A mortgage monthly budget Excel template helps you manage your financial commitments associated with homeownership. This free template allows you to input your mortgage details, such as loan amount, interest rate, and loan term, while automatically calculating your monthly payments. Customize your budget by adding other monthly expenses, so you can see the full picture of your financial health and plan effectively for future expenses.

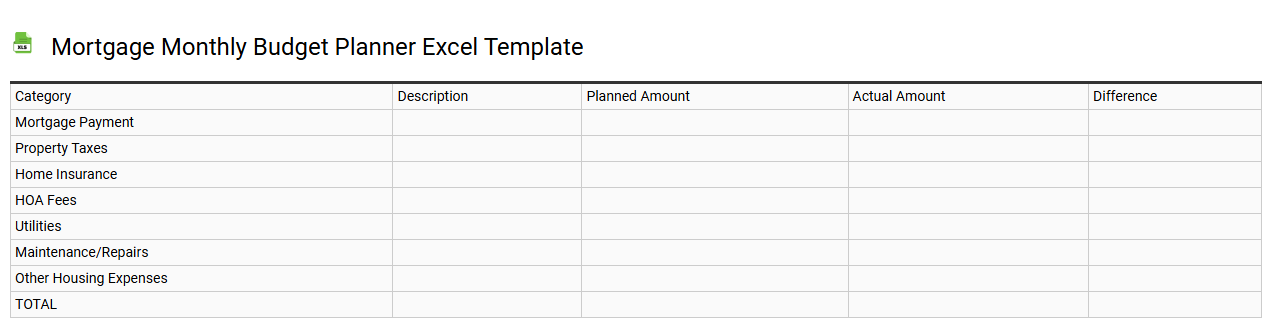

Mortgage monthly budget planner Excel template

💾 Mortgage monthly budget planner Excel template template .xls

A Mortgage Monthly Budget Planner Excel template is a financial tool designed to help you manage your mortgage payments and related expenses. It typically includes sections for inputting your loan amount, interest rate, and loan term, automatically calculating your monthly mortgage payment. You can track additional expenses like property taxes, homeowner's insurance, and maintenance costs, allowing you to develop a more comprehensive view of your financial obligations. This template can be useful for planning your budget effectively and can also be adapted for more advanced tasks such as forecasting future financial scenarios or analyzing amortization schedules.

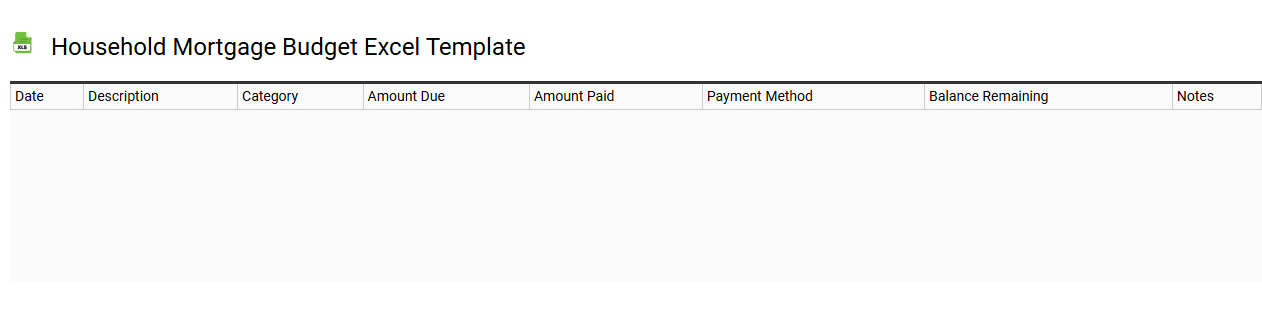

Household mortgage budget Excel template

💾 Household mortgage budget Excel template template .xls

A Household Mortgage Budget Excel template serves as a powerful financial tool that helps you manage your mortgage expenses effectively. This template allows you to input your mortgage details, such as loan amount, interest rate, and repayment term, automatically calculating monthly payments and total interest paid over the life of the loan. You can track other household expenses, providing a comprehensive view of your budget to ensure you stay within financial limits. It can also be adapted for advanced financial planning needs, such as refinancing scenarios or investment property analysis.

