Explore a range of free Excel templates designed specifically for managing employee loan deductions. These user-friendly templates allow you to easily input loan amounts, payment schedules, and employee details, simplifying the tracking process. Customize the layout to suit your company's needs, ensuring accurate deductions and transparent financial records.

Employee loan deduction tracking Excel template

![]()

💾 Employee loan deduction tracking Excel template template .xls

An Employee Loan Deduction Tracking Excel template is a tool designed to help organizations manage and monitor loan deductions for their employees. This template typically includes fields for employee names, loan amounts, deduction percentages, pay periods, and remaining balances. With this organized format, you can easily calculate deductions for each payroll cycle and keep track of repayment progress. Such a template not only simplifies the tracking process but also ensures compliance with company policies and helps identify potential financial trends within your workforce, paving the way for more advanced analytics in employee financial management.

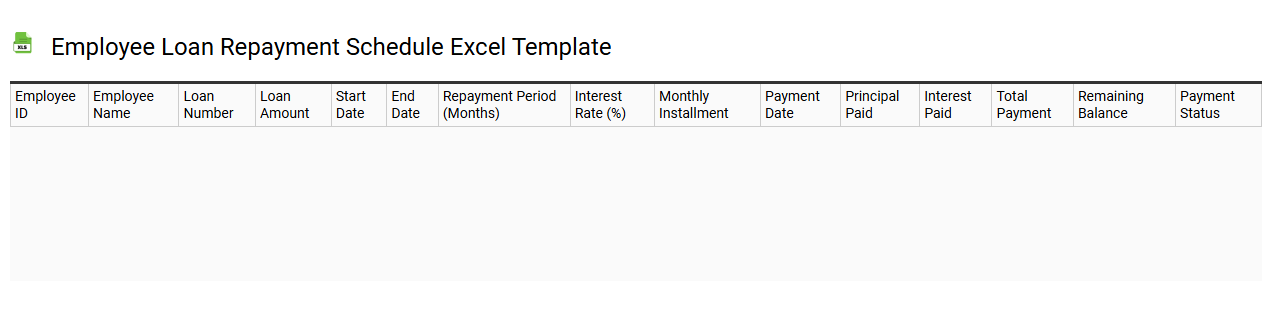

Employee loan repayment schedule Excel template

💾 Employee loan repayment schedule Excel template template .xls

An Employee loan repayment schedule Excel template is a structured tool that helps both employers and employees manage and track the repayment of loans provided by the company. This template typically includes essential data fields such as the loan amount, interest rate, repayment period, monthly payment calculations, and remaining balance after each payment. You can easily modify the template to accommodate varying loan terms or specific employee agreements. By utilizing this template, you ensure timely repayments and can identify any potential financial issues that may arise, with advanced features like automated reminders and graphical representations for forecasting future payment trends.

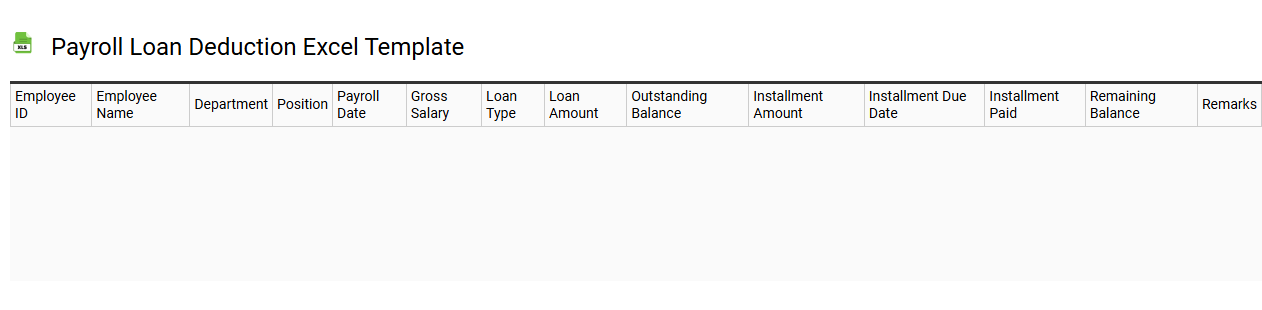

Payroll loan deduction Excel template

💾 Payroll loan deduction Excel template template .xls

A Payroll loan deduction Excel template is a tool designed to assist businesses in managing employee loan repayments through payroll deductions. This template typically includes columns for employee names, loan amounts, deduction rates, and payment schedules, allowing for easy tracking of individual loan statuses. You can customize it to fit your company's specific payroll cycles, ensuring accurate calculations and timely payments. This template serves basic loan management needs but can also be expanded to include advanced features like interest calculations, amortization schedules, or integration with payroll software for comprehensive financial tracking.

