Explore a variety of free XLS templates designed specifically for debt payoff budgeting. These templates allow you to track your debts, consolidate payments, and visualize your financial progress with ease. Each template typically includes sections for listing creditors, interest rates, minimum payments, and payoff timelines, empowering you to take control of your financial future.

Debt payoff tracker Excel template

![]()

💾 Debt payoff tracker Excel template template .xls

A Debt Payoff Tracker Excel template is a financial tool designed to help you manage and eliminate debt efficiently. It typically includes sections for listing your debts, interest rates, minimum payments, and payoff dates, making it easy to visualize your progress over time. As you input your payments, the template updates your remaining balances and helps you strategize your repayment plan. Effective use of this template can lead to potential needs for advanced financial modeling techniques such as amortization schedules and debt snowball or avalanche methods.

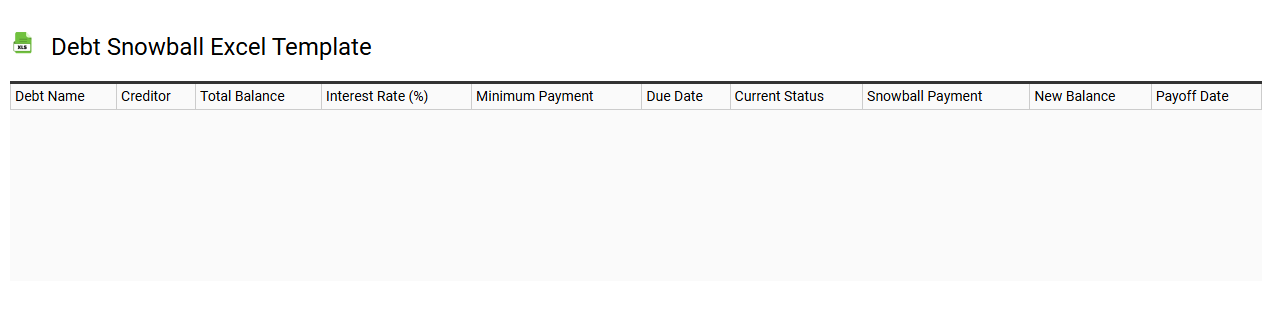

Debt snowball Excel template

💾 Debt snowball Excel template template .xls

A Debt Snowball Excel template is a financial tool designed to help individuals manage and eliminate personal debt systematically. It allows you to list all your debts, including their amounts, interest rates, and minimum payments. You can prioritize them from smallest to largest, focusing on paying off the smallest debts first while making minimum payments on the others. This method not only motivates you by celebrating small victories but also introduces potential future needs, such as incorporating amortization schedules or advanced debt repayment strategies.

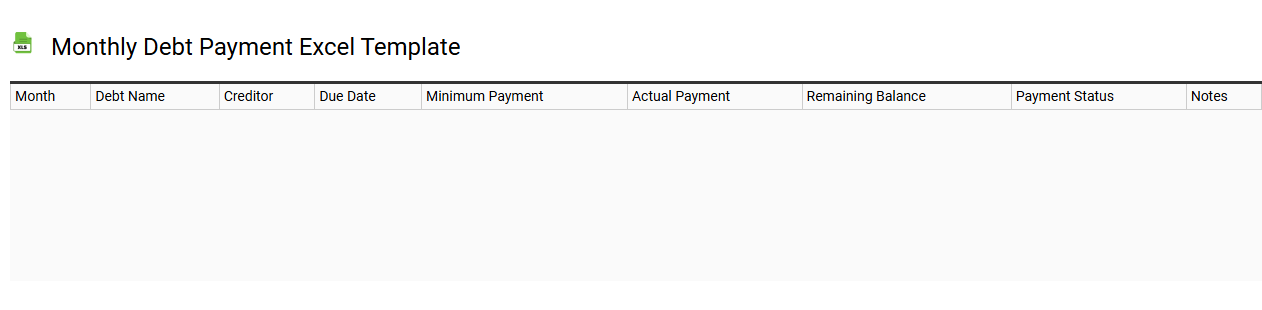

Monthly debt payment Excel template

💾 Monthly debt payment Excel template template .xls

A Monthly Debt Payment Excel template is a structured spreadsheet designed to help you track, calculate, and manage your monthly debt obligations effectively. It typically includes columns for various types of debt, such as credit cards, personal loans, and mortgages, along with their respective interest rates, loan amounts, and minimum payments. You can input your payment due dates and keep tabs on outstanding balances, making it easier to visualize your financial commitments over time. This tool not only helps you stay organized but also empowers you to plan for potential needs like debt snowball strategies or refinancing opportunities, incorporating terms such as amortization schedules and principal reductions.

