Explore a range of free XLS templates designed specifically for corporate loan monitoring. These templates typically feature sections for tracking loan details, interest rates, payment schedules, and outstanding balances. Customizable fields allow you to input specific loan data, making it easy to keep your records organized and up-to-date for effective financial management.

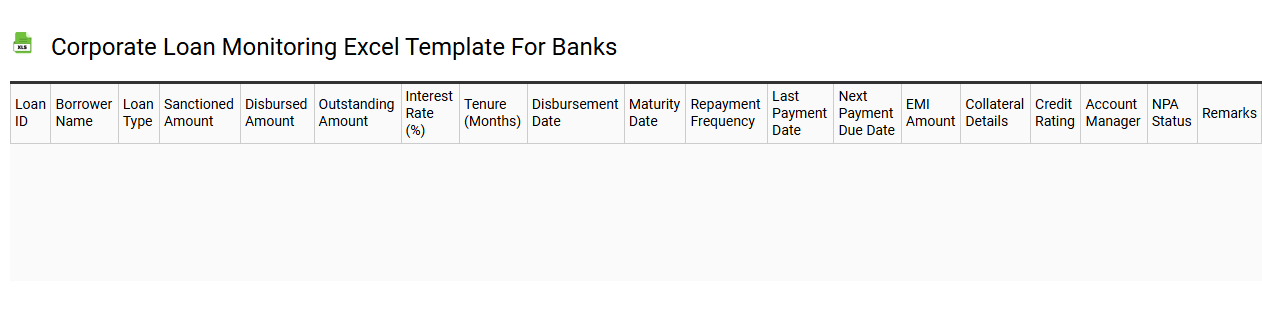

Corporate loan monitoring Excel template for banks

💾 Corporate loan monitoring Excel template for banks template .xls

A Corporate Loan Monitoring Excel template for banks serves as a structured tool to oversee the performance and risk associated with business loans. This template typically includes essential fields like borrower information, loan amounts, interest rates, repayment schedules, and credit risk assessments. Banks use this template to track key metrics, such as payment delinquencies, outstanding balances, and financial ratios, allowing for timely intervention if any issues arise. You can utilize this template for fundamental loan management, while further potential needs could involve integrating predictive analytics and advanced risk modeling techniques for enhanced decision-making.

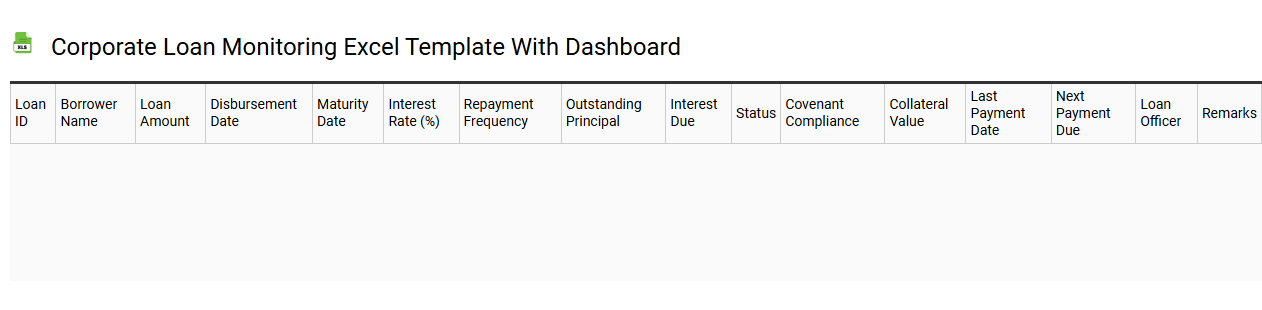

Corporate loan monitoring Excel template with dashboard

💾 Corporate loan monitoring Excel template with dashboard template .xls

A Corporate Loan Monitoring Excel template with dashboard serves as a comprehensive tool for tracking, managing, and analyzing various corporate loans. This template typically includes sections for loan details, borrower information, payment schedules, interest rates, and outstanding balances. The dashboard visually represents key metrics through charts and graphs, allowing for quick assessments of loan performance, repayment statuses, and potential risks. Such a template assists you in maintaining oversight while also accommodating further customization for advanced scenarios like credit risk analysis and financial forecasting.

