Discover a range of free XLS templates designed specifically for payroll compliance audits. These templates include comprehensive checklists, detailed tracking sheets for employee hours and wages, and built-in formulas to simplify calculations and ensure accuracy. You can enhance your audit processes by using these user-friendly templates, helping you to easily maintain compliance while streamlining payroll management.

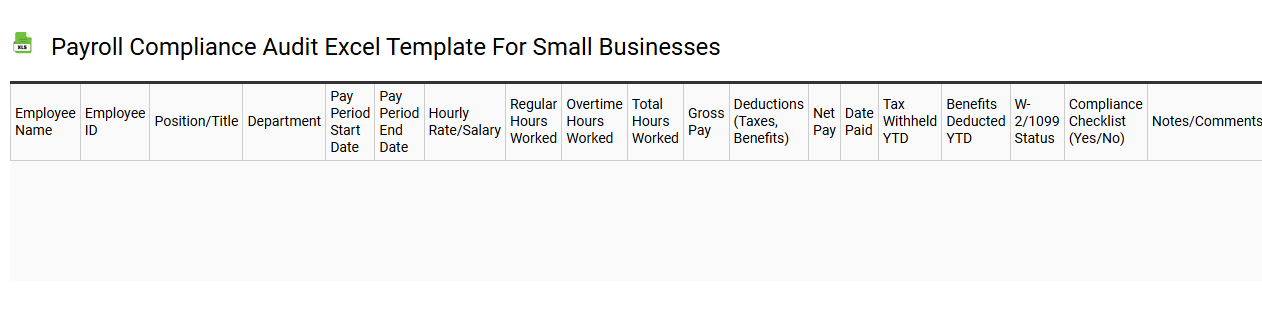

Payroll compliance audit Excel template for small businesses

💾 Payroll compliance audit Excel template for small businesses template .xls

A Payroll compliance audit Excel template serves as a systematic tool designed to help small businesses ensure adherence to payroll regulations and standards. This template organizes employee data, including wages, tax withholdings, and benefits information, making it easier to identify discrepancies or areas of non-compliance. By utilizing this resource, you can strengthen your payroll processes, minimize human error, and ensure that all recordings align with federal and state laws. Beyond basic payroll auditing, the template can adapt to incorporate advanced analytics and reporting features for deeper insights into labor costs and compliance trends.

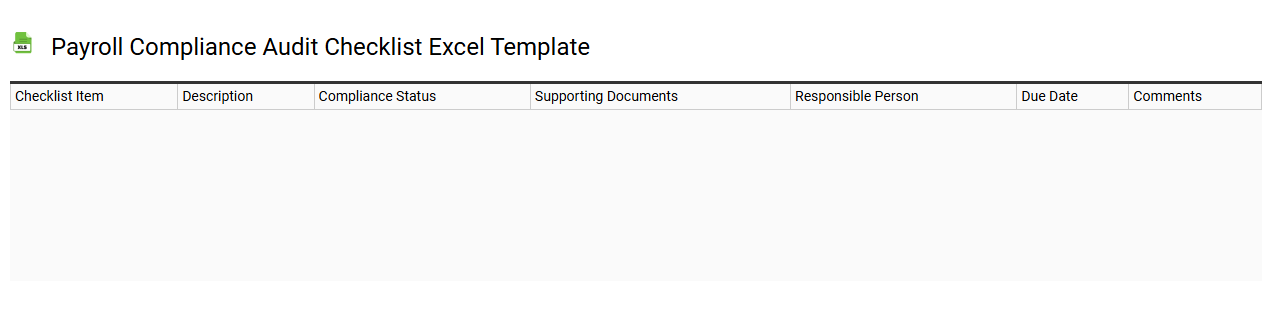

Payroll compliance audit checklist Excel template

💾 Payroll compliance audit checklist Excel template template .xls

A Payroll compliance audit checklist Excel template serves as a structured tool for organizations to ensure adherence to payroll laws and regulations. It typically includes categories such as employee classifications, wage calculations, tax withholdings, and benefits administration. Each item on the checklist is designed to verify that all payroll processes comply with federal, state, and local labor laws. Using this template not only streamlines the audit process but also helps identify areas where enhancements may be required for efficient payroll practices, facilitating advanced solutions like automated compliance tracking and real-time reporting capabilities.

