A variety of free Excel templates for startup payroll are available to streamline your payroll process. Each template typically includes essential components like employee information, hours worked, tax calculations, and net pay, ensuring accuracy and compliance. Using these templates can save you time and reduce errors, allowing you to focus on growing your business.

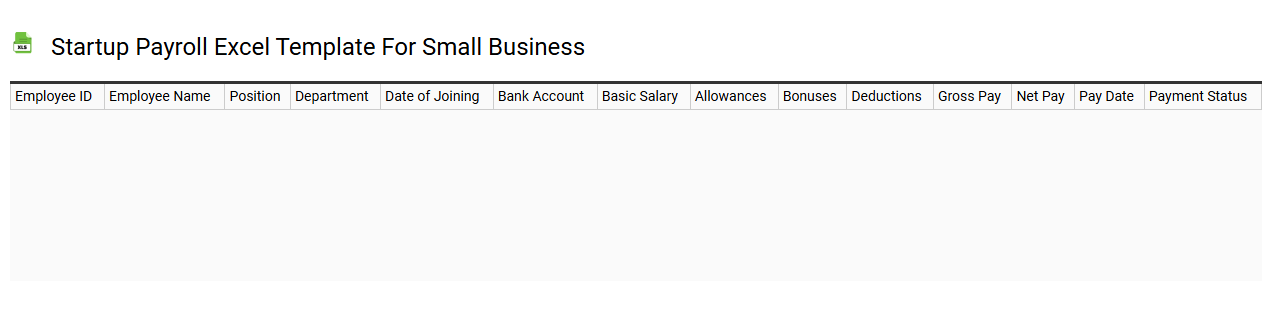

Startup payroll Excel template for small business

💾 Startup payroll Excel template for small business template .xls

A Startup payroll Excel template for small businesses is a customizable spreadsheet designed to simplify the payroll process. It typically includes columns for employee names, hours worked, pay rates, tax deductions, and net pay calculations. Such templates often provide built-in formulas to automatically calculate total wages and withholdings, reducing manual errors. These tools cater to basic payroll needs but can also be expanded for more complex requirements like multi-state taxation and employee benefits management.

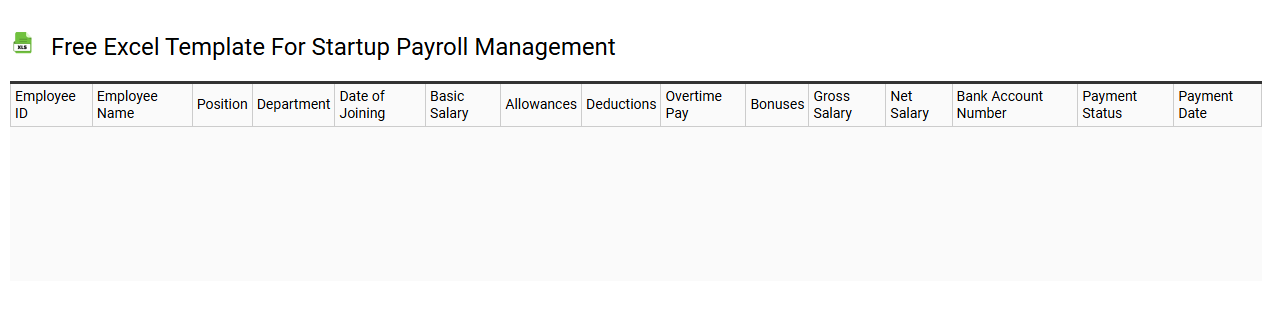

Free Excel template for startup payroll management

💾 Free Excel template for startup payroll management template .xls

A free Excel template for startup payroll management provides a structured tool to efficiently track employee salaries, deductions, and net payments. This template typically includes sections for employee details such as name, position, and hours worked, along with fields for overtime calculations and taxes. The built-in formulas automate calculations for gross pay, taxable income, and take-home pay, simplifying the payroll process for your business. While basic templates are effective for managing payroll efficiently, further potential enhancements may involve integrating advanced features such as automated tax updates, compliance tracking, and employee benefit management systems.

