Explore an array of free XLS templates tailored specifically for calculating mortgage closing costs. Each template offers a user-friendly layout, allowing you to input your loan details, interest rates, and various closing expenses seamlessly. Whether you're a first-time homebuyer or refinancing an existing mortgage, these resources empower you to understand and manage your financial obligations effectively.

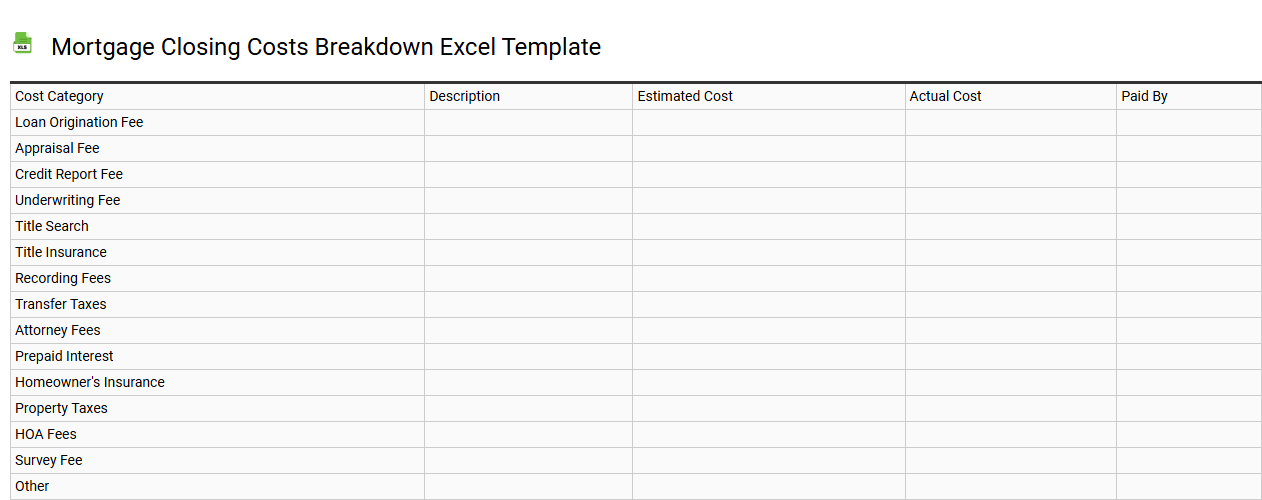

Mortgage closing costs breakdown Excel template

💾 Mortgage closing costs breakdown Excel template template .xls

A Mortgage closing costs breakdown Excel template is a detailed spreadsheet designed to help homebuyers understand and manage the various expenses associated with closing on a mortgage. This template typically includes categories such as loan origination fees, appraisal fees, title insurance, and attorney fees, along with specific line items for each cost. Users can input estimated amounts, making it easy to see the total cash required at closing and identify where adjustments might be necessary. You can also expand this tool to track future expenses or compare different loan scenarios using advanced financial modeling techniques.

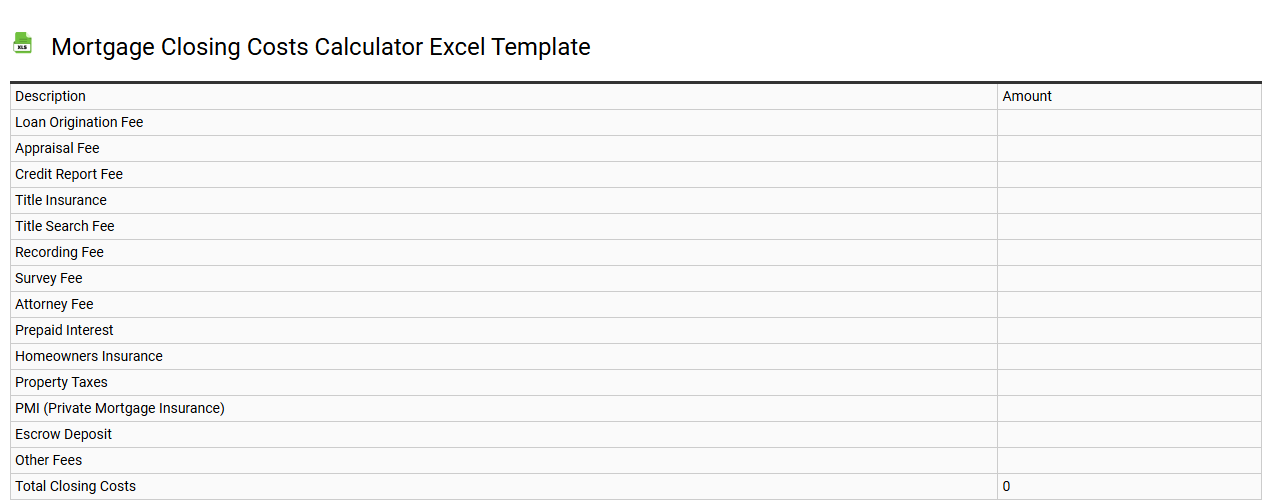

Mortgage closing costs calculator Excel template

💾 Mortgage closing costs calculator Excel template template .xls

A Mortgage Closing Costs Calculator Excel template is a customizable tool designed to help homebuyers estimate the expenses associated with closing a mortgage. This template typically includes sections for various closing costs, such as appraisal fees, title insurance, attorney fees, and pre-paid taxes, allowing users to input their specific figures. Users can easily adjust different variables to see how changes affect the total closing costs, providing a clear financial picture. Beyond basic functionalities, this template can be enhanced with complex financial formulas or integrated with other financial planning tools for more advanced investment analysis.

