Explore a variety of free XLS templates specifically designed for managing receivables balance. These templates often include features such as automated calculations for outstanding invoices, detailed tracking of payment due dates, and visual representations of your receivables aging. By utilizing these templates, you can streamline your financial management process, ensuring that you stay organized and informed about your cash flow.

Receivables balance tracking Excel template

![]()

💾 Receivables balance tracking Excel template template .xls

Receivables balance tracking Excel templates serve as essential tools for managing outstanding payments within a business. These templates streamline the recording of invoices, payments received, and outstanding amounts owed by customers, providing clear visibility into cash flow. Users benefit from organized data, making it easier to identify overdue accounts and generate reports for better financial planning. Beyond basic tracking, these templates can evolve to incorporate advanced forecasting and analytical tools, enabling insights into payment trends and strategic financial decisions.

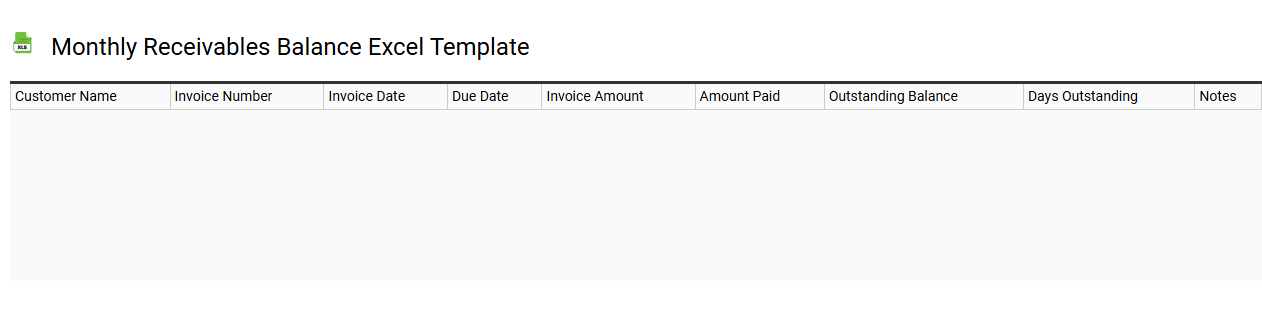

Monthly receivables balance Excel template

💾 Monthly receivables balance Excel template template .xls

A Monthly Receivables Balance Excel template serves as a streamlined tool for tracking amounts owed to a business by its customers over the course of a month. This template typically includes columns for customer names, invoice numbers, amounts due, payment due dates, and the status of each invoice. You can easily update and manipulate this data, creating charts to visualize trends such as outstanding receivables or payment timelines. Beyond basic invoicing, this template can also assist in forecasting cash flow and assessing credit risk, allowing for more advanced financial analysis and decision-making.

