Explore a range of free loan amortization Excel templates designed to simplify your financial planning. These templates typically feature structured tables where you can input loan amounts, interest rates, and loan terms, automatically calculating monthly payments and total interest paid. With user-friendly layouts, you can easily track your repayment progress and understand the financial implications of your borrowing decisions.

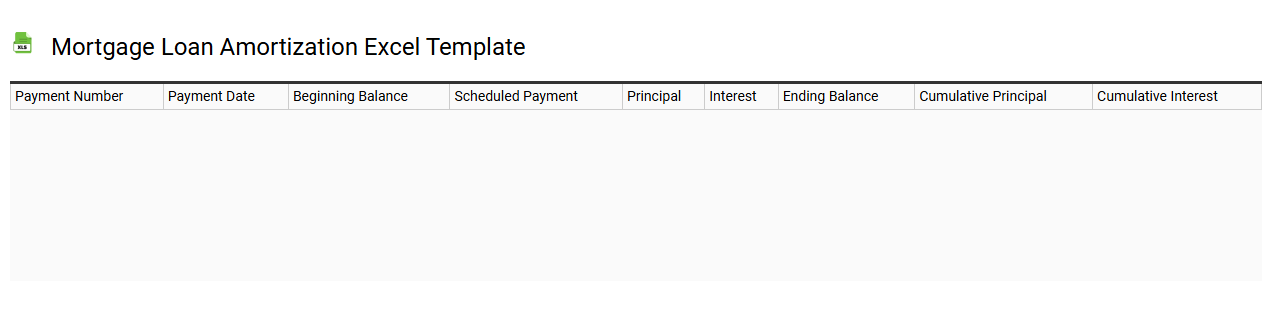

Mortgage loan amortization Excel template

💾 Mortgage loan amortization Excel template template .xls

A mortgage loan amortization Excel template is a pre-designed spreadsheet tool that helps you calculate and track the amortization schedule of a mortgage. It typically includes fields for loan amount, interest rate, loan term, and monthly payment, allowing you to visualize the breakdown of each payment into principal and interest. You can see how much of your monthly payment reduces the principal balance over time, along with the total interest paid throughout the life of the loan. This template is invaluable for budgeting and managing your mortgage effectively, while also providing a foundation for advanced financial analysis like sensitivity analysis or loan refinancing scenarios.

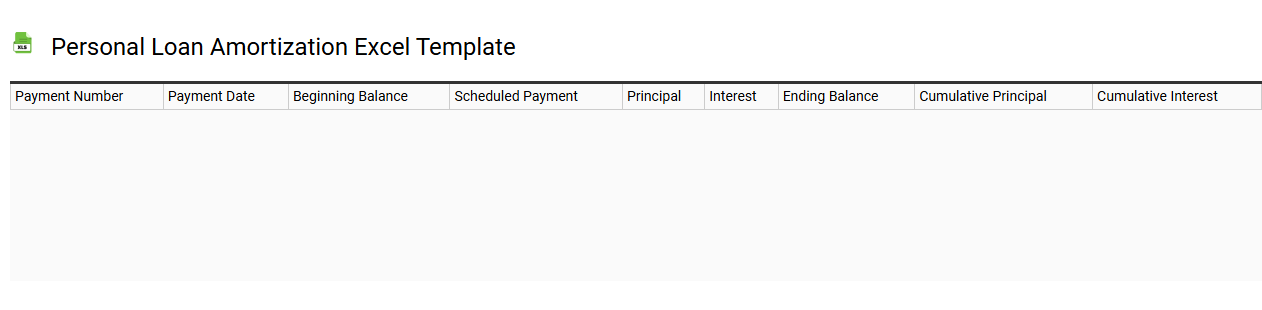

Personal loan amortization Excel template

💾 Personal loan amortization Excel template template .xls

A Personal Loan Amortization Excel template is a pre-designed spreadsheet tool that helps you manage and understand your personal loan repayment schedule. It typically includes fields for loan amount, interest rate, loan term, and payment frequency, allowing you to calculate monthly payments and total cost of the loan over its duration. Each payment breakdown details how much goes toward interest versus principal, providing clarity on your repayment progress. For even more advanced usage, consider incorporating features such as prepayment options, varying interest rates, or advanced financial simulations.

