Explore a variety of free Excel templates designed specifically for tracking loan write-offs. Each template features user-friendly layouts, allowing you to efficiently input data such as borrower names, loan amounts, overdue dates, and write-off statuses. Utilizing these customizable templates can enhance your financial management, making it easier for you to monitor and analyze loan write-off trends.

Loan write-off tracking Excel template

![]()

💾 Loan write-off tracking Excel template template .xls

A Loan Write-Off Tracking Excel template is a specialized tool designed to monitor and manage loans that have been deemed uncollectible. This template typically includes essential columns for borrower details, loan amounts, dates of issue, write-off reasons, and recovery efforts. You can visualize outstanding balances and write-off statuses easily, streamlining your financial management process. Using this template not only aids in tracking current loan situations but also prepares you to assess potential future loan recovery strategies, integrating metrics like debt-to-equity ratios or loss given default calculations.

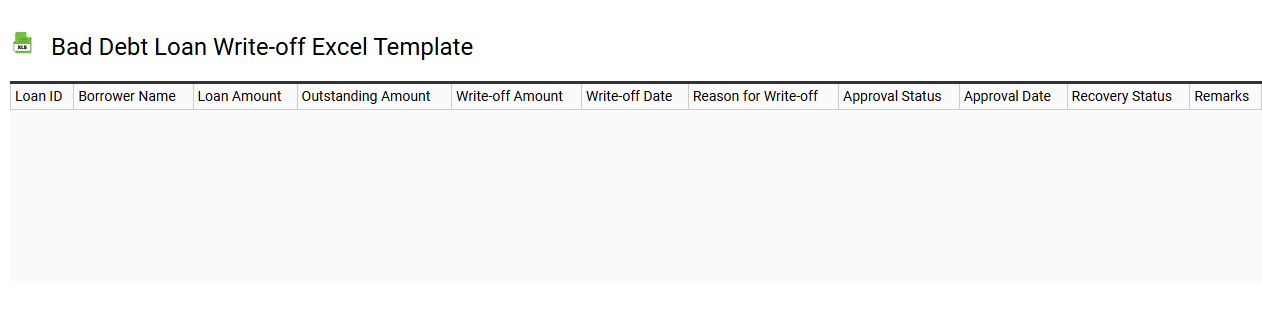

Bad debt loan write-off Excel template

💾 Bad debt loan write-off Excel template template .xls

A Bad Debt Loan Write-Off Excel template serves as a financial tool to systematically manage and record debts deemed uncollectible. This template typically includes sections for debtor information, loan amounts, outstanding balances, and the reason for the write-off. You can easily calculate totals, track write-off dates, and monitor the overall impact on your financial statements. Such a template not only simplifies your record-keeping but also prepares you to assess potential future needs, including integrating advanced financial metrics and analytics for informed decision-making.

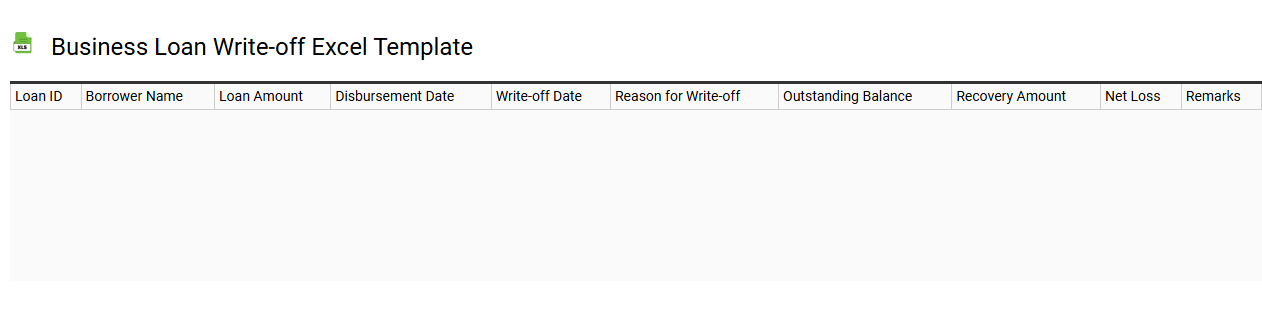

Business loan write-off Excel template

💾 Business loan write-off Excel template template .xls

A Business Loan Write-Off Excel template is a structured spreadsheet designed to help businesses effectively manage and analyze their loan write-off processes. This template typically includes fields for loan amounts, outstanding balances, interest rates, and reasons for write-offs. By using such a template, businesses can track financial impacts, assess risks, and maintain records for accounting purposes. This tool can simplify your financial analysis, while also providing a foundation for more advanced financial modeling, such as loss forecasting or debt recovery strategies.

