Explore a range of free Excel templates designed specifically for first-time home buyers. These templates include sections for tracking your mortgage payments, calculating interest rates, and managing your budget effectively. With user-friendly layouts, you can easily input your financial information, allowing you to visualize your pathway to homeownership.

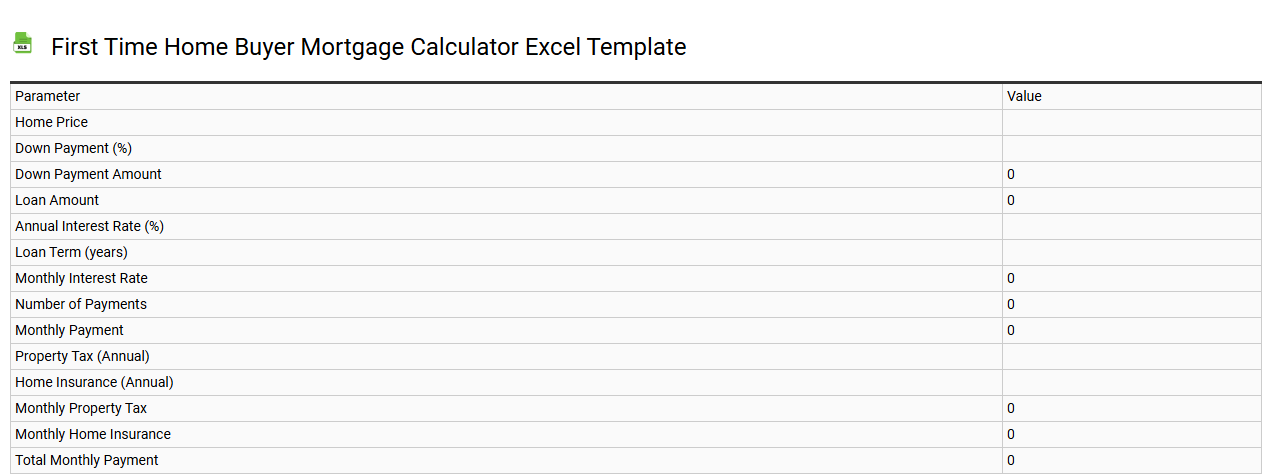

First time home buyer mortgage calculator Excel template

💾 First time home buyer mortgage calculator Excel template template .xls

A First Time Home Buyer Mortgage Calculator Excel template allows you to input key financial data such as loan amount, interest rate, and loan term to rapidly assess your mortgage options. This customizable template often includes built-in formulas that compute monthly payments, total interest paid, and amortization schedules. Features may also allow you to explore different scenarios by adjusting parameters, helping you understand how changes impact your overall mortgage costs. You can leverage this tool for basic budgeting while also adapting it for advanced analyses like prepayment strategies or exploring investment tax implications.