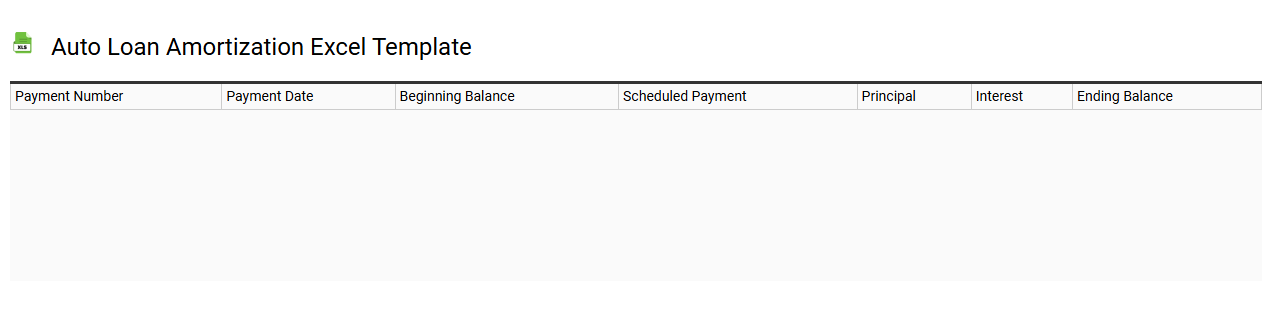

Auto loan amortization Excel template

💾 Auto loan amortization Excel template template .xls

An auto loan amortization Excel template provides a structured way to track your auto loan payments over time. This template typically includes essential details such as loan amount, interest rate, loan term, and monthly payment calculations. You can visualize your repayment schedule through an amortization table, which breaks down each payment into principal and interest, highlighting how your loan balance decreases with each installment. You can use this template for standard auto loans or explore further potential needs by incorporating advanced features like payment calculators and graphical representations of your repayment progress.

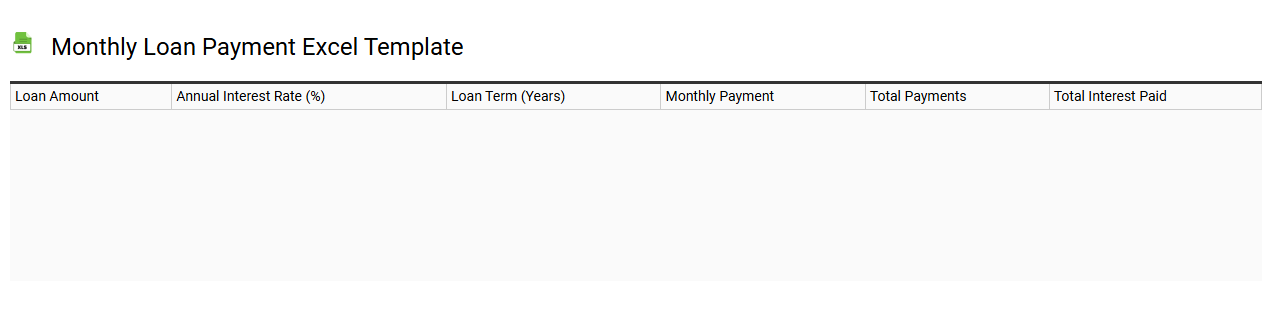

Monthly loan payment Excel template

💾 Monthly loan payment Excel template template .xls

A Monthly Loan Payment Excel template is a tool designed to help you calculate and manage your loan repayments easily. It typically includes customizable fields for loan amount, interest rate, loan term, and payment frequency. You can visualize total interest paid over the loan's duration alongside a detailed amortization schedule. This template can serve basic needs, but with further enhancement, it can incorporate features like early repayment scenarios, variable interest rates, or tax implications.

