Explore diverse free XLS templates designed for loan tracking that enhance your financial management. These templates typically feature organized sections for tracking loan amounts, interest rates, payment dates, and remaining balances, helping you visualize your payment schedule easily. With customizable fields, you can tailor each template to match your unique financial situation, ensuring a streamlined overview of your loans.

Loan tracker Excel template for personal finance

![]()

💾 Loan tracker Excel template for personal finance template .xls

A Loan Tracker Excel template is a valuable tool designed to help you manage personal loans effectively. This spreadsheet typically includes columns for loan details such as loan amount, interest rate, payment frequency, and due dates, allowing you to monitor your outstanding balances and track monthly payments. You can also visualize repayment progress through charts, making it easier to set financial goals. As you familiarize yourself with this basic functionality, consider incorporating complex formulas, pivot tables, or macros to enhance your financial tracking and reporting capabilities.

Loan amortization tracker Excel template

![]()

💾 Loan amortization tracker Excel template template .xls

A Loan Amortization Tracker Excel template is a financial tool that helps you manage and monitor your loan repayment schedule. It typically includes essential components such as the principal amount, interest rate, payment frequency, and duration of the loan. You can visualize your payment schedule through amortization tables, which break down each payment into principal and interest portions over time. This template enhances your ability to keep track of remaining balances and can assist in projecting future financial needs, like refinancing or prepayments.

Mortgage loan tracker Excel template

![]()

💾 Mortgage loan tracker Excel template template .xls

A Mortgage Loan Tracker Excel template is a powerful tool designed to help homeowners and prospective buyers manage their mortgage payments and track loan details efficiently. It typically features input sections for loan amount, interest rate, term, and monthly payments, allowing you to monitor payment schedules and remaining balances. Visual graphs and charts often illustrate principal and interest distributions over time, providing clarity on your mortgage journey. You can further customize this template to explore advanced financial analyses, such as amortization schedules and early repayment impact.

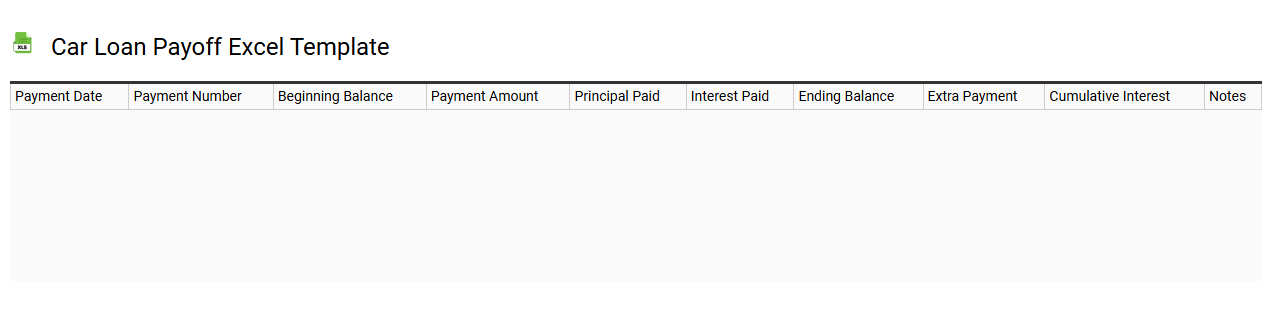

Car loan payoff Excel template

💾 Car loan payoff Excel template template .xls

A car loan payoff Excel template is a structured spreadsheet designed to help you track and manage your car loan repayment process. This template typically includes columns for the loan's principal amount, interest rate, monthly payment, remaining balance, and due dates, allowing for easy visualization of your financial obligations. It can also feature amortization schedules, showing how much interest and principal you pay with each installment over time. Utilizing this template can assist in planning for early repayment options or refinancing needs, alongside advanced concepts like interest savings calculations and total loan cost projections.

