Explore a range of free Excel templates designed specifically for tracking adjustable rate loans. These templates allow you to easily input loan details, interest rate adjustments, and payment information, ensuring you stay informed about your loan's status. With user-friendly layouts and clear data visualization, you can monitor changes over time and make more informed financial decisions.

Adjustable rate loan tracker Excel template

![]()

💾 Adjustable rate loan tracker Excel template template .xls

An Adjustable Rate Loan Tracker Excel template is a practical tool designed to help you monitor and manage adjustable-rate mortgages or loans. This template allows you to input essential loan details such as initial interest rates, adjustment periods, and remaining balances, providing a clear view of potential changes in your payment amounts over time. Features often include dynamic graphs and charts that visualize interest rate fluctuations, making it easier to forecast future payments based on varying market rates. Such templates are valuable not only for basic tracking but also for advanced analysis, enabling you to incorporate factors like amortization schedules or prepayment options for more informed financial planning.

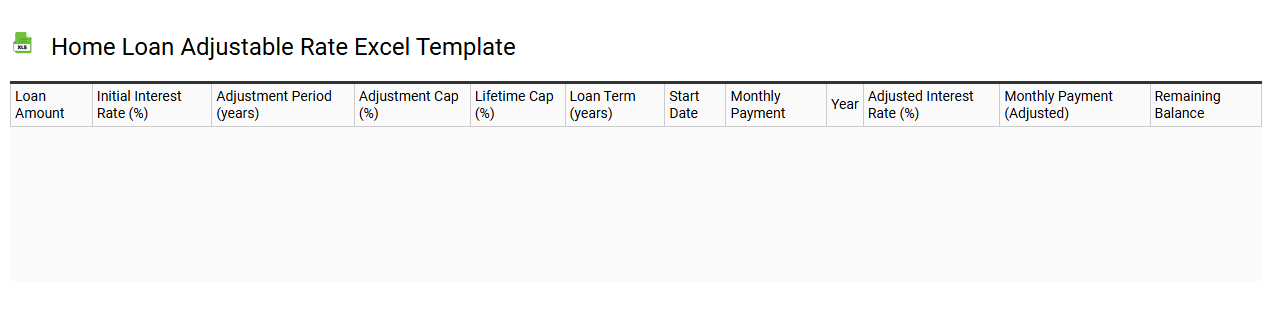

Home loan adjustable rate Excel template

💾 Home loan adjustable rate Excel template template .xls

Home loan adjustable rate Excel templates serve as financial tools for managing mortgage calculations. These templates typically include fields for inputting loan amounts, interest rates, and loan durations, providing users with a clear visualization of monthly payments and interest fluctuations. Graphs and charts often depict the amortization schedule, illustrating how principal and interest components shift over time. Such a template not only aids in planning your current mortgage payments but can also be expanded for advanced scenarios, incorporating concepts like rate caps, payment shocks, or refinancing fluctuations.

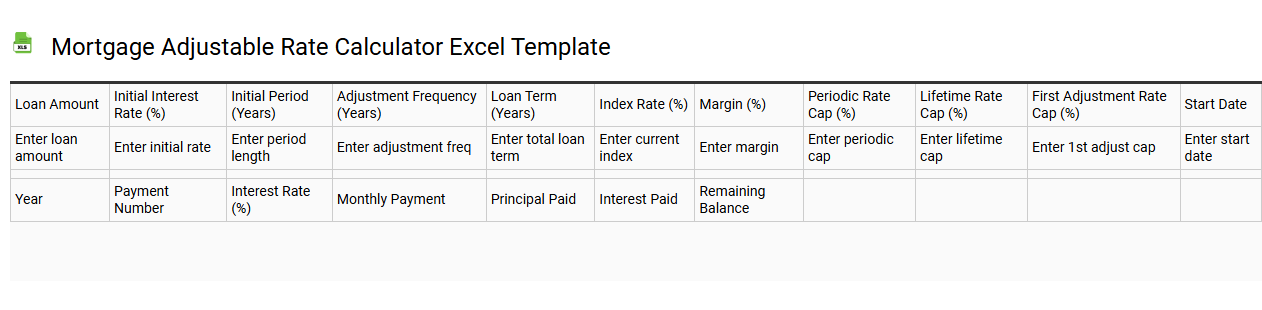

Mortgage adjustable rate calculator Excel template

💾 Mortgage adjustable rate calculator Excel template template .xls

A Mortgage Adjustable Rate Calculator Excel template is a customizable spreadsheet designed to help you analyze adjustable-rate mortgage (ARM) scenarios. This tool allows you to input key loan details, such as principal amount, interest rate adjustments, and loan term, enabling a detailed projection of monthly payments over time. Users can visualize how changing interest rates impact their future financial obligations, making it easier to plan and budget effectively. This template can serve basic needs, while advanced users may explore features like amortization schedules, rate cap calculations, or even sensitivity analyses for various market conditions.