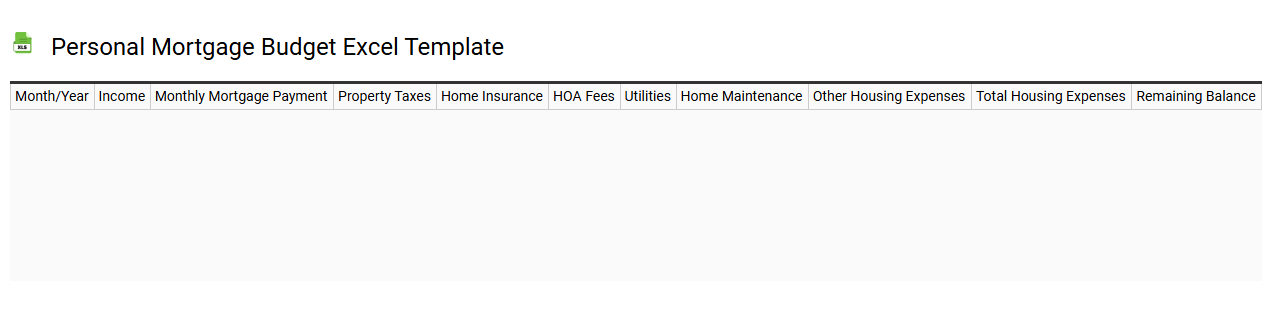

Personal mortgage budget Excel template

💾 Personal mortgage budget Excel template template .xls

A Personal Mortgage Budget Excel template is a customizable spreadsheet designed to help you manage and track your mortgage payments alongside other financial obligations. This template typically includes sections for inputting your loan amount, interest rate, loan term, and monthly payment details. You can visualize your overall budget by incorporating categories such as property taxes, homeowners insurance, and maintenance costs. As you assess your financial landscape, this tool can simplify your calculations and identify future financial needs, even allowing for advanced features like amortization schedules and scenario analysis.

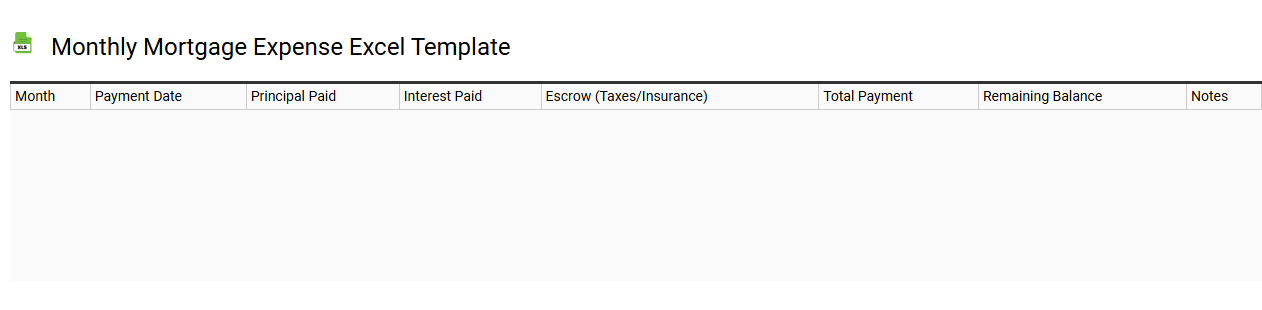

Monthly mortgage expense Excel template

💾 Monthly mortgage expense Excel template template .xls

A Monthly Mortgage Expense Excel template is a pre-designed spreadsheet that helps you track and manage your mortgage payments. This tool typically includes fields for principal, interest, property taxes, homeowner's insurance, and private mortgage insurance (PMI). You can easily input your loan amount, interest rate, and loan term, allowing you to see a breakdown of your monthly payment. This template can also be customized for advanced features such as amortization schedules or prepayment calculations to better address your financial planning needs.

