Explore a variety of free XLS templates designed specifically for payroll audit sheets in Excel. These templates streamline tracking employee hours, wages, and deductions, ensuring accuracy and compliance. You can customize the formats to fit your specific payroll requirements, making audits more efficient and less time-consuming.

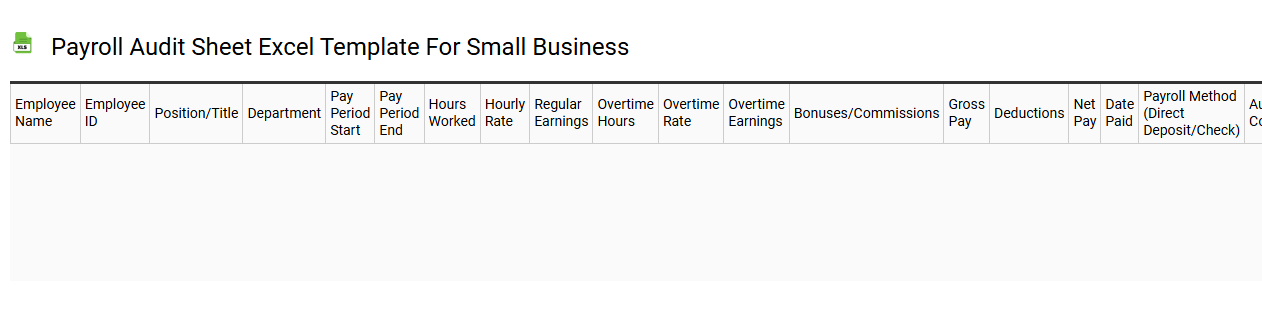

Payroll audit sheet Excel template for small business

💾 Payroll audit sheet Excel template for small business template .xls

A Payroll Audit Sheet Excel template for small businesses serves as a systematic tool to track and verify payroll data. This template typically encompasses employee names, hours worked, wages, tax deductions, and other relevant compensation details. By using this sheet, you can ensure accuracy in payroll processing, identify discrepancies, and maintain compliance with labor regulations. For those looking to enhance their payroll management, the template can be expanded to include advanced features like automated calculations for overtime, tax projections, and detailed reporting functionalities.

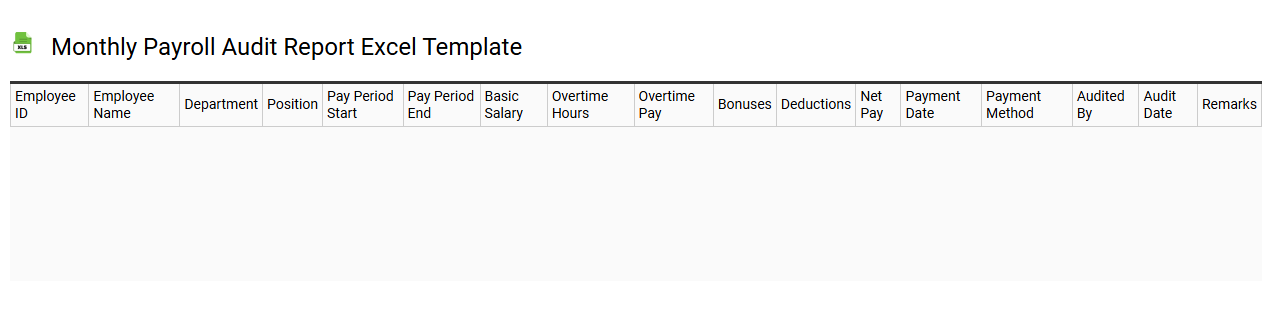

Monthly payroll audit report Excel template

💾 Monthly payroll audit report Excel template template .xls

A Monthly Payroll Audit Report Excel template is a tool designed to streamline the process of reviewing payroll data for accuracy and compliance. It typically includes sections for employee names, hours worked, wages, deductions, and benefit contributions, enabling you to analyze salary expenses effectively. With built-in formulas, this template can automatically calculate totals and identify discrepancies, facilitating a quicker review process. Utilizing this template can not only help ensure accurate payroll processing but also serve as a foundation for advanced analytics, such as forecasting salary trends or modeling employee turnover.

