Explore a variety of free XLS templates designed specifically for creating tax receipts efficiently. These templates typically feature structured layouts that simplify data entry, allowing you to include essential details such as the recipient's name, address, date of payment, and the amount paid. Customizable fields enable you to tailor the receipts to your unique business needs, ensuring accuracy and professionalism for your financial documentation.

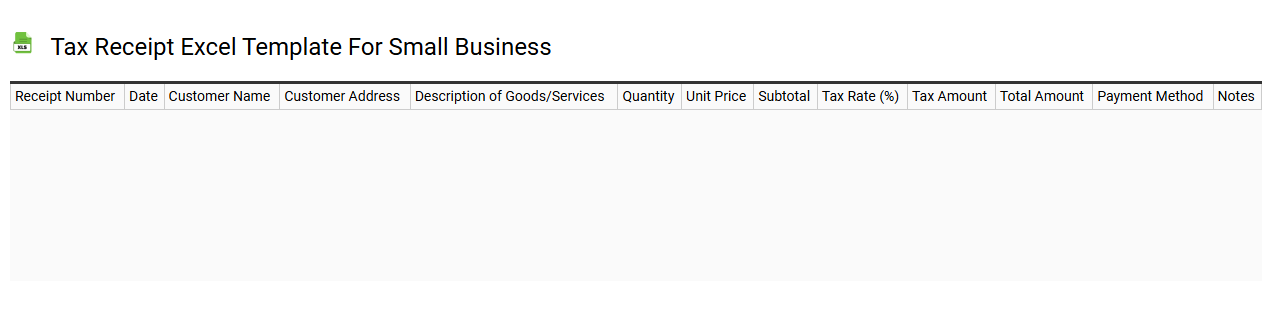

Tax receipt Excel template for small business

💾 Tax receipt Excel template for small business template .xls

A Tax receipt Excel template for small businesses simplifies the process of documenting transactions for tax purposes. It typically includes fields for the date, transaction description, amount, and payer details, ensuring all necessary information is captured accurately. Customizable features allow you to adapt the template according to your business needs. Using this tool not only streamlines your record-keeping but also prepares you for comprehensive tax reporting and compliance, while further potential needs may include integration with accounting software and advanced data analytics.

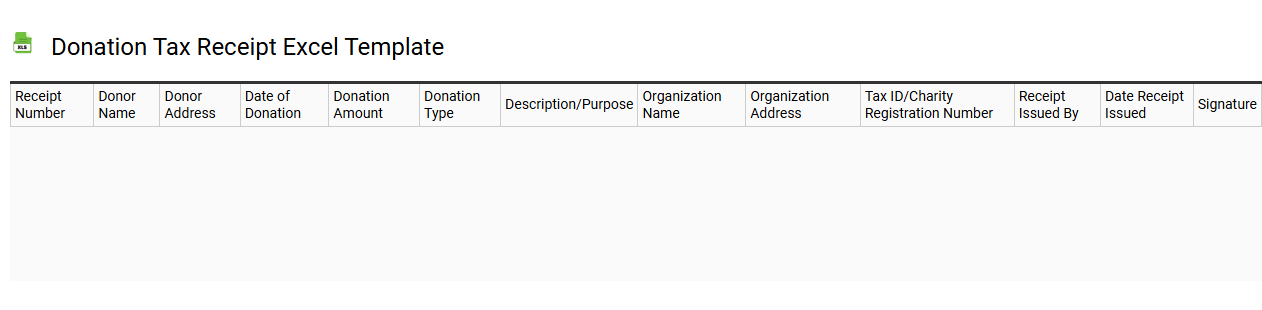

Donation tax receipt Excel template

💾 Donation tax receipt Excel template template .xls

A Donation Tax Receipt Excel template is a pre-formatted spreadsheet designed to help organizations and individuals issue tax receipts for donations received. The template typically includes fields for donor information, including name, address, and donation amount, as well as a description of the donation and the date received. You can customize these templates to meet specific legal requirements and maintain accurate records for both the donor and the organization. This tool not only streamlines the donation tracking process but also facilitates compliance with tax regulations and reporting, supporting more advanced features like automated calculations and integration with financial software systems.