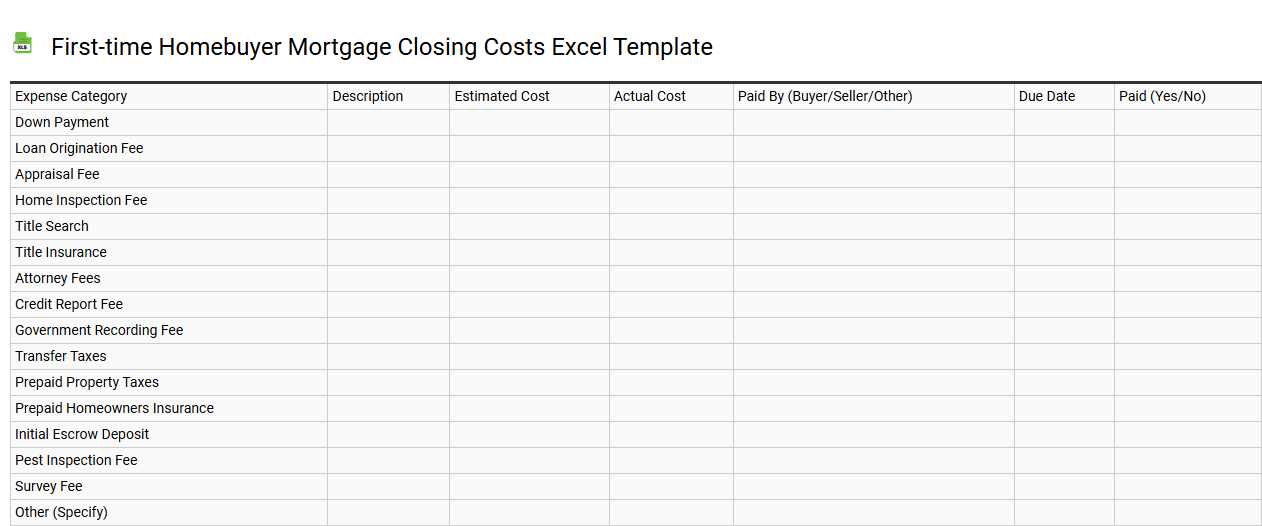

First-time homebuyer mortgage closing costs Excel template

💾 First-time homebuyer mortgage closing costs Excel template template .xls

A First-time Homebuyer Mortgage Closing Costs Excel template is a practical tool designed to help prospective homeowners estimate and organize the various closing costs associated with purchasing a home. This spreadsheet typically includes categories such as lender fees, appraisal costs, title insurance, and prepaid taxes or insurance, providing you a clear breakdown of what to expect at closing. By filling out the template with specific figures related to your transaction, you can gain insights into the total cash needed for your home purchase. Understanding these costs can also assist in budgeting for future financial responsibilities, paving the way for advanced financial planning and investment strategies.

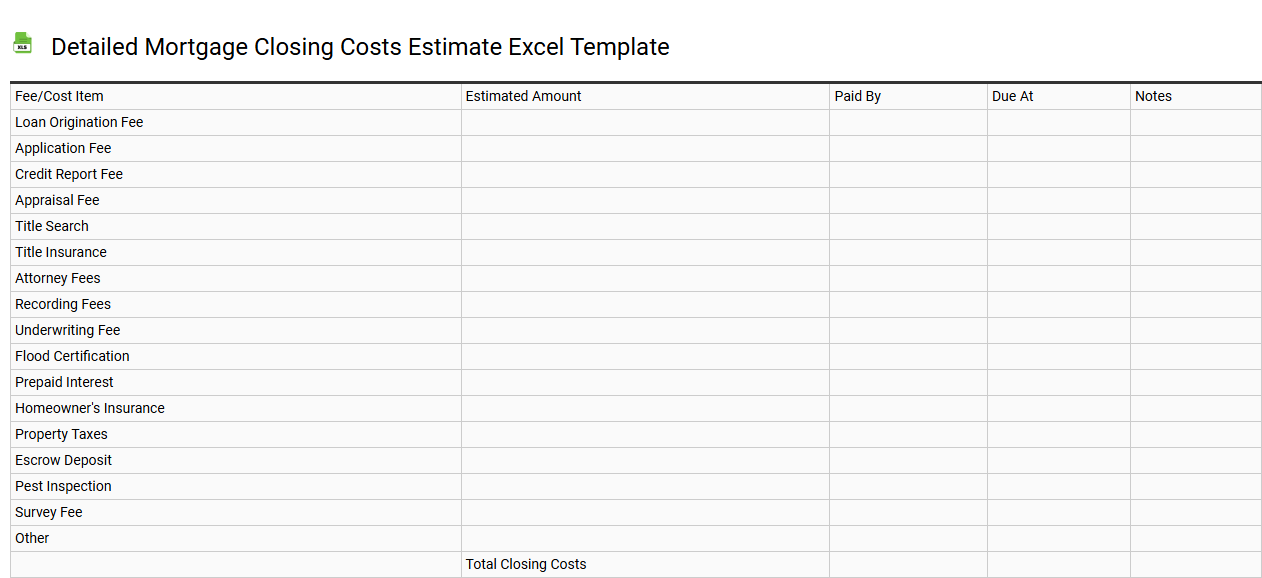

Detailed mortgage closing costs estimate Excel template

💾 Detailed mortgage closing costs estimate Excel template template .xls

A Detailed Mortgage Closing Costs Estimate Excel template provides a clear breakdown of all potential expenses associated with closing a mortgage. It typically includes line items such as appraisal fees, title insurance, credit report charges, and attorney fees, allowing for a comprehensive overview of costs. You can easily customize the template to reflect specific rates and fees from lenders, ensuring accurate estimates tailored to your situation. Understanding these costs is vital for effective budgeting, and while this template serves basic forecasting needs, advanced calculations can incorporate variables like interest rate fluctuations and amortization schedules.