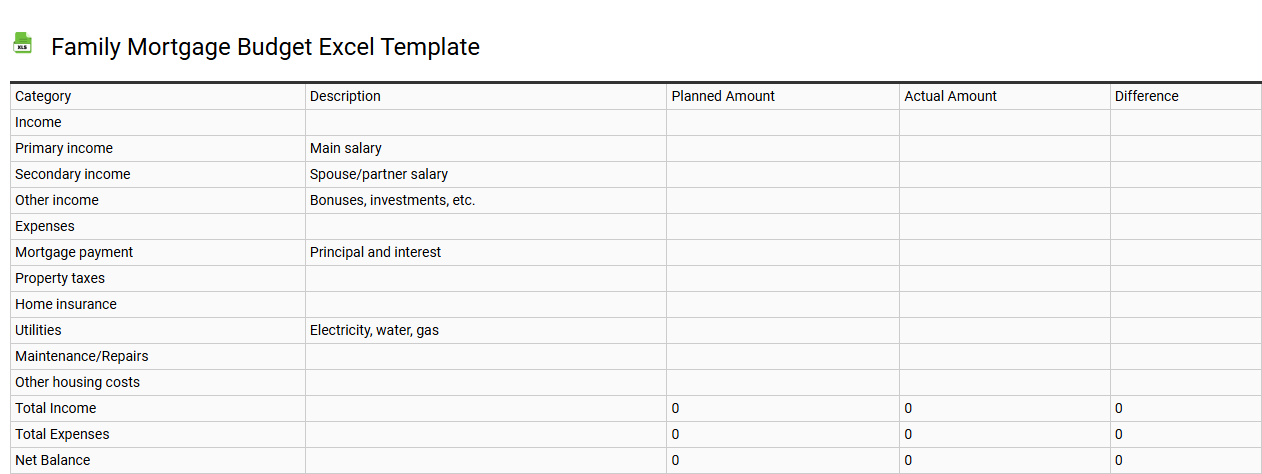

Family mortgage budget Excel template

💾 Family mortgage budget Excel template template .xls

A Family mortgage budget Excel template is a practical tool designed to help individuals or families manage their mortgage-related expenses efficiently. It typically includes sections for monthly mortgage payments, property taxes, homeowners insurance, and maintenance costs, providing a comprehensive overview of financial obligations. Users can input their current mortgage interest rates, loan amounts, and payment schedules, facilitating easy tracking of annual costs. This template is useful not only for budgeting monthly expenses but also for planning future financial strategies, such as refinancing or investing in additional properties.