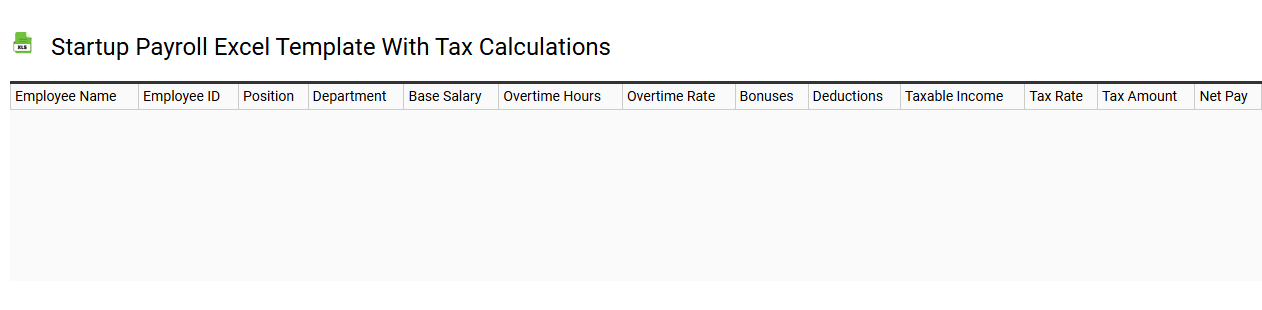

Startup payroll Excel template with tax calculations

💾 Startup payroll Excel template with tax calculations template .xls

A Startup payroll Excel template with tax calculations is a specialized spreadsheet designed to manage employee payroll efficiently. It includes essential fields such as employee names, positions, hours worked, wages, and various tax deductions, allowing for accurate calculations of net pay. The template typically automates tax calculations based on local and federal tax rates, ensuring compliance with regulatory requirements. You can start with this basic tool for managing payroll, and as your business grows, you might explore advanced topics like automated payroll systems or integration with accounting software.

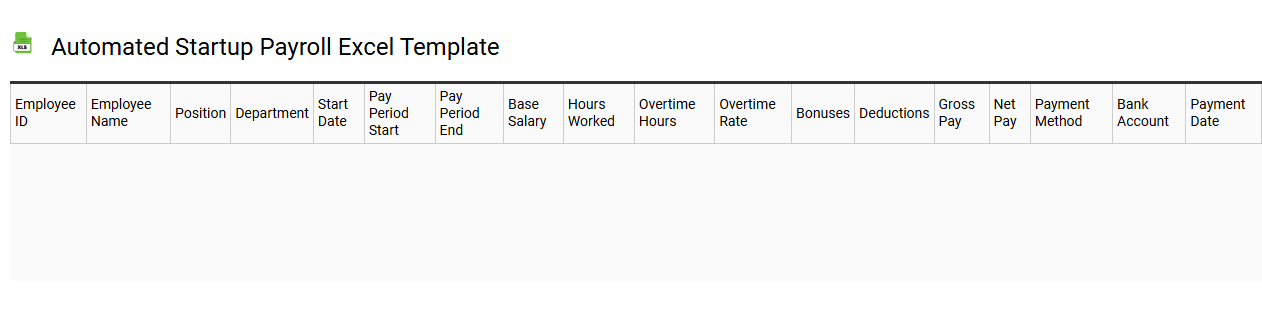

Automated startup payroll Excel template

💾 Automated startup payroll Excel template template .xls

An Automated Startup Payroll Excel template is a pre-designed spreadsheet tool intended for new businesses to efficiently manage employee payroll. This template allows you to input various employee details, such as names, hours worked, and pay rates, automatically calculating the total payroll expenses. Built-in formulas streamline operations, reducing manual calculations and minimizing errors, which is crucial for startups. You can further customize the template to include advanced features like tax deductions, overtime calculations, and benefits management, catering to specific business needs as your organization expands.

