Explore a variety of free Excel templates designed for tracking your savings account balance effectively. With user-friendly layouts, these templates allow you to record deposits, withdrawals, and interest earned while visualizing your financial growth over time. Easily customize fields to suit your needs, ensuring accurate monitoring of your savings journey.

Savings account balance tracker Excel template

![]()

💾 Savings account balance tracker Excel template template .xls

A Savings Account Balance Tracker Excel template is a pre-designed spreadsheet that helps you monitor your savings account balance over time. It typically includes sections for inputting dates, deposit amounts, withdrawal amounts, and resulting balances, allowing for easy tracking of financial activity. This template can help you visualize trends, set savings goals, and maintain awareness of your financial status. You can further enhance your tracking with advanced features such as conditional formatting, pivot tables, or formulas for more in-depth analysis of your savings patterns.

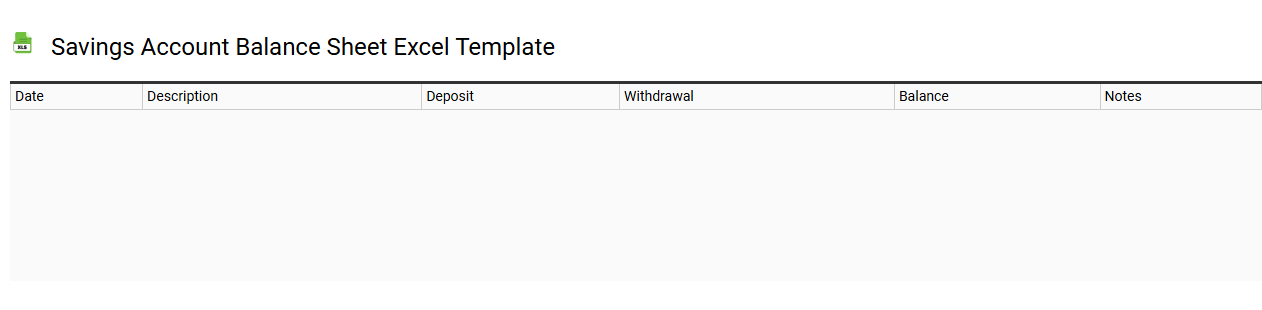

Savings account balance sheet Excel template

💾 Savings account balance sheet Excel template template .xls

A Savings Account Balance Sheet Excel template serves as a structured tool for tracking and managing your savings account transactions, including deposits, withdrawals, interest accrued, and overall balance over time. This template typically includes various fields such as the date of each transaction, transaction type, amount, and the resulting balance after each entry, allowing for a clear understanding of your financial status. You can customize the template to reflect specific categories or goals, helping to visualize your progress towards savings targets or financial milestones. Using this template can not only enhance your budgeting skills but also offer insights into more complex financial needs, like investment strategies or retirement planning.

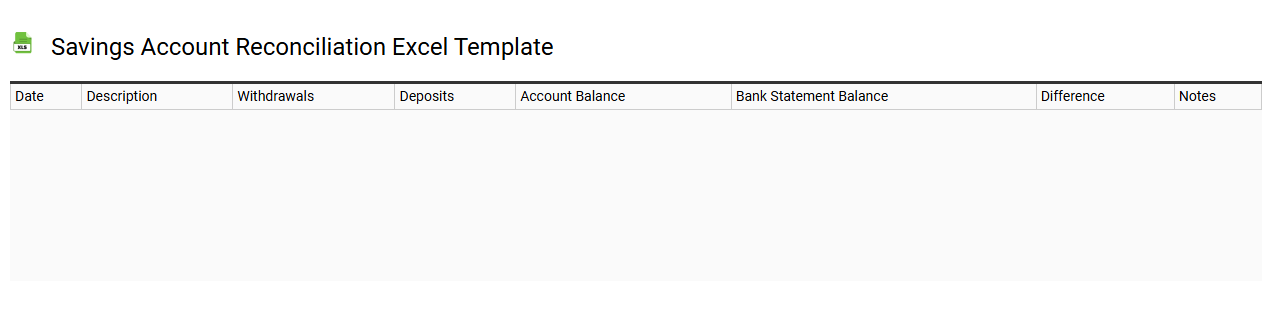

Savings account reconciliation Excel template

💾 Savings account reconciliation Excel template template .xls

A Savings Account Reconciliation Excel template is a structured worksheet designed to help individuals and businesses accurately track and reconcile their savings account transactions. This template typically includes sections for recording deposits, withdrawals, and interest earned, along with designated areas for noting discrepancies between bank statements and personal records. By utilizing this tool, you can ensure that your financial records are up-to-date and aligned with the bank's data, helping to identify any errors or unauthorized transactions. Such templates can serve as a foundation for more advanced financial analytics, budgeting, or tracking multiple accounts effectively.

