Explore a selection of free XLS templates designed specifically for managing an unsecured loan ledger. Each template allows you to track loan details, including borrower information, loan amounts, interest rates, and repayment schedules. These user-friendly formats ensure you can efficiently monitor outstanding balances, payment histories, and due dates, helping you stay organized and informed about your finances.

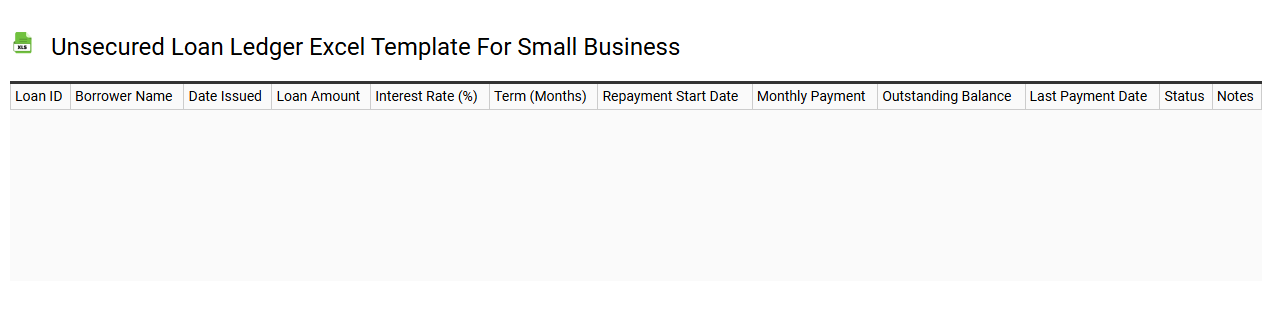

Unsecured loan ledger Excel template for small business

💾 Unsecured loan ledger Excel template for small business template .xls

An unsecured loan ledger Excel template for small businesses serves as a financial tracking tool, allowing you to monitor loans that do not require collateral. This template typically includes sections for loan amount, interest rate, repayment schedule, and a record of payments made. You can easily update your balance as payments are processed, helping you maintain an accurate overview of your financial obligations. Utilizing this template can simplify basic bookkeeping functions, and you may later explore advanced features like automated calculations or integration with accounting software for comprehensive financial management.

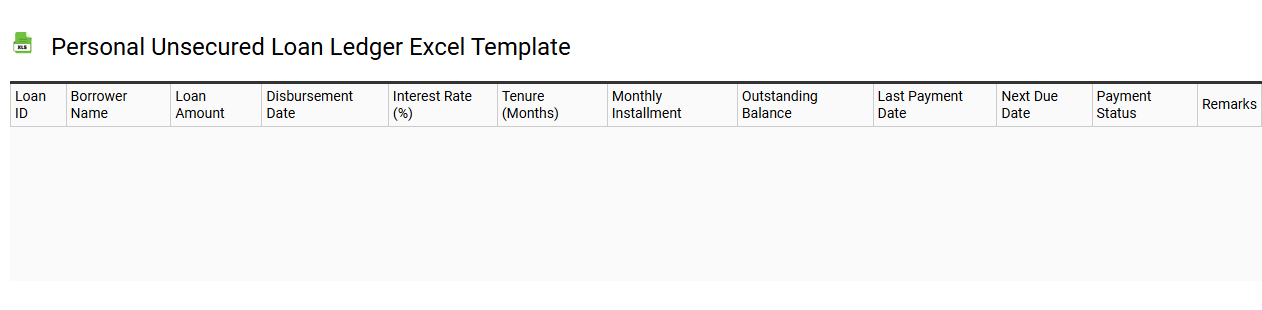

Personal unsecured loan ledger Excel template

💾 Personal unsecured loan ledger Excel template template .xls

The Personal Unsecured Loan Ledger Excel template is a structured tool designed to help individuals track their unsecured loans effectively. It typically includes columns for the lender's name, loan amount, interest rate, payment due dates, and payments made, offering a clear visual representation of one's loan obligations. Users can easily monitor their repayment progress and remain organized by inputting relevant data. This template is not just for basic tracking; it can be expanded to include advanced features like amortization schedules or interest calculations to better manage your financial future.