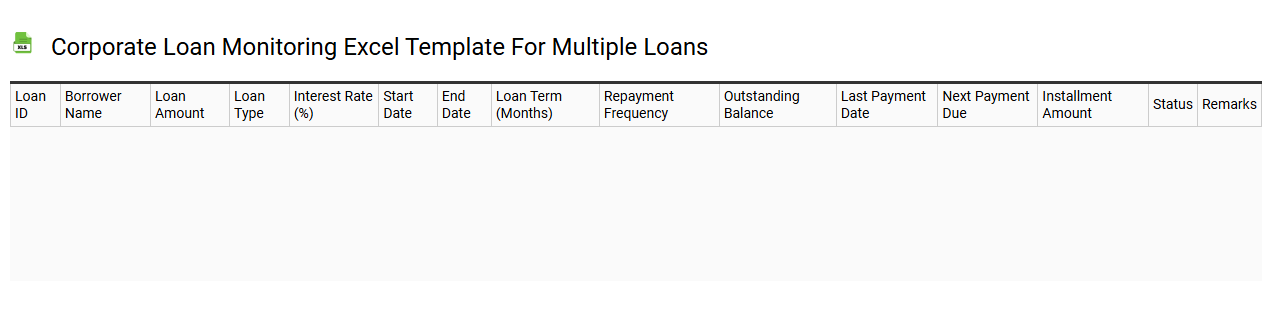

Corporate loan monitoring Excel template for multiple loans

💾 Corporate loan monitoring Excel template for multiple loans template .xls

A Corporate loan monitoring Excel template for multiple loans is a structured spreadsheet designed to help businesses manage and track various loans efficiently. Each section may include key details such as loan amount, interest rate, repayment terms, payment schedules, and current balances. You can update fields regularly to reflect repayment progress and analyze financial obligations over time. This tool simplifies the monitoring process and aids in budgeting, while also providing insights into potential refinancing options or additional financing needs, such as revolving credit facilities or term loans.

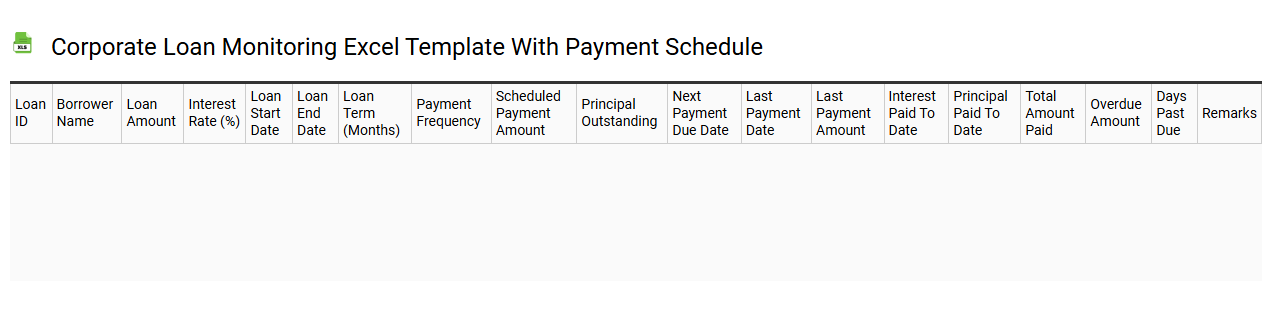

Corporate loan monitoring Excel template with payment schedule

💾 Corporate loan monitoring Excel template with payment schedule template .xls

A Corporate Loan Monitoring Excel template is a structured tool designed to help businesses track their loan details efficiently. It typically includes fields for loan amounts, interest rates, payment due dates, and total repayment schedules. You can visualize your payment progress with interactive charts and graphs, making it easier to understand your financial obligations. Basic usage of this template involves recording payments, while further potential needs may include advanced analytics, forecasting, and integration with financial modeling techniques.

