A yearly depreciation schedule Excel template allows you to efficiently track and calculate the depreciation of your assets over a specific period. It typically features columns for asset description, initial cost, useful life, depreciation method, and accumulated depreciation. This organized format enables you to maintain clear records, helping you make informed financial decisions for your business or personal investments.

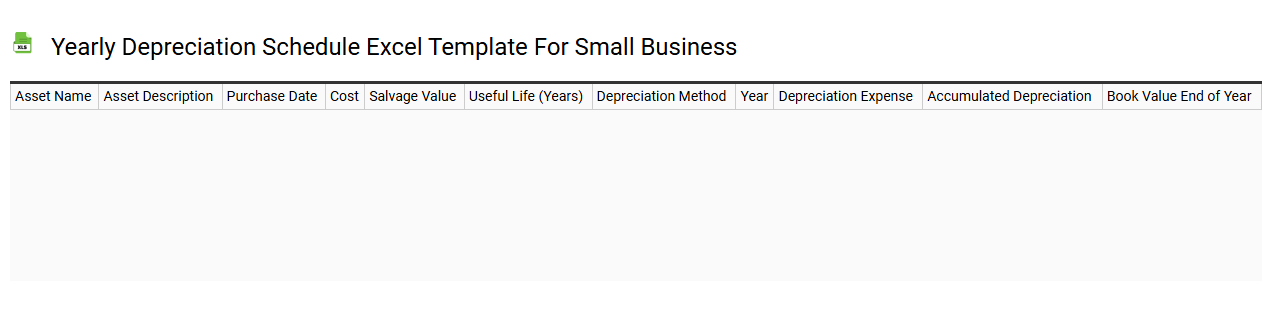

Yearly depreciation schedule Excel template for small business

💾 Yearly depreciation schedule Excel template for small business template .xls

A yearly depreciation schedule Excel template for small businesses provides a structured approach to tracking the depreciation of assets over time. This template typically includes columns for asset description, purchase date, initial cost, estimated lifespan, depreciation method, annual depreciation amount, and accumulated depreciation. Users can visually analyze how asset value diminishes yearly, aiding in financial planning and tax preparation. Understanding basic usage can simplify financial management, while further potential needs may involve advanced terms like MACRS or Section 179 deductions for optimized tax strategies.

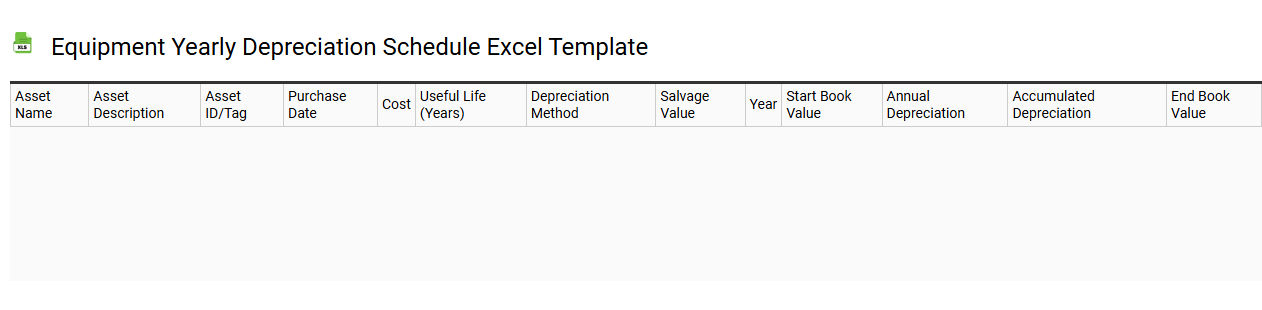

Equipment yearly depreciation schedule Excel template

💾 Equipment yearly depreciation schedule Excel template template .xls

An equipment yearly depreciation schedule Excel template is a structured framework used to systematically track the depreciation of physical assets over time. This template typically includes columns for asset description, purchase date, original cost, useful life, and depreciation method, such as straight-line or declining balance. Each row represents a different piece of equipment, allowing you to calculate annual depreciation expenses and maintain accurate financial records. You can leverage this template for basic tracking or expand into complex financial modeling, including net book value calculations and tax implications.