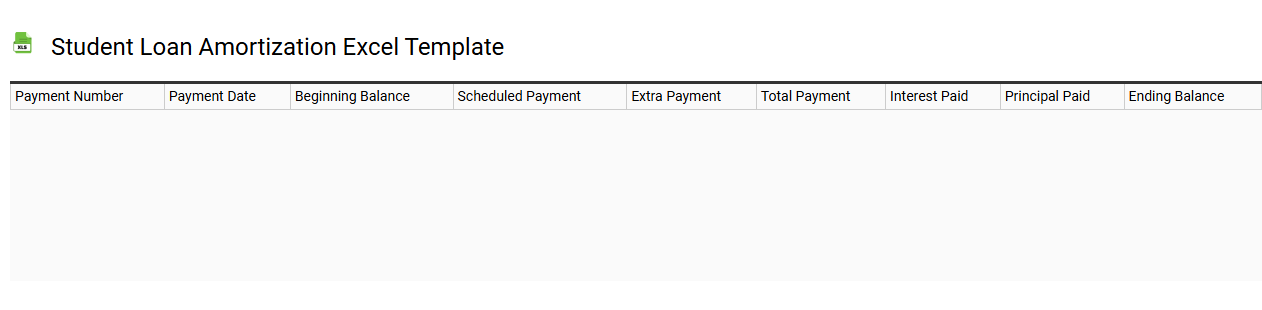

Student loan amortization Excel template

💾 Student loan amortization Excel template template .xls

A Student loan amortization Excel template is a specialized spreadsheet designed to help you manage and understand your student loan repayments. It typically includes fields for loan amount, interest rate, loan term, and payment frequency, allowing you to calculate your monthly payments and see a complete amortization schedule. This template visually represents how much of each payment goes towards interest versus the principal balance over time, making it easier to track your progress. You can use this template for basic loan tracking or expand its functionality to incorporate additional loans, calculate different interest rates, or simulate prepayment scenarios to optimize your repayment strategy.

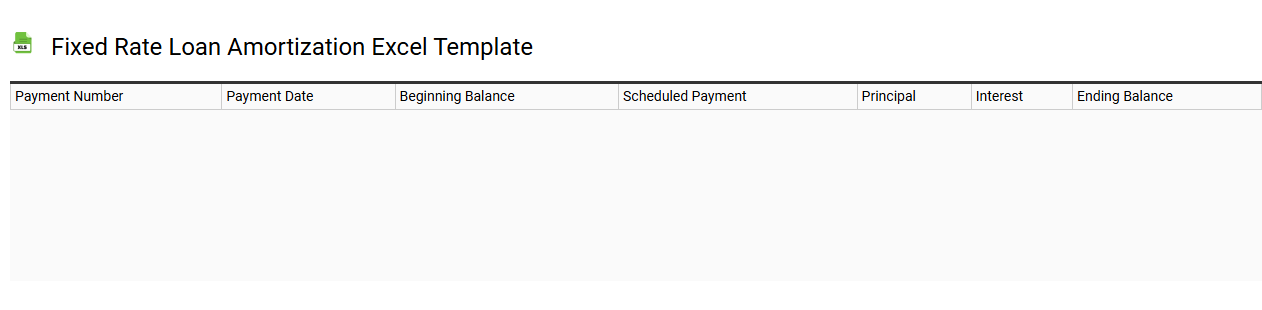

Fixed rate loan amortization Excel template

💾 Fixed rate loan amortization Excel template template .xls

A Fixed Rate Loan Amortization Excel template is a financial tool designed to help you track and manage the repayment of a fixed-rate loan over time. This template typically includes a structured table that outlines each payment period, the principal amount, interest accrued, and the remaining balance after each payment. You can visualize how your monthly payments are allocated between interest and principal, which is beneficial in understanding the loan's cost over its lifespan. For your financial planning needs, this template can be useful for personal loans, mortgages, or any fixed-rate borrowing, with further potential applications in complex financial modeling and cash flow forecasting.

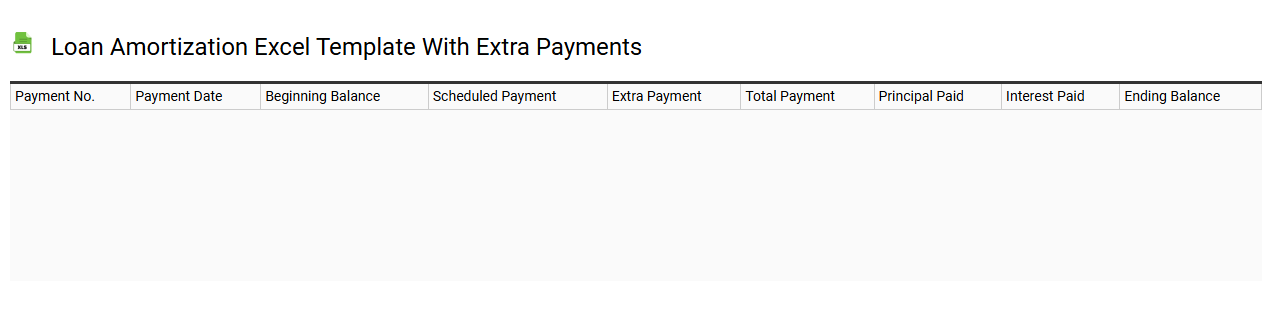

Loan amortization Excel template with extra payments

💾 Loan amortization Excel template with extra payments template .xls

A loan amortization Excel template with extra payments allows you to visualize and manage the repayment of a loan, incorporating both standard and additional payments. Each row in the table typically represents a payment period, detailing the principal, interest, and total payment breakdown. With the inclusion of extra payments, users can see how additional contributions towards the principal reduce the overall interest paid and shorten the loan term. This tool is essential for planning your finances effectively, whether you aim to pay off a mortgage, student loan, or personal loan while also considering further potential needs like adjustable-rate considerations or refinancing options.