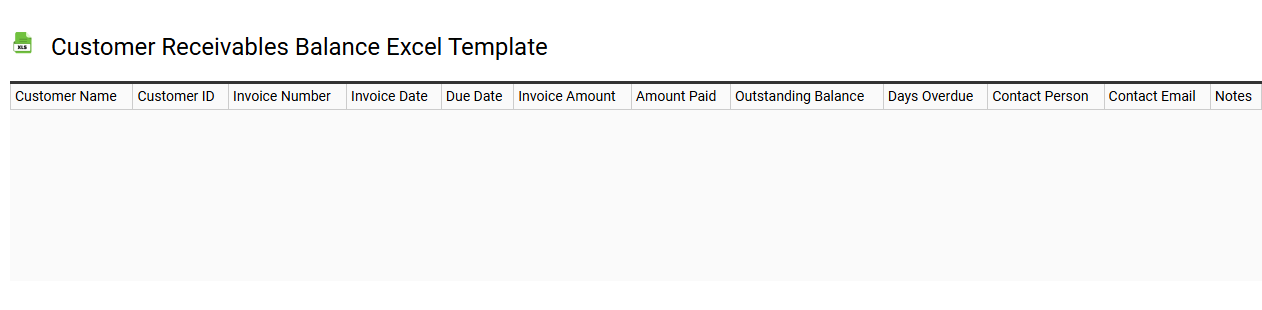

Customer receivables balance Excel template

💾 Customer receivables balance Excel template template .xls

A Customer Receivables Balance Excel template is a pre-designed spreadsheet used by businesses to track outstanding customer invoices and payments. This template typically includes columns for customer names, invoice numbers, due dates, amounts owed, payment status, and aging analysis. Users can easily update the template to reflect new transactions, enabling efficient monitoring of receivables and cash flow management. Effective utilization of this template helps identify overdue accounts while providing insights into potential credit risk and collections strategy, paving the way for more advanced financial reporting tools or integrated accounting solutions.

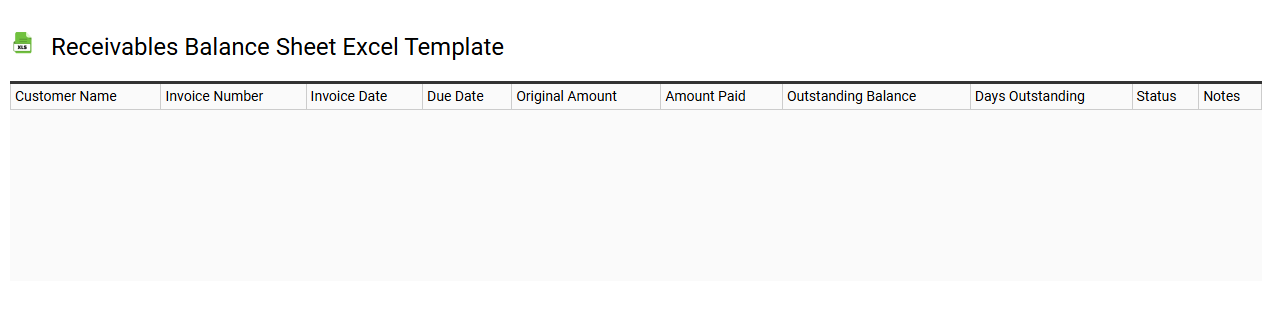

Receivables balance sheet Excel template

💾 Receivables balance sheet Excel template template .xls

A Receivables balance sheet Excel template is a structured financial tool designed to help you track and manage outstanding customer invoices. This template typically includes fields for customer names, invoice amounts, due dates, and payment statuses, facilitating easy monitoring of cash flow from receivables. You can customize the layout to suit your specific business needs, making it user-friendly for both small and large enterprises. Basic usage involves inputting data regularly, while advanced features may include automated calculations, pivot tables for insightful reporting, and integration with accounting software for enhanced financial oversight.

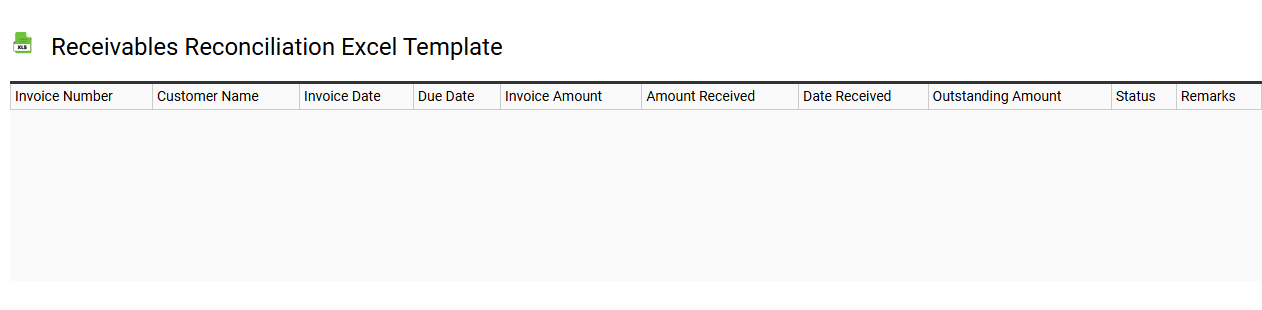

Receivables reconciliation Excel template

💾 Receivables reconciliation Excel template template .xls

A Receivables Reconciliation Excel template serves as a tool to track and verify outstanding customer invoices against records held by your business. It typically includes columns for invoice numbers, amounts, due dates, payment statuses, and customer details, allowing for efficient comparison and identification of discrepancies. By organizing this data, you can ensure accuracy in financial reporting and facilitate timely follow-ups on overdue accounts. Beyond basic tracking, this template can be customized to include advanced features like pivot tables for trend analysis and automated alerts for payment reminders.

