Explore a selection of free XLS templates designed specifically for Bank loan monitoring, each tailored to streamline your financial tracking. These templates offer organized sections to record loan amounts, interest rates, repayment schedules, and outstanding balances, ensuring you maintain a clear overview of your financial commitments. With user-friendly layouts and customizable features, you can adjust the templates to fit your unique needs and monitor your loans effectively.

Bank loan monitoring Excel template for monthly tracking

![]()

💾 Bank loan monitoring Excel template for monthly tracking template .xls

A Bank loan monitoring Excel template serves as a structured tool to facilitate the tracking of your loan repayments, interest rates, and remaining balances on a monthly basis. This template typically includes columns for recording the loan amount, payment dates, installment amounts, and any additional fees applied throughout the loan term. Visual representations such as graphs can highlight payment progress and interest accumulation, allowing you to easily grasp your financial standing over time. Using this template can help you maintain timely payments and better manage your financial obligations, with potential for advanced features like forecasting cash flow, amortization schedules, and integration with accounting software.

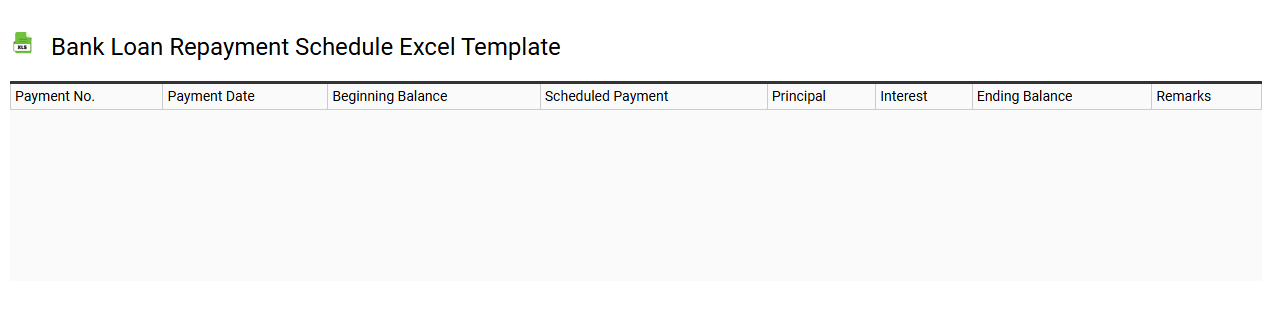

Bank loan repayment schedule Excel template

💾 Bank loan repayment schedule Excel template template .xls

A Bank loan repayment schedule Excel template is a structured spreadsheet designed to help you manage and visualize your loan repayments over time. It typically includes vital details such as loan amount, interest rate, repayment period, and payment frequency, allowing you to track monthly or biweekly payments. Each entry outlines the principal and interest portions of each payment, along with remaining balances, providing clarity on your financial obligations. Utilizing this tool can simplify budgeting and aid in forecasting how changes in interest rates or additional payments might affect your financial plan. For further potential needs, you might explore advanced features like amortization calculators, payment reminders, or integrating with financial forecasting models.

