A well-designed mortgage tracker spreadsheet in Excel helps you manage your mortgage payments effectively. This template allows you to input your loan details, track monthly payments, and calculate remaining balances, giving you a clear overview of your financial obligations. Visual elements like charts and graphs provide immediate insight into your mortgage status, making financial planning easier and more efficient.

Free mortgage tracker Excel template download

![]()

💾 Free mortgage tracker Excel template download template .xls

A Free Mortgage Tracker Excel template is a pre-designed spreadsheet that helps you monitor various aspects of your mortgage, such as balance, interest rate, payment dates, and remaining terms. This tool enables you to input your mortgage details and easily track your progress over time, making it simpler to stay organized and manage payments. Visual graph representations can provide insights into how much interest you have paid and how your balance decreases over time. You can use this template for basic tracking, and if your needs evolve, consider integrating advanced financial modeling and forecasting functions.

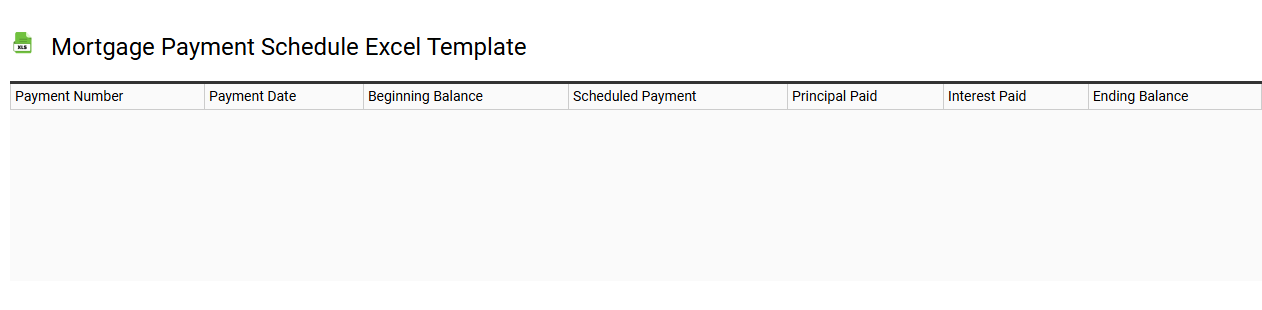

Mortgage payment schedule Excel template

💾 Mortgage payment schedule Excel template template .xls

A mortgage payment schedule Excel template provides a structured format for tracking your loan repayment over time. It typically includes essential details such as the loan amount, interest rate, payment frequency, and amortization period. You can easily visualize your monthly or bi-weekly payments, see how much of each payment goes toward the principal, and understand how interest impacts your total cost. This tool can help you plan for future financial needs and explore advanced options like refinancing or additional principal payments, enhancing your overall financial strategy.

Monthly mortgage payment tracker Excel template

![]()

💾 Monthly mortgage payment tracker Excel template template .xls

A Monthly Mortgage Payment Tracker Excel template helps you monitor your mortgage payments conveniently. This tool allows you to input details such as your loan amount, interest rate, and payment date, ensuring you stay organized with each monthly obligation. You can visualize your outstanding balance over time and calculate how much interest you're paying versus the principal. Such templates can also serve as a foundation for managing additional costs like property taxes and insurance, while offering the potential for complex financial modeling with amortization schedules and refinancing scenarios.