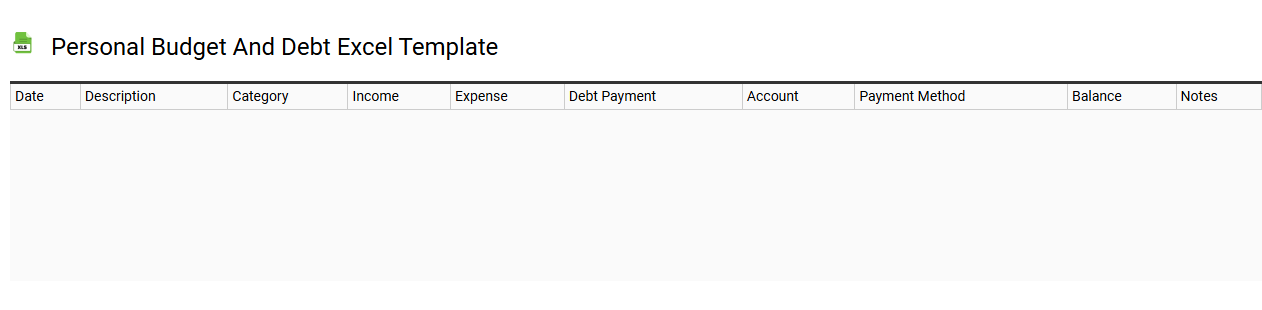

Personal budget and debt Excel template

💾 Personal budget and debt Excel template template .xls

A personal budget and debt Excel template is a structured spreadsheet designed to help individuals manage their finances effectively. It typically includes sections for income, monthly expenses, savings goals, and debt repayment plans. You can input your financial information to track your spending habits, visualize cash flow, and set achievable financial objectives. This tool is beneficial not only for basic budgeting needs but also for analyzing spending trends, creating detailed debt snowball strategies, and forecasting long-term financial outcomes.

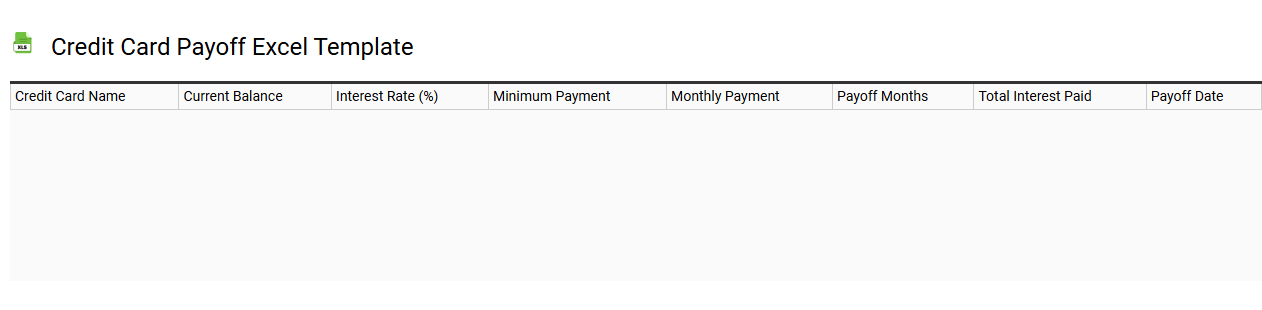

Credit card payoff Excel template

💾 Credit card payoff Excel template template .xls

A credit card payoff Excel template is a structured spreadsheet designed to help you manage and pay off credit card debt efficiently. This tool typically includes fields for entering your card balances, interest rates, minimum payments, and due dates, allowing you to track your financial progress. Visual elements such as charts or graphs often depict your payoff timeline, enhancing your understanding of how long it will take to eliminate your debt based on current payment habits. By utilizing this template, you can plan for various payment strategies, such as the avalanche or snowball methods, and assess advanced scenarios like balance transfer options or debt consolidation strategies.