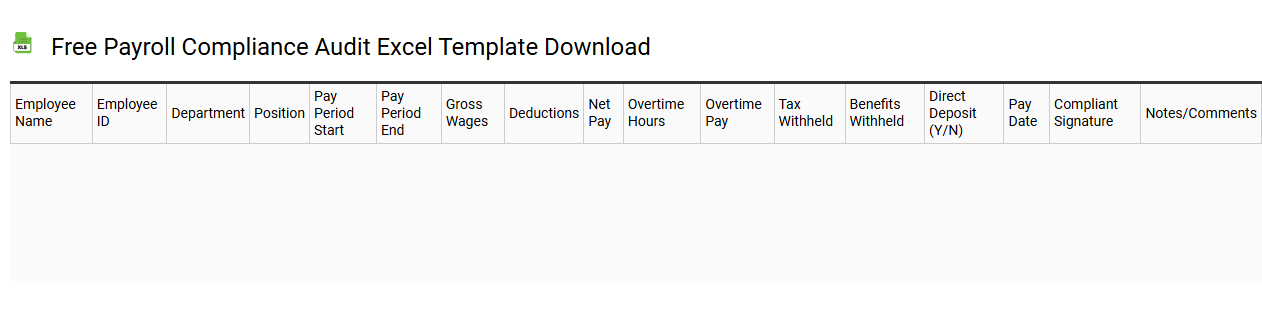

Free payroll compliance audit Excel template download

💾 Free payroll compliance audit Excel template download template .xls

A Free Payroll Compliance Audit Excel template is a tool designed to assist businesses in reviewing their payroll processes for accuracy and adherence to legal requirements. This template typically includes sections for employee data, hours worked, wage rates, tax withholding, and benefit deductions, allowing for a thorough examination of payroll records. With built-in formulas, it helps streamline calculations to ensure that all payments are correct and that payroll taxes are properly managed. Understanding this tool's basic functions can lead to more advanced applications, such as integration with HR systems or tailored compliance reporting to manage complex regulatory changes.

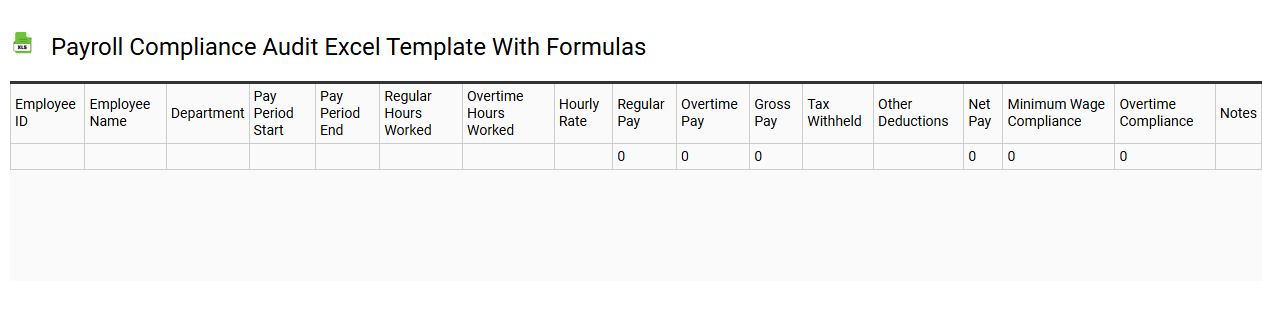

Payroll compliance audit Excel template with formulas

💾 Payroll compliance audit Excel template with formulas template .xls

A Payroll Compliance Audit Excel template is a structured sheet designed to help organizations ensure their payroll processes adhere to legal and regulatory standards. This template typically includes sections for employee data, wage calculations, tax deductions, and benefits contributions. Formulas automate calculations for gross pay, net pay, and any applicable taxes or deductions, minimizing errors and enhancing accuracy. You can use this tool to manage your payroll compliance effectively while also expanding its potential by integrating advanced functions like VLOOKUP for cross-referencing data and pivot tables for detailed reporting.