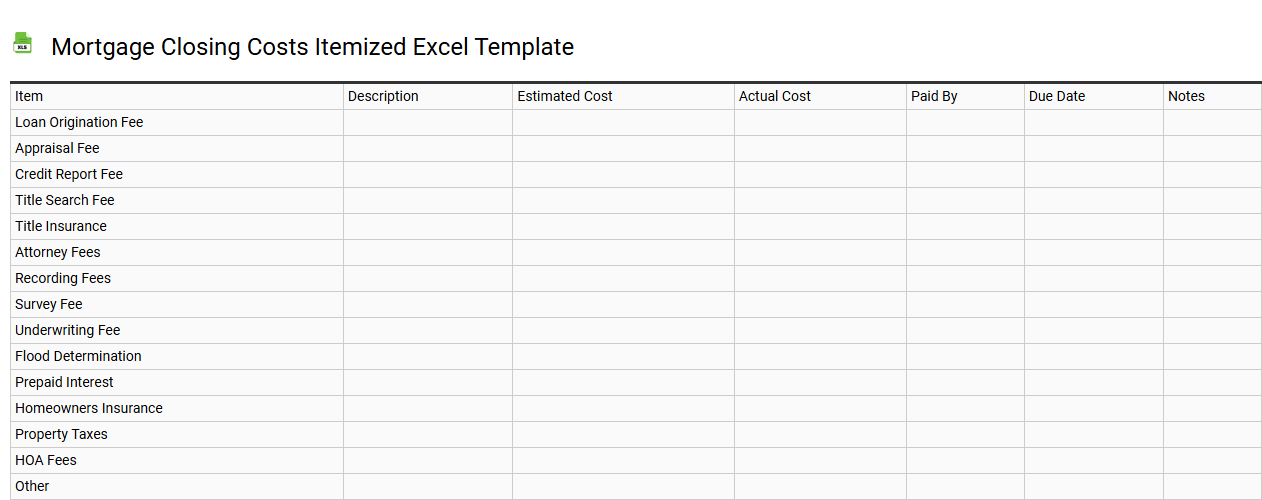

Mortgage closing costs itemized Excel template

💾 Mortgage closing costs itemized Excel template template .xls

A mortgage closing costs itemized Excel template serves as a practical tool for homebuyers, helping to clearly outline and calculate the various expenses associated with finalizing a mortgage. This template typically includes fields for major cost categories such as loan origination fees, title insurance, appraisal fees, and attorney fees, allowing for organized tracking of all financial obligations. You can customize the template according to your specific mortgage details and expected costs, providing a personalized overview of your financial responsibilities. Through this comprehensive format, you can effectively manage your immediate expenses while strategizing for potential future needs like refinancing or home equity loans.

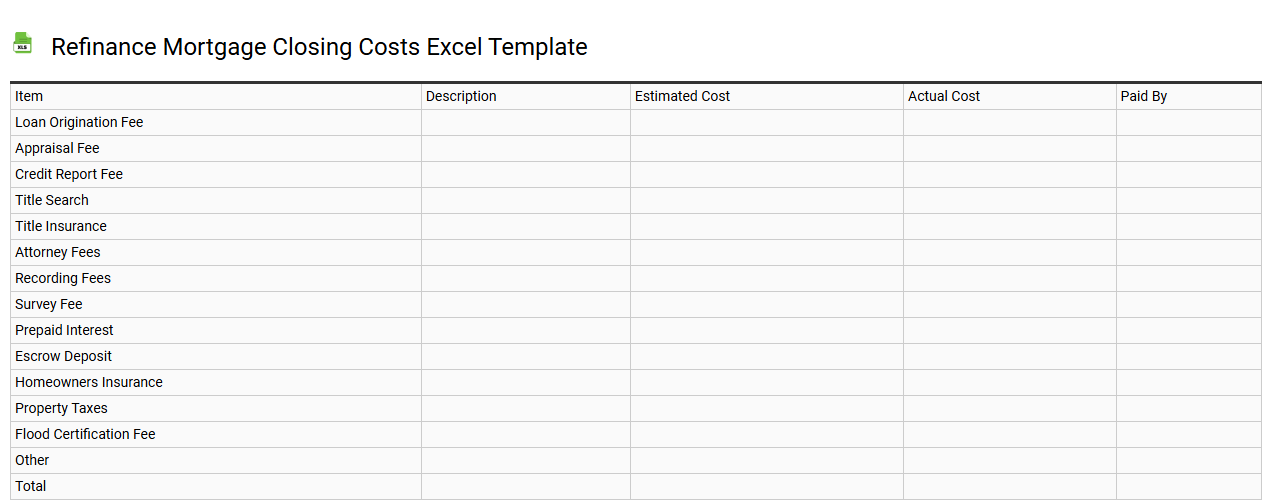

Refinance mortgage closing costs Excel template

💾 Refinance mortgage closing costs Excel template template .xls

A refinance mortgage closing costs Excel template is a digital tool designed to help you calculate and track the expenses associated with refinancing a mortgage. This template typically includes fields for entering loan amounts, interest rates, and various closing costs such as appraisal fees, title insurance, and attorney fees. You can easily adjust parameters to see how different scenarios impact your overall costs, providing a clear financial picture. This template not only supports basic refinancing calculations but also has potential uses for more advanced financial modeling, including amortization schedules and breakeven analysis.