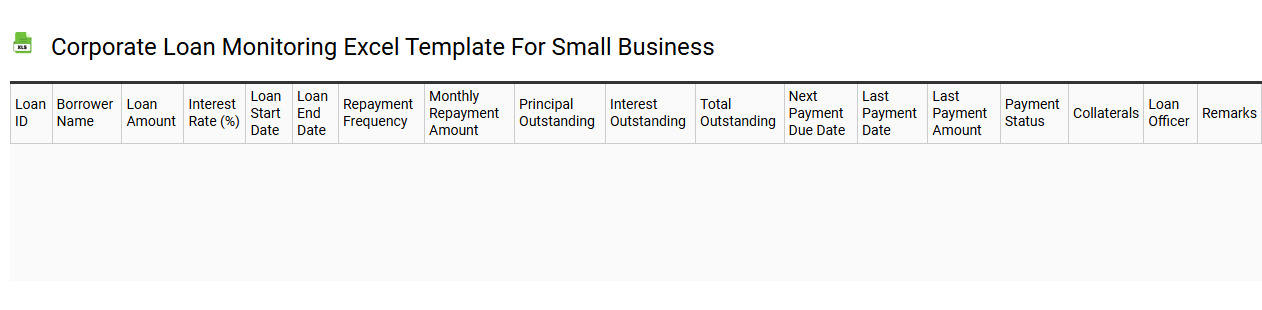

Corporate loan monitoring Excel template for small business

💾 Corporate loan monitoring Excel template for small business template .xls

A Corporate loan monitoring Excel template for small business acts as a vital tool to keep track of loan details and repayment schedules. This template typically includes fields for loan amount, interest rate, term length, payment frequency, and due dates, providing a comprehensive view of your financial obligations. It allows for easy updates, tracking of actual payments against scheduled ones, and may even incorporate formulas for calculating outstanding balances and interest accrued. Utilizing this template streamlines basic financial management while offering potential for advanced financial modeling or forecasting needs.

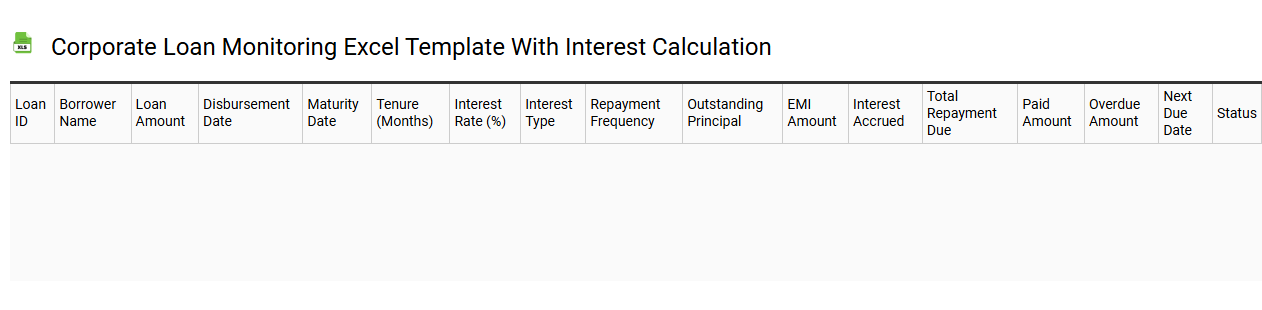

Corporate loan monitoring Excel template with interest calculation

💾 Corporate loan monitoring Excel template with interest calculation template .xls

A Corporate loan monitoring Excel template is a specialized tool designed to track loan details, including principal amounts, interest rates, repayment schedules, and outstanding balances. It allows users to input various loan parameters such as the loan amount, interest rate, and loan term, automatically calculating interest accrual based on the specified data. This template often features built-in formulas to provide real-time updates on the remaining payments and total interest paid over the loan duration. You can also customize it for more advanced needs, such as incorporating amortization schedules or sensitivity analysis for interest rate fluctuations.

Corporate loan monitoring Excel template for monthly tracking

![]()

💾 Corporate loan monitoring Excel template for monthly tracking template .xls

A Corporate loan monitoring Excel template serves as a vital tool for businesses to keep track of their loans on a monthly basis. It typically includes key sections such as loan details, repayment schedules, interest rates, and balance calculations. Users can input transaction data, monitor payment dates, and assess the overall financial health of their company through visual graphs and analytics. This template not only facilitates basic loan management but also has the potential for advanced functionalities like integration with accounting software, automated alerts for due payments, and customizable dashboards for real-time financial insights.

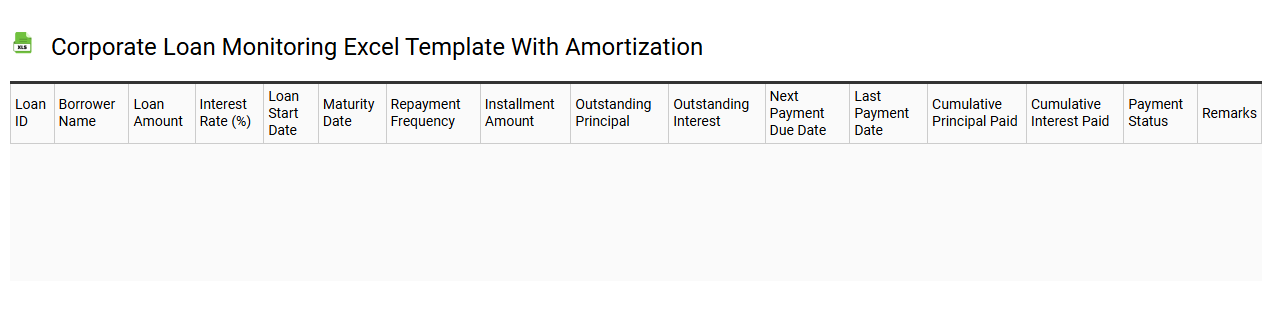

Corporate loan monitoring Excel template with amortization

💾 Corporate loan monitoring Excel template with amortization template .xls

A corporate loan monitoring Excel template with amortization serves as a comprehensive tool to track and manage business loans. It typically includes sections for loan details, payment schedules, remaining balances, and interest calculations, all of which allow you to easily visualize the loan's progress over time. Each payment entry is organized in a manner that distinguishes principal from interest, providing a clear picture of your financial obligation. This template not only assists in basic tracking but can also be extended to evaluate potential refinancing options or assess debt-to-equity ratios for more advanced financial analysis.

