Explore a range of free Excel templates specifically designed for debt analysis. These templates allow you to meticulously track and manage your debts, providing a clear overview of your financial obligations. You can input your loan amounts, interest rates, and payment schedules, making it easier to visualize your repayment progress and overall financial health.

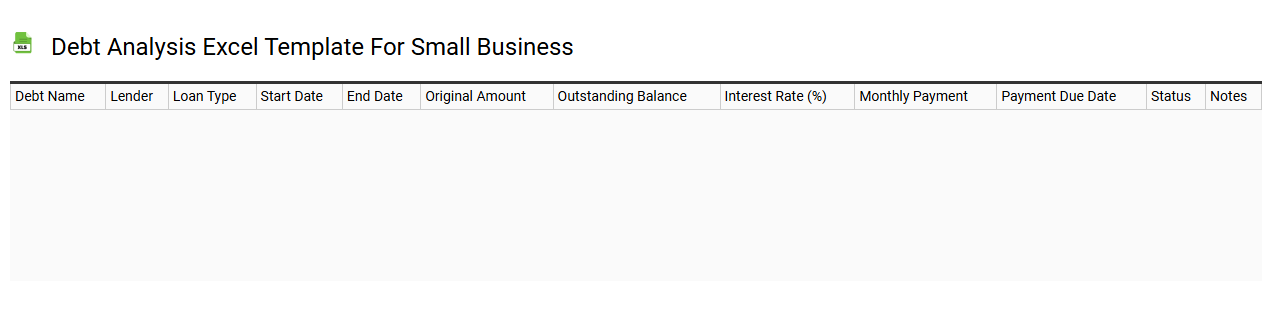

Debt analysis Excel template for small business

💾 Debt analysis Excel template for small business template .xls

A Debt Analysis Excel template for small businesses provides a structured framework for evaluating and managing financial obligations. This tool typically includes sections for listing various debts, their interest rates, repayment terms, and maturity dates, allowing you to visualize your overall financial health. It helps identify high-interest debts, track repayment progress, and suggest strategies for debt reduction. You can easily adapt the template for more advanced financial modeling, such as cash flow forecasting and scenario analysis.

Personal debt tracking Excel template

![]()

💾 Personal debt tracking Excel template template .xls

A Personal Debt Tracking Excel template serves as a customizable tool designed to help individuals manage and monitor their personal debts effectively. This spreadsheet typically features columns for debt types, outstanding balances, interest rates, minimum monthly payments, due dates, and payment histories. Users can input their financial data to visualize the total debt amount and track progress towards becoming debt-free. As you utilize this template, you might consider integrating advanced financial metrics such as debt-to-income ratios or amortization schedules for deeper insights.

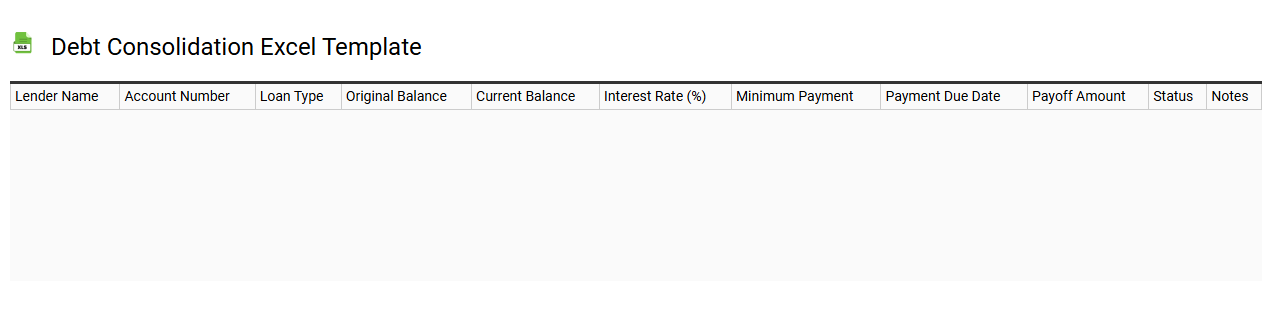

Debt consolidation Excel template

💾 Debt consolidation Excel template template .xls

A Debt Consolidation Excel template is a structured spreadsheet designed to help individuals or businesses manage multiple debts more efficiently by merging them into a single payment. This template typically includes sections for listing all current debts, including details such as creditor names, outstanding balances, interest rates, and minimum monthly payments. With built-in formulas, it calculates total debt, monthly payments, and potential savings in interest over time, providing users a clear overview of their financial situation. This tool not only assists in tracking debt repayment but also highlights opportunities for further financial strategies, such as refinancing or exploring debt avalanche or snowball methods.