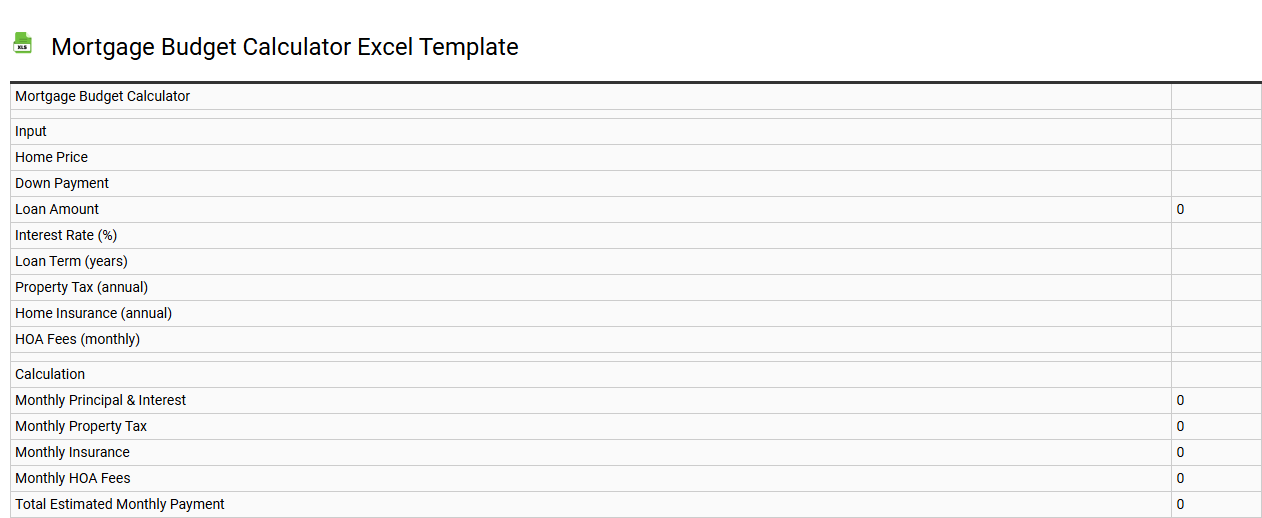

Mortgage budget calculator Excel template

💾 Mortgage budget calculator Excel template template .xls

A mortgage budget calculator Excel template allows you to efficiently estimate your monthly mortgage payments based on variables such as loan amount, interest rate, and loan term. This template typically includes fields for property taxes, homeowner's insurance, and PMI, providing a comprehensive view of your total housing costs. You can easily modify the input values to see how changes affect your budget and overall affordability. This tool can further assist you in evaluating more complex financial scenarios, such as refinancing options or comparing different mortgage products.

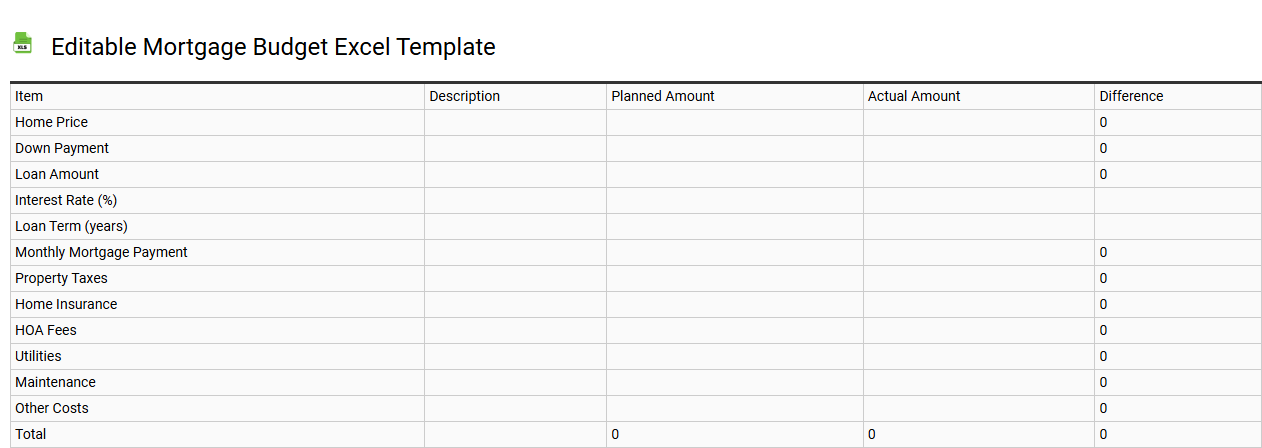

Editable mortgage budget Excel template

💾 Editable mortgage budget Excel template template .xls

An editable mortgage budget Excel template is a customizable spreadsheet designed to help you manage and plan your mortgage expenses effectively. This tool typically includes sections for income, mortgage payments, property taxes, insurance, and maintenance costs, allowing for a comprehensive overview of your financial obligations. You can modify categories and amounts to reflect your specific financial situation, ensuring tailored budgeting that can adapt as your needs change. With this template, you can track your monthly payments, analyze your financial readiness for homeownership, and consider advanced metrics like amortization schedules and equity calculations for future financial strategies.