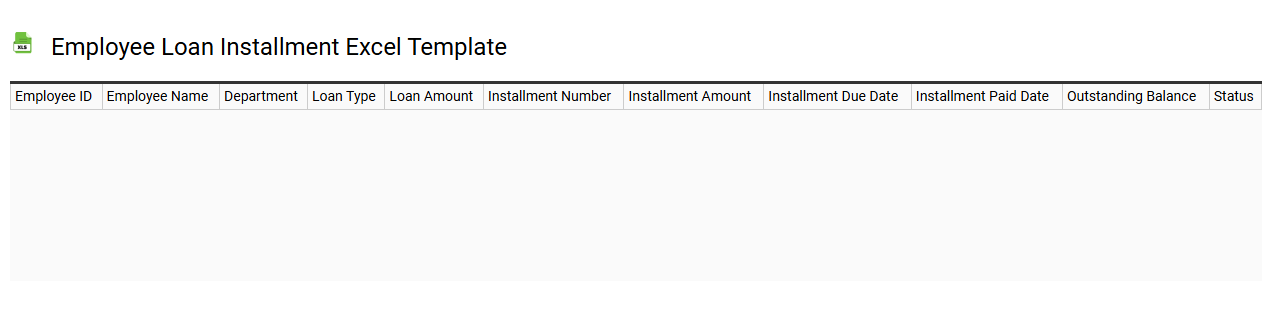

Employee loan installment Excel template

💾 Employee loan installment Excel template template .xls

An Employee Loan Installment Excel template is a structured spreadsheet designed to help organizations manage and track loans provided to employees. This template typically includes fields for employee information, loan amount, interest rate, payment frequency, and repayment schedule. You can easily customize the template to calculate remaining balances and interest accrued over time, simplifying the financial tracking process. The basic usage allows for straightforward loan management, while further potential needs may incorporate advanced features like automated amortization calculations or integrated financial reporting tools.

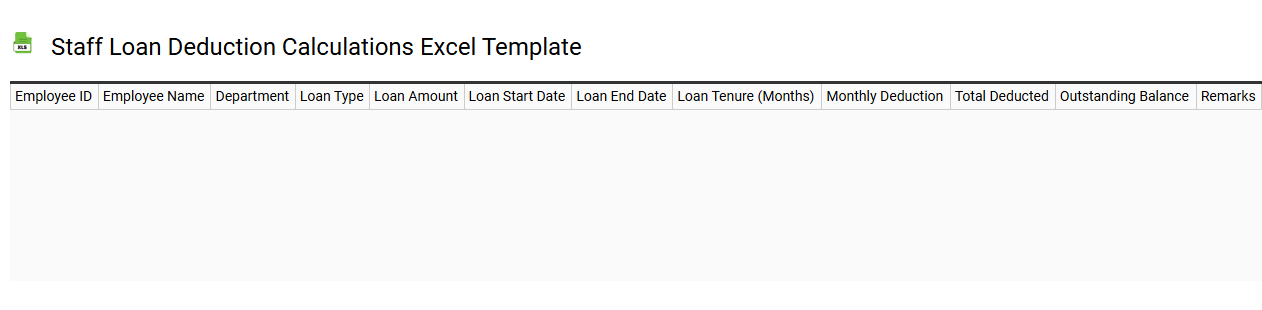

Staff loan deduction calculations Excel template

💾 Staff loan deduction calculations Excel template template .xls

A Staff Loan Deduction Calculations Excel template is a structured spreadsheet designed to efficiently track and manage loan deductions from employee salaries. This template typically includes fields for employee names, loan amounts, interest rates, deduction periods, and total deductions. You can easily input data and utilize built-in formulas to automatically calculate the remaining loan balance and monthly payment amounts. Beyond basic usage for managing loan repayments, this template can be further enhanced to include complex features like amortization schedules and interest forecasts for advanced financial planning.