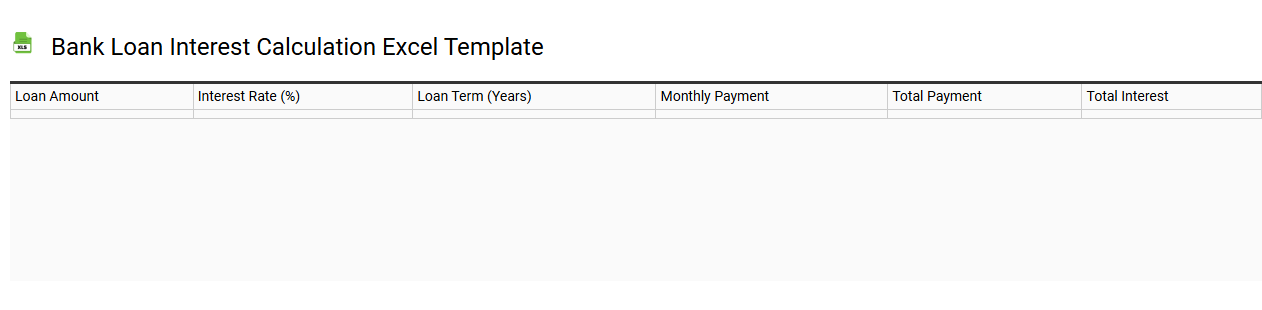

Bank loan interest calculation Excel template

💾 Bank loan interest calculation Excel template template .xls

A Bank loan interest calculation Excel template is a structured spreadsheet designed to help you compute the interest on loans. This template typically features predefined formulas that automate calculations for various parameters, such as loan amount, interest rate, loan term, and payment frequency. Users can easily input their specific loan details, and the template will output essential figures, including total interest paid, monthly payments, and remaining balance. For more advanced functions, you can customize it to include amortization schedules and various repayment strategies, catering to more sophisticated financial planning needs.

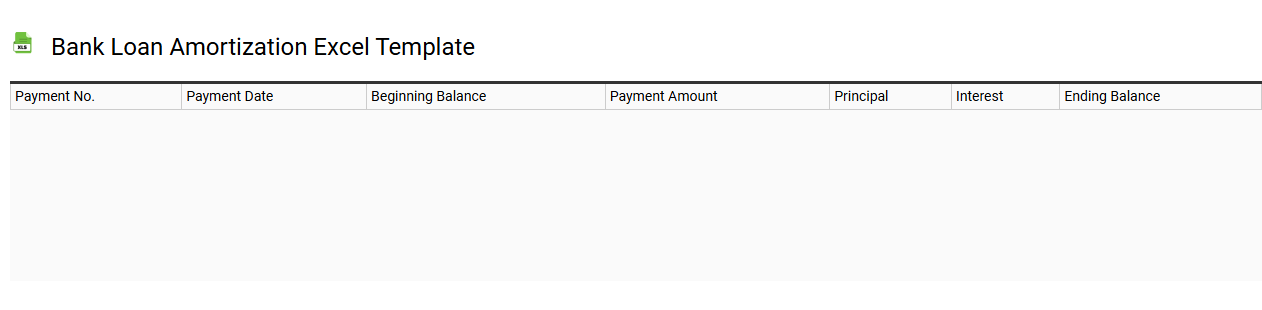

Bank loan amortization Excel template

💾 Bank loan amortization Excel template template .xls

A bank loan amortization Excel template is a structured spreadsheet designed to help you calculate and track the repayment of a loan over time. This template typically includes key features such as the loan amount, interest rate, loan term, and monthly payment calculations. As you input these details, the sheet generates an amortization schedule, displaying how much of each payment goes toward interest versus principal over the course of the loan. This tool is invaluable for managing personal finances, allowing you to visualize your repayment progress and make informed decisions about potential prepayments or refinancing options. In addition to the basic features, you can explore advanced functionalities like variable interest rates, tax implications, or integration with financial forecasting tools.

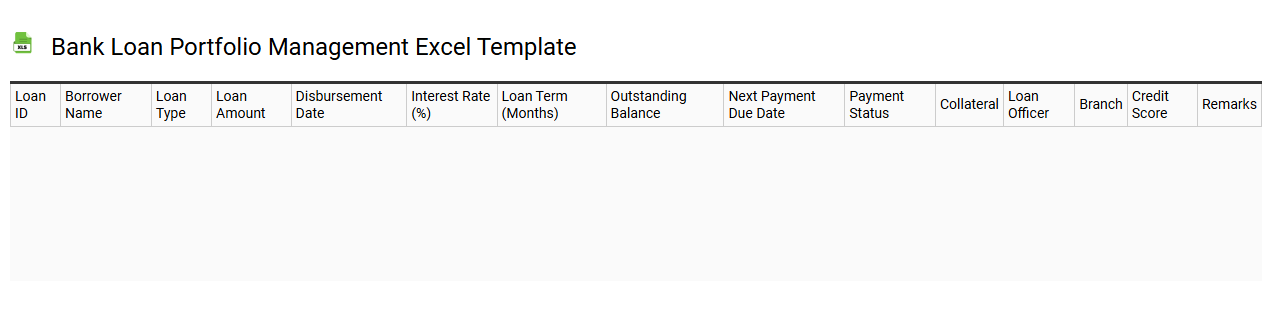

Bank loan portfolio management Excel template

💾 Bank loan portfolio management Excel template template .xls

A Bank loan portfolio management Excel template is a structured spreadsheet designed for financial institutions to effectively track, manage, and analyze their lending activities. This template typically includes features for categorizing loans, monitoring interest rates, assessing borrower risk, and managing repayment schedules. It allows institutions to visualize their portfolio's performance through charts and graphs, facilitating better decision-making. Such a template serves basic functions like tracking loan details and payments but can be further enhanced with advanced analytics, risk assessment models, and predictive insights into future loan performance.