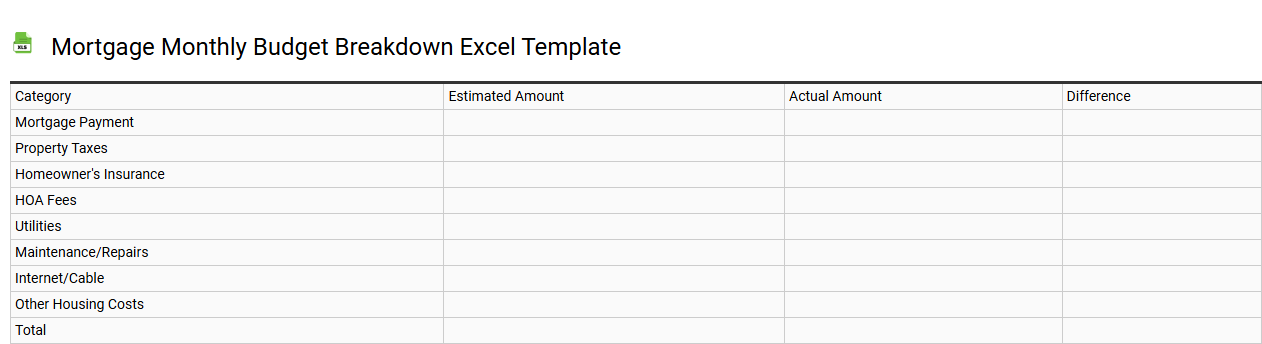

Mortgage monthly budget breakdown Excel template

💾 Mortgage monthly budget breakdown Excel template template .xls

A Mortgage monthly budget breakdown Excel template is a useful financial tool designed to help you manage your home expenses. It typically includes various categories such as principal and interest payments, property taxes, homeowners insurance, and private mortgage insurance (PMI). You can also include maintenance and utility costs to create a comprehensive overview of your housing expenses. As you become familiar with the basics, you might explore advanced features such as amortization schedules, interest rate projections, and investment comparisons to further enhance your real estate financial planning.

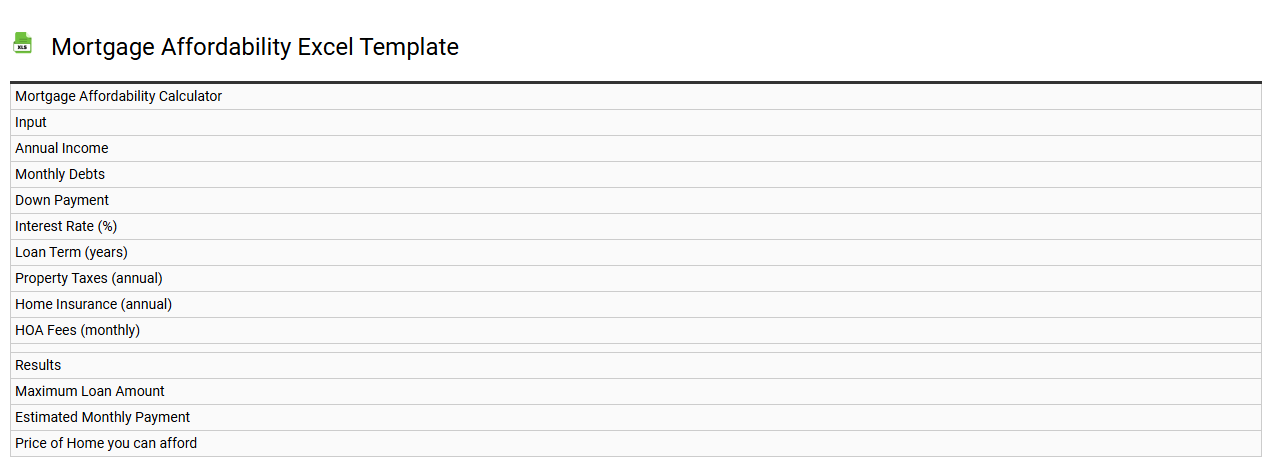

Mortgage affordability Excel template

💾 Mortgage affordability Excel template template .xls

A Mortgage affordability Excel template is a financial tool designed to help you evaluate your ability to secure a mortgage based on your income, expenses, and existing debts. This template typically includes fields for entering various financial inputs, such as salary, monthly expenses, and current debt obligations, automatically calculating how much mortgage you can afford. It may also provide a breakdown of potential monthly payments, interest rates, and loan terms, allowing you to visualize different mortgage scenarios. You can use this template for basic budgeting, but it also has further potential for advanced financial analysis, including debt-to-income ratios and future investment considerations.