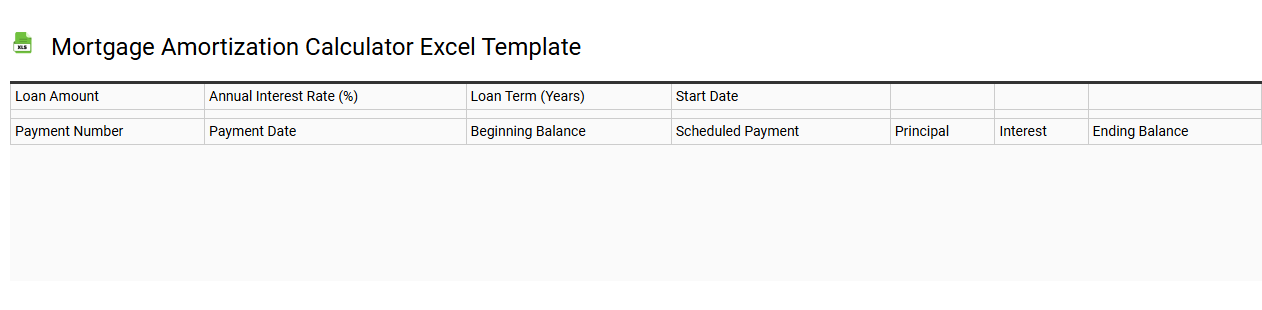

Mortgage amortization calculator Excel template

💾 Mortgage amortization calculator Excel template template .xls

A Mortgage amortization calculator Excel template is a convenient tool for estimating monthly mortgage payments, itemizing interest and principal over the loan's lifespan. It features user-friendly input fields for key parameters such as loan amount, interest rate, and term length, instantly generating an amortization schedule. This schedule provides a clear breakdown of each payment's allocation towards interest and principal, allowing for better financial planning. For more advanced needs, such as incorporating variable interest rates or additional payments, the template can be customized with complex Excel functions.

Mortgage interest tracker Excel template

![]()

💾 Mortgage interest tracker Excel template template .xls

A Mortgage Interest Tracker Excel template is a dynamic tool designed to help homeowners and real estate investors monitor the interest accrued on their mortgage loans. This template allows you to input crucial details such as loan amount, interest rate, loan term, and payment frequency, providing a clear visualization of your financial obligations over time. You can track how payments affect both the principal and interest components, enabling you to make informed decisions about additional payments or refinancing opportunities. Beyond basic tracking, the template can be customized with advanced functions like amortization schedules, scenario analysis, and sensitivity analysis to explore various mortgage strategies.

Simple mortgage tracker Excel template

![]()

💾 Simple mortgage tracker Excel template template .xls

A Simple Mortgage Tracker Excel template is a practical tool designed to help you manage and monitor mortgage payments effectively. This template typically features input fields for loan amount, interest rate, term duration, and payment frequency, enabling automatic calculations of monthly payments, total interest paid, and remaining balance. It often includes graphical representations, such as charts, to visually track your mortgage progress over time. With this template, you can easily analyze your financial situation and make informed decisions, while also allowing for more advanced calculations related to extra payments or refinancing scenarios.

Mortgage tracker Excel template for monthly payments

![]()

💾 Mortgage tracker Excel template for monthly payments template .xls

A Mortgage Tracker Excel template for monthly payments serves as a comprehensive tool to help you monitor and manage your mortgage loans. This template typically includes detailed sections for entering loan amounts, interest rates, and loan terms, enabling you to calculate monthly payments effortlessly. You can visualize the amortization schedule, showcasing how much of each payment goes toward principal and interest over time. Utilizing such a template can simplify tracking your financial obligations and highlight potential savings through additional payments or refinancing options, paving the way for advanced features like what-if analysis or long-term cost projections.

Amortization schedule Excel template for mortgage tracking

![]()

💾 Amortization schedule Excel template for mortgage tracking template .xls

An amortization schedule Excel template for mortgage tracking is a structured spreadsheet that helps you manage and visualize loan repayment over time. This template typically includes essential columns such as payment number, payment amount, principal paid, interest paid, and remaining balance. It enables you to see how much of each payment goes toward reducing the principal versus interest, making it easier for you to understand the financial impact of your mortgage. Tracking your mortgage with this tool can assist in identifying opportunities for prepayments or refinancing, which may enhance financial efficiency through terms like effective interest rate and total interest savings.