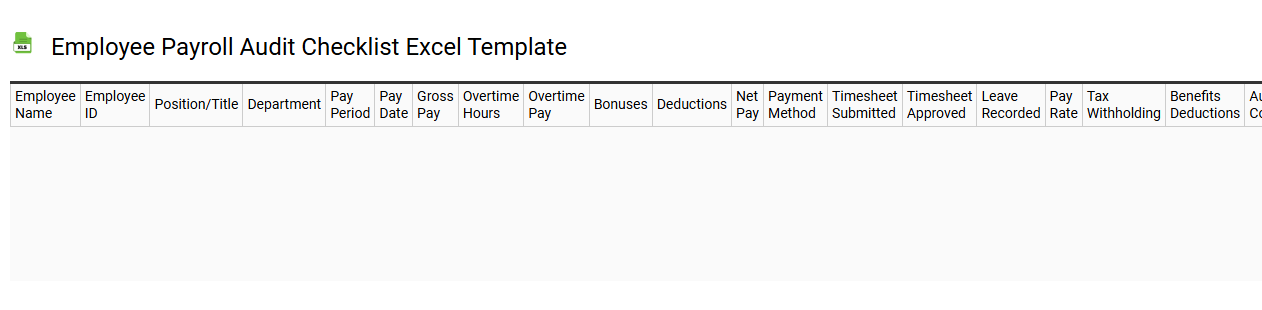

Employee payroll audit checklist Excel template

💾 Employee payroll audit checklist Excel template template .xls

An Employee Payroll Audit Checklist Excel template is a structured tool designed to streamline the process of reviewing payroll records. This template includes various categories such as employee information, hours worked, overtime calculations, deductions, and tax withholdings. You can easily input data and verify accuracy, ensuring compliance with labor laws and company policies. By maintaining this checklist, you're equipped to identify discrepancies and improve payroll accuracy, while also laying the groundwork for more advanced payroll audit analytics like trend analysis and compliance forecasting.

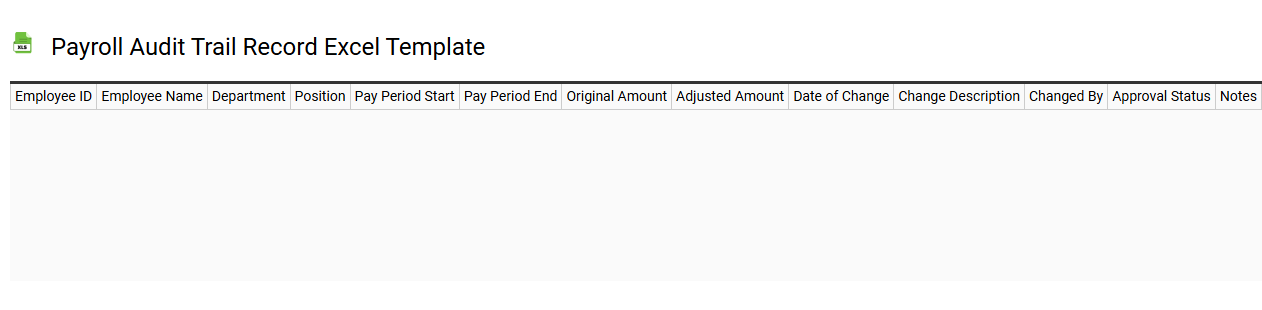

Payroll audit trail record Excel template

💾 Payroll audit trail record Excel template template .xls

A Payroll audit trail record Excel template serves as a structured tool for meticulously tracking all payroll-related transactions within an organization. It typically includes essential fields such as employee names, payment dates, wages, deductions, and any adjustments made to the payroll. This template enhances accountability by providing a clear record that can be referenced during audits or reconciliations. Your organization can leverage this tool for basic record-keeping, while also considering its potential for advanced analytics, compliance checks, and audit readiness.