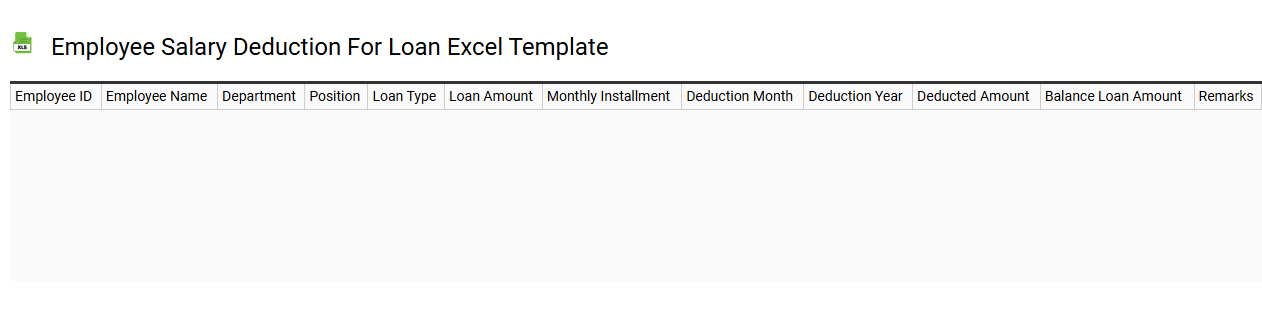

Employee salary deduction for loan Excel template

💾 Employee salary deduction for loan Excel template template .xls

An Employee Salary Deduction for Loan Excel template is a structured spreadsheet designed to facilitate the tracking and management of salary deductions for loans issued to employees. It typically includes fields for employee details such as name, identification number, loan amount, deduction percentage, and repayment schedule. This template allows HR and payroll departments to calculate the amount to be deducted from each payroll cycle, ensuring compliance with company policies and employee agreements. Utilizing such a template minimizes errors, streamlines payroll processing, and prepares your organization for potential audits while accommodating advanced features like automated calculations and graphical data representation.

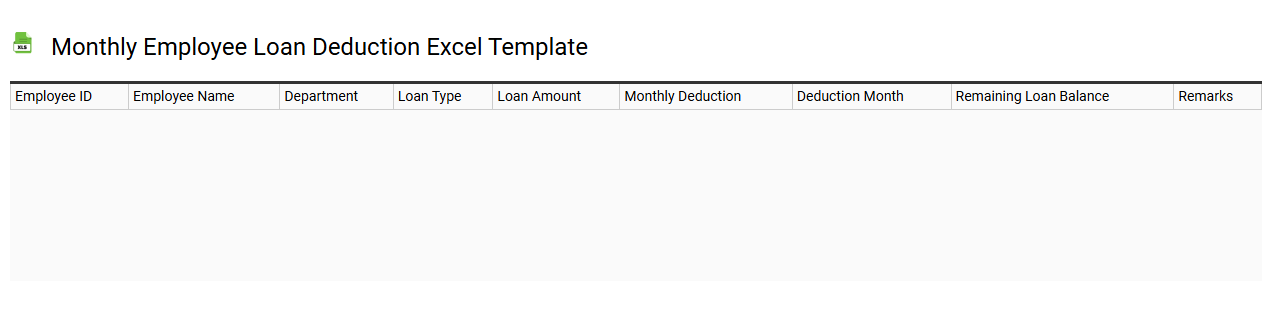

Monthly employee loan deduction Excel template

💾 Monthly employee loan deduction Excel template template .xls

A Monthly Employee Loan Deduction Excel template is a practical tool designed to automate the tracking of loan repayments from employee salaries. This template typically includes fields for employee names, loan amounts, interest rates, deduction dates, and remaining balances. Each month, you input the corresponding deduction amounts, which allows for real-time tracking of how much has been repaid versus the principal. Mastering this template not only aids in efficient record-keeping but also helps in preparing for future financial projections, such as calculating loan amortization schedules and analyzing overall employee debt management.

