Explore a collection of free Excel templates specifically designed for merger and acquisition timelines. These templates feature structured columns for key milestones, deadlines, and responsible parties, facilitating a clear and organized tracking process. User-friendly formats allow you to easily customize each template to fit the unique aspects of your merger or acquisition project, ensuring nothing is overlooked.

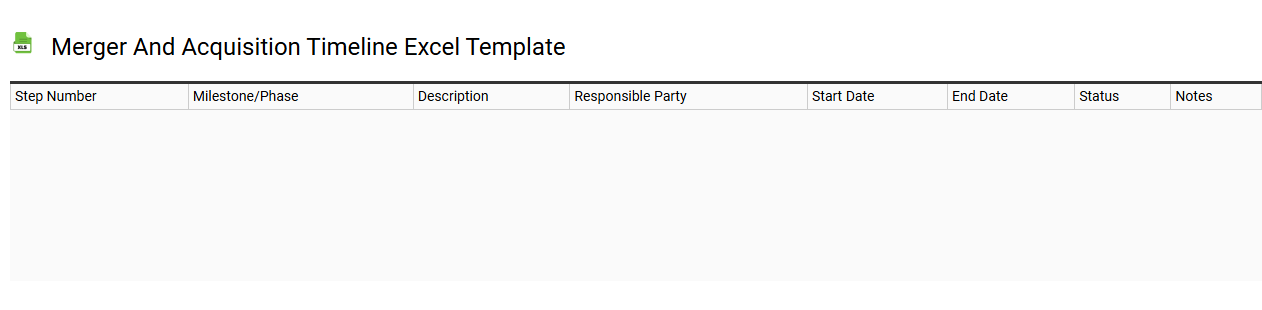

Merger and acquisition timeline Excel template

💾 Merger and acquisition timeline Excel template template .xls

A Merger and Acquisition (M&A) timeline Excel template serves as a structured tool to outline the key phases and milestones involved in the M&A process. It typically includes various stages such as due diligence, valuation assessment, deal negotiations, and closing activities, all presented in a clear, chronological format. This visual representation allows stakeholders to track progress, set deadlines, and ensure all necessary steps are completed efficiently. Your organization can utilize this template for basic project management while considering advanced capabilities like integrating financial modeling, risk assessments, and stakeholder analysis for more comprehensive oversight.

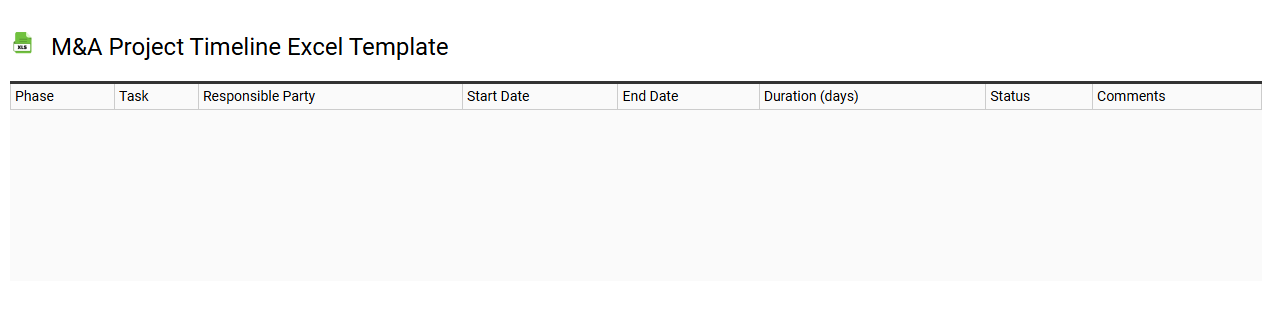

M&A project timeline Excel template

💾 M&A project timeline Excel template template .xls

An M&A project timeline Excel template is a structured tool designed to facilitate the planning and execution of mergers and acquisitions. It typically includes key phases such as due diligence, negotiations, and integration, with defined milestones and deadlines for each stage. Visual elements like Gantt charts can enhance clarity, allowing stakeholders to track progress and manage resources effectively. This template can serve your basic organizational needs while also accommodating advanced project management features like real-time collaboration and automated reporting.