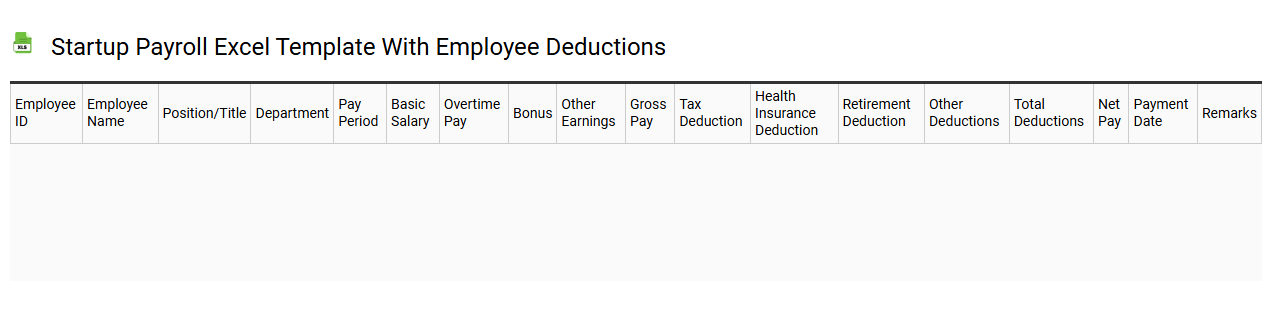

Startup payroll Excel template with employee deductions

💾 Startup payroll Excel template with employee deductions template .xls

A Startup payroll Excel template with employee deductions is a customizable spreadsheet designed to streamline the payroll process for new businesses. This template typically includes sections for employee details, hours worked, gross pay, and deductions such as taxes, health insurance, and retirement contributions. By using this tool, you can efficiently calculate net pay while ensuring compliance with regulatory requirements. For more sophisticated needs, you might explore options like automated payroll software or advanced analytics tools that integrate with your accounting systems.

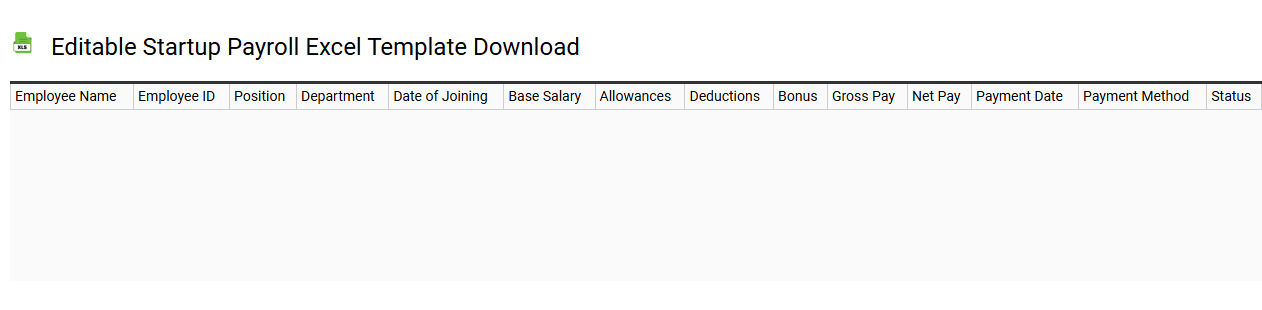

Editable startup payroll Excel template download

💾 Editable startup payroll Excel template download template .xls

An editable startup payroll Excel template is a pre-designed spreadsheet specifically tailored for new businesses to manage employee compensation effectively. This template typically includes essential columns like employee names, hours worked, pay rates, deductions, and net pay calculations. Customizable features allow you to adjust it according to your specific payroll policies, including overtime rates or tax compliance needs. As your business grows, this template can scale, supporting advanced functionalities like employee classifications and benefits tracking, ensuring comprehensive payroll management.