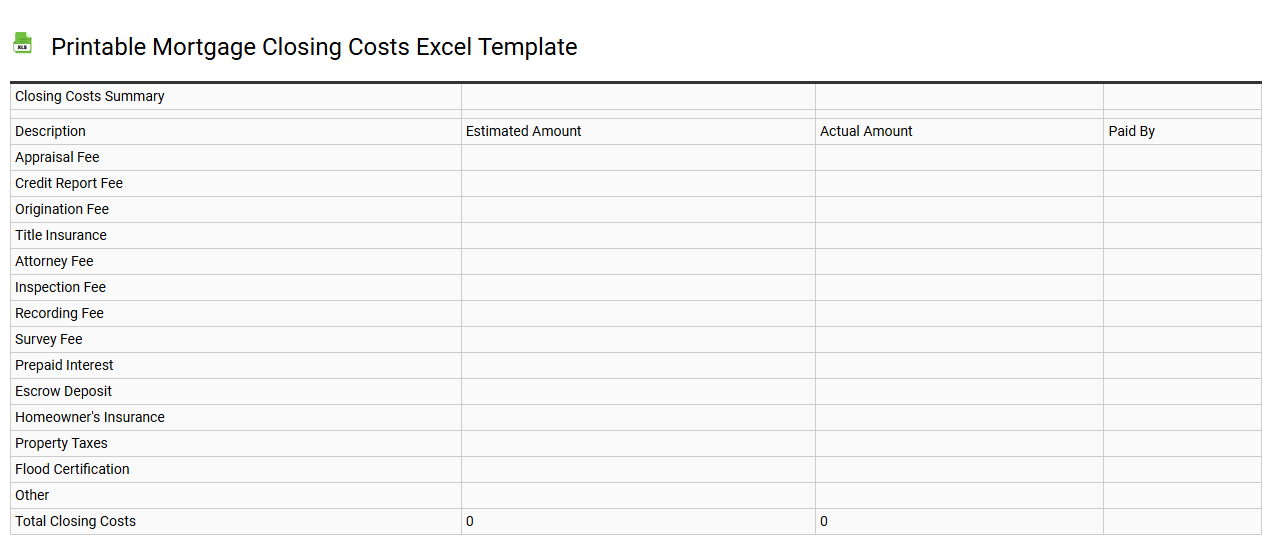

Printable mortgage closing costs Excel template

💾 Printable mortgage closing costs Excel template template .xls

A Printable mortgage closing costs Excel template is a pre-formatted spreadsheet designed to help homeowners and buyers calculate and organize their closing expenses associated with a mortgage. This template typically includes line items for various costs such as loan origination fees, title insurance, appraisal fees, and inspection costs. You can easily input your financial data, allowing you to gain a clear overview of the total costs you may incur during the closing process. Such templates can serve as a valuable tool for budgeting your home purchase while also facilitating a deeper understanding of potential future expenses related to mortgage management, such as refinancing and interest adjustments.

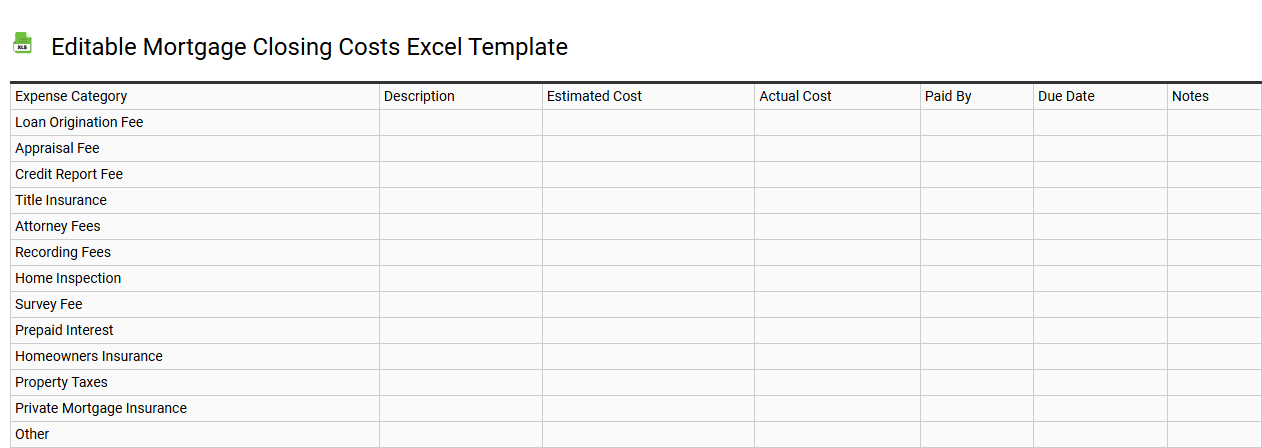

Editable mortgage closing costs Excel template

💾 Editable mortgage closing costs Excel template template .xls

An Editable Mortgage Closing Costs Excel Template is a customizable spreadsheet designed to help homebuyers and real estate professionals systematically organize and calculate various expenses associated with closing a mortgage. This tool typically includes fields for loan origination fees, title insurance, appraisal fees, and attorney fees, allowing you to input specific values and see a comprehensive overview of total costs. The template often features formulas for automatic calculations, ensuring accuracy while providing an easy-to-understand breakdown of expenses. You can utilize this resource for basic budgeting or delve deeper into advanced financial scenarios such as amortization schedules or interest rate comparisons.

Free mortgage closing costs tracking Excel template

![]()

💾 Free mortgage closing costs tracking Excel template template .xls

A free mortgage closing costs tracking Excel template is a tool designed to help you monitor and manage expenses associated with the closing of a mortgage. This user-friendly spreadsheet typically includes categories for various charges such as loan origination fees, appraisal fees, title insurance, and other miscellaneous costs. You can easily input your estimated expenses alongside actual costs to keep track of your financial commitments throughout the mortgage process. For those looking to delve deeper, the template can be customized to include advanced calculations for amortization schedules or net present value analysis, catering to your unique financial needs.