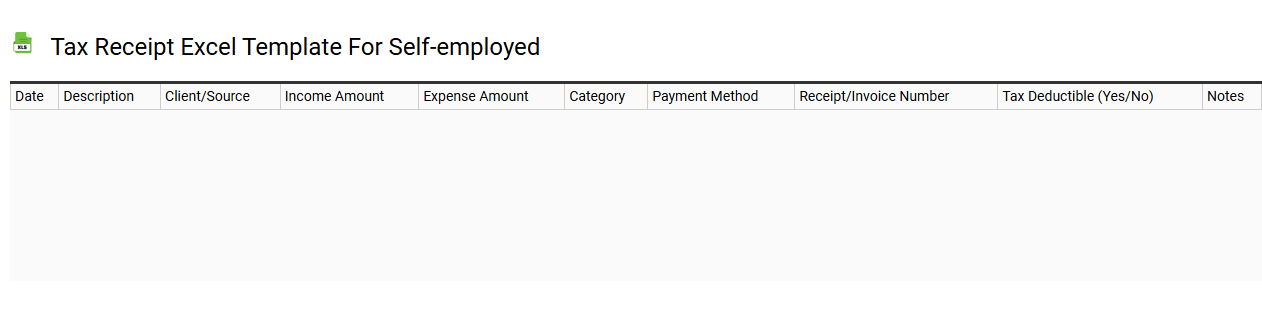

Tax receipt Excel template for self-employed

💾 Tax receipt Excel template for self-employed template .xls

A Tax Receipt Excel template for self-employed individuals is a structured spreadsheet designed to facilitate the creation and organization of tax receipts for business expenses and income. This template typically includes fields for the date, description of services or products, amount received, tax identification number, and any applicable tax rates. It enhances accuracy by allowing you to input data easily, ensuring that all necessary financial details are captured in one place. Using this template not only streamlines the tax filing process but also provides a foundation for more complex tracking needs such as profit and loss statements or cash flow analysis.

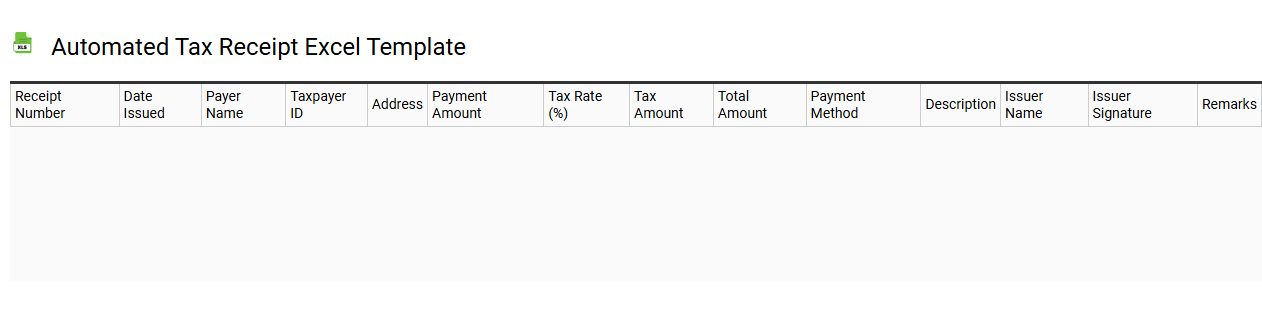

Automated tax receipt Excel template

💾 Automated tax receipt Excel template template .xls

An Automated Tax Receipt Excel Template is a pre-designed spreadsheet that streamlines the process of generating tax receipts. This template typically includes fields for essential information such as the donor's name, donation amount, date, and purpose of the donation. Users can easily input data, which the template then processes to create professional-looking receipts ready for distribution. This tool is particularly beneficial for nonprofit organizations, enabling accurate tracking and easy customization for future tax reporting or donor appreciation needs, extending to features like data analytics and integration with accounting systems.