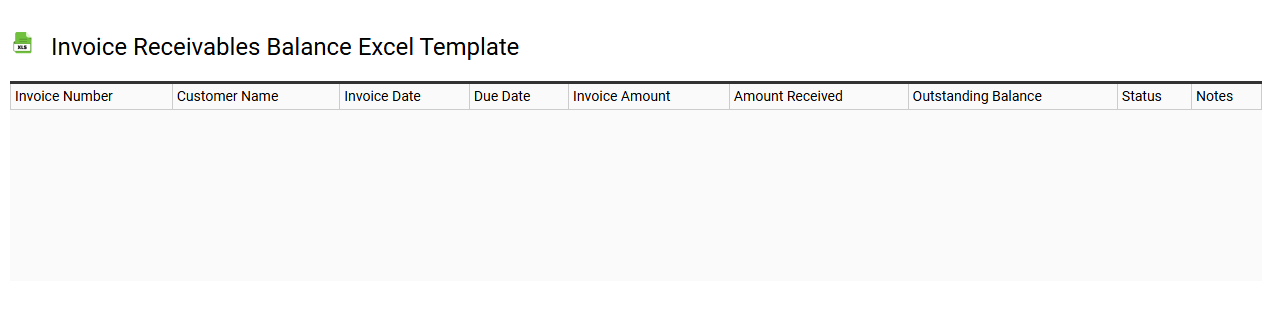

Invoice receivables balance Excel template

💾 Invoice receivables balance Excel template template .xls

An Invoice Receivables Balance Excel template is a pre-formatted spreadsheet tool designed to help businesses manage and track outstanding customer invoices. This template typically includes columns for invoice numbers, customer names, due dates, amounts owed, payment statuses, and aging reports, allowing for easy monitoring of receivables. By utilizing this template, you can quickly gain insights into cash flow, identify overdue payments, and prioritize follow-ups with clients. It serves basic functions like tracking transactions while also offering potential for advanced financial analysis or integration with accounting software, optimizing your accounts receivable management.

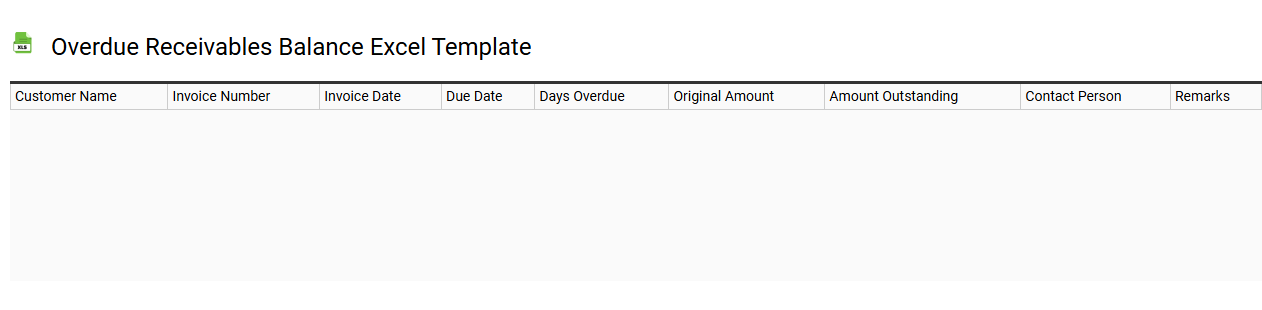

Overdue receivables balance Excel template

💾 Overdue receivables balance Excel template template .xls

An Overdue Receivables Balance Excel template helps businesses track accounts that have exceeded their payment due dates, allowing for effective cash flow management. This template typically includes columns for customer names, invoice numbers, due dates, outstanding amounts, and notes regarding communications or payment arrangements. By visualizing overdue accounts, you gain insights into your financial health and can prioritize collection efforts effectively. You can use this simple tool for daily monitoring, while future enhancements may involve integrating advanced analytics or automation features for predictive cash flow forecasting.