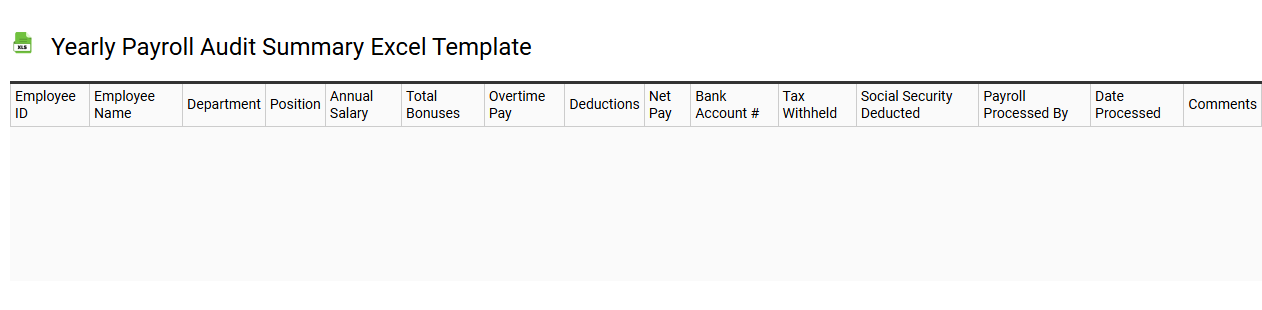

Yearly payroll audit summary Excel template

💾 Yearly payroll audit summary Excel template template .xls

A Yearly Payroll Audit Summary Excel template serves as an essential tool for businesses to evaluate their payroll expenditures over a 12-month period. This organized spreadsheet captures key data such as employee names, salaries, deductions, and tax contributions, enabling effective assessment of compliance with labor laws and company policies. You can easily identify discrepancies, track overtime payments, and maintain accurate records of bonuses or adjustments throughout the year. Utilizing this template not only streamlines annual audits but also lays the groundwork for more complex analyses, such as predictive payroll forecasting and advanced data analytics for strategic decision-making.

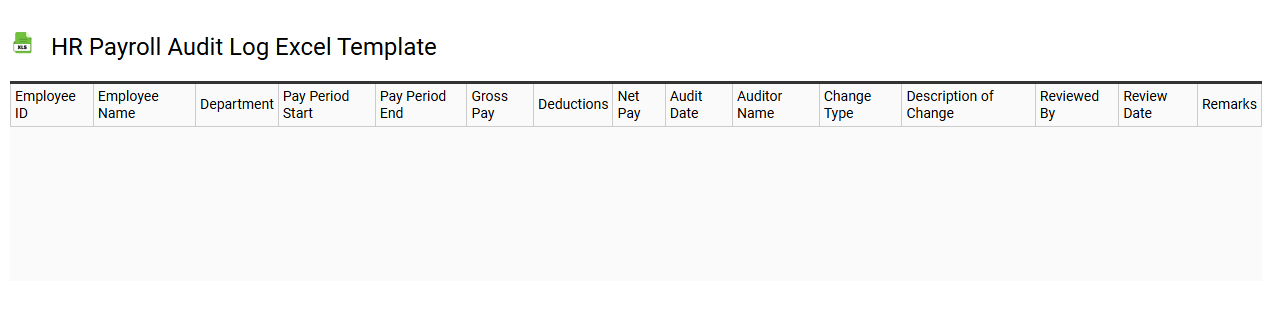

HR payroll audit log Excel template

💾 HR payroll audit log Excel template template .xls

An HR payroll audit log Excel template is a structured tool designed for tracking and reviewing payroll activities within an organization. It typically includes columns for employee names, identification numbers, pay periods, hours worked, overtime hours, deductions, and net pay. This template serves to ensure accuracy in payroll processing and compliance with regulations, enabling HR professionals to identify discrepancies and address them promptly. You can utilize this template for basic payroll tracking, while advanced uses may involve integrating it with HR analytics and financial forecasting.

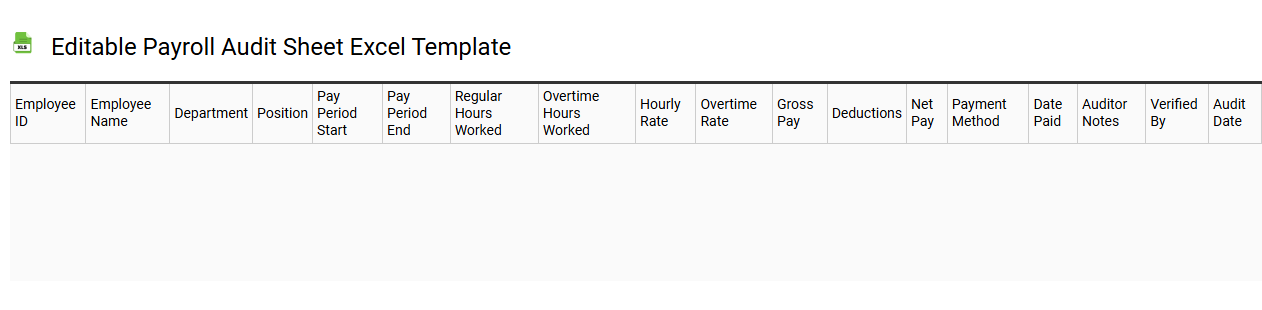

Editable payroll audit sheet Excel template

💾 Editable payroll audit sheet Excel template template .xls

An editable payroll audit sheet Excel template serves as a crucial tool for businesses to maintain accurate and compliant payroll records. This template allows you to log employee hours, calculate wages, and track deductions systematically, providing a clear overview of payroll expenses. Featuring preset formulas for tax calculation and compliance checks, it simplifies the auditing process by enabling quick identification of discrepancies. With this template, your basic payroll management needs can evolve into more complex functions like real-time data analysis and integration with accounting software.