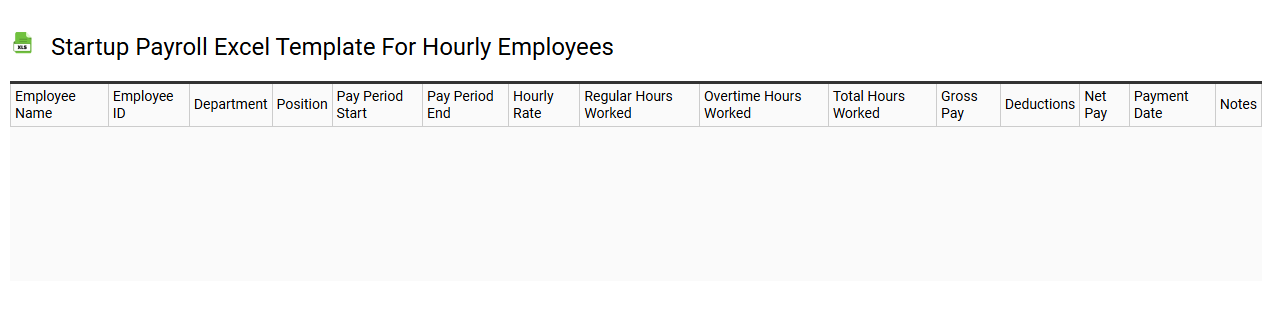

Startup payroll Excel template for hourly employees

💾 Startup payroll Excel template for hourly employees template .xls

A Startup payroll Excel template for hourly employees streamlines the payroll process by automating calculations related to hours worked, wages, and deductions. This user-friendly spreadsheet typically features columns for employee names, hourly rates, work hours, overtime, and total earnings, making it easy for you to manage payroll efficiently. The template can also incorporate formulas that calculate taxes and withholdings, ensuring accurate net pay. While this basic setup covers your immediate payroll needs, advanced versions may include features like benefits tracking, performance metrics, and compliance management tools.

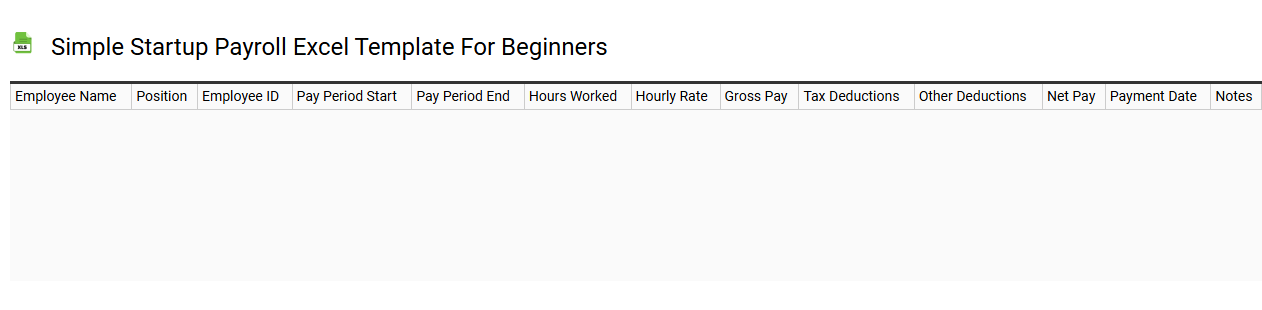

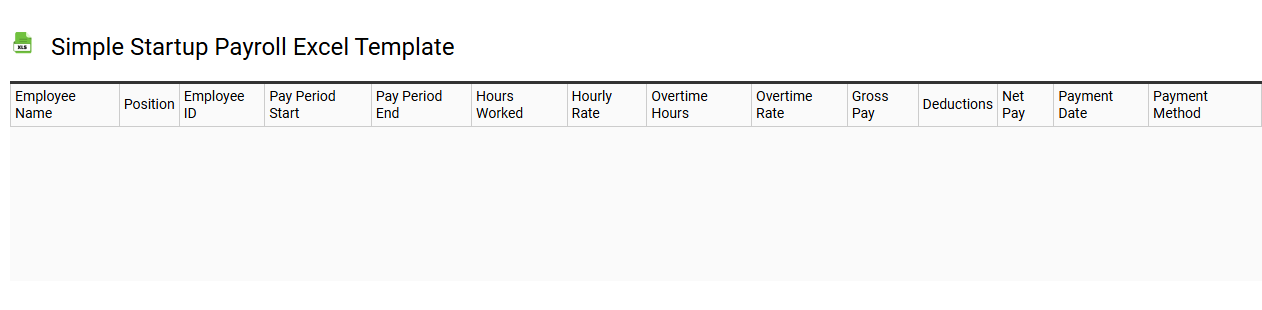

Simple startup payroll Excel template for beginners

💾 Simple startup payroll Excel template for beginners template .xls

A Simple startup payroll Excel template streamlines the process of tracking employee compensation for new businesses. This template typically includes essential fields such as employee names, hours worked, pay rates, and tax deductions, along with a section for calculating total wages. You can easily customize the layout to fit your specific needs, ensuring your payroll management remains organized and efficient. Understanding this basic usage can pave the way for more advanced applications, like integrating automated payroll systems or utilizing payroll software for comprehensive financial reporting.