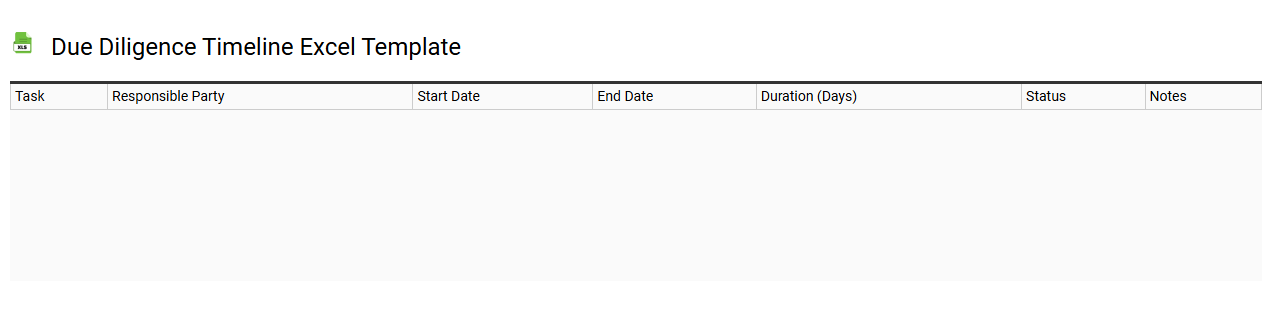

Due diligence timeline Excel template

💾 Due diligence timeline Excel template template .xls

A Due Diligence Timeline Excel template serves as a structured tool that helps track the steps and deadlines involved in the due diligence process during mergers, acquisitions, or investments. It typically outlines key activities, responsible parties, and target completion dates, facilitating efficient project management and communication among stakeholders. This template is customizable, allowing you to adapt it to specific transactions or industry requirements, ensuring clarity and accountability throughout the process. Such a tool can streamline basic due diligence tasks and may be expanded to include complex analyses like financial modeling, risk assessment, and compliance verification for advanced applications.

Acquisition process tracker Excel template

![]()

💾 Acquisition process tracker Excel template template .xls

An Acquisition Process Tracker Excel template is a structured tool designed to streamline the management of acquisition activities for your organization. This template typically includes key columns such as acquisition phases, timelines, responsible parties, and status updates, allowing you to monitor progress efficiently. You can customize it to align with specific project requirements, ensuring clarity and accountability in each step. Leveraging this template can enhance basic tracking needs and support advanced project management techniques like stakeholder analysis and risk assessment.

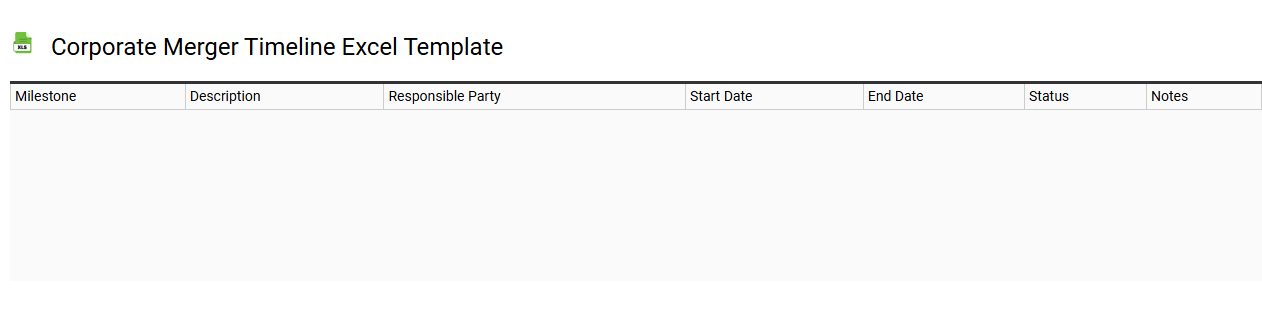

Corporate merger timeline Excel template

💾 Corporate merger timeline Excel template template .xls

A Corporate merger timeline Excel template serves as a structured tool to track and visualize the key phases of a merger. This template includes distinct sections for pre-merger activities, due diligence, regulatory approvals, and post-merger integration. Each phase is presented in a clear, linear format with specific timeframes, allowing for easy updates and adjustments as the merger progresses. You can highlight critical milestones and assign responsibilities, ensuring that every aspect of the merger process is accounted for while also enabling insights into complex project management needs. For more intricate planning, consider incorporating Gantt charts or customized dashboards within your template to enhance project tracking and reporting capabilities.