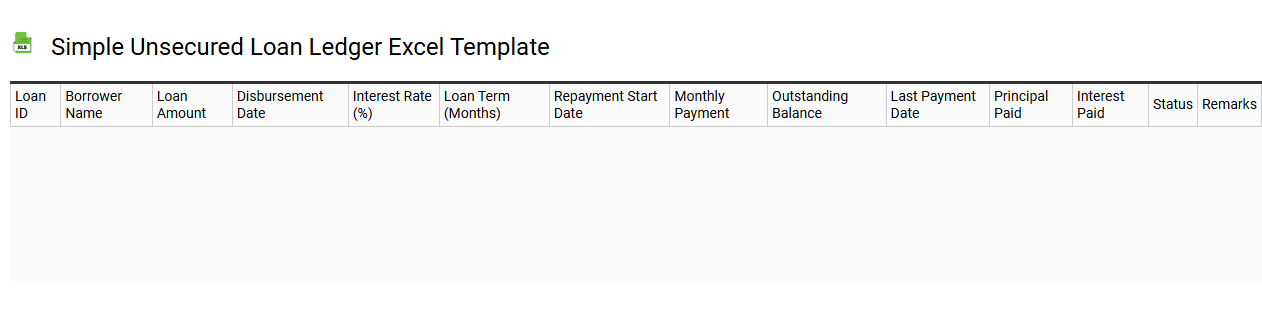

Simple unsecured loan ledger Excel template

💾 Simple unsecured loan ledger Excel template template .xls

A Simple Unsecured Loan Ledger Excel template serves as a basic financial tool to track unsecured loans, providing a clear overview of borrowed amounts, repayment schedules, and outstanding balances. This template typically includes columns for the borrower's name, loan amount, interest rate, payment due dates, and payment history, allowing for easily manageable records. By using this spreadsheet, you can monitor your loan obligations and ensure timely payments, helping you maintain a healthy financial status. With proper customization, this template can evolve to manage more complex loan scenarios, including multiple borrowers or varying interest rates, enhancing your financial tracking capabilities.

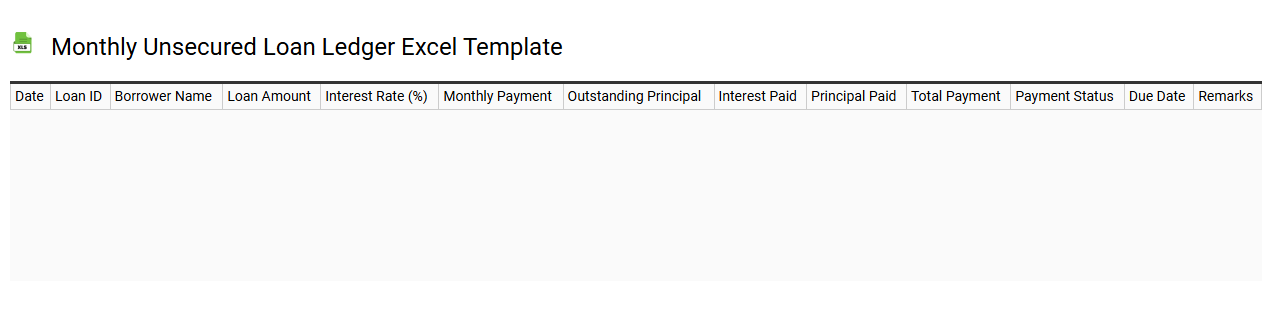

Monthly unsecured loan ledger Excel template

💾 Monthly unsecured loan ledger Excel template template .xls

A Monthly Unsecured Loan Ledger Excel template is a financial tool designed to help you track and manage unsecured loans on a monthly basis. This template typically includes sections for recording the loan amount, interest rate, payment due dates, and payment status. Features like automatic calculations of total payments and remaining balances enhance your ability to stay organized. You can also customize it to implement advanced financial models or track multiple loans, providing scalability for your future financial management needs.