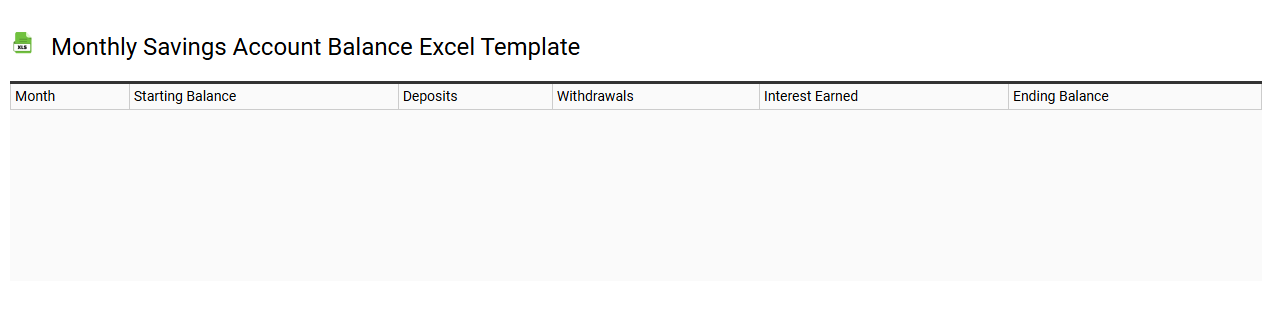

Monthly savings account balance Excel template

💾 Monthly savings account balance Excel template template .xls

A monthly savings account balance Excel template helps you track the growth of your savings over time. It usually features columns for the date, balance, deposits, withdrawals, and interest earned, allowing for organized data entry. This structured approach enables you to visualize your savings trends, forecast future balances, and make informed financial decisions. You can further customize the template for specific needs, such as integrating advanced financial metrics like compound interest calculations or projections based on varying interest rates.

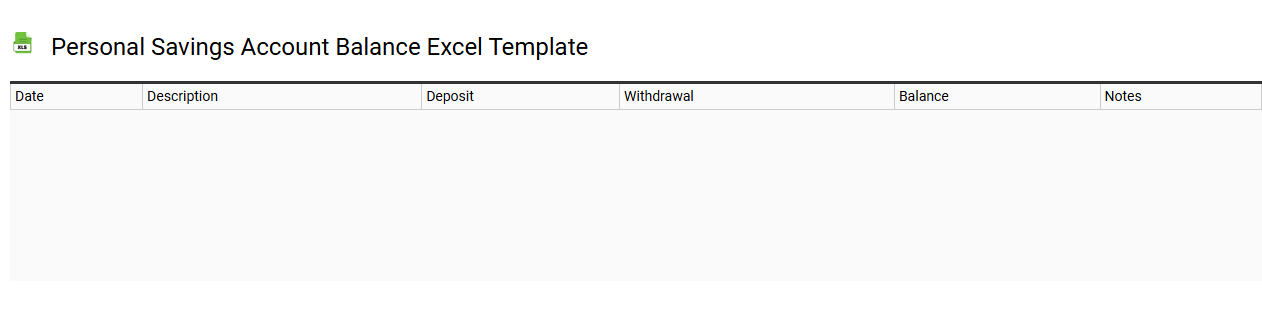

Personal savings account balance Excel template

💾 Personal savings account balance Excel template template .xls

A Personal Savings Account Balance Excel template serves as a convenient tool for tracking your savings over time. It allows you to input your account balance, interest rates, and any deposits or withdrawals you make. You can visualize your financial progress through various charts and graphs, aiding in goal-setting and budgeting decisions. This template can start with basic savings management while offering potential for advanced features like compound interest calculations and forecasting future savings trends.