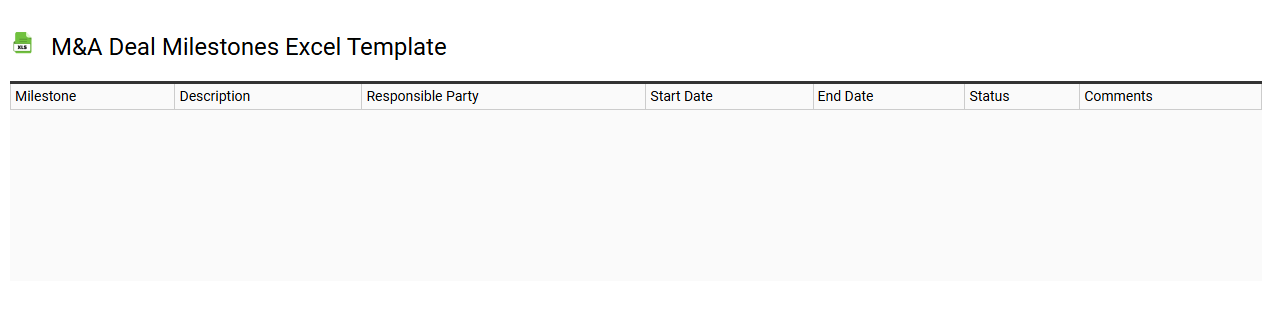

M&A deal milestones Excel template

💾 M&A deal milestones Excel template template .xls

A M&A deal milestones Excel template organizes key phases and activities of mergers and acquisitions. This template typically includes sections for due diligence, regulatory approvals, financing, and integration activities, allowing stakeholders to track progress efficiently. You can customize it to suit specific transaction requirements and timelines, enhancing clarity for all parties involved. Using this template can help streamline basic processes while also accommodating advanced analytical needs, such as scenario modeling or risk assessment frameworks.

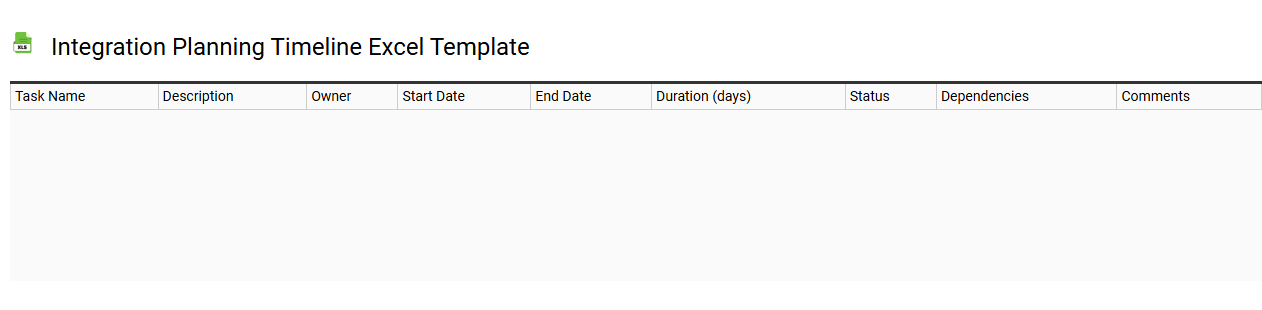

Integration planning timeline Excel template

💾 Integration planning timeline Excel template template .xls

An Integration Planning Timeline Excel template serves as a structured tool to outline, manage, and track the various phases of a project's integration process. This template typically includes essential milestones, deliverable due dates, and key stakeholders involved, allowing for clear visualization of the entire integration journey. You can customize it to fit your project's unique needs, making it suitable for different timelines and complexities. Beyond basic usage for monitoring deadlines, this template can also facilitate advanced resource allocation, dependency mapping, and risk management analysis.