Bank loan disbursement tracker Excel template

![]()

💾 Bank loan disbursement tracker Excel template template .xls

A Bank Loan Disbursement Tracker Excel template is a specialized tool designed to help individuals and businesses monitor the disbursement of loans from financial institutions. This template typically includes various fields such as loan amount, disbursement date, repayment schedule, interest rates, and outstanding balances. You can easily input data and keep track of multiple loans in one organized spreadsheet, providing clarity on your financial obligations. Such a tracker can also serve as a foundation for more advanced financial analysis needs, such as calculating amortization schedules or evaluating cash flow projections.

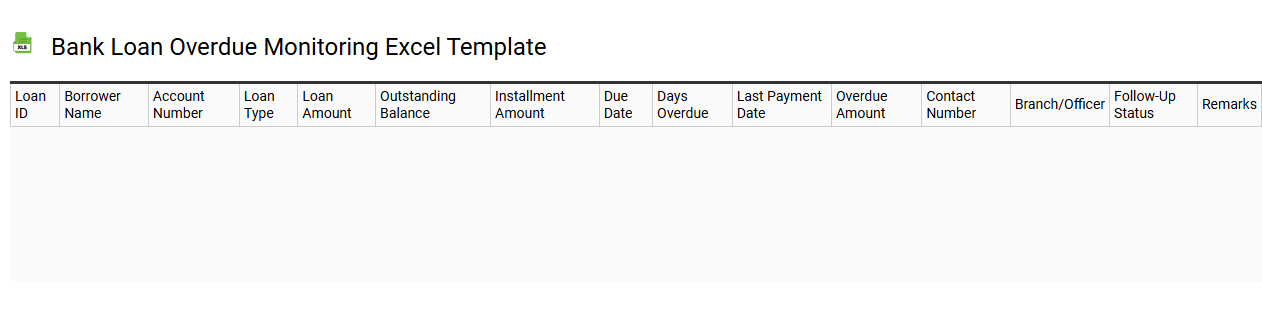

Bank loan overdue monitoring Excel template

💾 Bank loan overdue monitoring Excel template template .xls

A Bank loan overdue monitoring Excel template is a specialized tool designed to help financial institutions and individual lenders track overdue loans effectively. It typically includes columns for loan details, borrower information, due dates, payment status, and amount overdue, enabling users to visualize outstanding payments clearly. This template can assist in identifying trends related to late payments, assessing borrower risk, and automating reminders for follow-ups. You can easily adapt it for advanced financial modeling or complex data analysis needs, such as integrating machine learning algorithms for predictive analytics.

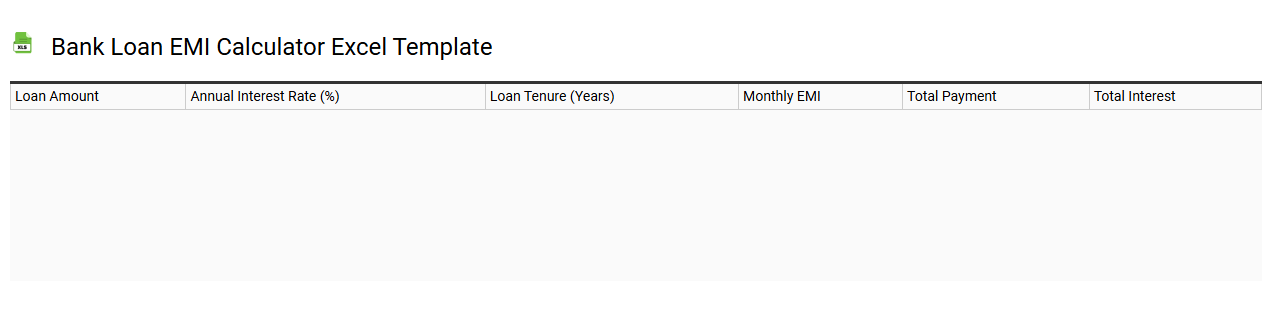

Bank loan EMI calculator Excel template

💾 Bank loan EMI calculator Excel template template .xls

A Bank Loan EMI Calculator Excel template is a user-friendly tool designed to help you calculate your Equated Monthly Installments (EMIs) for various types of loans, such as home loans or personal loans. This template typically requires you to input the principal loan amount, interest rate, and loan tenure, enabling you to view your monthly payment obligations quickly. It can also provide insights into the total interest payable over the loan's duration, allowing for better financial planning. For those wishing to delve deeper, the template can be customized to accommodate advanced calculations like varying interest rates or early loan repayments.