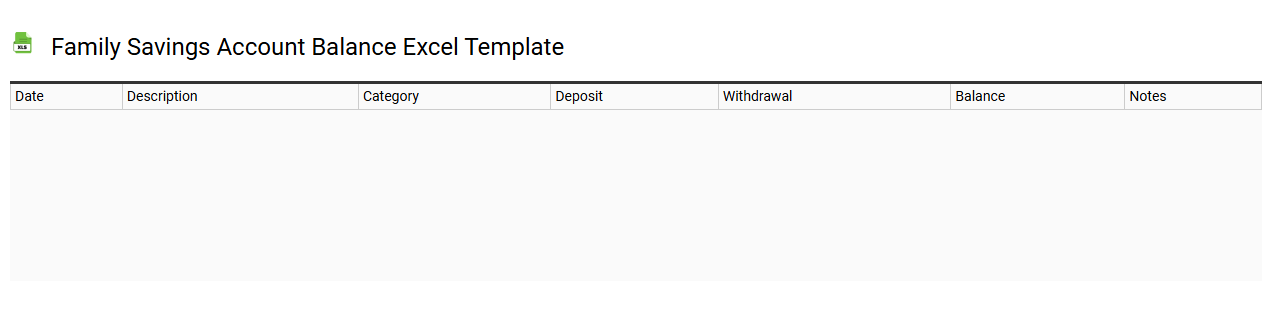

Family savings account balance Excel template

💾 Family savings account balance Excel template template .xls

A Family Savings Account Balance Excel template is a pre-designed spreadsheet that helps you track your family's savings account balances over time. It typically includes columns for the date, account holder names, deposits, withdrawals, and the current balance. You can easily enter your financial information to visualize trends in savings, helping you budget for future expenses or goals. This tool can serve basic financial management needs but can also be expanded with advanced features like formulas for interest calculations or automated reporting.

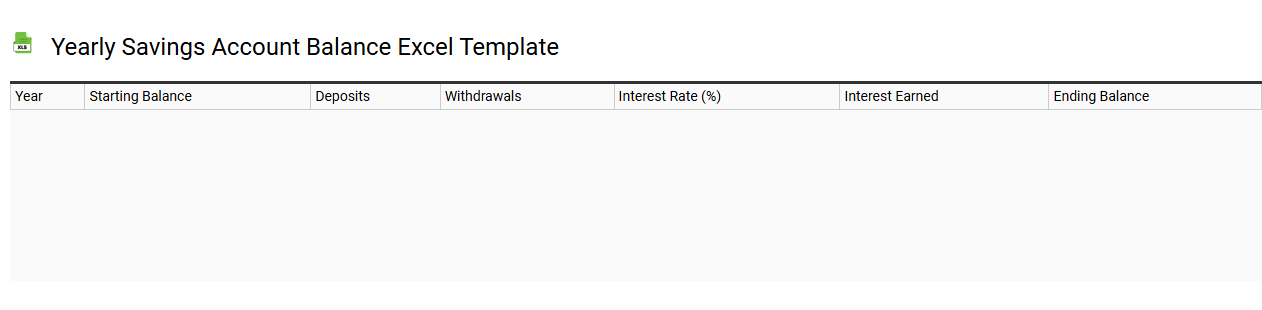

Yearly savings account balance Excel template

💾 Yearly savings account balance Excel template template .xls

A Yearly Savings Account Balance Excel template is a structured spreadsheet designed to help you track and manage your savings over a 12-month period. This template typically includes sections for inputting your starting balance, monthly contributions, interest rates, and total savings at the end of each month, allowing you to visualize your financial growth. By analyzing this data, you can set realistic goals and adjust your savings strategies as needed. Basic usage involves entering your initial savings and contributing amounts, while advanced features may include integrating complex interest calculations and forecasting future savings growth based on varying interest rates.