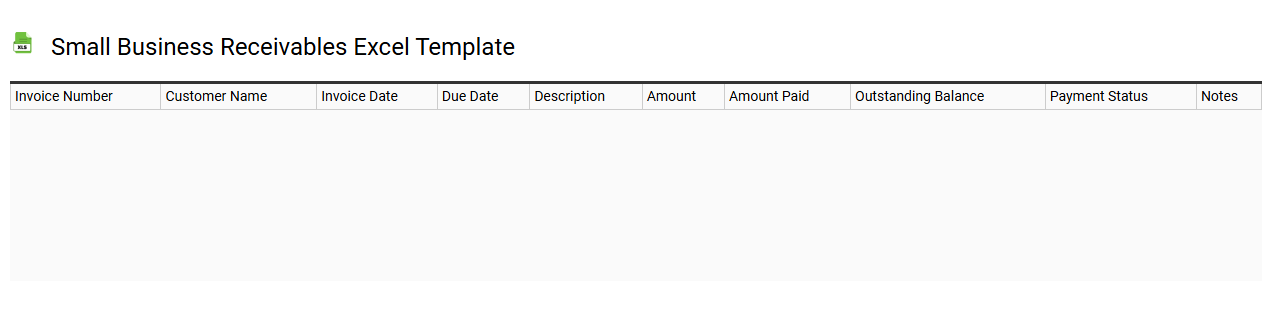

Small business receivables Excel template

💾 Small business receivables Excel template template .xls

A Small Business Receivables Excel template serves as a structured tool for tracking outstanding payments owed by customers. It typically includes essential fields such as customer name, invoice number, date of invoice, due date, and amount due, enabling you to monitor financial transactions effectively. This template streamlines the accounting process, helping to ensure timely follow-ups on overdue invoices and maintain positive cash flow. Understanding these fundamentals can also pave the way for more advanced financial analysis, including aging reports and cash flow projections.

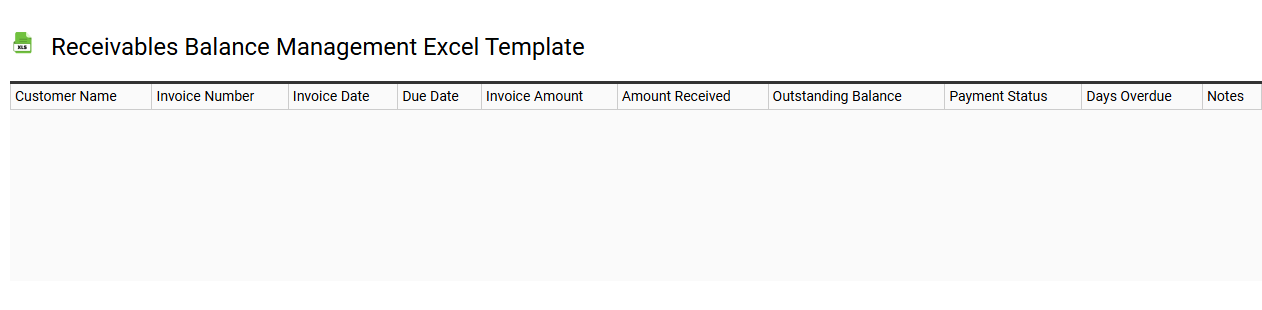

Receivables balance management Excel template

💾 Receivables balance management Excel template template .xls

Receivables balance management Excel templates streamline the tracking of outstanding invoices and customer payments, enhancing cash flow visibility. These templates typically include fields for customer names, invoice amounts, due dates, and payment status, allowing you to monitor overdue accounts efficiently. Users can employ conditional formatting to highlight overdue invoices, making it easy to prioritize follow-ups. Beyond basic tracking, such templates can integrate advanced analytics for forecasting cash flow and optimizing credit risk assessments.