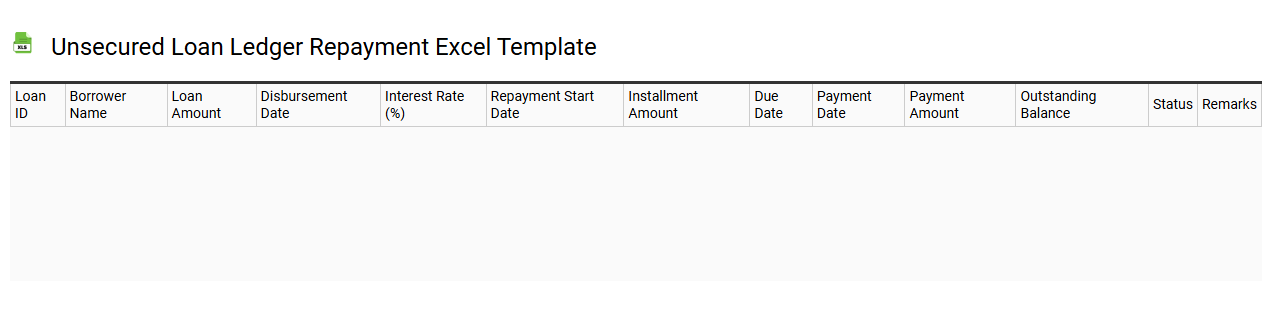

Unsecured loan ledger repayment Excel template

💾 Unsecured loan ledger repayment Excel template template .xls

An Unsecured Loan Ledger Repayment Excel template is a digital tool designed to help you track and manage your unsecured loans effectively. This template typically includes sections for loan amounts, repayment due dates, interest rates, and payment histories, allowing for clear visibility into your repayment obligations. Each entry can be customized to reflect various loan terms and schedules, assisting in organizational efficiency. You might find this template useful for basic tracking but it can be tailored for advanced financial modeling or forecasting scenarios.

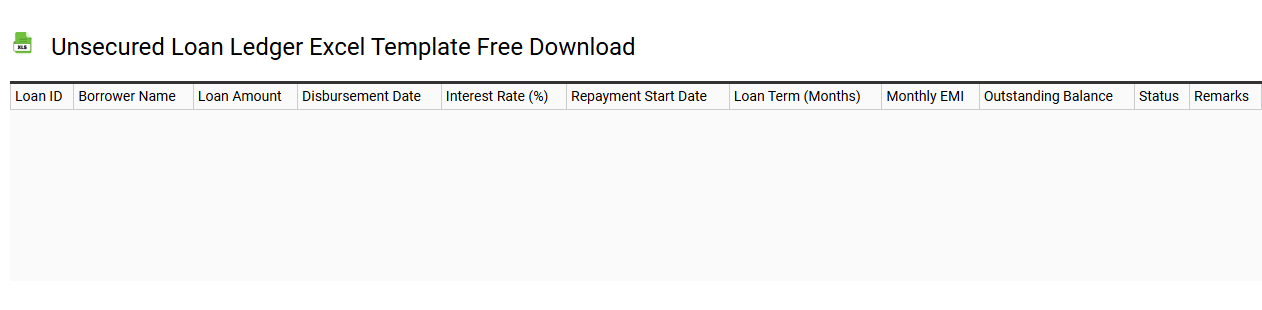

Unsecured loan ledger Excel template free download

💾 Unsecured loan ledger Excel template free download template .xls

An unsecured loan ledger Excel template is a digital tool designed to help individuals or businesses track and manage unsecured loans. This template typically includes fields for borrower details, loan amounts, interest rates, payment schedules, and outstanding balances. You can easily customize the layout to suit your specific needs, ensuring that you have a clear overview of your loan management. Such a template is beneficial for monitoring repayments, calculating interest accrued, and providing insights into overall financial health, while also serving as a foundation for more advanced financial modeling or integrating with accounting software.

Unsecured loan tracker Excel template

![]()

💾 Unsecured loan tracker Excel template template .xls

An Unsecured Loan Tracker Excel template serves as a valuable tool for individuals or businesses managing their unsecured loans. This template typically includes sections for loan details, such as borrowing amount, interest rates, repayment terms, and due dates, enabling you to monitor outstanding balances and payment history effectively. Users can visualize their financial obligations and keep track of multiple loans in one organized spreadsheet. For advanced usage, consider incorporating automated formulas, conditional formatting, and data analysis tools to enhance tracking and optimize repayment strategies.