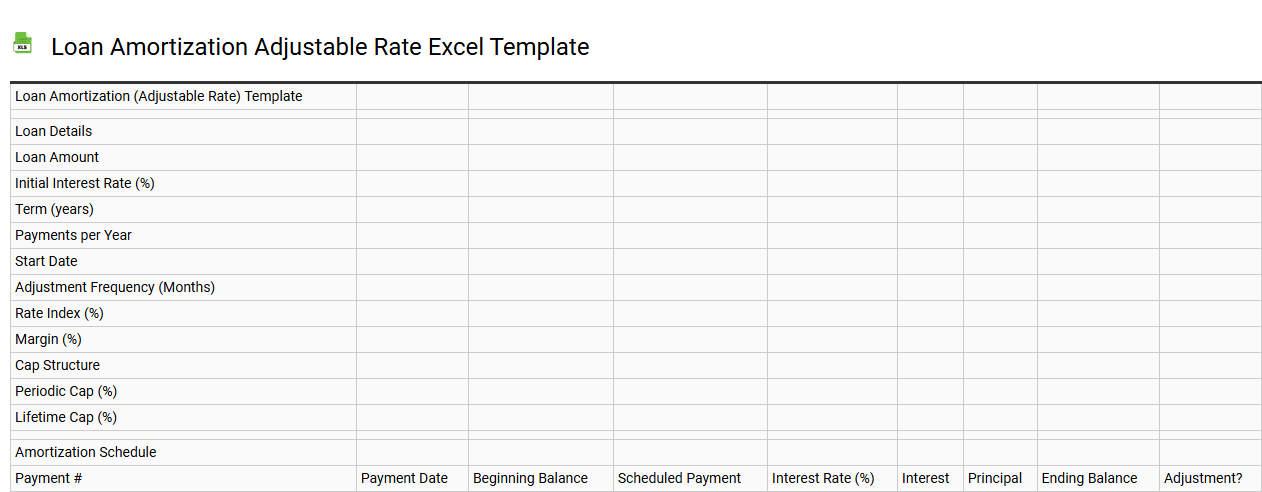

Loan amortization adjustable rate Excel template

💾 Loan amortization adjustable rate Excel template template .xls

A Loan Amortization Adjustable Rate Excel Template is a financial tool designed to help you calculate the monthly payments of an adjustable-rate mortgage (ARM). It includes features like principal and interest breakdowns, showing how payments change over time with varying interest rates. Users can input their loan amount, initial interest rate, adjustment frequency, and duration to create a personalized amortization schedule. This template not only simplifies the understanding of loan payments but also serves as a foundation for analyzing future financial scenarios, including the impacts of rate adjustments on total costs and strategies for refinancing or additional payments.

ARM loan interest tracker Excel template

![]()

💾 ARM loan interest tracker Excel template template .xls

An ARM (Adjustable Rate Mortgage) loan interest tracker Excel template is a useful tool for monitoring the fluctuating interest rates associated with adjustable-rate mortgages. This template allows you to input your loan details, such as the initial interest rate, adjustment periods, and loan balance, enabling you to see how changes in interest rates affect your monthly payments. You can visualize potential future payments based on different interest scenarios by incorporating built-in formulas that automatically calculate adjustments according to the rate index. This tool can be invaluable for managing budgeting and planning, as well as for evaluating more advanced financial strategies like refinancing or navigating rate caps.

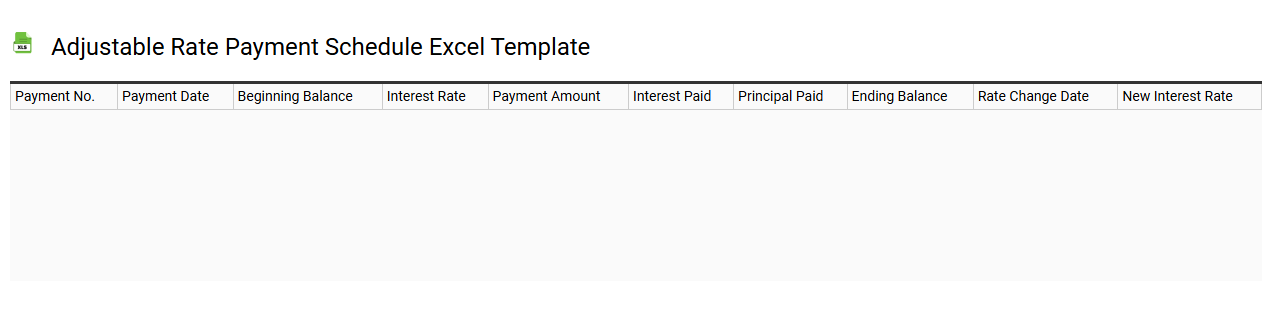

Adjustable rate payment schedule Excel template

💾 Adjustable rate payment schedule Excel template template .xls

An Adjustable Rate Payment Schedule Excel template is a versatile financial tool designed to help you manage loans with variable interest rates. This template typically includes fields for principal amounts, fluctuating interest rates, payment frequencies, and amortization periods. With user-friendly formulas, it automatically calculates monthly payments and remaining balances, providing a clear view of your financial commitments. Such a template is especially useful for monitoring long-term loans and planning for potential changes in payments or rates, enabling you to explore advanced options like refinancing or debt restructuring.