Personal loan write-off tracking Excel template

![]()

💾 Personal loan write-off tracking Excel template template .xls

A Personal Loan Write-Off Tracking Excel template serves as a detailed tool for managing your financial data pertaining to personal loans that may go unpaid or are deemed uncollectible. This template typically includes various columns such as borrower details, loan amounts, payment status, and the date the loan was deemed a write-off. Customizable fields allow you to input specific data relevant to your financial situation, enabling clearer tracking of losses over time. You can use this template not only to monitor existing write-offs but also to analyze trends and make informed decisions for future lending or financial strategies.

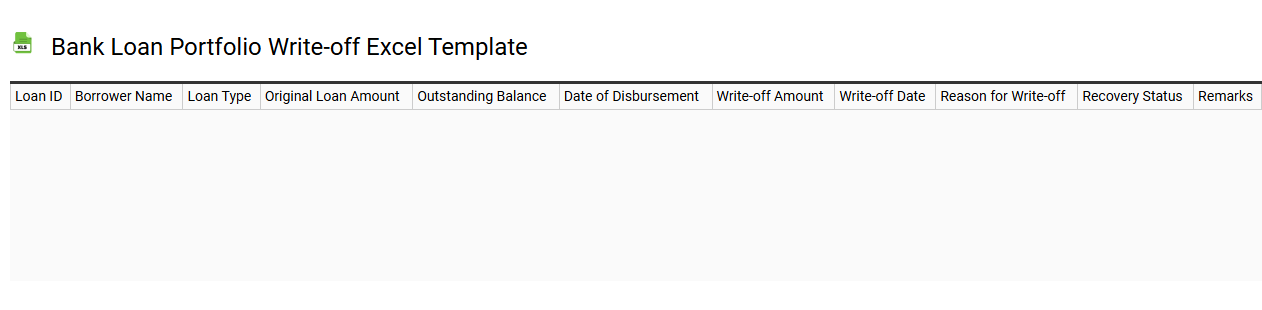

Bank loan portfolio write-off Excel template

💾 Bank loan portfolio write-off Excel template template .xls

A Bank loan portfolio write-off Excel template serves as a systematic tool for financial institutions to track and manage loans deemed uncollectible. It includes structured tables for inputting borrower details, loan amounts, default dates, and calculated write-off amounts. Users can analyze data to identify trends in loan defaults and assess risk factors associated with their lending practices. This template can facilitate basic tracking and reporting; for further potential needs, you might explore advanced features like data visualization, predictive analytics, or integration with financial modeling software.

Loan loss provision tracking Excel template

![]()

💾 Loan loss provision tracking Excel template template .xls

A Loan Loss Provision Tracking Excel template is a spreadsheet designed to help financial institutions monitor and manage the provisions set aside for potential loan losses. This template typically includes columns for loan details, borrower information, outstanding balance, risk ratings, and the amount reserved for potential losses. You can customize the template to calculate the required provisions based on historical loss data and current portfolio performance, making it easier for you to ensure compliance with regulatory requirements. This template serves as a foundation for tracking loan loss provisions, but it can also expand into complex financial models, including loss forecasting and stress testing scenarios.

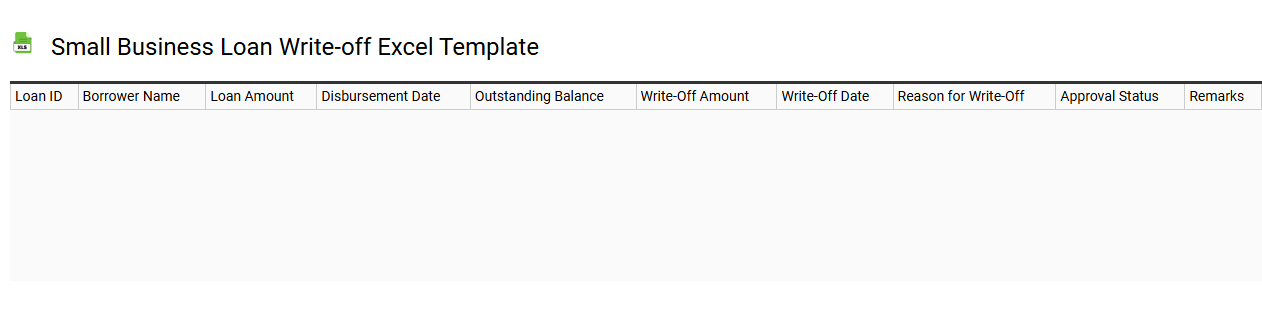

Small business loan write-off Excel template

💾 Small business loan write-off Excel template template .xls

A Small Business Loan Write-Off Excel template serves as a structured tool to track and manage write-offs associated with unpaid loans. This template typically includes columns for borrower details, loan amounts, outstanding balances, and the reasons for each write-off. You can easily calculate total losses and track write-off dates to maintain clear records for accounting and tax purposes. Beyond basic tracking, this template can also integrate advanced financial analysis features, such as cash flow projections and impact assessments on your business's financial health.