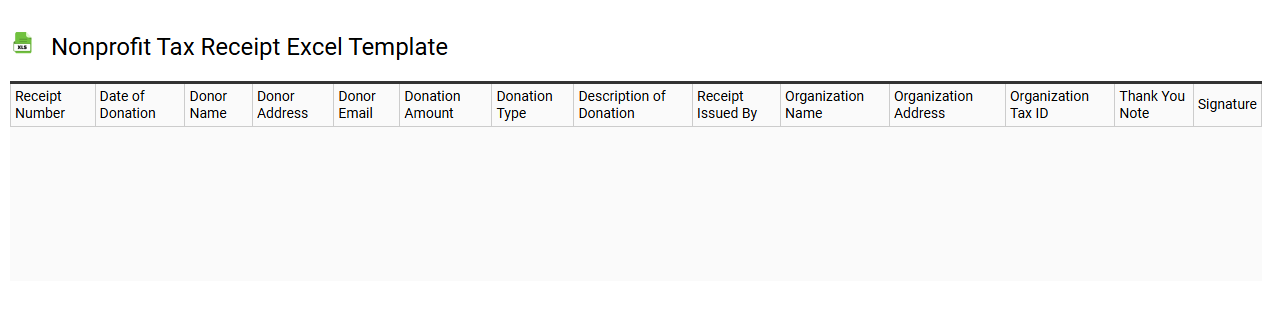

Nonprofit tax receipt Excel template

💾 Nonprofit tax receipt Excel template template .xls

A nonprofit tax receipt Excel template is a pre-formatted spreadsheet designed to help organizations issue tax receipts to donors efficiently. This template typically includes fields for donor information, donation date, donation amount, and the nonprofit's details, such as name and EIN (Employer Identification Number). With clear sections for both the donor and charitable organization, it simplifies record-keeping and compliance with tax regulations. You can customize the template to include additional information like specific fund allocation or project designations, accommodating both basic usage and further advanced reporting needs.

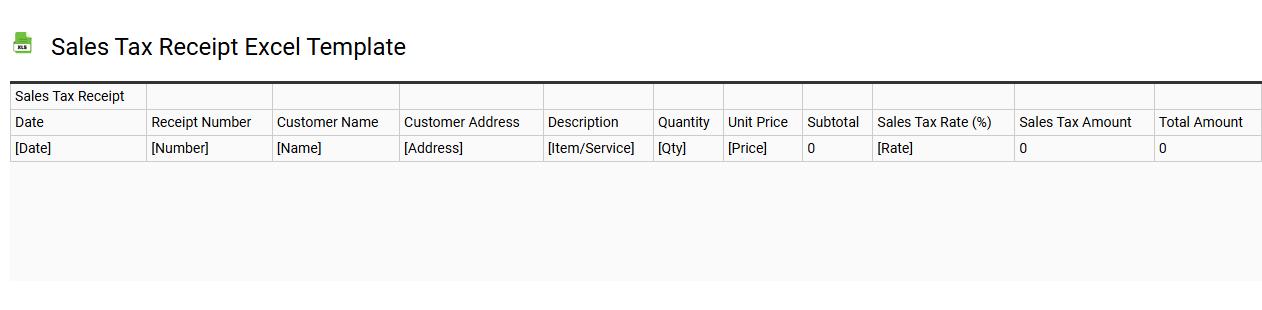

Sales tax receipt Excel template

💾 Sales tax receipt Excel template template .xls

A Sales Tax Receipt Excel template is a pre-designed spreadsheet that assists businesses in documenting sales transactions and calculating the corresponding sales tax. This user-friendly tool typically includes fields for entering transaction details such as the date of sale, item description, quantity, price per item, subtotal, tax rate, and total amount due. With clear formatting and formulas, it automates tax calculations and ensures accurate records are maintained for accounting purposes. You can customize the template to suit your business needs, and it may serve as a fundamental resource for managing financial records while opening avenues for advanced financial analytics or tax preparation software integration later on.