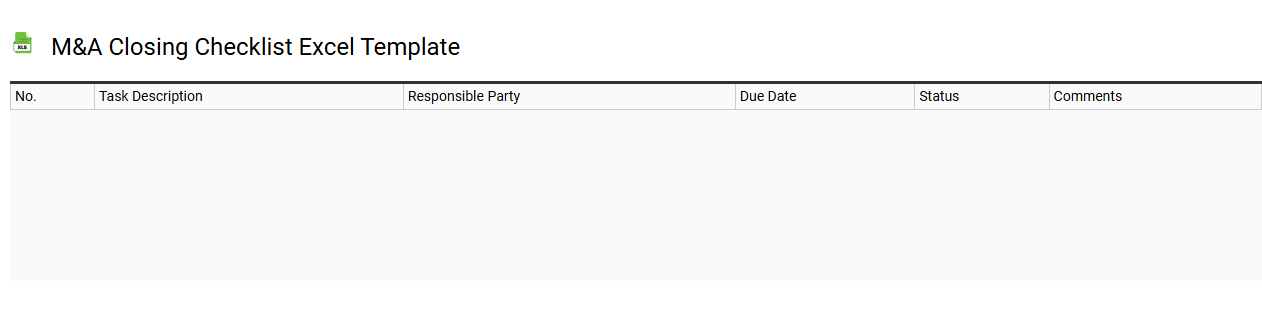

M&A closing checklist Excel template

💾 M&A closing checklist Excel template template .xls

A M&A closing checklist Excel template is a structured tool designed to facilitate the merger and acquisition process, ensuring that all essential tasks and documentation are systematically addressed before finalizing the deal. This template typically includes key items such as regulatory approvals, financial due diligence outcomes, and necessary legal documentation, providing a clear sequence of actions for all parties involved. By organizing these elements into a user-friendly format, it helps streamline communication and collaboration, while minimizing potential oversights. You can adapt this basic template to fit your company's specific needs, considering further enhancements like integration planning or post-merger evaluation metrics.

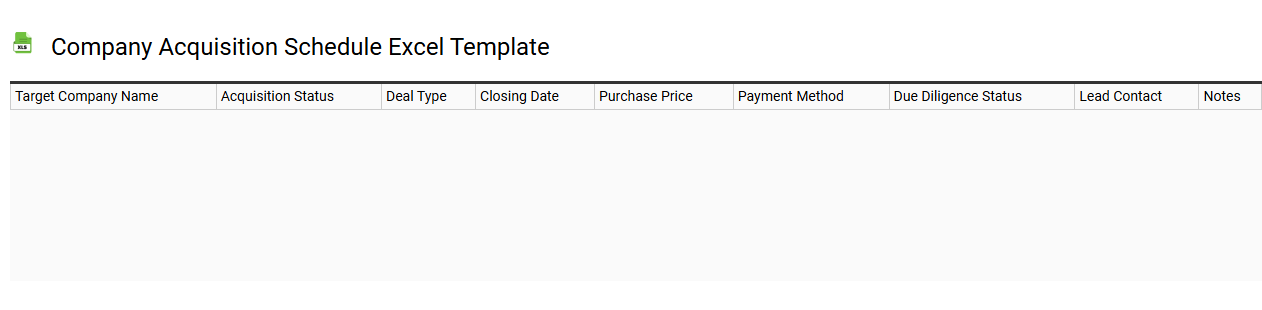

Company acquisition schedule Excel template

💾 Company acquisition schedule Excel template template .xls

A company acquisition schedule Excel template is a structured spreadsheet designed to streamline the planning and tracking of acquisition processes. This template typically includes key sections such as timelines, responsible parties, and deliverables, ensuring all aspects of the acquisition are organized and accessible. You can customize it to reflect various acquisition phases, like due diligence, valuation, and legal approvals. Basic usage involves filling in the necessary information, with potential for advanced needs, such as integration planning or financial modeling for future acquisitions.

Pre-merger activity tracker Excel template

![]()

💾 Pre-merger activity tracker Excel template template .xls

A Pre-merger Activity Tracker Excel template organizes and monitors all essential tasks and milestones leading up to a merger or acquisition. This tool includes sections for due diligence, stakeholder communications, and regulatory compliance timelines, ensuring you stay organized throughout the process. Each entry allows for detailed notes, responsible parties, and deadlines, promoting accountability and clarity among team members. As you manage pre-merger activities, this template can also be adapted for future integration strategies or post-merger evaluations, enhancing your overall project management capabilities.