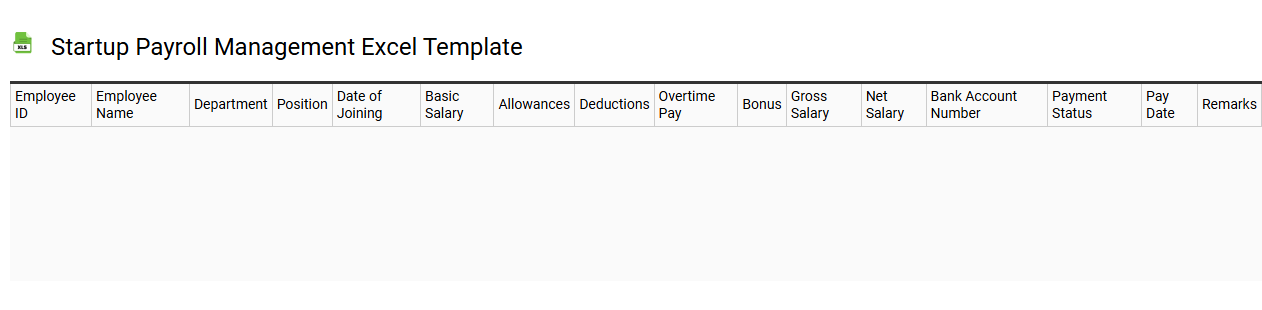

Startup payroll management Excel template

💾 Startup payroll management Excel template template .xls

A Startup Payroll Management Excel template streamlines the process of managing employee compensation, tax deductions, and benefits in a systematic manner. It features customizable fields to input employee details, salaries, and applicable taxes, making it easier to track payroll calculations. This template is designed to enhance accuracy, reduce the likelihood of errors, and save valuable time in financial management. You can utilize this tool for basic payroll needs or expand its functionality to incorporate advanced analytics, forecasting, or integration with larger HR management systems.

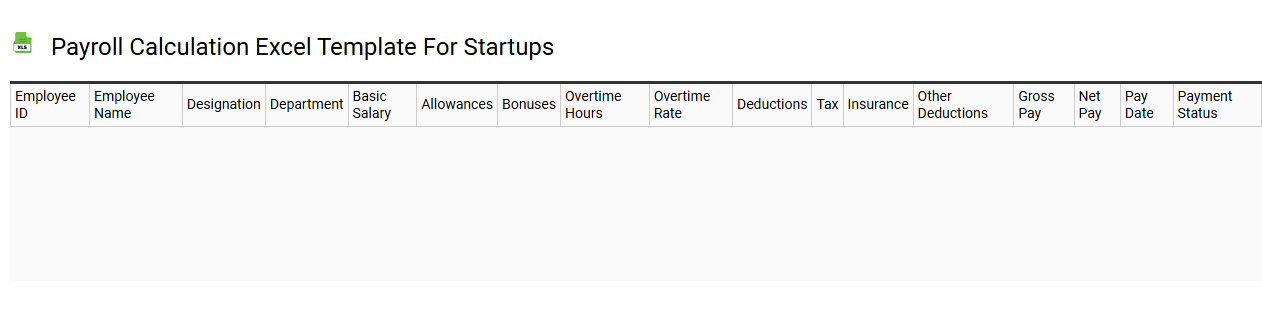

Payroll calculation Excel template for startups

💾 Payroll calculation Excel template for startups template .xls

A Payroll calculation Excel template for startups simplifies the process of managing employee salaries and related deductions. This user-friendly tool enables you to input essential data such as employee names, positions, hourly rates, and hours worked. Custom formulas automatically compute gross pay, taxes, and net pay, streamlining earnings calculations and ensuring accuracy. For further needs, consider incorporating advanced features like automated tax updates, integration with time-tracking software, and compliance checks for labor regulations.