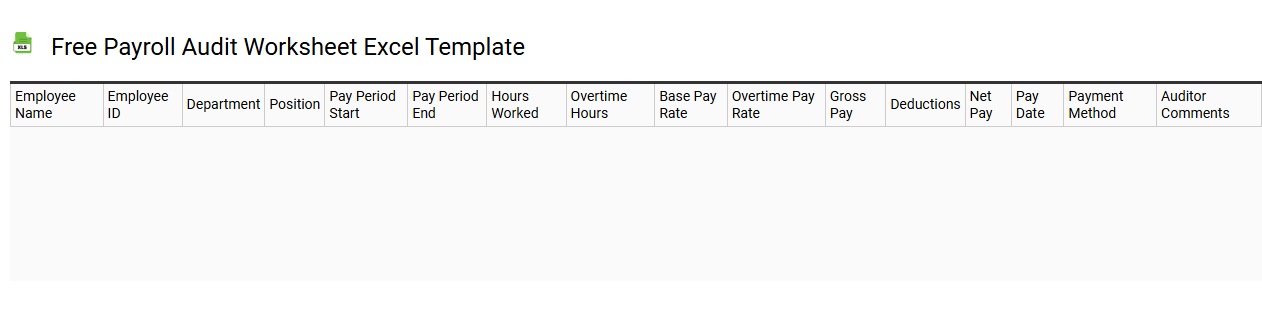

Free payroll audit worksheet Excel template

💾 Free payroll audit worksheet Excel template template .xls

A Free Payroll Audit Worksheet Excel template is a tool designed to help businesses systematically review their payroll processes. This template typically includes various sections to evaluate employee data, pay rates, deductions, and tax calculations. By organizing this information, you can identify discrepancies or errors in payroll management, ensuring compliance with local regulations. As you familiarize yourself with basic payroll auditing practices, this template can also serve as a foundation for more advanced analytics, such as forecasting payroll costs or assessing labor productivity.

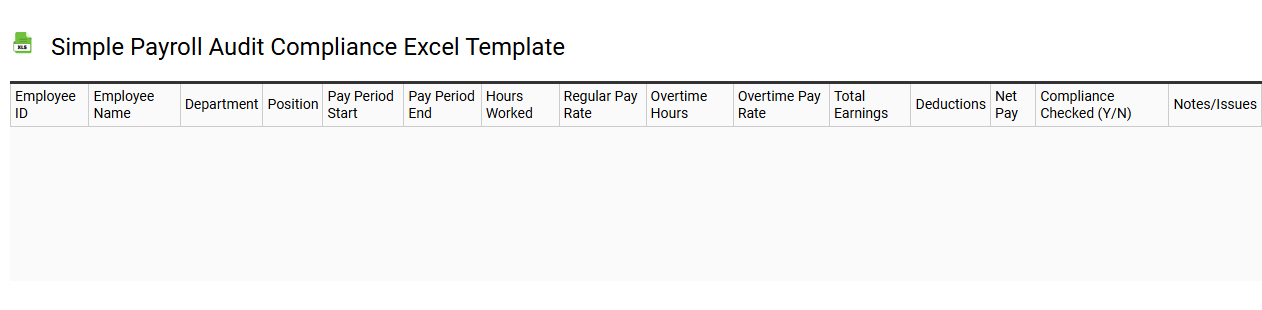

Simple payroll audit compliance Excel template

💾 Simple payroll audit compliance Excel template template .xls

A simple payroll audit compliance Excel template streamlines the process of ensuring payroll accuracy and adherence to regulatory requirements. This template typically includes columns for employee names, hours worked, wages, tax deductions, and other relevant payroll components, facilitating quick data entry and validation. Built-in formulas enable automatic calculations for gross and net pay, making it easier to spot discrepancies. For your business, such a template not only aids in basic payroll management but can also scale to accommodate advanced features like integration with HR systems or compliance tracking tools.