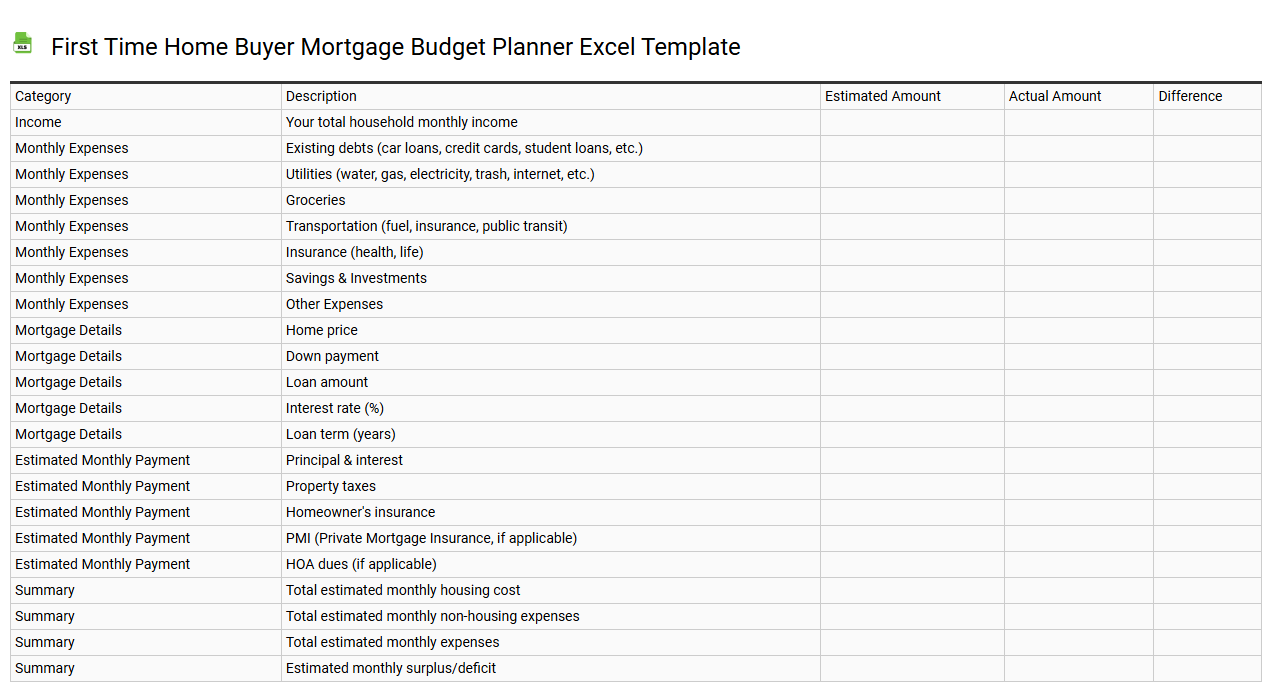

First time home buyer mortgage budget planner Excel template

💾 First time home buyer mortgage budget planner Excel template template .xls

The First Time Home Buyer Mortgage Budget Planner Excel template is a practical tool designed to help you estimate and manage your home purchasing expenses. This template typically includes sections for your anticipated home price, down payment, monthly mortgage payments, property taxes, homeowner's insurance, and associated closing costs. By inputting your financial details, you can visualize your budget, ensuring that you stay within your financial limits while considering all essential expenses. This resource not only aids in basic budgeting but can also be adapted for further financial analyses like long-term investment forecasting or property appreciation projections.

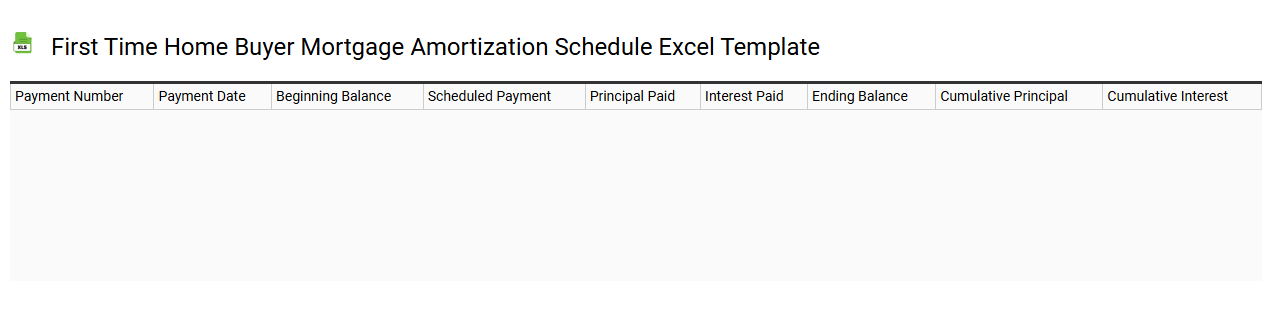

First time home buyer mortgage amortization schedule Excel template

💾 First time home buyer mortgage amortization schedule Excel template template .xls

A First-time Home Buyer Mortgage Amortization Schedule Excel template provides a structured framework for calculating monthly mortgage payments based on various parameters like loan amount, interest rate, and loan term. Users can input their financial data to visualize how their payments will decrease over time, clearly showing the remaining balance with each installment. The template often includes detailed amortization tables that break down principal and interest portions, allowing for insightful financial planning. This tool is invaluable not just for managing current mortgage commitments, but also for considering future financial strategies, such as refinancing options or early repayment assessments.