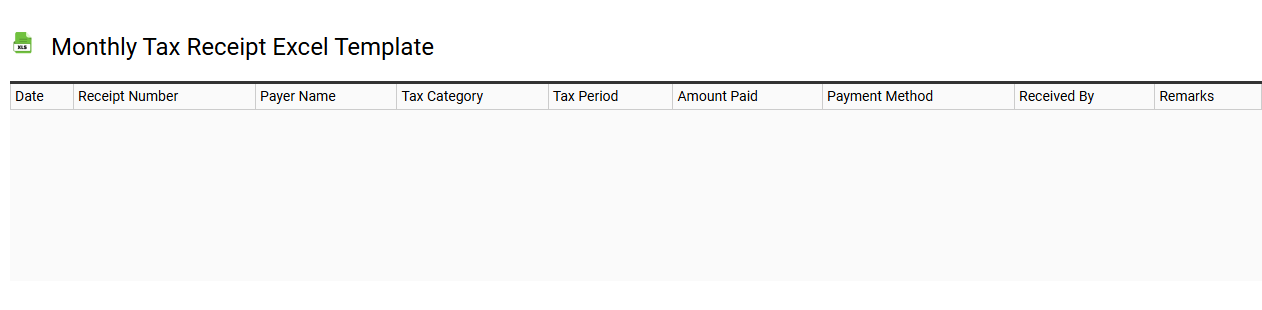

Monthly tax receipt Excel template

💾 Monthly tax receipt Excel template template .xls

A Monthly Tax Receipt Excel template is a pre-designed spreadsheet that helps individuals and businesses organize and track their tax-related transactions over a month. This template typically includes fields for date, description of transaction, amount, and any applicable tax rate, allowing for straightforward record-keeping. You can customize it to fit your specific tax needs, integrating formulas for automatic calculations and summary reports. Understanding these basics prepares you for further potential requirements, such as integrating advanced tax software or formulating tax strategies involving depreciation and capital gains.

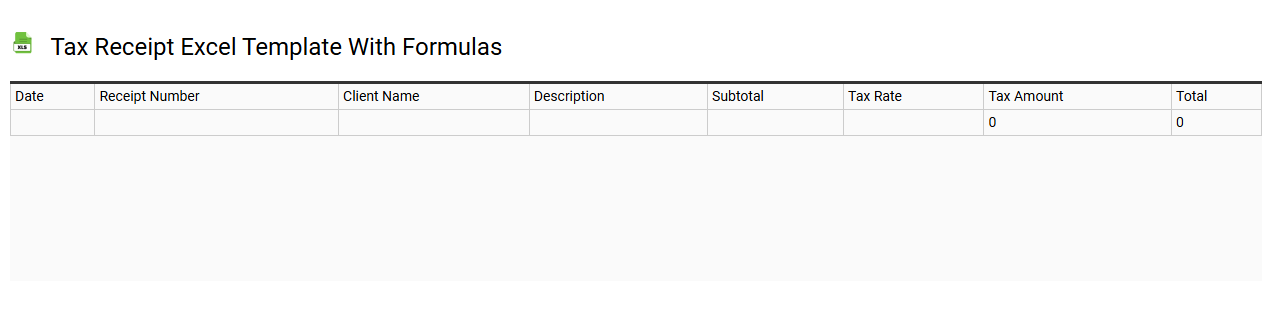

Tax receipt Excel template with formulas

💾 Tax receipt Excel template with formulas template .xls

A Tax Receipt Excel template with formulas is a structured spreadsheet that simplifies the process of generating tax receipts for donations or payments. The template typically includes fields for the date, donor's name, donation amount, and other relevant details, with built-in formulas for automatic calculations, such as totals and tax deductions. Formatting can enhance readability, with designated areas for signatures and organization logos. This basic tool can evolve to include advanced functionalities like automated report generation or integration with accounting software.