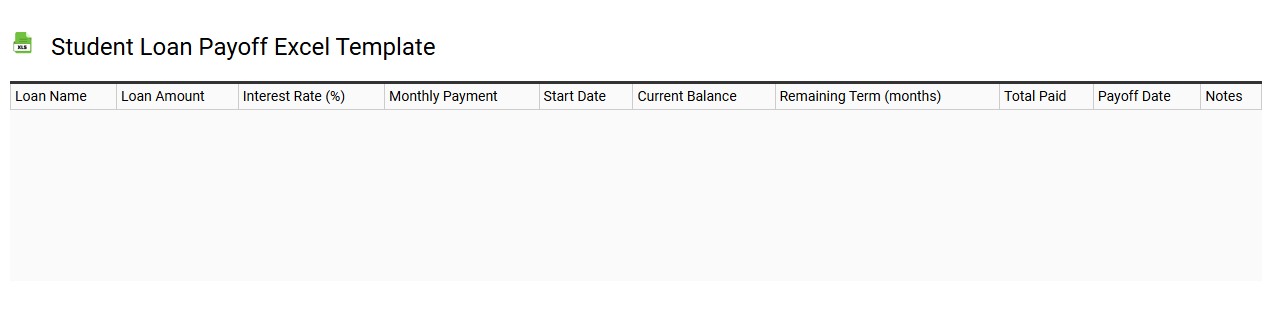

Student loan payoff Excel template

💾 Student loan payoff Excel template template .xls

A Student loan payoff Excel template is a customizable spreadsheet designed to help you manage and track your student loan payments efficiently. It enables you to input various loan details such as principal amount, interest rate, and payment frequency, providing a clear overview of your repayment schedule. By visualizing your loan balance over time, you can identify how additional payments might accelerate your payoff timeline. This tool can also be adapted for more complex financial needs, such as incorporating advanced amortization calculations and budgeting strategies.

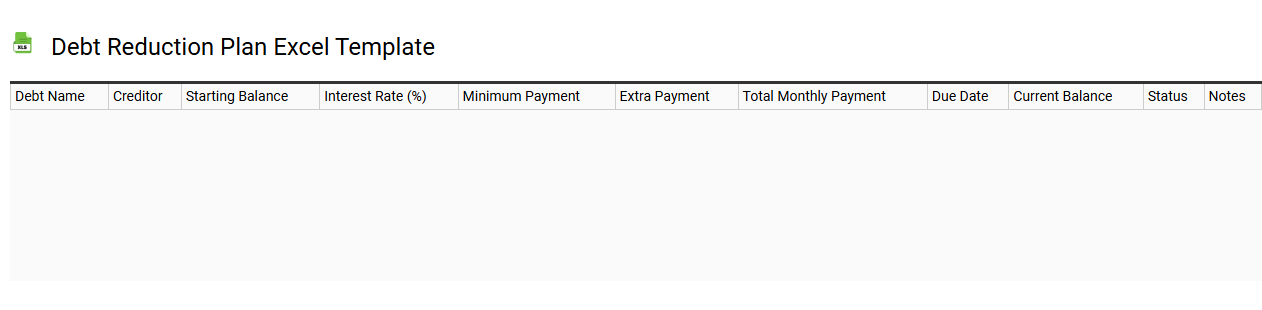

Debt reduction plan Excel template

💾 Debt reduction plan Excel template template .xls

A Debt Reduction Plan Excel template is a structured financial tool designed to help individuals or businesses manage and mitigate their debt. This template typically includes sections for listing all debts, interest rates, minimum payments, and total balances to provide a clear snapshot of your financial obligations. It may also incorporate payment schedules, allowing you to visualize how different payment strategies affect your debt over time. By tracking your progress and analyzing repayment scenarios, you can effectively strategize for future financial health or more complex financial strategies like debt consolidation or refinancing.