First time home buyer mortgage payment tracker Excel template

![]()

💾 First time home buyer mortgage payment tracker Excel template template .xls

A first-time home buyer mortgage payment tracker Excel template helps you monitor and manage your mortgage payments effectively. It usually includes essential fields such as loan amount, interest rate, monthly payment, and remaining balance. You can easily visualize your payment schedule, track principal and interest amounts, and see how extra payments impact your loan duration. Your financial planning benefits from this tool, enabling tracking not only current payments but also projecting future expenses and potential refinancing opportunities or adjustments in budgeting needs as your financial situation evolves.

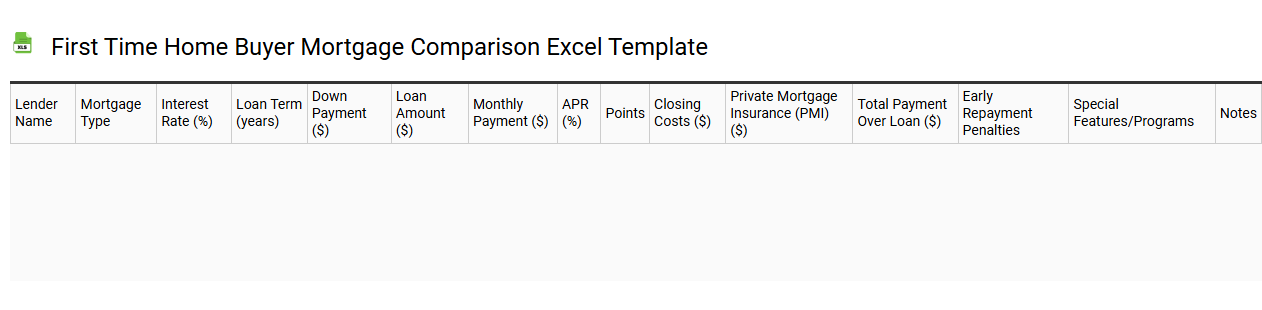

First time home buyer mortgage comparison Excel template

💾 First time home buyer mortgage comparison Excel template template .xls

A First Time Home Buyer Mortgage Comparison Excel template serves as a valuable tool that helps you evaluate various mortgage options in a structured format. You can input different lenders, interest rates, loan terms, and monthly payments to visualize how each option impacts your budget. The template enables you to calculate the total interest paid over the life of the loan, providing clarity on the long-term financial commitment. This analysis aids in making informed decisions about your mortgage choice and can be adapted to assess more complex scenarios involving additional factors such as homeowner's insurance or property taxes.