Microfinance loan write-off tracking Excel template

![]()

💾 Microfinance loan write-off tracking Excel template template .xls

A Microfinance loan write-off tracking Excel template is a spreadsheet designed to help organizations manage and monitor the write-off process for loans that are deemed uncollectible. This template often includes various columns such as borrower details, loan amounts, reasons for write-off, dates, and current status. By utilizing this tool, you can easily categorize and analyze the performance of loan portfolios, enabling more informed financial decisions. Beyond basic tracking, this template can also support advanced needs such as forecasting write-off trends and assessing the impact on financial sustainability.

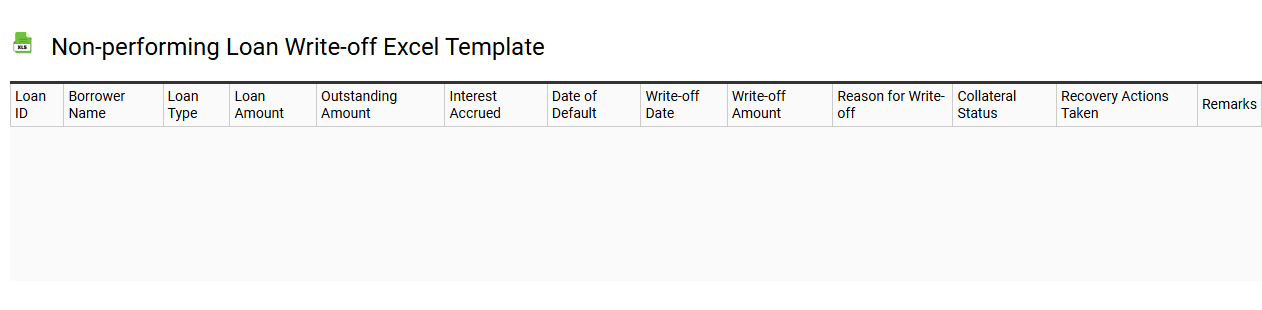

Non-performing loan write-off Excel template

💾 Non-performing loan write-off Excel template template .xls

A Non-Performing Loan (NPL) Write-Off Excel template serves as a structured tool for financial professionals to track and manage loans that are unlikely to be repaid. This template typically includes fields for borrower information, loan amounts, payment histories, and reasons for classification as non-performing. You can benefit from its clear layout to visualize financial impacts, facilitating informed decision-making regarding asset management. Users may further explore intricate functionalities such as loan recovery forecasting, impact analysis on profit margins, and compliance tracking for regulatory standards.

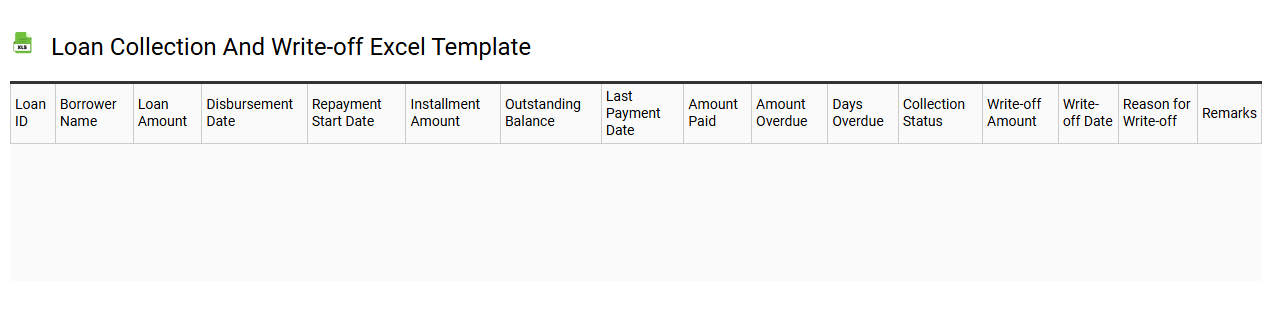

Loan collection and write-off Excel template

💾 Loan collection and write-off Excel template template .xls

Loan collection refers to the systematic process of recovering unpaid debts from borrowers. A well-structured Excel template for this purpose can help you track outstanding loans, overdue payments, and payment schedules efficiently. You can monitor borrower details, including names, contact information, loan amounts, payment due dates, and the status of collections. This template not only assists in managing current collections but can also be adapted for further potential needs like analyzing trends, forecasting cash flows, or integrating complex banking protocols such as DCF (Discounted Cash Flow) and NPV (Net Present Value) calculations.