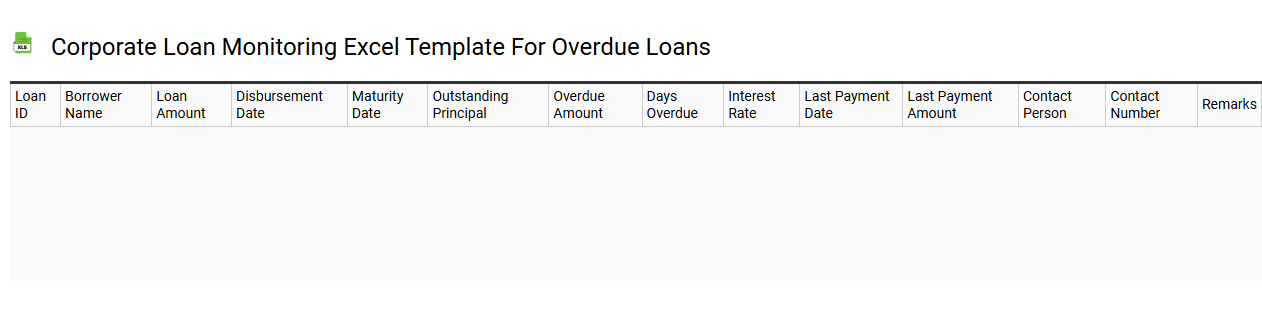

Corporate loan monitoring Excel template for overdue loans

💾 Corporate loan monitoring Excel template for overdue loans template .xls

A Corporate loan monitoring Excel template for overdue loans is a structured spreadsheet designed to track, manage, and assess overdue corporate loans. This template typically includes key loan details such as borrower names, loan amounts, interest rates, and the original loan dates, all of which facilitate easy monitoring. You can configure it to highlight overdue amounts, days past due, and repayment schedules, allowing for streamlined communication with borrowers. Basic usage may involve daily updates, while advanced needs could encompass features such as predictive analytics, automated reminders, or integration with financial reporting systems.

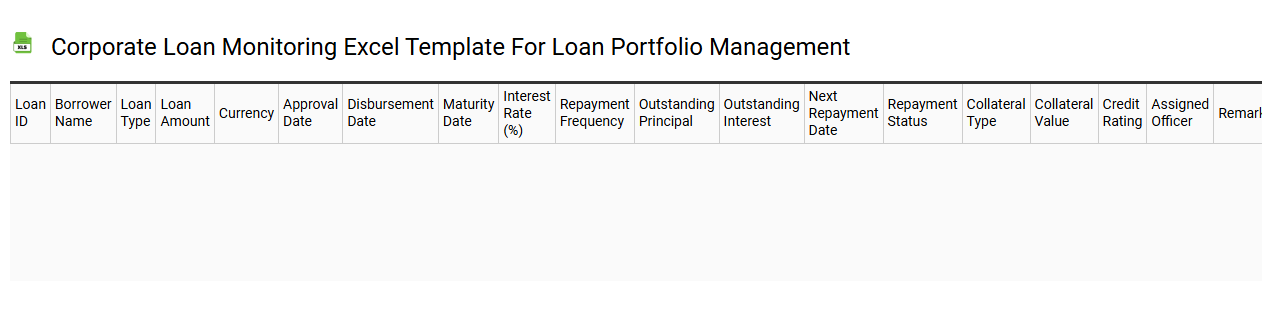

Corporate loan monitoring Excel template for loan portfolio management

💾 Corporate loan monitoring Excel template for loan portfolio management template .xls

A Corporate Loan Monitoring Excel template serves as a comprehensive tool for managing and tracking loan portfolios effectively. It features sections for entering loan details including borrower names, loan amounts, interest rates, maturity dates, and payment schedules, enabling you to maintain precise records. This template often integrates features like conditional formatting to highlight overdue payments, charts for visualizing loan performance, and summary tables for quick insights into portfolio health. This basic yet robust structure can be expanded with advanced analytics, risk assessment metrics, and scenario modeling for deeper financial forecasting needs.