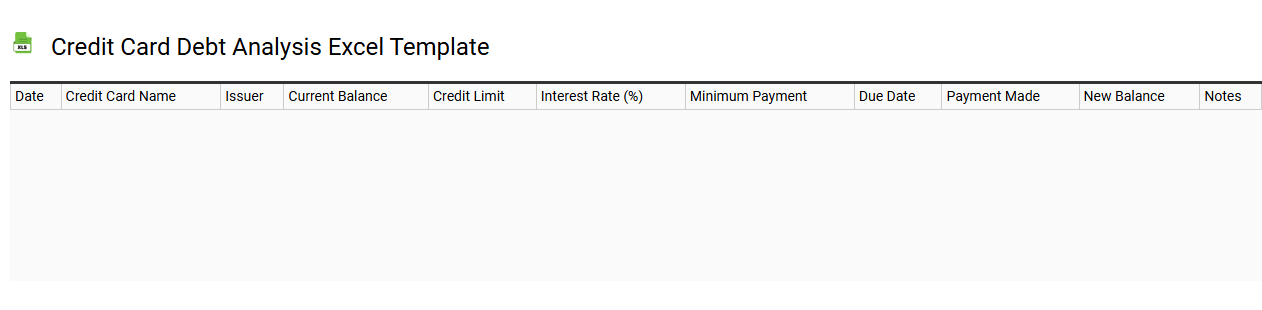

Credit card debt analysis Excel template

💾 Credit card debt analysis Excel template template .xls

A Credit Card Debt Analysis Excel template is a structured spreadsheet designed to help you track, analyze, and manage your credit card debts. This template typically includes features such as outstanding balance tracking, interest rate calculations, monthly payment schedules, and total interest paid over time. By visualizing your debt data, you can identify trends and understand your financial situation better. Basic usage can support budgeting and timely payment planning, while advanced functionalities could involve forecasting potential savings through debt consolidation or simulating different payment strategies using advanced financial modeling techniques.

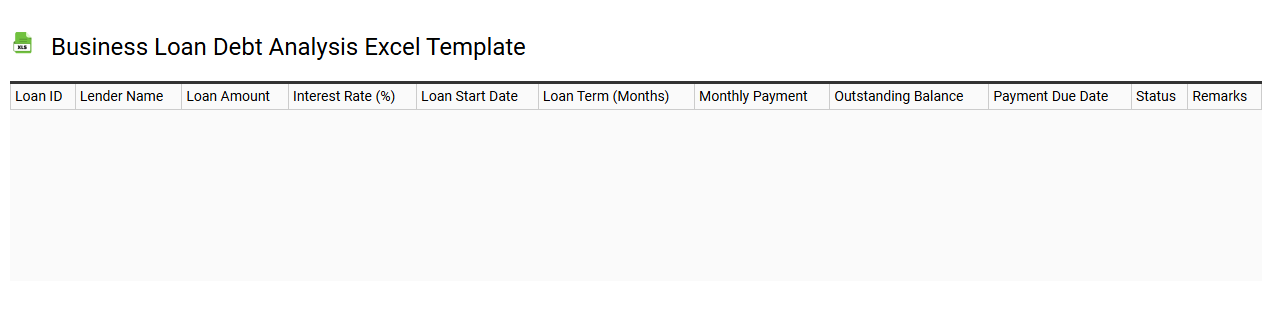

Business loan debt analysis Excel template

💾 Business loan debt analysis Excel template template .xls

A Business Loan Debt Analysis Excel template is a structured tool designed to help business owners evaluate their loan obligations and financial health. This template typically includes sections for inputting loan amounts, interest rates, payment schedules, and remaining balances, providing a clear overview of current debts and repayment progress. Charts and graphs may visually represent data, making it easier to assess financial trends and make informed decisions. You can use this template for basic financial tracking, with potential for advanced analyses such as cash flow forecasting and loan optimization strategies.