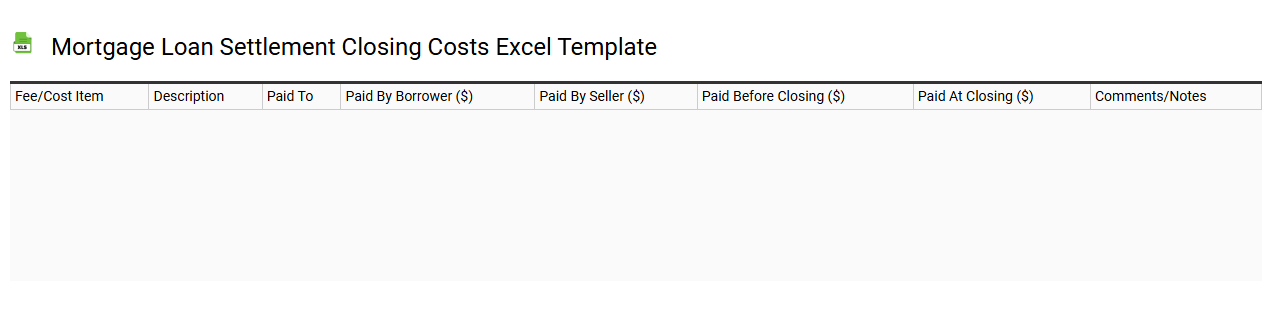

Mortgage loan settlement closing costs Excel template

💾 Mortgage loan settlement closing costs Excel template template .xls

A Mortgage loan settlement closing costs Excel template provides a structured format to track and calculate all expenses associated with closing a real estate transaction. This template typically includes line items for various costs such as loan origination fees, appraisal fees, title insurance, and property taxes, ensuring that you have a comprehensive view of your financial obligations. You can customize the template to reflect the specific details of your mortgage, including lender requirements and local fees. Understanding this template can help you better prepare for future real estate transactions and manage budgeting needs, including more complex financial strategies like amortization schedules or equity calculations.

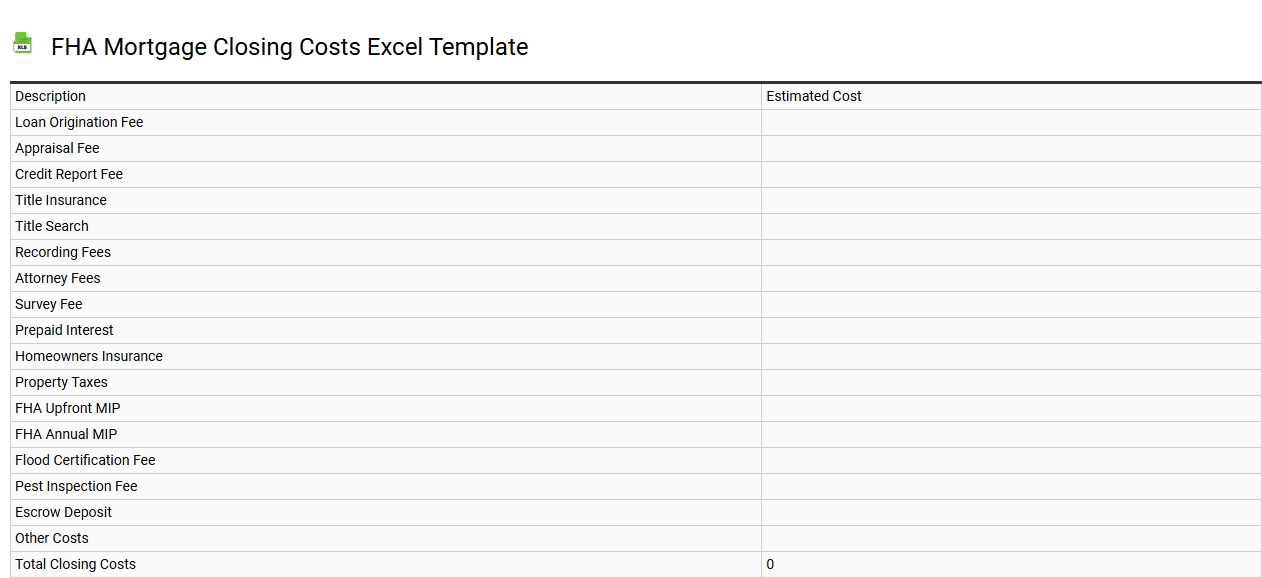

FHA mortgage closing costs Excel template

💾 FHA mortgage closing costs Excel template template .xls

An FHA mortgage closing costs Excel template provides a detailed outline of expenses associated with closing an FHA loan. This template typically includes fees such as appraisal costs, loan origination fees, title insurance, and recording fees. By organizing these costs in a spreadsheet format, you can easily track and manage your financial obligations, ensuring that all figures are accurately calculated and accounted for. Understanding these costs will help you prepare for your financial commitment and plan for potential future needs like refinancing or home equity loans.