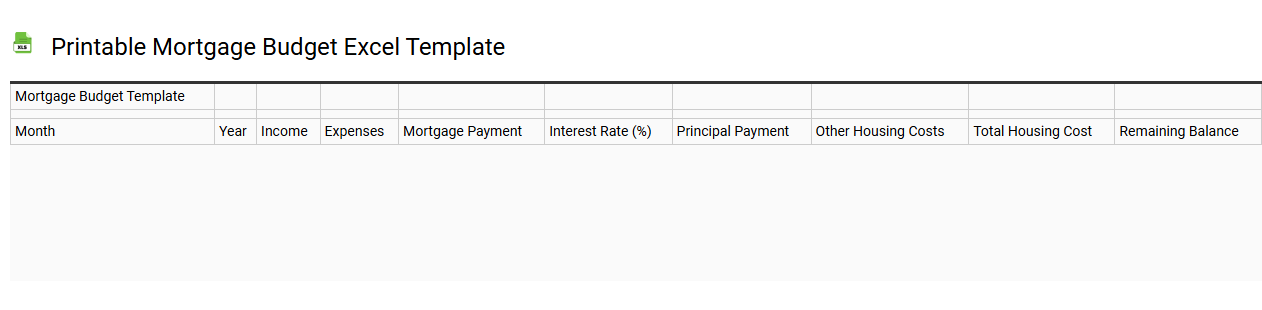

Printable mortgage budget Excel template

💾 Printable mortgage budget Excel template template .xls

A printable mortgage budget Excel template is designed to help you manage your mortgage-related expenses in a structured and organized manner. This template typically includes sections for your monthly mortgage payment, property taxes, homeowners insurance, and additional costs such as maintenance and utilities. With clear categories and spaces for inputting figures, it allows you to easily track your budget and adjust as needed. You can use this basic tool to build a foundation for comprehensive financial planning, and consider exploring advanced features like amortization schedules and cash flow projections for deeper insights.

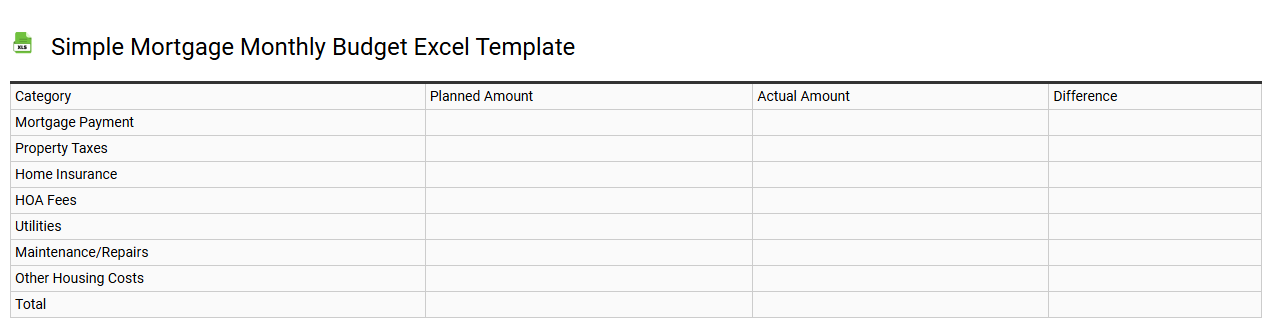

Simple mortgage monthly budget Excel template

💾 Simple mortgage monthly budget Excel template template .xls

A Simple mortgage monthly budget Excel template is a user-friendly tool designed to help you manage and forecast your mortgage expenses effectively. It typically includes sections for monthly payment calculations, principal balance tracking, and interest tracking, allowing you to visualize your financial commitments clearly. You can customize this template to reflect your unique loan details, such as interest rates and loan terms, making it easier to assess your budget. This basic template serves as a foundation for more advanced financial planning, incorporating features like amortization schedules or variable rate adjustments as your needs evolve.