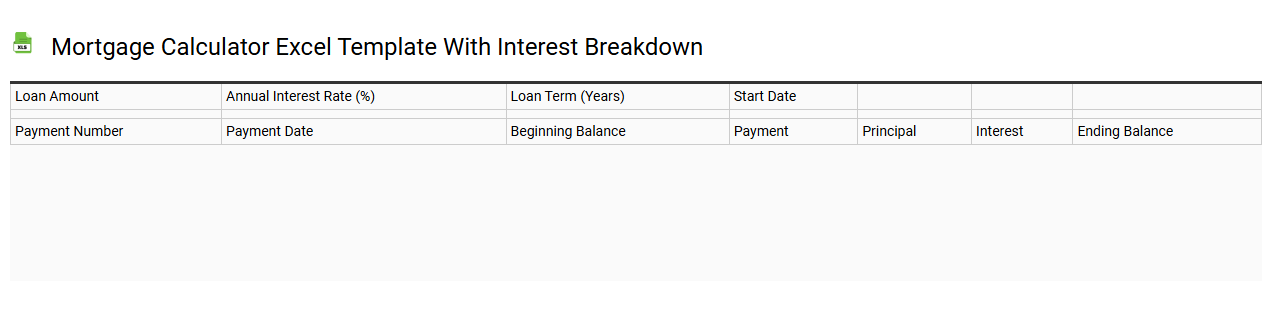

Mortgage calculator Excel template with interest breakdown

💾 Mortgage calculator Excel template with interest breakdown template .xls

A Mortgage Calculator Excel template with interest breakdown provides a detailed view of your mortgage payments over time. It allows you to input key variables like loan amount, interest rate, and loan term, generating a comprehensive table that displays monthly payments along with principal and interest contributions. You can visualize the amortization schedule, helping you understand how much of your payment is applied toward the principal versus interest each month. This tool is not only useful for budgeting your current mortgage but can also aid in analyzing future scenarios, such as additional payments or refinancing options, leveraging advanced financial modeling techniques.

Mortgage balance tracking Excel template automated

![]()

💾 Mortgage balance tracking Excel template automated template .xls

Mortgage balance tracking Excel templates automate the process of monitoring your mortgage repayment progress in a user-friendly spreadsheet format. This tool allows you to input critical data such as loan amount, interest rate, payment frequency, and remaining balance, which the template then calculates to project future balances and interest paid over time. Visualization components, such as graphs and charts, offer a clear view of how your mortgage balance decreases with each payment, enhancing your understanding of your financial journey. For enhanced usage, consider exploring advanced functionalities like real-time data integration or amortization schedule simulations.

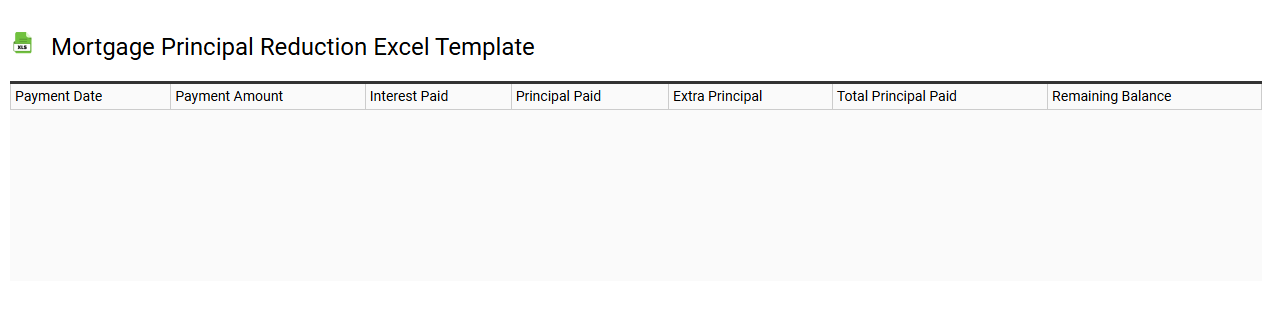

Mortgage principal reduction Excel template

💾 Mortgage principal reduction Excel template template .xls

A mortgage principal reduction Excel template is a financial tool designed to help you track and analyze the reduction of your mortgage principal balance over time. This template typically includes fields for inputting loan amounts, interest rates, and payment schedules, allowing you to visualize how additional payments can affect the principal balance and interest savings. You can see how different payment strategies impact overall loan duration and total interest paid, making it easier to strategize your repayment plan. For advanced tracking, you might incorporate features such as amortization schedules, custom payment frequencies, or scenario analyses to explore various repayment options and their potential effects on your financial situation.