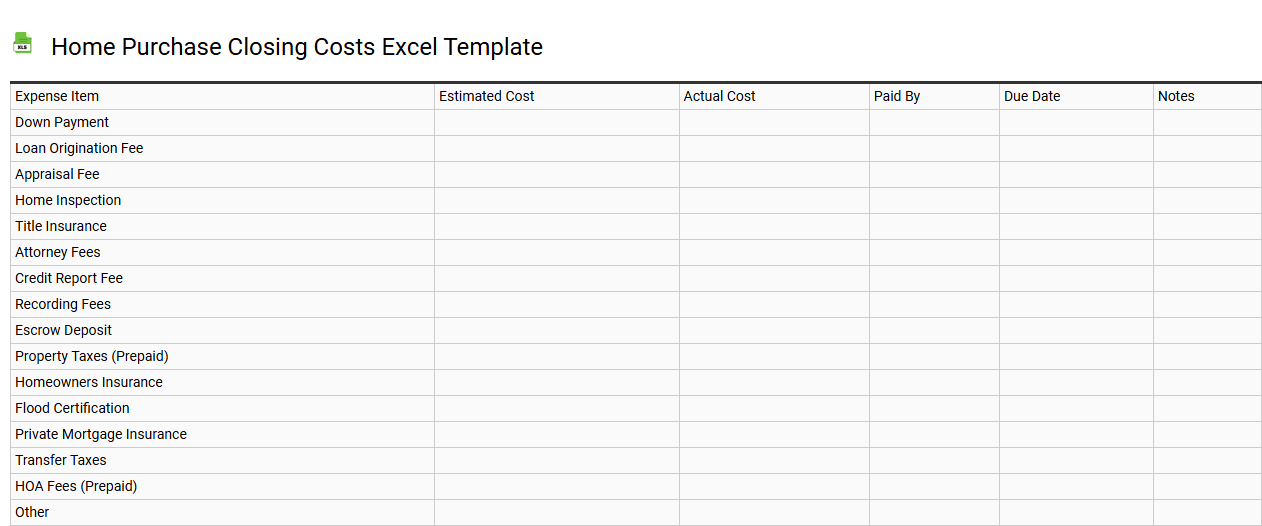

Home purchase closing costs Excel template

💾 Home purchase closing costs Excel template template .xls

A home purchase closing costs Excel template is a comprehensive tool designed to help you estimate and manage the various expenses incurred during the closing process of a real estate transaction. This template typically includes line items such as loan origination fees, appraisal fees, title insurance, attorney fees, and property taxes, allowing for easy tracking and organization of all related costs. It provides an organized layout where you can input specific data, making it easier for you to calculate the total closing costs and plan your budget accordingly. Understanding this template's functionality is crucial for first-time homebuyers and seasoned investors, as it can further assist in detailed financial analysis and decision-making through advanced features like amortization schedules and investment return calculations.

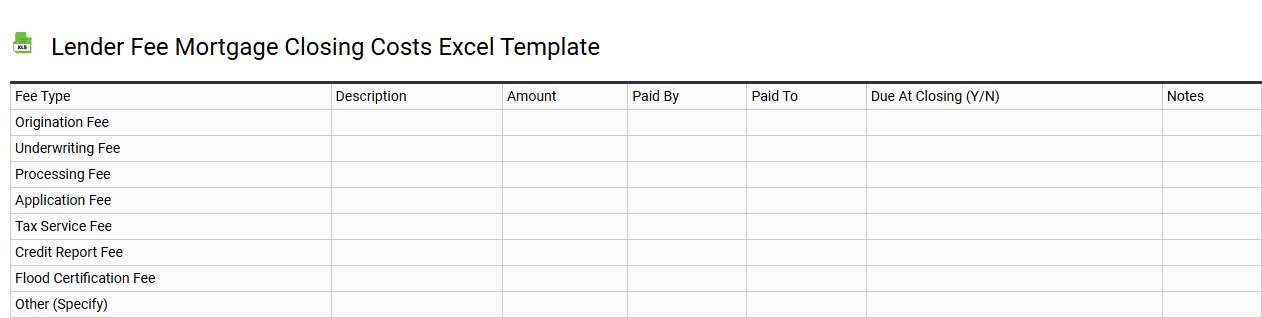

Lender fee mortgage closing costs Excel template

💾 Lender fee mortgage closing costs Excel template template .xls

A Lender Fee Mortgage Closing Costs Excel template serves as a detailed breakdown of the expenses associated with finalizing a mortgage loan. This template typically includes categories such as origination fees, underwriting fees, and processing fees, allowing you to calculate the total cost of your loan. By organizing these expenses in an Excel format, you gain the ability to easily adjust figures and assess how different fees impact your overall mortgage cost. Such a tool can aid homebuyers in budgeting and understanding their financial commitment, paving the way for future analysis involving more complex amortization schedules or interest rate evaluations.

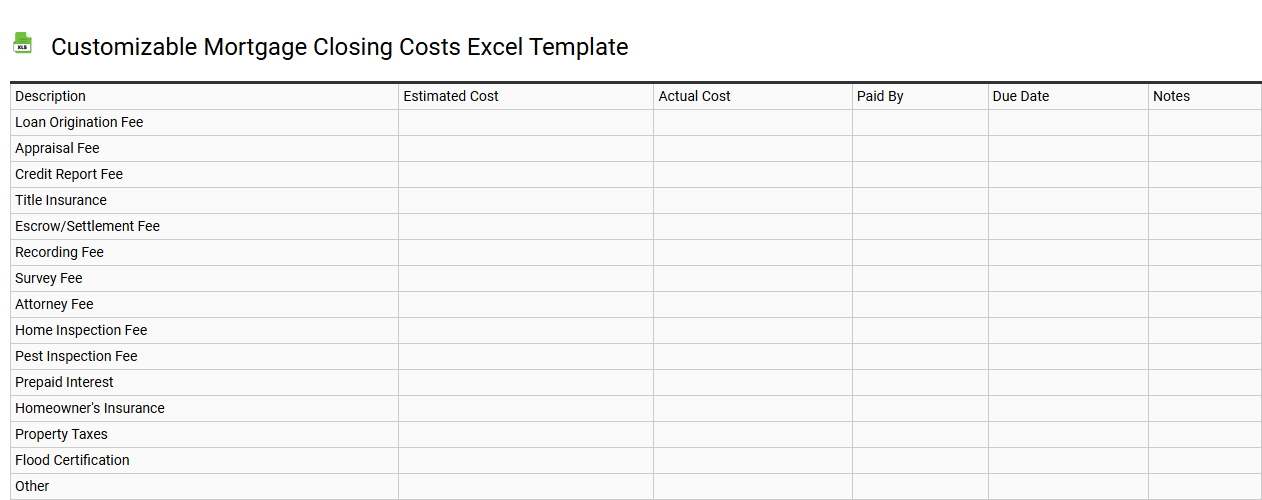

Customizable mortgage closing costs Excel template

💾 Customizable mortgage closing costs Excel template template .xls

A customizable mortgage closing costs Excel template is a versatile tool designed to help you estimate and manage expenses associated with closing a mortgage. This template typically includes line items for fees such as loan origination, appraisal, title services, and insurance, allowing you to input specific amounts based on your loan terms. You can easily adjust the template by adding or removing items, ensuring it aligns with your unique financial situation. Understanding these costs can prepare you for future needs, such as refinancing or upgrading to more complex financial modeling software.