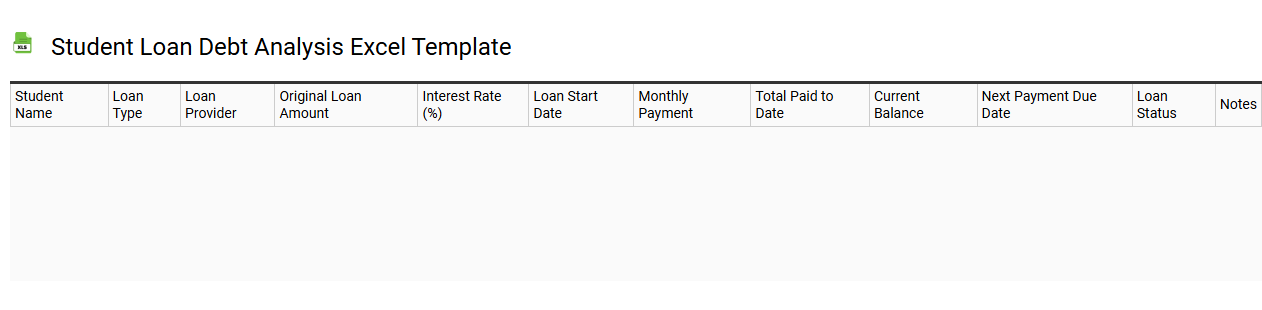

Student loan debt analysis Excel template

💾 Student loan debt analysis Excel template template .xls

A Student loan debt analysis Excel template is a structured spreadsheet designed to help you systematically evaluate and manage student loans. It typically includes sections for entering loan details such as principal amounts, interest rates, and repayment terms, which provide clarity on your financial obligations. The template often incorporates formulas to calculate monthly payments, total interest paid over the life of the loan, and payoff timelines, ensuring you understand the total cost of borrowing. By utilizing this tool, you can effectively monitor your debts and explore advanced financial strategies, like loan refinancing or consolidation.

Personal debt tracker Excel template

![]()

💾 Personal debt tracker Excel template template .xls

A Personal Debt Tracker Excel template serves as a structured tool for managing and monitoring various debts, including credit cards, loans, and mortgages. This spreadsheet typically includes categories such as creditor names, outstanding balances, interest rates, minimum payments, and due dates, allowing you to visualize your financial obligations. You can easily update your payments and see the impact on your debt reduction progress over time. For more advanced needs, you might explore features like debt repayment calculators or amortization schedules to better strategize your financial management plan.

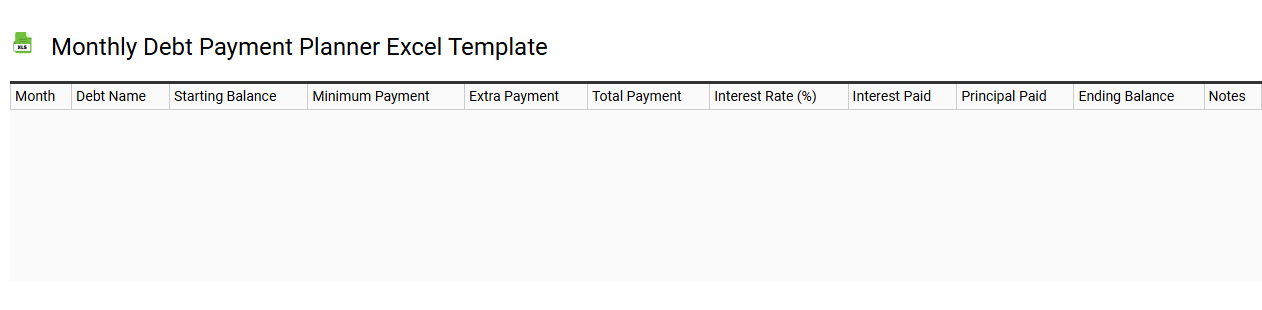

Monthly debt payment planner Excel template

💾 Monthly debt payment planner Excel template template .xls

A monthly debt payment planner Excel template is a customizable spreadsheet designed to help users track and manage their debt obligations. This tool enables you to input various loans, credit card balances, interest rates, and minimum payments, creating a clear overview of your financial commitments. You can visualize your payment progress, discover outstanding balances, and identify potential overpayments or areas for adjustment. With basic formulas for calculating totals and payment schedules, you can further explore advanced financial strategies like debt snowball or avalanche methods to optimize your repayment plan.