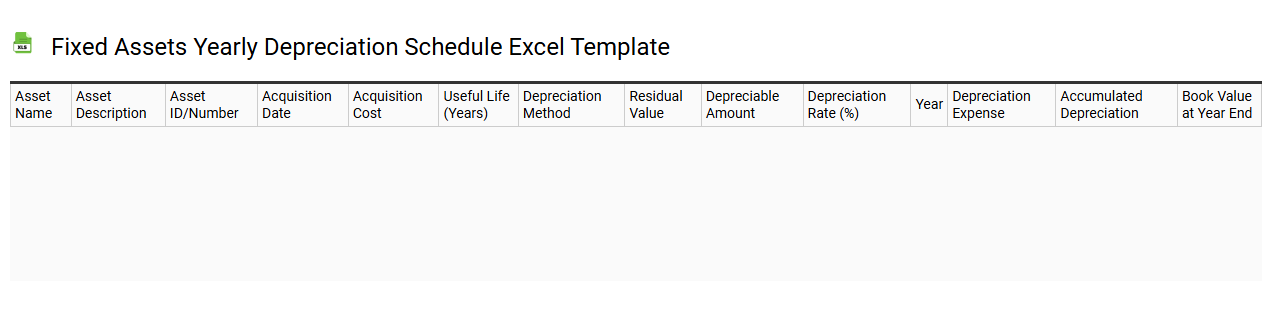

Fixed assets yearly depreciation schedule Excel template

💾 Fixed assets yearly depreciation schedule Excel template template .xls

A Fixed Assets Yearly Depreciation Schedule Excel template is a structured spreadsheet used to track the depreciation of fixed assets over time. This template includes essential details such as the asset name, purchase date, purchase cost, useful life, and the method of depreciation, commonly using straight-line or declining balance methods. Each year, the spreadsheet calculates accumulated depreciation, providing clear insights into the asset's value decrease over its lifespan. You can leverage this tool for financial reporting, tax preparation, and budgeting, while also exploring advanced concepts like impairment testing and tax code considerations for asset disposals.

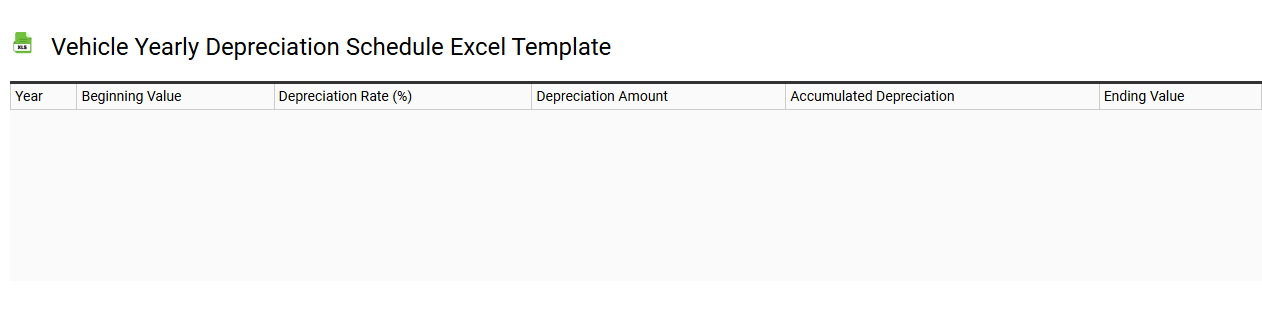

Vehicle yearly depreciation schedule Excel template

💾 Vehicle yearly depreciation schedule Excel template template .xls

A Vehicle yearly depreciation schedule Excel template offers a structured approach to calculate and track the depreciation of a vehicle over time. This template typically includes essential columns such as the purchase price, useful life, salvage value, and annual depreciation expense. You can easily input your vehicle's data, allowing the spreadsheet to automatically compute the depreciation for each year based on the selected method, such as straight-line or declining balance. Utilizing such a template helps you maintain accurate financial records, enabling smarter decisions regarding maintenance, resale, or fleet management, while allowing for advanced financial analysis like present value calculations or tax implications.