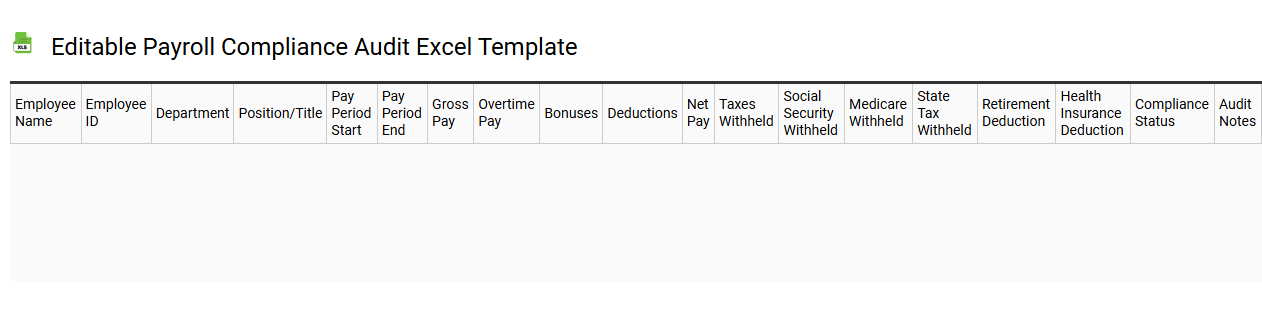

Editable payroll compliance audit Excel template

💾 Editable payroll compliance audit Excel template template .xls

An editable payroll compliance audit Excel template serves as a systematic tool designed to streamline the process of reviewing payroll practices against legal and regulatory requirements. This template typically includes pre-defined sections for inputting employee details, wage information, tax calculations, and other payroll-related data, which allows for easy modification and personalization. Users can efficiently track compliance with federal and state labor laws, ensuring that all payroll practices are in line with current legislation. You can leverage this template for basic payroll audits while also exploring advanced features like data visualization, automated error checking, and integration with financial software for comprehensive payroll management.

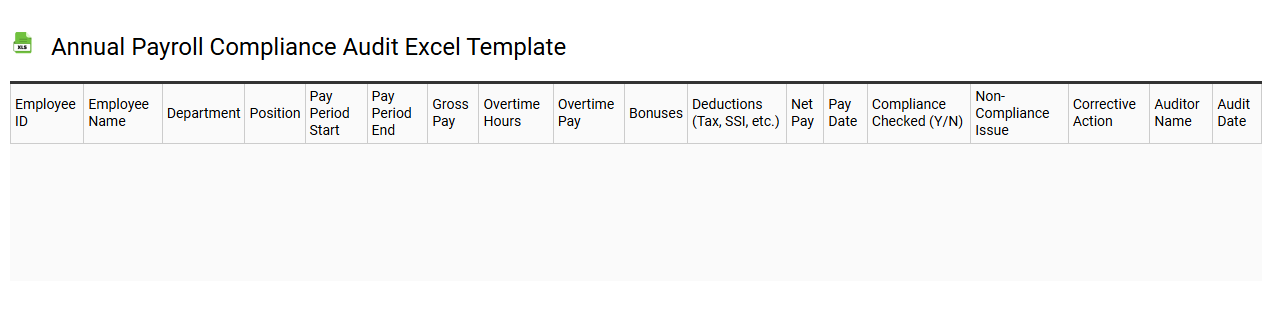

Annual payroll compliance audit Excel template

💾 Annual payroll compliance audit Excel template template .xls

An Annual Payroll Compliance Audit Excel template streamlines the process of reviewing payroll practices to ensure adherence to legal standards and organizational policies. This customizable spreadsheet allows you to track essential elements such as employee classifications, hours worked, tax withholdings, and benefit deductions, ensuring that every detail aligns with regulatory requirements. With features such as automated calculations and data validation, the template minimizes the risk of errors and enhances efficiency in payroll assessments. You can utilize this tool not only for basic payroll compliance but also to identify potential areas for improvement, evaluate efficiency metrics, and prepare for more sophisticated analyses such as predictive modeling or machine learning applications in payroll processing.

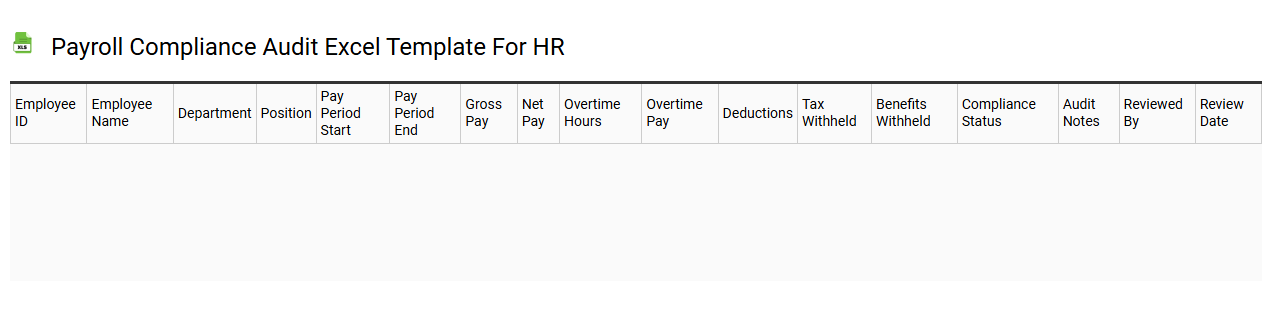

Payroll compliance audit Excel template for HR

💾 Payroll compliance audit Excel template for HR template .xls

A Payroll compliance audit Excel template for HR is a structured tool designed to ensure adherence to payroll regulations and policies. This template typically includes sections for recording employee details, hours worked, pay rates, deductions, and tax withholdings, enabling a comprehensive review of payroll processes. With built-in formulas, it allows for automated calculations, enhancing accuracy and efficiency during audits. You can also expand its functionality by incorporating advanced features like automated data validation, conditional formatting, and integration with payroll software to address future compliance needs.