VA loan mortgage closing costs Excel template

💾 VA loan mortgage closing costs Excel template template .xls

A VA loan mortgage closing costs Excel template serves as an invaluable tool for homebuyers utilizing VA loans. This template typically includes categories for various expenses, such as appraisal fees, title insurance, and funding fees, allowing you to itemize and track costs efficiently. Users can input their specific values to calculate total closing costs, ensuring transparency and budget management. Understanding this template can facilitate more informed financial decisions, paving the way for advanced financial planning and analysis, particularly when considering investment properties or refinancing options.

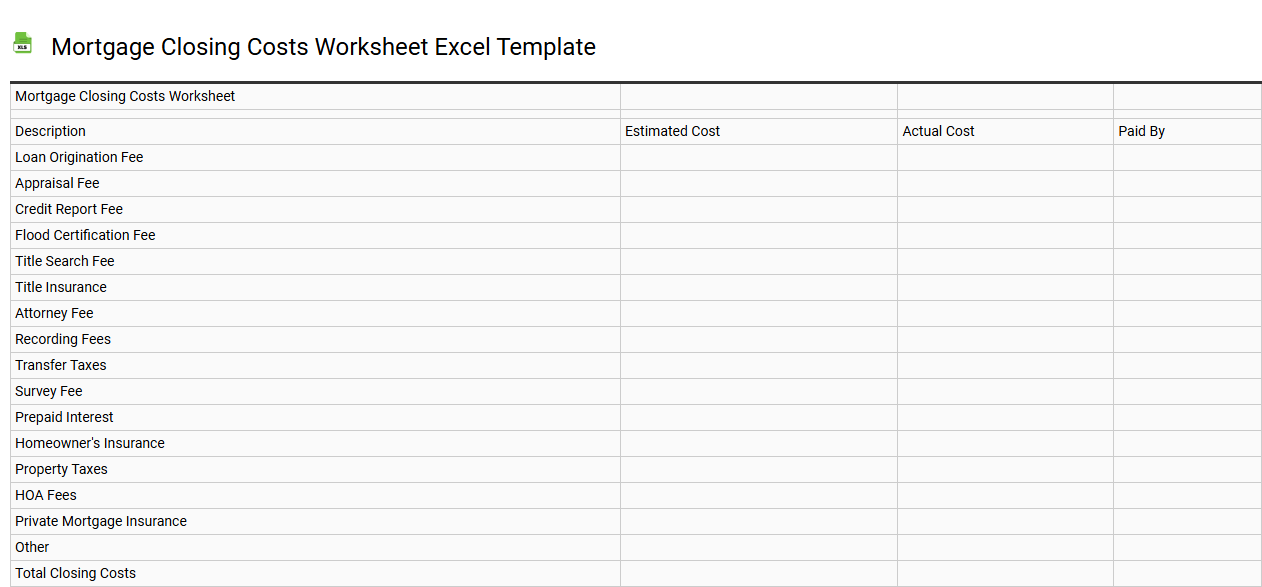

Mortgage closing costs worksheet Excel template

💾 Mortgage closing costs worksheet Excel template template .xls

A Mortgage Closing Costs Worksheet Excel template is a practical tool designed to help homebuyers and real estate professionals estimate and organize the various expenses associated with closing a mortgage loan. This template typically includes fields for essential costs such as loan origination fees, title insurance, appraisal fees, and attorney fees, allowing you to add or modify items as necessary. You can input data related to your specific mortgage transaction, streamlining the budgeting process and ensuring you understand the financial responsibilities involved. Using this template can help you navigate the complex closing process, and it may also serve as a foundation for future financial planning needs, including comprehensive cost analysis and cash flow forecasting.

Investment property mortgage closing costs Excel template

💾 Investment property mortgage closing costs Excel template template .xls

An Investment Property Mortgage Closing Costs Excel Template is a comprehensive financial planning tool designed to help real estate investors estimate and manage the various expenses incurred during the closing process of purchasing an investment property. This template typically includes detailed line items for costs such as appraisal fees, title insurance, loan origination fees, and inspection costs, allowing you to gain a clear understanding of the total amount needed at closing. Featuring user-friendly formulas and customizable fields, it enables you to input specific expenses tailored to your property and financing options, ensuring accuracy in your calculations. By utilizing this template, you can effectively plan your budget and prepare for potential additional costs related to ongoing property management or future financing needs, such as refinancing or renovations.