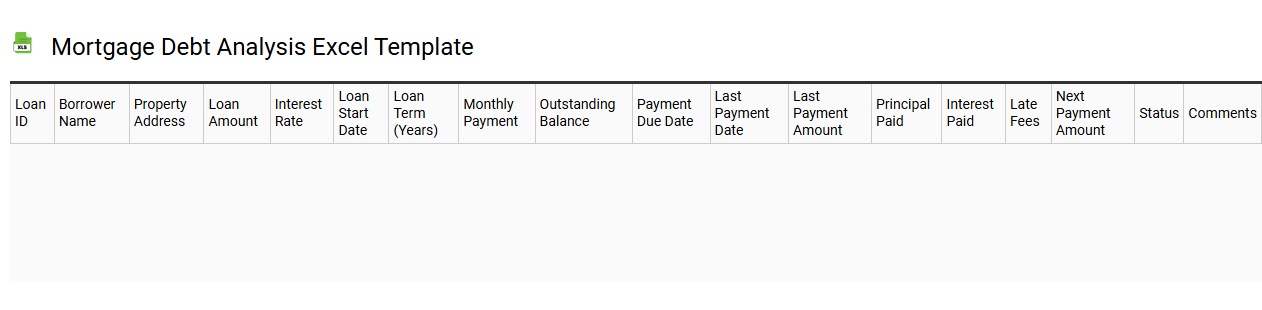

Mortgage debt analysis Excel template

💾 Mortgage debt analysis Excel template template .xls

A Mortgage Debt Analysis Excel template helps you systematically evaluate and manage your mortgage-related financial data. It typically includes structured sections for loan details, payment schedules, interest calculations, and total debt assessments. You can input variables like loan amounts, interest rates, and term lengths, allowing for an insightful analysis of monthly payments and overall cost. This tool not only serves basic budgeting needs but can also extend to sophisticated financial modeling, incorporating terms like amortization schedules and principal prepayment scenarios for in-depth financial strategies.

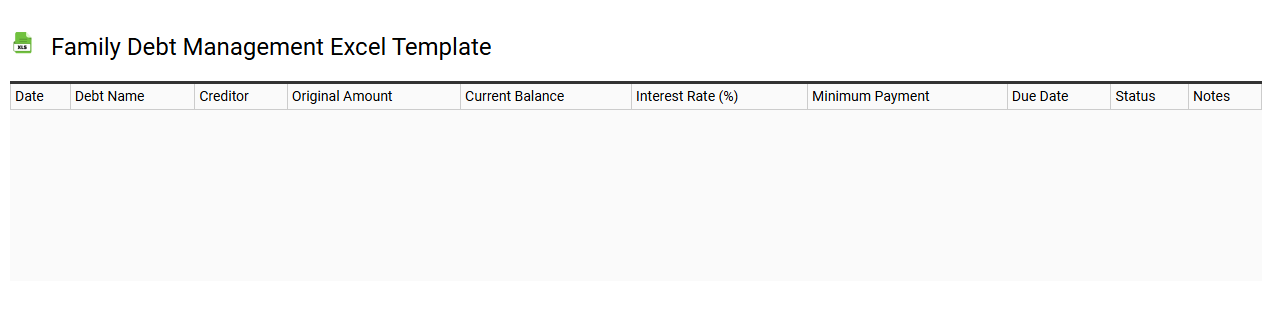

Family debt management Excel template

💾 Family debt management Excel template template .xls

A Family Debt Management Excel template is a structured spreadsheet designed to help you track and manage family debts efficiently. This template typically includes sections for documenting each debt, such as the creditor name, total amount owed, interest rate, minimum payment, and due date. Users can monitor their payment history, calculate remaining balances, and visualize progress through charts or graphs. This basic tool can evolve into more advanced financial analysis, incorporating additional features like budget planning, debt payoff strategies, and forecasts based on changing interest rates or income levels.

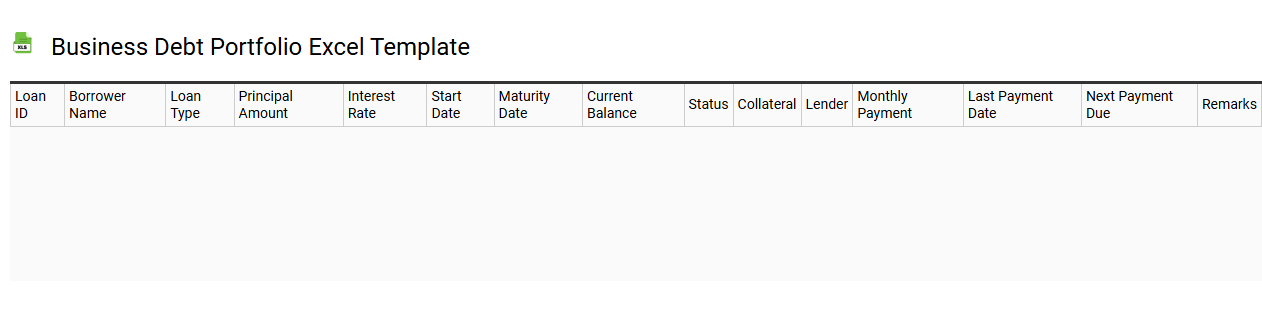

Business debt portfolio Excel template

💾 Business debt portfolio Excel template template .xls

A Business Debt Portfolio Excel template is a structured spreadsheet designed to help organizations manage and track their debts effectively. It includes various sections for entering details such as creditor names, loan amounts, interest rates, payment schedules, and outstanding balances. This organized layout allows users to monitor debt repayment progress and assess financial obligations at a glance. Such a template can serve basic needs for tracking debts while also offering potential for advanced features like data visualization, cash flow forecasting, and integration with financial modeling.