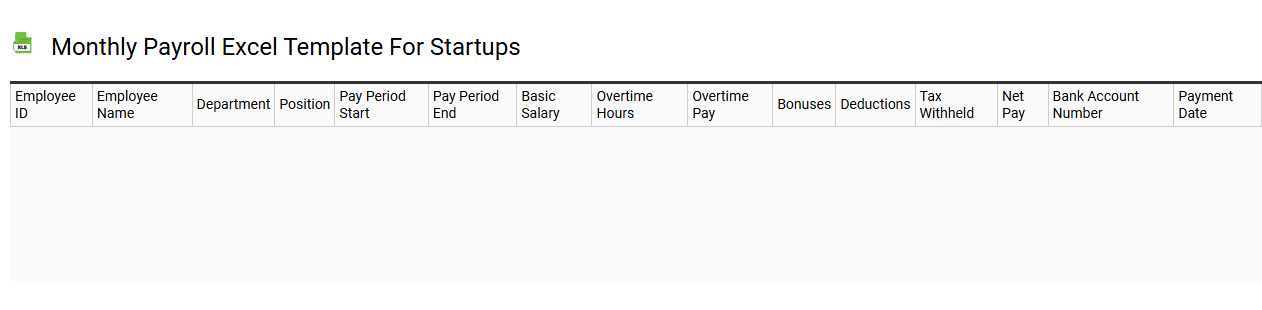

Monthly payroll Excel template for startups

💾 Monthly payroll Excel template for startups template .xls

A monthly payroll Excel template for startups streamlines the process of calculating employee wages, taxes, and deductions. The template typically includes fields for employee names, positions, hours worked, hourly rates or salaries, and applicable tax rates. You can easily customize it to accommodate different employee classifications, such as full-time, part-time, and contract workers. This tool not only simplifies payroll management but also aids in tracking labor costs, ensuring compliance with labor regulations, and preparing for audits or financial assessments, while offering scalability for advanced payroll solutions like automated calculations or integration with HR systems.

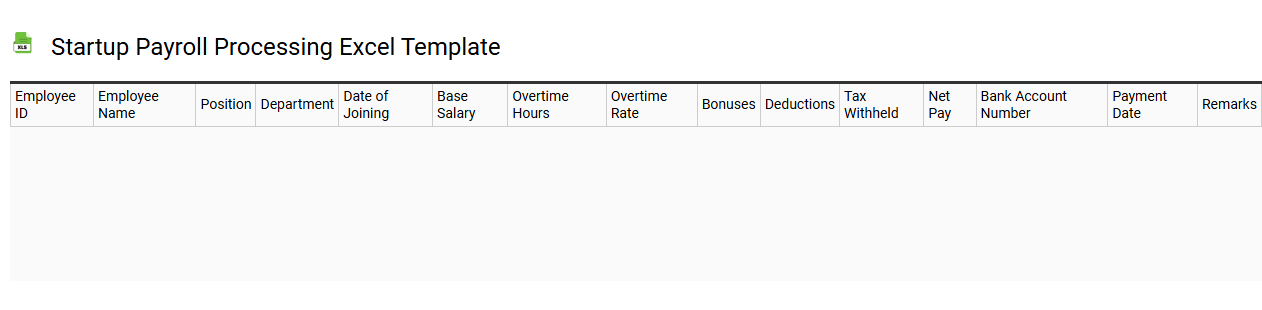

Startup payroll processing Excel template

💾 Startup payroll processing Excel template template .xls

A Startup payroll processing Excel template is a structured spreadsheet designed to simplify and automate the management of employee wages, withholding taxes, and benefits for new businesses. This template typically includes columns for employee names, hours worked, rates of pay, deductions, and gross and net pay calculations. You can easily customize it to meet the specific needs of your startup, ensuring compliance with local labor laws and tax regulations. Such a tool is essential for maintaining accurate records, and as your business grows, you may explore payroll software solutions or integrate advanced human resource management systems to enhance efficiency.