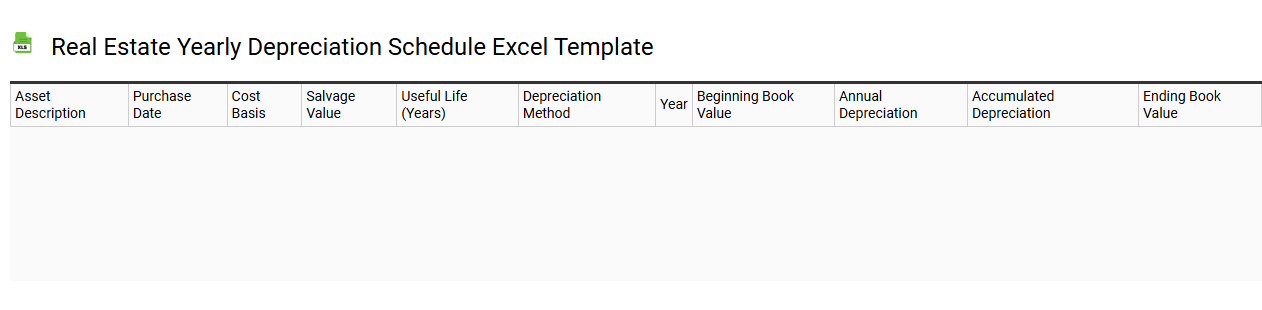

Real estate yearly depreciation schedule Excel template

💾 Real estate yearly depreciation schedule Excel template template .xls

A real estate yearly depreciation schedule Excel template is a structured spreadsheet tool designed to track and calculate the depreciation of real estate properties over time. This template typically includes rows for each property, columns for purchase price, year, depreciation method, accumulated depreciation, and annual depreciation expense. Users can easily input relevant data, allowing for simple calculations and adjustments according to different depreciation strategies such as straight-line or declining balance methods. You can utilize this tool for basic accounting needs or explore advanced functionalities like integrating tax implications and conducting sensitivity analysis on investment scenarios.

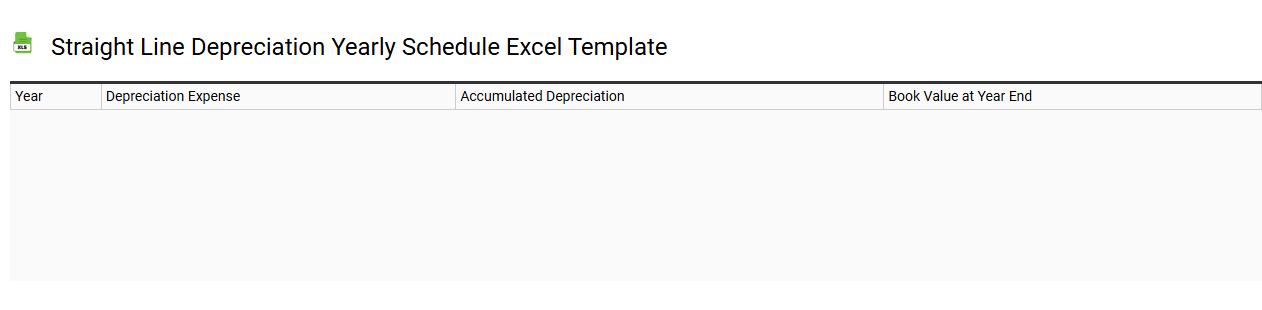

Straight line depreciation yearly schedule Excel template

💾 Straight line depreciation yearly schedule Excel template template .xls

A Straight Line Depreciation yearly schedule Excel template is a pre-designed spreadsheet that simplifies the calculation of depreciation for fixed assets. This template allows you to input the asset's purchase price, useful life, and salvage value, automatically computing the annual depreciation expense. You can clearly visualize the asset's value over time through a straightforward table format, making it easier to track financial performance and asset management. For further potential needs, you may explore features like forecasting, tax implications, or integrating advanced financial modeling techniques.

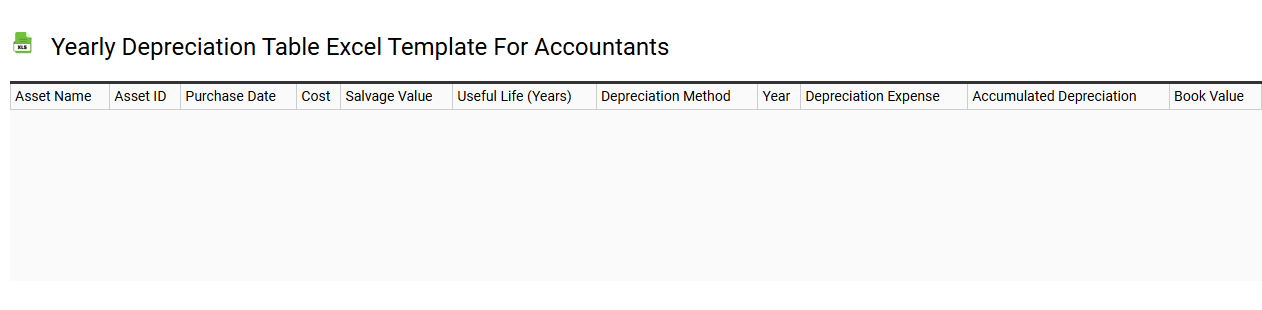

Yearly depreciation table Excel template for accountants

💾 Yearly depreciation table Excel template for accountants template .xls

A yearly depreciation table Excel template provides accountants with a streamlined way to calculate and track the depreciation of fixed assets over time. This template typically includes columns for the asset description, purchase date, initial cost, expected useful life, and depreciation method, allowing for a systematic approach to financial reporting. You can input various assets into the template, and it automatically calculates annual depreciation amounts based on the chosen method, such as straight-line or declining balance. This tool not only simplifies the yearly accounting process but also serves advanced needs, such as integrating tax implications or forecasting future asset values.

