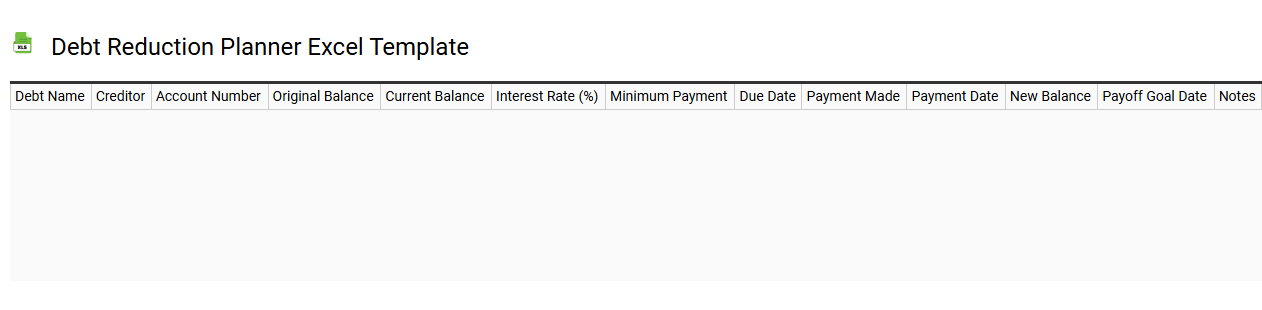

Debt reduction planner Excel template

💾 Debt reduction planner Excel template template .xls

A Debt Reduction Planner Excel template is a customizable financial tool designed to help individuals manage and reduce their debts systematically. It typically includes features like a detailed input section for various debts, including balances, interest rates, and minimum payments, allowing you to visualize your financial obligations. Color-coded charts and graphs illustrate your progress over time, making it easier to track your journey towards financial freedom. You can utilize this template for basic debt tracking or enhance it with advanced functionalities like amortization schedules and debt snowball or avalanche calculators to optimize your repayment strategy.

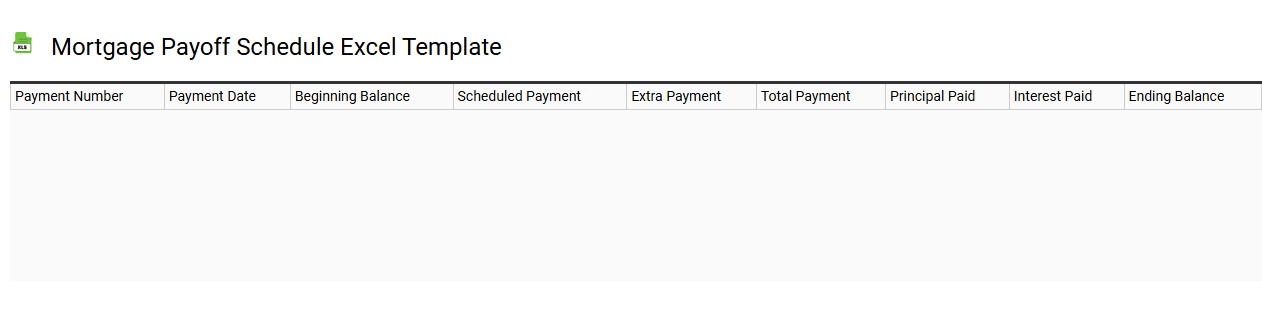

Mortgage payoff schedule Excel template

💾 Mortgage payoff schedule Excel template template .xls

A mortgage payoff schedule Excel template is a useful financial tool that allows you to manage and visualize your mortgage repayment over time. This template typically includes key information such as your principal balance, interest rate, monthly payment amount, and a breakdown of principal and interest for each payment. As you make payments, the template can help track how much of your loan remains to be paid off, providing clarity on when you will achieve full repayment. For your needs, you can adapt this template to explore further advanced calculations, like amortization adjustments or early payoff scenarios.

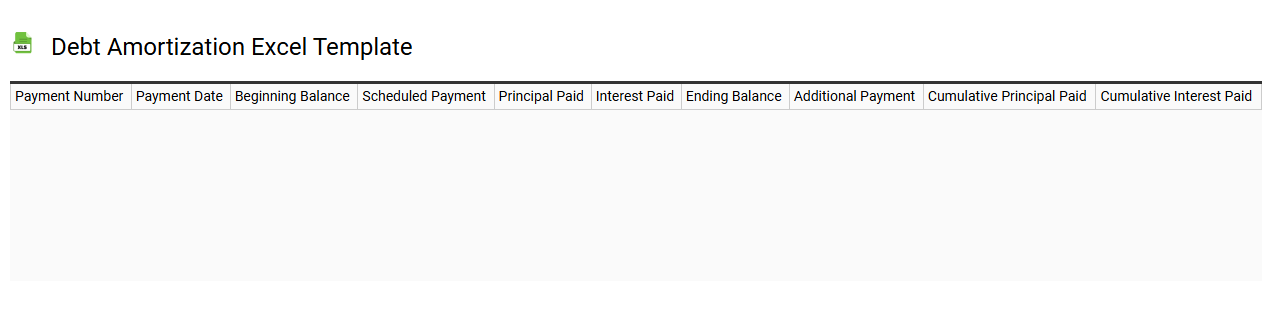

Debt amortization Excel template

💾 Debt amortization Excel template template .xls

A debt amortization Excel template is a structured spreadsheet tool designed to help you track the repayment of loans over time. It typically includes sections for the loan amount, interest rate, repayment period, and scheduled payments, allowing for clear visibility into how much you owe at any given time. Each row outlines individual payment schedules, showing how much goes towards interest versus principal, and it can automatically calculate totals based on your inputs. Such a template can serve basic functions for personal finance management while also offering advanced features like sensitivity analysis and forecasting future payment scenarios.