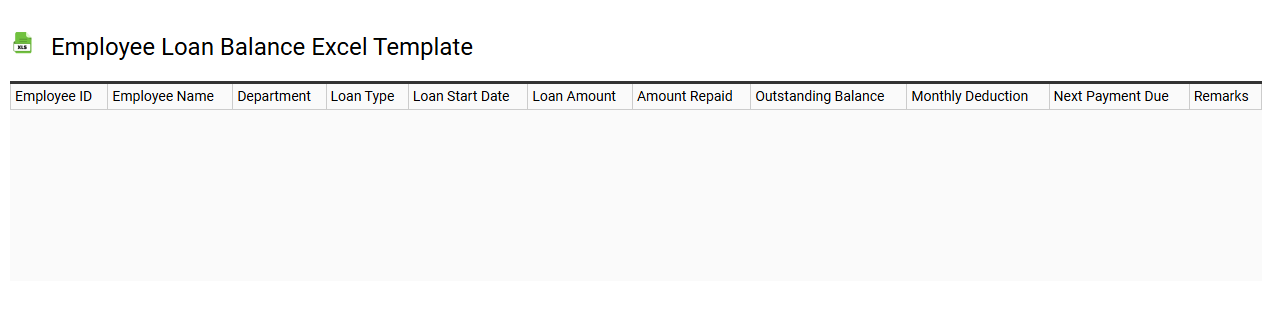

Employee loan balance Excel template

💾 Employee loan balance Excel template template .xls

An Employee Loan Balance Excel template is a structured spreadsheet designed to track and manage loan balances given to employees by an organization. This template typically features columns for employee names, loan amounts, repayment schedules, interest rates, and remaining balances, allowing for clear visibility of outstanding debts. You can easily update this template to reflect payments made, ensuring accurate calculations of principal and interest owed. For more advanced needs, consider integrating features such as automated payment reminders, data visualization of repayment progress, or linking to a payroll system for streamlined updates.

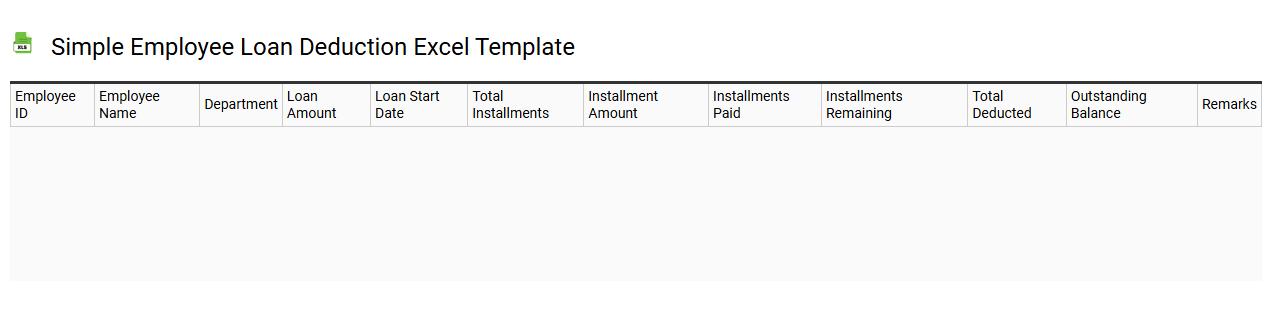

Simple employee loan deduction Excel template

💾 Simple employee loan deduction Excel template template .xls

A Simple Employee Loan Deduction Excel template is a practical tool designed to help businesses manage and track loan deductions from employee salaries. This user-friendly spreadsheet typically includes columns for employee names, loan amounts, repayment schedules, and individual deduction amounts per pay period. Each entry allows for easy updates and calculations, ensuring that both employer and employee stay informed about the loan balance and payment history. You can further customize the template with advanced formulas or conditional formatting to analyze trends and project future deductions or repayment scenarios.

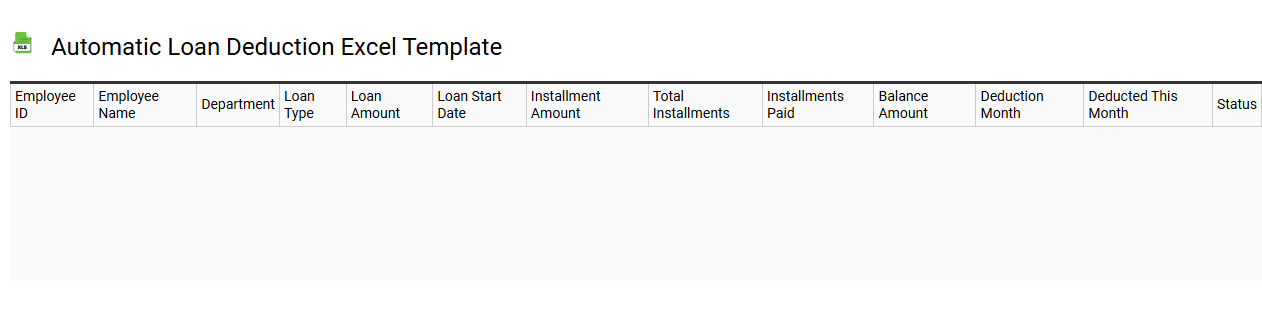

Automatic loan deduction Excel template

💾 Automatic loan deduction Excel template template .xls

An Automatic Loan Deduction Excel template is a pre-designed spreadsheet that helps you manage and track loan repayment schedules. It typically includes fields for loan amounts, interest rates, payment dates, and the duration of the loan. Each entry automatically calculates the total payments due and the remaining balance, providing a clear overview of your financial obligations. This tool not only facilitates monthly budgeting but also has the potential to incorporate advanced features like conditional formatting and data analysis for deeper insights into your loan management.