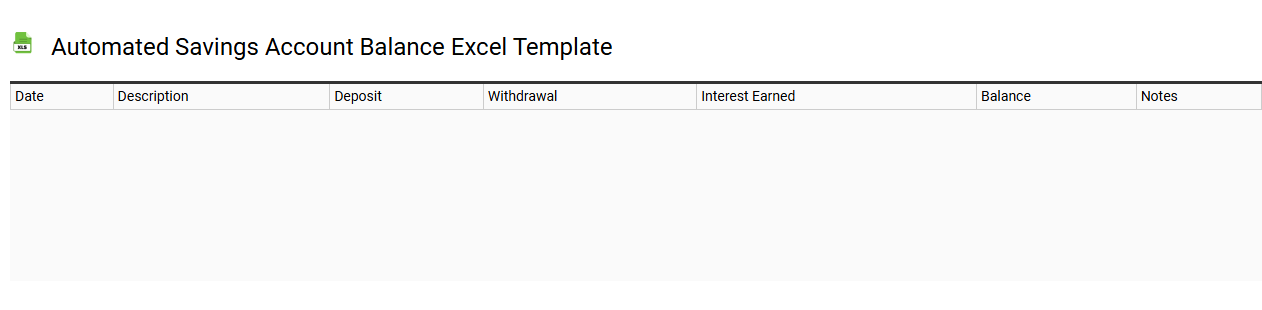

Automated savings account balance Excel template

💾 Automated savings account balance Excel template template .xls

An Automated Savings Account Balance Excel template is a pre-designed spreadsheet that allows you to track and manage your savings efficiently. This template typically includes various features such as input fields for initial deposit, interest rates, and monthly contributions, allowing you to visualize your savings growth over time. Formulas are embedded to automatically calculate interest accrued and projected balance based on your specified contributions and interest conditions. Such a template can serve as a basic tool for monitoring your savings journey, while also supporting more advanced functions like data analysis and investment forecasting for future financial planning.

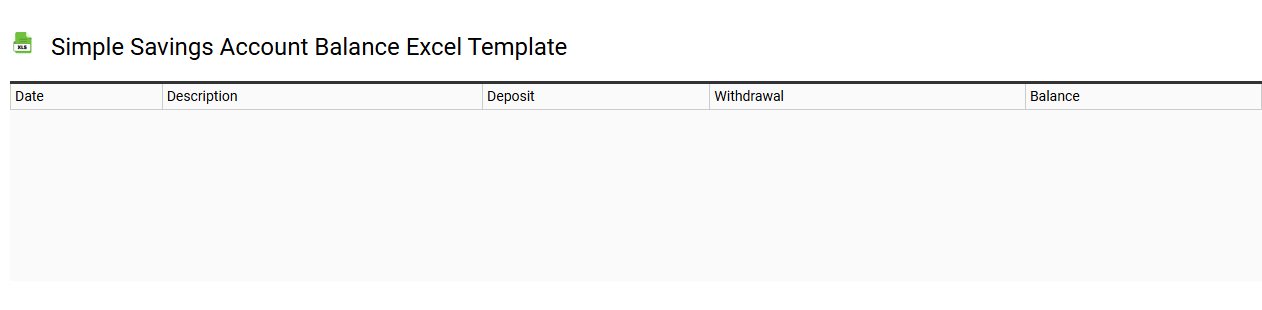

Simple savings account balance Excel template

💾 Simple savings account balance Excel template template .xls

A Simple Savings Account Balance Excel template is a customizable spreadsheet designed to help individuals track their savings account balance over time. This template typically includes columns for dates, deposits, withdrawals, interest earned, and the running balance, providing a clear overview of your financial habits. Features like easily adjustable formulas can automatically calculate totals and interest based on your specified annual rates. You can use this tool for basic savings management, while advanced users may incorporate features such as automated charts, budget forecasting, or integration with financial software for comprehensive analysis.

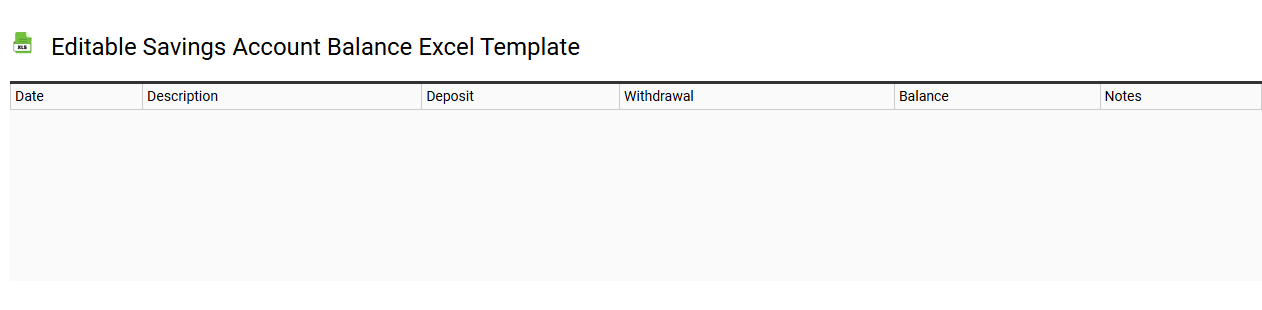

Editable savings account balance Excel template

💾 Editable savings account balance Excel template template .xls

An editable savings account balance Excel template is a customizable spreadsheet designed to help you track and manage your savings account balance over time. This tool allows you to input transactions such as deposits, withdrawals, and interest earned, giving you a clear picture of your financial status at a glance. You can also assign categories for your transactions, enabling you to see where your money is coming from and going. For more sophisticated usage, consider incorporating features like automatic balance calculations and advanced data visualization or even integrating it with financial forecasting models.