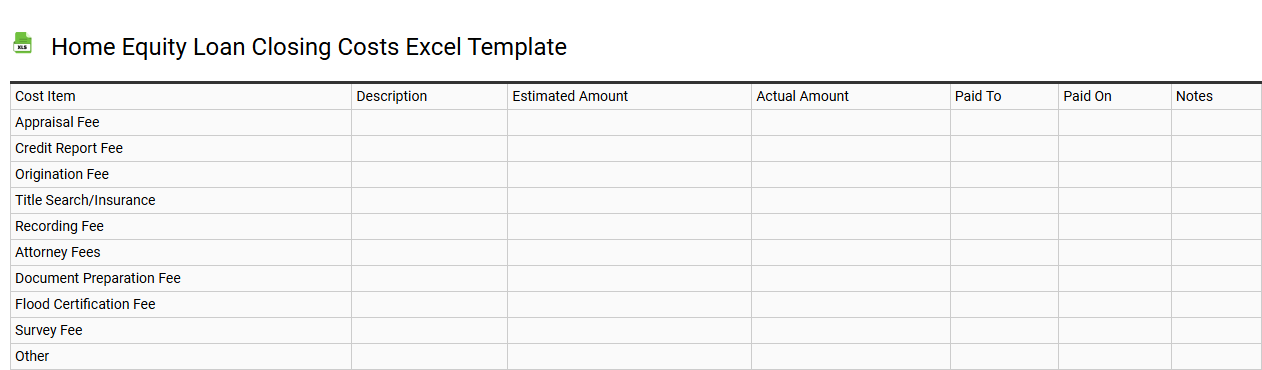

Home equity loan closing costs Excel template

💾 Home equity loan closing costs Excel template template .xls

A Home Equity Loan Closing Costs Excel template is a tool designed to help homeowners calculate the expenses associated with securing a home equity loan. This template typically includes various line items such as origination fees, appraisal costs, title insurance, and attorney fees, providing clarity on the total financial outlay required. You can easily input your specific loan details to generate an estimate of the closing costs, allowing for better budget planning. Understanding these costs is crucial, especially as you may consider further options like refinancing or exploring home equity lines of credit for advanced financial strategies.

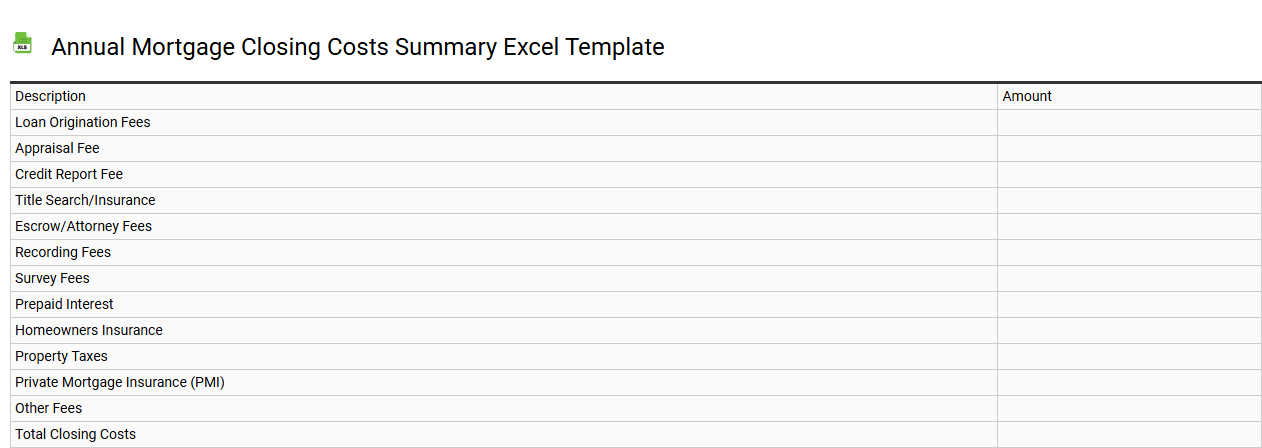

Annual mortgage closing costs summary Excel template

💾 Annual mortgage closing costs summary Excel template template .xls

The Annual Mortgage Closing Costs Summary Excel template is a financial tool designed to help you track and analyze the costs associated with closing a mortgage. It organizes expenses such as appraisal fees, title insurance, and origination fees, providing you with a comprehensive view of your financial obligations at closing. By inputting specific data, you can monitor your costs over time, identify potential savings, and make informed budgeting decisions. This template can also serve as a foundation for more advanced financial analyses, such as calculating your loan amortization and exploring interest rate variations or refinancing options.

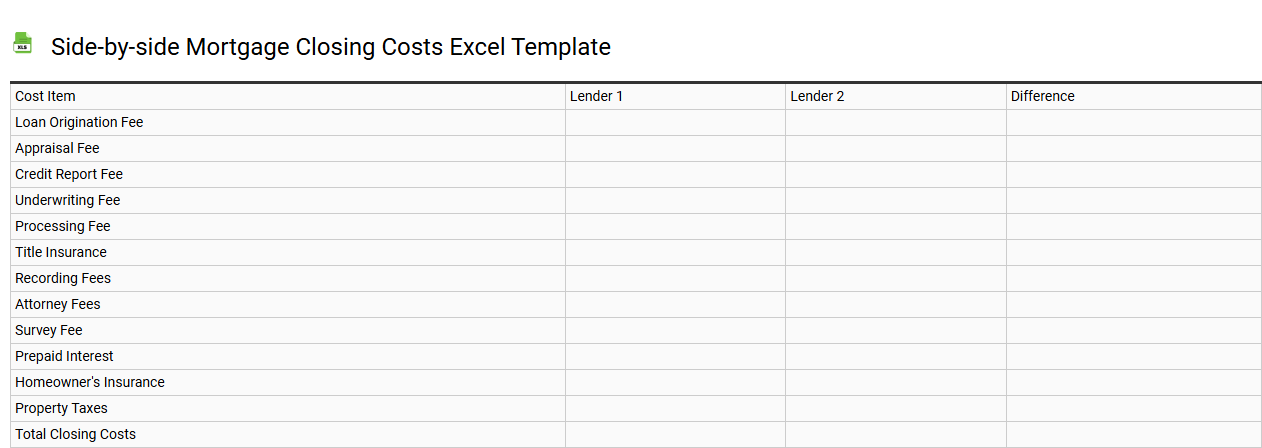

Side-by-side mortgage closing costs Excel template

💾 Side-by-side mortgage closing costs Excel template template .xls

A side-by-side mortgage closing costs Excel template provides a comprehensive way to compare various closing cost estimates from different lenders. This template typically includes categories such as loan origination fees, title insurance, appraisal fees, and other miscellaneous costs, allowing you to dissect each lender's offerings. You can easily input your specific mortgage details to generate a clear financial overview, enabling you to make well-informed decisions. For basic usage, this tool simplifies your calculations, while more advanced users can explore features like scenario analysis and customizable charts for deeper insights into potential savings.