Variable rate mortgage tracker Excel template

![]()

💾 Variable rate mortgage tracker Excel template template .xls

A Variable Rate Mortgage Tracker Excel template is a financial tool designed to help you monitor and manage your variable-rate mortgage payments. This template typically includes fields for inputting your mortgage details, such as the principal amount, interest rate, and payment frequency. You can easily track changes in interest rates over time and see how they impact your monthly payments and overall balance. This tool can assist you in making informed decisions regarding refinancing options, budgeting, or early repayment strategies while offering the potential for advanced analyses like amortization schedules or interest rate forecasting.

Adjustable loan payment tracker Excel template

![]()

💾 Adjustable loan payment tracker Excel template template .xls

An Adjustable Loan Payment Tracker Excel template is a customizable tool designed to help you monitor and manage your loan payments effectively. This template allows you to input various loan details, such as principal amount, interest rate, loan term, and payment frequency, giving you a clear overview of your financial obligations. You can track your payments over time, see how they affect your remaining balance, and analyze interest costs. With features for adjusting parameters like payment amounts and due dates, this template suits both basic budgeting and more complex financial planning needs, including recalculating amortization schedules and forecasting total interest paid.

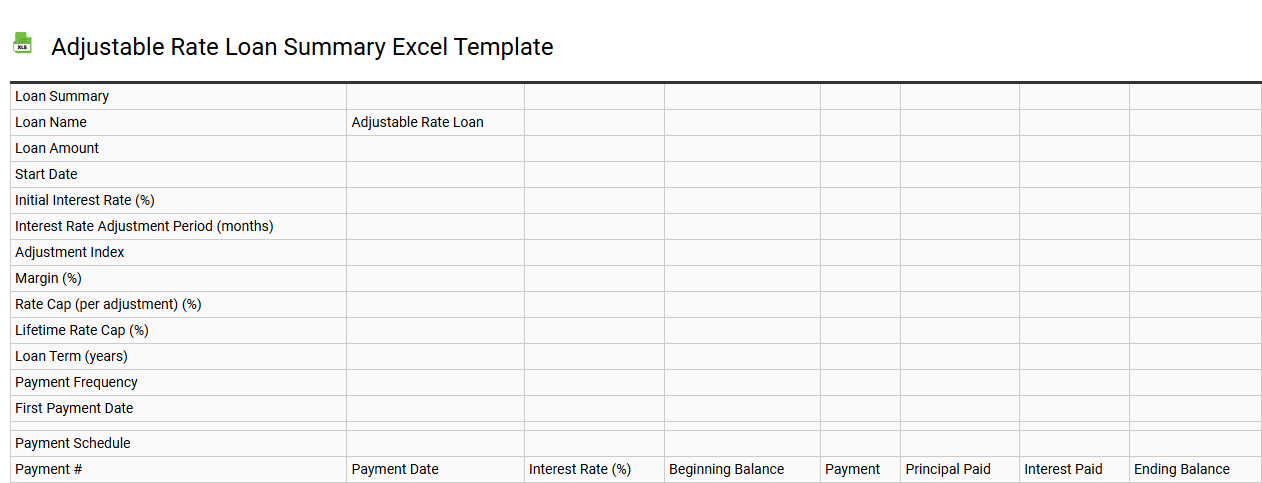

Adjustable rate loan summary Excel template

💾 Adjustable rate loan summary Excel template template .xls

An Adjustable Rate Loan Summary Excel template is a specialized tool designed to help you manage and analyze adjustable-rate loans. This template typically includes sections for basic loan information, interest rate adjustments, monthly payment calculations, and amortization schedules. You can easily input key data such as the loan amount, initial interest rate, adjustment frequency, and loan term. With features to track payment changes over time and visualize potential financial implications, it supports basic budgeting while allowing for advanced analyses like scenario modeling and sensitivity analysis.

Adjustable interest loan tracking Excel template

![]()

💾 Adjustable interest loan tracking Excel template template .xls

An Adjustable Interest Loan Tracking Excel template is a powerful tool designed to help manage and monitor loans with fluctuating interest rates. This template allows you to input details such as loan amount, interest rate, payment frequency, and remaining balance, all updated automatically to reflect any changes in interest rates. You can visually see how your payments evolve over time and how interest rate adjustments impact your overall loan cost. For basic usage, it efficiently manages payments, while for advanced needs, it can incorporate complex calculations like amortization schedules and total interest paid under variable rates.