Student loan payment tracker Excel template

![]()

💾 Student loan payment tracker Excel template template .xls

The Student Loan Payment Tracker Excel template is a versatile tool designed to help you monitor and manage your student loan payments effectively. It allows you to input various loans, track payment amounts, due dates, and outstanding balances all in one organized spreadsheet. This template often includes features like calculators for interest accrual and amortization schedules to give you a clearer picture of your financial commitments. Beyond basic tracking, you can customize it further to analyze repayment strategies or project future payments based on changing interest rates.

Loan balance tracker Excel template

![]()

💾 Loan balance tracker Excel template template .xls

A Loan Balance Tracker Excel template is a customizable spreadsheet designed to help you monitor and manage your loan payments and balances effectively. It typically features sections for entering loan details, payment schedules, and interest rates, allowing you to visualize how much you owe over time. You can easily track your progress, see the impact of extra payments, and calculate how much interest you'll pay overall. This tool can evolve into a sophisticated financial management system, incorporating advanced functions like amortization schedules, debt snowball strategies, and financial projections tailored to your specific needs.

Home loan EMI tracker Excel template

![]()

💾 Home loan EMI tracker Excel template template .xls

A Home Loan EMI Tracker Excel template is a powerful tool designed to help you manage and monitor your home loan payments efficiently. This customizable spreadsheet allows you to input key details such as loan amount, interest rate, and loan tenure, automatically calculating your monthly Equated Monthly Installment (EMI). You can also track your outstanding balance, payment due dates, and total interest paid over the loan term. Such a tracker not only enhances your financial management but also aids in analyzing potential refinancing or prepayment strategies, ensuring you make informed decisions as your financial situation evolves.

Small business loan tracking Excel template

![]()

💾 Small business loan tracking Excel template template .xls

A Small Business Loan Tracking Excel template serves as a robust tool for managing and monitoring your loans. This customizable spreadsheet allows you to input vital details such as loan amounts, interest rates, payment schedules, and remaining balances. You can visually track your cash flow and repayment progress over time, simplifying budget management and financial forecasting. Utilizing this template can help you pinpoint upcoming payment dates and potential cash shortfalls, ensuring a solid approach to financial health and identifying opportunities for refinancing or loan adjustments in the future.

Home loan repayment Excel template tracker

![]()

💾 Home loan repayment Excel template tracker template .xls

A home loan repayment Excel template tracker is a pre-designed spreadsheet tool that helps you manage and monitor your home loan repayments effectively. This template typically includes features like payment schedules, interest calculations, and remaining balance tracking, allowing you to visualize your amortization progress. Input your loan amount, interest rate, and repayment term to receive organized details regarding each payment, including principal and interest components. For basic usage, such a template is ideal; however, you can also explore advanced functionalities like scenario analysis, cash flow projections, or sensitivity analyses for a deeper understanding of your financial situation.

Small business loan tracker Excel template

![]()

💾 Small business loan tracker Excel template template .xls

A Small Business Loan Tracker Excel template is a valuable tool designed to help entrepreneurs manage and monitor their loan details. This template typically includes sections for recording the loan amount, interest rate, repayment schedule, and payment due dates. You can easily input and update the information to track your payments, assess your remaining balance, and calculate interest accrued over time. With this organized approach, you gain insights into your cash flow and can make informed decisions regarding future financial strategies, including refinancing options, budgeting, and growth initiatives for your business.