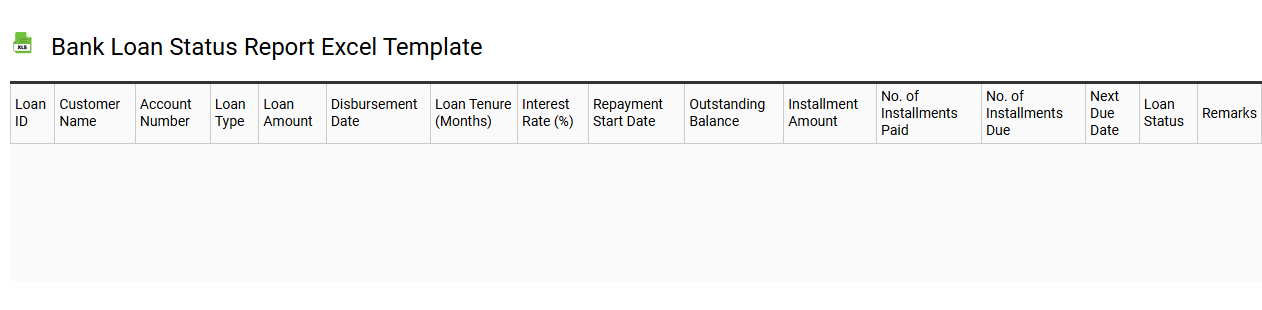

Bank loan status report Excel template

💾 Bank loan status report Excel template template .xls

A Bank Loan Status Report Excel template is a structured tool that helps you track and manage the status of your loans efficiently. This template typically includes key information such as loan amounts, interest rates, payment schedules, and outstanding balances. Users can also find sections for tracking payment due dates and any late fees incurred, aiding in timely repayment management. Utilizing such a template can assist in monitoring current obligations and planning for future financing needs, including advanced analyses like amortization schedules or cash flow forecasting.

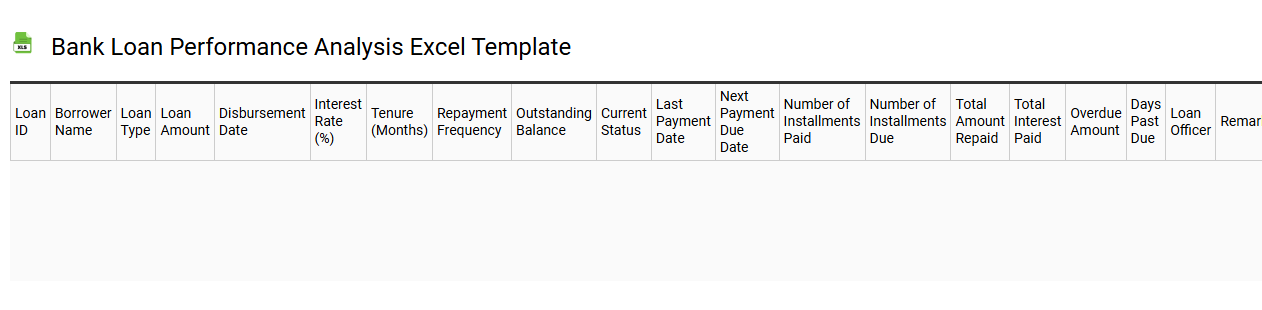

Bank loan performance analysis Excel template

💾 Bank loan performance analysis Excel template template .xls

A Bank Loan Performance Analysis Excel template is a structured spreadsheet designed to evaluate the effectiveness of a bank's loan portfolio. It typically includes key metrics such as loan amounts, interest rates, repayment schedules, and default rates. By utilizing various data visualization tools, like graphs and charts, you can gain insights into trends and performance indicators over time. This template not only helps in assessing current loan performance but also lays the groundwork for more advanced analysis, such as risk modeling and predictive analytics.