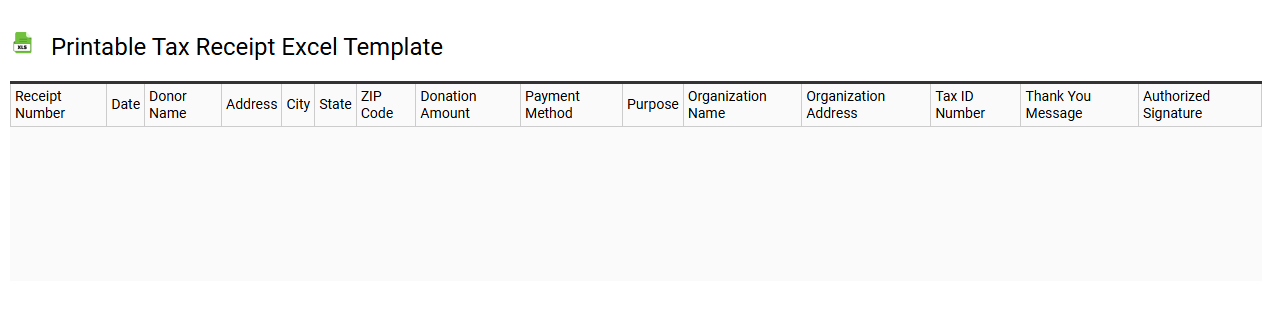

Printable tax receipt Excel template

💾 Printable tax receipt Excel template template .xls

A printable tax receipt Excel template serves as a standardized document that helps you generate receipts for various transactions, often relating to tax-deductible expenses. This template typically includes essential fields such as the date, the service provider's name, amount paid, and a description of the service. Designed for easy customization, it allows you to add your logo or alter the layout to suit your needs. Understanding its basic usage can streamline your record-keeping, while mastering advanced features like conditional formatting or automated calculations can enhance its functionality for more complex financial tracking.

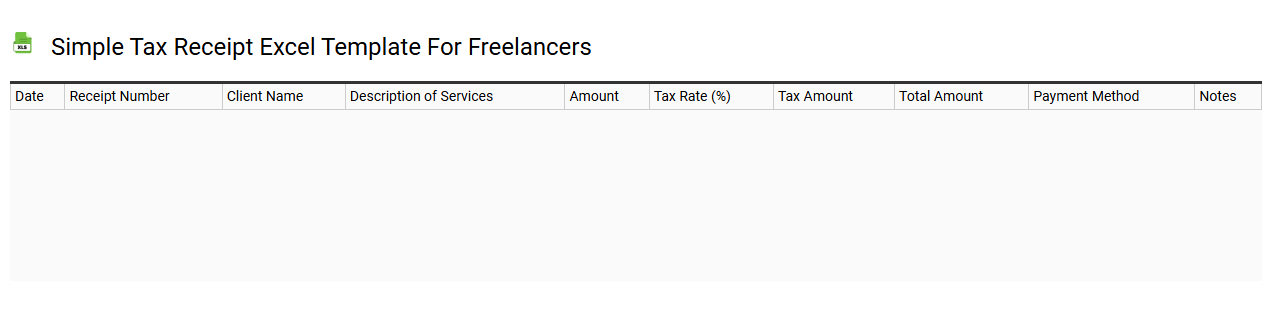

Simple tax receipt Excel template for freelancers

💾 Simple tax receipt Excel template for freelancers template .xls

A Simple Tax Receipt Excel template for freelancers is a structured spreadsheet designed to simplify the process of recording and issuing receipts for services rendered. This template typically includes fields for essential information such as your name, business details, client's information, the services provided, the amount received, and the date of the transaction. The clean layout allows for easy data entry and customization to suit your unique freelance business requirements. By using this template, you can efficiently track your income and prepare for potential tax filing, while offering your clients a professional receipt that complies with tax regulations. Further potential needs may involve incorporating advanced features like automated calculations, expense tracking, or integration with accounting software.