Payroll compliance audit tracking Excel template

![]()

💾 Payroll compliance audit tracking Excel template template .xls

A Payroll Compliance Audit Tracking Excel template is a structured tool designed to help organizations manage and monitor their payroll processes to ensure compliance with applicable laws and regulations. This template includes various sections for tracking employee data, payroll calculations, tax withholdings, and other critical payroll elements. It provides a user-friendly interface for entering and reviewing payroll records, making it easier to identify discrepancies or areas of concern. With basic capabilities to log payroll activities, the template can also be expanded to include advanced features such as automated compliance checks and reporting functionalities to meet more complex regulatory requirements.

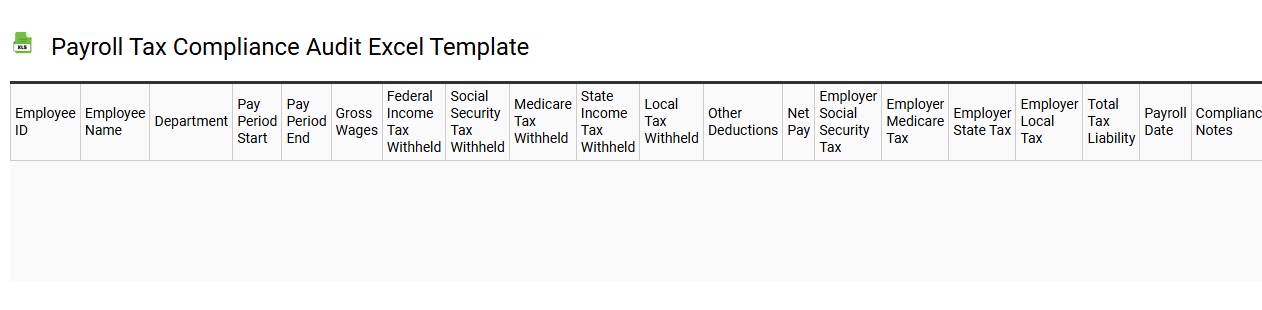

Payroll tax compliance audit Excel template

💾 Payroll tax compliance audit Excel template template .xls

A Payroll Tax Compliance Audit Excel template serves as a structured tool to streamline the assessment of payroll tax obligations. This template typically includes detailed sections for recording employee wage data, tax withholdings, and contributions for local, state, and federal taxes. You can easily input various payroll figures and utilize built-in formulas to calculate discrepancies or ensure compliance with tax regulations. As you analyze your payroll processes with this template, it can also lay the groundwork for integrating advanced auditing techniques like predictive analytics and real-time compliance monitoring.

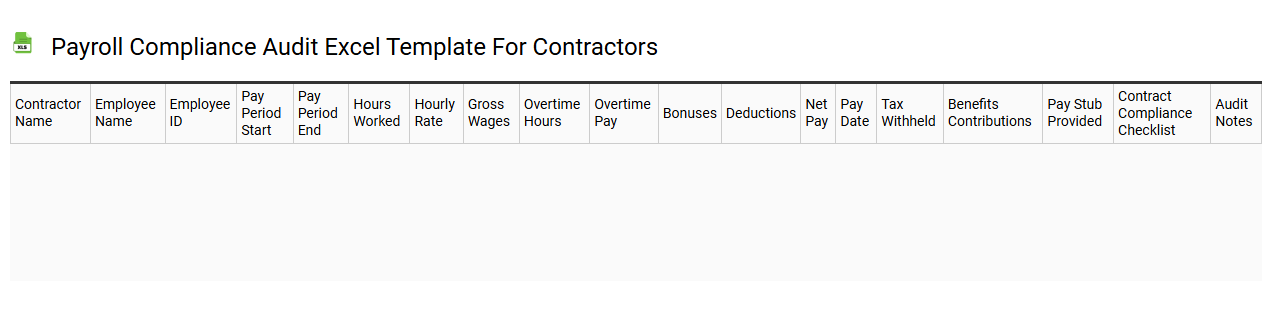

Payroll compliance audit Excel template for contractors

💾 Payroll compliance audit Excel template for contractors template .xls

A Payroll compliance audit Excel template for contractors is a structured tool designed to assist businesses in ensuring adherence to payroll regulations and requirements specific to contracted workers. This template typically includes essential columns such as contractor name, hours worked, payment rate, tax deductions, and compliance checks for local labor laws. By organizing payroll data in this format, you can easily identify discrepancies or compliance issues and maintain accurate records for auditing purposes. This foundational tool can evolve into more advanced financial management systems or integration with payroll software, optimizing your overall payroll processes and compliance tracking.