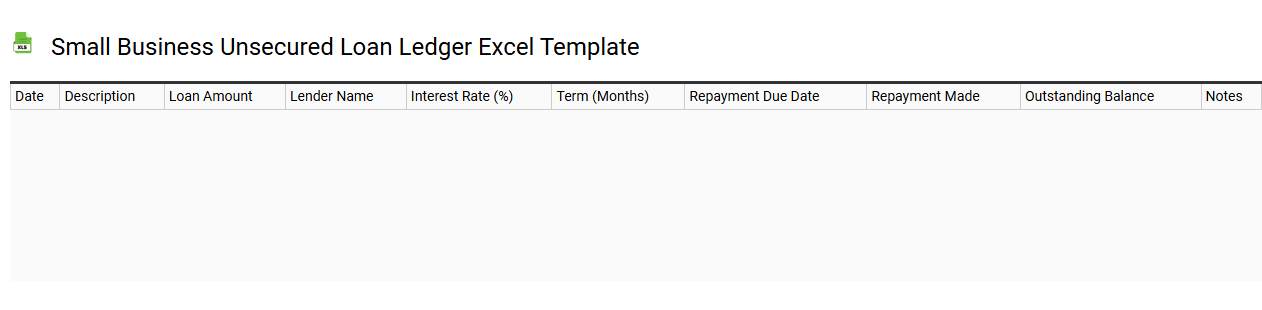

Small business unsecured loan ledger Excel template

💾 Small business unsecured loan ledger Excel template template .xls

A Small Business Unsecured Loan Ledger Excel template is a structured spreadsheet designed to help business owners track their unsecured loans, payments, and balances efficiently. This template allows you to record important details such as loan amounts, interest rates, payment due dates, and outstanding balances. Customizable features enable you to tailor the ledger to fit your specific business needs, ensuring accurate financial management. You can use this template to monitor cash flow and assess your repayment schedule, with capabilities to adapt it for complex financial scenarios like refinancing or integrating with accounting software.

Monthly unsecured loan payment tracker Excel template

![]()

💾 Monthly unsecured loan payment tracker Excel template template .xls

A Monthly Unsecured Loan Payment Tracker Excel template is a structured spreadsheet designed to help you monitor and manage your unsecured loan payments effectively. This template typically features columns for loan amounts, interest rates, payment due dates, and current balances, allowing for a comprehensive overview of your loan commitments. You can easily input your monthly payments, principal reductions, and interest accruals, giving you a clear understanding of your financial obligations over time. This tool is essential for maintaining good financial health, and can even support more advanced analysis such as amortization schedules and interest forecasting.

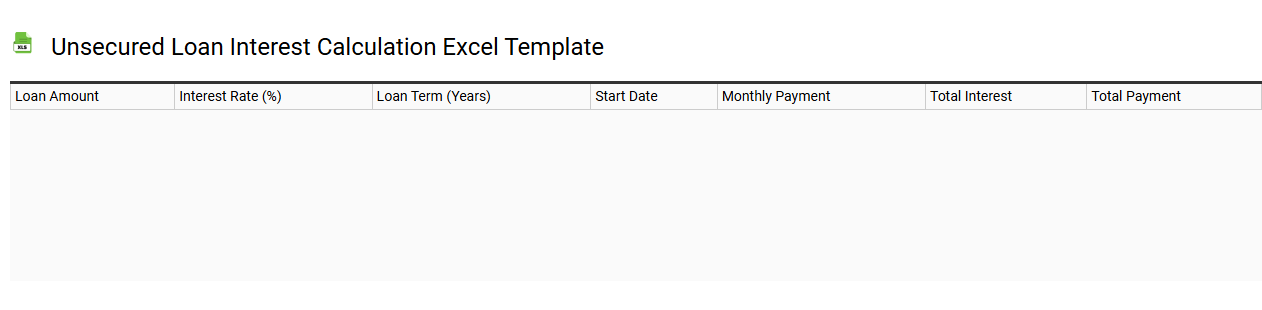

Unsecured loan interest calculation Excel template

💾 Unsecured loan interest calculation Excel template template .xls

An unsecured loan interest calculation Excel template simplifies the process of determining the interest on loans that do not require collateral. With clear input fields for loan amount, interest rate, and loan term, it enables you to calculate monthly payments and total interest paid over the life of the loan. You can easily modify the template to assess different scenarios by adjusting the parameters, allowing for effective financial planning. This tool is not only useful for basic calculations but can also accommodate advanced modeling, such as amortization schedules and varying interest rates.