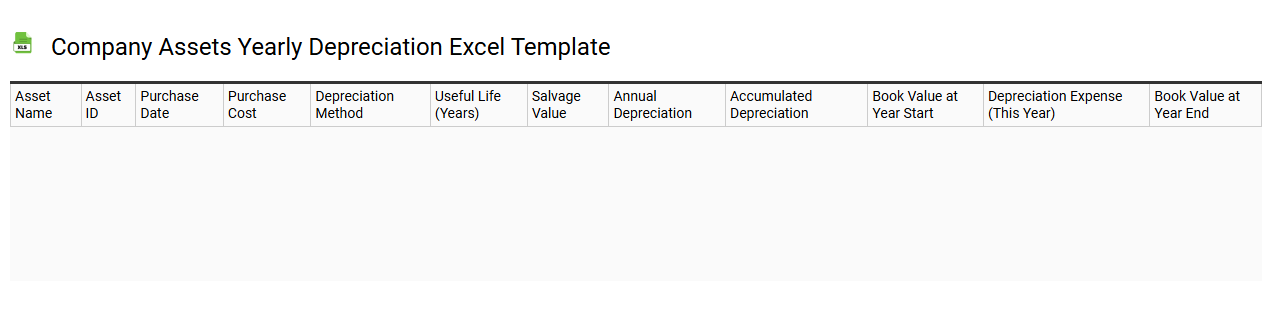

Company assets yearly depreciation Excel template

💾 Company assets yearly depreciation Excel template template .xls

A Company assets yearly depreciation Excel template is a tool designed to streamline the calculation of asset depreciation over a specified period. This template typically includes columns for asset descriptions, purchase dates, initial costs, estimated useful lives, depreciation methods, and accumulated depreciation. With built-in formulas, it automates the computation of annual depreciation expenses based on your chosen method, whether it be straight-line, declining balance, or units of production. This basic setup allows for further customization, accommodating advanced techniques like accelerated depreciation or tax-adjusted calculations to meet specific financial reporting needs.

Yearly depreciation expense tracker Excel template

![]()

💾 Yearly depreciation expense tracker Excel template template .xls

A yearly depreciation expense tracker Excel template is a structured tool designed to calculate and track the depreciation of assets over time. It typically includes sections for entering asset details, acquisition costs, useful life, and depreciation methods such as straight-line or declining balance. The template automates calculations, providing a clear view of annual depreciation expenses and accumulated depreciation. You can customize it to meet specific accounting needs, while advanced features could include integration with financial forecasting and asset management systems for enhanced reporting and analysis.

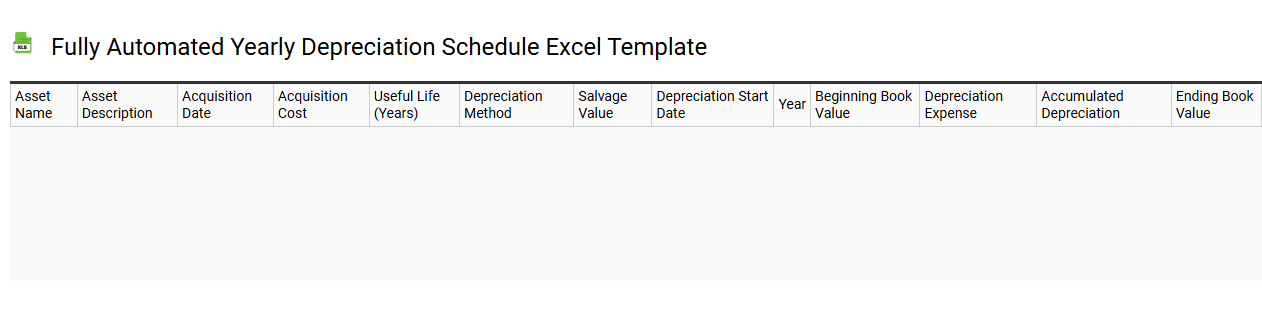

Fully automated yearly depreciation schedule Excel template

💾 Fully automated yearly depreciation schedule Excel template template .xls

A fully automated yearly depreciation schedule Excel template streamlines the calculation of asset depreciation over its useful life. This template utilizes built-in formulas to automatically update asset values based on your input, saving you time and minimizing errors. Customizable fields allow you to enter asset purchase price, useful life, and residual value, generating a clear breakdown of annual depreciation for each asset. You can further explore the potential of advanced depreciation methods, such as double declining balance or units of production, to enhance financial analysis and planning.