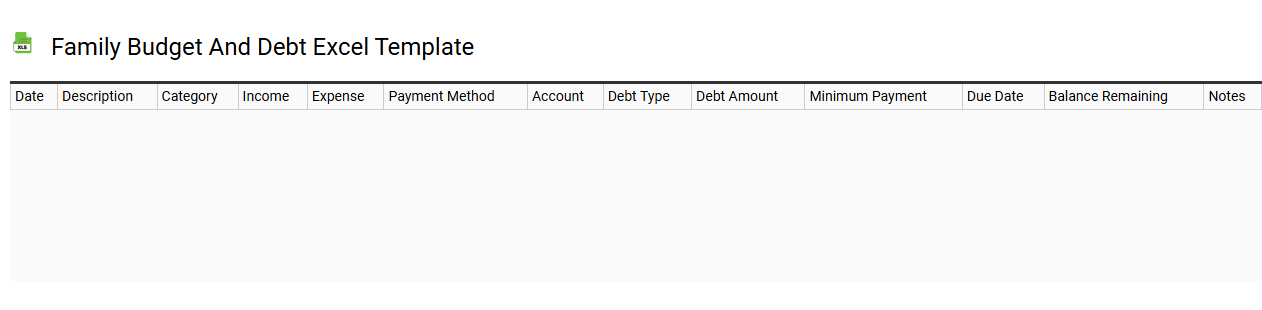

Family budget and debt Excel template

💾 Family budget and debt Excel template template .xls

A Family Budget and Debt Excel template serves as a financial planning tool, helping you track income, expenses, and debts systematically. This template enables you to categorize daily living costs such as groceries, utilities, and transportation alongside monthly payments for loans and credit cards. With easy-to-navigate sections, you can visualize your financial standing through charts and graphs, empowering you to make informed decisions about savings and spending. Beyond basic budgeting, your needs might evolve to include tracking investments and forecasting long-term financial goals with advanced Excel functions like pivot tables and complex formulas.

Mortgage payoff tracker Excel template

![]()

💾 Mortgage payoff tracker Excel template template .xls

A mortgage payoff tracker Excel template is a useful tool designed to help homeowners visualize and manage their mortgage repayment journey. It allows you to input details such as your mortgage balance, interest rate, and payment frequency. By tracking your payments over time, you can see how much principal and interest you're paying each month, providing clarity on your financial progress. This template can adapt to various scenarios, such as extra payments or changes in interest rates, enabling you to explore advanced strategies like refinancing or accelerated payoff methods.

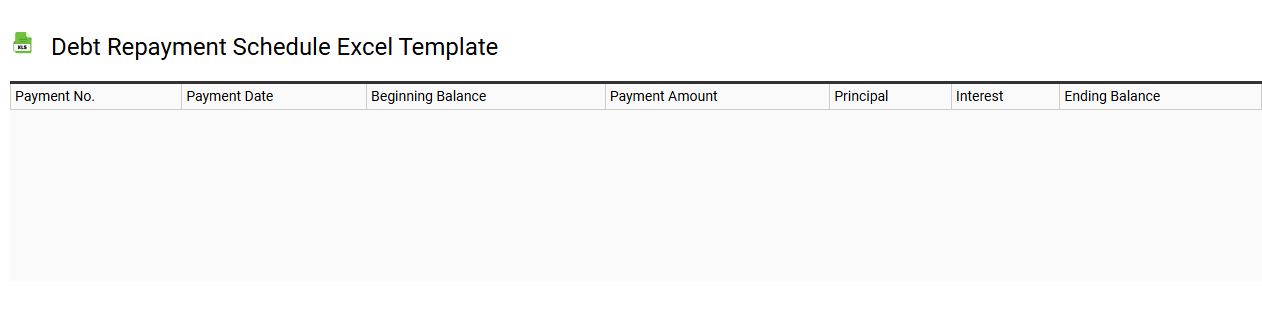

Debt repayment schedule Excel template

💾 Debt repayment schedule Excel template template .xls

A debt repayment schedule Excel template is an organized tool designed to help users systematically track and manage their debt repayments. It typically includes columns for the total loan amount, interest rate, monthly payment amount, due dates, and remaining balance over time. This schedule allows you to visualize your repayment progress, ensuring you stay on track with your financial obligations. You can modify this template to accommodate various types of loans, such as personal, student, or mortgage loans, and integrate advanced functions like amortization calculations and payment projections.