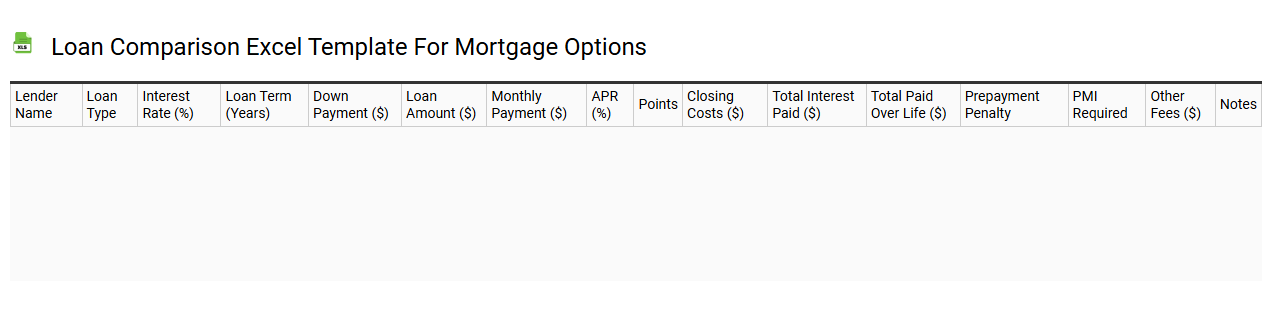

Loan comparison Excel template for mortgage options

💾 Loan comparison Excel template for mortgage options template .xls

A Loan Comparison Excel template for mortgage options serves as a practical tool for evaluating various loan offers side-by-side. This template typically includes detailed fields for interest rates, loan terms, monthly payments, and total costs over the life of the loan. You will find additional metrics like annual percentage rate (APR), down payment requirements, and property taxes incorporated for comprehensive analysis. While basic usage focuses on comparing different mortgage options, potential needs may extend to more advanced functions such as amortization schedules and scenario analysis for better decision-making.

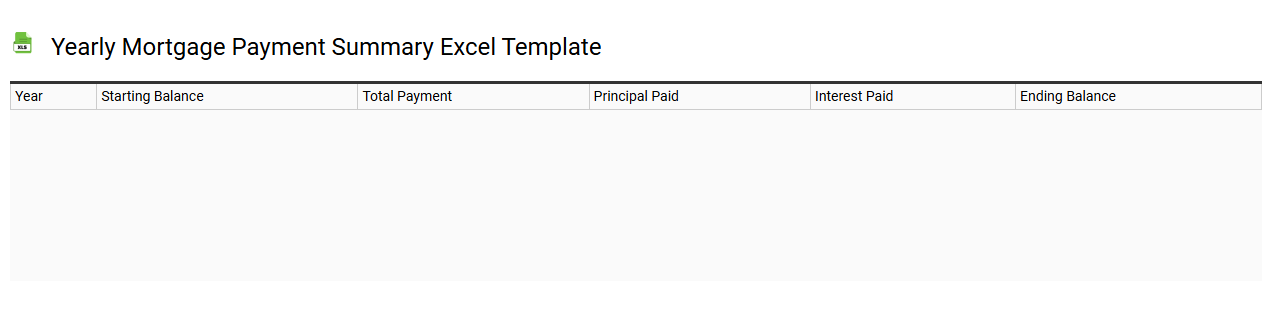

Yearly mortgage payment summary Excel template

💾 Yearly mortgage payment summary Excel template template .xls

A Yearly Mortgage Payment Summary Excel template provides an organized way to track and calculate mortgage payments over a specified year. This tool typically includes sections for principal balance, interest rates, payment schedules, and cumulative totals, allowing users to visualize their financial obligations. You will find columns for monthly payments, with additional rows detailing how much of each payment goes toward interest versus principal reduction. For those looking to enhance their financial planning, advanced features such as amortization schedules, tax implications, and future refinancing scenarios can be integrated.

Multiple mortgage accounts tracker Excel template

![]()

💾 Multiple mortgage accounts tracker Excel template template .xls

A Multiple Mortgage Accounts Tracker Excel template is a specialized spreadsheet designed to help homeowners or investors manage various mortgage accounts efficiently. This tool allows you to input details such as lender names, loan amounts, interest rates, repayment schedules, and outstanding balances for multiple properties. By consolidating all relevant information in one location, you gain better insights into your financial commitments and can monitor payments and remaining balances with ease. For basic usage, this template assists in tracking mortgages, while advanced users can incorporate financial forecasting and investment analysis features.