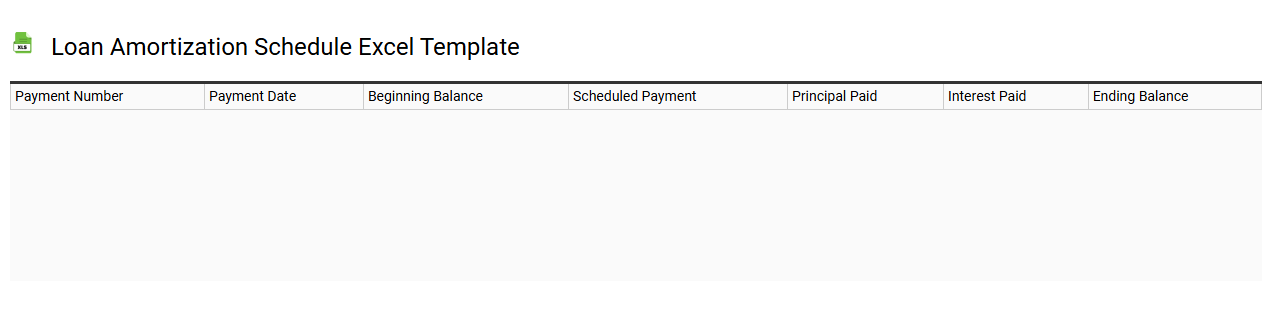

Loan amortization schedule Excel template

💾 Loan amortization schedule Excel template template .xls

A loan amortization schedule Excel template is a structured spreadsheet designed to break down your loan payments over time. Each row displays the principal amount, interest payment, total payment, and remaining balance for each period, offering a clear view of how each payment affects the loan's overall balance. This tool helps you visualize the impact of extra payments, potential refinancing options, and the total interest paid over the loan's term. With basic usage for tracking standard loans, it can also be tailored for advanced financial modeling, including varying interest rates or balloon payments.

Auto loan payment tracker Excel template

![]()

💾 Auto loan payment tracker Excel template template .xls

An Auto Loan Payment Tracker Excel template is a specialized financial tool designed to help you monitor and manage your auto loan payments effectively. This template typically includes fields for the loan amount, interest rate, monthly payment, due date, and remaining balance. You can customize it to project future payments and calculate potential savings from extra payments. Utilizing this template not only helps you stay organized, but it also aids in identifying opportunities for refinancing or making lump sum payments for long-term financial planning.

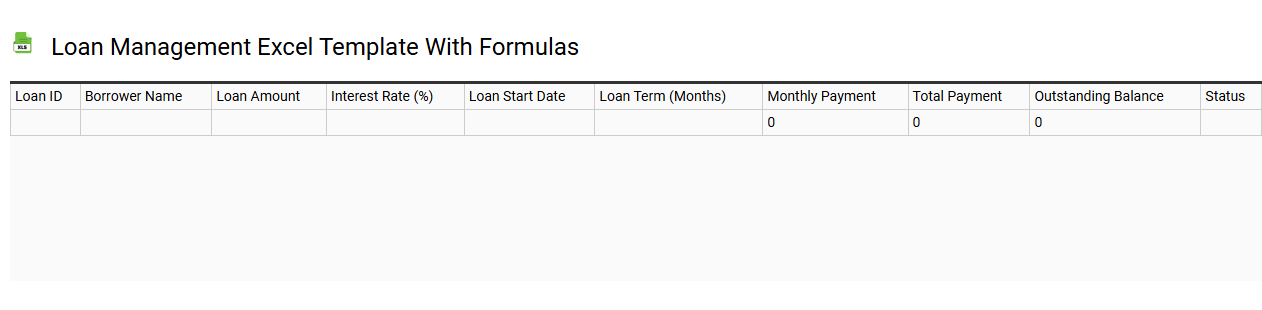

Loan management Excel template with formulas

💾 Loan management Excel template with formulas template .xls

A Loan Management Excel template with formulas serves as a powerful tool to track and manage loan-related finances efficiently. It typically includes sections for principal amount, interest rates, payment schedules, and outstanding balances. Users can apply formulas to automate calculations for monthly payments, total interest paid, and remaining balance after each payment. This template is not just a basic budgeting tool; it can evolve into an advanced financial model incorporating features like amortization schedules, automated reminders for due dates, or scenario analysis for different interest rates and payment plans, enhancing its functionality significantly for your needs.

Monthly loan repayment tracker Excel template

![]()

💾 Monthly loan repayment tracker Excel template template .xls

A Monthly Loan Repayment Tracker Excel template is a specialized spreadsheet designed to help you monitor and organize your loan repayments effectively. It typically includes columns for tracking the loan amount, interest rate, monthly payment, and remaining balance, allowing you to visualize your financial commitments clearly. You can input the payment due dates and amounts, making it easier for you to stay on top of your repayment schedule. This tool not only aids in managing current loans but also has the potential to incorporate advanced features like amortization schedules or integration with budgeting tools for a comprehensive financial overview.