Simple startup payroll Excel template

💾 Simple startup payroll Excel template template .xls

A Simple startup payroll Excel template is a user-friendly spreadsheet designed for small businesses or startups to efficiently manage employee salaries, withholdings, and payroll calculations. This template typically includes sections for employee names, job titles, hours worked, hourly wages, tax deductions, and total pay, ensuring you can easily track employee compensation. Users can customize fields based on specific needs, enabling seamless integration with their existing payroll systems or accounting software. You can expand its functionality to include advanced features like automated tax calculations, employee benefits tracking, or compliance with regional labor laws.

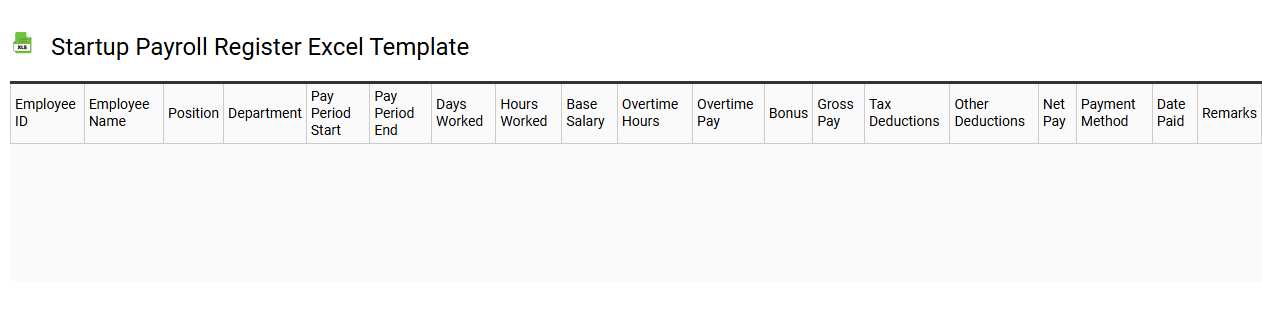

Startup payroll register Excel template

💾 Startup payroll register Excel template template .xls

A Startup payroll register Excel template is a structured spreadsheet designed to help new businesses organize and manage employee payroll information efficiently. This template typically includes essential columns such as employee names, identification numbers, hours worked, hourly wages, deductions, and net pay. By utilizing this tool, you can streamline payroll processes, ensuring accurate calculations and compliance with tax regulations. As your company grows, you may need to expand this basic template into more complex payroll systems that incorporate advanced features like automated calculations, tax withholdings, and integration with accounting software.

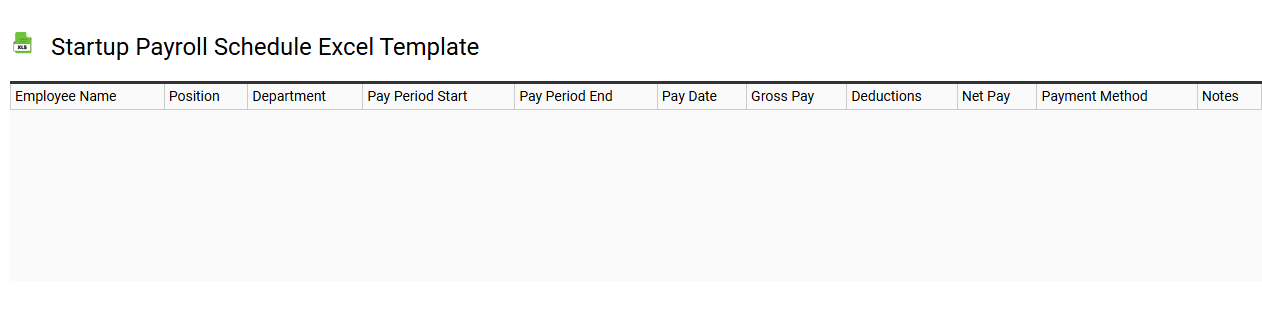

Startup payroll schedule Excel template

💾 Startup payroll schedule Excel template template .xls

A Startup payroll schedule Excel template streamlines the process of managing employee compensation for new businesses. This template typically includes essential columns for employee names, roles, hours worked, pay rates, and total earnings, allowing for easy calculations and adjustments. You can customize the template to fit your payroll frequency, whether it's weekly, biweekly, or monthly. This basic tool provides a foundation for tracking payroll, with further potential for integrating advanced features like automated tax calculations and benefit deductions as your business grows.