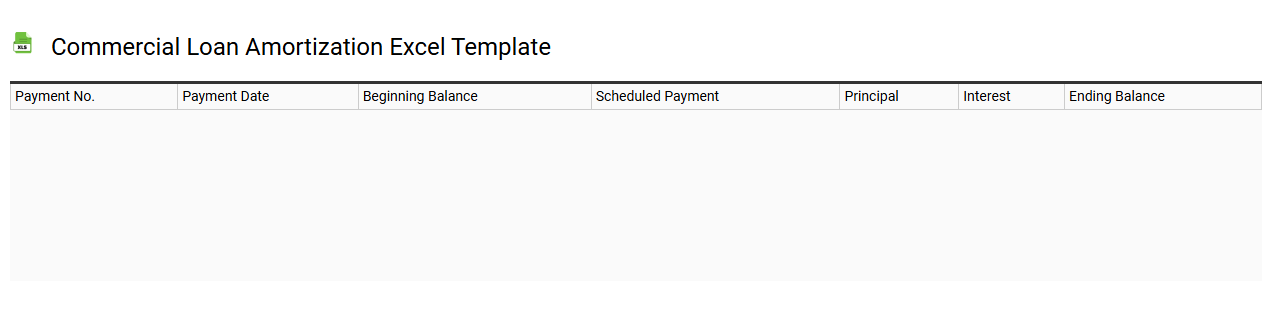

Commercial loan amortization Excel template

💾 Commercial loan amortization Excel template template .xls

A Commercial loan amortization Excel template is a pre-designed spreadsheet used to calculate and track the repayment schedule for a commercial loan. This template typically includes fields for loan amount, interest rate, term length, and payment frequency, allowing you to see how much of each payment goes toward principal and interest. It visually represents the amortization schedule, detailing outstanding balance over time and total interest paid. This basic tool can evolve to accommodate complex scenarios like variable interest rates or additional payments, enhancing your financial modeling capabilities.

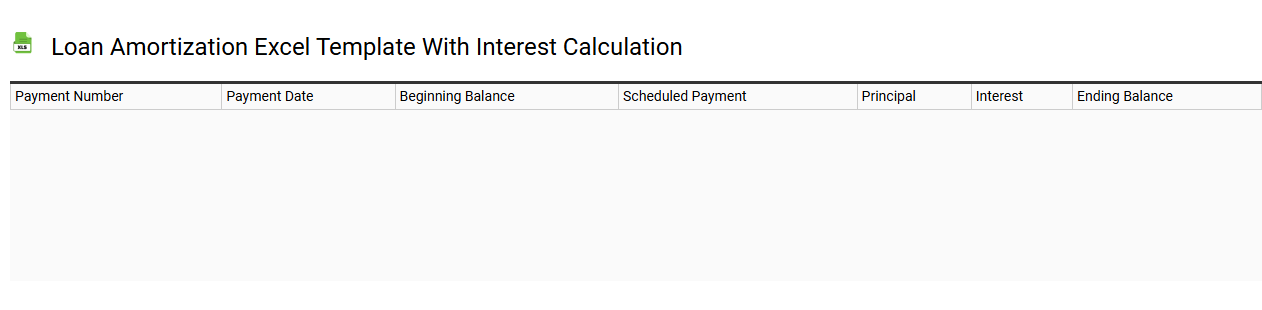

Loan amortization Excel template with interest calculation

💾 Loan amortization Excel template with interest calculation template .xls

A Loan Amortization Excel template is a structured spreadsheet that assists you in tracking the repayment of a loan over time. It typically includes several key columns such as payment number, payment amount, principal paid, interest paid, and remaining balance. This tool allows you to visualize how each payment is allocated toward the principal and interest, facilitating better financial planning. You can use this basic template for straightforward loans, with further potential applications for more complex financing scenarios like adjustable-rate mortgages or investments.