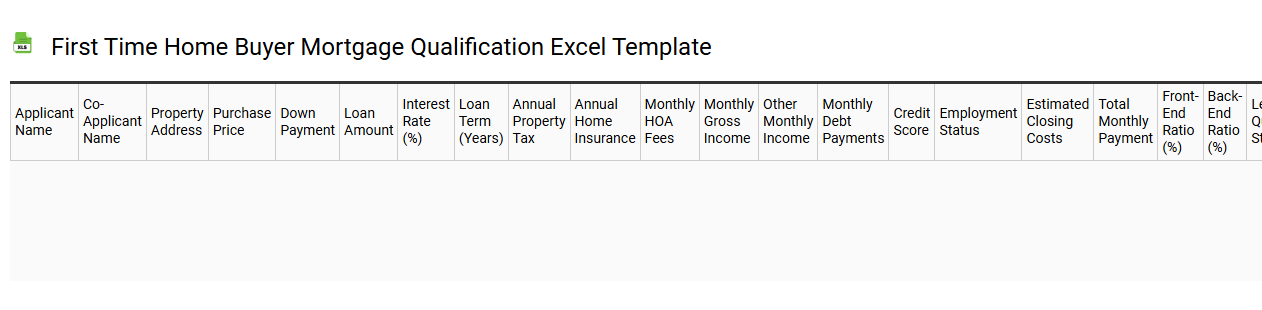

First time home buyer mortgage qualification Excel template

💾 First time home buyer mortgage qualification Excel template template .xls

The First Time Home Buyer Mortgage Qualification Excel template is a comprehensive tool designed to help aspiring homeowners evaluate their financial readiness for purchasing a property. This template typically includes sections for entering income details, expenses, debts, and potential mortgage options, providing a clear picture of your affordability. You can track various factors such as credit score requirements, down payment options, and interest rates, making it easier to compare different mortgage scenarios. Utilizing this template not only aids in understanding your current financial status but also prepares you for advanced concepts like debt-to-income ratios and loan-to-value calculations, ensuring you make well-informed decisions throughout the home buying process.

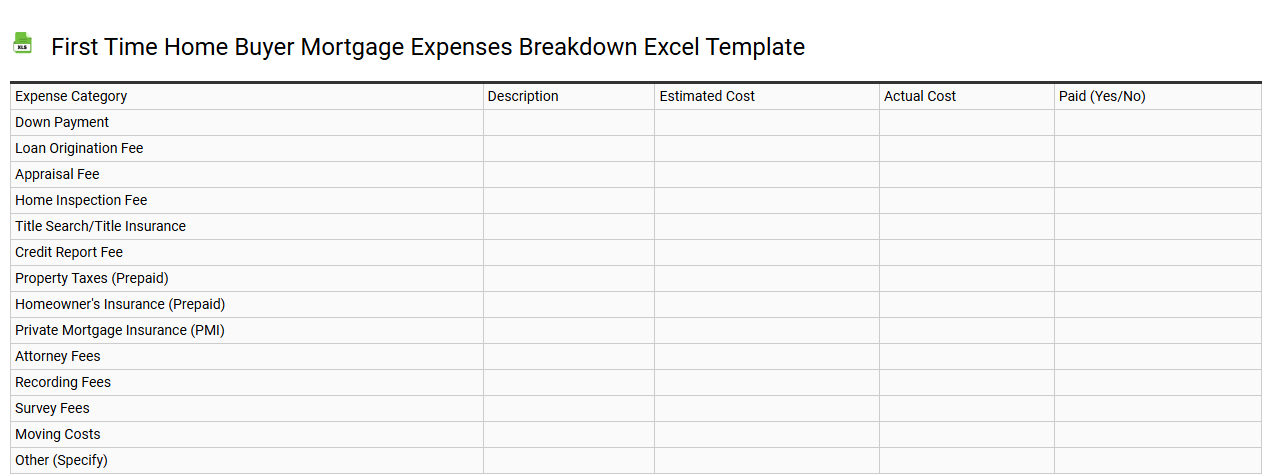

First time home buyer mortgage expenses breakdown Excel template

💾 First time home buyer mortgage expenses breakdown Excel template template .xls

A First-Time Home Buyer Mortgage Expenses Breakdown Excel template offers a detailed overview of the various costs associated with purchasing a home. You can input key data such as purchase price, down payment, loan type, and interest rates. The template typically includes calculations for monthly mortgage payments, property taxes, homeowner's insurance, and private mortgage insurance (PMI). By utilizing it, you gain insight into your total investment and can plan for potential future expenses, like maintenance costs or home improvements, as well as advanced financial planning tools like amortization schedules or equity calculations.