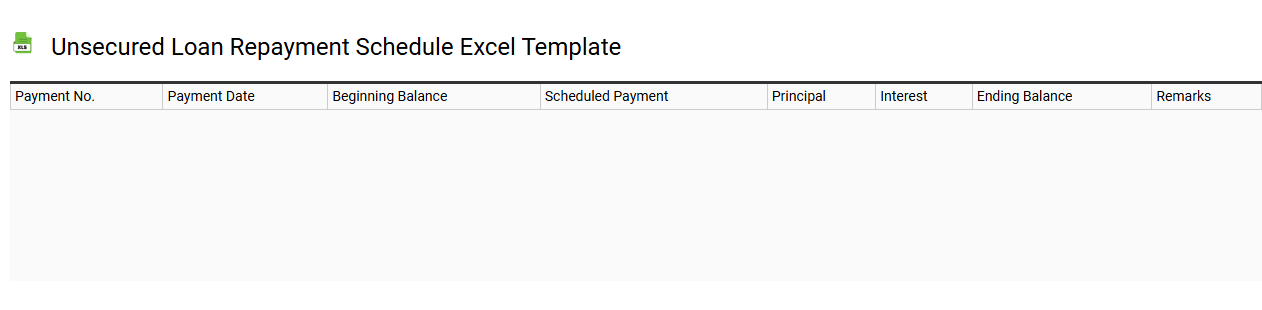

Unsecured loan repayment schedule Excel template

💾 Unsecured loan repayment schedule Excel template template .xls

An unsecured loan repayment schedule Excel template provides a structured framework for tracking loan repayment. This template typically includes columns for the loan amount, interest rate, payment frequency, due dates, and remaining balance. Users can input their loan terms to automatically calculate monthly payments and visualize the amortization schedule over time. Such a tool is essential for effectively managing your finances, helping you stay on top of payment deadlines while offering the flexibility to explore more complex financial scenarios like loan refinancing or debt consolidation.

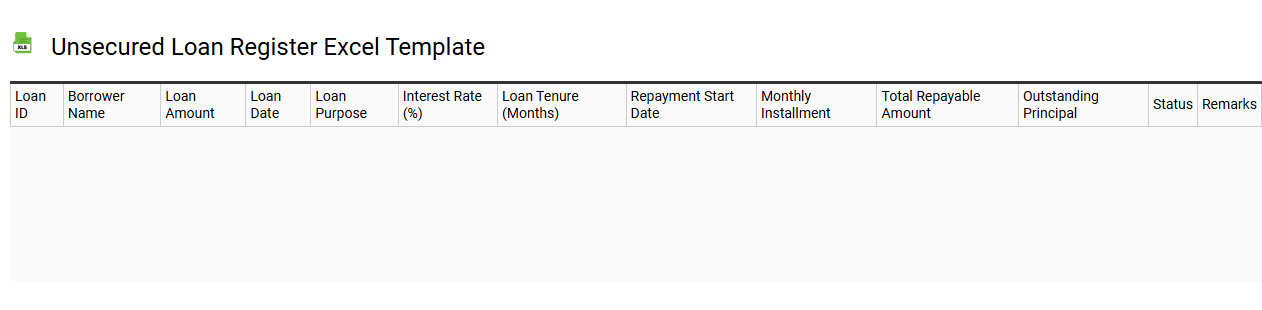

Unsecured loan register Excel template

💾 Unsecured loan register Excel template template .xls

An Unsecured Loan Register Excel template is a structured spreadsheet designed to track and manage unsecured loans. This template typically includes columns for borrower details, loan amounts, interest rates, repayment terms, and due dates, allowing you to easily monitor each loan's status. You can customize it to include notes on borrower interactions or payment histories, making it a comprehensive tool for financial management. This basic template can evolve into more advanced functionalities, such as automated payment reminders and data analyses to evaluate lending trends.

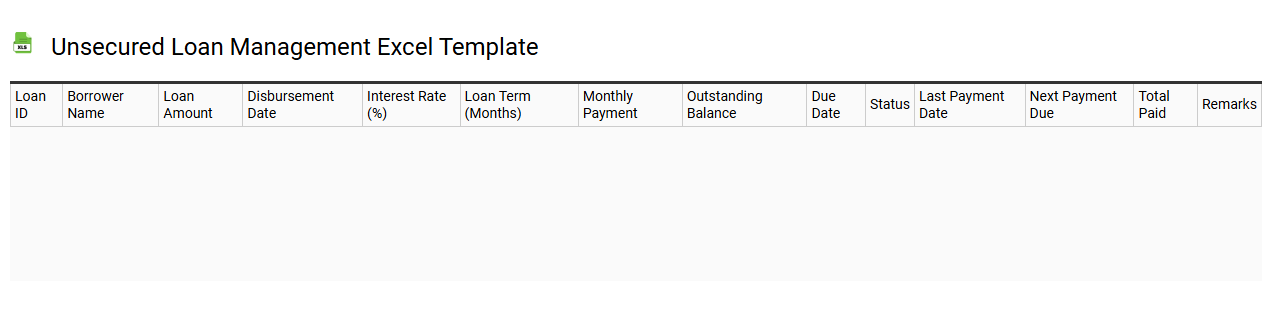

Unsecured loan management Excel template

💾 Unsecured loan management Excel template template .xls

An Unsecured Loan Management Excel template helps you track and manage loans that are not backed by collateral, making it essential for personal finance and small business applications. This template typically includes fields for borrower information, loan amount, interest rates, repayment schedules, and outstanding balances, providing a comprehensive overview of your financial obligations. Clear formatting and calculations enable you to monitor payment deadlines and total interest paid over the loan's life, assisting you in making informed financial decisions. For further potential needs, advanced users may explore integrating this data with financial modeling software or employing macro functions for automation.