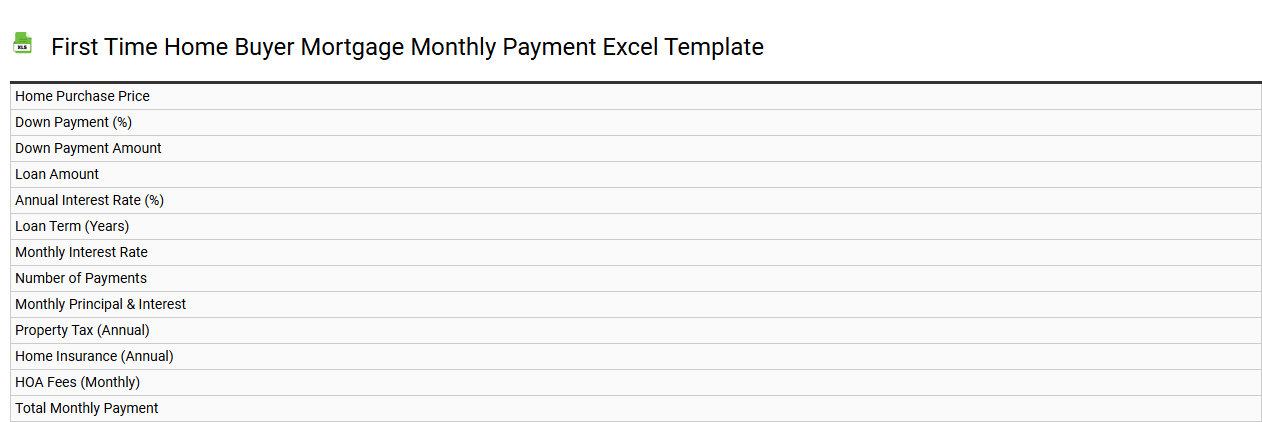

First time home buyer mortgage monthly payment Excel template

💾 First time home buyer mortgage monthly payment Excel template template .xls

The First Time Home Buyer Mortgage Monthly Payment Excel template simplifies your home buying journey by calculating monthly payments based on various loan amounts, interest rates, and loan terms. Enter your specifics, such as the purchase price, down payment, and interest rate to receive instant insights into your mortgage obligations. This user-friendly tool also includes fields for property taxes, homeowners insurance, and private mortgage insurance, ensuring comprehensive financial planning. As you explore this template, consider further potential needs like forecasting future payments, calculating amortization schedules, or integrating investment analyses for real estate portfolios.

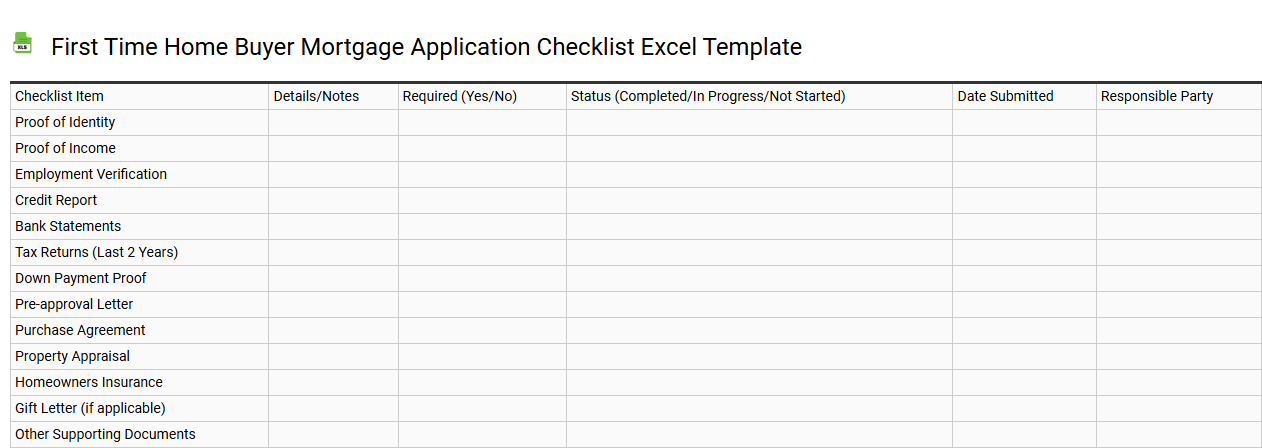

First time home buyer mortgage application checklist Excel template

💾 First time home buyer mortgage application checklist Excel template template .xls

A First Time Home Buyer Mortgage Application Checklist Excel template provides a structured format to organize essential documents and information when applying for a mortgage. Key categories often include personal identification, income verification, credit history, and asset documentation. This tool simplifies the process by ensuring you compile all necessary paperwork, such as W-2 forms, bank statements, and tax returns. Utilizing this template can significantly enhance your readiness for the mortgage application process, setting a strong foundation for potential future needs like refinancing or home equity loans.